Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

So we know now why the stock price crashed from above $1 towards .50c??

Just the fee is $150K?, for a 750K note purchase, the ah's giving up 150K in fees?...nasty. So the stock price will hit.50 or below the floor today!!

Anyone notice the form "D" filing yesterday? I especially like item "5. Issuer Size" where he checks "Decline to Disclose" LOL Beware of item 6 labeled 506(b). Theft of your trading dollars is legal as long as they tell you before hand in the filings. Business as usual for Data433

Form D December 13

https://www.otcmarkets.com/filing/html?id=16257850&guid=eLP-kp9g9ulS-ch

....Companies conducting an offering under Rule 506(b) can raise an unlimited amount of money and can sell securities to an unlimited number of accredited investors...

New 8K out with more dilution on the way. Fixed price is .50, however there are nice price protections in place. Refer to the "Subsequent Equity Sales" section in the note and understand that this appears to be a floorless note. Looks like Jason is sacking a new group of shareholders. Surprise!, Surprise! Surprise! as Gomer would say. ![]()

8K Filing

https://www.otcmarkets.com/filing/html?id=16253877&guid=PJP-kaZlBdQtB3h

On December 7, 2022, Data443 Risk Mitigation, Inc....

... Pursuant to the Securities Purchase Agreement, the Company sold, and the Investor purchased, $750,000.00 in principal amount of unsecured convertible notes (the “Notes”) and warrants (the “Warrants”)....

...The Notes are convertible into shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), at a conversion price per share of $0.50, subject to adjustment under certain circumstances described in the Notes....

The Note

https://www.otcmarkets.com/filing/html?id=16253877&guid=PJP-kaZlBdQtB3h#ex4-1_htm

Upon the execution and delivery of this Note, the sum of $600,000.00 shall be remitted and delivered to, or on behalf of, the Company, and $150,000.00 shall be retained by the Holder through an OID (original issue discount) (the “OID”) to cover the Holder’s accounting fees, monitoring, and other non-legal transactional costs incurred in connection with the purchase and sale of this Note.

c) Subsequent Equity Sales.

....any shares of Common Stock and/or Common Stock Equivalents (including the issuance or sale of shares of Common Stock owned or held by or for the account of the Company, but excluding any securities issued or sold or deemed to have been issued or sold solely in connection with an Exempt Issuance) for a consideration per share (the “New Issuance Price”)less than a price equal to the Conversion Price in effect immediately prior to such issuance or sale or deemed issuance or sale (such Conversion Price then in effect is referred to herein as the “Applicable Price”) (the foregoing a “Dilutive Issuance”), then immediately after such Dilutive Issuance, the Conversion Price then in effect shall be reduced to an amount equal to the New Issuance Price;...

Sons of bitches at ATDS, besides others brought down this stock from $7 to .70c, this is post split high of 7 to now at .70c!..

And he just hit the Reset button on pps to .50, thru unregistered shares/convertible notes.

Looking at the market the past 18 months, I can’t decide if it’s the economy, or a tidal wave of sociopathic CEOs.

Yes...! No question about it. Part II of your post is interesting, "sustainable" business. It is rather a lucrative and futuristic business, it has got solid future, the only problem is management and CEO fkn it up?.

That said, 2M O/S or below 200M A/S after all the splits can't go any bad now, all bad things already happened. The worst can happen now is increase in O/S and float to another 100 or 200M, max it?...

I think, they will come out with a forward split!!!!....to spruce the buyers!. Yea, I hear you saying "how is that"?, whatever means they can do it!?, they will!..

We didn't believe this would split with 1 million shares outstanding last March. Look at the action today. This is a share selling business with a deteriorating balance sheet. It is however a sustainable business model if they continue to find buyers after every split.

Yes, that is the case. However, it got to change!!.. it is a low float, low O/S and even the A/S is just under 200M!

so it is matter of time for someone to grab a big chunk of this small share structure.....whatever I am saying is not about Fundamental or profitable business, it is about technical stock price, and it is bound to rally on that alone.

If they don't touch the share structure? Doesn't seem likely since revenue is way off year over year. 2,386,166 outstanding share count that was only 125,000 the first week of March after the 3rd split in less than 3 years. It will be interesting to see if traders continue to buy up those shares as they stream off of restricted status. Jason Remillard has shown a shameless contempt for shareholders for years with the constant dilution.

The trend for the last three years have proven to be disastrous. Just look at the ROI and it should provide you with a better picture

Yea!..that is Ok.

This one hit the bottom of the barrel, worst has happened already!..2M O/S, only about .9M on float, it has to recover from this crash landing in the days ahead!

, so there is only one way for it, go up! $2, then to $7 and then to $14!!..

If they do not touch the share structure, those numbers will soon happen Dec-Jan!. July was the peak, since then it crashed and Sept was the most notorious month for the entire stock market, ATDS was destroyed in Sept. Oct, useless month, Nov further down trend....and thats over.

Watch out for a big bounce, the better way to play is to Average it!. Averaging to recover the losses at this damn dirt cheap price.

I grabbed a few shares recently. Not a substantial position at all.

Most of the recent Buys in ATDS seems to be from "Insiders" NSIDER POWER

I

96.788

Last 8 transactions

Buy: 617980 | Sell: 108 (Shares)

3 shares?...how about 100 dollars a pop!!! Lol!

in a blink of an eye, it will go to $7 and then to $14, so go ahead throw away that 3 shares!!!! Lol!!

You have to admit that Jason can really move shares for whatever reason. Even with the dilution clearly coming and the year over year Q3 number down 39%. They have been trying to sell the ransomware product long before the deal to acquire it in the $3.4 million deal and clearly it isn't adding much to the bottom line. PCMag's poor rating after testing reveals what we always have known. That is that Jason buys software that never found its market for the purpose of promoting and selling shares. Traders are still soaking it up once again. I am looking at the 5 year split adjusted chart and the volume today is by far the highest and they are really banking some serious bucks! LOL. The price is up 24% with more than 137K shares traders yet the price really didn't move relative to yesterdays sell off and the price as of last Thursday. All this accumulation can't be very comforting to those who now own more than 800K shares at a $1 stuck in restricted status for another 5 months or so. This is fun to watch even if not tradable. ![]()

For the quarterly period ended September 30, 2022

https://www.otcmarkets.com/filing/html?id=16200180&guid=XkP-kK_3v0GAB3h

Where did Jason manage to find a group of investors to put up $1.00 a share for 829K shares? They must see the share dump already in place. Jason took 108,000 of common shares for himself but that likely just puts a small dent in the value of the 150K of Series "A" shares that he owns. According to the 2021 S-1 filing he claimed a ratio of 15,000 :1 of the common to his series "A" shares.

For the quarterly period ended September 30, 2022

https://www.otcmarkets.com/filing/html?id=16200180&guid=2aG-kKevTCFAB3h

Common stock

On August 25, 2022, Data443 Risk Mitigation, Inc initiated a private placement transaction with certain “accredited investors,”...

...we offered and sold to the Investors a total of 829,000 shares of our common stock, par value $0.001 at a purchase price of $1.00 per share...

...private placement exemption from registration provided by Section 4(a)(2) of the Securities Act and by Rule 506 of Regulation D, promulgated thereunder and on similar exemptions under applicable state laws. The Offering closed November 4, 2022, and we will issue the shares to the investors in due course...

As of September 30, 2022 and December 31, 2021, 1,078,173 and 122,044 shares of Common stock were issued and outstanding, respectively.

From the June 2021 S1 filing

https://sec.report/Document/0001493152-21-013614/

"Our sole director and chief executive officer has the ability to control all matters submitted to stockholders for approval, which limits minority stockholders’ ability to influence corporate affairs."

"Our sole director and chief executive officer, Jason Remillard, holds 150,000 shares of our Series A Preferred Stock (each share votes as the equivalent of 15,000 shares of common stock on all matters submitted for a vote by the common stockholders), and as such, Mr. Remillard would be able to control all matters submitted to our stockholders for approval, as well as our management and affairs. For example, Mr. Remillard would control the election of directors and approval of any merger, consolidation, or sale of all or substantially all of our assets."

Haha , hell wait in line

Anyone want to buy my 3 shares after 3 splits for 10 bucks a pop?

Also it would seem to appear that the compliance manager has been removed from the companies profile for the otc .

Needs to receive well-written letters from a few shareholders... and their representatives, it appears...

I certainly misstated that number and it is much worse. LOL I haven't been paying much attention to this and apparently those buying big lots the past couple of weeks or haven't either. What a stinking mess. The big bump in the restricted shares was the regulation "D" offering last month. There must be some sort of anti dilution protections in that offering. 1.3 million new shares added to the OS since September 30th. 743K shares held at DTC and 914K of the OS is unrestricted so presumably 171K more are eligible to get into the game. Looking at the 1.4 million restricted minus the 829k that just went restricted we potentially have 642K shares that are eligible to go live on the unrestricted line. Why anyone would touch this with Jason's history is beyond me. ![]()

For the quarterly period ended September 30, 2022

https://www.otcmarkets.com/filing/html?id=16200180&guid=0FG-kHadOtpnQth

Common stock

....During the nine months ended September 30, 2022, we issued Common stock as follows:

> 288,885 shares issued for conversion of debt;

> 6,631 shares issued upon the cash-less exercise of warrants;

> 380,952 shares issued for consideration under an asset purchase agreement;

> 108,000 shares issued for conversion of Series A preferred stock;

> 153,491 shares issued for services;

> 18,170 shares issued as a loan fee in connection with the issuance of promissory notes; and

>

829,000 shares were subscribed for cash pursuant to private placement offering.

As of September 30, 2022 and December 31, 2021, 1,078,173 and 122,044 shares of Common stock were issued and outstanding, respectively.

OTC markets show the O/S right around 2.4 million

So the VP is also the CFO who has a pretty lucrative pay package including quarterly options awards which we discussed last week on this board. Those two form 4s are for "options" to buy and it wouldn't surprise me to learn that those big buys of the common the past 2 weeks was based on the notion that they actually bought in.

The fact is that they split this stock at the beginning of March which resulted in 125K outstanding shares. Weeks later Jason issued 800K new shares, most of which went into restricted status. These unregistered shares would require a 6 month holding period. If you look at the current outstanding share count increase it is where it was when it split about 1 million and the restricted share count is almost 1.5 million now. This is but a share selling scam and it appears to be much worse now.

There are many more to come because the 381K shares that Centurion received won't put but a dent in that $3.4 million ransomeware deal. The revenue is way off year over year so that software must be selling as poorly as PCMag rated it's effectiveness. ![]() Looks to me like Jason may be pulling his 4th reverse split in less than 4 years early into the new year. Watch the reduction in restricted share count for the timing. Jason has raised millions in the past selling shares at less than a dime so from here he is probably giddy with excitement. LOL Jason took the share price at the beginning of 2020 from the low $0.70s to a $0.01 in less than 4 months. Jason prints shares for free and that is the way that he conducts business.

Looks to me like Jason may be pulling his 4th reverse split in less than 4 years early into the new year. Watch the reduction in restricted share count for the timing. Jason has raised millions in the past selling shares at less than a dime so from here he is probably giddy with excitement. LOL Jason took the share price at the beginning of 2020 from the low $0.70s to a $0.01 in less than 4 months. Jason prints shares for free and that is the way that he conducts business.

March 2022 8:1 Stock Split 8K

https://sec.report/Document/0001493152-22-006663/

...The Certificate (i) reduced the number of authorized shares of common stock by a ratio of 1-for-8, resulting in one hundred twenty five million (125,000,000) authorized shares of common stock...

...Split was approved on March 7, 2022 and the Reverse Stock Split was effected on March 8, 2022...

For the quarterly period ended March 31, 2022

https://sec.report/Document/0001493152-22-014062/

NOTE 15: SUBSEQUENT EVENTS

Subsequent to March 31, 2022, the Company issued 807,663 shares of common stock as follows:

> 380,952 shares to Centurion Holdings LLC as part of the acquisition (see Note 1).

> 160,416 shares issued for conversion of debt and interest.

> 108,000 shares to our CEO for conversion of Series A Preferred Stock.

> 146,291 shares issued under a registration statement on Form S-8, to employees

and consultants for services.

> 7,200 shares issued for a restricted stock award.

> 4,804 shares to debt holders for commitment obligations.

Form 4 Jason Remillard

https://www.otcmarkets.com/filing/html?id=16208361&guid=8SG-knIyAU7-B3h

Form 4 McCraw Greg

https://www.otcmarkets.com/filing/html?id=16208351&guid=8SG-knIyAU7-B3h

The VP bought 41,800 shares November 15 at $1.70.

You mean massive buying lots over and over and over again and yet the stock price doesn’t move a damn bit. Haha the ask walls are always around 1-2 thousand and we see buying in the thousands and more and more but the wall doesn’t budge a damn bit. It actually seems that the ask price is then less even though all of the activity has been purchasing shares . I think Jason is shorting the stock the days he isn’t dumping his shares , which happens to be almost every day . But the dark pool activity seems to always be active as well . The market cap is now below a million again and no end in sight . When they move into the new offices I bet you it will take less than a month for an eviction notice to be filed

They have had some big buys go through without dropping the price. I don't get it. Now sell off today on much lower volume. Jason moved early to cash out those shares that he issued himself at .01. Hundreds of thousand of shares still waiting to get into the market and that won't stop Jason from issuing more. The revenue is well off the year over year number so that $3.4 million ransomware must be as useless as PC mag reviewed it to be. Jason may have bought his last pig in poke finally. LOL

He’s willing to risk the future of the company for his own selfish needs . What’s new , right . The fins and the companies future are looking more and more at stake and all he can do is continue to dump more shares

You’re right about that . Nowhere to be found is more like it for the SEC

Jason probably already cashed out that 108,000 shares at a penny. The date exercisable on the form 4 was 11/15/2017 which would probably be the date of the series "A" shares. Then there is the balance of the 800K shares issued two weeks after the reverse split earlier this year. Add another 931K shares with the new regulation "D" offering at a dollar. That is a lot of shares to get into the market before he needs another cash infusion to keep this tragedy operating. I don't know if even an annual reverse split will keep this going.

Where is the SEC when a business model is so clearly and simply about selling shares? The unloading of his controlling series "A" shares tells me that Jason himself admits that this is not sustainable. Looking at the volume for the past 10 days and it appears that traders are still buying into the story. Keep watching that restricted, unrestricted, and held at the DTC counts as it changes before the next date with the reverse split.

Form 4 April 2020

https://www.otcmarkets.com/filing/html?id=15751388&guid=02KwkegWbj3TB3h

For the quarterly period ended March 31, 2022

https://sec.report/Document/0001493152-22-014062/

NOTE 15: SUBSEQUENT EVENTS

Subsequent to March 31, 2022, the Company issued 807,663 shares of common stock as follows:

>380,952 shares to Centurion Holdings LLC as part of the acquisition (see Note 1).

>160,416 sharesissued for conversion of debt and interest.

>108,000 shares to our CEO for conversion of Series A Preferred Stock.

>46,291 shares issued under a registration statement on Form S-8, to employees and consultants for services.

>7,200 shares issued for a restricted stock award.

>4,804 shares to debt holders for commitment obligations.

Regulation "D" Offering 8K

https://app.quotemedia.com/data/downloadFiling?webmasterId=90423&ref=117039830&type=HTML&symbol=ATDS&companyName=Data443+Risk+Mitigation%2C+Inc.&formType=8-K&formDescription=Current+report+pursuant+to+Section+13+or+15%28d%29&dateFiled=2022-11-07&CK=1068689

...with each Investor pursuant to which we offered and sold to the Investors a total of 931,000 shares of our common stock, par value $0.001 (the “Common Stock”), at a purchase price of $1.00 per share, for aggregate gross proceeds of approximately $931,000. We intend to use the net proceeds from the sale of the Common Stock for general corporate purposes....

I was referencing the form 4 for the CFO and didn't pay close attention to Jason's form 4. The CFO is entitled to restricted stock and and stock options totaling $80K a quarter? That kind of money could make one as a big a crook as Jason. LOL Would certainly give him incentive to move some shares same as Jason. Looks like that form 4 issuing options for 41,800 shares at $1.70 would cover 2 quarters per the employment agreement.

CFO employment 8K

https://app.quotemedia.com/data/downloadFiling?webmasterId=90423&ref=117067428&type=HTML&symbol=ATDS&companyName=Data443+Risk+Mitigation%2C+Inc.&formType=4&formDescription=Statement+of+changes+in+beneficial+ownership+of+securities&dateFiled=2022-11-16&CK=1068689

https://app.quotemedia.com/data/downloadFiling?webmasterId=90423&ref=116938596&type=HTML&symbol=ATDS&companyName=Data443+Risk+Mitigation%2C+Inc.&formType=8-K&formDescription=Current+report+pursuant+to+Section+13+or+15%28d%29&dateFiled=2022-09-08&CK=1068689

In connection with his appointment, Mr. McCraw will be entitled to an annual base salary in the amount of $180,000, and quarterly grants of restricted stock awards and incentive stock options in amounts equivalent to $45,000 and $35,000, respectively. Mr. McCraw will also be eligible to participate in the Company’s bonus plan, with Mr. McCraw’s eligible bonus payment to be based on achievement of certain performance objectives and goals.

This should clear up any confusions . If he purchased the shares the price of the security purchased wouldn’t be totaling to 0 dollars also the options do expire in 2027 . Jason would

Of had to of purchased the options at certain price in which he didn’t . He’s issued himself around 400-500k shares and the first stock option he purchased earlier in the year was around 108k and he purchased those shares at a penny

Item 1(Title of Derivative Security ) states "Options to Purchase Common Stock". It doesn't appear to me that any actual transaction has taken place as of yet and the options don't expire until 2032. Jason's end game with everything he does is to separate retail traders from their cash through the sales of worthless paper. I'm sure that he didn't expect PC Mag to test his latest $3.4 million ransomware acquisition and rate it so poorly. The revenue is well off 2021 numbers and the liquidity in this market has dried up.

But was he buying? Or received shares in lieu of cash payment??

Looks like 2 form 4s for "options", nothing more to take from it. I probably duped some into buying.

https://www.nasdaq.com/market-activity/stocks/atds/sec-filings

What is Jason up to now? There are a number of filings recently including the S-1. You know Jason is diluting when he releases a lot of filings and starts promoting heavily. I see decent volume today and find it hard to believe that traders would touch this stock.

https://www.nasdaq.com/market-activity/stocks/atds/sec-filings

https://app.quotemedia.com/data/downloadFiling?webmasterId=90423&ref=117039830&type=HTML&symbol=ATDS&companyName=Data443+Risk+Mitigation%2C+Inc.&formType=8-K&formDescription=Current+report+pursuant+to+Section+13+or+15%28d%29&dateFiled=2022-11-07&CK=1068689

...In connection with the Offering, we entered into a securities purchase agreement (“Securities Purchase Agreement”) with each Investor pursuant to which we offered and sold to the Investors a total of 931,000 shares of our common stock, par value $0.001 (the “Common Stock”), at a purchase price of $1.00 per share, for aggregate gross proceeds of approximately $931,000....

Statement of Changes in Beneficial Ownership (4)

Source: Edgar (US Regulatory)

FORM 4

[ ] Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

OMB APPROVAL

OMB Number: 3235-0287

Estimated average burden

hours per response... 0.5

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

1. Name and Address of Reporting Person *

McCraw Greg 2. Issuer Name and Ticker or Trading Symbol

Data443 Risk Mitigation, Inc. [ ATDS ] 5. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Vice President and CFO

(Last) (First) (Middle)

4000 PARK DRIVE, SUITE 400 3. Date of Earliest Transaction (MM/DD/YYYY)

11/15/2022

(Street)

RESEARCH TRIANGLE PARK, NC 27709

(City) (State) (Zip)

4. If Amendment, Date Original Filed (MM/DD/YYYY)

6. Individual or Joint/Group Filing (Check Applicable Line)

_X _ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

1.Title of Security

(Instr. 3) 2. Trans. Date 2A. Deemed Execution Date, if any 3. Trans. Code

(Instr. 8) 4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) 5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4) 6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4) 7. Nature of Indirect Beneficial Ownership (Instr. 4)

Code V Amount (A) or (D) Price

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

1. Title of Derivate Security

(Instr. 3) 2. Conversion or Exercise Price of Derivative Security 3. Trans. Date 3A. Deemed Execution Date, if any 4. Trans. Code

(Instr. 8) 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) 6. Date Exercisable and Expiration Date 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) 8. Price of Derivative Security

(Instr. 5) 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) 11. Nature of Indirect Beneficial Ownership (Instr. 4)

Code V (A) (D) Date Exercisable Expiration Date Title Amount or Number of Shares

Options to Purchase Common Stock $1.7 11/15/2022 A 41800 11/15/2022 11/15/2032 Common Stock 41800 $0 41800 D

Explanation of Responses:

Reporting Owners

Reporting Owner Name / Address

Relationships

Director 10% Owner Officer Other

McCraw Greg

4000 PARK DRIVE, SUITE 400

RESEARCH TRIANGLE PARK, NC 27709

Vice President and CFO

Signatures

/s/ Greg McCraw 11/16/2022

**Signature of Reporting Person Date

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

* If the form is filed by more than one reporting person, see Instruction 4(b)(v).

** Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

Note: File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure.

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid

Idk for sure but if the CFO is buying, watch it.

So what you saying. They got their act together?

The CFO bought shares and I reckon he knows what’s going on with the company.

Look at 3 months chart — how pathetic and ill-conceived was that 1/8 RS...

Sure wish they’d get there act together.

$3.4 million Centurion deal for the ransomware product that PC mag rated as fair. They also noted that "Shortly after we published this review, Data443 Ransomware Recovery Manager was pulled from the market. The balance sheet looks as bad as ever now. Those new shares purchased for .01 to pay for the deal and others likely went into restricted status for the rule 144 waiting period of 6 months. Those will be eligible to hit the market soon. One thing is for certain, trading losses will be the source of funding as it always has.

Data443 Reports Second Quarter and First Half 2022 Results and Provides Corporate Update

August 16, 2022 09:53 ET | Source: Data443 Risk Mitigation, Inc.

https://www.globenewswire.com/en/news-release/2022/08/16/2499279/0/en/Data443-Reports-Second-Quarter-and-First-Half-2022-Results-and-Provides-Corporate-Update.html

Liquidity:

As of June 30, 2022, we had no cash and a bank overdraft of $3,781 and our principal sources of liquidity were trade accounts receivable of $231,507 and prepaid, advance payment for acquisition of $2,726,188 and other current assets of $27,950, as compared to cash of $1,204,933, trade accounts receivable of $21,569 and prepaid and other current assets of $70,802 as of December 31, 2021.

The net loss for the six months ended June 30, 2022 was $4,279,531 compared to a loss of $3,721,652 for the six months ended June 30, 2021.

Centurion purchase agreement 8K

https://sec.report/Document/0001493152-22-002091/#index.html

4.3.2. Payment. The Purchase Price, as determined above, shall be payable in the following form and manner:

(a) Two Hundred Fifty Thousand Dollars ($250,000) payable in cash at Closing in the form of a wire transfer of immediately available funds in accordance with instructions to be provided by Seller.

(b) Two Million Nine Hundred Thousand Dollars ($2,900,000) payable pursuant to a promissory note issued by Data443 in favor of Seller at Closing in the form mutually agreed to by the Parties (the “Note”).

(c) Two Hundred Fifty Thousand Dollars ($250,000) in the form of a contingent payment, as further described in Section 4.5, below (the “Contingent Payment”).

PC Magazine Ransomware Review.

https://www.pcmag.com/reviews/data443-ransomware-recovery-manager

...Unfortunately, that ransomware protection didn’t prove out in our hands-on testing...

Editors' Note: Shortly after we published this review, Data443 Ransomware Recovery Manager was pulled from the market. If it becomes available again, we will retest it and update this review accordingly.

For the quarterly period ended March 31, 2022

https://sec.report/Document/0001493152-22-014062/

Subsequent to March 31, 2022, the Company issued 807,663 shares of common stock as follows:

> 380,952 shares to Centurion Holdings LLC as part of the acquisition (see Note 1).

> 160,416 shares issued for conversion of debt and interest.

> 108,000 shares to our CEO for conversion of Series A Preferred Stock.

? 146,291 shares issued under a registration statement on Form S-8, to employees and consultants for services.

> 7,200 shares issued for a restricted stock award.

> 4,804 shares to debt holders for commitment obligations.

Not if it gets above $4 in its own.

Looks like Jason will need another reverse split soon. LOL. Wait, Jason, Centurion, and others own nearly all the stock now. I hope they choke on it.

Someone keeps selling 1,000 shares trades. Is it Jason???

What a complete Sh*tSh*w this has become. This is the first press release that went into such detail about the quarterly numbers and it doesn't look good. One glaring omission in the press release is anything about their latest acquisition. LOL $3.4 million Centurion deal for the ransomware product that PC mag rated as fair. They also noted that "Shortly after we published this review, Data443 Ransomware Recovery Manager was pulled from the market." It doesn't look like traders will be bailing Jason out this time. Karma. ![]()

Data443 Reports Second Quarter and First Half 2022 Results and Provides Corporate Update

August 16, 2022 09:53 ET | Source: Data443 Risk Mitigation, Inc.

https://www.globenewswire.com/en/news-release/2022/08/16/2499279/0/en/Data443-Reports-Second-Quarter-and-First-Half-2022-Results-and-Provides-Corporate-Update.html

Liquidity:

As of June 30, 2022, we had no cash and a bank overdraft of $3,781 and our principal sources of liquidity were trade accounts receivable of $231,507 and prepaid, advance payment for acquisition of $2,726,188 and other current assets of $27,950, as compared to cash of $1,204,933, trade accounts receivable of $21,569 and prepaid and other current assets of $70,802 as of December 31, 2021.

The net loss for the six months ended June 30, 2022 was $4,279,531 compared to a loss of $3,721,652 for the six months ended June 30, 2021.

https://sec.report/Document/0001493152-22-002091/#index.html

4.3.2. Payment. The Purchase Price, as determined above, shall be payable in the following form and manner:

(a) Two Hundred Fifty Thousand Dollars ($250,000) payable in cash at Closing in the form of a wire transfer of immediately available funds in accordance with instructions to be provided by Seller.

(b) Two Million Nine Hundred Thousand Dollars ($2,900,000) payable pursuant to a promissory note issued by Data443 in favor of Seller at Closing in the form mutually agreed to by the Parties (the “Note”).

(c) Two Hundred Fifty Thousand Dollars ($250,000) in the form of a contingent payment, as further described in Section 4.5, below (the “Contingent Payment”).

PC Magazine Ransomware Review.

https://www.pcmag.com/reviews/data443-ransomware-recovery-manager

...Unfortunately, that ransomware protection didn’t prove out in our hands-on testing...

Editors' Note: Shortly after we published this review, Data443 Ransomware Recovery Manager was pulled from the market. If it becomes available again, we will retest it and update this review accordingly.

I wouldn't exactly call that messy write-up an official looking filing. They file the 8K on the SEC EDGAR site but not the 2021 annual or the Q2. As usual something always stinks with this stock. It sure looks to me like he is hiding something.

The price is back to the level before the split with nearly the same outstanding share count. Looking at my notes I had 1,063,068 on 02/28/2022 taken from the OTC site. Looking at the share structure the bulk of the new shares issued went into the restricted column. Not sure how that works but are restricted shares that are not vested affected by another reverse split?

Anyone at this point who doesn't believe Jason would do another split is a fool in my opinion. Look at the difference between the Unrestricted and the DTC number. Looks like there are a lot of shares waiting to get into the game. If he splits again those will be dumped before hand.

https://www.otcmarkets.com/stock/ATDS/security

Outstanding Shares 1,078,173 09/30/2022

Restricted 542,985 09/30/2022

Unrestricted 535,188 09/30/2022

Held at DTC 356,716 09/30/2022

For the quarterly period ended March 31, 2022

https://sec.report/Document/0001493152-22-014062/

NOTE 15: SUBSEQUENT EVENTS

Subsequent to March 31, 2022, the Company issued 807,663 shares of common stock as follows:

> 380,952 shares to Centurion Holdings LLC as part of the acquisition (see

Note 1).

> 160,416 shares issued for conversion of debt and interest.

> 108,000 shares to our CEO for conversion of Series A Preferred Stock.

> 146,291 shares issued under a registration statement on Form S-8, to

employees and consultants for services.

> 7,200 shares issued for a restricted stock award.

> 4,804 shares to debt holders for commitment obligations.

I don’t but it’s on IHub

|

Followers

|

614

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

112648

|

|

Created

|

06/28/02

|

Type

|

Free

|

| Moderators | |||

New $300k toxic note courtesy of maxim

Latest 10-Q observation

NOTE 3: LIQUIDITY AND GOING CONCERN

The accompanying consolidated financial statements have been prepared (i) in accordance with accounting principles generally accepted in the United States, and (ii) assuming that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. After a period of no income, the Company has recently generated increasing income. However, the Company is subject to the risks and uncertainties associated with a business with growing revenue, as well as limitations on its operating capital resources. These matters, among others, raise substantial doubt about the ability of the Company to continue as a going concern. These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should the Company be unable to continue as a going concern. In light of these matters, the Company’s ability to continue as a going concern is dependent upon the Company’s ability to raise capital and generate revenue and profits in the future.

Summary

Data443 Rik Mitigation (ATDS: OTC) is a solid and fast-growing cyber security company that has seen its shares falling from $1.09 in the past 12 months to 1 cent within the past week. The company has been growing, but convertible note holders have been liquidating without regard to price and have consequently created an extremely undervalued opportunity for investors.

Adds Sophisticated Content Analysis and Intelligent Content Migration Capabilities to Growing Software-as-a-Service (SaaS) Portfolio

RESEARCH TRIANGLE PARK, NC, Aug. 20, 2020 (GLOBE NEWSWIRE) -- Data443 Risk Mitigation, Inc. (“Data443” or the “Company”) (OTCPK: ATDS), a leading data security and privacy software company, is pleased to announce that it has acquired the intellectual property rights and assets of FileFacets®, a Software-as-a-Service (SaaS) platform that performs sophisticated data discovery and content search of structured and unstructured data within corporate networks, servers, content management systems, email, desktops and laptops.

The acquisition has closed, and all assets have been transferred. Terms of the transaction were not disclosed.

8K Filing August 21st 2020

On August 17, 2020, following receipt of written approval from stockholders acting without a meeting and holding at least the minimum number of votes that would be necessary to authorize or take such action at a meeting, Data443 Risk Mitigation, Inc. (the “Company”) filed a Certificate of Amendment to the Articles of Incorporation with the Secretary of State of the State of Nevada to increase the number of authorized shares of common stock from 750,000,000 to 1,500,000,000, effective August 17, 2020. The Certificate of Amendment is attached to this Current Report as Exhibit 3.1. All descriptions of the Certificate of Amendment herein are qualified in their entirety to the text of Exhibit 3.1 hereto, which is incorporated herein by reference.

On August 17, 2020, the holders of 86% of the issued and outstanding shares of stock of the Company entitled to vote took action by their written consent and without a meeting, pursuant to Nevada Revised Statute 78.320. The number of shares entitled to vote was deemed to be 2,620,701,789, representing the total number of issued and outstanding shares of (i) common stock; and, (ii) Series A Preferred Stock converted into common stock for purposes of voting. The Certificate of Amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of common stock from 750,000,000 to 1,500,000,000 was approved. 2,250,000,000 shares were voted in favor of the Amendment, and such stockholders signed a written consent taking such action without a meeting or involvement of the Company. The written consent was delivered to the Company on August 17, 2020. | SUBJECT TO |

Rapidly combining some of the best DRM, eDiscovery, Classification, Identity Governance and DLP technologies into a solution positioned for Privacy and Compliance activities – across virtually any data source and device. The only provider to offer a full GDPR/CCPA request management platform, and an open sourced platform that has over 10,000 active installations.

The ARALOC Boardroom by Data443™ Content Distribution and Board Management System provides custom configured and branded native apps to streamline your corporate board governance and security guidelines. The only product on the market that features an array of user-friendly board content publishing and distribution automation controls, Boardroom requires minimal training and support. Using THE ARALOC Content Library, board members can use dedicated apps to view board materials from their mobile or desktop devices online or offline. With industry-leading fully enabled Rich Media Support, members are able to upload and encrypt all file formats for distribution. System notifications and automatic synchronization ensure board members always have the most recent board content materials. Multi-level views allow multiple boards to be houses and controlled from one central location.

GDPR Compliance

The GDPR Framework WordPress Plugin by Data443 allows for an easy, fast and cost-effective compliance solution for the GDPR. Achieve a fast time-to-value with 12 GDPR articles being met straight out-of-the-box. In a few clicks you can handle DSARs, consent, report and many other GDPR requirements. We are developer-friendly. Everything can be extended; every feature and template can be overridden. We are excited to announce we just hit 100k downloads and 10k active installations.

CCPA Compliance

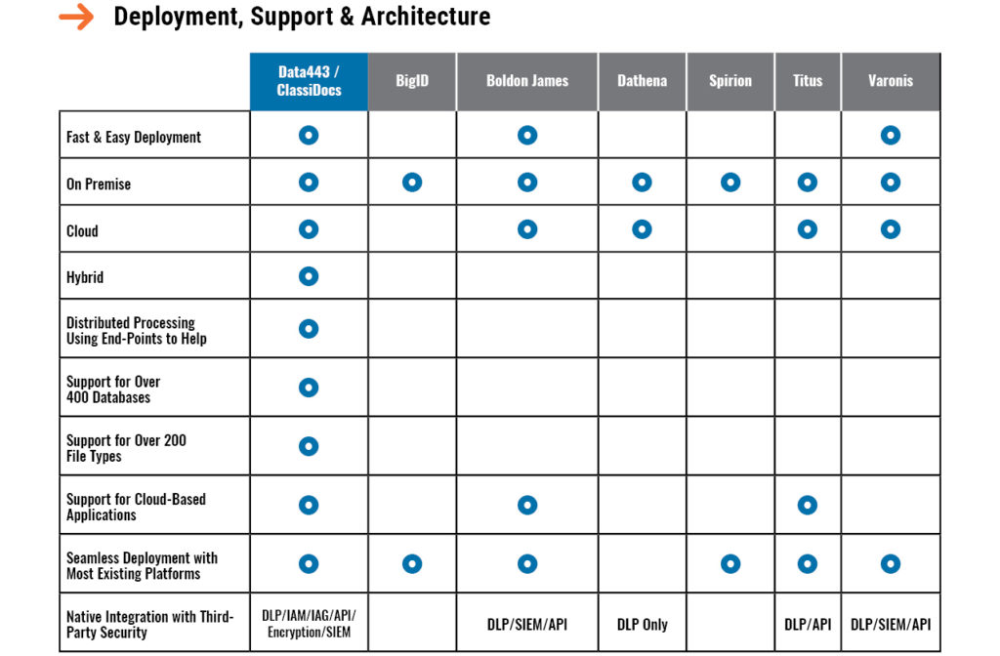

Data443 ClassiDocs™ allows for an easy, fast and cost-effective compliance solution for the new CCPA. Achieve a fast time-to-value with the five key requirements of CCPA being met straight out-of-the-box. Data443 ClassiDocs™ supports over 200 file types and 400 databases while integrating with your existing DLP/CASB/SIEM/Cloud Solutions. Data443 ClassiDocs™ is the solution for classification, governance, and discovery across all data sources.

ClassiDocs™ takes the effort out of classifying your data by applying the same rules, technology, machine learning, and ongoing classification stewardship throughout the organization. This ensures always-accurate, continually relevant data security for your whole IT estate. ClassiDocs™ is purposefully user-centric to increase adoption and adherence with no training. Ease-of-use control with minimal interruptions and your-company-specific branding allows users to engage quickly and make fewer mistakes. Administration is simple via an easy-to-understand, centralized control panel that delivers both preset and customizable analytics.

RESEARCH TRIANGLE PARK, NC, July 29, 2020 – Data443 Risk Mitigation, Inc. (“Data443” or the “Company”) (OTCPK: ATDS), a leading data security and privacy software company, today announced that it has appointed Mr. Omkhar Arasaratnam, a 20-year expert in information technology and leadership in global cybersecurity projects to its Advisory Board effective immediately.

Mr. Arasaratnam currently serves as Director of Engineering, Assurant Security for Google LLC, and is a Senior Fellow with the NYU Center for Cybersecurity at the NYU Tandon School of Engineering, and a member of the NYU Cyber Fellow Advisory Council. Previously, Mr. Arasaratnam served as Executive Director of Data Project Engineering at JPMorgan Chase, and has previously led security organizations at financial and technology institutions, such as Credit Suisse, Deutsche Bank, TD Bank Group, and IBM. In this capacity, he has revolutionized the effectiveness of cybersecurity controls. He is an accomplished author with several granted patents and has led contributions to many international standards.

DATA443 RISK MITIGATION PROVIDES BUSINESS UPDATE

RESEARCH TRIANGLE PARK, NORTH CAROLINA – (July 13, 2020) – Data443 Risk Mitigation, Inc. (“Data443” or the “Company”) (OTCPK: ATDS), a leading data security and privacy software company, today provided updates on its current business and financing arrangements:

Completed Payments to Modevity, LLC for the ARALOC™ platform, the Secure Private Data Storage, Protection, and enablement platform

As previously disclosed, on October 22, 2018, Data443 acquired all technology, sales assets, and customers of Modevity’s enterprise cloud-based data storage, protection, and workflow automation platform, ARALOC™. ARALOC continues to lead the industry with Digital Rights Management, Secure Content Distribution and nearly instant large organization implementation. Data443 continues to innovate with the product and will have forthcoming product and customer announcements in the near term. Additionally, Data443 has now remitted to Modevity all amounts due under the purchase transaction (over $1.2MM USD) and owes no further amounts or any other consideration to Modevity.

Reached Shareholder-Friendly Forbearance Agreements for Outstanding Convertible Notes

Effective July 1, 2020, Data443 entered into privately negotiated agreements with a number of existing holders of the company’s outstanding convertible notes, which is intended to reduce short-term debt obligations of the company, while also deferring a significant amount of debt which otherwise could have been converted into common stock. The revised terms of these existing convertible notes can be found in the Form 8-K that was filed by the Company on July 10, 2020, which can be accessed at:

https://www.sec.gov/Archives/edgar/data/1068689/000149315220013083/form8-k.htm

Data443 Risk Mitigation, Inc. (OTCPK: ATDS), a leading data security and privacy software company, announced today that it has completed its corporate actions with FINRA and began trading today with its new symbol – ATDS: All Things Data Security™.

Key Takeaways:

Over only the past two years, the company has combined the technology, people and revenue assets of 5 product lines to form one of the fastest growing data privacy organization on the market. These products on their own are market leaders in individual segments of the data security, compliance and governance marketplace.

Jason Remillard, Founder and CEO of Data443 stated, “The wide operating platform we have built has two main purposes – provide a foundation for operating revenues for the company and provide a supporting platform for our forthcoming privacy enablement platforms. We have more announcements coming in both areas in the near term – I am proud of the work of the whole team bringing this all together with all of our constraints – it is a considerable accomplishment!”

Data443 Risk Mitigation, Inc. (OTCPK: LDSRD), a leading data security and privacy software company, today reported operating results for the three and nine months ended September 30, 2019, including net revenue of $628,000 for the quarter, and strong billings growth quarter over quarter. Net billings represent actual sales which include revenues to be deferred over the term of the contract periods.

Jason Remillard, CEO of Data443, commented, “We delivered strong third quarter and nine-month results and continue to make solid progress towards achieving our long-term goals in delivering a complete data privacy, security and governance ecosystem that is unique and unrivaled in the marketplace. I’m very pleased with the seamless integration of DataExpressTM into the Company, along with achieving a significant customer renewal, and more to come! There’s no question that the last several months have been challenging in terms of our recent corporate actions, but I’m very proud of our team for keeping focused on the tasks at hand.”

“As we look towards the end of 2019, we expect to end the year at a very active pace, both commercially, as well as at the corporate level. As of today, we are less than two months away from the California Consumer Privacy Act (CCPA) taking effect, the first significant data consent and privacy legislation in the United States, perhaps the most comprehensive regulations since GDPR. Many companies don’t understand that preparations need to be made now, before the regulation (and enforcement) goes into effect on January 1, 2020. This poses an incredible opportunity to drive home the importance of mitigating these compliance risks, positioning our sales staff to deliver more education and demos, with the goal of increasing our already growing customer base.

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443 Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today announced another major client win within its DataExpress™ NonStop (DXNS) Secure Managed File Transfer Service. The customer is a leading global payments technology company that operates in over 200 countries and territories worldwide.

The customer approached Data443 with the following key business challenges:

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443 Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today announced it has completed the acquisition of DataExpress™, one of the world’s leading vendors for secure sensitive data transfer for hybrid cloud.

Key Takeaways:

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443 Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today announced continued momentum in its product line with the addition of high-profile new data sources to enable in CCPA, GDPR, eDiscovery, archiving and data retention requirements.

The growing platform list of integrations include support for leading social media channels such as Twitter, Facebook, Instagram and LinkedIn. These platforms are rife with potential privacy information and have a large part to play in any litigation response.

Within ArcMail’s recently released Hybrid Cloud/On-Premise Software Subscription service, customers are enabled to search faster, store smarter, and protect better in light of increasing data privacy and compliance requirements. For highly-regulated industries like education, financial services, and government, ArcMail’s Hybrid Cloud/On-Premise Software Subscription service allows the organization to leverage a subscription-based service for full and continuous coverage, while reducing IT burden and spend.

TheAccessHub™ accelerates Identity Governance time-to-value by more than 2,600 percent

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, and N8 Identity, Inc. the leader in agile, cloud-based identity governance solutions, today announced a major client win following a three-month pilot.

The new client, a global NYC-based 1.4B market cap NYSE-traded organization, approached Data443 and N8 Identity with the following key business challenges...

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, today announced the completion of joint efforts with finance partners resulting in the favorable new terms on existing debt. Additionally, the Company has received notice of final conversion of the $125,000 legacy convertible note issued by the Company in 2014 and subsequently acquired by Blue Citi LLC (“Blue Citi”).

Effective June 19, 2019 the Company and three existing note holders have agreed as follows:

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, announced today that it has received notice from the Securities and Exchange Commission (the “SEC”) that the SEC has completed its review of the Form 10 Registration Statement as filed with the SEC on January 11, 2019; and, amended on April 24, 2019. The Form 10 was effective as of March 12, 2019. The completion of review by the SEC further confirms the Company’s commitment to being subject to the reporting requirements of the SEC, and specifically of the Exchange Act of 1934, as amended. While the Company has already filed an Annual Report on Form 10-K and five (5) periodic reports on Form 8-K since the filing of the Form 10, the Company will not be required to file any further amendments to the Form 10.

Jason Remillard, Chief Executive Officer of the Company and founder of Data443, said, “The completion of the review of our Form 10 by the SEC is yet another milestone achieved in our continued growth. We view it as a validation of our reporting process and financial management, which continues to evolve. Similar to when the Form 10 went effective back in March, this also underscores our commitment to provide our investors with transparency and accountability.”

“We are excited to bring Mr. Dawson onto the Data443 team to help us achieve our growth goals and support both our investor and client communities,” said Jason Remillard, founder and CEO of Data443. “His expertise will make an immediate and long-term impact on our business and we are especially enthusiastic about his ability to build and manage finance and accounting practices within complex, highly-regulated industries.”

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today filed its Form 10-K with the U.S. Securities and Exchange Commission (the “SEC”) to disclose its financial results for the fourth quarter and fiscal year ended December 31, 2018.

Key Takeaways:

Management Commentary:

Jason Remillard, Founder of Data443 and CEO of LandStar, commented, “2018 was much more than a transitional year for LandStar; it was a major foundational year in which we established the platform that the Company is being built upon. I’m excited to say that we are now at the point where we can accelerate the pace of our planned corporate actions, as well as continue on our product development and acquisition roadmap.”

“These results only validate what has been our growth strategy all along; to acquire highly successful companies with complementary technologies and skill-sets that can easily fit and rapidly enhance our market positioning, provide a healthy customer base, and that are accretive to our bottom-line. I’m happy to report our initial revenues, and look forward to subsequent quarterly reports, when the full-quarter’s contribution of revenues from our acquired businesses will be reflected in our financial statements.”

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, announced that it is has launched its online ordering platform for the ARALOC™ Board Management product.

Jason Remillard, Chief Executive Officer of LandStar and founder of Data443™, commented, “As we continue our marketing campaigns, the ability to order and provision online is an important step in the customer buying journey. Our trial and buy portal has been long planned and we are pleased to offer several different editions of the leading ARALOC Board Management Software platform. We will introduce more purchase options for the ARALOC platform and the rest of our product catalogue over the near Our existing stockholders may experience significant dilution from the sale of our common stock pursuant to the Financing Agreement.

The sale of our common stock to PAG Group, LLC in accordance with the Financing Agreement may have a dilutive impact on our stockholders. As a result, the market price of our common stock could decline. In addition, the lower our stock price is at the time we exercise our put options, the more shares of our common stock we will have to issue to PAG in order to exercise a put under the Financing Agreement. If our stock price decreases, then our existing stockholders would experience greater dilution for any given dollar amount raised through the offering.

The perceived risk of dilution may cause our stockholders to sell their shares, which may cause a decline in the price of our common stock. Moreover, the perceived risk of dilution and the resulting downward pressure on our stock price could encourage investors to engage in short sales of our common stock. By increasing the number of shares offered for sale, material amounts of short selling could further contribute to progressive price declines in our common stock.

PAG Group, LLC will pay less than the then-prevailing market price of our common stock, which could cause the price of our common stock to decline.

Our common stock to be issued under the Financing Agreement will be purchased at a ten percent (10%) discount, or ninety percent (90%) of the lowest closing price for our common stock during the ten (10) consecutive trading days immediately preceding the date on which we issue a Put Notice to PAG (as provided for in the Financing Agreement).

PAG has a financial incentive to sell our shares immediately upon receiving them to realize the profit between the discounted price and the market price. If PAG sells our shares, the price of our common stock may decrease. If our stock price decreases, PAG may have further incentive to sell such shares. Accordingly, the discounted sales price in the Financing Agreement may cause the price of our common stock to decline.

We may not have access to the full amount under the Financing Agreement.

The lowest closing price of our common stock during the ten (10) consecutive trading day period immediately preceding the filing of this Registration Statement was approximately $0.26. At that price we would be able to sell shares to PAG under the Financing Agreement at the discounted price of $0.234. At that discounted price, the 4,046,995 shares would only represent $946,997, which is far below the full amount of the Financing Agreement.

"Data443 has joined forces with Business Partner Solutions, Inc. (BPS), a U.S.-based security focused value-added reseller (VAR). Founded in 2005, BPS is a certified CPUC and Woman Owned and Operated enterprise, a proven go-to for security VAR focused on providing emerging but proven security and compliance solutions to its customers. These clients include many Fortune 500 companies, public utilities, healthcare and retail. The partnership expands U.S. market coverage for Data443’s growing portfolio of products and aligns the company with a leading reseller that has specific expertise in data security, privacy compliance, and risk mitigation."

Data443, a leading data security and privacy company, announced today the completion of the audit of its Consolidated Annual Financial Statements for the fiscal years ending December 31, 2016 & 2017. An independent auditor (which is a PCAOB registered accounting firm) completed two consecutive years of the audits of the Company’s financial statements within the guidelines of Generally Accepted Accounting Principles (GAAP). The results will be filed without delay with OTC Markets as an amendment to the Company’s previously filed financials for its year ending December 31, 2017.

https://www.data443.com/pr-n8-letter-of-intent/

Recorded audio of the session can be accessed here:

https://www.data443.com/investor-faq/

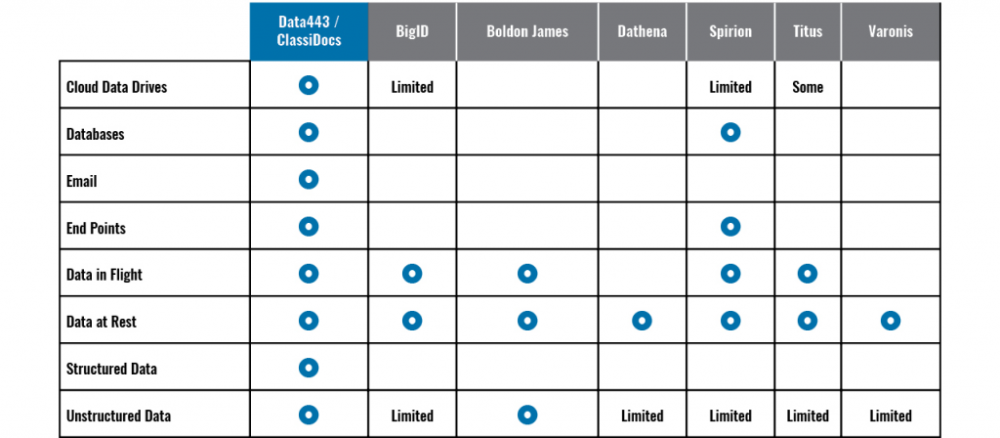

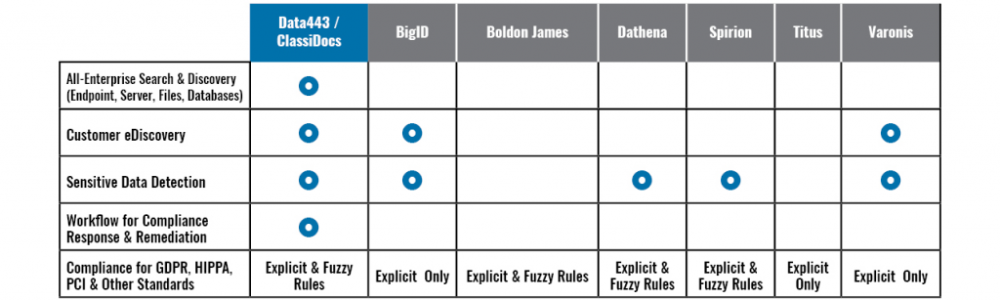

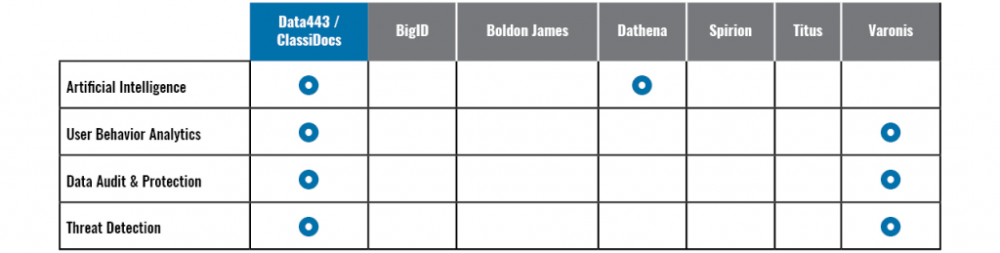

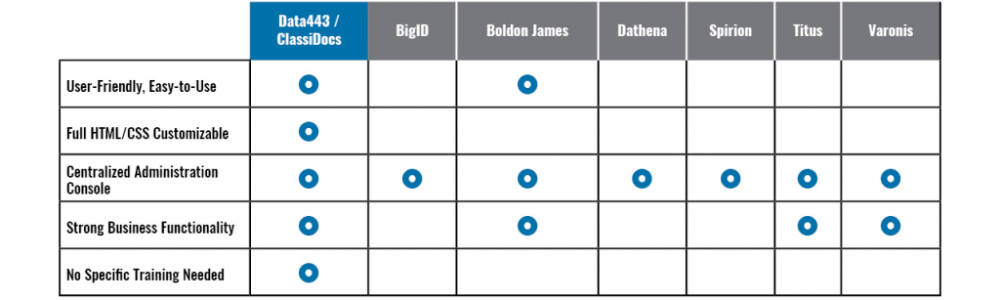

Data443/ClassicDocs Competitive Review

\

\

\

\

\

\

\

Classidocs Pricing

ARALOC Pricing

WORD PRESS PLUGIN INFO

Data443 Secures Global Rights to Leading WordPress GDPR Solution

https://wordpress.org/plugins/gdpr-framework/advanced/

| Today | 188 |

|---|---|

| Yesterday | 156 |

| Last 7 Days | 2,877 |

| All Time | 232,028 |

"A Serious Effort at GDPR Compliance. GDPR compliance is a complicated matter. Definitely not something you want to wing by yourself. And definitely not something you want to ignore. The obvious solution is a plugin that guides you through the process of making your site compliant. This plugin is the easiest and most comprehensive attempt that I have found so far. It has a wizard that walks you through the setup and lots of options you can configure afterward. It even builds a page where users can download and delete their personal data. It’s written by developers for developers, so you can customize just about everything. In today’s world, you’d expect to pay a hefty annual subscription for something like this. But the developers are providing it for free. All they’re asking is a five-star review, and I’m happy to give it to them. Thanks guys!"

"My colleagues and I are amazed at the functionality of this plugin. We researched many solutions to adding GDRP compliance to our client’s sites and your FREE plugin was the best. The documentation you include was essential to our understanding of GDRP.

We were also impressed at how fast the support team responded with fix a recent glitch with a new feature."

"This plugin cuts the time it takes to understand the new guidelines in half! So easy to use, everyone should be using it."

"Very happy with this plugin. There is attention to detail and it works well for visitors wanting to download the data we have. Very much hope they add the cookie policy part soon so we can have everything just under this one plugin. Big thanks and appreciation to the developers "

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |