Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ha ha nice .....Ice.........

BSKS $6.90 New 52w High Again!

Thanks bro... Its never to late to turn the good side of the force.

Cya

Oh, I've definitely learned some shady stuff. Why do you think I'm always so pessimistic?

Don't worry, I couldn't find any shares to short for this.

Enjoy~

Hopefully more good things then bad?

Yeah, most info you learn from experience. I've worked with a few local irvine hedgefunds and learned a thing or two.

Thanks for the info... Thats what I was looking for, its hard to find that section in the etrade trading manual... Ha!

ahhh now it makes sense sell orders are a MUST! No point except that if I had a large portfolio, I would not want it in Scotttrades hands with or without a sell order.

If your shares do not have a sell order, they can be loaned out to be shorted. That is correct.

I'm not sure what your point is. The shares come from the clearing company.

4.27M with 60% owned... so 1.71M for the public

And it should be liquid after the R/S with a price over a 1$

yeah

under 2 mil float ?

geeeez

those are the ones that can really run

seen them go from a penny to several dollars in a day w that type of float

I think this very similar... actually better then BSKS current share structure... does anyone disagree?

After 1:4 R/S will leave 23.79M Outstanding / 4.27M Float - 60% owned by Equities.com?

Leaving 9.51M for Insiders & 1.71M in the Float?

BSKS is where 39M with 9M in float?

This BSKS price move was the follow-up on a 30 to 1 split and business merger so from $0.05 to $1.50 after the split and then to over $6.00 is reasonably attainable after that major reduction in float and the new business benefits.

For Globetrac, a 4 to 1 reverse split and the completion of the acquisition of a High Grade Internet Financial business such as Equities.com should take the stock to the same level as BSKS, in a similar short period. This will occur from the combined National and International Investor attention that the Equities.com Website will generate when their public trading status becomes the subject of major news inputs on the Website concerning their revenue growth and other positive developments which will then certainly stimulate the large number of investors who log on to this Website to continually invest in this Company's shares.

It might be your lucky day...

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69621499

NICE !

GOOD PLAY

I NEED one like that soon

been rough since late Apr

first part of the yr i was on FIRE

My first trade was Bank of Ireland@.77 March 9, 2009... It climbed to about $20 in a very short time... And their share structure was nothing like BSKS...

looks like it's very possible

hell of a move last couple of months that's for sure

Its up there with the smell of money.... Looks like MMs like that smell too... Doesn't seem like they are trying to hold BSKS down? I would expect another leap to $8 maybe $12 shortly.

If shes a breathing women... I'll take her, I love them all LOL

Ahhhh me too... If shes a breathing women... I'll take her, I love them all LOL

you're a brunette man too huh ?

but i'll take the blong this time

don't want to be to picky LOL

BSKS, Moral Hazard in who holds your shares?

So it would help these Market Makers who broker these short sales when the CEO of these Brokerages like Scottrade sit on the board of these Market Makers like Knight Capital... Correct?

Brokerages Lend Customers Shares to Affiliated Market Makers for a fee... Like the Partnership between Scottrade/Knight Capital (largest MM for the OTC) & (largest MM who benefits from shorting stocks)

EXECUTIVE PROFILE

Rodger O. Riney

Founder, Chief Executive Officer and President, Scottrade, Inc.

-- --

BACKGROUND

Mr. Rodger O. Riney founded Scottrade, Inc. in 1980 and serves as its President and Chief Executive Officer. Mr. Riney serves as Chief Executive Officer and President of Scottrade Center. In 1969, Mr. Riney joined Edward Jones & Co., a brokerage firm, and served as a its General Partner since 1975. As an expert in financial technology, he led corporate strategy and operations for Scottrade, Inc. since its inception, including Scottrade's entry into Web-based trading ...

Director, Member of Compensation Committee and Member of Nominating & Corporate Governance Committee Knight Capital Group, Inc.

OTHER AFFILIATIONS

Knight Capital Group, Inc.

University of Missouri-Columbia

Scottrade Center

http://investing.businessweek.com/research/stocks/private/person.asp?personId=780346&privcapId=4279857&previousCapId=4279857&previousTitle=Scottrade,%20Inc.

I would be vary weary if I had BSKS shares in Scottrade's hands... Wouldn't you all?

Maybe just a Little Moral Hazard involved here... Which best Interest would you really be looking after?

Stock Lenders... Brokers Customers... Means shares that the customers of the Brokers have (Scottrade, Etrade, etc...)Correct? And these customers have no idea their shares are being loaned of for shorting purposes... Do they?

Thanks for your response

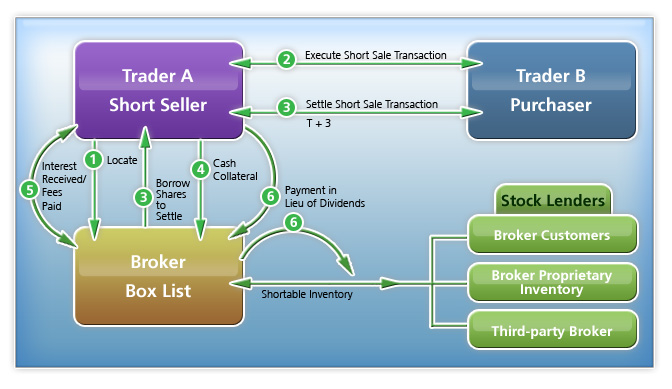

The Mechanics of a Short Sale

http://www.interactivebrokers.com/en/p.php?f=shortableStocks

Scenario: Trader A decides he wants to sell a stock short in hopes of being able to repurchase it at a lower price in the future.

Locate shares for shorting.

To enact a short sale, Trader A must first confirm that he will be able to borrow the number of shares he plans to sell. Brokers keep a list of available inventory on what is called a Box List. Brokers populate the Box List through their own inventory and shares of others, including their customers who borrow on margin and agree to lend their shares, and other third-party brokers.

Execute a short sale trade.

After locating available shares, Trader A executes a short sale trade on trade date, or “T.” Most major equity markets have a three-day settlement period, which means that the exchange of shares for cash occurs three days following the trade date, or “T+3.” .

Shares are borrowed and the short sale transaction settles.

On the morning of T+3, Trader A's Securities Lending Department determines its actual delivery obligations for that day. They consult their Box List and use the shares to settle the short sale. As with the short sale availability process, in the case that their own Box List does not contain borrowable inventory, they consult and use shares from the Box List of other brokers.

It is important to understand that there may be times where a given stock appears to be borrowable on T, but in the intervening three days the availability changes such that on T+3 it is no longer borrowable. This creates a situation in which the short sale trade will "fail;" in other words the timely delivery obligation will not be met by the broker. In this case, a forced repurchase, or "buy-in" may be issued by the broker and the resulting buy trade will be charged to the Trader A’s account, thereby reducing or eliminating the short position.

Cash from the short sale is used as collateral on borrowed shares.

When the trade settles, the cash received from selling the shares is used as collateral on Trader A's borrowed shares. Trader A's Broker invests the cash collateral.

Interest is paid to or by the short seller( if applicable).

A portion of the interest from the invested collateral is used to pay administration fees and stock borrowing fees. Because of steep administration costs, remaining interest is generally only paid out to large balance short sellers. In certain hard to borrow cases, borrowing fees are so high (greater than the interest earned) that the short seller ends up paying additional interest for the privilege of borrowing a security. Customers may view the indicative short stock interest rates for a specific stock through the Short Stock (SLB) Availability tool located in the Tools section of their Account Management page.

Payments in Lieu of Dividends made by short seller (if required).

If the stock in the short sale pays dividends, the purchaser of the stock receives the dividend payments. However, the lender of the shares is also entitled to dividend payments since he did not sell the stock but is only lending it. Trader A is responsible to making these payments to the lender in the form Payment in Lieu of Dividends.

At some point in the future the need to maintain the borrow is reduced, either when Trader A decides to repurchase his short position, or if the shares are recalled by the lender. In the former case, the deal is closed. In the latter case, the broker will try to find another lender, the loan will be moved to the new trader or broker, and Trader A's short position will remain unaffected. In the case that no substitute loan can be arranged, the broker may notify Trader A that the loan has been recalled and that he must cover his position immediately. In many cases the broker will simply execute the forced repurchase, or buy-in, of the recalled shares.

Finding accurate short ratios for over the counter markets is pretty much impossible. All those links people post are garbage.

Finding shares to short is unrelated, that depends on how many shares your broker has. They sometimes don't have shares of obscure or otc companies.

Can you help me get a better understanding for short interest? How does it really work and where do you go to find what is available?

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69633283

Thanks,

ICE

Artic Cat...............

When did they start making you find BSKS shares to short? I thought you didnt need them.... Go figure locate shares to short. What if I just borrow some? Does anyone mind if I could just borrow some of your shares to short? I promise I'll give them back to you after i'm done.

IM FREEEEEEEEEEE!!!!! Ah feels so good... Funny how some can run BSKS from the inside! Not speaking of myself of course... I'm just a slave holding the crown, for now...

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69574869

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69569200

http://www.equities.com/blog/all-glory-fleeting-not-my-quadriga

All Glory Fleeting... Not on this board! Not on my Quadriga!

http://www.equitygroups.com/BSKS-discussion/BSKS--The-Health-Insurance-Portability-and-Accountability-Act-of-1996

The Health Insurance Portability and Accountability Act of 1996

The Administrative Simplification provisions of the Health Insurance Portability and Accountability Act of 1996 (HIPAA, Title II) require the Department of Health and Human Services (HHS) to adopt national standards for electronic health care transactions and national identifiers for providers, health plans, and employers. To date, the implementation of HIPAA standards has increased the use of electronic data interchange. Provisions under the Affordable Care Act of 2010 will further these increases and include requirements to adopt:

• operating rules for each of the HIPAA covered transactions

• a unique, standard Health Plan Identifier (HPID)

• a standard and operating rules for electronic funds transfer (EFT) and electronic remittance advice (RA) and claims attachments.

In addition, health plans will be required to certify their compliance. The Act provides for substantial penalties for failures to certify or comply with the new standards and operating rules.

For more information regarding HIPAA including additional provisions under the Patient Protections and Affordable Care Act (Affordable Care Act or ACA) of 2010, go to the "Related Links Outside CMS".

HIPPA Information

Smart Cards Represent an Excellent Solution for HIPAA Compliance and Support New Applications That Improve Medical Care

The presence of processing capability and memory in a smart card, along with the smart card’s ability to support multiple applications, make smart cards an efficient and flexible mechanism that can help organizations achieve HIPAA compliance while meeting the goals of patients and practitioners. Smart cards have a unique ability to make information access easier for users while at the same time enforcing the more robust security policies required of health care organizations to bring their environments into HIPAA compliance. Smart cards can represent an excellent solution to an organization’s multiple physical and electronic security requirements. Systems that use smart cards as the identity token and secure data carrier have unique benefits.

Smart cards can provide easier information access management, ensuring that users are following established security policies.

Smart cards are a familiar form factor that can be used for both physical access to facilities and logical access to information on personal computers and networks.

Smart cards can help enforce access control to health information, providing support for both user authentication and encryption of data on the card and during transmission.

Smart cards can store health information on the card, performing as secure portable data carriers that are under the control of the patient and the health care professional.

Smart cards, with on-card intelligence and processing capabilities and the ability to use standards-based cryptography, are uniquely capable of enabling compliance with strong privacy guidelines and of enforcing the privacy and security policies set by the health care organization

Smart cards provide a feature-rich platform for health care organizations to implement new applications that improve access to and convenience of medical care.

Health care organizations worldwide are implementing smart health cards. With the appropriate security architecture, smart cards can be a very valuable tool to providers, insurers, and patients alike. They can be an instrumental component of any system that is designed to ensure compliance with HIPAA regulations, as well as supporting new applications that deliver clinical and administrative benefits.

About This Report

This report was developed by the Smart Card Alliance to describe how smart cards can be used to meet HIPAA Security Rule and Privacy Rule requirements. Designed as an educational overview for decision makers, it summarizes the HIPAA privacy and security requirements, provides an overview on how smart cards work, describes how smart cards can be used to support HIPAA compliance and implement other health care applications, and outlines key implementation success factors. The report also includes profiles of smart health card implementations including the University of Pittsburgh Medical Center, Mississippi Baptist Health Systems, and the French, German and Taiwanese health cards.

This report provides answers to commonly asked questions about the use of smart cards as health care cards, such as:

What requirements do the HIPAA Security Rule and Privacy Rule impose on health care providers, insurers, and patients?

How do smart cards work?

How can smart cards help health care organizations fulfill the HIPAA requirements?

What capabilities do smart cards provide for clinical and administrative benefits that extend beyond HIPAA requirements?

What can we learn from organizations who are currently using smart cards as health care cards?

What considerations are important to the successful implementation of a system that uses smart cards as health care cards?

If you would like to join the task force, please contact info@smartcardalliance.org.

Great Source of Information regarding Smart Cards

Smart Card with Biometrics = BSKS

Bluesky System Holding, Inc. (OTC:BB:BSKS), is the exclusive worldwide licensee of next generation secure data cards by reason of a certain License Agreement with Supera Group, LLC. ("Supera"). In connection with that Agreement, BSKS licensed more than 30 issued patents for the manufacture and sale of readers/writers and high-capacity data storage in a credit card format for the use in healthcare, and patient management, medical, dental and pharmaceutical records and other health applications. Bluesky expects the licensed technology to be a game changer in that the delivery of this next generation platform brings secured transactions into the modern world of technology that is being demanded by users.

At least he admits what he does

Explains why he's always doom & gloomy LOL

I tried to find shares to short but couldn't. Damn. There is no way this stays at 6 dollars by the end of the month. Santa Claus won't allow it.

So.. next quarter we will see a different balance sheet?

Thats the old company. Which is a real estate company (one building) in Srpingfield , MA. The new company is Supera (or at least the holder of the company they put into the shell) which is a $350 million revenue medical device company. The company they put into the shell is Supera Corp just a smaller division with many contract and all the tech. and management to do it (Health Smarcards) globally.

Anywhere near 12 what ? It appears to have trouble getting above 6.60 - 6.70

Hell I'm shorting this if it goes anywhere near 12.. this company has zero cash and gets 4k a quarter in rent.. net loss in the millions..

thing is

there's no volume to speak of

so

how does one make sense of it

i'm not sure what to think here

Anyone else concerned about this or am I just paranoid ??

So you feel that BSKS will go to $ 12.00 ??

Does not appear that this stock has many followers and / or posts relating to it's performance. From approx $ 2.15 on Nov17th, up to approx $ 4.25 on Nov 25 and today looking at $ 6.50 ??? Some information says that the company has no money or business. Anyone venture to try and explain the increases ??? Hope we don't wake one morning and nothing is there ??

BSKS - Could this be a squeeze? Very nice move from the bottom.

Def a mystery here

Running up on nothing

it occured longer than in one day however....

it shows a real estate losing money...there needs to be 8-K with current business

|

Followers

|

11

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

536

|

|

Created

|

10/15/09

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |