Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Stock Technical Analysis is Bullish across the board on CAL.

First time in a long time.

I'm Bullish also. Great week or two ahead of us.

http://www.stockta.com/cgi-bin/analysis.pl?symb=CAL.C&num1=3&cobrand=&mode=stock

by spud, thanks good info! ![]()

God Bless

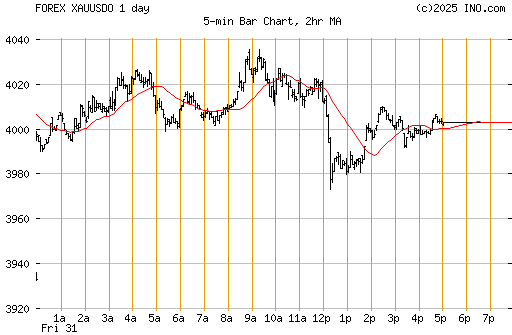

The Eurozone crisis is getting worse daily which is good for gold

and when Greece defaults and the contagion spreads across the

Atlantic their is going to be a stampede into gold -

GOLD chart TA Fib correction is done and Au LT bull strong running UP -

frequent reaction trend 62% of prior trend -

new bull trends will be often 162% of the previous correction - ![]()

the Au bull will run to way over fiat$2000 per ounce - ![]()

about 162% of prev. correction take Au to about fiat$2025 per ounce -

E.g....

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in a Blanket gold field -

Zim have many advantages -

CALVF GOLD's low cost production of Gold $585.0 per ounce for the production leader -

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon -

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

Ps.

The GOLD is the REAL MONEY -

The Legal Tender In USA -

fiat$ all paper print currency poncy scheme -

Mr. Gold finger - The Rothschilds 500 TRILLION DOLLARS -

Caledonia Mining Corporation (CALVF)

http://www.otcqx.com/qx/market/quote?symbol=CALVF&tab=0

Barf Bucket Banksters : Keiser Report

the more fiats the fraud 666 banksters cults print -

the Higher Gold & Silver FLY -

Mugabe’s illness triggers panic -

http://www.theindependent.co.zw/local/32939-mugabes-illness-triggers-panic.html

Friday, 28 October 2011 10:30

Dumisani Muleya

ZANU PF, which has dominated the country’s political landscape for over

three decades without a break, is now at a crossroads as President Robert

Mugabe’s health problems, worsened by old age, mount ahead of the next

crucial elections which could mark the beginning of the end.

Mugabe this week left for Singapore again —

suggesting his prostate cancer condition is increasingly critical —

for further medical checks after his recent visit there which

he claimed was on family business, official sources

said.

Informed reports say Mugabe is suffering from prostate cancer

which metastasised, spreading to other organs of the body,

while creating tumours.

Doctors have reportedly advised Mugabe to retire to avoid

straining himself and worsening his condition,

mainly before the 2008 elections.

The situation has now worsened since then.

Gaddafi was a tyrant and a big ally of Mugabe -

Gaddafi’s death means one less comrade less for Mugabe, -

said Iden Wetherell, an editor of the Zimbabwe Independent.

http://www.thezimbabwemail.com/zimbabwe/9363-robert-mugabe-s-zanu-pf-pays-tribute-to-gaddafi.html

Hussein, Bin Laden, Gaddafi KILLED... Whos Next? -

The Gold Standard Now - Board of Advisors:

http://www.thegoldstandardnow.org/

A PROJECT OF

THE LEHRMAN INSTITUTE

Lewis E. Lehrman, Chairman

Kathleen M. Packard, Publisher

Ralph J. Benko, Editor

The Gold Standard Now

Board of Advisors:

Senior Advisors

Sean Fieler, James Grant

and John D. Mueller

Senior European Advisor

Paul Fabra

Advisors

Jeffrey Bell, Ralph J. Benko,

Andresen Blom, Frank Cannon,

Rich Danker, Brian Domitrovic,

Charles Kadlec, Christopher K. Potter,

and Frank Trotta

In Memoriam

Professor Jacques Rueff

(1896-1978)

http://www.thegoldstandardnow.org/about

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68472528

GFY - ![]()

I'm in and happy

God Bless

How QE3 Could Bring About $5,000 Gold & $1,000 Silver -

Rocky Vega

In his recent commentary, Ambrose Evans-Pritchard sees the world nearing a revived gold standard as the US, Europe, and Japan all continue testing the limits of maximum sovereign debt levels.

With potential for QE3 - a third round of the Federal Reserve's quantitative easing program - on the horizon, governments around the world must consider alternatives to the US dollar and other paper money. These developments are likely to continue impacting precious metal prices.

From The Telegraph:

"'It is very scary: the flight to gold is accelerating at a faster and faster speed,' said Peter Hambro, chairman of Britain's biggest pure gold listing Petropavlovsk. 'One of the big US banks texted me today to say that if QE3 actually happens, we could see gold at $5,000 and silver at $1,000. I feel terribly sorry for anybody on fixed incomes tied to a fiat currency because they are not going to be able to buy things with that paper money.'

"China, Russia, Brazil, India, the Mid-East petro-powers have diversified their $7 trillion reserves into euros over the last decade to limit dollar exposure. As Europe's monetary union itself faces an existential crisis, there is no other safe-haven currency able to absorb the flows. The Swiss franc, Canada's loonie, the Aussie, and Korea's won are too small.

"'There is no depth of market in these other currencies, so gold is the obvious play,' said Neil Mellor from BNY Mellon. Western central banks (though not the US, Germany, or Italy) sold much of their gold at the depths of the bear market a decade ago. The Bank of England wins the booby prize for selling into the bottom at €254 an ounce on Gordon Brown's orders in 1999. But Russia, China, India, the Gulf states, the Philippines, and Kazakhstan have been buying."

Evans-Pritchard notes that China in particular delays and obscures its large gold accumulations. It has already recently doubled its holdings and plans to continuing growing its hoard from 1,054 to roughly 8,000 tonnes. Another strategic buyer of gold he cites is Switzerland, which has hearings underway on how to develop a "a parallel Gold Franc." You can read additional details in his Telegraph commentary on how there could be a return to the gold standard as world order unravels.

25 October 2011

Rocky Vega,

The Daily Reckoning

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68468708

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68303667

God Bless

CAL Profitable Gold producers - make a dd...CAL low cost

Gold miner penny bargain play -

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost of Gold $585.0 per ounce for the production leader - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon - ![]()

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

Ps.

Zimbabwean Prime Minister Morgan Tsvangirai is in South Africa to

promote the launch of his autobiography "At the Deep End".

He spoke to ABN's Godfrey Mutizwa about the indigenization law -

Thanks for the reads.

Interesting thoughts.

Libya Revolution or Coup? IMF Report 2010 & 2011, Chavez Gold Bailouts Occupy Anonymous

Tyrant Robert Mugabe Recieves Prostate Cancer Treatment

In Singapore

Hussein, Bin Laden, Gaddafi KILLED... Whos Next? -

Still have it on watch. Trading pretty flat right now.

Gold higher at 1658.30 (+16.33). Silver 31.622 (+0.264).

Dollar lower.

Euro steady. Stocks called higher.

Treasuries mixed.

Caledonia Mining Corporation Joins OTCQX

NEW YORK, Oct. 17, 2011 /PRNewswire/ --

OTC Markets Group Inc. (OTCQX: OTCM), the financial information

and technology services company that provides the world's largest

electronic marketplace for broker-dealers to trade over-the-

counter ("OTC") stocks, announced that

Caledonia Mining Corporation

(OTCQX: CALVF; TSX: CAL; AIM: CMCL),

an African focused mining, development and exploration company,

is now trading on the highest tier of the OTC market, OTCQX®.

Caledonia Mining will begin trading today on the OTC market's

prestigious tier, OTCQX International.

Investors can find current financial disclosure and Real-Time

Level 2 quotes for the Company on

http://www.otcqx.com

and

http://www.otcmarkets.com

"OTCQX provides the highest level of visibility and access to U.S.

investors possible in the OTC marketplace," said R. Cromwell

Coulson, President and Chief Executive Officer of OTC Markets

Group. "We are pleased to welcome Caledonia Mining to OTCQX."

Collins Stewart LLC will serve as Caledonia Mining's

Principal American Liaison ("PAL") on OTCQX, responsible for

providing guidance on OTCQX requirements.

About Caledonia Mining Corporation.

Caledonia Mining Corporation

(OTCQX: CALVF; TSX: CAL; AIM: CMCL) trades in the United States

on OTCQX under the symbol "CALVF", in Canada on TSX under the

symbol "CAL" and in the United Kingdom on the Alternative

Investment Market of the London Stock Exchange under the symbol

"CMCL".

Caledonia Mining is an African focused mining, development and

exploration company.

Caledonia's main assets are the Blanket gold mine in Zimbabwe,

which produces 40,000 oz of gold per annum,

the Nama Cobalt/Copper Project in Zambia

and the Rooipoort & Mapochs PGE Projects in South Africa.

About OTC Markets Group Inc.

OTC Markets Group Inc. (OTCQX: OTCM) operates the world's largest

electronic marketplace for broker-dealers to trade unlisted

stocks.

Our OTC Link™ platform supports an open network of competing

broker-dealers that provide investors with the best prices in

over 10,000 OTC securities.

We categorize the wide spectrum of OTC-traded companies into

three tiers -

OTCQX (the quality-controlled marketplace for investor friendly

companies),

OTCQB® (the U.S. reporting company marketplace for development

stage companies),

and OTC Pink™ (the speculative trading marketplace) -

so investors can identify the level and quality of information

companies provide.

To learn more about how OTC Markets Group makes the unlisted

markets more transparent, informed, and efficient, visit

http://www.otcmarkets.com

Subscribe to the OTCQX RSS Feed at http://syndicate.otcmarkets.com/syndicate/rssPinkNews.xml

SOURCE OTC Markets Group Inc.

Back

http://tmx.quotemedia.com/article.php?newsid=45284580&qm_symbol=CAL

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost of Gold $585.0 per ounce for the production leader - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon - ![]()

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

Caledonia Mining moves to the OTCQX -

http://www.caledoniamining.com/pdfs/10172011.pdf

Toronto, Ontario – October 17, 2011:

Caledonia Mining Corporation (“Caledonia”)

(TSX: CAL, OTCQX: CALVF, AIM: CMCL) is pleased to announce

the commencement of trading in its shares this morning on

the OTCQX International, the premier tier of the

US Over-the-Counter (OTC) market.

Collins Stewart LLC will serve as Caledonia’s Principal American

Liaison ("PAL") on OTCQX, responsible for providing guidance on

OTCQX requirements and US

securities laws.

Commenting on this news, Stefan Hayden, Caledonia’s Chief

Executive said:

“"We are very pleased to be a part of OTCQX and believe trading

on the highest tier of the OTC will provide Caledonia with

enhanced market access to a larger spread of institutional

investors and with improved liquidity.

We are confident that the move to the more transparent,

premier tier OTCQX market will provide the United States

investment community with improved access to Caledonia."

About OTCQX: The OTCQX marketplace is the premier tier of the US

Over-theCounter market.

Investor-focused companies use the quality-controlled OTCQX

platform to offer investors transparent trading, superior

information, and easy access

through their regulated U.S. broker-dealers.

The innovative OTCQX platform offers companies and their

shareholders a level of marketplace services formerly available

only on a U.S. exchange.

For more information about OTCQX, visit

http://www.otcqx.com

Investors can find current financial disclosure and Real-Time Level 2 quotes for

Caledonia on

http://www.otcqx.com

and

http://www.otcmarkets.com

Implications for Investors who previously traded on the OTCBB:

Those Caledonia shares previously traded on the OTCBB

will continue to be freely tradable

on the OTCQX.

About Collins Stewart LLC:

Collins Stewart LLC is a subsidiary of Collins Stewart

Hawkpoint plc, a leading independent financial advisory group and

parent company of Collins Stewart Europe Limited,

Caledonia’s nominated adviser and broker in London.

Collins Stewart LLC is a market maker in over 500 stocks and is

one of the leading

market makers on the OTCQX.

For more information, please contact:

Caledonia Mining Corporation

http://www.caledoniamining.com

Collins Stewart Europe Limited

Mark Learmonth John Prior / Sebastian Jones

Tel: + 27 11 447 2499 Tel: + 44 20 7523 8350

marklearmonth@caledoniamining.com

Renmark Financial Communications Inc Collins Stewart LLC

John Boidman or Dustin Buenaventura

Tel: +1 514 939 3989 or +1 416 644 2020

jboidman@renmarkfinancial.com

Dan Mintz

Tel: +1 212 389 8022

DMintz@collinsstewartllc.com

dbuenaventura@renmarkfinancial.com

----

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost of Gold $585.0 per ounce for the production leader - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon - ![]()

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

Q-reus' on 'Caledonia Mining Corporation (TSE:CAL) ![]() -

-

Short New History tells us -

Blanket Gold Mine -

started production in 1904 -

Early workers tended to mine the visible gold sections

of the pay shoots, i.e. pick the "eyes" out of the mine.

Significant early production milestones were:

in 1965 Falconbridge acquired the property and increased gold

production to an average of approximately 45 kg per month;

in 1993 Kinross took over the property and built an enlarged

Carbon-in-Leach ("CIL") plant with capacity of approximately

3,800 tonnes per day ("tpd") to treat an old tailings dump

together with the run-of-mine ore. Gold production reached

a level of 110 kg per month during the tailings treatment

years from 1995 to 2007.

To date in excess of 1 million ounces of gold have been

produced from the property.

http://www.caledoniamining.com/blanket2test2.php

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67883074

Short Older History tells us -

Great Shona Mashona Masonic -

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost of Gold $585.0 per ounce for the production leader - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon - ![]()

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

The mugabee banksters puppet, has said f-u to zim mining companies

for more than 20 yrs and he is 87yrs old and dying in cancer -

Zimbabwe's President Mugabe dying of cancer:

http://theafricareport.com/archives2/politics/5171200-zimbabwes-president-mugabe-dying-of-cancer-wikileaks.html

ex...empowerment-plan -

Zimplats biggest Zim- mining comp. was given to amend its proposal

was short and the company has now requested … about two months

to work on another proposal," said the paper -

"A new proposal would be submitted to government before the end

of November," Zimplats deputy chairman Much Masunda was quoted

as saying. "The new plan will have an element of

the community share ownership trust" and it has to be done

before 2015 - 5 year empow.-plan.

(mugabe polo-tic 20yrs old ploy to get more votes -

mugabe have tried to be copycat of the ussr bolsheviks super

red 666 banksters cults -

http://doreenellenbelldotan.info/AdolfRothschildHitler.htm

BS obama-ozama muslim brother-hood is more of bigger

success for the ussr super red banksters cults than

mugabe and anti-Christ BS obama super red cults

in US scares me much more than mugabe puppet!

BS super red copycat of ussr more communism to

put PEOPLE in his fema gulags and remove all

CONSTITUTIONAL RIGHTS FOR THE PEOPLE! -

is mugabe a scare to mining - think again -

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost of Gold $585.0 per ounce for the production leader - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon - ![]()

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67749405

God Bless

Mugabe health now a crucial election issue -

http://www.thezimbabwemail.com/zimbabwe/9232-mugabe-health-now-a-crucial-election-issue.html

Zanu-PF could break-up at Congress in Bulawayo =

http://www.thezimbabwemail.com/zimbabwe/9236-zanu-pf-could-break-up-at-congress-in-bulawayo.html

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67749405

If someone think mugabe 88yrs cancer sick -

is more danger than BS in oval -

well, the brain is a wonderful organ -

it starts the minute you get UP -

in the morning - does not stop until-

you get to the office -

think again -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67672283

America was made great by the likes of Bob Hope, Johnny Cash and Steve Jobs.

now, there's no hope, no cash, and no jobs -

NYBob, CAL is not being manipulated. Anyone who follows CAL knows the reason for the undervaluation is the Zimbabwe very high political & empowerment risks. The Zim government is trying to take 51% ownership of the Blanket mine, CAL's only "real" asset" & the source of ALL of CAL's income. That is the reason for the undervaluation.

WOW!!!!!!!!!!!!!!

Q-reus thanks, Caledonia mining ex.. how can anyone explain how

a company such as Caledonia have 2 very successful quarters

where 100 percent gains are being made

and yet the share price declines ... this

price action runs contrary to the laws of economics and

therefore no other conclusion can be reached other than

the share price is being manipulated....

Often said, the more manipulation the better -

the higher it will FLY ![]()

When this was done in the physical market back in the late 70's

they were able to successfully do it for some agonizing months,

but eventually the laws of economics took hold and prices

soared higher very quickly.

It will happen again!

NAMA great cobalr & copper world class -

drilling ongoing since Mar. -

the drill results will be out at any time soon ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66906662

btw.

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost of Gold $585.0 per ounce for the production leader - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year -

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling results out soon - ![]()

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force -

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

Thanks NYBob for the historical insight.

Gold LCNS Since September 6 (3 reporting weeks) gold has declined a net $224.95 or 12% (from $1,874.87 to $1,649.92 Tuesday) while the large commercial net short positioning (LCNS) fell by 61,031 contracts or 26.8%.

166,683 contracts net short is the lowest LCNS since May 5, 2009 (160,445 then with $896.75 gold).

465,414 is the lowest COMEX open interest for gold since February 1, 2011 (462,907 then with $1,341.10 gold).

Since August 2, (gold $1,659.23), gold drove up to test the $1,920s and round tripped back to about $1,650 for this COT report. As it did the large commercial traders got the heck out of 42% of their net short positioning (from 287,634 to 166,683 contracts net short). So, in effect, since August 2 gold has dropped a net $9.31 or 0.6% but the large commercial net short positioning plunged a net 120,951 contracts or 42%. – Gold is very close to where it was August 2, but the commercials are hugely less net short, 12.1 million ounces less net short at virtually the same price today.

Producer/Merchant’s reduced their net short positioning by 19,531 or 10.7% for the week.

Swap Dealers were down to just 4,270 contracts net short gold, having covered or offset 11,414 contracts for the week. Swap Dealers have reduced their collective net short gold positioning by a stunning 87,424 contracts or 95% just since August 2.

465,414 is the lowest open interest for gold since February 1 (462,907 then with $1,341.10 gold).

That is all for now, but there is more to come.

Posted by Gene Arensberg at 03:57:04 PM in

Got Gold

King Solomon & Q-Sheba

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67548731

God Bless

Errol Flynn congratulation GFY welcome to Caledonia Mining Corporation (TSE:CAL) long TEAM -

you were right on - why is it so low in price -

the indig. has been baked in it since a long time -

it is on CAL's web site and on every news release -

for a long time -

http://tmx.quotemedia.com/quote.php?qm_symbol=calvf:us

it maybe a reason to why CAL got to acquire Blanket Gold

Mine of Kinross Gold in 2006 for a low price -

http://www.caledoniamining.com/blanket.php

mugabe has talked about the indig. for 10s of years -

some think its to get more public votes -

Note.

Mugabe (88yrs) dying of cancer? -

http://au.news.yahoo.com/a/-/australian-news/10196912/mugabe-dying-of-cancer-cables/

NYBoB--BOUGHT IN , But what will the Indigenization going to do to stock price ?

Lost kingdoms of Africa: Zimbabwe part 1 -

The Biggest Secret In American History..Part 1 TubeTruthers.com! -

The ruins of Great Zimbabwe – the capital of the Queen of Sheba -

Among the gold mines of the inland plains -

Zambezi rivers [there is a]...fortress built of stones of

marvelous size, and there appears to be no mortar joining

them.... This edifice is almost surrounded by hills,

upon which are others resembling it in the fashioning of stone

and the absence of mortar, and one of them is a tower more than

12 fathoms high.

The natives of the country call these edifices Symbaoe, which

according to their language signifies court.--Viçente Pegado,

Captain, Portuguese Garrison of Sofala, 1531

Sometime in the early fourteenth century the people of Great

Zimbabwe began building the Great Enclosure, completing the

structure over the course of a century.

Scattered remains of the Valley Complex,

just north of the Great Enclosure,

can be seen in the foreground -

http://whc.unesco.org/en/list/364

http://whc.unesco.org/en/list/364/gallery/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67504530

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67439567

http://www.caledoniamining.com/blanket3test2.php

To prefer Zim. - as long as the banksters rules

as king 666 pin in the USA -

How You Can Say GOODBYE to the IRS -

Ron Paul telling us that he will remove the taxes -

for they in total - are against the USA Constitution Rights

of the PEOPLE in USA -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37064827

E.g., -

Montanore, Goldman Sachs - GS is the short seller -

pawn for banksters using bailouts from the People -

to short sell and destroy the Western Societies -

if the People follow the 666 GS they create US to be

a new bolsheviks khazars ussr were 100 mil. People were

put into gulags concentration deads-camps to be murdered -

and add the WWI & WWII the Rothschild created -

http://www.reformation.org/adolf-hitler.html

- you get 100s of million People murdered -

the more the fed banksters add to the fiats currencies -

fraud poncy schemes -

the Higher the Gold and Silver

will FLY on the long term trend -

The Fed Audit - U.S. provided a whopping $16 trillion in secret

loans to bail out American and foreign banks and businesses

during the worst economic crisis since the Great Depression.

http://sanders.senate.gov/newsroom/news/?id=9E2A4EA8-6E73-4BE2-A753-62060DCBB3C3

As a result of this audit, we now know that the Federal Reserve

provided more than $16 trillion in total financial assistance

to some of the largest financial institutions and corporations

in the United States and throughout the world," said Sanders.

Bernie Sanders: The Fed Audit: "U.S. provided a whopping $16

trillion in secret loans to bail out US and foreign banks"

http://www.dailypaul.com/171633/bernie-sanders-the-fed-audit-us-provided-a-whopping-16-trillion-in-secret-loans-to-bail-out-us-and-foreign-banks

Update - Audit The Fed: HR 459 - 162 Co-sponsors

http://www.dailypaul.com/155726/update-hr-459-55-co-sponsors

the GS used to nss - naked short sell the market to destroy it -

when it was not more allowed and the People discovered the

destruction -

they now use the banksters bailouts robbed from the People

to destroy the markets and the People -

history repeat itself -

of Great Russia destruction to be ussr and when all values

are robbed the 666 moves from the Eastern Europe to the

Western EURO and to the USA to repeat what the 666 did in ussr!

- the banksters news media will PR out the 666 cults GS video all over

the market to get as many fools of the People to follow and contribute

to the destruction of the Western Societies -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67458299

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67455722

End the Income Tax, Abolish the IRS -

By tmartin • April 15, 2009

http://www.ronpaul.com/2009-04-15/end-the-income-tax-abolish-the-irs/

Ron Paul supports the elimination of the income tax and the Internal Revenue Service (IRS). He asserts that Congress had no power to impose a direct income tax and has called for the repeal of the 16th Amendment to the Constitution, which was ratified on February 3, 1913.

An income tax is the most degrading and totalitarian of all possible taxes. Its implementation wrongly suggests that the government owns the lives and labor of the citizens it is supposed to represent. Tellingly, “a heavy progressive or graduated income tax” is Plank #2 of the Communist Manifesto, which was written by Karl Marx and Friedrich Engels and first published in 1848.

To provide funding for the federal government, Ron Paul supports excise taxes, non-protectionist tariffs, massive cuts in spending.

Ron Paul discusses the income tax and the “FAIR Tax” in May 2007:

http://investorshub.advfn.com/boards/board.aspx?board_id=3626

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67461364

How You Can Say GOODBYE to the IRS -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=52327546

by mick, thank you great info - ![]()

God Bless

Lost kingdoms of Africa: Zimbabwe part 2 -

CALVF TTM PE = 6.15 - very oversold and undervalued -

That PE of 7 is probably based on the 12 month trailing data

from Q2 2010 to Q1 2011.

CALVF made $.0096 per share in the last six months, and $0.0035

in the prior 6 months time period, so total earnings

for the last 12 months equaled $0.013.

Dividing the current stock price of $0.08/$0.013, I get a PE

of 6.15 based on the trailing twelve month (TTM) period.

CALVF should earn about 1.5 cents per quarter in the next

two quarters, so dropping off the $0.0035 and adding $0.03

to the $0.0096 earnings from the last six months,

annual earnings for CALVF in 2011 should be $0.039,

and that means that at the current 8 cent stock price

the PE would drop to 2.05 by the end of the year.

Minera Andes closed on Friday at $2.00 per share,

and trailing 12 month earnings totaled $0.16 per share,

so MNEAF is trading at a PE of 12.5.

Richmont Mines (RIC) had trailing 12 month earnings

of $0.70, and closed on Friday at $10.48 per share.

That stock is trading at a PE of 14.97.

Based on where Richmont and Minera are currently trading,

CALVF should be trading between 48 and 60 cents per share

by the end of the year.

by ganndolph on another CALVF forum

Hedge Fund Heavyweight Says Gold Bet Not Over -

Sep 19th, 2011 07:48 by News

19-Sep (Bloomberg) —

Gold, platinum and Brent oil will lead gains in commodities

as investors seek to protect their assets and shortages emerge,

according to Tony Hall, the hedge- fund manager who earned 33

percent for his clients this year.

Gold may climb 21 percent to a record $2,200 an ounce by the end

of 2011, platinum may gain 10 percent and Brent could rise 25

percent to $140 a barrel in six months, said the London- based

chief investment officer of Duet Commodities Fund Ltd., which

manages more than $100 million of assets.

…“We still believe in the gold story. If you believe the world

is in trouble or in further economic growth disruption, then gold

is a good safe haven.

If you believe that the world is going to come out okay, then

it’s a good inflation hedge.”

Given the still strong GOLD demand for a narrowed field of

safe-haven assets, dips are likely to continue to be limited

and short-lived -

Gold’s ‘Perfect Storm’ to Continue on Haven Demand -

Morgan Stanley banksters Says

Sep 13th, 2011 07:58 by News

September 12 (Bloomberg) —

Gold’s “perfect storm” is expected to continue on renewed investor

demand for haven assets, potentially driving the metal to its 1980

inflation- adjusted record, according to Morgan Stanley.

In 1980, gold hit a then-record $873 an ounce. In today’s dollars,

that would be $2,399.05, according to the U.S.

Labor Department’s inflation calculator....

http://www.bls.gov/data/inflation_calculator.htm

dd...CALVF low cost Gold miner penny bargain play -

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost production leader Au$585.0/oz - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year - ![]()

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force - ![]()

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

God Bless

Ps.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66957329

Gold extended modestly lower in overseas trading, as European

FinMins met in Poland for the latest round of

discussions on how to save the euro.

Once again, nothing of real substance seems to have come out of

the meeting, which has prompted the yellow metal to rebound back

to above the $1800 zone -

In fact, the attendees decided to put off until October the final

call on whether Greece will get the next tranche of their

bailout, all but assuring that Greece will be taken right

to the edge of the precipice once again and the market

will be on tenterhooks for the next couple of weeks

as the bankster clubbing more fears into the market

and pumping the fiat$ poncy schemes -

You can deduce from this decision that the FinMins simply have

no sense of urgency with regard to Greece, or there is no

consensus that the next tranche will or should be forthcoming.

As I think the markets have made it pretty clear that the Greek

situation is urgent —

the upcoming dollar liquidity wave notwithstanding —

it’s pretty clear what the probable reason for the delay

is… what nwo 666 banksters want to destroy the

confidence in the market for US and help China and India -

to rob more Mfg jobs from the US People etc. -

Shona Mashona becomes a golden key -

http://investorshub.advfn.com/boards/replies.aspx?msg=59249631

God Bless

Deposits draining from European banks; China sets high price

for bailout -

Submitted by cpowell on Wed, 2011-09-14 14:22.

Section: Daily Dispatches

10:18a ET Wednesday, September 14, 2011

Dear Friend of GATA and Gold:

A couple of quick headlines for you. ...

Deposit Flight from European Banks Means Collateral Risks

Piling Up at ECB:

http://www.bloomberg.com/news/2011-09-13/deposit-flight-from-european-ba...

And The Telegraph's Ambrose Evans-Pritchard reports that China

is demanding a high price for rescuing European bonds:

http://www.telegraph.co.uk/finance/china-business/8761805/China-states-p...

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67096514

Resort to SDRs for next bailouts will spur rush to gold,

Rickards says -

Submitted by cpowell on Wed, 2011-09-14 03:31.

Section: Daily Dispatches

11:32p ET Tuesday, September 11, 2011

Dear Friend of GATA and Gold:

Geopolitical analyst James G. Rickards, who spoke at GATA's Gold Rush 2011

conference in London last month, tonight tells King World News

that the major Western industrial powers are likely to start

resorting to the "Special Drawing Rights" of the International

Monetary Fund for the cash needed for the next round of bailouts.

And when that happens, Rickards says, "the game really is over.

It will be very transparent that we're just replacing one kind

of paper money with another kind of paper money and that is

going to accelerate the rush to gold."

If Rickards says it, ordinarily it's a lock, but let's add one contigency.

As long as prospective purchasers of gold are content to leave

their metal in the custody of bullion banks like HSBC and

J.P. MorganChase, forfeiting their metal to the Western central

bank fractional-reserve gold banking system, where their metal

is turned against them, then infinite amounts of imaginary gold,

paper gold and gold derivatives, will be able

to keep suppressing the gold price indefinitely.

Russia has known this since at least 2004:

http://www.gata.org/node/4235

China has known this since at least 2008 or 2009:

http://www.gata.org/node/10380

http://www.gata.org/node/10416

Venezuela seems to have figured it out this year:

http://www.gata.org/node/10281

http://www.gata.org/node/10286

And even Goldman Sachs, formerly a participant in the scheme,

is now heavily hinting about it:

http://www.gata.org/node/10408

But the Western financial news media resolutely refuse to get

near the issue, though GATA has handed the documentation to

many of their top journalists and has patiently explained it

to some of them.

(At least one such journalist was courteous enough to be a

little apologetic in walking away from it the other day.)

If the Western central banking system and its agents

can keep creating paper gold as easily as they can create

SDRs, Western financial journalism may have many more years

of noting smugly, without expressing the slightest curiosity,

that gold isn't keeping up with inflation.

The conclusion will be a matter of the readiness of any of

the Eastern powers to pull the plug on the scheme when they

decide that they have adequately hedged their exposure to

the currencies of the gold price-suppressing Western powers.

An excerpt from the King World News interview with Rickards

is headlined "Monetary System Will Go Gold Soon" and

you can find it here:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/14_Ji...

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost production leader Au$585.0/oz - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year - ![]()

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA world class cobalt-copper-belt

type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

God Bless

Gold Should Be An Asset Class Unto Itself -

September 14, 2011

http://seekingalpha.com/article/293485-gold-should-be-an-asset-class-unto-itself

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=65676391

Gold’s ‘Perfect Storm’ to Continue on Haven Demand -

Morgan Stanley banksters Says

Sep 13th, 2011 07:58 by News

September 12 (Bloomberg) —

Gold’s “perfect storm” is expected to continue on renewed investor

demand for haven assets, potentially driving the metal to its 1980

inflation- adjusted record, according to Morgan Stanley.

In 1980, gold hit a then-record $873 an ounce. In today’s dollars,

that would be $2,399.05, according to the U.S.

Labor Department’s inflation calculator....

http://www.bls.gov/data/inflation_calculator.htm

dd...CALVF low cost Gold miner penny bargain play -

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost production leader Au$585.0/oz - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year - ![]()

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force - ![]()

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

God Bless

WikiLeaks: Mugabe fears being hanged for crimes -

http://nehandaradio.com/

-- Moyo also accused the Zezuru clan of manipulating the party’s

constitution

to accommodate Mugabe.

He said; “The actions perpetuated the party’s constitution to

forestall reform and to perpetuate the clique’s primacy in

the party without following constitutional procedures.”

“The Zezuru clique’s extra-legal putsch provoked a strong counter-

effort (the Tsholotsho movement), which was suppressed out of

fear of a Karanga-Ndebele-Manyika alliance,” Moyo told the

congressional officers.

Daily News

Cobalt: A Critical Metal to Clean Energy -

Thursday, September 8, 2011

Cobalt has been used as a pigment in glass and porcelain for centuries.

Most notably it was used to create that distinctive blue color

in fine china.

Other than that, cobalt was mainly seen as a byproduct of mining

copper and nickel ore.

The bulk of cobalt production has been from the Copperbelt

in central Africa since the 1970s.

But when Zaire (Now the Democratic Republic of Congo) had

political strife in 1976, cobalt production was all but cut off.

The price of cobalt skyrocketed.

As a result, most manufacturers found alternatives to cobalt and

demand at the time waned somewhat for the blue metal.

(Courtesy: Financial Times)

But cobalt is making a comeback.

Aerospace and green technologies have introduced a slew of new

applications for cobalt. According to the Department of Energy,

cobalt can’t be as easily replaced this time around…

Cobalt: One of 14 Critical Metals to Clean Energy

In December of 2010, The U.S. Department of Energy outlined its

“Critical Materials Strategy.”

Cobalt is one of 14 elements defined as a critical metal to clean

energy over the next 5-15 years.

Nine of these 14 are classified as rare-earth elements.

The DOE sees cobalt as such a critical metal because of its use

in lithium ion batteries. The DOE predicts that each electric-

powered vehicle (PHEVs and EVs) will demand 9.4 kg of cobalt.

That doesn’t even include all of the cell phones, tablets and

laptops that will continue to use lithium ion batteries.

Cobalt is also a significant ingredient in Nickel Cadmium and

NiMH rechargeable batteries.

Besides the demand for cobalt from batteries, the other critical

use for the metal is in superalloys.

Cobalt superalloys are used extensively in military aerospace

engineering.

Because of the resistance to heat and corrosion the cobalt

superalloy is particularly useful for gas turbine engines.

Other industrial uses of cobalt include:

As a binding agent in steel-belted tires

Used in magnets

Desulfurization of crude oil

Liquid-to-natural gas production

Electroplating

Although cobalt doesn’t get a ton of press, it’s a pretty

important metal in this day and age.

Even if we don’t realize it, the U.S. government seems to.

‘A Debilitating Impact’ on the U.S.

MIT’s technology review reported that U.S. diplomatic cables

released by WikiLeaks last year mention an African cobalt mine.

According to the report, The Department of Homeland Security

claimed that the single mine is so important that it’s

“incapacitation or destruction… would have a debilitating impact”

on the national economy and U.S. security.

Considering the volatile state of Africa’s political scene, it’s

not very reassuring.

But since only 15 percent of U.S. consumption of cobalt is via

recycled metals, the United States relies on 85 percent of its

cobalt from foreign sources.

Something else that isn’t reassuring for Americans – 40 percent

of all cobalt production is from African mines, and 99 percent

of that African cobalt is processed and sold by the Chinese.

Much like the rare earth metals, China has a virtual grapple

hold on cobalt production.

The U.S. hasn’t mined cobalt since 1971 and hasn’t processed it

since 1985.

Much like rare earth materials, China used its cheap labor and

lack of environmental regulation to undercut the competition.

But that is starting to change this year.

Cobalt Projects and Producers

While the cobalt exposure is diversified with gold and copper,

it’s also subject to the volatile political climate in the

Democratic Republic of Congo.

It’d be wise for investors to keep an eye on this developing

industry and world news that affects it over the next few years.

Good investing -

Caledonia Mining Announces Cobalt Off-take Agreement with Large Chinese Refiner

Toronto, Ontario - January 29, 2008:

Caledonia Mining Corporation -

("Caledonia") (TSX: CAL, NASDAQ-OTCBB: CALVF and AIM: CMCL)

is pleased to announce the signing of a cobalt off-take agreement

with a large Chinese refiner.

Under the terms of the agreement, Caledonia will supply a minimum

of 21,000 tonnes of cobalt metal equivalent in the form of cobalt

hydroxide from its Nama Cobalt Project over the next six years.

The agreement specifies that the price shall be based on the

published monthly average for 99..3% cobalt from the London Metal

Exchange, and contains a guaranteed "Take or Pay" minimum cobalt

price of US$12/lb of cobalt metal.

The agreement is renewable.

http://www.24hgold.com/english/news-company-gold-silver-announces-cobalt-off-take-agreement-with-large-chinese-refiner.aspx?articleid=219313

Caledonia Awarded Mining Licences for Nama Cobalt Project -

http://www.24hgold.com/english/news-company-gold-silver-awarded-mining-licences-for-nama-cobalt-project.aspx?articleid=324145

CAL NAMA World Class Project - drill results soon on copper & cobalt target -

http://www.caledoniamining.com/nam1.php -

Caledonia Mining Corporation is a well diversified company -

The Blanket Gold Mine located in Zim have many advantages

CALVF GOLD's low cost production leader Au$585.0/oz - ![]()

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year - ![]()

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALEDONIA MINING CORP. A Profitable Gold Miner!

(CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CAL Production Cost Au US$585.0 per ounce -

CAL has 800+ mine workers and located 268 old Gold Mines

workings on the 100% owned large Blanket Gold Mines Property -

Gold Mines Producers to Fly HIGH -

CALVF from pennies to above $6.-/sh -

twice before - top trend line > $6.-/sh est.

CALVF 3rd time run UP GO>GO

CALVF drilling on NAMA, drilling

world class cobalt-copper-belt type mineralization -

http://www.caledoniamining.com/nam1.php

CALVF has some advantages with comparison to USA and Canada -

e.g., low taxes;

Corporate Income tax at 25% -

lower labour cost but a happy work force ![]()

Indigenisation program Mugabe talked about for 20 years -

but the leading Peoples opposition don't want -

year 2015 is a deadline -

self declared king pin Mugabe 88yrs old is sadly in serious

cancer sickness -

Blanket Gold Mines Project -

the capacity of the secondary and tertiary crushers was increased

to over 2,000 tpd and the capacity of the rod mills was

increased to 1,800 tpd.

The product from the regrind mill is pumped into a carbon

in leach ("CIL") plant consisting of eight, 600 cubic meter

leach tanks equipped with 45 kW agitators where leaching

at 50% solids and simultaneous adsorption of dissolved gold

onto activated carbon takes place.

The CIL plant has a design capacity of 3,800 tonnes of milled ore

per day.

Elution of the gold from the loaded carbon and electro winning

is done on site.

Gold is deposited onto wire wool cathodes, the loaded cathodes

are acid-digested and the resultant gold solids are smelted

to produce gold bullion of approximately 90% purity, prior

to Blanket exporting it directly to Rand Refinery in South Africa

for final refining and sale.

The full proceeds of sale (i.e. before payment of any royalty)

are paid to Blanket's foreign currency account with a commercial

bank within approximately 7 days of receipt of the gold by Rand

Refineries.

http://www.caledoniamining.com/blanket3test2.php

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66906730

God Bless

Blanket Gold Mine in Zimbabwe achieves record daily production -

TORONTO, Sept. 8, 2011 /CNW Telbec/ -

Caledonia Mining Corporation -

("Caledonia") (TSX: CAL) (NASDAQ-OTCBB: CALVF) (AIM: CMCL)

is pleased to report that the Blanket Gold Mine ("Blanket")

in Zimbabwe has broken its underground production record.

On 6thSeptember 2011, Blanket's No 4 Shaft hoisted 1,220 tonnes

of ore and a further 141 tonnes of ore were hoisted via

the Lima Shaft.

This daily total ore production of 1,361 tonnes is significantly

higher than Blanket's target of 1,000 tonnes of ore per day

and represents a new underground mining record for the mine,

for which production records date back to 1906.

Commenting on this news, Stefan Hayden, Caledonia's Chief

Executive said:

"This is a tremendous achievement by the management and employees

at Blanket, who are to be heartily congratulated and bodes well

for Blanket achieving its future production targets."

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66906662

http://investorshub.advfn.com/boards/board.aspx?board_id=7060

http://www.caledoniamining.com/pdfs/09082011.pdf

God Bless

CAL's NAMA Cobalt is King of Critical Metals - ![]()

microcap what did you hear about NAMA cobalt? -

did you hear this? -

Critical metals have a very high supply risk because a large

share of the worldwide production comes mainly from

a handful of countries -

- The Critical Metals Report -

Most people don't know or care about cobalt -

But, as with a number of metals we seldom hear about -

we would certainly miss cobalt if it were not available -

for use in many cutting-edge applications -

In Critical Metals Report -

CAL Ahead of the Herd to be NICE -

CEO talked about the supply and demand -

for critical metals and told us -

NAMA cobalt - the King of Critical Metals -

He also told us why he likes CAL -

emerging cobalt producers that could reward investors -

looking to participate in this very tight market -

dominated by China -

CAL's BLANKET GOLD MINE Production Au 40,000 oz/year -

- http://www.caledoniamining.com/pdfs/CALPres05262011.pdf -

- http://www.caledoniamining.com/pdfs/CALPres05192011.pdf -

- http://www.caledoniamining.com/blanket2test2.php -

- http://www.caledoniamining.com/blanket3test2.php -

- CAL's A target production rate of 100,000 oz per annum -

- www.caledoniamining.com/blanket4test2.php -

- CALEDONIA MINING CORP. A Profitable Gold Miner! -

- (CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL) -

- http://www.caledoniamining.com/blanket.php -

- CAL Production Cost Au US$585.0 per ounce -

- CAL has 800+ mine workers and 268 old Gold Mines workings -

- on the 100% owned large Blanket Gold Mines Property -

- Gold Mines Producers often 1st of GOLD Au Bulls to Fly HIGH -

- CAL drilling on NAMA, commenced in March 2011 to identify -

- world class Cobalt-copper-belt type mineralization -

- http://www.caledoniamining.com/nam1.php --

chart is building nicely NYB~

board marked ![]()

CAL chart at bottom Alert LT accumulation is pointing UP golden Au opportunity -

producer - ![]()

CAL TI MACD alert Buy zone ![]()

CALVF ![]()

Shona Mashona Masonic Golden Key ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=7060

have a great Golden Day ![]()

God Bless

|

Followers

|

6

|

Posters

|

|

|