Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

hi 'cosmiclifeform'

I think the first Traitor was tony frudakis himself-This young conservative intellectual RAT, who left the sinking DNAG ship; did not even mentioned about dnaprint on his Linkedin Profile: http://www.linkedin.com/pub/tony-frudakis/4b/aa2/455

still holding my original 66k shares "as a great reminder of" y2k:)...good to see you here again- always good to remember old times and old friends (especially 'frogdreaming'![]() . God Bless

. God Bless

lol lol long on none exziting company that was a scam to begin with buy more

Medical Marijuana is becoming legal on the state of Florida, Were DNAG was corporate at one time maybe one of those old patent will work on the next generation marijuana treatment.

Maps

Good luck to all longs....

I made a mistake on my previous post. The date should be July 12, 2005 instead of July 7, 2005.

Sorry,

Gus Harrell

withus1w

Read post #74362 on this board. It states that the reverse split occurred on July 7, 2005. I don't know his source for this information. You may want to verify its accuracy.

Good Luck,

Gus harrell

Told everyone this stock was over with a long time ago

List of accredible industries:

DNAP on list...

http://www.fda.gov/downloads/AboutFDA/WorkingatFDA/Ethics/UCM239183.pdf

Take care,

Ann

can anyone tell me the exact date of the 20 to 1 reverse split, I have finally sold my shares and need to get my records together for taxes.

Thanks for any help

<<<"Is there any value at all to this stock? I thought it went bankrupt">>> NO.......IT DID

<<<"Is there any value at all to this stock? I thought it went bankrupt">>>

Is there any value at all to this stock? I thought it went bankrupt.

Ahhh good old DNAG, "The Worlds Most Undervalued Stock" according to my old friend Mr. Gannon.

It's about time. Seems to take the SEC a long time to catch up with these scams... a long time after the money has all gone away.

THIS STOCK IS A DOG! DON'T BUY. TMMI TRUDEF is the real deal!. research www.tmmi.us www.trudefblog.us This company DNAG missed the boat, it has sailed buh bye......

DNAG is looking great at this level

DNAG is looking great at this level

200% spread too......meaning you can buy and automatically be minus 67% in the blink of an eye....what a deal,,,,,,again!!!

Well put. Hurts just to look at them again.

DNAG is looking good at this level

+(DNAG)+ I owned this stock back in 2004 (buy-in $0.06 / sold $0.095) before the company folded back in 2009. This may be it's "shell" still out here so be very careful on investing into this one.

"DNAPrint Genomics was a genetics company with a wide range of products related to genetic profiling. They provided forensic and consumer products, mostly based around finding "Ancestry Informative Markers" in DNA samples that they claimed enabled them to correctly identify the ancestry of a human based on a sample of their DNA. The company ceased operations in February 2009."

IT'S PICK THE TOMATOES!! TIME TO MAKE THE DONUTES!!

HUGE RTO IS ON THE WAY HERE!!! STAY TUNED THIS OLD GARBAGE BIN WILL PREVAIL!!

HOLD ON TIGHT FOLKS NEWS IS ON THE WAY HERE,IT'S BEEN TOOO LONG NOW

you got that right!

Is it just a SHELL?

It is hard to divorce yourself, from a penny stock you have owned, and thought it would make you millions of dollars. When the dust settles and the divorce is final, there is a lot of bitterness and tons of name calling. A lot of collateral damage is done as well. The reason for this is simple, you need a lengthy courtship, before you marry a penny stock because experience is the best teacher.

there is no company here only a shell?

Stem Cell Therapeutics (SSS.V) (SCTPF) is a completely new story to hit the United States. It is one of only three public companies developing therapeutics targeting cancer stem cells. The other companies are Verastem (VSTM) and Stemline (STML). Each of those companies have a market capitalization of well over two hundred milliion dollars.

SCTPF has two portfolio products. One is based on the science generated by Dr. Aaron Shimmer, a clinician scientist from the University of Toronto and Prince Margaret Hospital. In his highly awarded career he has prioritized repurposing currently marketed drugs for their activity against cancer stem cells. The company has licensed his clinical stage asset, a reformulated version of Pfizer's drug Tigecycline, for which clinical data is expected in early Q3 2013.

SCTPF's other cancer stem cell product has been developed by Dr. John Dick, Phd, who is credited with the initial identification of Leukemic Stem Cells. Our product is a CD47/SIRPa fusion protein. Dr. Irving Weissman of Stanford University is working on a monoclonal antibody targeting CD47, and he has validated the target. Dr. Weissman has just received a twenty million dollar grant from the California Institute for Regenerative Medicine to continue his research. Last year a private company, Inhibrx, entered into an option and license agreement with Celgene. The deal potential is in excess of five hundred million dollars. Evidently Celgene really wanted to get access to that antibody.

Both docs are on the company SAB and follow on products are expected to be collaborated on.

Of note, the Chairman of SCTPF, David Allan, is the person that brought these two assets into this company. David was the CEO of YMI at the time it acquired an Australian company by the name of Cytopia for twelve million dollars. YMI was sold three years later for over five hundred million dollars to Gilead.

By the way, most of Verastem's valuation is based on this drug in licensed from Pfizer. This was the terms of the licensing deal.

VS-6063 in-licensed from Pfizer

In July 2012, Verastem in-licensed the worldwide commercial rights from Pfizer for the FAK inhibitor VS-6063 (PF-04554878). Pfizer received a one-time cash payment of $1.5 million and 192,012 shares of VSTM common stock.

PFE is eligible to: Receive up to $2 million in developmental milestones

• Up to $125 million should certain regulatory and commercial sales milestones be met

• High single to mid double digit royalties on future net sales of VS-6063, for 10 years

Please review the attached company powerpoint presentation and get back to me if you would like to discuss this.

If it goes to the grey market you can write it off i had another bag i had to do it that way.

I had this stock for years they r/s on me and left me with very little. What i see it someone else whats this shell and whats old shareholders out so they are making a market to get people to sell, JMHO

The majority shareholder of DNAG was not central to anything. He bought his ahares after everything had happened.

Dan Gannon came into some money (lottery winner?) who fancied himself as becoming a big player in the stock market and multiplying his fortune many times over. During 2008 he was pouring money into Fannie Mae just as fast as he was buying up DNAG. That's where I met him on-line in another place and time.

I, and others, told him his pouring money into FNMA probably wasn't such a good idea, but he had a hard head. Of course, as events played out it was the fault of "evil short sellers", and not his showing up to invest in a bubble that had already burst, that was the cause of the problems.

At the same time, he was extremely enthusiastic about the "World's Most Undervalued Company" (DNAG). I visited DNAPrint in December 2008, and found the doors locked and old stickers from UPS and FEDEX on the door. The "DNAPrint Genomics" sign was on the ground. The place had obviously been locked up for some time. I reported this on another forum and Mr. Gannon's responses were typical.

At that time, he actually didn't even want to know anything about DNAG. He thought that he would then have "insider information" and could be prosecuted by the SEC for buying more shares.

As for the secret club on Yahoo boards, there was never any real business discussed there. It was simply a place where he and a few others could safely post platitudes about how wonderful the world's most undervalued company was in an environment free of any pesky realism.

DNAG .0004 starting

I remember some of you. The only time I really made money on Dnap was on the runnup to .18 after the TV piece on the Louisianna serial killer. Bought a couple hundred K at .02 and sold around .16 It is to this day my best penny profit. Only penny I'm in now is ACTC. Stem cell company in trials. Good luck to all former Dnapers. You deserve it!

I bought Dnaprint back in July and August of 2000. I remember Tony saying Dnaprint would be a fortune 500 company in five years. It has been almost thirteen years since then. I started trading stocks in January of 2000. I learned that hype would not make a long term held penny stock money. It took a few years to realize that many penny stocks are just there to make the stock ceo, officers, and promoters money. If you can get hold, of a penny stock publicly trading stock company, you can make a comfortable living trying to promote an idea or invention or etc... legitimately. Failure is the most common conclusion to many penny stocks. Consequently, one concludes that a penny stock is going to fail, and one's speculative money is gone. To a new stock trader a hyped stock can cause that trader to sinks lots, of money in a penny stock, without understanding the business nature, of start up otc/pink trading penny stocks. I sold Dnaprint long ago, once I realized Tony was trying to sell his invention/patents in exchange for a comfortable living. Seems that the truth in penny stock land is after all just wisp of honesty, and the next second that truth is no more. Stock news and truths are dynamic in penny stock land.

imho

Hal

Froggy, the more you claim to know, the more you appear to BE, Gannon.

I don't have any insider information cosmic, I just seem to pay attention more than you do.

Dan Gannon was an uninformed investor from Oregon who came into a lot of money quite suddenly. (google?)

He dove headfirst into DNAG without listening to a single word of caution from those who tried to warn him but bought into the hype from those who would not admit their mistakes. (cosmic?)He was a negligible individual in the dying days of the company and had absolutely zero effect on the plight of the existing shareholders.

After the company was completely dead.

-After the big three had printed all the shares they had and diluted the pps to nothing.

-After they had traded away ALL of the IP and remaining assets to Dutchess.

-After they had exhausted every avenue available to keep their money machine alive.

-After they had walked away.

The company was nothing but an empty shell that was seven million dollars in debt. A clean shell would have been a possible asset worth a few tens of thousand dollars. Being $7 mil in debt made it nothing but a liability.

The shareholders had NOTHING left at that point. No claims to the IP, no share of any future business. Everything of value was OWNED by Dutchess, who had paid for it fair and square.

Only then did Dan Gannon enter the picture.

You can dig into the death throes all you want and you can work through all of the machinations of Gannon and his investor group, but you will find not a single thread on which you can hang any liability to the existing shareholders.

His ridiculous promises to 'save' the company and his 'secretive' cabal to obtain the worthless IP might give you some fodder for a scapegoat, but whatever he did, he did AFTER DNAG was dead.

Hire a lawyer if you want, hire a detective, but don't expect a single 'crime' to be discovered, or any possibility of redemption for the lost investment.

Gannon is and was irrelevant.

Cosmic-You never answered my question about the top secret Yahoo members only board. Was you then or now a member? A lot of decisions were made by that group that others would not have know about. See screen capture below: This is the message group Dan started after he went underground and used for support and to work under cover

Dan Gannon was CENTRAL to everything that happened...

Hi FrogDreaming...

Good to hear from you also. Actually I was hoping you would stop by and say...Hi... I do hope you are doing well.

We had some great dialogs in the past...and while we strongly differed in our views...I actually appreciated your thoughtful and provocative discussions that always kept us on our toes...

Welcome back to you as well...

Here's a few thoughts on your thoughts...

--------------------

Hello Cosmic,

I see you have returned with a 'slightly' different viewpoint than when we last spoke.

Yes...time and further experience has given me a different viewpoint... The events were definitely learning experiences.

No shame. No blame. Lessons learned. Thanks.

My recent posts on iHub suggesting that all newbie DNAG investors do their proper DD and go back and read your posts is my compliment to you for your knowledge and information at the time. Hopefully they can extrapolate to the present and start asking informed questions...

Good to see you back...and I'm very interested in your current insights....

You said: Let me caution you on your list of "what we know and can prove..."

1) DNAPrint is a dead company.- PR - DNAPrint Genomics Closed Business 2/2009. TRUE

2) Dan the Man Gannon was centrally involved in what happened to DNAPrint Genomics and to DNAG shareholders: NOT ENTIRELY CORRECT (see below).

Actually it is ENTIRELY correct.

Dan Gannon's multiple roles as the majority DNAG shareholder, the buyer of the IP assets, and a DNAPrint board member absolutely puts Dan Gannon CENTRAL to everything that happened (see more below).

A) Dan the Man bought millions of DNAG shares to become a majority DNAG shareholder to get some control of DNAPrint Genomics. NOT REALLY.

- Dan bought millions of shares alright but did his best to avoid becoming an 'insider'. Only after he was forced to file his ownership of greater than 5% with the SEC was he drawn into the management mess. Until that time he was convinced that DNAG was a real company with valuable assets.

Froggy...with all due respect... unless you are Dan...how do you know what Dan's real intentions were...when only Dan knows...? Dan's rapid purchase of millions of DNAG shares didn't show that he was avoiding anything. Quite the contrary. He was a proud puppy when he got to file his SEC Form 4's for all his millions of DNAG shares... He loved the stage light on himself.

So...Froggy...How do you know Dan Gannon's REAL purpose wasn't to grab millions of DNAG shares so he actually COULD totally control all that happened to DNAPrint's IP assets...?

Because...that looks EXACTLY like what DID happen...

And Froggy...again respectfully...you seem to be defending Dan Gannon. WHY are you defending Dan now?

Froggy...ARE YOU Dan Gannon...?? Or are you a "deep insider" personally working with Gannon and trying to cover everything up...?

Your comments have made us very curious FrogDreaming...

Please explain just how you know all the things you are stating about Dan...that only Dan would know...?

B) Dan the Man started an investor group to buy DNAPrint's IP assets from Dutchess Capital to save DNAPrint Genomics. ARGUABLE

First of all...NOT arguable... Fact.

DNAG iHub and Yahoo boards are full of Dan's posts about "starting an investor group to save DNAPrint Genomics." Proven Fact.

- After Gomez, Frudakis and Gabriel realized they couldn't squeeze any blood out of him, they walked away, washing their hands of the whole scam. That left DAN, as the largest stock owner as the only one left for Dutchess to negotiate with.

-Dutchess know the IP was worthless (else why wouldn't Frudakis et. al. have leveraged it to obtain continuation capital?) and they also knew that Gannon was a sucker. -They offered to sell him the IP and convinced him he was getting a 'deal'.

Regarding your opinion of the perceived value of DNAPrint's IP assets.

I do agree that the fact Dutchess sold the IP assets clearly indicates that they didn't value them at the time...but at the same time there were other parties interested that DID value them...so the IP assets definitely held value to some people then. However that is way past being an issue for debate now.

Froggy... You seem to have some profound Dutchess insights to what happened back then. Sounds like you have more insider information here that we didn't have back then...??

How did you find out that Dutchess knows Dan was a sucker? Were you privy to Dutchess's discussions with Dan...? How do you know anything about these Dutchess discussions? Only Dan knew about them...

C) Dan the Man was on DNAPrint's board when they gave away ALL of DNAPrint IP assets to DDC... and screwed DNAG shareholders. DDC WAS Dan Gannon et. al.

Could you please explain that further...?

Not sure what you mean by that..."DDC WAS Dan Gannon et al."

Are you suggesting there were covert relationships between DDC and Dan and the board that we DNAG shareholders didn't know about...?

Please help us understand what does that mean....."DDC WAS Dan Gannon et.al....?

-The shareholders were already screwed, they had lost the DNAPrint IP long before that to Dutchess. The shareholders were completely out of the picture by the time Dutchess screwed Gannon.

There is a big difference between "closing the business" and "killing the company" ... The "business is closed" but the "company" still continues even with an empty shell still trading.

Granted Dan was not involved until after the board announced DNAPrint closed for business (PR)....and that Dutchess held the IP assets before Dan got involved.

So I agree that DNAG shareholders were basically already screwed when Gabriel closed the business...

But...when Dan came into the picture and started buying millions of DNAG shares....DNAPrint as a "company" still was salvageable...

Dan Gannon came along to save them...and DNAG shareholders were not...absolutely completely totally...screwed...not yet anyway.

The iHub and Yahoo boards are filled with Dan's promise's tossing DNAG shareholders a lifeline...specifically and very clearly promising to SAVE DNAPrint Genomics... Fact...

And Dan Gannon was the majority DNAG shareholder and buyer of DNAPrint's IP assets from Dutchess...AND...Dan was on DNAPrint's board of directors... Can't get more CENTRAL or more directly responsible than that...

Instead Dan and the board suddenly gave away all the IP assets to DDC and the board resigned and ran away as fast as possible.

Dan Gannon was CENTRAL to those events...and now you can finally say ...with Dan breaking his promises...

DNAG shareholders were NOW absolutely completely totally screwed...by Dan Gannon and the board.

Dan's multiple roles and direct involvement definitely leaves Dan in the middle of all that happened with the IP assets. All Facts.

D) DDC ended up with all of DNAPrint's IP assets in an "exclusive worldwide license" that shut out DNAG shareholders. SEE ABOVE

- DNAG shareholders were shut out long before the DDC license.

Repetitive statement already answered above.

Dan was involved with multiple roles on the board with the DDC license...so that puts Dan central to it all...and directly responsible for it. Fact.

And the DDC license is between DNAPrint Genomics and DDC...so there is clear question if the DNAG shareholders are actually shut out at this point. Who got the DDC license fees...and who is getting the DDC royalty monies...? And who is spending it all...?

-The 'exclusive worldwide license' hasn't netted DDC a single cent above their investment. They are just as screwed as DNAG shareholders. In fact I would bet that if you talked to them they would be more than glad to sell you the IP for pennies on the dollar compared to their cost. LOL

Again it sounds like you have insider information we don't have...are you an insider to all these DDC dealings...?

How do you know exactly that DDC hasn't profited from their "exclusive worldwide license" of DNAPrint's IP assets...? Do you have a copy of DDC's license and DDC's Profit/Loss statement so we can see for ourselves if they profited or not...? How do you know all this stuff anyway...?

E) DNAPrint is now dead and has absolutely no IP assets. DNAG is a toxic ghost shell with nothing but debt. TRUE

- BUT DNAPrint was dead the day after it entered ito the death spiral finance deal with Dutchess. All the management knew what they were doing. They knew the IP was worthless and all they could do was suck the juice out of the stock price, which they did.

So in summary...

We agree Dan was not involved with Gabriel closing DNAPrint Genomics as a business.

However...Dan Gannon DID get centrally involved AFTER the business closed...by buying millions of DNAG shares to become a majority DNAG shareholder, buying the IP assets, and getting on DNAPrint's board of directors... You can't get more central than that...

Now we can talk about the AFTER...when Dan Gannon WAS involved. ...then what happened?

Dan The Man Gannon became our majority DNAG shareholder...

Dan The Man Gannon got on DNAPrint's board of directors...

Dan The Man Gannon puts together an investor group to buy DNAPrint's IP assets from Dutchess...

DDC ends up with a totally "exclusive worldwide license" that buries the IP assets...

Dan The Man Gannon disappears...

The SEC reportable "material events" were legally required to be reported to DNAG shareholders and the public... They weren't.

And all of this is much too coincidental and curiously questionable about Dan Gannon's motives and possible kickbacks in all this...

I'm just a layperson...but it's easy to see a pattern of possible criminal intent to crush DNAPrint Genomics and squash their IP assets...

At the time the new DNA Ancestry and Forensics markets were multi-million dollar potential.

Who knows if DNAPrint's competition did all this to crush them...and Dan Gannon was their hit man...?

Just my humble questions. Lots of speculation. No real answers yet.

Hopefully this is something the DNAG shareholders will pursue and find out.

Maybe even get an attorney's quick opinion about the millions of lost potential revenues...

Even better for the long time DNAG investors to see someone finally held accountable...and hopefully punished...

DNAG shareholders have a legal right to ask and demand answers from Dan Gannon.

Let's see what Dan The Man has to say...

Froggy.... Please let us know...how do you know about all that "insider" stuff that only Dan Gannon would know. Your insider knowledge continues to be very impressive.

Nice talking to you again,

See you.

You too Froggy...!

Take care.

Cosmic

While you are waiting for DNAG to spike.... Take a look at

KBLB. Commercialization getting close.

Then enlighten us Mr kramer

Hello Cosmic,

I see you have returned with a 'slightly' different viewpoint than when we last spoke.

Let me caution you on your list of "what we know and can prove..."

1) DNAPrint is a dead company.- PR - DNAPrint Genomics Closed Business 2/2009. TRUE

2) Dan the Man Gannon was centrally involved in what happened to DNAPrint Genomics and to DNAG shareholders: NOT ENTIRELY CORRECT.

- Dan was a latecomer to DNAG, he arrived long after the company had completed it's death spiral and all the assets had been claimed by Dutchess. His involvement was only peripheral to the death throes.

A) Dan the Man bought millions of DNAG shares to become a majority DNAG shareholder to get some control of DNAPrint Genomics. NOT REALLY.

- Dan bought millions of shares alright but did his best to avoid becoming an 'insider'. Only after he was forced to file his ownership of greater than 5% with the SEC was he drawn into the management mess. Until that time he was convinced that DNAG was a real company with valuable assets.

B) Dan the Man started an investor group to buy DNAPrint's IP assets from Dutchess Capital to save DNAPrint Genomics. ARGUABLE

- After Gomez, Frudakis and Gabriel realized they couldn't squeeze any blood out of him, they walked away, washing their hands of the whole scam. That left DAN, as the largest stock owner as the only one left for Dutchess to negotiate with.

-Dutchess know the IP was worthless (else why wouldn't Frudakis et. al. have leveraged it to obtain continuation capital?) and they also knew that Gannon was a sucker.

-They offered to sell him the IP and convinced him he was getting a 'deal'.

C) Dan the Man was on DNAPrint's board when they gave away ALL of DNAPrint IP assets to DDC... and screwed DNAG shareholders. DDC WAS Dan Gannon et. al.

-The shareholders were already screwed, they had lost the DNAPrint IP long before that to Dutchess. The shareholders were completely out of the picture by the time Dutchess screwed Gannon.

D) DDC ended up with all of DNAPrint's IP assets in an "exclusive worldwide license" that shut out DNAG shareholders. SEE ABOVE

- DNAG shareholders were shut out long before the DDC license.

-The 'exclusive worldwide license' hasn't netted DDC a single cent above their investment. They are just as screwed as DNAG shareholders. In fact I would bet that if you talked to them they would be more than glad to sell you the IP for pennies on the dollar compared to their cost. LOL

E) DNAPrint is now dead and has absolutely no IP assets. DNAG is a toxic ghost shell with nothing but debt. TRUE

- BUT DNAPrint was dead the day after it entered ito the death spiral finance deal with Dutchess. All the management knew what they were doing. They knew the IP was worthless and all they could do was suck the juice out of the stock price, which they did.

Frudakis was a disgraced scientist who was fired from his job in Seattle. He moved to Florida to live with his parents and took up with a stock swindling outfit as a tout. His posts and multiple aliases on the Raging Bull boards are all evidence of his past. He was given the empty shell that he used for DNAPrint by his boss.

They were given a SNP machine by (Orchid?) as a loss leader in order to sell the expensive kits (much like HP sells cheap printers so they can sell you the ink cartridges) With tat he started the company. It was all smoke and mirrors as they discovered absolutely nothing on their own. They eventuall licensed AncestrybyDNA and the forensic stuff from an associate professor at a university that was created bu his grad students.

Frudakis had nothing at all but he kept the swindle going until he convinced the shareholders to let him increase the AS from millions to billions. Once he had those shares to sell, he took up with Gabriel and they printed shares as fast as they could sell them. The resulting empty shell is the result.

Nice talking to you again,

See you.

Getting better! Moving on up.

I'm buying some more as soon as funds clear.

|

Followers

|

297

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

82595

|

|

Created

|

08/19/00

|

Type

|

Free

|

| Moderators | |||

DNA

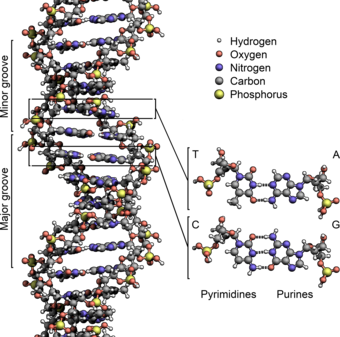

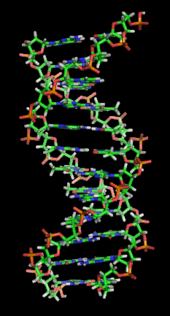

Deoxyribonucleic acid (DNA) is a molecule encoding the genetic instructions used in the development and functioning of all known living organisms and many viruses. Along with RNA and proteins, DNA is one of the three major macromolecules that are essential for all known forms of life. Genetic information is encoded as a sequence of nucleotides (guanine, adenine, thymine, and cytosine) recorded using the letters G, A, T, and C. Most DNA molecules are double-stranded helices, consisting of two long polymers of simple units called nucleotides, molecules with backbones made of alternating sugars (deoxyribose) and phosphate groups (related to phosphoric acid), with the nucleobases (G, A, T, C) attached to the sugars. DNA is well-suited for biological information storage, since the DNA backbone is resistant to cleavage and the double-stranded structure provides the molecule with a built-in duplicate of the encoded information.

These two strands run in opposite directions to each other and are therefore anti-parallel, one backbone being 3' (three prime) and the other 5' (five prime). This refers to the direction the 3rd and 5th carbon on the sugar molecule is facing. Attached to each sugar is one of four types of molecules called nucleobases (informally, bases). It is the sequence of these four nucleobases along the backbone that encodes information. This information is read using the genetic code, which specifies the sequence of the amino acids within proteins. The code is read by copying stretches of DNA into the related nucleic acid RNA in a process called transcription.

Within cells, DNA is organized into long structures called chromosomes. During cell division these chromosomes are duplicated in the process of DNA replication, providing each cell its own complete set of chromosomes. Eukaryotic organisms (animals, plants, fungi, and protists) store most of their DNA inside the cell nucleus and some of their DNA in organelles, such as mitochondria or chloroplasts.[1] In contrast, prokaryotes (bacteria and archaea) store their DNA only in the cytoplasm. Within the chromosomes, chromatin proteins such as histones compact and organize DNA. These compact structures guide the interactions between DNA and other proteins, helping control which parts of the DNA are transcribed.

Properties

DNA is a long polymer made from repeating units called nucleotides.[2][3][4] DNA was first identified and isolated by Friedrich Miescher and the double helix structure of DNA was first discovered by James D. Watson and Francis Crick. The structure of DNA of all species comprises two helical chains each coiled round the same axis, and each with a pitch of 34 ångströms (3.4 nanometres) and a radius of 10 ångströms (1.0 nanometres).[5] According to another study, when measured in a particular solution, the DNA chain measured 22 to 26 ångströms wide (2.2 to 2.6 nanometres), and one nucleotide unit measured 3.3 Å (0.33 nm) long.[6] Although each individual repeating unit is very small, DNA polymers can be very large molecules containing millions of nucleotides. For instance, the largest human chromosome, chromosome number 1, is approximately 220 million base pairs long.[7]

In living organisms DNA does not usually exist as a single molecule, but instead as a pair of molecules that are held tightly together.[8][9] These two long strands entwine like vines, in the shape of a double helix. The nucleotide repeats contain both the segment of the backbone of the molecule, which holds the chain together, and a nucleobase, which interacts with the other DNA strand in the helix. A nucleobase linked to a sugar is called a nucleoside and a base linked to a sugar and one or more phosphate groups is called a nucleotide. A polymer comprising multiple linked nucleotides (as in DNA) is called a polynucleotide.[10]

The backbone of the DNA strand is made from alternating phosphate and sugar residues.[11] The sugar in DNA is 2-deoxyribose, which is a pentose (five-carbon) sugar. The sugars are joined together by phosphate groups that form phosphodiester bonds between the third and fifth carbon atoms of adjacent sugar rings. These asymmetric bonds mean a strand of DNA has a direction. In a double helix the direction of the nucleotides in one strand is opposite to their direction in the other strand: the strands are antiparallel. The asymmetric ends of DNA strands are called the 5′ (five prime) and 3′ (three prime) ends, with the 5' end having a terminal phosphate group and the 3' end a terminal hydroxyl group. One major difference between DNA and RNA is the sugar, with the 2-deoxyribose in DNA being replaced by the alternative pentose sugar ribose in RNA.[9]

The DNA double helix is stabilized primarily by two forces: hydrogen bonds between nucleotides and base-stacking interactions among aromatic nucleobases.[13] In the aqueous environment of the cell, the conjugated π bonds of nucleotide bases align perpendicular to the axis of the DNA molecule, minimizing their interaction with the solvation shell and therefore, the Gibbs free energy. The four bases found in DNA are adenine (abbreviated A), cytosine (C), guanine (G) and thymine (T). These four bases are attached to the sugar/phosphate to form the complete nucleotide, as shown for adenosine monophosphate.

The nucleobases are classified into two types: the purines, A and G, being fused five- and six-membered heterocyclic compounds, and the pyrimidines, the six-membered rings C and T.[9] A fifth pyrimidine nucleobase, uracil (U), usually takes the place of thymine in RNA and differs from thymine by lacking a methyl group on its ring. In addition to RNA and DNA a large number of artificial nucleic acid analogues have also been created to study the properties of nucleic acids, or for use in biotechnology.[14]

Uracil is not usually found in DNA, occurring only as a breakdown product of cytosine. However in a number of bacteriophages - Bacillus subtilis bacteriophages PBS1 and PBS2 and Yersinia bacteriophage piR1-37 - thymine has been replaced by uracil.[15] A modified form (beta-d-glucopyranosyloxymethyluracil) is also found in a number of organisms: the flagellates Diplonema and Euglena, and all the kinetoplastid genera[16] Biosynthesis of J occurs in two steps: in the first step a specific thymidine in DNA is converted into hydroxymethyldeoxyuridine; in the second HOMedU is glycosylated to form J.[17] Proteins that bind specifically to this base have been identified.[18][19][20] These proteins appear to be distant relatives of the Tet1 oncogene that is involved in the pathogenesis of acute myeloid leukemia.[21] J appears to act as a termination signal for RNA polymerase II.[22][23]

| Volume: | - |

| Day Range: | |

| Last Trade Time: |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |