Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

That is complete Bullshit

$CORV I added this morning on volume. $.345 is solid resistance that has been pierced a few times. $.33 shows minor support.

$CXRXF has offered $.42 for $CORV. The buyer is ADVANZ PHARMA CORP LTD COM LTD VTG and hit a high of $19.40 this morning running off low of $3.41 just three days ago.

Congrats on $CNRXF holders.

$CORV holders look solid with buys at these lows.

Rain

CORV--Under accumulation today. Another offer coming?? Possible.

No reason to at this point, although I don't understand why it's not trading closer to the .42 sale price.

Did you see what cxrxf just did omg this will blow once people wake up!!!!!

Parent company just tapped 20$ after trump name drop... when are people gonna slap this lol

Its coming

I got 15 from 6.12 congrats

I just sold CXRXF for $15 from $5.25 they are the company buying Corv... just shows the value of Corvs assets.

Oh boy...people have lost their damned minds. Easy 30 percent from today's $0.32 buys. Only a handful of hedge fund managers will have that for the entire 2020! And I am having it I a few days to weeks. You just wonder why some people are still in this business ....to just give cash away!!! Amazing!

Lol....got a couple of thousands this morning at $0.32. Thirty percent profit is GUARANTEED in two months. Many hedge fund managers will shave their beards to get 30 percent in normal market conditions. And some DUMB IDIOTS are making it possible for us here. Took out as much at $0.32 even. LMFAOO

CORV moving up AH .3498 now on nice buys.

SEC INVESTIGATION ! BWAAAA HAAAAA!

CORV lots of accumulation lately.Might see .40 today.imo

CORV so undiscovered Load up IMO

CORV BEST PLAY OUT THERE.Turning around now.Lots of buys coming in.

Matter of fact. all shares of corv will be bought at least .42

Matter all shares will of corv will be bought at least .42

Wow you were right. CXRXF is up by 48%

Not this SCAM, it is going down again........whoops

Gm all. Ok so I've read and researched but i will be frank, I'm a dumb newbie. Please explain what this (cash buy right?) acquisition means for the stock.. feel free to talk to me like a 5yr old. Lol

CXRXF is ripping now $5.65

The company buying them. CXRXF stock price is at $3.50 I'm surprised that people aren't jumping all over this

Another higher offer is expected from UTHR United Therapeutics prior to the 4/27 pdufa for Treyvant. Corv was wise to "accept the arrangement" so they could publish the potential buyout to force UTHR to the table. do your DD...Corv is not selling their entire company for $76M when UTHR paid over $200M for steadymed last year just for US rights to Treyvant..know what you own!

Thanks GC!

CORV

ADVANZ PHARMA to Acquire Correvio

Date : 03/16/2020 @ 7:00AM

Source : PR Newswire (Canada)

Stock : Correvio Pharma Corporation (CORV)

Quote : 0.3451 0.0343 (11.04%) @ 7:59PM

ADVANZ PHARMA to Acquire Correvio

Correvio Pharma (NASDAQ:CORV)

Intraday Stock Chart

Today : Monday 16 March 2020

Click Here for more Correvio Pharma Charts.

NASDAQ: CORV TSX: CORV

Acquisition Expected to Have a Total Purchase Price of Approximately US$76 Million Including the Repayment of Certain Correvio Indebtedness

ADVANZ PHARMA Intends to Pay for the Acquisition with Cash on Hand

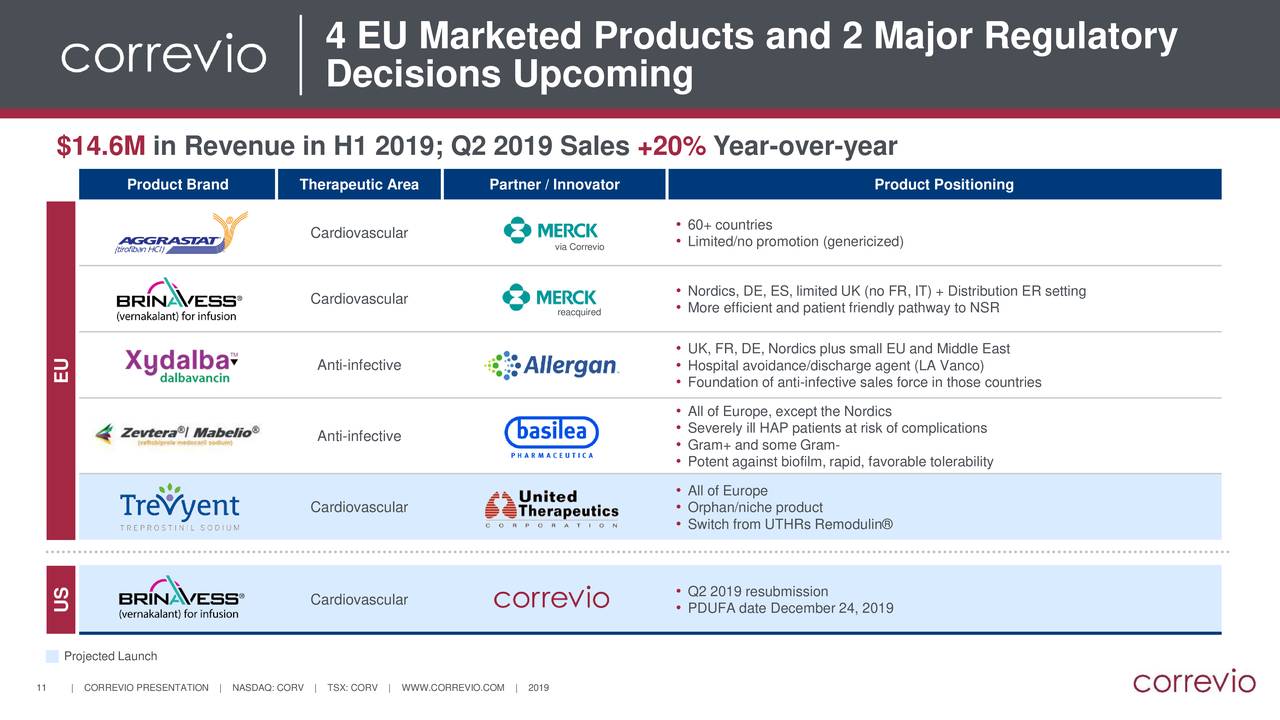

Provides ADVANZ PHARMA with an Immediate and Direct Commercial Presence in Germany, France, Spain, Italy, and the Benelux region, While Strengthening its Existing Presence in the Nordics and the United Kingdom

Further Diversifies ADVANZ PHARMA's Portfolio of Medicines by Adding Established and Innovative High-Quality Brands Sold in Over 60 Countries Around the World

VANCOUVER, March 16, 2020 /CNW/ - Correvio Pharma Corp. (NASDAQ: CORV) (TSX: CORV), a specialty pharmaceutical company focused on commercializing hospital drugs, today announced its entry into an arrangement agreement ("Arrangement Agreement") dated March 15, 2020, for ADVANZ PHARMA Corp. Limited ("ADVANZ PHARMA", TSX:ADVZ) to acquire all of the issued and outstanding shares of Correvio. The acquisition, which will be executed through ADVANZ PHARMA's wholly-owned subsidiary Mercury Pharma Group Limited ("Mercury"), is expected to have a total purchase price of approximately US$76 million, which includes the repayment of certain Correvio indebtedness, pursuant to a plan of arrangement under the Canada Business Corporations Act (the "Arrangement").

ADVANZ PHARMA is a global pharmaceutical company with a diversified portfolio of more than 200 branded and unbranded products, and product sales in more 90 countries.

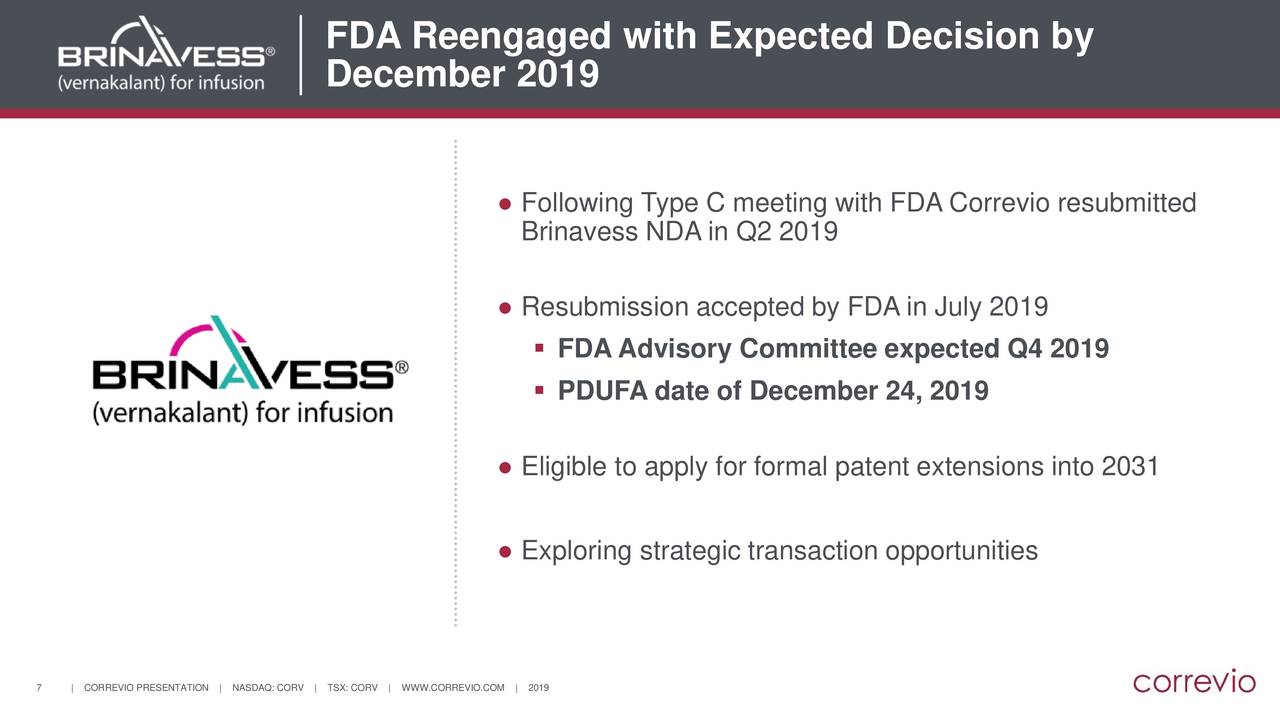

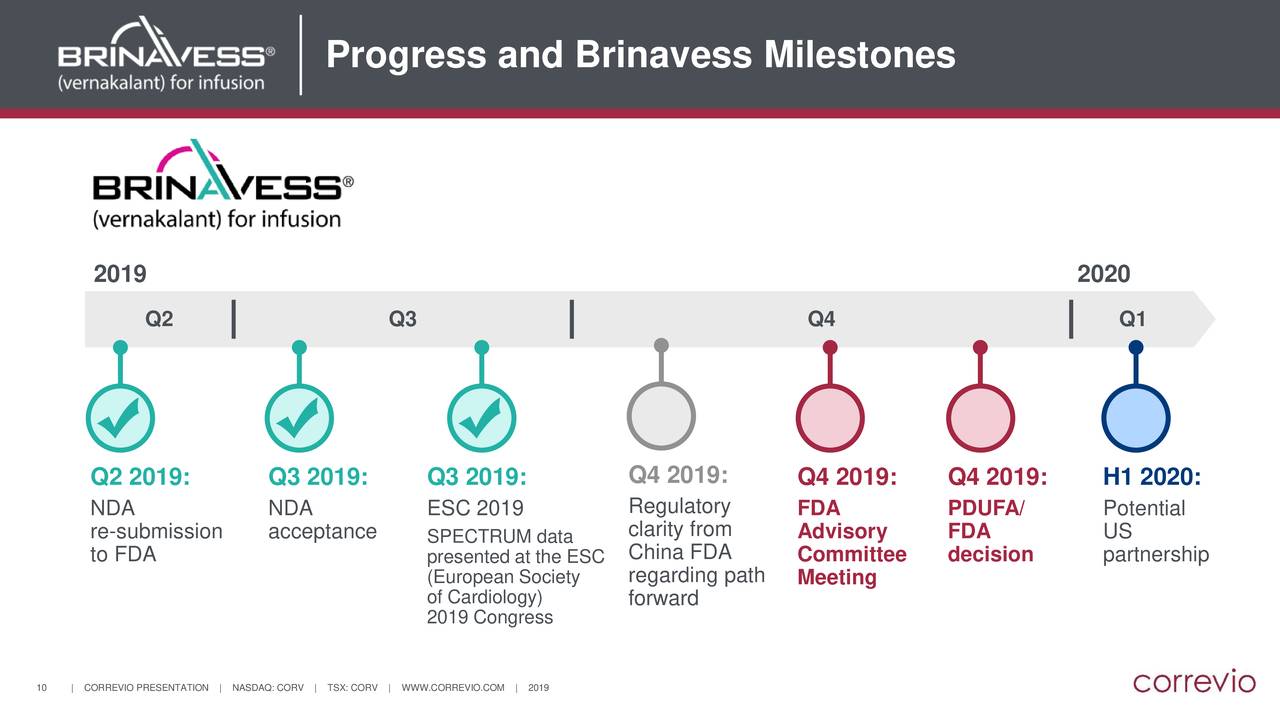

Mark H.N. Corrigan, MD, Chief Executive Officer of Correvio, commented: "Since announcing our intent to explore strategic alternatives in December 2019, we have diligently evaluated a number of opportunities and concluded that a partnership with ADVANZ PHARMA represents the best outcome for our shareholders and other stakeholders, including our employees. We believe that bringing the highly skilled and talented employees from the two organizations together will deliver increased scale, depth of commercial capability, breadth of geographical reach and complementary business models to bring important medicines to patients across the globe."

"Correvio's highly experienced European commercial team provides us with a direct commercial presence in France, Germany, Spain, Italy and the Benelux region, while further strengthening our existing presence in the Nordics and the United Kingdom," said Graeme Duncan, Chief Executive Officer of ADVANZ PHARMA. "Correvio's niche portfolio, consisting of an established brand, and two growing, patent-protected brands, plus a pipeline of potential product launches, are highly complementary to our current priorities and future focus. This is a transformative transaction that we are very excited about, creating what we believe is a leading global platform with advanced commercial capabilities in Western Europe, which should enable us to access further portfolio opportunities going forward."

The Boards of Directors of both companies have unanimously approved the transaction, which remains subject to approval by Correvio securityholders. The Board of Directors of Correvio unanimously recommends that Correvio shareholders vote in favour of the Arrangement. The transaction is subject to customary closing conditions and is expected to be completed during the second quarter of 2020.

Piper Sandler is serving as financial advisor to Correvio. Blake, Cassels & Graydon LLP is serving as legal counsel and Skadden, Arps, Slate, Meagher & Flom LLP is serving U.S. legal counsel to Correvio. PJT Partners is serving as financial advisor, and Fasken Marinteau DuMoulin, and White & Case as legal advisors to ADVANZ PHARMA and its board of directors as part of the transaction.

Further Transaction Details

Under the terms of the transaction, ADVANZ PHARMA will be paying US$0.42 per issued and outstanding share (the "Consideration"), valuing Correvio's equity at approximately US$28 million on a fully diluted basis.

Inclusive of the repayment of Correvio's outstanding debt of approximately US$48 million, this represents a total consideration of approximately US$76 million, excluding Correvio's cash assumed by ADVANZ PHARMA.

ADVANZ PHARMA intends to pay for the acquisition of Correvio with its cash on hand. As of September 30, 2019, ADVANZ PHARMA's cash position was approximately US$243 million.

As part of the transaction, (i) each holder of an in-the-money share purchase option of Correvio that is outstanding immediately prior to the effective time of the arrangement will be acquired for cancellation in consideration for a cash payment equal to the product obtained by multiplying the amount by which the Consideration exceeds the exercise price per share of such in-the-money option by the number of shares underlying such option; (ii) each holder of a restricted share unit or phantom share unit of Correvio that is outstanding immediately prior to the effective time will be acquired for cancellation for a cash payment equal to the Consideration; and (iii) all out-of-the-money share purchase options of Correvio will be cancelled for no consideration. All amounts are subject to applicable withholdings.

Correvio has agreed to hold a meeting of its securityholders by no later than May 20, 2020 in order for shareholders to consider and, if deemed advisable, approve the transaction. Closing is subject to obtaining such shareholder approval, obtaining an interim and final order approving the transaction from the Supreme Court of British Columbia, and to certain other customary conditions as set out in the Arrangement Agreement.

Each of Correvio and Mercury have provided representations and warranties customary for a transaction of this nature and Correvio has provided customary interim period covenants regarding the operation of its business in the ordinary course during such period. In addition, Correvio has agreed to certain non-solicitation covenants and has agreed to pay a termination fee of US$3.5 million in the event that it accepts a superior proposal, changes its recommendation that Correvio shareholders vote in favour of the transaction or in certain other circumstances, subject to certain customary exceptions.

In connection with the transaction and subject to closing, Correvio will apply to have its shares delisted from the TSX and Nasdaq and Correvio will cease to be a reporting issuer under Canadian and U.S. securities law.

A copy of the Arrangement Agreement, which appends a copy of the Plan of Arrangement, will be available on each of the ADVANZ PHARMA and Correvio SEDAR profiles at www.sedar.com.

Each senior officer and director of Correvio has delivered to Mercury a voting support agreement pursuant to which each such officer and director has agreed to, among other things, vote such person's shares in favour of the shareholder resolution approving the transaction.

The Correvio board of directors has received an opinion from its financial advisor, Piper Sandler Companies, that, subject to the assumptions and limitations contained therein, the transaction is fair, from a financial point of view, to the Correvio shareholders.

About ADVANZ PHARMA

ADVANZ PHARMA operates an international specialty pharmaceutical business with a diversified portfolio of more than 200 branded and unbranded products, and sales in more than 90 countries, and going forward, is focused on becoming the leading platform for niche-established medicines, with advanced commercial capabilities throughout Western Europe.

ADVANZ PHARMA's registered office is in Jersey, Channel Islands. The Company operates globally through its subsidiaries in Sydney, Australia; London, England; Mumbai, India; Dublin, Ireland; St. Helier, Jersey; and in Helsingborg, Sweden.

About Correvio Pharma Corp.

Correvio Pharma Corp. is a specialty pharmaceutical company focused on providing innovative, high-quality brands that meet the needs of acute care physicians and patients. With a commercial presence and distribution network covering over 60 countries worldwide, Correvio develops, acquires and commercializes brands for the in-hospital, acute care market segment. The Company's portfolio of approved and marketed brands includes: Xydalba™ (dalbavancin hydrochloride), for the treatment of acute bacterial skin and skin structure infections (ABSSSI); Zevtera®/Mabelio® (ceftobiprole medocaril sodium), a cephalosporin antibiotic for the treatment of community- and hospital-acquired pneumonia (CAP, HAP); Brinavess® (vernakalant IV) for the rapid conversion of recent onset atrial fibrillation to sinus rhythm; Aggrastat® (tirofiban hydrochloride) for the reduction of thrombotic cardiovascular events in patients with acute coronary syndrome. Correvio's pipeline of product candidates includes Trevyent®, a drug device combination that is designed to deliver treprostinil, the world's leading treatment for pulmonary arterial hypertension.

Correvio is traded on the NASDAQ Capital Market (CORV) and the Toronto Stock Exchange (CORV). For more information, please visit our web site www.correvio.com.

Correvio's Forward-Looking Statement Disclaimer

Certain statements in this news release contain "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 or "forward-looking information" under applicable Canadian securities legislation (collectively, "forward-looking statements"). Forward-looking statements include statements that may relate to our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs and other information that may not be based on historical fact. Forward-looking statements can often be identified by the use of terminology such as "believe", "may", "plan", "will", "estimate", "continue", "anticipate", "intend", "expect", "look forward to" and similar expressions. Forward-looking statements are necessarily based on estimates and assumptions made by us based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate.

By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, achievements, events or developments to be materially different from any future results, performance, achievements, events or developments expressed or implied by such forward-looking statements. These forward-looking statements include, but are not limited to, statements relating to anticipated benefits of the Arrangement to Correvio and its securityholders; the timing and receipt of required shareholder and court approvals for the Arrangement; the ability of Correvio and ADVANZ PHARMA to satisfy the other conditions to, and to complete, the Arrangement, the anticipated timing of mailing of the information circulars regarding the Arrangement, the closing of the Arrangement, the intention to seek a delisting of the common shares of Correvio on Nasdaq and TSX, expectations regarding the impact of this transaction on Correvio and ADVANZ PHARMA's financial and operating results, strategy and business; the intention of ADVANZ PHARMA to bring additional products into its portfolio; regulatory approvals of products and the anticipated timing thereof; and the anticipated timing of the completion of the arrangement.

In respect of the forward-looking statements and information concerning the anticipated completion of the proposed Arrangement and the anticipated timing for completion of the Arrangement, Correvio has provided them in reliance on certain assumptions and believes that they are reasonable at this time, including the assumptions as to the time required to prepare and mail shareholder meeting materials, including the required management information circular; the ability of the parties to receive, in a timely manner, the necessary securityholder and court approvals; and the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the Arrangement. These dates may change for a number of reasons, including unforeseen delays in preparing meeting materials, inability to secure necessary securityholder and court approvals in the time assumed or the need for additional time to satisfy the other conditions to the completion of the Arrangement. Accordingly, you should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times.

These statements reflect Correvio's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by Correvio, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or information and Correvio has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: risks associated with the arrangement and acquisitions generally, such as the failure to satisfy the closing conditions contained in the arrangement agreement, the occurrence of a material adverse effect or other events which may give the parties a basis on which to terminate the arrangement agreement, the ability of the parties to complete and mail the management information circular to be prepared in connection with the special meeting of securityholders of Correvio, the ability to hold the meeting within the time frames indicated, and the approval of the transaction by the shareholders of Correvio and the risks and uncertainties facing Correvio as discussed in the annual report and detailed from time to time in our other filings with the Securities and Exchange Commission ("SEC") available at www.sec.gov and the Canadian securities regulatory authorities at www.sedar.com. In particular, we direct your attention to Correvio's Annual Report on Form 40-F for the year ended December 31, 2018 and its quarterly report filed November 14, 2019 for the third quarter of 2019. All of the risks and certainties disclosed in those filings are hereby incorporated by reference in their entirety into this news release.

While Correvio makes these forward-looking statements in good faith, given these risks, uncertainties and factors, you are cautioned not to place undue reliance on any forward-looking statements made in this press release. All forward-looking statements made herein are made as of the date hereof based on our current expectations and we undertake no obligation to revise or update such forward-looking statements to reflect subsequent events, information or circumstances, except as required by law. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to their inherent uncertainty.

Correvio® and the Correvio Logo are the proprietary trademarks of Correvio Pharma Corp.

Aggrastat® and Brinavess® are trademarks owned by Correvio and its affiliates worldwide.

Xydalba™ is a trademark of Allergan Pharmaceuticals International Limited, and used under license.

Zevtera® and Mabelio® are trademarks owned by Basilea Pharmaceutica International Ltd., and used under license.

Trevyent® is a trademark of SteadyMed Ltd. and used under license.

All other trademarks are the property of their respective owners.

Cision View original content:http://www.prnewswire.com/news-releases/advanz-pharma-to-acquire-correvio-301024562.html

SOURCE Correvio Pharma Corp

Copyright 2020 Canada NewsWire

I don't know why you're under the impression that people aren't flipping. We are in the OTC- anyone who has done this for any amount of time understands that 99.99% of the time these are just quick flips and will not make it out of the penny game.

We are just here to joke around and speculate like little tinfoil wearing goblins about a stock we have bought and sold 10+times already for profit.

Screaming about how this is a turd isn't 'waking' anybody up- we know what this is. All it does is make you look like an asshole.

I stand with my assessment of this being an overhyped scam.......flip now before this crashes.....sorry

No, it looks like you used special formatting and colors to be wrong again.

Haaahaaaa!!! MARKET MAKERS ARE BLOODY FOOLS

First sale was at 07:37:56 AM for $0.40. Then others. I KNOW THE WAY. Now,nI bought all those back under $0.34. You will be hurt....BADLY Dumbstruck!

LMFAOO....I figured MMs and idiots would love to read from me. So, I dumped first, from $0.40 to $0.385. Then I gambled the posts. Boy, they worked. These guys are so BRAIN DEAD!!! Gosh...pathetic bulkheads!!!

I just took some for .34 and change... Easy money to hold a few months, and who knows? A higher offer could happen, but I'm not expecting one...

LMFAOO..didn't think I'd pull this off but just did. Sold tons at $0.385 rpm, and just got them back at $0.34. Will still get $0.08 for those, and nibbling $0.04. Applaud me!!!

You'd think more would at these prices.

I'll take it. I had tons from $0.30 and was afraid when I saw the halt. Now, getting over $4000 just from Friday. It's all great. I wish every company did something for the shares, no matter how little. Dumb sellers have something to pay for crass IGNORANCE

Oh, actually I did get some 4700 at that DUMB $0.29 putsch on Friday. Then loaded huge at $0.32s. Fools gamble to our gains!!!

Oh well, I will sti take it. Ran three times to $0.60, made a ton on it. And now sitting on a ton I loaded on Friday at $0.31!!! Thanks Correvio. Now we move to the NEXT. Because of the naked shorts by clueless idiots, we may go higher than $0.42. We will see

BUYOUT DETAILS! Further Transaction Details

Under the terms of the transaction, ADVANZ PHARMA will be paying US$0.42 per issued and outstanding share (the "Consideration"), valuing Correvio's equity at approximately US$28 million on a fully diluted basis.

Inclusive of the repayment of Correvio's outstanding debt of approximately US$48 million, this represents a total consideration of approximately US$76 million, excluding Correvio's cash assumed by ADVANZ PHARMA.

Wow, another Bloody RED DAY here......looks like the promotors have jumped ship.

You're like the morning radio DJ of shitty advice.

$corv Share Structure

Market Cap Market Cap

19,810,223

03/12/2020

Authorized Shares

Not Available

Outstanding Shares

55,382,228

01/20/2020

so what??

|

Followers

|

47

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1123

|

|

Created

|

12/20/04

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |