Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

good reads about Cunningham Natural Resources Corp assets

It's good stuff mick but it's old news.

***** #8 / #2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars \/ $ENOR \/ 17% interest in Worldwide Diversified Holdings, Inc (“WDHI”) as a result of the spinoff

of the company’s non-energy assets.

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia

Rhino Energy Pty Ltd (“RHINO”)

CNRC has acquired a 40% interest in Rhino Energy Pty Ltd (“Rhino”). Rhino has a management team with global operational expertise having operated & non operated assets in 27 countries.

(http://www.rhinoenergy.com.au)

Cunningham Mining Ltd (“CML”)

CNRC has a 9% interest in Cunningham Mining Ltd (“CML”).

CE Energy Sponsors, LLC (“CEAC”)

CNRC owns 15% of CE Energy Sponsors, LLC, which is the sponsor of

CE Energy Acquisition Corp (“CEAC”) and has filed a registration statement for a $100 million dollar

special purpose acquisition corporation.

Worldwide Energy, Inc

CNRC owns 100% of Worldwide Energy, Inc as a Special Purpose Vehicle to acquire companies in energy and energy services, including energy transition opportunities.

Worldwide Diversified Holdings, Inc (“WDHI”)

CNRC has a 17% interest in Worldwide Diversified Holdings, Inc (“WDHI”) as a result of the spinoff

of the company’s non-energy assets.

WDHI is looking to acquire a diversified portfolio of minority and

controlling interests in businesses that WDHI believes

(i) operate in industries with long-term growth opportunities,

(ii) face minimal threats of technological or competitive obsolescence, and

(iii) have strong management teams largely in place.

WDHI will offer shareholders a unique opportunity of investments in diversified sectors.

(http://www.wdhinc.net)

***** #7 / #2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars \/ $ENOR

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia

Rhino Energy Pty Ltd (“RHINO”)

CNRC has acquired a 40% interest in Rhino Energy Pty Ltd (“Rhino”). Rhino has a management team with global operational expertise having operated & non operated assets in 27 countries.

Cunningham Mining Ltd (“CML”)

CNRC has a 9% interest in Cunningham Mining Ltd (“CML”).

CE Energy Sponsors, LLC (“CEAC”)

CNRC owns 15% of CE Energy Sponsors, LLC, which is the sponsor of

CE Energy Acquisition Corp (“CEAC”) and has filed a registration statement for a $100 million dollar

special purpose acquisition corporation.

CEAC intends to focus its search for a target business in the energy industry in North America,

Central, and South America. CEAC may also pursue an acquisition opportunity in renewable

energy which refers to energy from a source that is sustainable,

such as wind, hydropower, geothermal or solar power.

***** #6 / #2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars \/ $ENOR

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia

Rhino Energy Pty Ltd (“RHINO”)

CNRC has acquired a 40% interest in Rhino Energy Pty Ltd (“Rhino”). Rhino has a management team with global operational expertise having operated & non operated assets in 27 countries.

Cunningham Mining Ltd (“CML”)

CNRC has a 9% interest in Cunningham Mining Ltd (“CML”).

CML has completed the acquisition of the Placer Claims. Known as the ‘Nugget Trap Placer Mine”

in the British Columbia Mineral Title registry,

it covers 573.7 acres and the accompanying permits and authorizations (“Property”) that is situated

within the Skeena Mining Division of British Columbia, Canada, in the area known as BC’s Golden Triangle.

A recent independent assay, which includes data from a 25-pit test program,

indicated an average of over Au 25.54 grams gold per cubic meter of pay dirt as well as meaningful amounts of silver.

CML is in the process of permitting for a 15,000 cubic yard per annum pay dirt mining program

with the British Columbia Ministry of Mines.

***** #5 / #2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars \/ $ENOR

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia

Rhino Energy Pty Ltd (“RHINO”)

CNRC has acquired a 40% interest in Rhino Energy Pty Ltd (“Rhino”). Rhino has a management team with global operational expertise having operated & non operated assets in 27 countries.

The team has managed production of +1.7 million BOE/D. Rhino has assembled a truly world class team that has been involved in some of the most historic oil & gas projects globally over the last 30 years. Rhino is focused on building a material production base through acquisitions in countries and basins where we have a strong track record. It will focus on delivering quality and quantity of news flow to build a positive market sentiment and investor following. Rhino has an initial investment in a junior energy company currently focused on the development of its interests in the Cold Lake and Wabasca areas of Alberta in Canada. (http://www.rhinoenergy.com.au)

***** #4 / #2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars \/ $ENOR

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia.

NOW \/ https://www.eon-r.com/

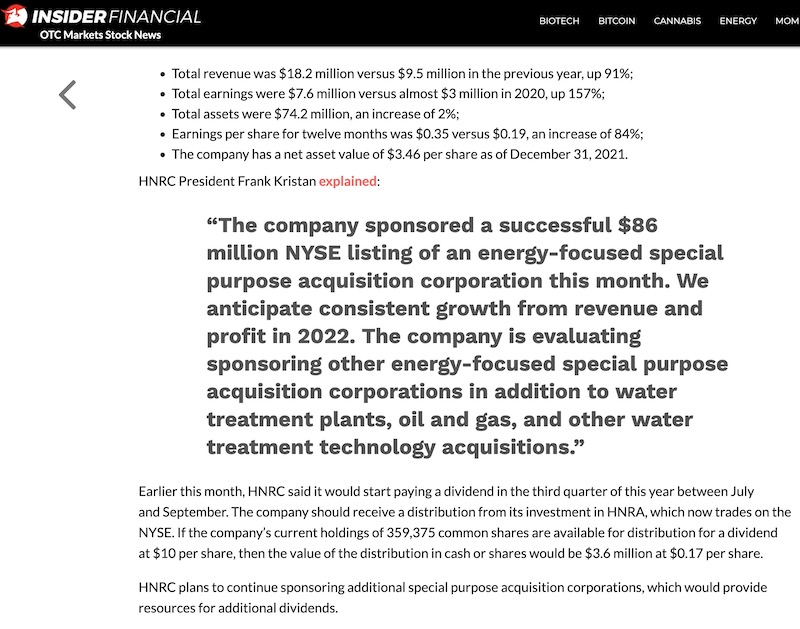

HNR Acquisition Corp (“HNRA”)

CNRC has invested in HNR Acquisition Corp. On February 11, 2022, HNRA closed its initial public offering listing on the NYSE with aggregate proceeds of $86,250,000 (NYSE:HNRA). HNRA is a newly organized blank check company formed for the purpose of effecting a business combination with one or more businesses.

While HNRA may pursue an initial business combination target in any business or industry, it intends to focus on assets used in exploring, developing, producing, transporting, storing, gathering, processing, fractionating, refining, distributing, or marketing of natural gas, natural gas liquids, crude oil, or refined products in North America. (HTTP://www.hnra-nyse.com)

Welcome to

EON Resources Inc. (“EON”)

(formerly HNR Acquisition Corp)

NOW \/ https://www.eon-r.com/

Keep updated on our company's developments, financial performance, and corporate practices

About EON Resources Inc.

EON Resources Inc. (“EON” or the “Company”) was formerly HNR Acquisition Corp (“HNRA”) until the name was changed September 18, 2024. EON is listed on the New York Stock Exchange (“NYSE American”) under the symbol “EONR"

EON is an independent energy company focused on Energy, Oil, Natural Resources, and other aspects of the Energy Industry. Our current focus is as an upstream energy company with producing oil and gas properties in the Permian Basin. Our plans are to maximize total returns to its shareholders by growing through acquisition and through the development and enhancement of onshore oil and natural gas properties in the United States.

Our first acquisition in November 2023 is a waterflood project, which includes 342 producing oil and gas wells, ~13,700 contiguous acres located on the Northwest Shelf of the Permian Basin in New Mexico. Our Investor Presentation Deck and the Proxy Statement filings with the SEC have more detailed information regarding the acquisition and the property included.

EON has an experienced management team with extensive experience in the oil and gas industry. We are excited about the acquisition and our future. More information on the management team can be found under Our Team in the About Us section of this website.

#3 \/ #2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia.

Kharrouba Copper Company, Inc. (“KCC”)

CNRC agreed to purchase up to 19.9% interest in KCC, a copper mining producer located in Morocco. KCC acquired a significant land position of 319 km2 hosting copper ore. KCC inherited significant previous development on its concessions undertaken by the French before Morocco became independent in 1956.

The copper ore position has formed the foundation for major development of the copper mining and processing operation to substantially increase reserves and production over time. KCC has an established management and operating team drawing from deep experience led by Scott M. Hand as Executive Chairman of KCC. Mr. Hand was the former Chairman and CEO of Inco Limited, which sold to Brazil’s Vale SA for USD $19 billion in 2006.

#2 \/ Some interestng views here \/ $CNRC \/ December 31st, 2022, is $352 million dollars

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia.

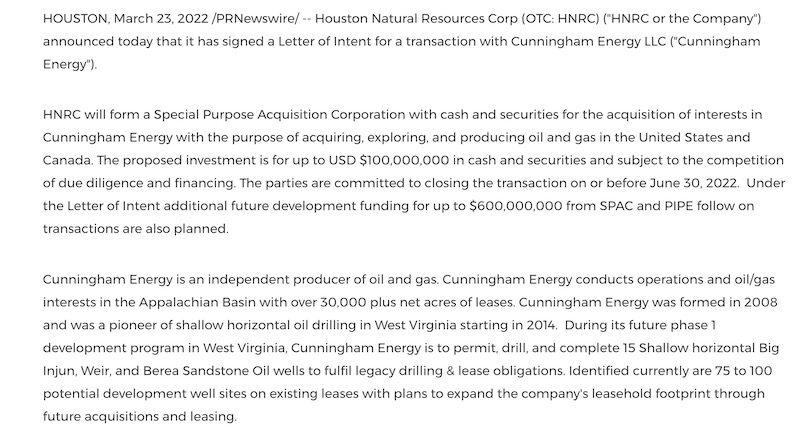

Cunningham Energy, LLC

CNRC owns 100% of Cunningham Energy LLC. Cunningham Energy was founded in 2008 for the purpose of acquiring, exploring, and producing oil and gas in the Appalachian, Illinois, and Williston Basins. Cunningham Energy and its affiliates own interests in approximately 600 wells, 170 of which are re-works with a 98% successful completion rate. They were the pioneers of shallow horizontal oil drilling in West Virginia spetrotarting in 2014.

The company acquired 30,000 net acres in numerous transactions throughout the Appalachian Basin Acreage acquisition was completed over a 10-year time frame as data emerged. Metrics of shallow oil lease values were increased as drilling progressed, with some cases yielding over 10-12x returns.

They acquired and negotiated control of 965,000 net acres in Canada. Negotiated a 75% Net Revenue Interest basis with estimated reserves of more than 500M barrels of oil via an earnout with a Cunningham controlled Canadian entity. An independent engineering firm completed an updated evaluation of the oil & gas assets of Cunningham Energy.

The updated independently appraised value of the CE’s leasehold position, as of December 31st, 2022, is $352 million dollars, assuming the current proposed sixty-eight (68) well drilling program is completed. (http://www.cunninghamenergy.com)

Some interestng views here \/ $CNRC

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia.

Some interestng views here \/ $CNRC

https://cunninghamnaturalresources.com/operations/

Operations

At Cunningham Natural Resources (CNR), our efforts span beyond North America,

with projects in Africa, South America, and Southeast Asia.

thanks and a Great Holiday to all

Happy Birthday! I hope you are healthy and enjoying your life!

wow , you got senority on me. congrats 24 happy birthday.

Merry Christmas!!🎄❤️🙏🍸

did a little today

fyi....tomorrow is my b/d....will be 87 yrs old.....this will surprise in a short while......glta

at the most....maybe 45 to 50 million.......probably not even half that.......there were about 80 million shares of hnrc when the divy was done

....

Wdhi will trade and there are not trillions of shares in my opinion.

Where do I come up with this stuff??? Pretty simple look it up Cunningham has a market cap of 6.4 million. Call your broker ask how you get a number for a share count. Use Tesla as an example cap devided by share price will give a rough count on how many charges there are. Your 60 days is February 19th give me my props when this turd is still a penny and wdhi still not trading

There are not even a billion shares. Where do you come up with this stuff?

6.4 million $ market cap devided by the current share price comes out to 3.4 trillion shares that's trillion with a T. Pretty simple math to figure out how many shares in circulation.....

I would be very happy with .05 or so. A dime and I buy a new car. LOL

WDHI is still free......I have 50 thousand shares pennies be great

May 2023 articles projected the wdhi at $3.50 per share. However during crooked scumbag Frank's webnar he said whatever the market maker priced it at is what it would be. My opinion since they extended the timeline to buy here to get the wdhi dividend is huge RED FLAG!!! I believe they oversold hnrc which will drive the dividend down to pennies like everything thing else scumbag frank touches

The stock has previously been deposited in each CNRC account holders brokerage account. It's not tradeable yet though.

Believe it will be paid in stock, they do not have the cash to pay that much of a dividend, it would drain their assets down too much.

Is that divy suppose to be paid in cash or shares?

So in 60 days if Cunningham is still trading at 2¢ and wdhi still not trading then what??? Maybe don't be to quick to bash what I believe is happening. They don't wanna release that $50 million set aside to pay the divy they don't have it in my opinion

He is definitely old school OTC. Buying up shell after shell leaving shareholders holding their bags of empty promises. Look at his insane financial statements, it's the same every time. This dude has zero morals.

That sounds awful! How come he hasnt been shut down yet, or is he just doing it the old school OTC way of burn it down and start another one. Rinse and repeat?

The only one making money here is frank Kristin. Look up his past scams as well as this one, he never audits anything, no company purchases/acquisitions are ever verifiable, he always offers dividends yet he only delivers them as a line item in shareholder's accounts but can never be sold. This is a scam plain and simple. I could go on and on but I think you get the picture.

The only people in here touting this scam are either people underwater and desperately trying to get back their lost funds, or people associated with the scam, IMHO.

how much money have you made on this so far? Just curious. I haven't gotten in just been watching for a LONG time and a lot of happy future things that have been posted here never seem to happen.

60 days starting when?

You never stop with the unfounded accusations. I understand your frustration but there is no evidence of fraudulent activity. Give them 60 days and no more.

Careful, a pumper/promoter here might read that post you made and say "look! shorty wants your shares before the big squeeze"!

Reached out to Schwab today inquiring about the wdhi dividend to see if any info was available. They asked me if I wanted them to send me a form to surrender the 9500 shares that currently have in one of my accounts. Said it would clean up the account wow what the fuck are these crooks up to

READY TO ROCK AND ROLL........DO NOT MISS THE BOAT.....CNRC,,,,GLTA

April 28th 2023 spinoff dividend was completed. Several times now they say a form has to be completed come on man. I've been in a couple spinoffs before 7-9 months max. Cunningham worth two cents allegedly they bought interest in multiple companies. Not seen one move by the terd ceo that makes me think otherwise. The dividend was proposed $3.50 for every two shares of hnrc. Frank said in a podcast the divy will be whatever the market maker thinks it's worth. BS

Again, you are making things up. Yes we should be able to trade wdhi by know but that doesn't equate to anyone stealing the money.

Bullshit on the email and form 211..... Really any competent attorney or CEO knows the process. That 50 million is gone that was set aside for wdhi divy . Lies,delays and excuses translates to fraud and corruption in my opinion 20 months this bullshit has been going on.

news that never come all fraud claime it to FBI that is the only way

An email from Frank rec;d today says that they have to fill out form 211 with the market maker.........they are working on that. They are also working on the liquidation event tot ake place in this 4th quarter. Keep in mind that the form 211 they will submit has to go thru and be aproved by FINRA..........mu best guess is 3 - 6 months for completion according to google search that is what they are stating for a form 211 approval.

What does that have to do with anything here?

50000shares WDHI here,,,,,,,,,,

Let's get to 3 cents first and then a nickel and that would be huge!

pls stop the nonsence

Sounds promising. Hopefully soon.

This doesnt seem to have turned out too well.

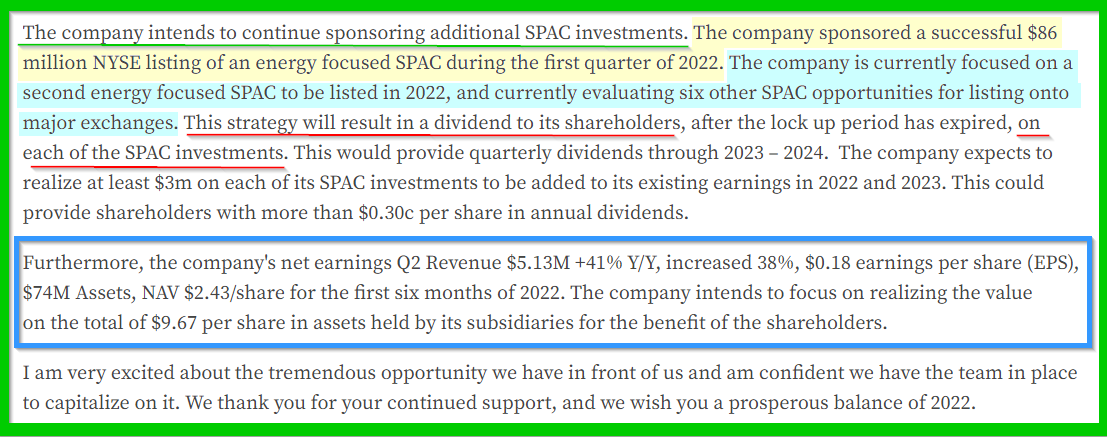

HNRC REPORTS RECORD RESULTS FOR PERIOD ENDING MARCH 31, 2022

https://www.prnewswire.com/news-releases/hnrc-reports-record-results-for-period-ending-march-31-2022-301535722.html

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |