Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

In seeing many incorrect calls elsewhere Want a number of future calls here ? We will see ...............

One month later (or more precisely 5 weeks) :

One month later (or more precisely 5 weeks) : * Compare the 2 Red Circles

Have been hoping for/anticipating (and are thankfully now receiving), a useful little pullback.

Try to only trade the best looking set ups.....(LAC's ain't nearly as good as this one)

Now I do not find your charts correct But that is not here So here is new so What is your % of correct calls ? Can you call one down the road on this one so all can see I have seen you on other stocks ware your not correct in fact wrong most of the time This may be different and a good investment We shall see Later .........

Chasing it (me)....It's like - Wha !.....C'mon !.....

I want to re-enter, but at a "lower-risk" entry !

Panzer, what else is in your uranium portfolio?

Added 1,000 more CCJ for Uranium portfolio

100% agree! Looking for $12.50 break CCJ BOOM!

I have exactly 1,000 shares tucked away for Uranium re-boom.

Sub 10 bucks is ez money!

Vexing...what is the future of nuclear? This is easily the best play now on uranium- I would prefer to wait for a bigger discount, maybe around $7-8. Buy 1000 shares and keep it tucked away.

There is just no reason to own it right now, but if you have a long term horizon, somebody will make a nice return in uranium/nuclear.

It may not be in CCJ, however. Tough call. BOL.

MY OPINION ONLY- I HOLD NO POSITION PRESENTLY.

Just bought a nice little position in CCJ

Seems a like a strong buy!

Only a company as well manage as Cameco can beat on EPS and revenue on the lowest prices of the commodity. Strong Buy here!

$CCJ Cameco (NYSE:CCJ) squandered opening gains following its Q4 earnings report, finishing -4.6% after the company warned of further uncertainty this year in the nuclear market.

In today's earnings conference call, CEO Tim Gitzel said he was "cautiously optimistic" about the industry and that CCJ had "seen reduction in global demand expectations, driven by early reactor retirements, delays in reactor construction programs, slower-than-expected restart process in Japan, and by changes to government administrations."

While Q4 earnings beat consensus estimates, revenue fell 8.8% Y/Y to C$809M, hurt by lower realized prices for uranium under its Nukem unit, which handles CCJ’s marketing operations globally.

stockstreak Panzer gets in 6-12 months early

In CCJ scenario hold massive Uranium Boom coming

Then take profits into strength

That's when you buy stockstreak!

More global nuke plants coming online dwindling supply

Panzer loading CCJ for 10 year hold minimum

Best Uranium play out there!

stockstreak, time to load CCJ!

CCJ - TD is only group with buy rating. All others rate it underperform. Look out below!

Good to see 9.00 again. Look out above if oil crosses $65.

Not much reaction. What do you think?

need more rockets to disintegrate over the ocean

Doesn't seem to be a lot of activity here lately.

What's been going on? Anyone been investing? What are your current opinions/thoughts of Uranium and Cameco?

In the news-- 59 firecrackers set off and nuclear is the issue

Unity Energy Corp (TSX V.UTY) is an exploration stage company that is currently focused on lithium exploration in southwestern Nevada, uranium in the Athabasca Basin, and gold in Val d'Or mining camp, Quebec.

Uranium holdings in the Athabasca basin includes a 100-per-cent interest in the McKenzie Lake, Close Lake, Hoppy Lake and Milliken Creek projects. Unity also has 50-per-cent option interest in the Mitchell Lake uranium project. The balance of the option interest is subject to an earn-in agreement with 92 Resource Corp (TSX:V.NTY). V.UTY is related to CCJ with respect to being located in same region in Athabasca basin.

FIGURES--THEY THINK trump WILL sorry, make their deal a better one

What are the driving factors behind Uranium that you are watching?

Nice post there cb and merci for the breakdown.

Cameco Corp will fight after Tokyo Electric cancels $1.3 billion contract

http://business.financialpost.com/news/mining/cameco-corp-vows-to-fight-back-as-japans-tepco-cancels-1-3-billion-uranium-contract

Cameco Corp. said Wednesday it has rejected a key Japanese customer’s attempt to cancel its contract — a move that would mean $1.3 billion in lost revenue — as the Saskatoon-based uranium giant works to protect deals signed with customers before the market tanked.

Tokyo Electric Power Company Holdings Inc. issued a termination notice for a uranium supply contract on Jan. 24. On Monday, the Japanese power company said it would not accept a delivery scheduled for Tuesday.

Cameco shares plunged 11.29 per cent to end the day at $14.70 on the Toronto Stock Exchange.

Tepco alleges a “force majeure” event — or an act of God — has occurred because it has been unable operate its generating plants for the past 18 months due to government regulations enacted after the disastrous Fukushima nuclear accident of 2011.

“We’re confident that Tepco’s force majeure complaint is without merit,” said Cameco CEO Tim Gitzel on a last-minute conference call with investors Wednesday morning.

“It appears to us and it is our opinion that Tepco simply doesn’t like the terms they agreed to, particularly the price and want to escape from the agreement.”

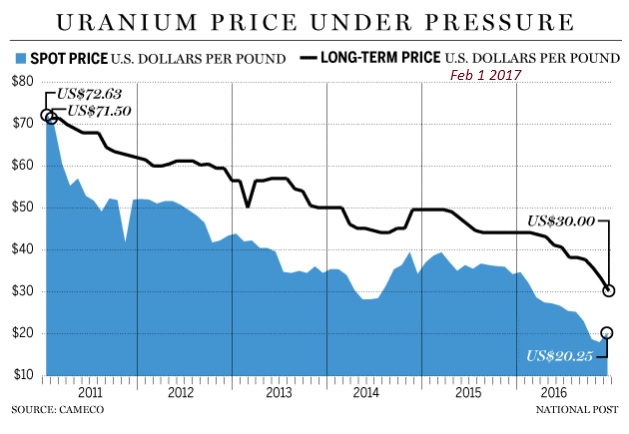

The entire nuclear industry is still feeling the aftershock of that disaster, with prices in the doldrums and customers re-evaluating contracts as they eye prices much lower than those in deals previously struck with Cameco.

OK Take a deep breath...the headlines say Cameco has lost a $1.3 billion contract so lets put that in perspective...

The $1.3 billion is projected sales over the next 11-12 years and amounts to $128 million/year for 2017, 2018 and 2019. This compares to what the annual sales are expected at $2.1 billion/year. So 128 divide by 2100 is 6.1% loss of anticipated sales. Its significant but not outrageous.

The PPS is down something like 12% this morning. Suck it up, sharpen your pencils, revisit the Australian deal and go to "Plan B". (Plan B is not to sue your customer but perhaps negotiate a "break up package" after all they may want some uranium sometime in the future)

Holy ^$*@ man, look at these :

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127766988

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127957327

MIGHT help one understand what's going on .....

Actually, Cameco downgraded themselves (plus ALSO (at some point) so too did an analyst)

But......

Yep, the entire Sector has "played" the swing.

There's some serious shennanigans goin' on here !

See also this post here :

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127774673

.

.

No sell-off if they don't pre-announce bad news. The U sector had great Mo until today.

Disclosure: Long URG at .58

I dunno really, I mean like today : They came out with (announced) a much poorer outlook and it/they instantly slumped on down to a more "support"ish level :

Hence : From the opening bell (and from even before it) both market makers and chart "technicians" would've had their eyes on this level :

And that's why I say "Don't ya' just love "T.A"" ?

TA can be blown up any time by fundamentals. Start announcing poor qt results or projections and TA, at least for that day, is useless.

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

285

|

|

Created

|

07/02/04

|

Type

|

Free

|

| Moderators TradingCharts | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |