Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$CYIO update 1) as posted in Annual, Management opted to convert total of $120k in accrued sal. into common shs priced significantly above current mkt pps (.02c) 2) Co. expecting to provide first details on acquisition target over the next 2wks. #AI #Proptech #StayTuned!!

$CYIO update 1) as posted in Annual, Management opted to convert total of $120k in accrued sal. into common shs priced significantly above current mkt pps (.02c) 2) Co. expecting to provide first details on acquisition target over the next 2wks. #AI #Proptech #StayTuned!!

— CYIOS Corporation (@cyioscorp) April 30, 2024

Yessir, let’s go!

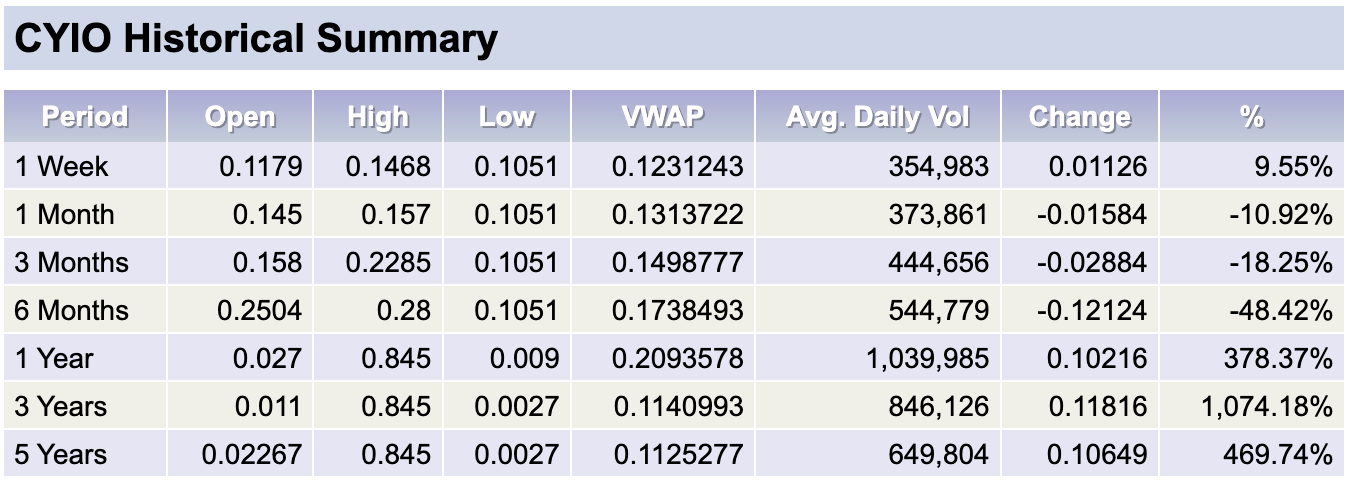

Ready for forthcoming acquisition- Helio Lending - Carbon Credits - company has been active. Ready for next leg

NorthTrail, please post a chart, as my Money Flow indicator is moving upward and is green. Appreciate it!

Actually, money flow has trended down while share price has trended up, in recent weeks.

IMO

Charts looking good again!

Do it! You won’t.

Can we see 80 cents againnnn?????

You don’t want to wake them

Time for this board to wake up! Seems tons of news is coming! New firm hired and good things on the horizon!

Hopefully soon!

Crickets.....15c2-11 means bring in socialism into the markets

Time for something, anything, hopefully lol!

May go even lower. Triple zeros??

Wouldn't it be pleasant to read that Cyios isn't on death's doorway?

That some great business opportunities missed over a 4 year period isn't the only story to be told and that there is growth and benefit to come (other than scrapping for 100ths of a penny in movements before sliding back again).

Because a once active message board has gone mostly silent doesn't mean the voices of the past have all departed.

Stan Lee NFT Collection Sells Out Almost Instantly, Rises 500% ( https://www.bloomberg.com/news/articles/2023-07-24/stan-lee-nft-collection-sells-out-almost-instantly-rises-500 )

Will consider buying back at .003 or so. HAWK

Welcome back! You’ve been missed! What I do, or what I think does not matter. Move on!

So Hulk

1. Who is this Mr. C ?

2. Does this recent post of yours, Hulk, indicate you have left ownership of Cyios stock . . . . or does it mean this mysterious "Mr. C" has left their ownership of Cyios stock ?

Is this a rally that's a rally or dilution disguised as a rally?

Moving higher. Large spread though. Thanks.

Moving on up. Last .0196 on much heavier volume. Thanks.

Quick question, and apologies in advance for my lack of knowledge, but aren’t financials and/or a filed extension due by now?

This is bullish.

Aren't readers suspicious?

When the latest hoopla of CYIOS's was the grand NFT opportunities regarding SLAM GIRL and the association with Stan Lee - was already to start back in mid September to Early October of 2022 - it was easy to understand why when Ethereum (associated with any and all NFT projects and valuations) plunged down to $900 in value - why CYIO became a silent whisper and a plunging stock price from its former $1700 range - - - even though supposedly there was "all this promise" of interest and desire - and a market brimming with interest and desirability on such a Marvel related Stan Lee influenced - new hot product grouping.

So fast forward to End of February of 2023 and BTC is in the 23,000+ to 26,000 pricing for numerous weeks already and Ethereum is in the 1575 to 1700 range - yet we don't see any positive movement or interest in CYIO stock. No bells or whistles sounded? No question marks? No mentiones of interest and desireability ???

Recent postings here were here about "who is arbitrarily supporting CYIO 's stock price at at a penny a share" ?

What is the very obvious answer?

Isn't it really likely that insiders or friends of insiders are buying "the public shareholders held stock" at a cent or below because they want the stock to stay public because they NEED the stock to stay public for their own future purposes and activities ??? And yet no press releases or commentary to be released because that keeps the stock price barely above water level (almost drowning but not quite). So is the entire staff so swamped with activity that they can't even communicate as a public company should in some form or another.

And public financial reporting ????

CYIO>>>> Still looking for.003 or lower. HAWK

Guess we’re all holding dead money for a while.

Guess we’re all holding dead money for a while.

Who has artificially propped this up over a penny for so long? If I was in this it would be in the trips where it apparently belongs.

Someone get a stick, and push the carcass of this thing. Make sure it’s dead before we bury it! Looks like dead money?

Some movement today, but I doubt it holds. .003 is still on my radar screen. TWT. HAWK

Is this POS ever going up again?

Is this POS ever going up again?

As I posted months ago. Now in the double zeros. .003 looks like a given. May or may not hold. TWT. HAWK

I recommend you read this link from start to finish of the short article. Start to finish.............

https://finance.yahoo.com/news/pudgy-penguins-nfts-break-time-215907480.html

Pudgy Penguins NFT collection is setting new heights. The rising tide is lifting associated projects, too.

It's rather stunning just how badly the crypto segment of the stock market has fallen.

Pay attention when the financial auditing companies don't want to be involved no matter how much they can charge.

This is a big deal because it's required to be a publicly traded company. The next 'shoe to drop' is going to be a big one.

https://finance.yahoo.com/news/accounting-firm-mazars-drops-all-crypto-clients-including-binance-and-cryptocom-153807881.html

Binance and Crypto.com are among the crypto companies dropped by the accounting firm Mazars, sending shockwaves through a crypto community looking for more tra...

|

Followers

|

211

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

14874

|

|

Created

|

01/18/07

|

Type

|

Free

|

| Moderators | |||

Check Out SLAM Girl NFT

https://slamgirl.io/

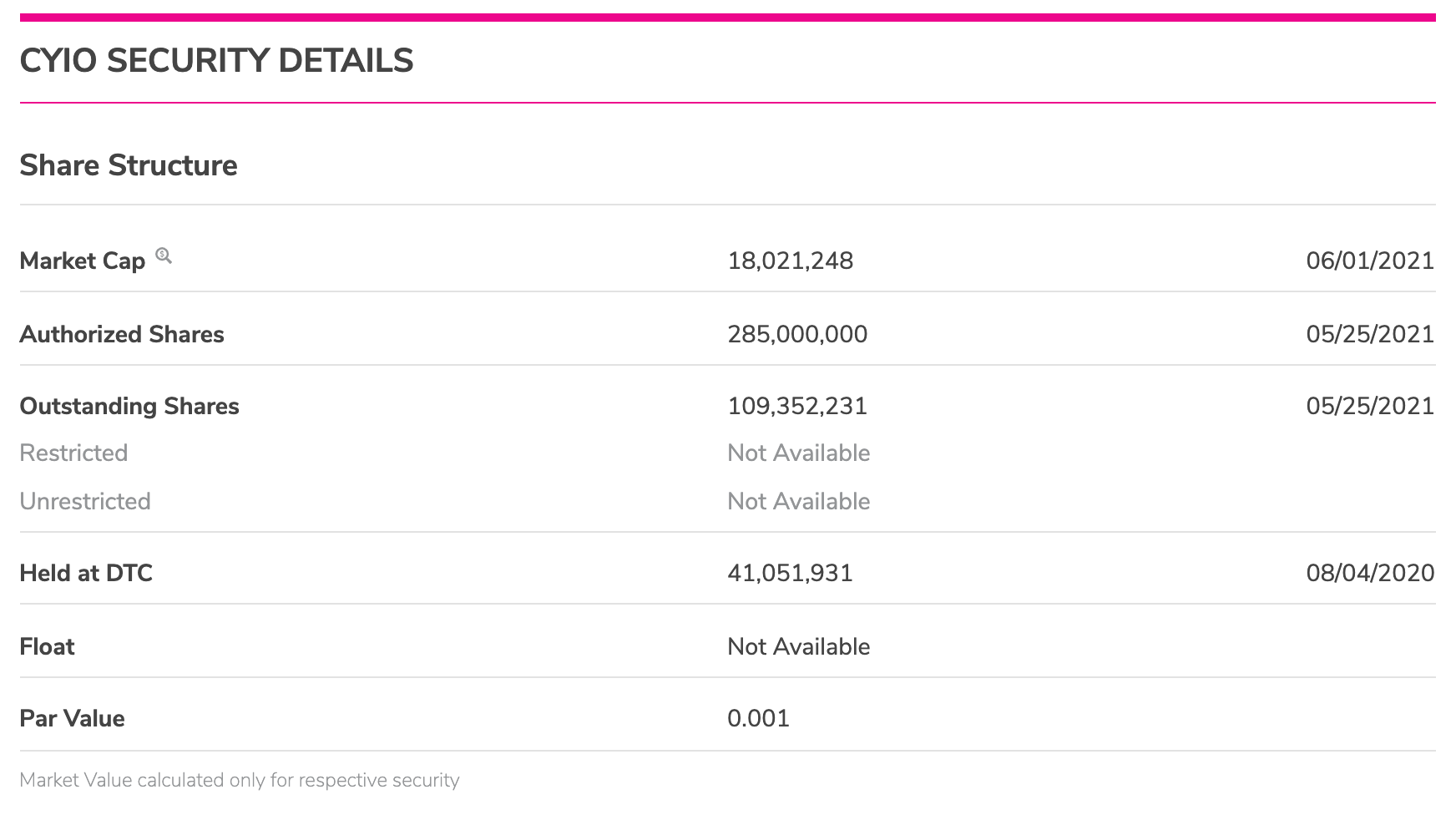

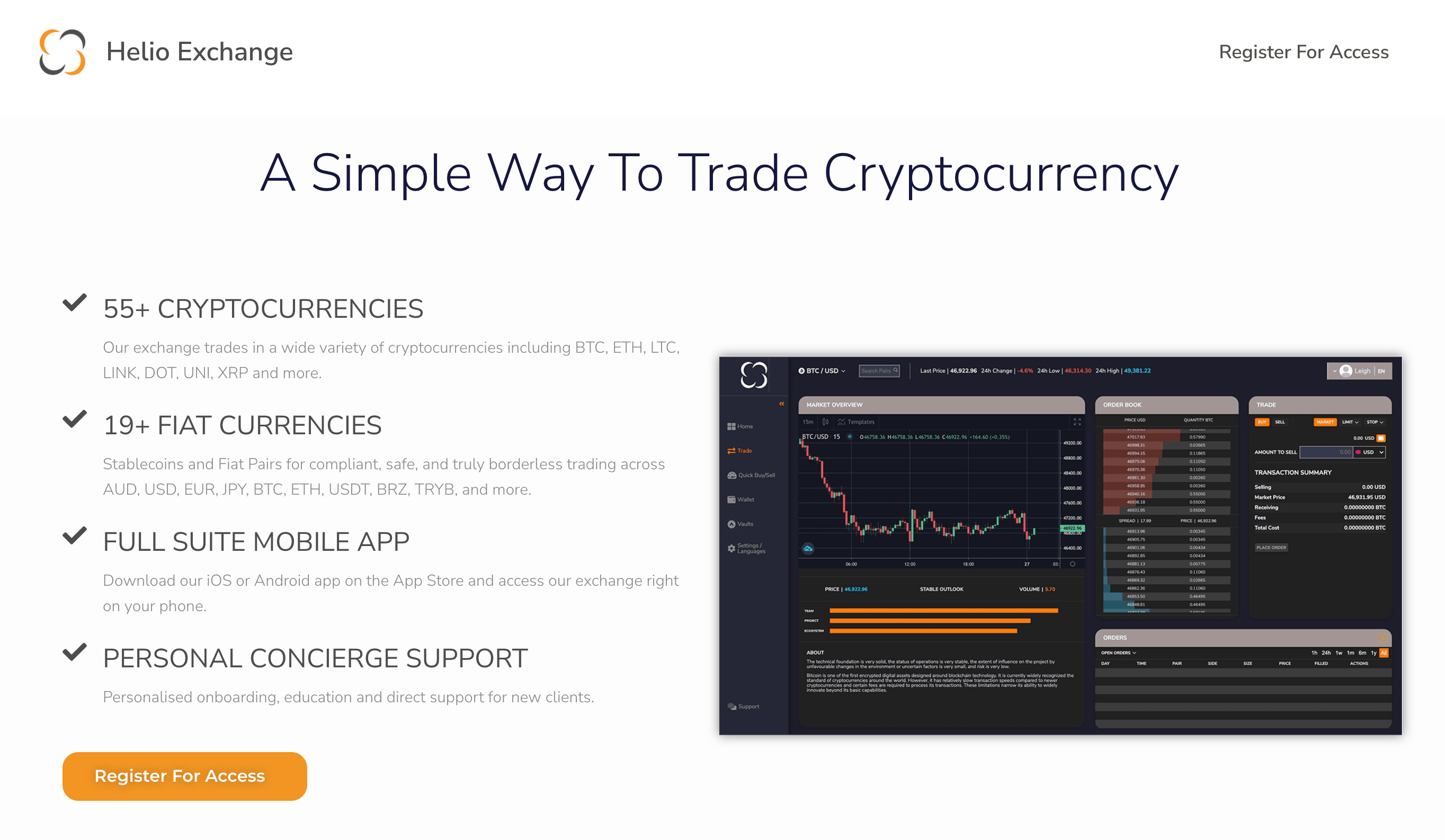

CYIOS Corporation is a publicly traded holding company with subsidiary businesses Helio Lending and Choice Wellness Inc. Through these subsidiaries, the Company is focused on crytocurrency lending through Helio's CeFi Aggregator platform, and Choice Wellness is focused on developing and marketing specialty branded products in the Health and Wellness markets, including the "DR's CHOICE" and "24" brand of products. The team has in-depth knowledge of the health and wellness markets, financial services industry, medical and health services, and blockchain. The Company looks to develop, distribute, and license proprietary products as well as evaluate potential acquisition opportunities. Further, the Company continues to seek and evaluate attractive business opportunities and to leverage its resources and expertise to build a diversified, sustainable business model. For more information, please visit www.cyioscorporation.com.

| David Lewis |  | John O'Shea |

| | + |  |

Helio Lending & Propy have recently begun participating together in a number of media events & webinars addressing the topic of Crypto-collateralized Real Estate Lending.

|

Helio / Propy partnership confirmed for property NFT collateralized loans |

https://heliolending.com/crypto-nft-diversification/ |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |