Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Possible Low of the day is in

https://schrts.co/HGXebNHD

If we get the Weekly W-S-1 confirmed at the end of next week. The Weekly Bull Cycle projections will be reset. So we will likely see a lot higher projections going to the 6000 level.

The current end of year projected range (based on current average 60 min cycle data) has a forecast of 5285.40 to 6023.12. So far this year the 60 min bear cycles are currently averaging 53 points and the bull cycles are averaging 61 points.

SPX Daily trend LL.........RSI14 cycle above 30..now...looking for under 30.....then rise....OPINION

SPX D...at 9th legs down..?

https://schrts.co/QQnJyVKg

We are within the range I projected a couple weeks back.

My earlier projection

With the 60-SC-1 confirmed today, the next 60 min cycle has to be a bull cycle.

The 60 min 60-E-2 & 60-SC-2 are both extremely overdue with current projected high range of 5152.95 to 5198.48

CCI10 on the daily chart is moving back up towards -100. Could get an up signal if we close green today..

https://schrts.co/PeQvPUze

Due to the confirmation today at the close of the 2nd hour of the 60 min 60-SC-1 (Extreme Overdue) projected low 4964.69. A UPRO Buy Signal is active, price target 59.16 and a SPXS Sell Signal is active, price target 11.37.

This is the 5th UPRO Buy Signal of this UPRO Bull Cycle, which averages 2.83 buy signals per cycle.

RCKS, Thanks...The 2 Guru's that I read are both looking for some kind of ramp then possibly more down...4600/4700 level from one..

Glen

Pretzel Update: SPX target hit of 5070 hit with the low yesterday......... but is that the full correction?

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174253021

Ron Walker is has down signals

60 min SPX target hit, the 10EMA

https://schrts.co/pZDjvBPH

Bought, UPRO, 100 shares at 63.05. This is due to the confirmation of the 60-E-1.

SPX.... 10./15...60....in green now........

1.10

https://schrts.co/EZHHnwdx

2.15.

https://schrts.co/MuIbsBaN

60...H...LINE 5138.70 +/-...?????

https://schrts.co/QRHbEfZC

5073 is the 60 min SPX target, the 10EMA...Looking like getting ready for last hour rampo..

https://schrts.co/pZDjvBPH

The Monthly 10EMA is now residing at 4774. CCI10 needs to drop back below +100 for that signal. It is now at +101.52. So might keep an eye on that one. But it would take some time getting down there anyway,,and probably a few bounces first also

https://schrts.co/NYYbWJUi

.

4969 is the Weekly SPX target, the 20MA...As I said earlier, we may see a bounce before we hit these lower targets...But we have the signals...So we see

https://schrts.co/uUUiqKyG

That is over some time. Maybe like a few months... But once they make the first rate cut they will ramp the market several hundred points so we then have to start over.But history says when rate cuts start the market will make a final low...

4921 is the Daily SPCX Target, the 100MA. Surely there will be some kind of bounce before too much more down???

https://schrts.co/SdPECvxF

UDOW 10.......look like in green now...72.75 w.stop.....

https://schrts.co/UKPpqdvx

Due to the 60 min 60-E-1 being confirmed at the close of the 1st hour, a UPRO Buy Signal is currently active, target price is 61.62.

SPX Daily. ZIG..........click pre post ....date 4/04/2024....

BEARs pictures ..4/04/2024

So Guru looking at weekly ma320? that is a dive

Glen

Pretzel Update: My bad, I saw the futures as the market was opening today and I thought the Correction had to be over, Friday's selling had to be just about the Middle East conflict ahead of the Weekend and I was sure Pretzel was right that the Market was ready to go up to New High's........... Ooooops the Market had other ideas.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174242084

4970 the Weekly SPX target....the 20MA,,,One guru I just read is looking at possible 3600 to 3700...My how fast the switch..

https://schrts.co/HWZpawMV

(E)SPX......10...+..Daily.....S...5050 H.line......for the day...4/15/2024 .. opinion

note RSI14=38.91 at print need more down under 30 number maybe...?

call it w9down ....4/15/2024

SPX 10...

https://schrts.co/jqYgUvHS

DAILY..

https://schrts.co/csFJMNap

(E)$VIX + $SPX...Daily......VIX Daily. trend HH

VIX 7up...in progress today..

https://schrts.co/dpcIdbcQ

$SPX Daily trend LL...

https://schrts.co/rpwbNBfN

If price on SPX gets back above 5080 possible rampo..??

https://schrts.co/AYQcPbet

60 Min SPX indicators very OS...Price below 320MA..I would expect some kind of up here before long...No up signal as I post this tho.

https://schrts.co/eKYkFcff

SPX daily target has been hit and exceeded...The 50MA

https://schrts.co/IVwivhDI

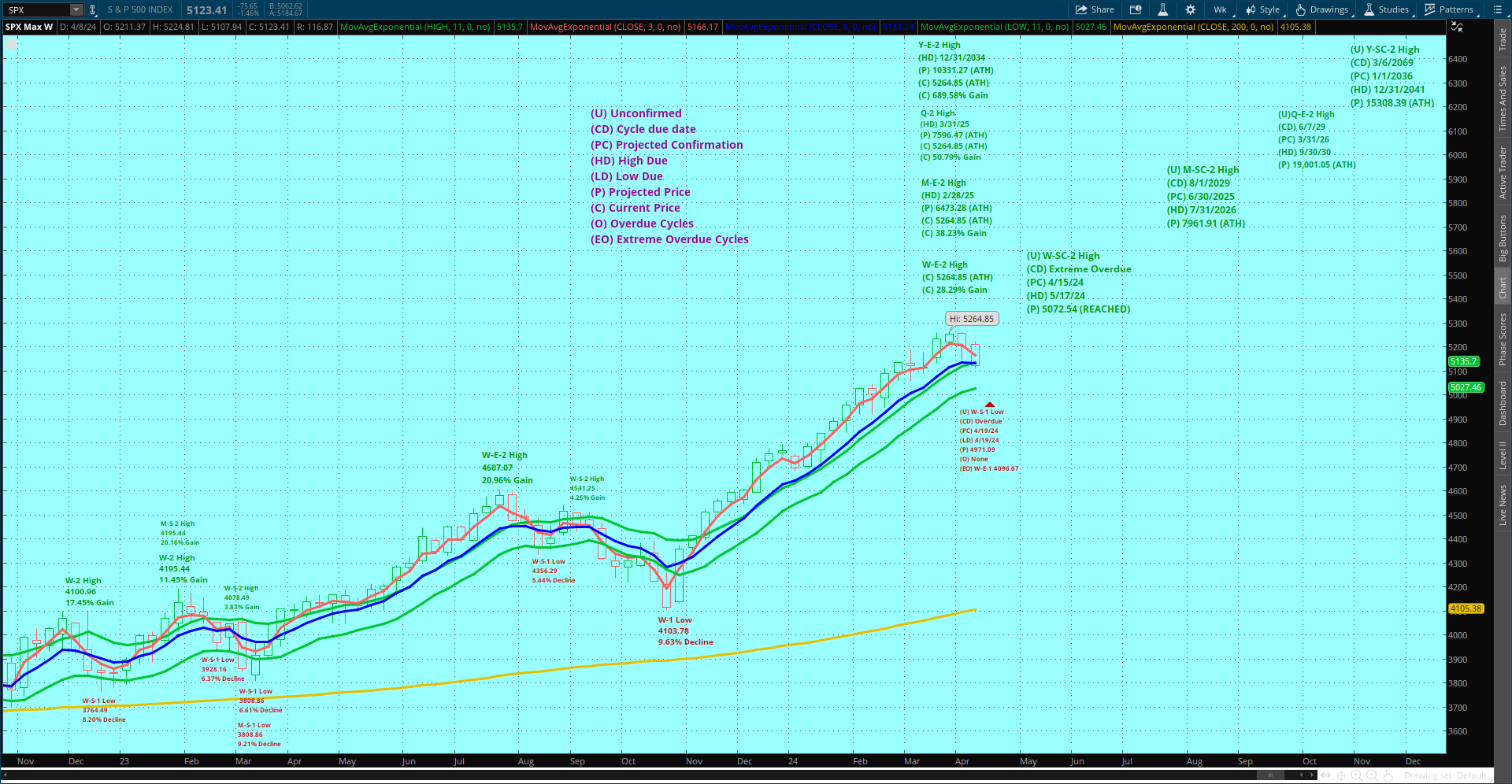

SPX Cycles Long Range Projection Chart. Today the Weekly W-SC-2 has been confirmed, projected high 5072.54 (Reached), the high is due 5/17/24. However, the Weekly is currently below it's UTL (currently at 5141.16) so there is now a slight possibility of a Weekly W-S-1 at the close on 4/26/24, projected low 4971.09, the low will be due 4/26/24.

5116 is the Daily SPX target, the 50MA..

https://schrts.co/NWqGVReP

SPX Cycles Long Range Projection Chart. The SPX Weekly closed below it's UTL (currently at 5135.70) which is Bear Territory, for a Weekly Bear Cycle to be confirmed the Weekly will have to open on Monday below the Weekly UTL and remain below the UTL until the close of the week. Probably a slim chance of getting confirmed because all of the 60 min Bull Cycle projections are currently above the Weekly UTL level. If by chance at the close on 4/19/24 the Weekly confirms the W-S-1 (Overdue) projected low 4971.09, the low will be due 4/19/24. If the W-S-1 were to get confirmed that would actually be bullish, as the Weekly Bull Cycle projections would be reset to a lot higher levels. If the W-S-1 doesn't get confirmed next week, the Weekly W-SC-2 (Extreme Overdue) will, however the Weekly W-SC-2 projected high of 5072.54 has already been reached. If the W-SC-2 doesn't get confirmed, it will remain extremely overdue, which means we could go from a W-S-1 to a W-SC-2 which could be a 500 to 1000 point gain over the next 28 to 30 weeks.

Bought, UPRO, 100 shares at 65.04. This is due to the confirmation of the 60-E-1.

5139 is the 60 min SPX target, the 10EMA..Price is now just below the

320 MA so possible ramp shortly...

https://schrts.co/ZyXgUQYT

The 4 hour SPX target is the 100 MA now at 5110...But still looking for some kind of ramp into the close...Hope not..

https://schrts.co/pqjXzrGC

A 60-E-1 has been confirmed. A UPRO Buy Signal is currently active, price target 62.99.

(E) $UPRO....60.....DAILY.....Weekly...broken under support...64.72

UPRO..BULL..60..Plays Under .CC50.

https://schrts.co/IfHFztjs

Daily UPRO..

https://schrts.co/rHIyxVKA

UPRO Weekly....Under .support =..64.72 TODAY low now 64.63 look at upper left corner ..open/hi/lo pre close..

https://schrts.co/kkiaACGC

Need to stay below 5130 or we may ramp big time into the close. Dippers know the places to jump in.

SPXU....15....60.....D......

15..

https://schrts.co/rbeffdNu

SPXU...60....BR. Plays Above CC50..

https://schrts.co/KSfQVaSg

Daily...ZIG CC20...

https://schrts.co/SDYpQSir

Right to S2 on the 15 min chart...Getting about time for the usual start of the ramp into the close.

https://schrts.co/xiAqVmXE

The Daily 50MA SPX target has been hit now at 5010.93

https://schrts.co/WjtgAQXr

Looks like good chance for the D-1 today at the close. A UPRO Buy Signal is possible today at the close of the 6th hour, target price 63.25.

I believe the D-1 will likely be the bottom of this Daily Bear Cycle. Monday the 60 min could confirm the extreme overdue 60-SC-1.

The Weekly will likely close today in Bear territory, but I doubt we get a Weekly Bear Cycle next week, right now all the 60 min Bull Cycle projections are above the Weekly UTL.

So we could be getting a nice Bull Rally starting Tuesday/Wednesday. The large 60 min Bull Cycle 60-E-2 & 60-SC-2 are both extremely overdue.

TZA.....Daily...ZIG...CC50....Candle ..

R=19.66.....Support......S. 18.68

https://schrts.co/arrcbWYu

UPRO......SPXU .......60....

UPRO..BULL..60..Plays Under .CC50.

https://schrts.co/IfHFztjs

SPXU...60....BR. Plays Above CC50..

https://schrts.co/KSfQVaSg

Thanks RCKS...Maybe some hope for down yet??

5111 is the Daily SPX target, the 50 MA

https://schrts.co/EdATmNCM

$SPX....60..M 9,18,7..+ ..VIX.....+..DAILY....TRENd...

60..Open GAP down ..M 9,18,7.(Fail cross.0.00.)...+..VIX .

https://schrts.co/hbsUYZgU

daily.

https://schrts.co/YRbCBxKP

Glen

Pretzel Update: Pretzel believes the Ball is in the Bear court and if they take the ball and run with it, the first target is 5070-5090........

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174224768

Price kissed the 15 min 320MA from below and then has PB a few points but still 20 mins left so could ramp up again...The Dippers are back today for sure.

https://schrts.co/bAkBkfBV

Glen's system:

For this system, I use the 10EMA, 20SMA, 34SMA,50SMA,100SMA, 140SMA and the 200SMA.

I use CCI10,20,34,60 and 100..

The system hit targets more often when going with the trend...

The targets are for the MA's at the time they are called and the actual target price when hit may be slightly different depending on how long it takes and how steep the MA's are moving..Each time frame update will also change the value of the MA.

So here is the way it works..Starting from a top...This works in ALL time frames from the 1 min to the monthly..

When CCI10 drops back below +100 price moves to the 10EMA

When CCI10 crosses below zero price moves to the 20MA

When CCI20 crosses zero price moves to the 34MA

When CCI34 moves below zero price moves to the 50MA

When CCI60 crosses zero price moves to the 100MA

When CCI100 crosses zero price moves to the 140MA

When CCI100 crosses below -100 price moves to the 200MA.

When CCI272 crosses zero price goes to the 320MA.

when price gets above all the MA's I use then you move to the next longest timeframe for targets and signals

Then you just start the system in reverse when CCI10 moves back above -100..

* After price gets above all the MA's on every time frame then you can not call any more up targets.(Monthly Chart is the longest)....You have to wait for CCI10 to drop back below +100 for a down signal on any timeframe.

** Use same instructions in reverse for opposite direction market movements

*** In strong market moves, countertrend moves will be difficult to hit

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |