Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

What do you make of the last month's awful returns? Does CYRX bounce back? Long term CYRX holder and I'm losing faith here....

Big run. The numbers are good. Look at the fine print.

Cryoport Inc. is a global provider of temperature-controlled and cold chain logistics solutions for temperature-sensitive life sciences commodities1. The company serves the biopharmaceutical industry with logistics solutions for biologic materials and regenerative medicine, including immunotherapies, stem cells and CAR T-cells1. Cryoport’s mission is to support life and health by providing reliable and comprehensive temperature-controlled supply chain solutions for the life sciences through its advanced technologies and dedicated personnel2.

Some of the products and services that Cryoport offers are:

Cryoport Express® liquid nitrogen dry vapor shippers, which can maintain temperatures below -150°C for up to 10 days3.

C3™ 2-8°C solution, which is a reusable, validated, and environmentally friendly packaging system that can keep materials between 2°C and 8°C for up to 96 hours3.

Cryoportal® logistics management platform, which is a cloud-based software that enables end-to-end visibility, tracking, and monitoring of shipments across the globe3.

Smartpak II® condition monitoring system and geo-sensing technology, which provide real-time data on location, temperature, orientation, humidity, pressure, and shock3.

Chain of Compliance®, which ensures full compliance at every step in the transportation process, from packaging to delivery3.

Clinical & Commercial Support, which provides dedicated project management, logistics coordination, and customer service teams to assist clients with their supply chain needs3.

Veri-Clean®, which is a validated cleaning process that eliminates the risk of cross-contamination and ensures the integrity of the shippers3.

BioServices, which include cell processing, storage, distribution, kitting, and biobanking solutions for cell and gene therapies4.

Cryoport has its headquarters in Brentwood, Tennessee. Its Global Supply Chain Centers are located in Houston, Texas and Morris Plains, New Jersey. Its Global Logistics Centers are located in Irvine, California; Amsterdam, The Netherlands; Sydney, Australia and Singapore5.

Cryoport is the leader in temperature-controlled supply chain solutions for the life sciences industry. It has over 650 active clinical trials, 10 commercial products, 650,000+ shipments, and 150+ countries served3. It also has a strong financial performance, with a revenue growth of 23% year-over-year in 2022.

I am really surprised this stock got down to these levels?

Ouch!

weaker than expected global demand for capital equipment; clinical trial start delays; and slower than expected ramps from certain clients

Second quarter revenue expected in the range of $56.5 - $57.5 million

Full year 2023 revenue now expected in the range of $233 - $243 million

New Bullish SA Article

https://seekingalpha.com/article/4615166-cryoport-cyrx-strong-player-cold-chain-logistics-solid-growth-prospects

I remain bullish on CYRX due to its dominant position in cold-chain logistics, comprehensive range of services, significant growth potential, and capable management team. As the field of cell and gene therapy experiences more regulatory filings and approvals, CYRX is well-positioned to benefit from the overall industry growth. Additionally, CYRX can leverage its existing cryogenic offerings by pursuing strategic mergers and acquisitions in the cold-chain solutions space. I view the stock as a buy and have an end-of-year price target of $25 on the stock.

10 Commercial Therapies at the end of Q1 2023

As of the end of the first quarter, Cryoport supported 10 commercial therapies and a total of 652 clinical trials globally, with 82 of these in Phase 3. We expect up to an additional 18 anticipated application filings, 10 new therapy approvals and an additional 11 label or geographic expansion approvals in 2023.

First Quarter 2023 Results

Record revenue of $63 million, representing 20% growth year-over-year

Growth across all lines of business: Biopharma/Pharma revenue up 19%; Animal Health revenue up 30%; Reproductive Medicine revenue up 13% year-over-year

Commercial Cell and Gene Therapy revenue up 28% year-over-year, now supporting 82 Phase 3 clinical trials

Strong balance sheet with $523 million in cash and short-term investments

NASHVILLE, Tenn., May 4, 2023 /PRNewswire/ -- Cryoport, Inc. (NASDAQ: CYRX) ("Cryoport" or the "Company"), a leading global provider of innovative temperature-controlled supply chain solutions for the life sciences, today announced financial results for the three months ended March 31, 2023.

Jerrell Shelton, CEO of Cryoport, commented, "We are pleased to report that we delivered record revenue of $62.8 million for the first quarter, representing top-line growth of 20% or 23% in constant currency compared to the first quarter of last year. This quarterly performance was driven by solid demand for our comprehensive set of products and services as we achieved double digit growth in each of our markets, Biopharma/Pharma, Reproductive Medicine, and Animal Health.

"We saw solid growth in Biopharma/Pharma with revenue increasing 19% year-over year. The Regenerative Medicine industry was one of the fastest growing therapeutic segments in 2022, with new innovative cell and gene therapies entering the market. This trend has continued in 2023 driving year-over-year growth in revenue from commercial therapies by 28% for the first quarter. Patient demand continues to outpace commercial cell therapy supply; however, biopharma companies and contract development and manufacturing organizations (CDMOs) are continuing to build out manufacturing capacity to meet patient demand and the expected future demand for cell and gene therapies. This bodes well for Cryoport as we believe that we are well positioned to support this expected growth with our advanced temperature-controlled supply chain solutions.

"Growth in Animal Health revenue for the quarter increased over 30% year-over-year. This was due to increases in our growing global population and its demand for animal protein as well as the expanding ownership of companion animals in developing and emerging regions. Companion animals are fueling the need for therapeutic innovation in this area to improve animals' lives. We are seeing increasing activity from top global animal health pharmaceutical companies to meet this demand.

"Reproductive Medicine revenue was $2.8 million for the first quarter of 2023 with revenue increasing 13% year-over-year. Growth was primarily driven by our continued progress in contracting with key reproductive clinic networks, as evidenced by our recent announcements regarding our support of Boston IVF and Inception Fertility.

"Looking ahead, given the current geopolitical instability and imbalance in the world economy, we remain committed to continuing our momentum throughout the remainder of 2023. We expect to benefit from growth in all our markets and especially the dynamic cell and gene therapy industry where Cryoport supports a total of 652 clinical trials globally with 82 of these in phase 3.

"As a leader in the development of advanced temperature-controlled supply chain solutions for the life sciences industry, we have recently launched the Cryoportal® v2 Logistics Management System. The Cryoportal® v2 is the first and, to our knowledge, the only ISPE GAMP® 5.0 validated system of its type to serve the life sciences and provides many new features and enhancements.

"Of course, we have not stopped there. Other key product and services initiatives planned for launch this year include our next generation, advanced Cryoport Elite™ shipper line, which is now starting to roll out with our ELITE™ Ultra-cold -80°C line of shippers supporting gene therapies. Cryoport ELITE™ shippers will provide additional de-risking, longer temperature hold-times, more advanced communications features, and new security controls. Near the end of the year, our SkyTrax™ Condition Monitoring System, a generational leap to an advanced condition monitoring system that will support temperature ranges from controlled room temperatures to cryogenic temperatures, will also be released as well.

"As we move forward, we expect the robust cell and gene therapy industry to continue its march forward and we will continue to provide new, innovative services and products that will drive our organic growth. Good examples of this are the build-out of our Global Supply Chain Center Network, the introduction of our IntegriCell™ platform to supply autologous and allogeneic cell therapies a standardized apheresis collection and end-to-end cryopreservation service for leukapheresis derived therapies, as well as our Fusion® and Vario® Cryogenic Freezer Systems.

"Our strategy and our team are committed to ensuring Cryoport is always delivering the highest quality, most reliable solutions to support life-saving cell and gene therapies, and we are constantly evaluating opportunities to ensure this – because we know 'a patient is waiting.'

"In my opinion, Cryoport is in a great position in the industry today and has never been stronger than it is today. We are looking forward to fulfilling our vision of becoming the essential supply chain company serving the life sciences," concluded Mr. Shelton.

Total revenues by market for the three months ended March 31, 2023, as compared to the same period in 2022 was as follows:

Boston IVF Agreement: Reproductive Material Shipments Across the U.S.

Apr. 25, 2023 8:30 AM ET

NASHVILLE, Tenn., April 25, 2023 /PRNewswire/ -- Cryoport, Inc. (CYRX) (NASDAQ: CYRX) ("Cryoport" or the "Company"), a leading global provider of innovative temperature-controlled supply chain solutions for the life sciences, reproductive medicine and animal health industries, today announced that it has signed a new three-year agreement with Boston IVF, a pioneer in reproductive healthcare and innovative research and one of the world's most experienced fertility treatment providers.

Utilizing Cryoport's end-to-end supply chain solutions, Boston IVF will now have the ability to integrate its regional and satellite labs across Massachusetts, New Hampshire, Maine, Rhode Island, New York and Indiana, along with its partner sites in Delaware, Ohio, Idaho, Utah and North Carolina. Cryoport's platform will improve the overall efficiency of Boston IVF's reproductive material shipments and ensure significant risk mitigation for patients and families entrusting Boston IVF with their care.

"Boston IVF is a widely recognized leader for reproductive medicine, having supported more than 150,000 babies born since 1986 while achieving some of the highest IVF success rates in the country," said Jerrell Shelton, CEO of Cryoport. "As we seek to provide more patients with peace of mind that their reproductive materials are being handled safely and securely, we're proud to partner with a team that is equally committed to delivering the best outcomes and experiences for their patients."

"Inside our clinics, our physicians are among the best in treating infertility and have affiliations with the Beth Israel Deaconess Medical Center and Harvard Medical School," said David Stern, CEO of Boston IVF. "We're always looking for ways to ensure exceptional patient care from start to finish in each fertility journey, and this includes the vital logistical component outside of the clinic. Cryoport's cutting-edge technology and nonstop monitoring simplify the entire supply chain process by ensuring that patients' reproductive materials are safe every step of the way."

That's a big if however if that does happen it should give them some good credibility.

Go Cryoport!

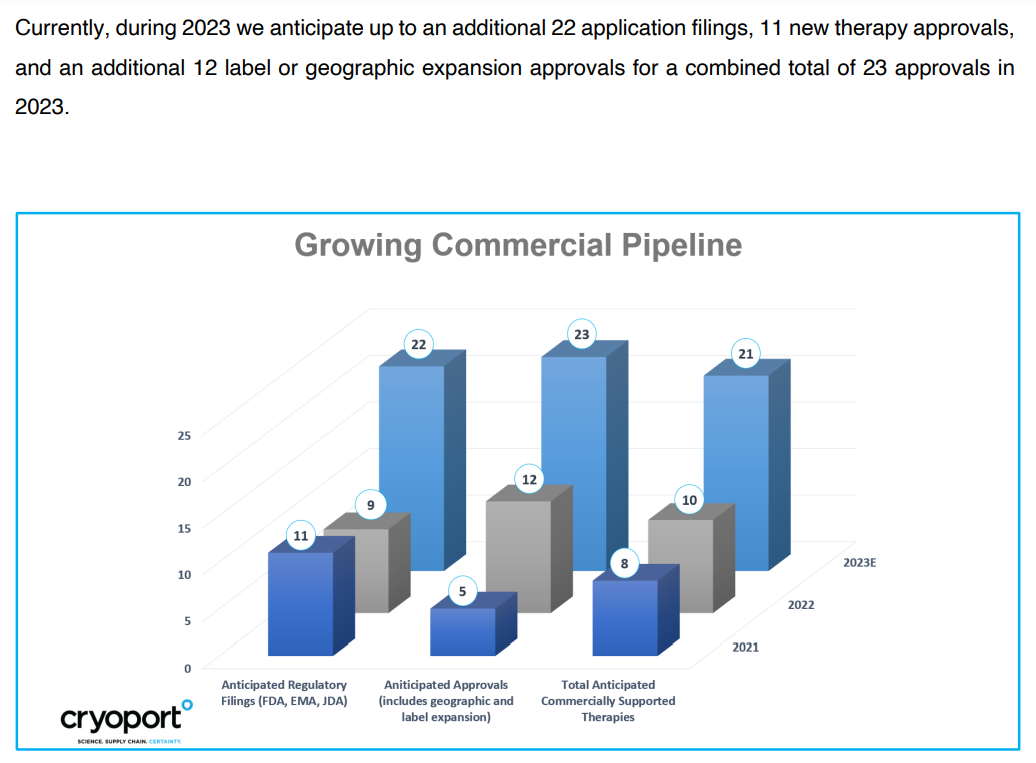

Approval Pipeline, as of Feb. 2023

That is the main slide I'm interested in as an investor.

That's where income growth can be boosted. If CYRX signs on 11 new approved therapies in 2023, that can only validate the entire growth approach, moving therapies from Ph I to Ph II to Ph III to commercial. Trials are at 654 as of Dec. 2022. From on quarter to the next, that's my first focus.

Best of luck with your investments!

Expanding Capabilities across Regions, Growth Factor

CYRX global footprint has expanded again, with more offerings on the entire logistical chain.

They are making themselves more attractive to their target companies as a one stop shop and establishing the foundation for a world wide operation and across functions. They keep betting on growth. A medium/long term strategy. Now the revenue needs to keep in line with the strategy, and so far, the pipeline points that way.

Best of luck with your investments!

Commercial Growth Pipeline, Feb. 2023

CYRX keeps adding more potential to their pipelines (and actual commercial on the backend. )

At the end of the year, we supported a total of 654 clinical trials worldwide, a net gain of 52 clinical trials since year-end 2021 and with 79 of these trials in Phase 3. At the end of the year, we also supported 10 commercial therapies, an increase from eight since year-end 2021.

SA Article

A fairly balanced view on CYRX, with the basic company overview, the possible catalysts, etc.

Conclusion:

We are constructive on CYRX's position in the life sciences value chain and believe the company has scope to rate higher, seeking upside targets to $38.5. Net-net, we rate CYRX a buy.

Blackrock increases CYRX position

https://www.nasdaq.com/articles/blackrock-increases-position-in-cryoport-cyrx

Probably the reason for the 10%+ PPS increase toay.

Best of luck with your investments!

And another partnership. The growth strategy is clear.

https://www.prnewswire.com/news-releases/cryoport-announces-new-strategic-partnership-with-syneos-health-to-advance-cell--gene-therapies-301724255.html

NASHVILLE, Tenn., Jan. 18, 2023 /PRNewswire/ -- Cryoport, Inc. (NASDAQ: CYRX) ("Cryoport"), a leading global provider of innovative temperature-controlled supply chain solutions to the life sciences industry focused on the pharmaceutical and cell and gene therapy markets, today announced a new strategic partnership with Syneos Health® (NASDAQ: SYNH), the only fully integrated biopharmaceutical solutions organization purpose-built to accelerate customer success. Both Cryoport and Syneos Health are world leading solutions companies with deep expertise and experience supporting clinical and commercial stage therapies. The partnership will support the global advancement of cell and gene therapies, providing the industry's first fully integrated biopharmaceutical and supply chain solution.

The new partnership couples the full suite of clinical development services offered by Syneos Health with IntegriCell™, Cryoport's platform providing standardized apheresis collection through BioLife Cellular Therapy Services, (part of Takeda), cryopreservation services, risk mitigation services, logistics support, and secondary packaging.

Jerrell Shelton, CEO of Cryoport, said, "We are excited to be partnering with Syneos Health as our two companies share a common vision for advancing standardized cell and gene therapies in the clinical trial arena. Syneos Health strategically integrates clinical development, medical affairs and commercial capabilities to address modern market realities. Syneos Health understands the value and opportunity to the industry of integrating the first fully standardized apheresis collection and cryoprocessing platform, IntegriCell™, into their solutions offering. The work we are doing with Syneos Health underscores the value Cryoport brings to its partners as well as its customers and further enhances our leadership position in the global cell and gene industry."

Michael Brooks, COO, Syneos Health, said, "Leveraging our relationship with Cryoport, Syneos Health will help deliver seamless integration and insights for key services for cell and gene trial operations to biopharmaceutical customers. This partnership will further help to accelerate treatment timelines and improve outcomes by expanding patient access to these life-changing therapies worldwide."

Bought another $17.41 slice today.

Best of luck with your investments!

Bullish SA Article

https://seekingalpha.com/article/4558376-cryoport-the-golden-stock

Conclusion

In all, I maintain my buy recommendation on Cryoport with a 5/5 stars rating. Cryoport is a special company for various reasons. As a logistic service provider, the company leverages the strong industry tailwind of cell/gene therapy innovators. Second, Cryoport grows aggressively both organically and through mergers and acquisitions. Despite the recent macroeconomic issues, the long-term future of Cryoport is brighter than ever. The company continues to ramp ups its revenues, clinical trials being supported, the opening of new centers, and acquisitions. If you are patient and leverage volatility to your advantage, Cryoport is most likely to give you a 10-bagger return in the next few years.

Q3 2022: Headwinds - Ukraine, China Covid Policies, Inflation

Third quarter revenue of $60.5 million; nine months 2022 revenue reaches $176.9 million; Cryoport Systems' revenue up 25% year-over-year

$530 million in cash and short-term investments

Supporting a record 643 global clinical trials; 61 net new trials added (year-over-year)

Entered strategic relationship with Takeda's BioLife Plasma Services for apheresis collection and leukopak production

Record number of new products and offerings slated to be released by Cryoport in 2023

Like many companies that operate globally, we were subject to macroeconomic headwinds during the third quarter and expect some of these pressures will extend into the fourth quarter. Specifically, during the third quarter, we experienced a convergence of macroeconomic pressures that impacted revenue including: a negative foreign exchange impact of $2.6 million due to the increased strength of the U.S. dollar against certain foreign currencies; recurring COVID lockdowns in China; supply chain related issues; the Russia/Ukraine war and its ripple effect throughout Europe; and industry capacity limitations, which interfered with cell and gene therapy commercial revenue acceleration.

SA Reference Article

A good summary of the investment thesis around CYRX as a growth company. It's a clear article, well organized, simple to read.

It captures why I invested in CYRX and why this is a medium/long term opportunity.

https://seekingalpha.com/article/4542593-cryoport-a-rare-investing-opportunity

The article goes over:

* An overview of the Company

* The Investment Thesis

* The industry Tailwinds

* EMEA Expansion - Belgium With Cell Matters Acquisition

* EMEA Expansion - Spain With Polar Express

* EMEA Expansion - France With Cell & Co BioServices

* Strategic Partnership With Takeda

* Operational Performance - Robust Expansion In All Business Segments

* Operational Performance - Supporting More Clinical Trials

* Competitor Landscape

* Financial Assessment

* Valuation Analysis

* Shares Repurchase Program

* Potential Risks

* Conclusion

Conclusion

In all, I maintain my buy recommendation on Cryoport with a 5/5 stars rating. Cryoport is a rare investment opportunity because it is profiting from the strong industry tailwind favoring cellular therapy innovators. So long as the cellular therapy sector continues to grow, leading companies like Cryoport (and BioLife) will enjoy more business, thus continuing to ramp up their topline growth. Over the years, the company would then bank a profit due to the economy of scale.

As it leverages growth with the sophisticated M/A approach, Cryoport can grow much faster than other firms. Over the years, Cryoport has been quite busy with making additive acquisitions. 2022 alone witnessed three significant buyouts - Cell&Co, Polar Expres, and Cell Matters. Then, there's the Takeda partnership.

Despite such strong growth, Cryoport is still a young company with substantial upsides. By purchasing shares in such a firm and holding it for many years, you can earn multi-bagger profits.

CYRX down in the last couple of weeks, without any substantive news.

Staying long.

Best of luck with your investments!

Houston again, partnering with Takeda's BioLife Plasma Services

The Houston location will help the partnership synergy.

Cryoport Enters into Strategic Relationship with Takeda's BioLife Plasma Services

Cryoport plans to establish an integrated supply chain platform with BioLife Plasma Services to offer standardized cell therapy collection, processing, and storage services in United States and Europe over time

NASHVILLE, Tenn., Sept. 8, 2022 /PRNewswire/ -- Cryoport, Inc. (Nasdaq: CYRX) ("Cryoport" or the "Company"), a global leader in temperature-controlled supply chain solutions for the life sciences industry, today announced it has entered into a strategic relationship with BioLife Plasma Services, part of the global biopharmaceutical company Takeda, intended to provide consistent, high-quality cellular starting material for use in the manufacture of life-saving cellular therapies.

By bringing together BioLife Plasma Services' proficiency in apheresis collection and their donation center infrastructure with Cryoport's life sciences' world-class capabilities and expertise in temperature-controlled supply chain solutions for the biopharmaceutical industry, the companies aim to establish a standardized, integrated apheresis collection, processing, and distribution solution for cellular therapies. Importantly, the new platform will leverage the cryo-processing expertise of Cell Matters, which Cryoport acquired in late July 2022.

Two US Based Global Supply Chain Centers, Houston and Morris Plains!

An important milestone for us was, after two years of development, the opening of our first two Global Supply Chain Centers in Houston, Texas and Morris Plains, New Jersey during the second quarter of this year. Grand Opening ceremonies were held in June, and these centers are now fully staffed with trained personnel and are beginning to support client activity.

These world-class facilities form the foundation of our Global Supply Chain Center Network and, importantly, include the addition of GMP (Good Manufacturing Practices) BioServices to our increasingly comprehensive supply chain solutions.

Belgium Cell Matters acquisition

After France Cell&Co earlier this year, CYRX acquired another EMEA company:

In April, we expanded our presence in the EMEA region with the acquisition of Cell&Co BioServices in France, and subsequent to quarter end, we acquired Cell Matters, a Belgium based company specializing in cryo-process optimization, cryo-processing, and cryopreservation; thereby expanding our supply chain platform upstream in support of standardized apheresis collection and processing.

Our increasing portfolio of new products and services, coupled with our expanding global footprint is enabling us to become “the partner of choice” across the cell and gene therapy (CGT) industry as we provide new solutions to derisk supply chain processes.

CYRX: Earnings Call Aug 4th:

The effect of the fire earlier this year should start to dissipate and the backlog could even boost this quarter's earnings.

Also curious about the distribution and volume of PI, PII, PIII and Commercial products supported.

Best of luck with your investments!

Bought more shares today.

Commercial Outlook - May 2022

We expect another year of continued commercial revenue ramp as our clients focus on expanding their commercial manufacturing capabilities, as currently approved products receive supplemental approvals for new or expanding indications, and as anticipated product launches come to fruition.

Two (2) Cryoport supported Biologic License Applications (BLAs) or Marketing

Authorization Applications (MAAs) were filed in first quarter 2022, based on internal information and data from the Alliance for Regenerative Medicine.

During the quarter, there were three (3) approvals consisting of

> one (1) new product,

> one (1) geographic expansion and

> one (1) move to earlier line treatment.

Currently, we anticipate up to an additional fifteen filings, three (3) new

therapy approvals, and an additional seven (7) label or geographic expansion approvals in 2022.

For 2023, another 20 BLA or MAA filings are anticipated, up from twelve previously.

Q1 Earning on 05/05/2022 - Confirmed.

Best of luck with your investments!

Bought more in the $22, so not completely playing with house money, but pretty close :)

Upcoming CC this week. The current valuation is way too low.

Best of luck with your investments!

Cell&Co BioServices acquisition: growth strategy.

CYRX is not kidding around. They are building a juggernaut. The latest acquisition:

Acquisition of Cell&Co BioServices, Clermont-Ferrand, France, accelerates Company's EMEA expansion plans and development of its Global Supply Chain Network

NASHVILLE, Tenn., April 18, 2022 /PRNewswire/ -- Cryoport, Inc. (Nasdaq: CYRX) ("Cryoport" or the "Company"), a global leader in temperature-controlled supply chain solutions for the life sciences industry, today announced that it has acquired Cell&Co BioServices, headquartered in Clermont-Ferrand, France with additional operations in Pont-du-Château, France. Founded in 2012, Cell&Co is a bioservices business providing biorepository, kitting, and logistics services to the life sciences industry. Its accreditations include ISO 9001, ANSM (Investigational Medicinal Products), NFS 96 900, and soon, ISO 20387. Supporting its biostorage and services of clinical and commercial biopharma therapies, Cell&Co has in-house QP services.

In 2021, Cell&Co recorded revenue of approximately €2.6 million. Cryoport's purchase price for Cell&Co was €6.2 million, comprised of upfront consideration of €3.6 million in the form of cash and Cryoport common stock, plus a potential earn-out of €2.5M based on achieving certain financial targets.

Regarding the acquisition, Jerrell Shelton, Chief Executive Officer of Cryoport, stated, "We are indeed pleased to have the Cell&Co team as a part of Cryoport. Cell&Co will play a significant role in Cryoport Systems' development of its Global Supply Chain Network, designed to meet the needs of the growing Regenerative Medicine industry worldwide. In fact, on a global basis, industry experts expect that between now and 2027 approximately 30 to 50 new cell and gene therapies will be introduced into the market each year. Cell&Co's competencies combined with its location in the centre of France makes it an excellent strategic fit for Cryoport Systems and will accelerate the expansion of its new Global Supply Chain Network by approximately two years.

"Coupled with our new Global Supply Chain Centers in Houston, Texas and Morris Plains, New Jersey, Cell&Co will add significantly to the development of Cryoport Systems' global service offering. It will also provide Cryoport Systems with an EU site for importation services for non-EU clients, which will add significant value for our clients and create additional opportunities for U.S. based regenerative medicine developers looking to conduct clinical trials or commercially distribute cell and gene therapies in EMEA."

Sofien Dessolin and Florent Belon, founders of Cell&Co BioServices made a joint statement saying, "The cell and gene therapy market is expected to grow rapidly and is a significant focus for us. We are proud of the work we have accomplished and even more of joining the Cryoport group with its objective of making medical innovation achievable and more reliable for the benefit of patients around the world. It is a source of great pride and a huge motivating factor. The time was right for us to be part of an industry-leading organization such as Cryoport in order to support our business, expand our product solutions, and become a significantly larger player in the life sciences industry. We are excited to be part of Cryoport's strategic platform in the advanced therapies space in EMEA and look forward to continuing to lead Cell&Co as an integral part of Cryoport as it builds out its Global Supply Chain Network and other services."

SA Article, another Bullish Analysis

https://seekingalpha.com/article/4501644-cryoport-industry-leader-basking-tailwinds

The conclusion:

In all, I maintain my buy recommendation on Cryoport with a five out of five stars rating. As you can appreciate, it's rare to find a growth company that leverages the M/A model, which is also an industry leader like Cryoport. Being the logistics provider for the growing cell/gene therapy innovators, Cryoport is basking in the industry tailwinds. Both organic and M/A revenues are growing and leaping aggressively. Concurrently, the company is building and expanding its infrastructures to support future growth. During this bear market, you have another chance to pick that same great company at a fraction of its intrinsic value. The management realized that their shares are trading at a bargain. As such, they are buying back shares.

SA Article

https://seekingalpha.com/article/4499176-cryoport-risky-investment-upside-potential

A few charts comparing PPS with net income, revenue, debt, total assets...

Best of luck with your investments!

New Prague facility returns to full production after fire

Q1 took a hit. CYRX says it's contained to Q1. Let's hope so.

Cryoport previously announced it would resume production at the New Prague facility during the week of February 14th and ramp up to full production during the first quarter of 2022.

The Company also guided to a revenue impact from the fire of $4 to $5 million limited to the first quarter of 2022. Production did resume as planned; however, a number of unexpected challenges resulting from the fire caused the recommissioning and validation of production to progress more slowly than had been previously anticipated.

As a result, Cryoport now expects a revenue impact from the fire of $9.0 to $9.5 million which will remain limited to the first quarter. As previously announced, the Company expects its insurance to cover the majority of the costs to restore and re-open the facility, as well as related business interruption losses. Management will concentrate on reducing shipment timelines to customers throughout the remainder of the year.

Gap up followed by a nice 9% move today (3/29/2022) thus far

I don't see news yet as to the reason behind it. The volume is below average (session is not closed yet), maybe just correcting after a very long down ramp (unjustified in my view, but that's the market).

I may be getting a bonus end of H1. If the PPS is still depressed, I might put back some money into CYRX. (I'm playing with house money for now after taking some nice benefit).

Best of luck with your investments!

Board's confidence in business model and outlook

At this stage in the company, I believe the board's confidence is warranted.

Jerrell Shelton, Cryoport CEO, said, "The authorization of the repurchase program reflects our constant focus on shareholder return and effective capital allocation. The authorization of this repurchase program demonstrates the Board's confidence in our business model and outlook, our financial performance, and our commitment to delivering value to our stakeholders. We plan to opportunistically repurchase shares of our common stock and convertible senior notes, while maintaining ample liquidity to support our growth organically and through potential acquisitions."

$100M Repurchase Program

Cryoport Authorizes $100 Million Repurchase Program

NASHVILLE, Tenn., March 11, 2022 /PRNewswire/ -- Cryoport, Inc. (NASDAQ: CYRX) ("Cryoport" or the "Company"), a global leader in temperature-controlled supply chain solutions for the life sciences industry, today announced its Board of Directors has unanimously authorized a repurchase program, under which Cryoport may repurchase up to $100 million of its outstanding common stock and/or convertible senior notes.

Jerrell Shelton, Cryoport CEO, said, "The authorization of the repurchase program reflects our constant focus on shareholder return and effective capital allocation. The authorization of this repurchase program demonstrates the Board's confidence in our business model and outlook, our financial performance, and our commitment to delivering value to our stakeholders. We plan to opportunistically repurchase shares of our common stock and convertible senior notes, while maintaining ample liquidity to support our growth organically and through potential acquisitions."

Repurchases may be made from time to time on the open market or otherwise, in such quantities, at such prices, and in such manner as determined by management at its discretion and will depend on a number of factors, including the market price of Cryoport's common stock, general market and economic conditions, and applicable legal requirements. The repurchase program will expire on December 31, 2025 and may be extended, suspended, modified or discontinued at any time. The company does not expect to incur debt to fund the repurchase program.

Increasing capacity to meet strong demand

One of the take-away for me during the CC was the obvious demand fueled by the continued investments in biotech industry which leads directly to feeding the pipeline. That demand requires more capacity to simply address it and the demand is not projected to stop. It's a moving train.

That is shown in turn in the number of clinical trials in the pipeline as of now.

http://ir.cryoport.com/~/media/Files/C/Cryoport-IR/reports-and-presentations/fourth-quarter-2021-in-review.pdf

The CC did a good job at highlighting this point.

Best of luck with your investments!

$628M in cash/cash equivalents/short term investments

http://ir.cryoport.com/~/media/Files/C/Cryoport-IR/reports-and-presentations/fourth-quarter-2021-in-review.pdf

Best of luck with your investments!

CYRX to Resume Production at New Prague Facility

NASHVILLE, Tenn., Feb. 9, 2022 /PRNewswire/ -- Cryoport, Inc. (Nasdaq: CYRX) ("Cryoport" or the "Company"), a global leader in temperature-controlled supply chain solutions for the life sciences industry, today provided an update on resumption of activities at the New Prague facility. As previously announced, a fire occurred in a portion of the MVE Biological Solutions manufacturing facility located in New Prague, Minnesota on January 25, 2022, causing production to be temporarily curtailed. The New Prague facility manufactures aluminum dewars and is one of MVE Biological Solutions' three global manufacturing facilities.

Cryoport expects to resume production at the New Prague facility during the week of February 14th and ramp up to full production during the first quarter of 2022. The Company anticipates the revenue impact of $4 to $5 million to be limited to the first quarter. Furthermore, the Company expects its insurance to cover the majority of the costs to restore and re-open the facility, as well as related business interruption losses.

Fire at the New Prague Facility

http://ir.cryoport.com/news-releases/2022/01-31-2022-223509366

I had been wondering why the crazy drop for CYRX until I saw this article.

While Cryoport anticipates that the reduced operations at the New Prague facility will adversely affect Cryoport's financial results for the first, and possibly second quarter of 2022, Cryoport does expect that a significant share of the loss resulting from the fire damage will be covered by its property and business interruption insurances.

Cryoport partners with Cell Matters to provide cryopreservation services

http://ir.cryoport.com/news-releases/2022/01-27-2022-133147012

Key aspects of the partnership:

* Cell Matters and Cryoport Systems will launch a joint service to support the development, the optimization, and the actual cryopreservation of leukopaks for preclinical, clinical, and commercial use. The partnership will solve the main challenge of cell therapy manufacturers which is the timely supply of high-quality manufacturing-ready leukopaks;

*Cryoport Systems and Cell Matters will provide clients with a new comprehensive suite of cryopreservation solutions.

Cell Matters, a Belgian based company, enhances cell therapy productivity by turning cryopreservation into a competitive advantage, offering an integrated set of GMP services, in line with regulatory, quality and GMP requirements of the cell therapy industry. The Company uniquely combines expertise in cryobiology, cell therapy production, and bio-logistics. Further, Cell Matters has launched a cryopreservation platform dedicated to the cryopreservation of leukopaks with the first international cell therapy customers currently onboarding.

SA article:

In all, I maintain my buy recommendation on Cryoport with a five out of five stars rating.

|

Followers

|

82

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

12138

|

|

Created

|

12/30/06

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |