Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Conquest Intersects Gold Mineralization in Five Drill Holes at

Smith Lake Gold Property in Northern Ontario -

TORONTO, ONTARIO--(Marketwire - March 20, 2012) -

Conquest Resources Limited

(TSX VENTURE:CQR) reports that it has completed fifteen drill

holes totaling 1,759 metres of diamond drilling in a planned

2,500 metre exploration program at its 100% owned Smith Lake

Gold Property, located adjacent to the former Renabie Gold

Mine, in northern Ontario.

Of the fifteen holes completed since the commencement of

drilling in February 2012, Conquest has received assay

results on the initial six holes with five of the six holes,

namely CSL-12-011, CSL-12-012, CSL-12-013, CSL-12-015 and

CSL-12-016 returning anomalous gold values between 0.52

and 2.80 grams of gold per tonne (gpt Au) over 0.25 to

1.52 metres true thickness in eleven of a total of

ninety-two samples, detailed below.

http://www.conquestresources.net/pdfs/CQR%20Smith%20Lake%20Update%2020120319.pdf

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

http://www.conquestresources.net/

http://www.conquestresources.net/project_details.php?pid=16&s=r

Conquest Commences Drilling at Its Smith Lake Gold Property

in Northern Ontario

TORONTO, ONTARIO--(Marketwire - Feb. 8, 2012) -

Conquest Resources Limited -

(TSX VENTURE:CQR) reports that it has commenced a 2,500 metre

diamond drilling program at its 100% owned Smith Lake Gold

Property, located within the Missanabie-Goudreau Greenstone

Belt, in northern Ontario.

Summit Drilling Services Inc. has been contracted to operate

their lightweight drilling equipment for an estimated three

months of BQ-sized exploration core drilling.

A total of 20 planned drill holes have been designed to test

near surface vein systems and other structural targets on

the property.

The first four holes of the program have been planned to follow

up Conquest's high grade 63.3 grams per tonne (g/t) gold

intersection from hole CSL-11-001 (as previously reported -

see Press Release dated September 19, 2011)

in the Company's 2011 autumn drilling program.

Second order priority holes will target east-west oriented

structures near the northern extension of the north-south

oriented Braminco Shear Zone.

Additional targets have been identified at sites with coincident

structural and Mobile Metal Ion ("MMI") surface

geochemical anomalies.

ABOUT THE SMITH LAKE PROPERTY

Conquest's Smith Lake Property consists of six patented mining

claims and 24 contiguous mining claims comprising over a 50

square kilometer area that is located contiguous with the

former Barrick/Homestake Renabie Gold Mine which closed in

1991 having produced more than 1,000,000 ounces of gold

since 1941 from reported reserves of approximately 6 million

tonnes at an average grade of 6.6 grams per tonne gold

and 2 grams per tonne silver.

During 2011, Conquest completed 1,109 metres of diamond drilling

on Conquest's 100% owned patented mining claims at Smith Lake.

The most significant gold intersection on the Smith Lake

Property was located in the first drill hole of the program

grading 63.3 grams per tonne (g/t) of gold over 0.28 metres

within a mineralized quartz vein in hole CSL-11-001.

Of a total 318 samples collected from the ten hole program,

30 samples returned anomalous assays ranging from 0.25 g/t

to 63.3 g/t gold over 0.22 to 1.50 metres in

core length thickness.

Gold mineralization in the Renabie area is the result of

repetitive hydraulic fracturing and shear zone inflation

within Archean-aged granitoid intrusives.

The repetitive nature of veining results in ribbon textured

veining that is strongly controlled by two main structural

trends oriented east-west and northwest-southeast, both of

which are present on Conquest's patented mining claim group

at Smith Lake.

QUALIFIED PERSON

Information of a scientific or technical nature contained

in this release has been prepared by or under the supervision

of Terence McKillen, P.Geo., the Chief Executive Officer

and Benjamin Batson, P. Geo., the Vice Present of Exploration

of the Company, both of whom are Qualified Persons within

the meaning of National Instrument 43-101 of the

Canadian Securities Administrators.

Samples were analyzed by AGAT Laboratories in Mississauga,

Ontario using a 50 gram pulp fire assay technique with

ICP-OES finish.

AGAT employs the use standards, blanks and duplicate samples

to calibrate on a regular basis within batches.

ABOUT THE COMPANY

Conquest is exploring several gold projects in Ontario.

These include the Alexander Gold Project at Red Lake;

the Sunday Lake property at Detour Lake in joint venture

with Detour Gold Corporation;

and, the Smith Lake Gold Project at Missanabie.

Conquest and Detour Gold Corporation are exploring for

structurally-hosted gold mineralization under a joint-venture

agreement at the Sunday Lake property located along

the Sunday Lake Deformation Zone approximately seven

kilometers east of Detour Gold's 15.6 million ounce

planned open pit gold mine.

Detour Gold, as operator, has agreed to expend $1,000,000

on exploration prior to September 30, 2012 to earn a

50% interest in the Sunday Lake Property.

Detour Gold completed 1,600 metres of exploration drilling

during winter 2011 and is currently planning a 2,000 metre

winter drilling program for 2012.

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

http://www.conquestresources.net/pdfs/2012%2002%2006%20CQR%20Smith%20Lake%20Winter%20Drilling%20StartUp.pdf

CQR reported 68 gram per tonne gold intersection over 1.68 metres (2.2 ounces per ton gold over 6 feet) -

http://www.conquestresources.net/pdfs/CQR%20-2011%2009%2014%20-%20NR%20re%20Smith%20Lake%20(3).pdf

Ore Train in Gold Mine Renabie, Ontario, Canada -

CONQUEST INTERSECTS 63 G/T GOLD OVER 0.28 METRES AT SMITH LAKE PROPERTY -

http://www.conquestresources.net/pdfs/Revised%20CQR%20(Smith%20Drilling)%2020110919.pdf

http://investorshub.advfn.com/boards/board.aspx?board_id=11788

http://www.conquestresources.net/

Renabie Gold Mine - short history -

The company’s first acquisition was the Renabie mine,

near Wawa, Ontario,

http://www.conquestresources.net/

http://www.conquestresources.net/project_details.php?pid=16&s=o

- which produced around 16,000 ounces of gold in 1984.

In 1984, Barrick Gold acquired Camflo Mining, which had

operations in the province of Quebec and in

the U.S. state of Nevada.

Barrick’s effort to purchase was slowed by skepticism the

company could assume Camflo’s debt of around $100 million.

The sale was finalized in May, 1984, with terms that obligated

Barrick Gold to repay the debt to The Royal Bank of Canada

within one year.

The debt was fully paid in January, 1985.

Barrick Resources acquisition was Mercur mine in Mercur, Utah

in June 1985, followed by the Gold Strike Mine, Nevada in 1986.

Gold Strike Mine is in Carlin trend, estimated producing

100 million ounces of gold. - GOLD AND SILVER

history often repeat itself -

Read more at:

http://www.goldsilverdailyprice.com/2011/07/barrick-gold.html

God Bless

Conquest Resources L (CQR) fiat$0.085 UP $0.015 +21.43% ![]()

Volume: 199,000 @ 3:59:41 PM ET

Bid Ask Day's Range

0.08 0.085 0.07 - 0.085

TSX:CQR Detailed Quote Wiki

Conquest Reports Surface Gold Mineralization on Its Smith Lake Ontario Property -

TORONTO, ONTARIO--(Marketwire - Nov. 17, 2011) -

Conquest Resources Limited

(TSX VENTURE:CQR) is pleased to report encouraging assay

results from surface channel samples obtained during its recent

mapping and sampling trench excavation carried out at its 100%

owned Smith Lake Gold Project where 50% of the samples

collected returned significant gold values ranging

from 1 to 14.7 grams per tonne gold.

The Smith Lake Property

is located adjacent to the former Renabie Gold Mine

in northern Ontario where Conquest has uncovered a mineralized

zone of significant width comprised of folded quartz veining

over six metres in true thickness where gold mineralization

appears consistently elevated.

An outcrop was excavated in conjunction with recently reported

preliminary diamond drilling at the site of a quartz vein

prospect where a total of 54 samples were cut from the trench

exposure and sent for gold assay.

Twenty-one channel samples and six grab samples assayed greater

than 1.0 gram of Gold per tonne (gpt Au) including:

14.7 gpt Au over 0.69 metres (m)

10.6 gpt Au over 1.06 m

adjacent to

6.45 gpt Au over 1.06 m

and

7.17 gpt Au over 1.05 m

7.41 gpt Au over 0.49 m

4.57 gpt Au over 1.07 m

http://tmx.quotemedia.com/article.php?newsid=46215246&qm_symbol=CQR

Conquest Reports Surface Gold Mineralization on Its Smith Lake Ontario Property

TORONTO, ONTARIO--(Marketwire - Nov. 17, 2011) -

Conquest Resources Limited

(TSX VENTURE:CQR) is pleased to report encouraging assay

results from surface channel samples obtained during its recent

mapping and sampling trench excavation carried out at its 100%

owned Smith Lake Gold Project where 50% of the samples

collected returned significant gold values ranging

from 1 to 14.7 grams per tonne gold.

The Smith Lake Property

is located adjacent to the former Renabie Gold Mine

in northern Ontario where Conquest has uncovered a mineralized

zone of significant width comprised of folded quartz veining

over six metres in true thickness where gold mineralization

appears consistently elevated.

An outcrop was excavated in conjunction with recently reported

preliminary diamond drilling at the site of a quartz vein

prospect where a total of 54 samples were cut from the trench

exposure and sent for gold assay.

Twenty-one channel samples and six grab samples assayed greater

than 1.0 gram of Gold per tonne (gpt Au) including:

14.7 gpt Au over 0.69 metres (m)

10.6 gpt Au over 1.06 m

adjacent to

6.45 gpt Au over 1.06 m

7.17 gpt Au over 1.05 m

7.41 gpt Au over 0.49 m

4.57 gpt Au over 1.07 m

http://tmx.quotemedia.com/article.php?newsid=46215246&qm_symbol=CQR

Conquest Intersects 6.34 Metres of 3.95 Grams Per Tonne Gold at Red Lake -

TORONTO, ONTARIO--(Marketwire - Oct. 13, 2011) -

Conquest Resources Limited

(TSX VENTURE:CQR) is pleased to report that the Company has

intersected 6.34 metres of gold mineralization grading 3.95

grams per tonne (gpt) gold in the most recently completed

drill hole at the Company's 100% owned Alexander Gold Project

in Red Lake, Ontario.

Hole CR-11-051 intersected 3.95 gpt gold over 6.34 metres,

including 17.50 gpt gold over 1.24 metres which includes

31.25 gpt gold over 0.53 metres of core at a hole depth

of 495 metres.

Hole CR-11-051 was collared in a northeasterly direction near

the southern property boundary adjacent to

Goldcorp's Red Lake mine property.

Assay results from hole CR-11-051, including this 31.25 gpt gold

assay, represent the highest grade intersections on the

Alexander Property to date.

This gold mineralization is present within a broad pyrite-

arsenopyrite bearing quartz monzodiorite intrusive of

unknown true thickness located in the hanging wall to

Eastern Shear Zone belonging to the Balmer Assemblage

suite of rocks.

CONQUEST'S ALEXANDER EASTERN SHEAR ZONE

During Summer 2011, Conquest discovered the Eastern Shear Zone,

a new sulphide mineralized zone of shearing found in hole

CR-11-048 (see Press Release – August 03, 2011) located 750

metres southeast of the Central Sulphide Shear Zone which was

discovered in exploration drilling by Conquest during 2004. Follow-up drilling in holes CR-11-049, -050, and -051 suggests

that the geometry and location of the Eastern Shear Zone is

similarly oriented in strike and dip, but is a separate zone

spatially from the Central Sulphide Shear Zone.

The Eastern Shear Zone is characterized by narrow

pyrite-(arsenopyrite) and pyrrhotite-(pyrite-arsenopyrite-

chalcopyrite) stringers with associated quartz-

carbonate-(pyrite) veins within a structural envelope

of shearing and biotite-chlorite-(silica) altered Balmer

assemblage basalts ranging from 5 to 10 metres in true thickness.

Earlier mining activities at Goldcorp's Red Lake Gold Mine –

No. 1 Red Lake Complex (the former Dickenson Mine) produced gold

from mineralized Balmer assemblage basalts similar to those

sulphide-carbonate bearing sheared Balmer volcanics which have

been identified at Conquest's Central Sulphide Shear Zone and

Eastern Shear Zone.

FUTURE PLANS

Follow-up drilling on the Company's Alexander Property is planned

in the next hole, CR-11-052, which will be collared in a

northeasterly direction from a setup located approximately 100

metres east of CR-11-048 (325 metres east of CR-11-051)

along the southern Conquest/Goldcorp mine property boundary

under freezing conditions during January 2012.

No drill holes have yet tested the eastern or depth extent

of the Eastern Shear Zone horizon, which is approximately

one square-kilometre in size along a vertical longitudinal

section oriented 130AZ/-60DIP through the central and

eastern portion of the Alexander Property.

The system remains open at depth and along strike and represents

a significant new exploration target.

ABOUT THE ALEXANDER GOLD PROJECT

Conquest's Alexander Property lies immediately east of Goldcorp

Inc.'s Red Lake and Campbell mines in the heart of the Red Lake

Gold Camp on the important "Mine Trend" regional structure and

is almost completely surrounded by Goldcorp's land holdings.

The Red Lake Mining District has produced in excess of 25

million ounces of gold over the past 60 years.

The important Balmer Assemblage volcanic rocks, which host the

majority of gold produced from the Red Lake greenstone belt,

and the adjacent Bruce Channel Formation metasedimentary rocks,

which host some of the new gold discoveries at Red Lake,

have been identified on the Alexander Property.

These prospective host rocks lie within the Red Lake Mine Trend

structural corridor which extends southeast from Goldcorp's two

gold mines on to and across the Conquest Alexander Property.

Many of the regional structures that have associated gold

mineralization in the area of the two producing gold mines

at Red Lake extend eastwards on to the Alexander Property.

A total of 9,772 metres of NQ sized drilling has been completed

by Conquest during 2011.

Two drill rigs are onsite and ready to resume drilling on

frozen ground following the year-end freeze-up.

QUALIFIED PERSON

Information of a scientific or technical nature contained in

this release has been prepared by or under the supervision

of Terence McKillen, P.Geo., the Chief Executive Officer

and Benjamin Batson, P. Geo., the Vice President of

Exploration of the Company, both of whom are Qualified

Persons within the meaning of National Instrument 43-101 of

the Canadian Securities Administrators.

Samples are analyzed by AGAT Laboratories in Mississauga,

Ontario using a 50 gram pulp fire assay technique with

ICP-OES finish. Conquest employs the use of standards,

blanks, and duplicate samples to maintain confidence in

the analytical techniques used to determine gold content

in its core.

Fifteen percent of the samples submitted to the laboratory

comprise samples used for quality assurance and control for

gold content.

AGAT also employ the use standards, blanks and duplicate

samples to calibrate on a regular basis within batches.

CONTINUED EXPLORATION AT CONQUEST'S OTHER GOLD PROPERTIES

Conquest is also drilling at its 100% owned Smith Lake Gold

Project located adjacent to the former Barrick Renabie Gold Mine

near Missanabie, Ontario.

A total of 1,109 metres of exploration drilling was completed

during the Fall of 2011.

The first hole of the program, CSL-11-001 contained a high grade

intersection of gold grading 63.3 grams per tonne over 0.28

metres within the targeted structurally hosted quartz-pyrite vein.

Historical production from vein-hosted gold bearing structures

at the adjacent former Renabie Gold Mine totaled more than

1,000,000 ounces of gold since 1941 from reported reserves

of approximately 6 million tonnes at an average grade

of 6.6 grams of gold and 2 grams of silver per tonne.

Assays are pending from holes CSL-11-002 through CSL-11-010

at Smith Lake and are expected by the end of October.

In addition to its drilling programs at Red Lake and Smith Lake,

Conquest is exploring for structurally-hosted gold

mineralization under a joint-venture agreement with

Detour Gold Corporation ("Detour Gold") at

the Sunday Lake property located along

the Sunday Lake Deformation Zone approximately seven kilometres

east of Detour Gold's 14.9 million ounce proposed open pit gold

mine.

Detour Gold completed a seven-hole drill program comprising

1,650 metres of exploration drilling during Winter 2010/11.

Conquest expects that additional exploration drilling will

be planned for Winter 2011/12.

Conquest holds 80,000 shares of Detour Gold Corporation.

There are currently 95,477,728 shares of Conquest issued

and outstanding.

This news release may include certain "forward-looking statements". All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, exploration results, and future plans and objectives of Conquest, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Conquest's expectations are exploration risks detailed herein and from time to time in the filings made by Conquest with securities regulators.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or the accuracy of this release.

http://www.conquestresources.net/news_breaking.php

http://www.conquestresources.net

http://tmx.quotemedia.com/article.php?newsid=45224246&qm_symbol=CQR

Renabie Gold Mine - short history -

The company’s first acquisition was the Renabie mine, near Wawa, Ontario,

which produced around 16,000 ounces of gold in 1984.

In 1984, Barrick Gold acquired Camflo Mining, which had operations

in the province of Quebec and in the U.S. state of Nevada.

Barrick’s effort to purchase was slowed by skepticism the company

could assume Camflo’s debt of around $100 million.

The sale was finalized in May, 1984, with terms that obligated

Barrick Gold to repay the debt to The Royal Bank of Canada

within one year. The debt was fully paid in January, 1985.

Barrick Resources acquisition was Mercur mine in Mercur , Utah

in June 1985, followed by the Gold Strike Mine, Nevada in 1986.

Gold Strike Mine is in Carlin trend, estimated producing 100

million ounces of gold. - GOLD AND SILVER

Read more at: http://www.goldsilverdailyprice.com/2011/07/barrick-gold.html

CQR reported 68 gram per tonne gold intersection over 1.68 metres (2.2 ounces per ton gold over 6 feet) -

http://www.conquestresources.net/pdfs/CQR%20-2011%2009%2014%20-%20NR%20re%20Smith%20Lake%20(3).pdf

Ore Train in Gold Mine Renabie, Ontario, Canada -

CONQUEST INTERSECTS 63 G/T GOLD OVER 0.28 METRES AT SMITH LAKE PROPERTY -

http://www.conquestresources.net/pdfs/Revised%20CQR%20(Smith%20Drilling)%2020110919.pdf

http://investorshub.advfn.com/boards/board.aspx?board_id=11788

http://www.conquestresources.net/

history often repeat itself -

Read more at:

http://www.goldsilverdailyprice.com/2011/07/barrick-gold.html

God Bless

CONQUEST INTERSECTS 63 G/T GOLD OVER 0.28 METRES AT SMITH LAKE PROPERTY -

http://www.conquestresources.net/pdfs/Revised%20CQR%20(Smith%20Drilling)%2020110919.pdf

http://www.conquestresources.net/

God Bless

Conquest Res (GM) (CQRLF)

0.0557 ? 0.0 (0.00%)

Volume: 0 @- ET

Bid Ask Day's Range

- - - - -

USOTC:CQRLF Detailed Quote

Conquest Intersects New Shear Zone in Drilling Program at Red Lake

TORONTO, ONTARIO--(Marketwire - Aug. 3, 2011) - Conquest Resources Limited (TSX VENTURE:CQR) reports that the Company has intersected a new shear zone containing significant sulphide mineralization in the ongoing 2011 Exploration Drilling Program at the Company's 100% owned Alexander Gold Project in Red Lake, Ontario.

The new showing was found in hole CR-11-048 located near the southern property boundary approximately 750 metres to the southeast of the central Sulphide Shear Zone which Conquest has been drilling in its 2011 program.

CR-11-048 which was completed to a depth of 1,094 metres is characterized by strongly sheared Balmer Assemblage basalt containing quartz carbonate veining and associated stringers of sulphide mineralization over 15 metres in core. Quartz-carbonate veining and sulphide mineralization is contained within an envelope of biotite-chlorite alteration that is most intense within the zone of strongest shearing over approximately 5 metres in thickness. True thickness of this new showing is unknown at this time.

While assays from the new sulphide mineralized shear zone in CR-11-048 did not contain anomalous gold values, additional work is warranted to investigate the presence of sulphide mineralization and significant alteration along this structural conduit.

In addition to the new shear zone, hole CR-11-048 intersected an interval of altered Basalt over 13 metres that was found to contain 1.02 grams of gold per tonne over 0.57 metres at a hole depth of 233 metres.

NEW SHEAR ZONE SHOWING

Hole CR-11-048 was collared in a northeasterly direction at a dip of -70 degrees and planned in the footwall area of a brecciated Balmer Assemblage basalt intersection identified in previous drilling. The hole was designed to test the concept that significant shear zones may be repeated in structures oriented parallel to key structural breaks recognized at the adjacent Goldcorp Red Lake Gold Mines. No previous drill holes have targeted this area.

Conquest previously identified shear structures similar to those intersected in CR-11-048 through trenching and drilling up to 450 metres in strike length in the central portion of the property but only drilled to 100 metres vertical depth. Hole CR-11-048 demonstrates, for the first time, that these sulphide mineralized shear zones exist at depths of at least 700 metres vertically.

"The identification of prospective shearing and associated sulphide mineralization is significant because many gold bearing zones in the Red Lake Gold Camp mines are characterized by a correlated affinity of gold mineralization to those quartz carbonate altered structural conduits which also contain sulphide mineralization" commented Benjamin Batson, Vice President Exploration of the Company.

"It is significant that many of the structural and hydrothermal ingredients for gold mineralization are present at 700 metres vertical depth on Conquest's Alexander property since the majority of deposits in the Red Lake Gold Camp are known to increase in depth in the direction of the Alexander Property."

Follow-up drilling is underway with hole CR-11-049 which has been collared 110 metres due west of CR-11-048 in a similar northeasterly direction. Additional drilling is planned to both the east and west of the new showing.

The system remains open at depth and along strike and represents a significant new exploration target as drilling continues through the remainder of the year.

CONQUEST'S DEEP DRILLING INTERSECTS 1.98 G/T GOLD OVER 0.2 METRES AT DEPTH OF 910 METRES

Conquest has also completed a wedge hole CR-11-047-W1 to a downhole depth of 1,448 metres. The wedge hole was cut from the parent hole CR-11-047 at a depth of 320 metres. The parent hole was collared on the Goldcorp mine property as previously announced (See Press Releases – April 14, 2011) and intersected Conquest's southern property boundary at a hole depth of 770 metres.

Sampling returned an assay of 1.98 grams of gold per tonne over 0.20 metres at a depth of 910 metres vertically from fine quartz-carbonate-tourmaline veins hosted in the footwall to a narrow zone of sheared Balmer Assemblage basalt on Conquest's property. Elevated gold values (486 to 764 ppb) were also intersected below 1,000 metres vertical depth within intrusives of intermediate composition.

ABOUT THE ALEXANDER GOLD PROJECT

Conquest's Alexander Property lies immediately east of Goldcorp Inc.'s Red Lake and Campbell mines in the heart of the Red Lake Gold Camp on the important "Mine Trend" regional structure and is almost completely surrounded by Goldcorp's land holdings. The Red Lake Mining District has produced in excess of 25 million ounces of gold over the past 60 years.

The important Balmer Assemblage volcanic rocks, which host the majority of gold produced from the Red Lake greenstone belt, and the adjacent Bruce Channel Formation metasedimentary rocks, which host some of the new gold discoveries at Red Lake, have been identified on the Alexander Property. These prospective host rocks lie within the Red Lake Mine Trend structural corridor which extends southeast from Goldcorp's two gold mines on to and across the Conquest Alexander Property. Many of the regional structures that have associated gold mineralization in the area of the two producing gold mines at Red Lake extend eastwards on to the Alexander Property.

A total of 7,000 metres of NQ sized drilling has been completed by Conquest during 2011. Conquest plans to complete an additional 3,000 metres of drilling during the balance of the year.

QUALIFIED PERSON

Information of a scientific or technical nature contained in this release has been prepared by or under the supervision of Terence McKillen, P.Geo., the Chief Executive Officer and Benjamin Batson, P. Geo., the Vice Present of Exploration of the Company, both of whom are Qualified Persons within the meaning of National Instrument 43-101 of the Canadian Securities Administrators.

Samples are analyzed by AGAT Laboratories in Mississauga, Ontario using a 50 gram pulp fire assay technique with ICP-OES finish. Conquest employs the use of standards, blanks, and duplicate samples to maintain confidence in the analytical techniques used to determine gold content in its core. Fifteen percent of the samples submitted to the laboratory comprise samples used for quality assurance and control for gold content. AGAT also employ the use standards, blanks and duplicate samples to calibrate on a regular basis within batches.

ABOUT THE COMPANY

In addition to its active drilling program at Red Lake, Conquest is exploring for structurally-hosted gold mineralization under a joint-venture agreement with Detour Gold Corporation ("Detour Gold") at the Sunday Lake property located along the Sunday Lake Deformation Zone approximately seven kilometres east of Detour Gold's 14.9 million ounce proposed open pit gold mine. Detour Gold completed a seven-hole drill program comprising 1,650 metres of exploration drilling during Winter 2010/11. Conquest expects that additional exploration drilling will be planned for Winter 2011/12.

Conquest is also exploring its Smith Lake Gold Project at Missanabie.

Conquest holds 100,000 shares of Detour Gold Corporation.

There are currently 95,477,728 shares of Conquest issued and outstanding.

This news release may include certain "forward-looking statements". All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, exploration results, and future plans and objectives of Conquest, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Conquest's expectations are exploration risks detailed herein and from time to time in the filings made by Conquest with securities regulators.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or the accuracy of this release.

http://www.marketwire.com/press-release/conquest-intersects-new-shear-zone-in-drilling-program-at-red-lake-tsx-venture-cqr-1545214.htm

.

Conquest Resources Limited owns The Piper Moss Gold Project,

Midlands Goldfield

http://www.conquestresources.net/project_details.php?pid=9&s=o

Project Overview

The Piper Moss Mine is a former gold production property

situated just 3km north of and in a similar geological

setting to the Globe & Phoenix Mine, the second largest gold

producer in Zimbabwe's history (over 2.3 million ounces gold).

The Moss vein from which most of the past production of 163,200

ounces (520,000 tonnes at 10.8gm/t gold) was derived can be

traced for over 1,200 metres and is up to 2m wide in places.

The deposit was formerly accessed on 14 levels by two shafts

and by over 10,670 metres of lateral development.

Other production came from the Sinola and Spur veins.

Several other mineralized structures occur parallel to

the Moss vein and contain ore grade values.

The New Reef is up to 1.5m thick and contains ore grade gold

values (average 19.9gm/t).

Potential exists for further gold reserves to be delineated

within the Moss vein system as well as in parallel and

cross-cutting veins.

Over 30 present and past producting gold mines are located

within 10km radius of the property. Conquest has identified

a number of other gold procuction properties in

the immediate area for acquisition.

Conquest plans to evaluate the potential to retreat

approximately 500,000 tonnes of tailings and other

surface stockpiles on the property by a vat leaching

process and will undertake a comprehensive reevaluation

of the primary gold potential through surface and

underground exploration.

Project Location

The Piper Moss property lies approximately 3 kilometres north

of the town of Kwe Kwe in the Midlands area of Zimbabwe.

The area has a rich gold mining tradition with over 30 past

producing mines located within a 10km radius.

A major highway, linking Harare to Bulawayo, passes along

the side of the property, providing excellent access.

The Harare-Bulawayo railway lies parallel to the highway

and electrical power is available to the site.

Project Details

The Piper Moss mine is a form er gold production property (6th largest in the Midlands Goldfield) situated just 3km north of and in a similar geological setting to the Globe & Phoenix Mine, the second largest gold producer in Zimbabwe's history (over 2.3 million ounces gold). The Piper Moss mine was formerly accessed on 14 levels by two shafts and by over 10,670 metres of lateral development.

The Moss vein from which most of the past production of 163,200 ounces (520,000 tonnes at 10.8gm/t gold) was derived can be traced for over 1,200 metres and is up to 2m wide in places. Several of the ore shoots contain very rich grades which have been estimated (in government reports) to be in excess of 1.0 ounces per ton 34.28gm/t). Other production came from the Sinola and Spur veins.

http://www.conquestresources.net/project_details.php?pid=9&s=d

Several other mineralized structures occur parallel to

the Moss vein and contain ore grade values.

http://www.conquestresources.net/projects.php

http://www.conquestresources.net/

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

http://www.conquestresources.net/news_project.php

http://www.conquestresources.net/news_breaking.php

http://www.conquestresources.net/invest_ownership_profile.php

Conquest Resources Limited owns The Beehive and Babs Gold Mines, Midlands Goldfield -

http://www.conquestresources.net/project_details.php?pid=7&s=o

The Babs & Beehive Mines are former gold production properties

situated respectively about 10km north and 30km northwest of

Kwe Kwe.

The mines were developed by African Gold PLC of London

between 1997 and 1998 at a cost of approximately $4.5 million

and operated for nine months before being placed on care

and maintenance in early 1999 as a result of falling gold

prices and increasing costs in Zimbabwean currency.

The inferred mineral resource for both mines is 360,000 tonnes

at a grade of 5.7gm/t gold.

A further open pit potential of 400,000 tonnes of low grade

mineralisation may be amenable to heap leach gold extraction.

The mines are considered to have excellent upside for additional

reserves to be delineated following completion of drilling

and underground development programmes.

As part of the acquisition Conquest acquired a 300 tonne per day

processing plant located at the Beehive mine site which

was constructed in 1998.

Project Location

The Beehive mine is located approximately 10km north of Kwekwe,

adjacent to the Indarama and Sherwood Star gold mines and

6km north of the Piper Moss mine.

The Babs mine is located 30km west of Kwe Kwe.

The Beehive mine is readily accessible from the main

Harare-Bulawayo highway and the Kwe Kwe-Gokwe paved

highway passes alongside the Babs property.

There is 33kva electrical power supply from the national

power grid available at both sites.

Project Geology

The mine properties lie within the Midlands Greenstone Belt,

the largest and most prolific of the greenstone belts in

terms of gold production for Zimbabwe.

Within the belt, the Bulawayan and Shamvian Groups represent

the two dominant stratigraphic units.

The Bulawayan Group is the older and defines the lateral extent

of the greenstone belt.

It consists primarily of mafic to felsic volcanics which

have been subdivided into a lower Mafic Formation, a middle

sequence consisting of intermediate volcanics known as

the Maliyami Formation, and an upper Felsic Formation.

The Shamvian Group unconformably overlies the Bulawayan volcanics and consists prim arily of a series of immature volcanic derived sediments which are generally represented by greywackes, grits, phyllites and conglomerates. The structural evolution of the Midlands Greenstone Belt initially involved extension, which led to the emplacement of the volcanics of the Bulawayan Group. Later the Sesombi, Whitewaters and Biri tonalites were intruded. This led to compressional deformation which formed a regional cleavage and foliation, folding and hearing, together with low grade metamorphism.

The Beehive mine is located along the regional Taba Mali deformation zone and is hosted in mafic greenstones and pillow lavas of the Mafic Formation of the Bulawayan Group. Three cross cutting banded ironstone bodies occur within the immediate mine complex which host gold mineralization. A felsic quartz porphyry containing low grade gold mineralization occurs to the south. The Babs mine is located in sheared propylitized andesitic lavas assigned to the Maliyama Formation of the upper Bulawayan Group. The Sesombi tonalitic intrusive occurs to the north and east of the mine.

Reserves and Resources

There are no reserves on the properties that can be defined

under National Instrument 43-101.

An inferred mineral resource for both mines, as presented

by L. S. Blake of Blake Geological Consultants Limited

in a report dated October 20, 2000, is 360,000 tonnes

at a grade of 5.7g/t gold

(Beehive: 145,000 tonnes at 8.8g/t Au; Babs: 214,000 tonnes

at 5.0g/t Au).

Blake indicates that a further inferred mineral resource

of 400,000 tonnes of low grade mineralisation may be amenable

to open pit mining and to heap leach gold extraction.

The properties are considered to have potential for mineral

resources and reserves to be delineated following completion

of drilling and underground development programmes.

http://www.conquestresources.net/project_details.php?pid=7&s=g

http://www.conquestresources.net/projects.php

http://www.conquestresources.net/

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

http://www.conquestresources.net/news_project.php

http://www.conquestresources.net/news_breaking.php

http://www.conquestresources.net/invest_ownership_profile.php

Conquest Resources L (CQR) fiat$0.125 UP $0.015 +13.64% ![]()

Volume: 80,800 @ 2:55:22 PM ET

Bid Ask Day's Range

0.115 0.125 0.12 - 0.125

Conquest Resources Ltd. (TSX:CQR) Presentation;

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

CQR Fact Sheet;

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=63616331

Conquest Resources L (CQR) fiat$0.125 UP $0.015 +13.64% ![]()

Volume: 35,000 @ 3:14:38 PM ET

Bid Ask Day's Range

0.115 0.125 0.125 - 0.125

TSX:CQR Detailed Quote

Conquest Resources Ltd. (TSX:CQR) Presentation;

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

CQR Fact Sheet;

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=63616331

Red Lake Gold Mine Mother -

Goldcorp makes welcome to CQRLF newborn Au-baby ![]()

will she help the Au-golden-baby

to grow into the Mother Au-lode ![]()

history tells CQRLF -

He Struck Gold on the Net (Really)

By: Linda TischlerMay 31, 2002

Rob McEwen owned an underperforming gold mine in northwestern Ontario, and he needed new ideas about where to dig. So he broke new ground -- and made data on the mine available online to anyone who wanted to help. Eureka! The Internet gold rush was on.

In January 1848, a work crew at John Sutter's mill, near Sacramento, California, came across a few select nuggets of gold. Before long, a half-million prospectors arrived there seeking instant riches. The gold rush was on. Some 153 years later, another gold rush broke out at an old mine called Red Lake, in northwestern Ontario. This time, the fortune hunters wielded geological-modeling software and database mining tools rather than picks and shovels. The big winners were from Australia. And they had never even seen the mine.

Rob McEwen, chairman and CEO of Goldcorp Inc., based in Toronto, had triggered the gold rush by issuing an extraordinary challenge to the world's geologists: We'll show you all of our data on the Red Lake mine online if you tell us where we're likely to find the next 6 million ounces of gold. The prize: a total of $575,000, with a top award of $105,000.

The mining community was flabbergasted. "We've seen very large data sets from government surveys online," says Nick Archibald, managing director of Fractal Graphics, the winning organization from West Perth, Australia. "But for a company to post that information and say, 'Here I am, warts and all,' is quite unusual indeed."

McEwen knew that the contest, which he called the Goldcorp Challenge, entailed big risks. For one thing, it exposed the company to a hostile-takeover bid. But the risks of continuing to do things the old way were even greater. "Mining is one of humanity's oldest industrial pursuits," McEwen says. "This is old old economy. But a mineral discovery is like a technological discovery. There's the same rapid creation of wealth as rising expectations improve profitability. If we could find gold faster, we could really improve the value of the company."

McEwen, a small, soft-spoken man with a neatly trimmed mustache and meticulous tailoring, had one big advantage over his slow-footed competitors: He wasn't a miner, he didn't think like a miner, and he wasn't constrained by a miner's conventional wisdom. As a young man, he went to work for Merrill Lynch, following his father into the investment business. But his father also had a fascination with gold, and McEwen grew up hearing tales of miners, prospectors, and grubstakes at the dinner table. Soon he was bitten by the gold bug too, and he hammered out a template of what he thought a 21st-century gold-mining company should look like. In 1989, he saw his chance. He stepped into a takeover battle as a white knight and emerged as majority owner of an old and underperforming mine in Ontario.

It was hardly a dream come true. The gold market was depressed. The mine's operating costs were high. The miners went on strike. McEwen even got a death threat. But the new owner knew that the mine had potential. "The Red Lake gold district had 2 operating gold mines and 13 former mines that had produced more than 18 million ounces combined," he says. "The mine next door had produced about 10 million ounces. Ours had produced only 3 million."

McEwen believed that the high-grade ore that ran through the neighboring mine was present in parts of the 55,000-acre Red Lake stake -- if only he could find it. His strategy began to take shape at a seminar at MIT in 1999. Company presidents from around the world had come there to learn about advances in information technology. Eventually, the group's attention turned to the Linux operating system and the open-source revolution. "I said, 'Open-source code! That's what I want!' " McEwen recalls.

His reasoning: If he could attract the attention of world-class talent to the problem of finding more gold in Red Lake, just as Linux managed to attract world-class programmers to the cause of better software, he could tap into thousands of minds that he wouldn't normally have access to. He could also speed up exploration and improve his odds of discovery.

At first, Goldcorp's geologists were appalled at the idea of exposing their super-secret data to the world. "This is a very conservative, very private industry," says Dr. James M. Franklin, former chief geoscientist for the Geological Survey of Canada and a judge in the Goldcorp Challenge. "Confidentiality and secrecy about reserves and exploration have been its watchwords. This was a totally unconventional thing to do."

But in March 2000, at an industry meeting, McEwen unveiled the Goldcorp Challenge. The external response was immediate. More than 1,400 scientists, engineers, and geologists from 50 countries downloaded the company's data and started their virtual exploration. When the entries started coming in, the panel of five judges was astonished by the creativity of the submissions. The top winner was a collaboration by two groups in Australia: Fractal Graphics, in West Perth, and Taylor Wall & Associates, in Queensland, which together had developed a powerful 3-D graphical depiction of the mine.

12next ›last

http://www.fastcompany.com/magazine/59/mcewen.html

He Struck Gold on the Net (Really)

By: Linda TischlerMay 31, 2002

Rob McEwen owned an underperforming gold mine in northwestern Ontario, and he needed new ideas about where to dig. So he broke new ground -- and made data on the mine available online to anyone who wanted to help. Eureka! The Internet gold rush was on.

For McEwen, the contest itself was a gold mine. "We have drilled four of the winners' top five targets and have hit on all four," he says. "But what's really important is that from a remote site, the winners were able to analyze a database and generate targets without ever visiting the property. It's clear that this is part of the future."

Between the new high-grade discoveries and the mine's modernized facilities, Red Lake is finally performing along the lines that McEwen had envisioned. In 1996, Red Lake was producing at an annual rate of 53,000 ounces at $360 an ounce. By 2001, the mine was producing 504,000 ounces at $59 an ounce. On the open market, gold currently trades for about $307 an ounce. The grade of the ore at McEwen's mine is extraordinarily high, confirming his suspicion that the vein that ran through the neighboring mine continues through Red Lake.

For McEwen, whose passion for gold is evident from the 82-pound sample rock containing 300 ounces of gold that he displays in his office and the dazzling gold, diamond, and lapis wedding ring that he sports on his finger, it doesn't get much better than this. "When you first pick up a piece of gold and hold it in your hand, when you feel the weight and see the luster, you feel like this is something special," McEwen says. "It's different than mining coal."

Contact Rob McEwen by email (rrmcewen@attglobal.net). To learn more about all of the Fast 50 winners, click here.

Sidebar: Nuggets of Wisdom

Red Lake, Ontario and West Perth, Australia are at opposite ends of the earth. But that didn't stop Nick Archibald and his team of geologists at Fractal Graphics, an Australian geoscience consulting firm, from thinking that they could find gold in Canada.

First-place winners of the 2001 Goldcorp Challenge, Archibald and his mates shared a grand prize of $105,000 for their presentation detailing likely targets for finding gold. "I'd never been to the mine," Archibald says. "I'd never even been to Canada."

But when he learned of the contest, Archibald recognized an opportunity for his company, which specializes in the production of 3-D models of mines. The prize money was appealing, but Archibald knew that winning would give a boost to his own hopes for expansion funds as well. "Our industry has been going through a hard time," he says. "We had been trying to raise venture capital. Any positive news could only be a big help for us."

Although the prize money, which Archibald's team shared with Taylor Wall & Associates, barely covered the cost of the project, the publicity has boosted the firm's business. "It would have taken us years to get the recognition in North America that this project gave us overnight," he says.

More important, Archibald adds, the Challenge has opened the industry's eyes to a new way of doing exploration. "This has been a big change for mining," he says. "This has been like a beacon in a sea of darkness."

Red Lake Gold Mine

RED LAKE

The Red Lake Gold Mine is composed of two operating complexes:

the Red Lake Complex and the Campbell Complex.

Red Lake Gold mine is Canada’s largest gold mine,

and in 2009 produced 623,000 ounces at a cash cost of $288/oz.

It is also one of the world’s richest gold mines

and lowest cost producers.

http://www.goldcorp.com/operations/red_lake_mine/

Conquest Commences Drilling from Goldcorp Red Lake Mine Property

Conquest Appoints Vice President of Exploration

Apr. 14, 2011 (Marketwire Canada) --

TORONTO, ONTARIO --

Conquest Resources Limited

(TSX VENTURE:CQR)is pleased to announce that the Company

has commenced drilling from Goldcorp's Red Lake Gold Mines Ltd.

("Goldcorp") mine property located next to Conquest's 100% owned

Alexander Property in Red Lake, Ontario.

Drilling with a second drill rig is underway on the initial 1,600

metre deep hole, CR-11-047, designed to test Balmer Assemblage

basalts which occur under the western corner of the Alexander

claim block.

The hole will be maintained for subsequent wedging following

the drilling of the parent hole expected during June.

Conquest has collared hole CR-11-047 from surface approximately

175 metres from the south western corner of the Alexander

Property boundary where an estimated 800 metres of drilling

in the upper portion of the hole will take place on Goldcorp's

property and the remaining lower portion will be on Conquest's

Alexander Property.

Conquest and Goldcorp will mutually benefit from the information

obtained through drilling.

No formal agreement or interest in the Alexander Property

has been assigned to Goldcorp.

SULPHIDE SHEAR ZONE DRILLING

The first drill hole (CR-11-044) was completed to a total hole

depth of 1,365 metres.

The hole was designed to target the deep extension of the

Sulphide Shear Zone which is known to exist on surface over

a true-thickness of 7-metres within the Balmer Assemblage.

A sheared zone of sulphide mineralization and quartz-carbonate

alteration was intersected at a vertical depth of 1,115 metres.

Several gold bearing intrusives between 480 and 900 metres

vertically were found to contain 1.49 grams per tonne (gpt)

gold over 1.17 metres, 0.51 gpt gold over 1.20 metres,

and 0.57 gpt gold over 1.12 metres of drill core.

Sampling from the sheared and sulphide mineralized zone did

not contain significant gold mineralization. The hole was

completed in Bruce Channel Formation metasediments.

The second hole (CR-11-045) was collared 150 metres to the

grid west and 260 metres to the grid north of CR-11-044.

The hole was completed to a depth of 909 metres.

A gold mineralized intermediate intrusive in the footwall

stratigraphy to the targeted extension of the Sulphide Shear

Zone returned 0.50 gpt over 5.45 metres, including 1.09 over

0.95 metres of drill core.

The hole was completed in Bruce Channel Formation metasediments.

The Sulphide Shear Zone was not intersected.

Interpretation of the core and local geology suggests that

the Sulphide Shear Zone has been offset by north-south

oriented faulting.

A third hole (CR-11-046) is currently being drilled to a

planned depth of 1,100 metres between CR-11-044 and -045

to follow up the extension of the Sulphide Shear Zone.

CONQUEST APPOINTS VICE PRESIDENT EXPLORATION

Conquest is pleased to announce the appointment of

Mr. Benjamin Batson (P. Geo) to the position of Vice President

Exploration of the Company.

Mr. Batson has worked with Conquest since 2009 as Exploration

Manager directing the Company's exploration program at Red Lake.

As a Professional Geologist and graduate of Geological

Engineering (Queen's University), Mr. Batson provides a strong

technical background and possesses a broad knowledge base of

the exploration and mining business in North America.

Mr. Batson will continue to focus the Company's efforts at

Red Lake, Ontario while also pursuing corporate development

opportunities in other favorable gold mining districts in

North America.

ABOUT THE ALEXANDER GOLD PROJECT

Conquest's Alexander Property lies immediately east of Goldcorp

Inc.'s Red Lake and Campbell mines in the heart of

the Red Lake Gold Camp on the important "Mine Trend"

regional structure and is almost completely surrounded

by Goldcorp's land holdings.

The Red Lake Mining District has produced in excess of

25 million ounces of gold over the past 60 years.

The important Balmer Assemblage volcanic rocks, which host

the majority of gold produced from the Red Lake greenstone belt,

and the adjacent Bruce Channel Formation metasedimentary rocks,

which host some of the new gold discoveries at Red Lake,

have been identified on the Alexander Property.

These prospective host rocks lie within the Red Lake Mine Trend

structural corridor which extends southeast from Goldcorp's

two gold mines on to and across the Conquest Alexander Property.

Many of the regional structures that have associated gold

mineralization in the area of the two producing gold mines

at Red Lake extend eastwards on to the Alexander Property.

For 2011, Conquest plans to conduct 15,000 metres of diamond

drilling in subsequent phases of exploration on

the Alexander Property.

The focus is to continue systematic drilling to test the Balmer

Assemblage stratigraphy in structures extending from the

adjacent Red Lake Mine (Goldcorp) within volcanic lithologies

below the 700 metre level under the western and central

portions of the Alexander Property.

QUALIFIED PERSON

Information of a scientific or technical nature contained in

this release has been prepared by or under the supervision

of Terence McKillen, P.Geo., the Chief Executive Officer of

the Company and a Qualified Person within the meaning of

National Instrument 43-101 of the Canadian Securities

Administrators.

Samples are analyzed by AGAT Laboratories in Mississauga, Ontario

using a 50 gram pulp fire assay technique with ICP-OES finish.

Conquest employs the use of standards, blanks, and duplicate

samples to maintain confidence in the analytical techniques

used to determine gold content in its core.

Fifteen percent of the samples submitted to the laboratory

comprise samples used for quality assurance and control for

gold content.

AGAT also employ the use standards, blanks and duplicate

samples to calibrate on a regular basis within batches.

ABOUT THE COMPANY

Conquest and Detour Gold Corporation ("Detour Gold")

are exploring for structurally-hosted gold mineralization

under a joint-venture agreement at the Sunday Lake property

located along the Sunday Lake Deformation Zone

approximately seven kilometres east of Detour Gold's

14.9 million ounce proposed open pit gold mine.

Detour Gold, as operator, has agreed to expend $1,000,000 on

exploration prior to September 30, 2014 to earn a 50% interest

in the Sunday Lake Property. Drilling is currently underway

by Detour Gold.

Conquest is exploring several gold projects in Ontario.

These include the Alexander Gold Project at Red Lake;

the Sunday Lake property at Detour Lake in joint venture

with Detour Cold Corporation;

and, the Smith Lake Gold Project at Missanabie.

Conquest holds 100,000 shares of Detour Gold Corporation.

There are currently 95,477,728 shares of Conquest issued

and outstanding.

This news release may include certain "forward-looking

statements". All statements other than ---from Conquest's

expectations are exploration risks detailed herein and from

time to time in the filings made by Conquest with

securities regulators.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy

or the accuracy of this release.

Conquest Resources Limited

President & CEO

647-728-4126

Conquest Resources Limited

Vice-President Investor Relations

604-984-8633

Conquest Resources Limited

Chairman

416-362-6686

info@conquestresources.net

http://www.conquestresources.net

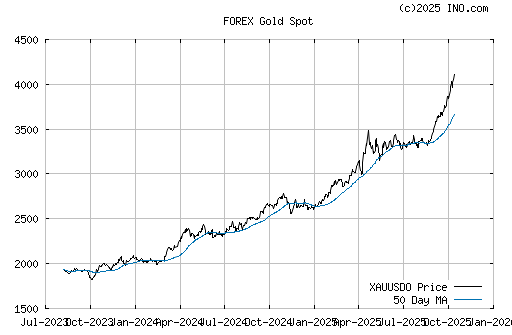

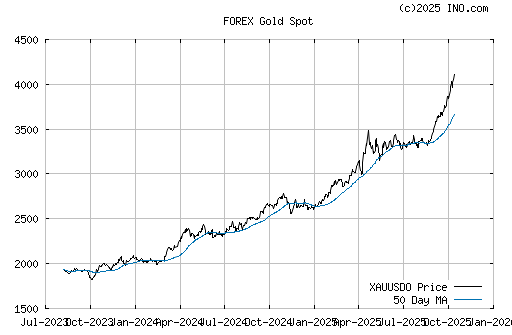

NWO Elites Au $3000 & Ag $100+++ 1st target -

Gold $3000/oz Lindsey Williams on Goldseek

Gold on a buy signal ![]()

Fiat poncy scheme on a sell signal -

Who Would Sell Gold Or Silver Now?

Jeff Berwick, The Dollar Vigilante

7 April 2011

Mainstream media, the majority of the public and value investors all believe that the precious metals are in a bubble. But that is because they do not understand the foundations underpinning a move into hard assets.

In this regard there are two camps:

The camp who believes that we live in a grand new world where governments can centrally plan economies better than the free market itself and where acceptance of government-sponsored, unbacked fiat paper monies is just a normal, unquestioned part of life.

The camp who sees central banks as being artificial and dangerous and who are quite surprised that this era of unbacked fiat currencies has lasted this long (nearly 40 years since the "Nixon Shock" on August 15, 1971)

Those in Camp #1 will never buy precious metals until it is already too late and the fiat currencies have all collapsed.

Those in Camp #2 will never sell their precious metals until they see an indication that the unpayable debts and deficits of the majority of western nations have reached a resolution - either by default (bankruptcy of the nations) or by hyperinflation (bankruptcy of the currency).

Which brings about an interesting state of affairs. Unlike any and every other bubble in the history of mankind, the holders of precious metals will not sell their holdings for fiat currency, at any price.

They may sell their precious metals to buy another asset which they deem as being undervalued in terms of gold or silver - which may mean they sell their precious metals, briefly, for fiat currency but then quickly sell that fiat currency in favor of another asset.

But for those who own precious metals for safety and/or profit against the assured demise of the global financial system there is no price at which they would sell their precious metals in favor of fiat currency.

Of course if someone offered you $10,000 per ounce today for your gold you would be crazy not to accept it. However, most holders of gold would sell at $10,000 and then immediately sell the fiat currency and repurchase the gold at the current market price near $1,400 to buy even more gold.

However, the great majority of people who hold precious metals as a hedge against the destruction of the US dollar reserve based financial system will never sell their precious metals, at market price, until they see a resolution of the debts of the western nations.

GOLD/SILVER SHORTAGES

This amazing scenario is playing out as we speak.

Reports have been coming in from all corners of the world over the last few months stating shortages in physical gold and silver bullion.

The operating capacity of domestic gold refineries in India have reached very low levels due to scarcity of scrap. Currently domestic gold refineries are operating between 25-30% of their installed capacity as against 35-40% around the same time last year. According to Ajay Mitra of the India and Middle East office of the World Gold Council, "Used gold sales have declined steadily in the last one year as consumers are holding jewellery in anticipation of higher prices."

They aren't so much anticipating "higher prices" of gold & silver as they are anticipating "lower prices" in their fiat currency. Until there is any indication that the ongoing, systematic destruction of fiat currencies worldwide will cease then there is no reason for anyone to sell their precious metals in favor of holding the fiat currencies.

Canada's biggest bullion bank, ScotiaMocatta "sold out" of all its silver coins and bars in January. They have apparently sourced some new supply of silver coins but as of the time of writing they still show 100 oz. Silver Bars as being "sold out".

Eric Sprott, one of the smartest men in the precious metals business stated that he expects gold to hit $2,150 and silver to hit $50 this year citing extreme shortages and great challenges to secure 15 million ounces of silver for his fund. He stated that "no supply exists in volume except from the margin of immediate producer output".

MOVE INTO BULLION AND PRODUCERS THIS YEAR

Up until this year it has been relatively safe to "play" in things such as gold/silver ETFs, futures and other "paper" assets. TDV believes that 2011 will be the last year in which it is still relatively easy to find and purchase gold/silver bullion and that those who have not yet begun to do so consider making this move immediately.

TDV issued a Special Report to subscribers entitled "How to Own Gold" on November 8, 2010 which includes more specific details on how and why to move into bullion products.

As well, as Eric Sprott pointed out above, one of the only liquid sources of gold and silver bullion now and in the future may be actual producers. The TDV Portfolio available to subscribers contains numerous large, mid and small cap producers. These equities may rise exponentially if it becomes clearer to the public that they are one of the only sources of accessible bullion available on the market.

Remember to diversify geographically to reduce political risk. We attempt to include miners from different parts of the world as part of this strategy.

Nice time to buy here ![]() bottom fishing Au safety bargain

bottom fishing Au safety bargain ![]()

RE:

CQR VALUATION: the Gold former production properties in Zimbabwe

fair market valuation should alone be higher than

CQR total Market Cap: 13,016,882 million

E.g.,

Beehive and Babs Gold Mines, Midlands Goldfield

Project Overview

The Babs & Beehive Mines are former gold production properties

situated respectively about 10km north and 30km northwest

of Kwe Kwe.

The mines were developed by African Gold PLC of London between

1997 and 1998 at a cost of approximately $4.5 million

and operated for nine months before being placed on care and

maintenance in early 1999 as a result of falling gold prices

and increasing costs in Zimbabwean currency.

The inferred mineral resource for both mines is 360,000 tonnes at

a grade of 5.7g m/t gold.

A further open pit potential of 400,000 tonnes of low grade mineralisation

may be amenable to heap leach gold extraction.

The mines are considered to have excellent upside for

additional reserves to be delineated following

completion of drilling and underground development programmes.

As part of the acquisition Conquest acquired a 300 tonne per day

processing plant located

at the Beehive mine site which was constructed in 1998.

http://www.conquestresources.net/project_details.php?pid=7&s=o

E.g,

Piper Moss Gold Project, Midlands Goldfield

Project Overview

The Piper Moss Mine is a former gold production property

situated just 3km north of and in a similar geological

setting to the Globe & Phoenix Mine,

the second largest gold producer in Zimbabwe's history

(over 2.3 million ounces gold).

The Moss vein from which mostof the past production of 163,200 ounces

(520,000 tonnes at 10.8 g m/t gold) was derived can be traced

for over 1,200 metres and is up to 2m wide inplaces.

The deposit was formerly accessed on 14 levels

by two shafts and byover 10,670 metres of lateral

development.

Other production came fromthe Sinola and Spur veins.

Several other mineralized structures occur parallel to

the Moss vein and contain ore grade values.

The New Reef isup to 1.5m thick and contains ore grade

gold values (average 19.9gm/t).

Potential exists for further gold reserves tobe delineated

within the Moss vein system as well

as in parallel andcross-cutting veins.

Over 30 present and past producting gold mines are located

within 10 km radius of the property.

Conquest has identified a number of other gold procuction

properties in the immediate area for acquisition.

Conquest plans to evaluate the potential to retreat

approximately 500,000 tonnes of tailings

and other surface stockpiles on the property

by a vat leaching process

and will undertake a comprehensive reevaluation of

the primary gold potential through surface and underground

exploration.

http://www.conquestresources.net/project_details.php?pid=9&s=o

The above Gold Mines should be restarted by CQR with todays Gold

price above $1,400.- per ounce a.s.a.p.!!!

Its a shame that they haven't been restarted yet?

CQR SChart TA TI P&F Alert Bullish Price

1st Target Objective fiat$.69 per share ![]() -

-

Note.,

P&F Point and Figure TI technical indicator is said to be

the oldest TI and the most reliabel TI indicator

GOLD SChart TA TI P&F Bullish Price

1st Target Objective $1716.48 per ounce

Let the Gold long term trend be your friend ![]()

Conquest Commences Drilling At Alexander Sulphide Shear Zone

In Red Lake

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=59638695

Detour Gold Commences Drilling Program at Conquest's Sunday Lake Property

Mar. 7, 2011 (Marketwire Canada) --

TORONTO, ONTARIO --

Conquest Resources Limited

(TSX VENTURE:CQR) is pleased to report that Detour Gold

Corporation ("Detour Gold") has commenced a 2,000-metre diamond

drilling program at Conquest's Sunday Lake Property,

which is currently under joint venture option to Detour Gold.

A total of 10 exploration drill holes are planned from five

prioritized drill target areas defined by Detour Gold by their

recently completed induced polarization (IP) geophysical survey

and MMI (Mobile Metal Ion) soil geochemical program conducted

on the property, (see CQR Press Releases – October 27, 2010

and January 19, 2011) and historical work compilation.

Detour Gold has defined prospective targets for gold

mineralization in areas of high chargeability along a shear

structure located 500 metres to the north and parallel to

the Sunday Lake Deformation Zone (SLDZ), which transect a

significant portion of the seven-kilometre length of

the Sunday Lake Property.

In September 2010, Conquest entered into a joint venture with

Detour Gold on Conquest's Sunday Lake Property pursuant to which

Detour Gold has the right to earn a 50% interest in the Sunday

Lake Property by completing $1,000,000 of exploration over

the next two years, including a minimum expenditure of

$500,000 prior to September 30, 2011.

Detour Gold has initiated construction activities at its

Detour Lake open pit mine, with a mineral reserve of 14.9

million ounces, located approximately seven kilometers west

of Conquest's Sunday Lake property.

Conquest holds 100,000 shares of Detour Gold Corporation.

ABOUT THE COMPANY

Conquest also continues to explore at its 100% owned

Alexander Gold Project in the heart of

the Red Lake gold camp with its ongoing multi-phase 20,000

metre, deep drilling program.

Conquest is exploring several gold projects in Ontario.

These include the Alexander Gold Project at Red Lake;

the Sunday Lake property at Detour Lake in joint venture with

Detour Gold Corporation;

and the Smith Lake Gold Project at Missanabie.

There are currently 95,239,092 shares of Conquest issued

and outstanding.

This news release may include certain "forward-looking

statements". All statements other than statements ---- from

time to time in the filings made by Conquest with securities

regulators.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or the

accuracy of this release.

Conquest Resources Limited

President & CEO

647-728-4126

Conquest Resources Limited

Vice-President

604-984-8633

Conquest Resources Limited

Chairman

416-362-6686

info@conquestresources.net

http://www.conquestresources.net

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://tmx.quotemedia.com/article.php?newsid=38250525&qm_symbol=CQR

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

Detour Gold Commences Drilling Program at Conquest's Sunday Lake Property

Mar. 7, 2011 (Marketwire Canada) --

TORONTO, ONTARIO --

Conquest Resources Limited

(TSX VENTURE:CQR) is pleased to report that Detour Gold

Corporation ("Detour Gold") has commenced a 2,000-metre diamond

drilling program at Conquest's Sunday Lake Property,

which is currently under joint venture option to Detour Gold.

A total of 10 exploration drill holes are planned from five

prioritized drill target areas defined by Detour Gold by their

recently completed induced polarization (IP) geophysical survey

and MMI (Mobile Metal Ion) soil geochemical program conducted

on the property, (see CQR Press Releases – October 27, 2010

and January 19, 2011) and historical work compilation.

Detour Gold has defined prospective targets for gold mineralization in areas of high chargeability along a shear structure located 500 metres to the north and parallel to the Sunday Lake Deformation Zone (SLDZ), which transect a significant portion of the seven-kilometre length of the Sunday Lake Property.

In September 2010, Conquest entered into a joint venture with

Detour Gold on Conquest's Sunday Lake Property pursuant to which

Detour Gold has the right to earn a 50% interest in the Sunday

Lake Property by completing $1,000,000 of exploration over

the next two years, including a minimum expenditure of

$500,000 prior to September 30, 2011.

Detour Gold has initiated construction activities at its

Detour Lake open pit mine, with a mineral reserve of 14.9

million ounces, located approximately seven kilometers west

of Conquest's Sunday Lake property.

Conquest holds 100,000 shares of Detour Gold Corporation.

ABOUT THE COMPANY

Conquest also continues to explore at its 100% owned

Alexander Gold Project in the heart of

the Red Lake gold camp with its ongoing multi-phase 20,000

metre, deep drilling program.

Conquest is exploring several gold projects in Ontario.

These include the Alexander Gold Project at Red Lake;

the Sunday Lake property at Detour Lake in joint venture with

Detour Gold Corporation;

and the Smith Lake Gold Project at Missanabie.

There are currently 95,239,092 shares of Conquest issued

and outstanding.

This news release may include certain "forward-looking

statements". All statements other than statements ---- from

time to time in the filings made by Conquest with securities

regulators.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or the

accuracy of this release.

Conquest Resources Limited

President & CEO

647-728-4126

Conquest Resources Limited

Vice-President

604-984-8633

Conquest Resources Limited

Chairman

416-362-6686

info@conquestresources.net

http://www.conquestresources.net

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://tmx.quotemedia.com/article.php?newsid=38250525&qm_symbol=CQR

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

Conquest Commences Drilling At Alexander Sulphide Shear Zone In Red Lake

TORONTO, ONTARIO, Feb. 7, 2011 (Marketwire) --

Conquest Resources Limited

(TSX VENTURE:CQR) is pleased to announce the commencement

of drilling at its 100% owned Alexander Property in Red Lake,

Ontario.

The 2011 Exploration Program will comprise approximately 15,000 metres

of NQ-sized drilling in five parent drill holes with additional

wedge holes under the central and western portions of the

Alexander Property.

Drilling will target favorable sheared Balmer Assemblage units

which are host to the adjacent Goldcorp Red Lake Gold Mines.

The first drill hole of the program (CR-11-044) has been collared

in a steeply dipping northerly direction under the central

portion of the Alexander Property.

The drill hole has been designed to intersect the down dip

extension of the Sulphide Shear Zone at approximately 1,000

metres vertical depth.

During the 2010 Exploration Program, trenching revealed a 7-metre

true thickness zone of intense shearing that contained extensive

sulphide mineralization and strong quartz carbonate alteration

known as the Sulphide Shear Zone.

Detailed structural mapping of this zone identified steeply

dipping sulphide stringer mineralization within a shear zone.

Elevated gold values of 300 to 400 parts-per-billion (ppb) were

obtained from within the Sulphide Shear Zone channel sampling

on surface (See Press Release dated September 27, 2010). Subsequent drilling during 2010 intersected further elevated

values in the shear zone at 80 to 180 metres vertical depth

which has provided encouragement to undertake further drilling

to locate the source of the anomalous gold in the shear system.

Conquest intends to investigate the extension of its Sulphide

Shear Zone along strike and at depth with the initial drilling

in its 2011 Exploration Drilling Program.

During 2010, Conquest completed 9,030 metres of drilling from

March through November comprising two deep parent holes and

three wedge holes for a total of 7,755 metres of drilling,

under the western portion of the Alexander Property, and three

drill holes totaling 1,275 metres of shallow drilling under

the Sulphide Shear Zone.

Conquest has contracted Boart Longyear Canada for its drilling

services on the project.

QUALIFIED PERSON

Information of a scientific or technical nature contained in this release has been prepared by or under the supervision of Terence McKillen, P.Geo., the Chief Executive Officer of the Corporation and a Qualified Person within the meaning of National Instrument 43-101 of the Canadian Securities Administrators.

ABOUT THE COMPANY

Conquest is exploring several gold projects in Ontario.

These include the Alexander Gold Project at Red Lake;

the Sunday Lake property at Detour Lake in joint venture with

Detour Cold Corporation;

and, the Smith Lake Gold Project at Missanabie.

Conquest and Detour Gold Corporation ("Detour Gold") are

exploring for structurally-hosted gold mineralization under

a joint-venture agreement at

the Sunday Lake property

located along the Sunday Lake Deformation Zone approximately

seven kilometres east of Detour Gold's 14.9 million ounce

proposed open pit gold mine.

Detour Gold, as operator, has agreed to expend $1,000,000 on

exploration prior to September 30, 2014 to earn a 50% interest

in the Sunday Lake Property.

Conquest holds 100,000 shares of Detour Gold Corporation.

There are currently 95,477,728 shares of Conquest issued and outstanding.

This news release may include certain "forward-looking statements". All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, exploration results, and future plans and objectives of Conquest, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Conquest's expectations are exploration risks detailed herein and from time to time in the filings made by Conquest with securities regulators.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or the accuracy of this release.

Conquest Resources Limited

President & CEO

647-728-4126

Conquest Resources Limited

Vice-President

604-984-8633

Conquest Resources Limited

Chairman

416-362-6686

info@conquestresources.net

http://www.conquestresources.net

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

http://tmx.quotemedia.com/article.php?newsid=38250525&qm_symbol=CQR

http://www.conquestresources.net/pdfs/CQR_Investor_Presentation.pdf

Conquest Commences Drilling At Alexander Sulphide Shear Zone In Red Lake - Feb 07, 2011 11:11 ET

http://www.marketwire.com/press-release/Conquest-Commences-Drilling-At-Alexander-Sulphide-Shear-Zone-In-Red-Lake-TSX-VENTURE-CQR-1391504.htm

Detour Gold’s hike in reserves fuels takeover talk