Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Namibia is heating up

Ocean Rig in talks to reactivate warm-stacked rigs as inquiries hit 2012 high

August 9, 2018

Ocean rig currently has contracts for three rigs, with Ocean Rig Skyros on a long-term deal in Angola with Total, Leiv Eiriksson semi-sub in Norway with Lundin till mid-December, and recently secured deals for Ocean Rig Poseidon drillship which will next week start drilling for Tullow and then for Chariot, both in Namibia.

Read more at:

https://www.offshoreenergytoday.com/ocean-rig-in-talks-to-reactivate-warm-stacked-rigs-as-inquiries-hit-2012-high/

"Tullow to start Drilling next week, then Chariot"

(Posted on August 9, 2018) “Ocean rig currently has contracts for three rigs, with Ocean Rig Skyros on a long-term deal in Angola with Total, Leiv Eiriksson semi-sub in Norway with Lundin till mid-December, and recently secured deals for Ocean Rig Poseidon drillship which will next week start drilling for Tullow and then for Chariot, both in Namibia.”

Fully funded to drill "S", however partnering process ongoing in Namibia, Brazil & Morocco with the potential to add significant cash to current position of ~US$30 million!

GLA!

Thanks. Exciting next few months

"173p (US$2.25) per share in the success case"

Chariot Oil & Gas CEO Larry Bottomley Presents to investors at the Oil Capital Conference (June 2018)

18:58: "Prospect S… finnCap assigned 23p/share risked on that prospect… in the success case that rises to 173p/share…"

20-bagger potential on prospect "S"!

I like the seismic here I wonder what the pps goes to if they hit on prospect S

November 2018 imo - now is the time to partner and generate some significant cash to advance our exploration programme..

...we currently own 100% of our license in Brazil, 75% of our license in Morocco and 65% of our license in Namibia - partnering process underway, for comparison PCL sold 10% of its Namibian license for US$7.7 Million, in 2013 we farmed out 35% of our license in Mauritania for US$26 million - any farmout deal should have a great impact on Shareprice pre drilling in November..

fingers crossed, GLA!

AEC, who farmed in to Tullow’s Block last year paying PCL US$7.7m for a 10% carried interest in the Cormorant drill, has raised US$45m in May 2018:

AEC US$45m - “The expected gross proceeds from the offering will be used to finance the Company?s acquisition, drilling and other joint venture costs for its projects offshore South Africa and offshore Namibia, as well as for general corporate purposes, including listing and transaction costs.”

..would not be surprised to see them farming in to our Central Blocks to have another well scheduled for 2018!

Looking at their near term potential costs they will have to pay PCL US$5.5m “acquisition costs” in October 2018 (@ Spud of Cormorant). Their share of “drilling costs” will be free carried by Tullow. Their other Blocks are located offshore South Africa where they own 90% in Block 2B and plan to drill in 3Q19, so “drilling costs” not imminent & they intend to farm down - similar to Chariot’s strategy a firm drilling commitment may give a commercial advantage in ongoing partnering discussions. In Block 11B/12B they will have to pay US$6.9m of pastcosts and plan to drill in December 2018 for which they will have to carry one of its partners (5.1%) up to a maximum of US$7.55m + their 4.9% share to drill a well which should be less than US$3m, so less than 6m in total. All in all ~US$20m of near term potential costs.

So there should be ~US$25m left to farmin to our Blocks offshore Namibia. :D

GLA

I bet we see a dollar pps on the first strike

is prospect S a deep sea fan play?

I got this : Chariot plans to drill Prospect S in Namibia in Q4 2018 targeting a gross mean prospective resource of 469mmbbls.

Full details on the Company can be found at:

http://www.chariotoilandgas.com/

Regards,

Henry

DH - Thanks for the update.

New prospect for the portfolio: P1 Brazil 911mmbbls

Chariot Oil & Gas announces 2017 final results - updates operations

Brazil:

? Integrated seismic interpretation and CPR completed with a large four-way dip- closed structure identified

? Portfolio consisting of seven prospective reservoir targets individually ranging up to 366mmbbls

? Single vertical well located at Prospect 1 can penetrate the TP-1, TP-3 and KP-3 stacked targets which have a summed on-licence gross mean prospective resource of 911mmbbls

? Partnering process initiated with dataroom open

if the well is successful im sure there will be ones lining up to make farm in offers

Chariot has contracted a rig for drilling

Courtesy of Malcy’s Blog 6/4/18

Chariot has contracted a rig for drilling one firm fully funded well and an optional second well depending on success on Prospect ‘S’ offshore Namibia in Q4 2018. The company describe Prospect S as ‘independently estimated as a gross mean prospective resource of 459 mmbbls and a probability of geologic success of 29% by Netherland Sewell Associated Inc., is one of five dip-closed structural traps, totalling 1,758mmbbls gross mean prospective resources, that have been identified in the Upper Cretaceous turbidite clastic play fairway’.

So that tells us then, they are hoping to farm-out this prospect and told me recently that there are a number of most exciting follow-on opportunities in these Central blocks which they hope to share if successful.

correct 1st one targeted to be drilled in September is the same one Pancontinetal is involved with, 2nd one targeted to be drilled in 4Q18 is with Chariot.

GL!

1st one in 3Q18 is the Cormorant well with

Tullow (35% operator)

ONGC (30%)

Pancontinental (20%)

Africa Energy Corp (10%)

Paragon (5%)

1st one in 3Q18 is the Cormorant well with

Tullow (35% operator)

ONGC (30%)

Pancontinental (20%)

Africa Energy Corp (10%)

Paragon (5%)

understand - what I find particular interesting is the recent US$45m raise from Africa Energy Corporation. Their Business strategy is "Access near-term catalysts via farmins or acquisitions", I would not be surprised to see them farming in to our blocks offshore Namibia where we offer a near term catalyst with the Drilling of prospect "S" in 4Q18... partnering process ongoing.

GL!

Hi HD. I think buccaneer1961 meant companies not wells. He seemed to pick up on my references to AOIFF, OIGLF, and and I am thinking PCOGF.

3rd one? as far as I know there are only two wells scheduled to be drilled offshore Namibia this year,

1st one in 3Q18 is the Cormorant well with

Tullow (35% operator)

ONGC (30%)

Pancontinental (20%)

Africa Energy Corp (10%)

Paragon (5%)

2nd one in 4Q18 is prspect "S" with

Chariot (65% operator)

Azinam (20%)

Namcor (10%)

Ignitus (5%)

ok,very good....this is th3rd one im interested in that has sept drill date

Tullow - "target spud date of September 1st"

https://www.offshoreenergytoday.com/tullow-preparing-for-namibian-wildcat-after-securing-rig/" rel="nofollow" target="_blank" >https://www.offshoreenergytoday.com/tullow-preparing-for-namibian-wildcat-after-securing-rig/

Chariot to drill after Tullow probably using the same drillship - Poseidon (ocean rig)..

I tried to find the info on the tullow drill,but couldn't find anything,i missed it,where? when? I found the other one...hot one of these and this is at a dollar imho

would be good to get over a dollar with a good report of hydrocarbon hit

ok,very good,thankyou very much

Most likely in October following the Tullow drill in 3Q18, here's the latest presentation:

www.chariotoilandgas.com/wp-content/uploads/2018/05/Corporate-Presentation-May-1.pdf

fully funded - however partnering process ongoing which will add significant cash if they manage to acquire a partner. Current Cash Position already very healthy ~US$30m. Current net share of the drill in 4Q18 is 65% and net costs to drill the well are estimated to amount to ~US$15m to Chariot. As far as I know Chariot is not directly related to edison who are an investment research and advisory Company covering all Kind of sectors and companies.

GL!

when does this company plan to drill? are they related to these guys? trying to find the connection

oilandgas@edisongroup.com

No oil @ RD-1 next stop Namibia 4Q18

www.proactiveinvestors.co.uk/companies/news/196025/chariot-oil-gas-well-fails-to-find-hydrocarbons-offshore-morocco-196025.html

GLA

Thanks DrillaHill for posting the link. It was very interesting reading. My micro portfolio of Africa Oil, Chariot, Pancontinental, Petro Matad, Tullow may actually show some life this year.

Wells to watch in 2018: RD-1 & S

we cover 2 out of 9 wells to watch in 2018:

https://www.baystreet.ca/articles/research_reports/edison/ExplorationWatch042018.pdf

GLA

Commencement of Drilling of Rabat Deep One Well

www.youroilandgasnews.com/chariot+starts+drilling+of+rabat+deep+1+well+in+morocco_148076.html

GLA

£15mln placing to add second well to campaign

www.proactiveinvestors.co.uk/companies/stocktube/8806/chariot-oil-and-gas-to-raise-more-than-15mln-to-add-second-well-to-campaign-8806.html

(Video Interview) - Larry Bottomley, chief executive of Chariot Oil & Gas Limited (LON: CHAR), discusses with Proactive's Andrew Scott their intention to raise more than £15mln through a placing and open offer to allow them to add a second well to their 2018 exploration campaign. Bottomley says they're keen to test Prospect S, offshore Namibia. This will be in addition to the 10% owned Rabat Deep exploration well, offshore Morocco, which will be drilled later this year by Eni.

Media Speculation about placing causing 30% SP drop

now confirmed by Chariot:

www.iii.co.uk/research/LSE:CHAR/news/item/2691949/statement-regarding-media-speculation?context=LSE:CHAR

"Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, notes the recent media speculation and confirms that it is in advanced stages of completing a new equity fundraising (the "Fundraising") to provide funds to allow the Group to deliver a second well within the near term comprising the drilling of Prospect S in Namibia, in addition to the carried drilling of the RD-1 well in Morocco by Eni.

The Board can confirm that it is looking to raise approximately US$15.0 million by way of a conditional placing as well as an additional up to approximately €5.0 million by way of an open offer (together the "Fundraising"). It is expected that the Fundraising will take place at 13 pence and the Company will make an announcement with further details in due course. "

The bad News - we were trading >20p last week now trading @ 14p!!!

The good News is that ist Looks very certain for us to drill a second well this year - so I expect us to move higher again within the next couple of weeks...

1st well in March with ENI in Morocco (confirmed)

2nd one in 2H18 in Namibia (to be confirmed)

targeting to drill a 3rd one in Morocco 1H19 (to be confirmed

...

wtf!

however - GLA!

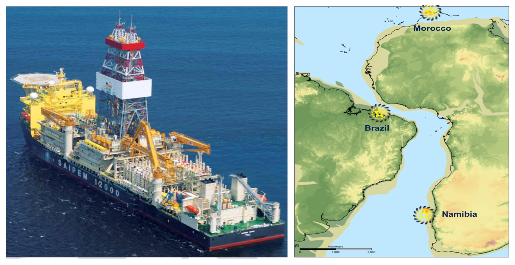

Saipem 12000 Drillship setting course for Morocco RD-1

...earlier than expected due to Turkish warships preventing ENI from Drilling offshore Cyprus:

www.ekathimerini.com/226092/article/ekathimerini/news/turkish-ships-threaten-to-sink-enis-drill-vessel

Four or five ships of the Turkish navy tried to once again obstruct the Saipem 12000 drill ship of Eni, that has over the last couple of weeks been prevented from performing its duty to search for hydrocarbons at Block 3 off Cyprus.

In a last-ditch effort before departing for Morocco, the drill ship attempted to approach the spot where it was supposed to begin its surveying, but the Turkish ships nearly caused a collision, that was averted in the last minute, after issuing clear threats to the Italian vessel that it would be sunk.

Eni’s ship left the spot and started sailing west, setting course for Morocco.

Marine Traffic - Saipem 12000 Past Track

Tullow in negotiations with Chariot on Namibia Drilling

Tullow is planning to drill offshore Namibia in September 2018. According to Chariot CEO Bottomley we are in negotiations with them to synergize our Drilling programs. I would not be surprised if these negotiations not only result in sharing a rig with Tullow but also lead to Tullow and /or ONGC farming in to our Blocks!

www.proactiveinvestors.co.uk/companies/stocktube/8483/chariot-oil-gas-boss-looks-ahead-to-exciting-2018-8483.html

"We’re looking to drill prospect S in the Central Blocks in the 2nd half of next year, there’ll be third party drilling at the same time so we’re in discussions and negotiations with them to see how we can synergize these programs to reduce those costs even further. Prospect S (29% COS) is a 300 million barrel prospective resource net to Chariot and there are another 6 prospects that will be derisked by that, another 1.4 billion barrels in that Portfolio."

# Namibia 2H18

Chariot @ NAPE Summit, Houston "Where Deals Happen"

Chariot O&G - Events and Financial Calendar

NAPE Summit, Houston 5 February – 9 February

APPEX Global, London 27 February – 1 March

AAPG European Regional Conference, Lisbon 2 May – 3 May

ICE, Cape Town 4 November – 7 November

Africa Oil Week, Cape Town 5 November – 9 November

PETEX, London 27 November – 29 November

NAPE Where Deals Happen

Success is not just what you know, but who you know. NAPE serves the upstream oil and gas industry by hosting the world’s largest, most successful marketplace where the primary purpose is connecting decision makers and investors. For the upstream oil and gas industry, NAPE is where deals happen

BOOOOOM what a great start here into 2018

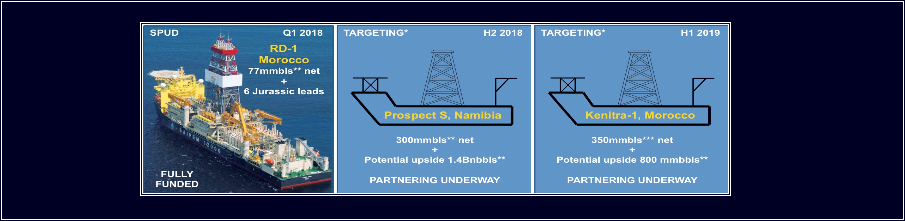

Targeting to drill three company-making wells in the nearterm:

www.chariotoilandgas.com/wp-content/uploads/2017/12/Corporate-Presentation-December.pdf

First Multi Billion Barrel Play opening well in Morocco to be spudded in March 2018!

Thanks for posting this DH. Please continue keeping us up to date. Do not know how many people check this board but I appreciate your postings.

Merry Christmas and Happy and Prosperous New Year

Thanks for posting this DH

Successful year ahead of high-impact exploration-programme in 2018

Pre Close Operational Update_Chariot O&G

The recent industry downturn has created a number of opportunities to capture significant cost reductions. Having previously taken advantage of the low seismic acquisition rates, Chariot is now focusing on the supply and demand dynamics of the deepwater drilling rig market. With rig rates at historic lows, Chariot has initiated a process to analyse how the Company can benefit from this lower cost environment. Utilising the expertise of its newly hired drilling manager, Chariot has conducted a thorough analysis of drilling cost estimates for its key prospects, feeding this data into the current partnering processes. Chariot has launched drilling preparations in Morocco and Namibia through the initiation of Environmental Impact Assessments, long lead items identification and other operational arrangements. Management believes that this preparatory work will enable Chariot to avoid unnecessary delays associated with its plans to drill three wells in the near term and to capitalise on the current low-cost environment for drilling.

Chariot O&G Corporate Presentation December 2018

Chariot O&G boss looks ahead to 'exciting' 2018

"It's a very exciting year ahead. We see the Rabat Deep-1 exploration well in Morocco as the focus,

we've got data rooms open in our other licences, we're looking to drill prospect S in the (Namibia) central blocks

in the second half of next year, and there'll be third-party drilling at the same time (Tullow)," Bottomley says.

Video Interview:

Chariot Oil & Gas boss looks ahead to 'exciting' 2018 (12/05/2017)

|

Followers

|

12

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

433

|

|

Created

|

09/12/11

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |