Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thanks for your post. Much appreciated. I took some profits today. Ya know, every nickel and dime matter.

LC

BLDE

I briefly owned BLDE and sold for a small profit. I really like the company! I think they have a good direction and increasing cash flow. I think future quarters will continually get better. I think it is a great long term hold but for me there is not enough meat on the bone for gain at the moment. I put a large investment into RONN, BEGI, and PLNH as I think they will have company altering catalysts approaching between now and the next the couple of months. I would like to buy back into BLDE in the future.

Still holding Blade?

I see Cathie Wood.is a huyer. That's a good sign.

LC

THANKS

I just bought! This stock is a no brainer, next quarter results will be very positively progressive!!!!!!!

This company is valued at a little more than what they hold in cash! Insane! BLDE has some serious potential!!!!! I don't own any shares but I will be following this company!

This appears to be another growing yet far undervalued stock!

Their March 12th report should be interesting, seeing how weather effects that quarter will be of concern.

This company has some serious growth potential.

This is an intriguing company, I do not own any shares as of yet but I am following.

Excellent article on BLDE in Barron's this weekend.

Why Blade Stock Is Ready To Take Off

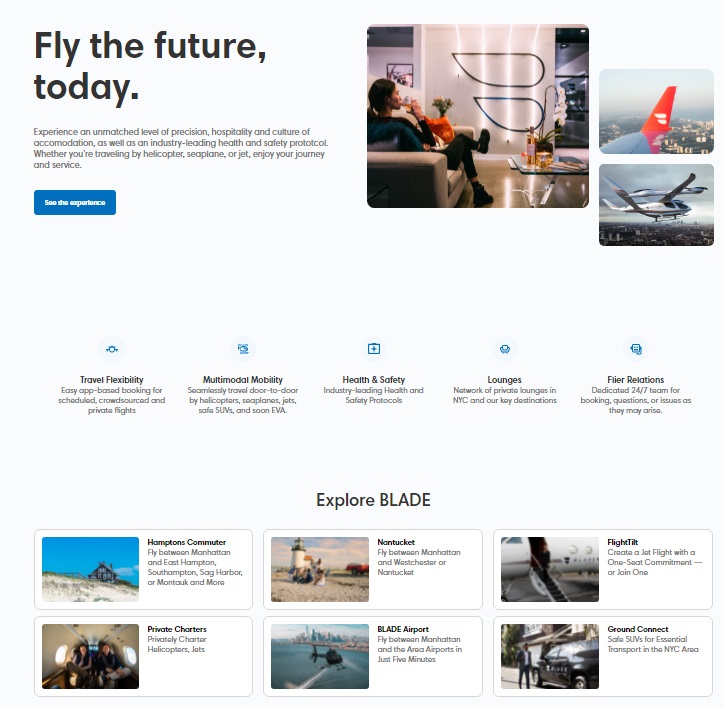

Blade Air Mobility is bringing ride-sharing to helicopters—just don’t call it the Uber of the sky. The stock can take off without that comparison.

Lately, new aircraft with the fancy name of “electric vertical takeoff and landing”—eVTOL— have been generating lots of buzz, as visions of The Jetsons dance in investors’ minds. These zero-emission aircraft are potentially disruptive technologies, but shares of companies dedicated to them are fraught with risks that come with highly speculative, forward-thinking companies: High valuations, no earnings, no sales, and a ton of cash burn.

Blade Air Mobility (ticker: BLDE) is a less risky way to invest in the eVTOL future, though certainly not risk-free. It’s easy to see why the New York–based company has been likened to Uber Technologies (UBER).

Like Uber, it doesn’t own vehicles, but instead has a network of 29 operators with many different aircraft transporting passengers and high-value cargo in cities around the world. It makes money by charging customers combinations of annual fees and per ride ticket prices, and, like Uber, it takes a slice of sales.

That’s where the comparison falls apart, however. Creating a network of pilots ferrying people to airports and dealing with landing fees and federal air-traffic control is a little different than having a fleet of drivers.

“I’ve given up fighting it,” says Blade CEO Rob Wiesenthal, of the Uber analogy. Blade deals with pilots and not gig-economy workers, he adds. And the level of complexity is higher.

Blade became a publicly traded company in May after merging with a special-purpose acquisition company, or SPAC—one of the first listed urban air-mobility companies. Other eVTOL companies followed, with manufacturers Joby Aviation ( JOBY), Archer Aviation (ACHR), and Lilium (LILM) completing SPAC mergers in August, September, and October, respectively.

Those three companies hope to reshape aviation by offering low-cost aircraft the way SpaceX created new commercial space opportunities with reusable rockets. It won’t be easy.

They have to navigate Federal Aviation Administration approvals while spending billions on aircraft development and watching out for rivals.

Their stocks, which have dropped 30% on average from post merger announcement highs, look a little too speculative given the cash they need to spend and competition between competing eVTOL designs.

Blade, for its part, is happy to see all of the investment going into eVTOL. That isn’t just because it will eventually lower costs. Blade can now offer flights for as low as $95, down from $695 in 2014. New eVTOLs will be much quieter than traditional helicopters, which are too loud to fly in some urban areas. “It’s about quiet,” says Wiesenthal. “When it’s quiet, we can build in more places.”

Blade operates about 10 routes and plans to expand to 28 by 2024, organically and through acquisitions. For instance, the company bought organ transplant transportation firm Trinity Air Medical in September for $23million. Trinity had about $16million in 2020 sales operating in 16 states. Being able to fly on Blade’s larger, existing network means that hospitals can save money, while offering another revenue stream for pilot partners and providing Blade with a foothold in new markets.

Other deals could be announced soon, says J.P. Morgan analyst Bill Peterson, who has an Overweight rating and a $16 price target on the stock, 58% above Friday’s close of $10.10 This isn’t to say that Blade’s stock is a safe bet. The company isn’t profitable. It burned through about $10 million in the calendar second quarter, though it has more than enough cash to expand infrastructure and its network using traditional helicopters and planes, in preparation for eVTOL commercialization. Nor is Blade cheap. Its stock was valued at about $500 million, net of the roughly $300 million in cash. That’s about seven to eight times estimated 2022 sales of $68 million.

Blade is getting close to profitability. During the first nine months of its fiscal year, sales amounted to about $30 million, up 100% year over year. Gross profits—essentially profits before administrative costs, interest, and taxes—came in at $6 million, up from about $1 million a year ago.

Blade needs greater scale to spread over its fixed costs, which were roughly $20million to $25million over the first nine months of its fiscal year. The more sales that Blade can generate off its base, the more profits it earns. Credit Suisse analyst Stephen Ju sees Blade sales growing from $43million in 2021 to $193 million in 2025, and gross profit increasing from about $9 million— a 21% profit margin—to $80 million, or a 41% profit margin. The company should reach positive free cash flow in 2025, enabled partly by Blade’s asset light business model, says Ju, who rates Blade stock an Outperform with a $14 price target—the lowest on the Street— a gain of 39% from Friday’s close.

And that’s just using good, old fashioned helicopters until 2025. If eVTOL does fly, it’s one more reason that Blade can take off.

Checkout $DNA, Ark Invest is loading that one Hard!

That's another 78 shares for me this morning in what I expect to be a continuing accumulation.

This management team knows what it's doing - I'm buying more tomorrow morning.

Haha, shit— my nndm & BLDE are my forevers LOL — would of loved a

Same. BLDE is my longest term hold

average of $13 here. Should of bought some 7's but we're good. Long term gains here when everyone starts taking plane taxis!

BLDE to Buy Organ-Transportation-Company Trinity Air Medical 9/09/2021.

**This is HUGE- BLDE could then provide immediate transport of organs by AIR!**

Blade Air Mobility Inc. said it would buy Trinity Air Medical Inc., a multi-modal organ-logistics and -transportation company, for an upfront purchase price of about $23 million.

The deal, expected to close next week, includes potential additional contingent consideration based on Trinity achieving Ebitda growth targets over a three-year period.

Blade said it expects the acquisition to accelerate revenue growth in Blade's MediMobility business.

"We expect the combination of Trinity's substantial flight volume with Blade's fast-growing MediMobility business to create the largest dedicated organ air transport company in the United States and enable us to secure more dedicated aircraft, resulting in better availability and pricing for the hospitals we collectively serve," said Blade Chief Financial Officer Will Heyburn.

Trinity is profitable and generated revenues of about $16 million in calendar year 2020, working with transplant centers and organ-procurement organizations in 16 states, Blade said.

"Trinity's end-to-end services integrate air missions with ground transport. Given the existence of landing pads at most hospitals today, we have the ability to immediately replace Trinity's ambulances with helicopters on certain hospital-to-hospital missions, while preparing for a transition to both existing 'last-mile' cargo drones as well as Electric Vertical Aircraft, as soon as they become available," said Blade Chief Executive Rob Wiesenthal."

GLTA

...

...

Just completed my first buy of 108 shares at $8.78, with many more to come over time.

Agreed on BLDE.

I just keep accumulating small batches, and will have a quit a bit soon.

GLTA

That will definitely help, although in spite of that their quarter over quarter comparisons have picked up nicely recently.

And in that regard, I'll be starting the long process of gradually building a position tomorrow morning. I actually hope it doesn't grow too fast so I'll have time to do so. I figure I have at least until the 10-Q to be filed in November.

I see it. Just need to get out of the pandemic

This is going to be so big within five years it will make people's heads spin.

Good stuff! Let’s get this party started!!!

BLDE revenues up 277% + $333m cash!

"Blade Air Mobility Reports Fiscal Third Quarter Ended June 30, 2021 Financial Results and Provides Corporate Update

Revenues up 277% in fiscal third quarter ended June 30, 2021 versus prior year period

Revenues increased 73% versus pre-covid quarter ended June 30, 2019

$333 million of cash and short-term investments to support enhanced acquisition strategy and new route expansion

Blade now has alliances with four separate Electric Vertical Aircraft (“EVA”) manufacturers: Eve (a division of Embraer S.A), Beta Technologies, Wisk (a joint venture between Boeing and Larry Page's Kitty Hawk) and magniX".

GLTA

..

..

BLDE nice move pre-market.

News been covering the new popularity of car/air conversions.

Let’s go !

BLDE will be back by on the straight UP trail by late Summer through Fall..

IMO ?

GLTA

Hey all — holding since 14 as EXPC threw the ups/downs hoping we bagged a winner in a couple years

BLDE looking like good opportunity to ADD while consolidating sideways...

GLTA

Thanks for starting this board. Been following Blade for some time now and believe it has a very bright future. Thus, I took a Position looking for a significant long term return. Plan on using their services next time in NYC, and hope to see an expansion along the Eastern Seaboard. EVTOL shows great promise.

BLDE nice move with merger news today 5/27...

"Blade Air Mobility Says Enters Into Alliance With MagniX For Electrification Of Lima's Amphibious Seaplanes For Urban Air Mobility Flights On Key Blade Routes

8:10 am ET May 27, 2021 (Benzinga) Print

Blade Urban Air Mobility, Inc. ("Blade" or the "Company"), a technology-powered urban air mobility platform, today announced an alliance whereby magniX USA Inc. ("magniX"), a leading manufacturer in electric aviation, will supply its Electric Propulsion Units ("EPU") to Lima NY Corp. ("Lima"), one of Blade's largest aircraft operating partners, for the conversion of Lima's Blade-branded fleet of amphibious Cessna Caravans to all-electric aircraft starting in early 2023, subject to certain conditions.

Blade is the exclusive platform for Lima flights offered to the public. Key routes include flights between the Blade Aqua Lounge at the East 23rd Street seaplane base in New York City, the eastern end of Long Island, New York, and the Blade Terminal in Nantucket, Massachusetts.

Based on current estimates, the all-electric Caravans will operate emission-free at the same speed as the current generation turbine Caravans, with a significantly reduced noise footprint and lower operating costs.

As part of the alliance, Lima will be the exclusive owner in the northeast United States of the supplemental type certificate ("STC") for the conversion of the Caravan's current generation turbine engine to the magniX EPU.

Blade President Melissa Tomkiel said, "Amphibious seaplane service has always been an essential part of our urban air mobility strategy, given the aircraft's unique ability to access city centers through conveniently located waterways, such as Manhattan's East River, as well as traditional airports. The electrification of our accessible fleet of Blade-branded aircraft, made possible through our alliance with magniX and Lima, one of our key operating partners, will further accelerate our transition to quiet, emission-free flight, allowing us to reduce the environmental and sound impact in and around the communities where we fly."

"Partnering with Blade and Lima to bring electric aviation to one of the largest cities, and highly populated regions in the United States, is an incredible proof point to the value of offering communities zero emissions, reduced noise, and lower operating costs," said magniX CEO Roei Ganzarski. "With electric propulsion as our cornerstone, magniX continues to build toward the new electric age of aviation."

Blade's alliance with magniX and Lima comes on the heels of a recent agreement for Blade to secure up to 20 BETA Technologies' ALIA Electric Vertical Aircraft ("EVA") on behalf of Blade's network of operators with scheduled delivery beginning in late 2024, and arrangements for Wisk Aero LLC, a joint venture between Boeing and Larry Page-backed Kitty Hawk, to own, operate and maintain up to 30 EVA for exclusive use across Blade's U.S. route network."

GLTA !

.

.

Thank you TruckingAngler for bringing this board on.

BLDE one of the only UP today...

Should look great on a full market up day !

GLTA

Thanks for the heads up. That was a big haircut.

BLDE finally on the way back UP...

There was no good reason for the decline after confirmation of the merger only weeks ago..

GLTA

..

...

....

|

Followers

|

8

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

37

|

|

Created

|

05/18/21

|

Type

|

Free

|

| Moderators | |||

May 5, 2021:

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |