Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

CVS made an excellent strategic move buying out MDVL Medavail, this removes all SpotRX locations out of Cano Health Care Centers and paves the way for CVS to buy CANO finally. Check press releases. Cano not talking yet , due your due deligence CVS on bought assets in Cano Health Centers and warehouse inventory and prescription information of customers. Great move CVS.

CVS Health Co. (CVS) Receives Consensus Recommendation of "Moderate Buy" from Brokerages

By: MarketBeat | January 25, 2023

• CVS Health Co. (NYSE:CVS) has been assigned a consensus rating of "Moderate Buy" from the eighteen analysts that are presently covering the stock, Marketbeat reports. Two analysts have rated the stock with a hold recommendation, ten have given a buy recommendation and one has given a strong buy recommendation to the company. The average 12 month price target among analysts that have covered the stock in the last year is $119.13...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS names new pharmacy services, consumer product chiefs

By: Investing.com | January 23, 2023

(Reuters) -CVS Health Corp said on Monday that David Joyner would return to head the U.S. diversified healthcare company's pharmacy services and tapped former Cigna Corp (NYSE:CI) executive Amy Bricker as its chief product officer for consumer business.

Joyner will become the chief of the pharmacy services segment, which also includes the company's pharmacy benefits management business Caremark, effective Jan. 30. He will succeed Alan Lotvin, who plans to retire in April, CVS said.

Bricker will start in the newly created role in February after serving as president of Express Scripts (NASDAQ:ESRX), rival Cigna Corp's pharmacy benefits unit.

The appointments follow some setbacks CVS faced in recent months in its businesses. Its largest health insurance plan for Medicare recipients received a lower performance rating from the U.S. Centers for Medicare and Medicaid Services in October. The lower rating could affect payments from the government for 2024, the company said.

In the same month, Centene (NYSE:CNC) Corp replaced Caremark with Express Scripts to manage the insurer's annual pharmacy spend of around $40 billion.

The loss of the account, along with the ratings decline, will likely reduce 2024 revenue by $2 billion, CVS said in November.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health (CVS) PT Raised to $120.00

By: MarketBeat | January 14, 2023

• CVS Health (NYSE:CVS) had its target price boosted by Morgan Stanley from $119.00 to $120.00 in a research note issued on Friday, Benzinga reports. The brokerage presently has an "overweight" rating on the pharmacy operator's stock. Morgan Stanley's target price would indicate a potential upside of 32.96% from the company's previous close...

Read Full Story »»»

DiscoverGold

DiscoverGold

Assetmark Inc. Purchases 70,764 Shares of CVS Health Co. (CVS)

By: MarketBeat | January 14, 2023

• Assetmark Inc. raised its position in shares of CVS Health Co. (NYSE:CVS) by 4.3% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,722,035 shares of the pharmacy operator's stock after acquiring an additional 70,764 shares during the period. Assetmark Inc. owned approximately 0.13% of CVS Health worth $164,230,000 as of its most recent SEC filing...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS 1.66 Million Shares at $89.18 #darkpool prints

By: Money Flow Mel | January 12, 2023

• $CVS 1.66 million share #darkpool prints at $89.18.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Opening shorter dated sweeper in to the 01/13 $91 CALLS

By: Money Flow Mel | January 6, 2023

• $CVS Opening shorter dated sweeper in to the 01/13 $91 CALLS

Presenting at the JPM Healthcare Conf on 01/10

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health (CVS) Price Target Cut to $101.00

By: MarketBeat | January 3, 2023

• CVS Health (NYSE:CVS) had its price objective dropped by Wells Fargo & Company from $106.00 to $101.00 in a research report issued on Tuesday, Benzinga reports. The brokerage currently has an "equal weight" rating on the pharmacy operator's stock. Wells Fargo & Company's price target would indicate a potential upside of 10.20% from the company's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Co. (CVS) EVP Sells $13,521,155.76 in Stock

By: MarketBeat | December 16, 2022

• CVS Health Co. (NYSE:CVS) EVP Thomas M. Moriarty sold 137,466 shares of CVS Health stock in a transaction dated Thursday, December 15th. The shares were sold at an average price of $98.36, for a total value of $13,521,155.76. Following the completion of the transaction, the executive vice president now owns 608,129 shares in the company, valued at approximately $59,815,568.44. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health board raises quarterly dividend by 10% to 60.5 cents

By: Morningstar | December 15, 2022

• CVS Health said Thursday its board has approved a 10% increase in its quarterly dividend to 60.5 cents a share. The new dividend will be payable Feb. 1 to shareholders of record as of Jan. 20. Shares were down 1% premarket, but are down 2.4% in the year through Wednesday's close, while the S&P 500 has fallen 16%.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Co. (CVS) Receives Consensus Recommendation of "Moderate Buy" from Analysts

By: My MarketBeat | December 6, 2022

• Shares of CVS Health Co. (NYSE:CVS - Get Rating) have earned an average recommendation of "Moderate Buy" from the twenty-two research firms that are currently covering the company, Marketbeat.com reports. Two research analysts have rated the stock with a hold rating, thirteen have issued a buy rating and one has issued a strong buy rating on the company. The average 1-year price target among analysts that have covered the stock in the last year is $118.84...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health (CVS) Given New $119.00 Price Target at Morgan Stanley

By: MarketBeat | November 23, 2022

• CVS Health (NYSE:CVS - Get Rating) had its price objective dropped by research analysts at Morgan Stanley from $124.00 to $119.00 in a report released on Wednesday, Stock Target Advisor reports. The firm currently has an "overweight" rating on the pharmacy operator's stock. Morgan Stanley's price target points to a potential upside of 19.59% from the stock's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

Short Interest in CVS Health Co. (CVS) Expands By 6.2%

By: Market Beat | November 16, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) was the recipient of a large growth in short interest in the month of October. As of October 31st, there was short interest totalling 13,290,000 shares, a growth of 6.2% from the October 15th total of 12,520,000 shares. Based on an average daily trading volume, of 5,650,000 shares, the days-to-cover ratio is presently 2.4 days. Currently, 1.0% of the shares of the company are short sold...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Tops Forecasts, Reserves Billions For Settlement

By: Barchart | November 2, 2022

CVS Health booked a third-quarter loss of more than $3 billion after setting aside money for a potential opioid litigation deal but still beat expectations and raised its 2022 forecast.

The health care giant detailed on Wednesday a planned nationwide settlement of lawsuits over how it has handled prescriptions for powerful painkillers linked to an overdose epidemic.

The company recorded in the recently completed quarter a $5.2 billion pretax charge for the settlement. That covers payments over 10 years, starting next year.

CVS CEO Karen Lynch told analysts Wednesday morning that the company has a “high degree of confidence” that states will accept the deal. She noted that state attorneys general were at the negotiating table when CVS Health began discussions late last month.

CVS Health also recorded a $2.5 billion loss in the quarter on assets held for sale to write down the company’s struggling Omnicare long-term care business. Lynch told analysts the company was “actively exploring strategic alternatives” for the business.

CVS Health also saw sales growth in the quarter from all three of its main businesses as total revenue climbed 10% to $81.2 billion.

Adjusted earnings, which don't count one-time items like the settlement, totaled $2.09 per share.

Analysts expected, on average, adjusted earnings of $2 per share on $76.74 billion in revenue, according to FactSet.

CVS operates one of the nation’s largest drugstore chains with nearly 10,000 retail locations. It runs prescription drug plans for big clients like insurers and employers through a large pharmacy benefit management business.

It also provides health insurance for more than 24 million people through its Aetna arm.

Prescription growth fueled an 11% jump in revenue from the company's largest segment, the pharmacy benefit management business.

The ongoing COVID-19 pandemic also continues to help sales. Company leaders said they expect more than $3 billion in revenue this year from vaccinations, diagnostic testing for the virus and test kits sold over the counter or without a prescription. But Chief Financial Officer Shawn Guertin cautioned against expecting a similar level of sales going forward.

CVS Health now expects adjusted earnings of $8.55 to $8.65 per share for this year, a higher and narrower forecast than it made in August.

FactSet says analysts predict, on average, earnings of $8.55 per share.

Guertin said CVS Health's initial goal for 2023 is to grow adjusted earnings to a range of $8.70 to $8.90 per share. The company will provide a detailed forecast early next year.

Analysts are looking for $9.07 per share next year.

Shares of CVS Health Corp., based in Woonsocket, Rhode Island, climbed 4%, or $3.89, to $98.51 Wednesday morning while broader indexes slipped.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health lifts forecast as PBM, insurance units drive profit beat

By: Investing.com | November 2, 2022

(Reuters) -CVS Health Corp on Wednesday raised its annual profit forecast after topping quarterly estimates on strong performance at its health insurance and pharmacy benefit management businesses.

CVS' health insurance business as well as peers Elevance Health and UnitedHealth (NYSE:UNH) have benefited from a slow recovery in elective procedures and a fall in COVID cases that has kept costs in check.

The insurance business' medical benefit ratio, or spending on claims against premiums earned, was 83.5%, compared with 85.8% a year earlier when COVID cases had surged due to the Delta wave.

Revenue from the insurance and pharmacy benefit management businesses rose around 10% each, while retail and pharmacy sales gained about 7%.

Pharmacy benefits managers serve as intermediaries among drug manufacturers, health insurers and pharmacies, and help negotiate prescription drug prices.

The company forecast sales of over-the-counter COVID-19 test kits to exceed 65 million units in 2022, and said it expects to administer 28 million vaccinations, with about 70% of that target already achieved through the third quarter.

It now expects 2022 adjusted earnings per share between $8.55 and $8.65, compared with $8.40 to $8.60 forecast earlier.

Excluding some one-off items, CVS Health (NYSE:CVS) reported a profit of $2.09 per share, compared with analysts' average estimate of $1.99 per share.

In the third quarter, the company also recorded a pre-tax charge of $5.2 billion related to the estimated liability for opioid-related claims settlement. The proposed settlement calls for CVS to pay the amount over 10 years.

Including the charge, it reported a net loss of $3.42 billion, or $2.60 per share, compared to a profit of $1.60 billion, or $1.20 per share, a year earlier.

It removes an "overhang" on CVS and is lower than investor expectations, Evercore ISI analyst Elizabeth Anderson said in a note.

Shares in the company were up 1% in premarket trade.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS forecasts higher profit for 2023

By: Investing.com | November 2, 2022

(Reuters) - CVS Health Corp (NYSE:CVS) on Wednesday forecast its adjusted profit to be in the range of $8.70 to $8.90 per share in 2023.

This is higher than the new adjusted earnings forecast of $8.55 to $8.65 per share for this year.

Read Full Story »»»

DiscoverGold

DiscoverGold

Short Interest in CVS Health Co. (CVS) Drops By 14.7%

By: MarketBeat | October 29, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) was the target of a significant decrease in short interest during the month of October. As of October 15th, there was short interest totalling 12,520,000 shares, a decrease of 14.7% from the September 30th total of 14,670,000 shares. Currently, 1.0% of the shares of the company are short sold. Based on an average daily trading volume, of 5,260,000 shares, the short-interest ratio is currently 2.4 days...

Read Full Story »»»

DiscoverGold

DiscoverGold

Earnings Preview: CVS Health Corp. (NYSE: CVS)

By: 24/7 Wall St. | October 31, 2022

• Here is a preview of four companies on deck to report quarterly results before markets open on Wednesday.

CVS Health

The country’s third-largest provider of health care plans, CVS Health Corp. (NYSE: CVS) has seen its stock price rise by about 5% in the past 12 months. While the company, also the second-largest drugstore operator in the United States, has outperformed rival Walgreens over the past decade, its 10-year return of about 156% pales beside the 1,060% gain of health insurer United Health Group. That is probably the main reason the company is trying to break into the primary care market by beginning to establish clinics in its 1,100 retail stores and working to gain a piece of the insurance market through its acquisition of Aetna.

Analysts remain bullish on the stock, with 21 of 27 brokerages having a Buy or Strong Buy rating. The rest rate the shares at Hold. At a share price of around $93.80, the stock’s upside potential based on a median price target of $120.00 is about 28%. At the high price target of $130, the implied upside is 38.6%.

The consensus revenue estimate for the third quarter is $76.78 billion, down 4.8% sequentially but 4.1% higher year over year. Adjusted EPS are forecast at $1.99, down 16.9% sequentially and up two cents year over year. For the full 2022 fiscal year, analysts are looking for EPS of $8.55, up 1.77%, and revenue of $312.35 billion, up about 6.9% year over year.

CVS stock trades at about 11.0 times expected 2021 EPS, 10.4 times estimated 2023 earnings of $9.06 and 9.5 times estimated 2024 earnings of $9.88 per share. The stock’s 52-week range is $86.28 to $111.25. CVS Health pays an annual dividend of $2.20 (yield of 2.34%). Total shareholder return for the past 12 months was 7.7%.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health (CVS) Set to Announce Quarterly Earnings on Wednesday

By: MarketBeat | October 26, 2022

• CVS Health (NYSE:CVS - Get Rating) is scheduled to issue its quarterly earnings data before the market opens on Wednesday, November 2nd. Analysts expect the company to announce earnings of $1.99 per share for the quarter. CVS Health has set its FY 2022 guidance at $8.40-$8.60 EPS.Investors interested in listening to the company's conference call can do so using this link...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Corp. (CVS) Back to the gap, might be a trade if it can get into it

By: Options Mike | October 23, 2022

• $CVS back to the gap, might be a trade if it can get into it. 4 bucks to be had there.

Read Full Story »»»

DiscoverGold

DiscoverGold

U.S. Justice Dept seeks more details on $8 billion CVS-Signify Health deal

By: Investing.com | October 20, 2022

(Reuters) -The U.S. Department of Justice has asked for more details on CVS Health Corp (NYSE:CVS)'s proposed $8 billion deal to buy Signify Health, in a possible indication that the companies face a longer deal investigation rather than a quick approval.

The deal, announced last month, was expected to face a tough antitrust review even though the two companies do not compete directly in any market, according to experts.

Large mergers and acquisitions have come under intense antitrust scrutiny, and lowering healthcare costs has been an important strategic mission for the Biden Administration.

UnitedHealth Group (NYSE:UNH) earlier this month completed its acquisition of Change Healthcare (NASDAQ:CHNG), after over a year of antitrust scrutiny.

Acquiring Signify Health will enable CVS, which operates a pharmacy chain, a health insurance business and offers pharmacy benefit management services, to provide further care management for at-home patients.

The deal is expected to close in the first half of 2023, CVS said in a filing on Thursday.

Signify offers technology and analytics to help with at-home care for patients. It has said its services can help identify potential health risks and gaps in care.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Target of Unusually High Options Trading

By: MarketBeat | October 10, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) saw some unusual options trading on Monday. Traders acquired 23,448 call options on the company. This is an increase of approximately 26% compared to the typical daily volume of 18,616 call options...

Read Full Story »»»

DiscoverGold

DiscoverGold

$CVS CALL WRITING coming in to the 11/18/22 $92.50 CALLS at the BID (writing to collect premium)

By: Money Flow Mel | October 7, 2022

• $CVS CALL WRITING coming in to the 11/18/22 $92.50 CALLS at the BID (writing to collect premium)

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health expects lower Medicare performance rating to impact 2024

By: Investing.com | October 6, 2022

(Reuters) - CVS Health (NYSE:CVS) Inc said its largest health insurance plan for Medicare recipients received a lower performance rating from the Federal government program, sending shares of the company down around 5% in extended trade.

In a regulatory filing late on Thursday, CVS said the newly-released Star Ratings for Medicare Advantage plans in 2023 lowered the rating for the company's Aetna National PPO plan to 3.5 stars from 4.5.

The reduced rating means the plan, which includes more than 1.9 million members, is ineligible for performance-based bonus payments from the government in 2024 and is likely to impact earnings.

Medicare Advantage plans are run by private insurers and are an alternative to the original Medicare - a government program for older Americans.

Star Ratings are a performance and quality score given by the U.S. Centers for Medicare & Medicaid Services, since 2007, based on its annual consumer surveys.

Ratings range from one to five stars, with five representing the highest possible ranking, and are used by customers to decide which insurance plans they want to enroll. Enrollment typically drops with a drop in ratings.

CVS said it does not expect any impact to its 2022 earnings forecast from the rating change and expects to mitigate any financial impact on its preliminary 2023 outlook.

Evercore analysts wrote in a note the ratings were down for the overall health insurance industry, but the move was expected as part of normalizing elevated ratings that had reflected allowances related to disruptions from the pandemic.

CVS said it still aims to grow adjusted earnings per share "at low double-digit year-over-year rates in 2024."

The Woonsocket Rhode Island-based company added it was evaluating some capital deployment alternatives, including share repurchases, to mitigate any possible impact on 2024 earnings.

CVS shares fell as much as 5.2% to $93.5 in extended trading.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Co. (NYSE:CVS) Plans $0.55 Quarterly Dividend

By: MarketBeat | September 21, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) declared a quarterly dividend on Wednesday, September 21st, RTT News reports. Investors of record on Friday, October 21st will be paid a dividend of 0.55 per share by the pharmacy operator on Tuesday, November 1st. This represents a $2.20 annualized dividend and a yield of 2.21%...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Co. (CVS) Short Interest Update

By: MarketBeat | September 19, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) was the recipient of a large decrease in short interest in the month of August. As of August 31st, there was short interest totalling 13,480,000 shares, a decrease of 10.4% from the August 15th total of 15,040,000 shares. Based on an average daily volume of 4,770,000 shares, the days-to-cover ratio is presently 2.8 days. Currently, 1.0% of the shares of the company are sold short...

Read Full Story »»»

DiscoverGold

DiscoverGold

Evercore ISI Raises CVS Health (CVS) Price Target to $125.00

By: MarketBeat | September 7, 2022

• CVS Health (NYSE:CVS - Get Rating) had its price objective increased by research analysts at Evercore ISI from $120.00 to $125.00 in a research note issued on Wednesday, The Fly reports. Evercore ISI's price objective points to a potential upside of 26.61% from the stock's previous close...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS expects 'meaningful' tax benefit from Signify acquisition

By: Investing.com | September 6, 2022

(Reuters) - CVS Health Corp (NYSE:CVS) said on Tuesday it expects "meaningful" tax benefits from its $8 billion purchase of home healthcare services company Signify Health.

CVS, which runs pharmacies, pharmacy benefits manager and the Aetna insurance plans, said on Monday it would pay $30.50 per share, or about $7.6 billion in equity, as well as about $400 million in equity appreciation rights for Signify.

Shares of Signify, which has a network of 10,000 clinicians who provide home-based assessments of patient health and social needs, were trading at $28.80, while CVS shares slipped marginally to $99.15.

CVS anticipates around $1.50 per share in tax benefit from the deal due to the transaction structure, CVS Chief Financial Officer Shawn Guertin said on a conference call on Tuesday, adding that the company could also see some "modest" synergy benefits.

The management of the two companies were positive about not losing Signify customers.

"It's always prudent to make some customer loss provision in your modeling just in terms of the financial benefit, and we've maintained that practice here. but nothing should be construed from that," Guertin said.With the new acquisition, CVS plans better collaboration between Signify and its other businesses.

Analysts have generally been positive about the deal but have said client retention and potential synergies from the deal would be key issues to look for.

"We see risk to Signify's revenue stream from competitors if the company is no longer independent," J.P. Morgan analyst Anne Samuel said in a note, but added that similar concerns were also made when CVS acquired Caremark more than a decade ago and yet Caremark is still the largest pharmacy benefit manager to other health insurers.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS to buy Signify Health in $8 billion deal

By: Investing.com | September 5, 2022

NEW YORK (Reuters) - CVS Health Corp (NYSE:CVS) on Monday agreed to buy home healthcare services company Signify Health for about $8 billion in cash, a move that will enable one of the largest U.S. healthcare companies to provide further care management to patients in their homes.

Healthcare companies like CVS have been expanding beyond managing health and pharmacy benefits with acquisitions of doctors groups and surgical centers in recent years.

"We’ve been very clear about what we were looking for in expanding our health services, either be it primary care, provider enablement or in the home, and Signify Health clearly checks off two boxes: into the home and provider enablement," CVS CEO Karen Lynch said in an interview.

Signify Health brings CVS, which runs pharmacies, pharmacy benefits and the Aetna insurance plans, a network of 10,000 clinicians who provide home-based assessments of patient health and social needs.

CVS expects the deal to close in the first half of 2023 and said that it expects the acquisition to be "meaningfully" accretive to earnings.

CVS said it would pay $30.50 per share for the company, or about $7.6 billion in equity as well as about $400 million in equity appreciation rights.

Lynch said the companies would work with regulators who review deals for any antitrust issues.

"We are not competitors. We don’t have any overlapping functions," Lynch said.

Large mergers and acquisitions have come under intense antitrust scrutiny and lowering healthcare costs has been an important strategic mission for the Biden Administration.

SIGNIFY HEALTH

Signify Health serves two groups of customers: about 50 U.S. health insurance plans including CVS' Aetna division and rivals such as UnitedHealth Group Inc (NYSE:UNH) and groups of providers. UnitedHealth and Amazon (NASDAQ:AMZN) Inc. are among companies that were interested in Signify, a source familiar with the discussions previously told Reuters.

Signify mostly serves the companies and providers associated with Medicare Advantage health plans, in which private insurers provide government-paid health benefits to people aged 65 and older. It also services Medicaid plans for people with low incomes.

The company said it expects to service 2.5 million people through annual in-person and virtual health assessments. The visits combine with technology and analytics to coordinate follow up care and social services with the goal of improving health of underserved populations and lowering health costs, Signify said.

Signify Health CEO Kyle Armbrester, who will remain as the head of the division, said the company plans to expand to commercial health plans.

The company, which went public in early 2021, has struggled since its stock market launch and had announced a restructuring earlier this summer. Talks of the sale process were first reported in August.

CVS said in a statement that the company is "increasingly confident" it can achieve its long-term earnings goals. As outlined in December of 2021, that includes high single-digit year-over year growth in 2023 and low double-digit year-over-year growth in 2024.

New Mountain Capital, which owns 60% of Signify Health, said that it planned to vote for the deal. CVS and Signify Health said both boards of directors had approved the deals.

CVS was advised by Bank of America (NYSE:BAC)'s BofA Securities and Signify Health by Goldman Sachs (NYSE:GS) and Deutsche Bank (ETR:DBKGn).

Read Full Story »»»

DiscoverGold

DiscoverGold

Stocks To Watch This Week: CVS Health (NYSE:CVS)

By: Investing.com | September 4, 2022

• Ryan Cohen is trying to revive growth at GameStop, which has seen sales slowed as gamers have shifted to digital downloads

• Kroger is experiencing shoppers “aggressively” turning to cheaper store brands as they cope with the highest inflation in four decades

• Media reports say CVS is ahead of other potential bidders to buy Signify Health

Investors will likely see another volatile week in equities when they return from the long Labor Day weekend, as hopes of a policy pivot from the Federal Reserve faded after another strong jobs report on Friday.

The recent labor-market data added to the evidence that the economy is robust enough to withstand more tightening, causing equities to come under fresh selling pressure after the strong summer rally.

Fed chairman Jerome Powell warned in a recent speech that people should expect some economic pain as it tries to bring inflation down toward its 2% target, which remains the central bank’s “overarching focus right now.”

Stocks were lower in the past week with the S&P 500 suffering its longest weekly losing streak since mid-June.

With these macroeconomic pressures, here are three stocks on our radar during the holiday-shortened trading week:

CVS Health

Shares of pharmacy giant CVS Health (NYSE:CVS) may see some action this week on reports that the chain is in advanced talks to acquire the home-healthcare company Signify Health (NYSE:SGFY) for around $8 billion.

The Wall Street Journal reported on Friday that CVS is ahead of other potential bidders, including Amazon.com (NASDAQ:AMZN) and UnitedHealth (NYSE:UNH), which had been circling Signify for a deal that could be announced soon.

CVS Fair Value per InvestingPro+

Source: InvestingPro+

Signify works with a large group of doctors to facilitate house calls, using analytics and technology to help physician groups, health plans, employers, and health systems with in-home care. It also offers health evaluations for Medicare Advantage and other plans, according to WSJ.

CVS shares, which closed on Friday at $99.44, have held up well in the current market downturn, falling over 3% this year.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS in advanced talks to buy Signify Health for $8 billion - WSJ

By: Investing.com | September 2, 2022

(Reuters) - CVS Health Corp (NYSE:CVS) is in advanced talks to acquire home-healthcare company Signify Health Inc for around $8 billion, the Wall Street Journal reported on Friday, citing people familiar with the matter.

Read Full Story »»»

DiscoverGold

DiscoverGold

$CVS 1.2 Million Share at $100.40 #darkpool print

By: Money Flow Mel | September 2, 2022

• $CVS 1.2 million share #darkpool print at $100.40.

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull Signal Could Push CVS Health Stock Towards 2022 Highs

By: Schaeffer's Investment Research | September 1, 2022

• CVS just pulled back to a historically bullish trendline

• The equity is marginally lower in 2022

CVS Health Corp (NYSE:CVS) stock has taken a step back on the charts, after a mid-August rally lost steam just above the $107 level, coming shy of its Feb. 8, annual high of $111.25. However, CVS could make another move towards its 2022 highs, and chip away at its 3.5% year-to-date deficit, given the equity is trading near a historically bullish trendline.

According to Schaeffer's Senior Quantitative Analyst Rocky White's latest study, CVS Health stock is within one standard deviation of its 40-day moving average. The security has seen nine similar signals over the past three years, and was higher one month later 78% of the time, averaging a 5.1% gain for that period. A similar move from its current perch of $99.53 would place the equity back above the $104 region.

The shares appear to be overdue for a short-term bounce. This is per CVS Health stock’s 14-day Relative Strength Index (RSI) of 27.5, which sits firmly in "oversold" territory.

An unwinding of pessimism in the options pits could provide additional tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CVS’ 10- and 50-day put/call volume ratios of 2.25 and 1.46, respectively, stand in the 97th and 100th percentiles of their annual ranges. This means puts have been getting picked up at a faster-than-usual clip of late.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health (CVS) Sees Large Volume Increase After Analyst Upgrade

By: MarketBeat | August 18, 2022

• Shares of CVS Health Co. (NYSE:CVS - Get Rating) saw unusually-high trading volume on Thursday after Tigress Financial raised their price target on the stock from $125.00 to $130.00. Approximately 95,861 shares changed hands during mid-day trading, a decline of 98% from the previous session's volume of 4,947,115 shares.The stock last traded at $103.62 and had previously closed at $104.92...

Read Full Story »»»

DiscoverGold

DiscoverGold

Tigress Financial Boosts CVS Health (CVS) Price Target to $130.00

By: MarketBeat | August 17, 2022

• CVS Health (NYSE:CVS - Get Rating) had its target price lifted by Tigress Financial from $125.00 to $130.00 in a note issued to investors on Wednesday, The Fly reports. Tigress Financial's target price would suggest a potential upside of 23.69% from the company's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health Sees Unusually Large Options Volume

By: MarketBeat | August 17, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) was the target of some unusual options trading activity on Wednesday. Investors bought 30,865 put options on the stock. This represents an increase of 28% compared to the average daily volume of 24,046 put options...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS, Walmart and Walgreens ordered to pay $650.6 million to Ohio counties in opioid case

By: Reuters | August 17, 2022

Pharmacy operators CVS, Walmart (NYSE:WMT) and Walgreens must pay a combined $650.6 million to two Ohio counties to address the damage done by the opioid epidemic, a federal judge ruled Wednesday.

The order by U.S. District Judge Dan Polster in Cleveland marks the first time pharmacy chains have been ordered to pay money in an opioid lawsuit. It comes after a jury last November concluded that the companies helped create a public nuisance in Lake and Trumbull counties by over-supplying addictive pain pills, many of which found their way onto the black market.

"The news today means that we will soon have the long-awaited resources necessary to extend aid to properly address the harms caused by this devastating epidemic," Trumbull County Commissioner Frank Fuda said in a statement.

The pharmacies, which have argued they cannot be liable for filling legal prescriptions from doctors, have said they would appeal that verdict.

Representatives of Walgreens and CVS both said Wednesday's decision was not supported by the law and that they planned to appeal it. Walmart did not immediately respond to a request for comment.

Walgreens was also found liable last week in an opioid lawsuit brought by San Francisco, though the judge has not yet determined how much it must pay there.

Polster said the sum must be paid over 15 years, with the amount for the first two years, or $86.7 million, to be paid immediately. He also ordered the companies to implement new procedures to combat illegal diversion of opioids.

The U.S. opioid epidemic has caused more than 500,000 overdose deaths over two decades, according to government data. More than 3,300 lawsuits have been filed, mostly by local governments, accusing drugmakers, distributors and pharmacy chains of fueling the crisis.

The litigation has resulted in several nationwide settlements, including a $26 billion deal with Johnson & Johnson (NYSE:JNJ) and the three leading distributors, a $2.37 billion settlement with AbbVie Inc (NYSE:ABBV) and a $4.25 billion settlement with Teva Pharmaceutical Industries (NYSE:TEVA) Ltd.

Pharmacies have yet to reach any nationwide settlement, but Walgreens and CVS settled with Florida for $683 million and $484 million, respectively.

Read Full Story »»»

DiscoverGold

DiscoverGold

$CVS Flashing some overbought signals after a powerful move

By: TrendSpider | August 14, 2022

• $CVS Flashing some overbought signals after a powerful move.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS and Walgreens Show Why Investment Objectives Matter

By: Schaeffer's Investment Research | August 10, 2022

• The Pharmaceutical Space is Changing

At first glance, CVS Health NYSE: CVS) looks clearly superior to Walgreens Boots Alliance (NYSE: WBA). In fact, in the last 12 months, and even over the last five years, these are two stocks on different trajectories.

But this is a time when understanding your “why” for owning a stock is so critical. This article will analyze the current, and future, outlook for both stocks and explain why each has a case to make for different investors.

THE PHARMACEUTICAL SPACE IS CHANGING

Even before the pandemic, many pharmacy chains were adapting to a wellness model. The idea is to become a destination for customers to manage their overall health care instead of simply being a place they go to pick up a prescription. By taking on the role of a neighborhood clinic, pharmacy chains are adding more value for their patients.

And both CVS and Walgreens are making significant in-roads into this space. CVS Health hosts over 1,100 MinuteClinic locations which are just one of the services provided by the company’s HealthHUB initiatives.

For its part, Walgreens offers its Village MD and Walgreens Health initiatives. As of the company's most recent earnings report, the company has seeded the former in 22 markets and plans to have approximately 200 clinics open by the end of 2022. And the company is planning to have approximately 100 Walgreens Health Corners open by the end of the year.

And both companies are active in virtual care with the ability of patients to access services through mobile apps and telehealth services. The Covid-19 pandemic made virtual care essential, but it also served as a proof of concept that, for some patients, may be a choice for managing chronic conditions.

WILL AN ACQUISITION HAVE A “SIGNIFICANT” IMPACT ON CVS STOCK?

CVS stock has been outperforming the market in the last year. And the stock is getting a lift from a Wall Street Journal report that it has made a bid to buy Signify Health. The acquisition makes sense if CVS intends to branch into the home-health sector. Signify Health uses technological solutions to aid in-home care. And, as the Journal reported, the company “offers in-home health evaluations for Medicare Advantage and other government-run managed care plans.”

As of this writing, it’s unclear whether the acquisition will go through. However, if it does, it could signal the next leg up for a stock that’s climbed 26% in the past 12 months and is essentially flat for the year. The company is projected to post single-digit growth in both revenue and earnings over the next five years without the Signify Health acquisition. Analysts are also moderately bullish on the stock giving it a 12% upside.

With that said, the company has been on a buying spree lately having bought Omnicare and Aetna for a total cost of over $40 billion dollars. While it does appear that the company’s free cash flow (FCF) should be more than enough to cover the purchase, short-term investors may be in for some volatility.

WALGREENS BOOTS ALLIANCE IS AN UNDERVALUED DIVIDEND STOCK

In contrast to CVS Health, Walgreens has seen its share price fall over 50% in the last five years. And WBA stock is down 16% in just the last 12 months. Making matters worse, the short interest on the stock is 3x higher than that of CVS stock. There is clearly bearish sentiment on Walgreens.

But there are bright spots if you are looking for under-the-radar value stocks. For starters, Walgreens pays a sustainable, growing dividend. In fact, the company has increased its dividend in each of the last 47 years.

And, by any objective measure, WBA stock is undervalued. The stock is trading at just over 7x earnings and the company scores above the sector average in key areas such as profit margin, return on equity, and return on assets. Analysts tracked by MarketBeat give the stock a $46.25 price target which gives the stock a 17% upside.

Read Full Story »»»

DiscoverGold

DiscoverGold

1 Health Care Stock That Continues to Outperform Its Competitors

By: Stock News | August 9, 2022

With a $133.91 billion market cap, CVS Health Corporation (CVS) provides health services in the United States. The company operates through four segments: Pharmacy Services; Retail/LTC; Health Care Benefits; and Corporate/Other.

It offers prescription drugs, traditional and consumer-directed health insurance products, pharmacy benefit management solutions, and consumer health and beauty products.

CVS reported solid second-quarter performance driven by its differentiated business model, with significant revenue growth across all its business segments. The company raised 2022 full-year EPS and cash flow from operations guidance.

CVS now expects EPS of $7.23 to $7.43, compared with a prior outlook of $6.93 and $7.13. It forecasts the adjusted EPS between $8.40 and $8.60, compared to the previous guidance of $8.20 to $8.40. In addition, the company expects cash flow from operations from $12.50 billion to $13.50 billion, up from the previously guided range of $12 billion and $13 billion.

Karen S. Lynch, CVS’ President and CEO said, “The continued success of our foundational businesses accelerated our strategy to expand access to health services and help consumers navigate to the best site of care.”

On August 3, Aetna, a CVS Health company, announced its entry into the individual insurance exchange marketplace in California with Aetna CVS Health’s co-branded insurance product. Its health insurance features quality and affordable care using virtual technology and in-person care. The new insurance product is expected to boost the company’s growth and profitability.

On May 30, CVS launched the CVS Health Virtual Primary Care, a virtual care solution accessible through a single digital platform. The solution integrates the company’s services, clinical expertise, and data for a more collective and consumer-centric healthcare experience.

In addition, it will use an interoperable electronic health record to allow members to transition between virtual and in-person care and share their clinical data with other providers. The new solution might improve CVS’ primary care and accelerate its business growth.

CVS’ shares have gained 8.3% over the past month and 25.5% over the past year to close the last trading session at $102.00.

Here is what could influence CVS’ performance in the upcoming months:

Robust Financials

CVS’ revenues increased 11.7% year-over-year to $42.81 billion in the fiscal 2022 second quarter ended June 30, 2022. The company’s operating income amounted to $4.57 billion, up 5.6% year-over-year. Its income before income tax provision grew 7.9% year-over-year to $4.03 billion.

Furthermore, the company net income and income per share attributable to CVS came in at $2.96 billion and $2.23, registering increases of 6.1% and 6.2%, respectively, from the prior-year period. Its cash inflows from operating activities rose 3.1% from the year-ago value to $9.01 billion.

Favorable Analyst Estimates

Analysts expect CVS’ revenue for the fiscal 2022 third quarter (ending September 2022) to come in at $76.80 billion, representing a rise of 4.1% from the same period in 2021. The $2.01 consensus EPS estimate for the ongoing quarter indicates a 2.2% year-over-year increase. The company has surpassed the consensus revenue and EPS estimates in each of the trailing four quarters.

In addition, CVS’ revenue and EPS for its fiscal year 2022 (ending December 2022) are expected to rise 6.9% and 1.7% year-over-year, respectively. Also, analysts expect the company’s revenue and EPS for the next year to grow 4.2% and 6% year-over-year, respectively.

Discounted Valuation

In terms of forward non-GAAP P/E, CVS’ 11.98x is 40.9% lower than the 20.27x industry average. The stock’s 0.62x forward EV/Sales is 85.1% lower than the 4.15x industry average. Also, its forward EV/EBITDA multiple of 9.67 compares with the industry average of 13.36.

In addition, CVS’ forward Price/Sales multiple of 0.43 compares with the industry average of 5.01. Its 11.38x forward Price/Cash Flow is 33.8% lower than the 17.19x industry average.

High Profitability

CVS’ trailing-12-month EBIT margin of 4.71% is 280.7% higher than the 1.24% industry average. Its trailing-12-month EBITDA margin of 6.14% is 36.7% higher than the 4.49% industry average. Likewise, the stock’s trailing-12-month asset turnover ratio of 1.33% is 284.5% higher than the industry average of 0.35%.

POWR Ratings Show Promise

CVS’ overall A rating equates to a Strong Buy in our POWR Ratings system. The POWR Ratings are calculated by accounting for 118 distinct factors, with each factor weighted to an optimal degree.

CVS has a grade A for Growth, consistent with its revenue and earnings growth estimates. It also has a grade of A for Stability. The stock’s beta of 0.96 justifies the Stability grade.

In addition, CVS has a grade of B for Value, in sync with its lower-than-industry valuation multiples.

CVS is ranked #1 out of 5 stocks in the Medical-Drug Stores industry.

Beyond what I have stated above, we have also given CVS grades for Sentiment, Quality, and Momentum. Get access to all the CVS ratings here.

Bottom Line

CVS reported strong financial results for the fiscal 2022 first quarter and affirmed continued growth for the full-year 2022. Furthermore, the company is well-positioned to benefit from its differentiated business model, with solid revenue growth across its Health Care Benefits, Pharmacy Services, and Retail/LTC segments.

The stock has outperformed its industry peers and the broader market over the past month. Given the company’s strong financials, solid revenue and earnings growth estimates, lower-than-industry valuation, reasonable stability, and high profitability, the stock could continue outperforming its competitors. Therefore, investing in this health care stock could be wise now.

How Does CVS Health Corporation (CVS) Stack Up Against its Peers?

CVS has an overall POWR Rating of A, which equates to a Strong Buy rating. This rating is superior to its peers within the Medical-Drug Stores industry, such as Walgreens Boots Alliance Inc. (WBA), Clicks Group Limited (CLCGY), and SunLink Health Systems, Inc. (SSY), which all are rated C (Neutral).

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health plans to buy Signify Health - WSJ

By: Investing.com | August 7, 2022

(Reuters) - CVS Health Corp (NYSE:CVS) is planning to buy Signify Health Inc as it looks to expand in home-health services, the Wall Street Journal reported on Sunday, citing sources.

Initial bids are due this coming week and CVS is planning to accept one, the reportsaid.

WSJ reported last week that Signify Health is working with bankers to explore strategic alternatives including a sale.

Signify has a market cap of around $4.66 billion based on its stock closing price on Friday, according to Reuters calculations.

CVS and Signify did not immediately respond to requests for comment outside business hours.

Read Full Story »»»

DiscoverGold

DiscoverGold

$CVS Nice move off sold report and good guidance

By: Options Mike | August 7, 2022

• $CVS Nice move off sold report and good guidance. Let the 8D catch up now and try a hold of it for a break of 104.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alan Lotvin Sells 22,541 Shares of CVS Health Co. (CVS) Stock

By: MarketBeat | August 6, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) EVP Alan Lotvin sold 22,541 shares of the firm's stock in a transaction that occurred on Thursday, August 4th. The stock was sold at an average price of $104.00, for a total transaction of $2,344,264.00. Following the completion of the transaction, the executive vice president now directly owns 109,183 shares of the company's stock, valued at $11,355,032. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website...

Read Full Story »»»

DiscoverGold

DiscoverGold

Oppenheimer Equities Analysts Reduce Earnings Estimates for CVS Health Co. (CVS)

By: MarketBeat | August 5, 2022

• CVS Health Co. (NYSE:CVS - Get Rating) - Research analysts at Oppenheimer decreased their Q3 2022 earnings per share (EPS) estimates for CVS Health in a report issued on Wednesday, August 3rd. Oppenheimer analyst M. Wiederhorn now forecasts that the pharmacy operator will post earnings of $2.00 per share for the quarter, down from their prior estimate of $2.03. The consensus estimate for CVS Health's current full-year earnings is $8.57 per share. Oppenheimer also issued estimates for CVS Health's Q4 2022 earnings at $1.96 EPS, FY2022 earnings at $8.57 EPS, Q2 2023 earnings at $2.40 EPS, Q4 2023 earnings at $2.19 EPS, FY2023 earnings at $9.04 EPS and FY2024 earnings at $9.92 EPS...

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS Health reports strong second quarter results, raises 2022 full-year EPS and cash flow from operations guidance

Wednesday, August 3, 2022

Visit Investor Relations for more about Q2 2022 earnings

WOONSOCKET, Rhode Island — CVS Health Corporation (NYSE: CVS) today announced operating results for the three months ended June 30, 2022.

Key financial data

https://www.cvshealth.com/sites/default/files/media-gallery/cvs-health-earnings-report-2022-q2.pdf

$CVS CVS reports huge earnings beat, raises FY22 EPS guidance into year end

By: TrendSpider | August 3, 2022

• $CVS CVS reports huge earnings beat, raises FY22 EPS guidance into year end.

~EPS: $2.40 vs $2.17 est

~SALES: $80.64B vs $76.37B est

~FY22 EPS $8.40-$8.60 vs $8.36 est

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS: 2 Stocks That Have Outperformed the S&P 500 in 2022

By: Stock News | July 29, 2022

This year, the stock market has experienced high volatility due to various macroeconomic and geopolitical concerns. The Dow Jones Industrial Average (DJIA) has declined 10.5% year-to-date, while the Nasdaq Composite (COMP) fell 22.2%. The benchmark S&P 500 index also declined 14.6% year-to-date.

With inflation hitting a multi-decade high, the Fed’s aggressive interest rate hikes to bring the prices down and the consequent possibility of a recession have amplified the market volatility. According to the Bureau of Economic Analysis report, the U.S. economy declined for the second consecutive quarter, with the Gross Domestic Product declining at an annualized rate of 0.9%. Therefore, many analysts believe that the economy has already entered a recession.

Since the beginning of the year, many stocks in the S&P 500 have gotten hammered. However, CVS Health Corporation (CVS) and Verizon Communications Inc. (VZ) have outperformed the most widely followed benchmark year-to-date. These stocks could maintain their momentum given their solid fundamentals and growth prospects. So, we think it could be wise to add them to your watchlist.

CVS Health Corporation (CVS)

CVS is a health service provider operating through four segments: Health Care Benefits, Pharmacy Services, Retail/LTC, and Corporate/Other. Its offerings include health & wellness services, health plans, pharmacy services, and prescription drug coverage.

On May 26, 2022, the company launched CVS Health Virtual Primary Care, a new virtual care solution available through a single digital platform. Demonstrating CVS’ bold strategy to improve primary care, the new solution offers a more coordinated health care experience for patients and providers through at-home health services or virtually.

On June 21, 2022, CVS announced the expansion of the free health screening program as part of its commitment to advance health equity in two new areas: Las Vegas, NV, and Richmond, VA.

CVS’ total revenue for the fiscal first quarter ended March 31, 2022, increased 11.2% year-over-year to $76.83 billion. The company’s adjusted operating income grew 6.6% year-over-year to $4.48 billion, while its net income rose 4% from the year-ago value to $2.31 billion. Also, its adjusted EPS increased 8.8% year-over-year to $2.22.

Analysts expect CVS’ EPS and revenue for the quarter ending September 30, 2022, to increase 2.8% and 4.5% year-over-year to $2.02 and $77.14 billion, respectively. It has surpassed the consensus EPS estimates in each of the trailing four quarters. The stock has declined 7.4% year-to-date to close the last trading session at $95.53.

CVS’ POWR Ratings reflect solid prospects. According to our proprietary rating system, it has an overall rating of A, translating to a Strong Buy. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

CVS has a B grade for Value, Stability, and Sentiment. It is ranked first out of 5 stocks in the Medical – Drug Stores industry. Click here to see the other ratings of CVS for Growth, Momentum, and Quality.

Read Full Story »»»

DiscoverGold

DiscoverGold

CVS The healthcare industry is expected to grow significantly, thanks to substantial demand driven by increasing …

By: Stock News | July 29, 2022

• CVS Health Corporation (CVS)

CVS provides health services in the United States. The company operates through four segments: Pharmacy Services; Retail/LTC; Health Care Benefits; and Corporate/Other. CVS offers prescription drugs, traditional and consumer-directed health insurance products, pharmacy benefit management solutions, and consumer health and beauty products.

The company operates over 9,900 retail locations, 1,200 MinuteClinic locations, online pharmacy websites, and onsite pharmacies.

In February, CVS Pharmacy, the retail division of CVS, launched six new innovative home health care products. The new CVS Health by Michael Graves Design features a wide range of products, including comfort grip chairs, easy-fold travel walkers, convertible shower chairs, and 3-in-1 comfort commodes.

The new launch of products is the company’s extension of the exclusive CVS Health product line, extending its customer reach and boosting sales.

In the fiscal 2022 first quarter ended March 31, 2022, CVS’ total revenues increased 11.2% year-over-year to $76.83 billion. Its adjusted operating income grew 6.6% year-over-year to $4.48 billion. The company’s adjusted income attributable to CVS and adjusted earnings per share came in at $2.94 billion and $2.22, up 9.1% and 8.8% from the prior-year period, respectively.

In addition, net cash provided by operating activities rose 23.2% year-over-year to $3.56 billion.

Analysts expect CVS’ EPS to grow 2.8% from the prior-year period to $2.02 for the fiscal 2022 third quarter ending September 2022. The $77.14 billion consensus revenue estimate for the ongoing quarter represents a 4.5% rise year-over-year. The company has surpassed the consensus EPS and revenue estimates in each of the trailing four quarters.

The stock has gained 14.7% over the past year to close the last trading session at $95.53.

CVS’ POWR Ratings reflect this promising outlook. It has an overall grade of A, equating to Strong Buy in our proprietary rating system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

CVS has a grade of B for Value, Stability, and Sentiment. Within the Medical – Drug Stores industry, it is ranked #1 of 5 stocks. Click here to see additional POWR Ratings (Momentum, Quality, and Growth) for CVS.

Read Full Story »»»

DiscoverGold

DiscoverGold

Should CVS Health Be in Your Portfolio?

By: Schaeffer's Investment Research | July 29, 2022

• Poor Expected Growth Rate

CVS Health (NYSE: CVS) has been caught in a couple of controversies over the last month. CVS was recently sued by the New York Attorney General for allegedly breaching antitrust laws. Additionally, laxatives sold by the company have been recalled after a suspected contamination of the products. This culmination of bad news and other factors has had an adverse effect on the company's stock price as it's currently down -10.31% for the last six months. Still, there are some investors who are loading up their bags with CVS in expectation of it charting higher for the years to come. In this article we'll examine some of the reasons why, as well as the downsides of adding it to one's portfolio.

POOR EXPECTED GROWTH RATE

First, let’s start with the weaknesses of CVS. The company is struggling with growing its revenues on a forward and yearly basis, and its numbers don't stack up attractively to its peers in the same industry sector. CVS's YoY revenue growth is 10.61% while the sector surges to 17.07%. The company's FWD revenue growth expectations are even bleaker at 6.26% compared to 14.80%.

In addition to failing to competitively grow its top line it's also struggling to grow some of its earnings metrics such as EBITDA despite having strong margins. CVS's FWD EBITDA growth is 4.72%, while the industry leads the way with 10.78%. This may be disappointing as its net income margin is 2.68%, while the sector struggles with this metric at -1.87%.

REVISIONS AND MOMENTUM IS ON CVS’S SIDE

The other side to the argument is that CVS has received numerous positive revisions for its EPS and revenue targets over the last three months. The company earned 22 positive EPS revisions and 17 positive revenue revisions. Overall, Wall St considers CVS a buy judging by its ratings. 10 analysts gave the stock a strong buy, and 8 gave it a buy rating. The rest rated the stock as a hold, while no analysts gave it a sell or strong sell rating.

For the more momentum-inclined investors, CVS might be worth a look. CVS is outperforming its peers in the same sector when it comes to price performance. It's beating the sector by 45.85% over 9 months and 49.66% over 12 months. Compared to the S&P 500, the company's gains are beating the market in a longer timeframe. CVS returned a 72% yield over three years, while the S&P 500 returned 34.59%. Over ten years, though, the company returned less, with 112.57% compared to the index's 193.83% return.

CVS VS. WALGREENS BOOTS ALLIANCE INC

Wallgreens Boots Alliance Inc (NASDAQ: WBA) makes an interesting comparison with CVS. WBA's market cap is significantly smaller than CVS with 33.90B compared to 125.72B. The losses for WBA have been steeper YTD with -23.62% compared to 5.87% for CVS. Additionally, the long-term return of the stock is also reduced, as over 10 years, WBA gave a 43.13% yield while CVS returned 166.34%.

In terms of dividends, CVS is stronger, but WBA's dividend is growing faster. The dividend rate and yield for CVS are $2.15 and 2.24%. The same stats for WBA are $1.92 and 3.65%. As a measure of the growth rate for the dividends on a 5-year basis, WBA's CAGR is 4.95%, while CVS lags at 2.24. This may partially be because WBA has seven years of consecutive dividend growth while CVS has only one.

For valuation WBA is the clear winner with an FWD P/E ratio of 6.45 compared to CVS's FWD P/E of 13.68. WBA is also cheaper on a Price / Sales basis with a ratio of 0.25 compared to 0.42.

Read Full Story »»»

DiscoverGold

DiscoverGold

New York Attorney General sues CVS Health for violating antitrust laws

By: Reuters | July 28, 2022

The New York Attorney General on Thursday sued CVS Health Corp (NYSE:CVS), saying the pharmacy chain violated antitrust laws and hurt New York safety-net hospitals and healthcare providers.

The lawsuit says CVS required safety-net hospitals and clinics to exclusively use a CVS-owned company, Wellpartner, to process and obtain federal subsidies on prescriptions filled at its pharmacies, which forced these providers to incur millions in additional costs.

CVS did not immediately respond to a Reuters request for comment.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

40

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

623

|

|

Created

|

01/16/11

|

Type

|

Free

|

| Moderators DiscoverGold | |||

READING $CVS/ [Valuation Analysis] Buy CVS before the Aetna acqusition is completed.

https://www.valuestocksblog.com/valuation-series/2018/1/13/valuation-analysis-buy-cvs-before-the-aetna-acqusition-is-completed

READING $CVS/ AETNA/ Aetna Acquisition

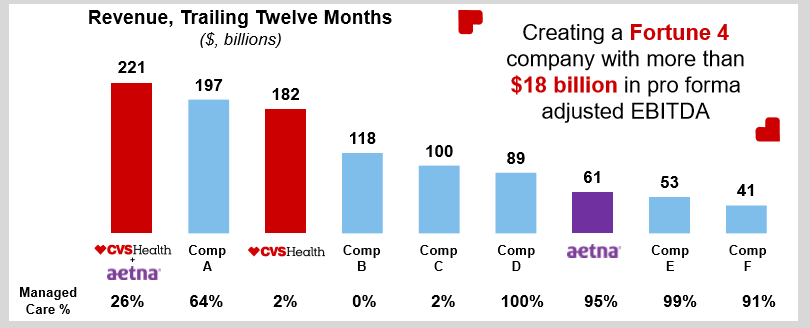

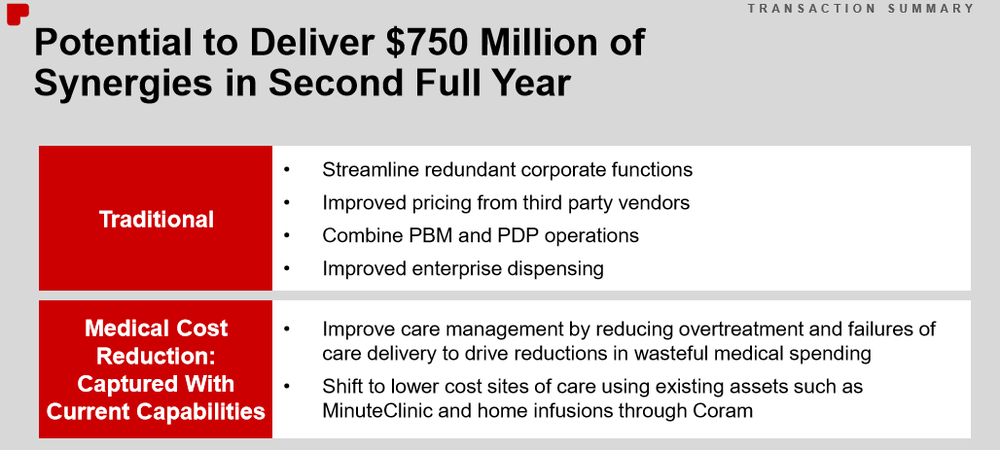

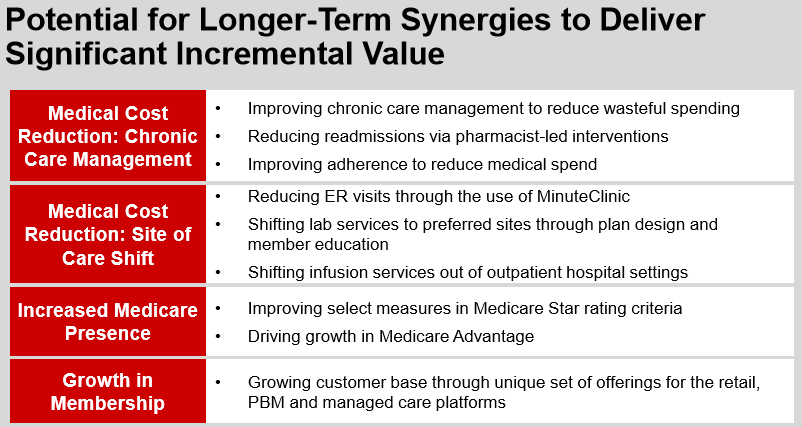

On December 3rd, 2017 CVS and Aetna (NYSE: AET), an American health insurance company, announced that they reached an agreement for CVS to acquire Aetna. The transaction is expected to close in the second half of 2018. It is subject to approval by CVS Health and Aetna shareholders, regulatory approvals and other customary closing conditions.

https://www.valuestocksblog.com/valuation-series/2018/1/13/valuation-analysis-buy-cvs-before-the-aetna-acqusition-is-completed

o Aetna Overview

· The third largest health insurance company in the U.S. with about 6% market share, serving an estimated 44.6 million people.

o Potential impact of the acquisition (synergy, etc.)

· Aetna currently has $61 billion in revenue. The combination of CVS and Aetna will most likely make the largest health care company in the U.S. in terms of the revenue.

CVS Caremark

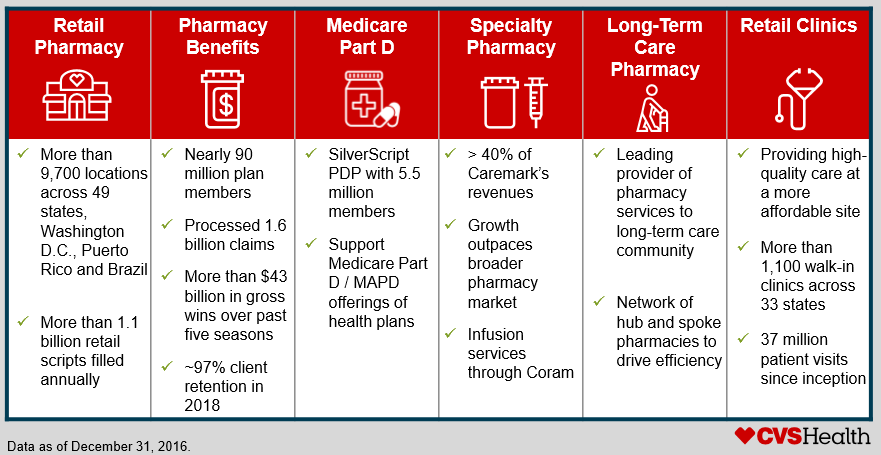

CVS Caremark is the largest pharmacy health care provider in the United States. Through our integrated offerings across the entire spectrum of pharmacy care, we are uniquely positioned to provide greater access, to engage plan members in behaviors that improve their health, and to lower overall health care costs for health plans, plan sponsors, and their members. As one of the country's largest pharmacy benefit managers (PBMs), we provide plan sponsors and participants access to a network of approximately 64,000 pharmacies including more than 7,100 CVS/pharmacy stores.

We employ approximately 200,000 colleagues in 41 states, the District of Columbia, and Puerto Rico. As of September 30, 2010, we operated 7,152 retail stores, 569 MinuteClinic locations, 44 retail specialty pharmacy stores, 18 specialty mail order pharmacies, five mail service pharmacies, and our CVS.com and Caremark.com Web sites.

Quick Facts

* Headquarters located in Woonsocket, R.I.

* More than $99 billion in annual revenue

* Ranked 18th on Fortune 500 for 2010

* No. 1 provider of prescriptions – more than 1 billion prescriptions filled or managed annually

* No. 1 Specialty Pharmacy

* Largest employer of Pharmacists and Nurse Practitioners

* 75 percent of the U.S. population lives within three miles of a CVS

* No. 1 Retail Clinic Operator

* More than 8 million MinuteClinic patient visits to date

* No. 1 Retail Loyalty Program – more than 65 million active ExtraCare customers

For further information, contact:

Michael P. McGuire

Senior Director, Investor Relations

CVS Caremark Corporation

1 CVS Drive, Woonsocket, RI 02895

401-770-4050

The Nation’s Largest Provider of Prescriptions Filling or Managing More Than One Billion Prescriptions Annually

Verified Internet Pharmacy Practice Site (VIPPS)

A Program of the National Association of Boards of Pharmacy

Caremark.com

www.caremark.com

| Corporation Caremark Rx, LLC | Phone 847-559-4700 |

| Address 2211 Sanders Road Northbrook, IL 60062 | Per Lofberg President |

| State of Incorporation CA | Experience Operating a Pharmacy Since June 1979 |

Retail Pharmacy

Step inside any of our more than 7,000 CVS/pharmacy locations from coast to coast, and you'll see that we have the prescription medications, related health care products, and other remedies you need "for all the ways you care." More than 20,000 highly trained Pharmacists are available to dispense prescriptions as well as helpful advice. We make things "CVS easy" for our pharmacy customers by offering 24-hour or extended-hours service in the pharmacy in 72 percent of our locations. Sixty percent of our stores provide drive-thru pharmacy windows as well. We also have more than 560 in-store MinuteClinic locations up and running, with more coming throughout 2010.

In the front of the store, customers appreciate our wide selection of popular beauty, health, and personal care brands as well as an assortment of exceptional brands not available at any other U.S. drugstore. Among them, our CVS/pharmacy store brand cough and cold products offer high-quality alternatives for value-conscious consumers. Our selection of proprietary brands includes favorites such as Cristophe® , Essence of Beauty®, Nuprin® , Playskool® , and Skin Effects by Dr. Jeffrey Dover®. CVS store brands as well as proprietary and other limited distribution products, with their higher margins, accounted for approximately 14 percent of our front-store sales in 2007. We are going to aggressively grow this business and expect it to represent 18 to 20 percent of front-store sales in the next three to five years.

Beauty is one of our core categories in the front of the store, and CVS/pharmacy was named Mass Beauty Retailer of the Year at the 2007 Women's Wear Daily Beauty Biz Awards.

Thomas M. Ryan

Chairman of the Board and Chief Executive Officer of CVS Caremark Corporation

Thomas M. Ryan, age 57, Chairman of CVS Caremark Corporation since November 2007 and Chief Executive Officer of CVS Caremark Corporation since May 1998; was President of CVS Caremark Corporation from May 1998 to May 2010; Chairman of CVS Corporation from April 1999 until March 2007; also President and CEO of CVS Pharmacy, Inc. from 1994 to 2007. Currently Director of Bank of America Corporation, and Yum! Brands, Inc.

Larry J. Merlo

President and Chief Operating Officer of CVS Caremark Corporation and President of CVS/pharmacy

Larry J. Merlo, age 55, President and Chief Operating Officer of CVS Caremark Corporation since May 2010. President of CVS/pharmacy since January 2007. Was Executive Vice President of CVS Caremark Corporation from January 2007 to May 2010; Executive Vice President - Stores of CVS Corporation from April 2000 to January 2007; and Executive Vice President - Stores of CVS Pharmacy, Inc. from March 1998 to January 2007. Currently Chairman, National Association of Drugs Stores.

Per Lofberg

Executive Vice President of CVS Caremark Corporation and President of Caremark Pharmacy Services

Per Lofberg, age 63, is President of Caremark Pharmacy Services, a position he assumed in January 2010. Previously, Mr. Lofberg was President and CEO of Generation Health. He is also the co-founder and served as CEO of Merck Capital Ventures; served as Chairman of Merck-Medco Managed Care LLC, which later became Medco Health Solutions; and, spent 15 years with Boston Consulting Group (BCG) in Boston, New York and Munich, West Germany. As President, he has responsibility for all facets of the PBM business.

Troyen A. Brennan, M.D., M.P.H.

Executive Vice President and Chief Medical Officer

Troyen A. Brennan, M.D., M.P.H, age 55, is Executive Vice President and Chief Medical Officer of CVS Caremark. Prior to joining CVS Caremark, Dr. Brennan was Chief Medical Officer of Aetna Inc. From 2000 to 2005, Dr. Brennan served as President and CEO of Brigham and Women's Physician's Organization. In his academic work, he was Professor of Medicine at Harvard Medical School, and Professor of Law and Public Health at Harvard School of Public Health. Dr. Brennan received his M.D. and M.P.H. degrees from Yale Medical School and his J.D. degree from Yale Law School. He completed his internship and residency in internal medicine at Massachusetts General Hospital. He is a member of the Institute of Medicine of the National Academy of Sciences.

David M. Denton

Executive Vice President and Chief Financial Officer of CVS Caremark Corporation

David M. Denton, age 45, is Executive Vice President and Chief Financial Officer of CVS Caremark Corporation, since January 2010. He previously held the position of Senior Vice President and Controller/Chief Accounting Officer of CVS Caremark Corporation, from March 2008 to December 2009; Senior Vice President, Financial Administration of CVS Caremark Corporation and CVS Pharmacy, Inc. from April 2007 until March 2008; Senior Vice President, Finance and Controller of PharmaCare Management Services, Inc., the Company’s pharmacy benefits management subsidiary, from October 2005 through April 2007. He has been with the Company since July 1999.

Lisa Bisaccia

Senior Vice President and Chief Human Resources Officer of CVS Caremark Corporation

Lisa Bisaccia, age 54, has been Senior Vice President and Chief Human Resources Officer of CVS Caremark Corporation since January 2010. She most recently served as Vice President of Human Resources. Since joining CVS Caremark in 2004, Mrs. Bisaccia has led major human resources initiatives including enhancing compensation practices, outsourcing human resources processing functions, and successfully managing all human resources support for the Retail business.

Douglas A. Sgarro

Executive Vice President and Chief Legal Officer of CVS Caremark Corporation and President of CVS Realty Co.

Douglas A. Sgarro, age 51, Executive Vice President and Chief Legal Officer of CVS Caremark Corporation and CVS Pharmacy, Inc. since March 2004 and President of CVS Realty Co., a real estate development company and a division of CVS Pharmacy, Inc. since October 1999; Senior Vice President and Chief Legal Officer of CVS Corporation and CVS Pharmacy, Inc. from September 1997 to March 2004. Mr. Sgarro is a graduate of Hamilton College and the University of Virginia Law School. He is a director of the United States Chamber of Commerce.

Jonathan C. Roberts

Executive Vice President and Chief Operating Officer, PBM

Jonathan C. Roberts, 54, is Executive Vice President of CVS Caremark, and Chief Operating Officer of the company’s PBM division, a position he has held since October 2010. Prior to that he served as EVP of Rx Purchasing, Pricing and Network Relations, from January 2009 to October 2010; Senior Vice President and Chief Information Officer of CVS Caremark Corporation from January 2006 until January 2009; Senior Vice President - Store Operations of CVS/pharmacy, Inc. from August 2002 until December 2005; and Area Vice President of Stores from April 1997 through August 2002.

Helena Foulkes

Executive Vice President and Chief Marketing Officer, CVS Caremark Corporation

Helena B. Foulkes, age 46, is the Executive Vice President and Chief Marketing Officer, CVS Caremark Corporation, a position she has held since January 2009. Previously, Ms. Foulkes was Senior Vice President of Health Services of CVS Pharmacy, Inc., from October 2007 through January 2009, Senior Vice President, Marketing and Operations Services from January 2007 through October 2007, and Senior Vice President, Advertising and Marketing from April 2002 to January 2007. In her fifteen-plus years with the Company, Ms. Foulkes has held positions in Marketing and Operations Services, Strategic Planning, Visual Merchandising and Category Management. She is a graduate of Harvard College and received an M.B.A. from Harvard Business School.

Stuart M. McGuigan

Senior Vice President and Chief Information Officer (CIO), CVS Caremark

Stuart M. McGuigan, age 52, is Senior Vice President and Chief Information Officer of CVS Caremark Corporation, a position he has held since December 2008. Previously, Mr. McGuigan was Senior Vice President and Chief Information Officer of Liberty Mutual Group from September 2004 to December 2008, and was Deputy Chief Information Officer and Senior Vice President of Liberty Mutual from February 2004 to September 2004; from 2000 to February 2004, Mr. McGuigan was Senior Vice President – Information Technology of Medco Health Solutions, Inc. He has served on the Board of Directors of NetScout, Inc. since 2005. In 2010, he was appointed to the Rhode Island Science and Technology Advisory Council (STAC).

Laird Daniels

Senior Vice President, Controller and Chief Accounting Officer of CVS Caremark Corporation

Laird Daniels, age 41, is Senior Vice President, Controller and Chief Accounting Officer of CVS Caremark Corporation, a position he assumed in January 2010. Previously, Mr. Daniels was Vice President of Finance and Retail Controller for CVS/pharmacy. He joined CVS Caremark in 1997.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |