Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Japan Trip

The auto tariffs are opposed by both domestic and international car companies. If imposed, they would likely blow up trade negotiations launched with the EU and Japan, which Trump is due to visit later this month.

Members of Congress from both parties also argue the president is abusing powers delegated to him by Congress to pursue a protectionist agenda. A group of steel importers are lobbying the Supreme Court to hear their constitutional challenge to Trump’s use of Section 232 with other business groups starting to join the fight.

The invocation of national security is designed to exploit a loophole in global trading rules that allows countries to restrict trade in times of war. It also has caused a brewing fight between the U.S. and other members at the World Trade Organization that is expected to escalate in the coming months.

Until the Trump administration the U.S. regularly lobbied other governments to adopt a narrow view of national security with regards to trade for fear that if everyone invoked the exemption it would render global rules useless.

U.S. officials used that message with counterparts in Beijing for years, said Jude Blanchette, a China expert at the Crumpton Group, a Washington consultancy. China has long invoked national security to justify censorship of the internet and limit access by foreign firms to industries it deems strategic.

“The U.S. now thinks in a maximalist way about national security,’’ Blanchette said. The Huawei escalation in recent days is just one reason why a recent breakdown in talks between the U.S. and China seemed unlikely to be resolved any time soon, he added.

The Trump administration has from its early days rejected trade orthodoxy, insisting it is finally addressing global economic injustices that have hurt the U.S. for too long.

In a speech to students at Harvard University last month, White House adviser Peter Navarro said Trump was rejecting “conventional fossilized wisdom’’ to take on China’s “deviant economic model’’ and other trade cheats such as Germany, which Trump has nominated as a target for auto restrictions.

“America should be comforted by having a president who wakes up every day thinking about how to grow the economy faster and create jobs for Americans while protecting national security,’’ Navarro said.

(Updates with proclamation in third to sixth paragraphs.)

UP NEXT

Trump Isolated on Iran as World Sees Confusion in U.S. Strategy

https://www.bloomberg.com/news/articles/2019-05-17/on-huawei-and-autos-trump-aligns-trade-with-security-doctrines

President Donald Trump is taking his trade wars into a new realm likely to both extend them and make them harder to resolve.

With his crackdown on Chinese telecom giant Huawei Technologies Co. and a new directive targeting European and Japanese carmakers, his administration is displaying its penchant to invoke U.S. national security in the broadest way possible. In doing so Trump is exploiting a loophole in global trading rules and doing what his predecessors spent years urging China and others not to at the risk of opening a protectionist Pandora’s box.

The administration’s willingness to bend the rules on national-security grounds is evident in a proclamation Trump issued on Friday that labeled imported cars a threat to U.S. national security and called for reducing imports. It also delays the imposition of auto tariffs for 180 days while U.S. officials negotiate with the EU and Japan to reduce their exports of automobiles and parts to the U.S.

Broad Definition

The proclamation invokes a broad justification of national security that trade experts say could be applied to almost any product imported into the U.S., arguing that the growing foreign competition from foreign automakers has hurt America’s ability to innovate.

The hit to sales of American-owned carmakers caused by competition from imported cars, it says, undermines domestic producers’ ability to invest in research and development “necessary for long-term automotive technological superiority.’’

“The lag in R&D expenditures by American-owned producers is weakening innovation and, accordingly, threatening to impair our national security,’’ the document says.

“That’s huge,’’ said Douglas Irwin, a trade historian at Dartmouth College. “That’s a very interesting train of logic that hasn’t been heard before and can justify stopping imports of anything.’’

[-chart]assets.bwbx.io/images/users/iqjWHBFdfxIU/iI9mhH7O62iQ/v1/620x-1.png[/chart]

https://www.bloomberg.com/news/articles/2019-05-17/on-huawei-and-autos-trump-aligns-trade-with-security-doctrines

The autos move is aimed largely at long-time allies in the EU and Japan. But with its emphasis on technological superiority it is not that different from the justifications the Trump administration is using in its trade war against China and the battle over key technologies embodied in its attack on Huawei.

In a diplomatic campaign that has stretched from Australia to Europe, U.S. officials have for months urged allies not to buy Huawei’s 5G equipment for new networks because of spying fears.

This week Trump issued an executive order that could effectively ban Huawei and Chinese sister firm ZTE Corp. from the U.S. market. The Commerce Department also placed Huawei on a blacklist that means U.S. suppliers will need licenses to sell the company components.

Bill Reinsch, who as undersecretary of Commerce in the Clinton administration headed the bureau responsible for both the Huawei and auto investigations, said the cases marked very different extremes of the Trump administration’s national security-driven trade policy.

Read More: U.S. Places Huawei and Scores of Affiliates on Export Blacklist

While U.S. intelligence officials have pushed for a crackdown on Huawei for years based partly on what they claim are its links to the People’s Liberation Army, it is hard to find anyone outside the administration who believes imported cars pose a threat.

The sort of argument the administration is making about cars and research spending is one experts have made for decades about more sensitive industries such as semiconductors, Reinsch said. No one has ever seriously argued it should apply to cars, he said.

Behind both the Huawei and auto cases lies the argument that U.S. national security depends on the nation’s economic security that Trump has advanced since becoming president and employed to impose steel and aluminum tariffs last year. Trump invoked the same statute used to justify the metals tariffs -- Section 232 of the Trade Expansion Act of 1962 -- to order an investigation into imported cars last year.

‘World Trade Week’

At the end of the most consequential week for trade policy in Trump’s presidency, investors looked weary from uncertainty. The MSCI Global Index slumped for a second straight week and the yield on 10-year Treasuries flirted with its low of the year. The Bloomberg Dollar Index, meanwhile, reached his highest level of the year.

https://www.bloomberg.com/news/articles/2019-05-19/tariff-man-trump-just-had-himself-a-wild-week-here-s-a-recap

[-chart]assets.bwbx.io/images/users/iqjWHBFdfxIU/ixyYxV.61yOM/v2/pidjEfPlU1QWZop3vfGKsrX.ke8XuWirGYh1PKgEw44kE/620x-1.png[/chart]

Trump may not be finished. On Friday, he foreshadowed the arrival of “World Trade Week,” May 20-26, in a proclamation that contained a not-so-coded message to what’s emerging as the main source of his economic angst: China.

“The United States will no longer tolerate any foreign nations gaining unfair advantages on American industries by stealing or forcing the transfer of our companies’ technology or intellectual property, subsidizing their exporters, illegally dumping products into our markets, and building excessive and unnecessary capacity,” Trump’s proclamation stated.

— With assistance by Jenny Leonard, and Shawn Donnan

Closer to Home

As if trade watchers hadn’t digested enough, Trump and his counterparts in Mexico and Canada announced on Friday that the U.S. will lift steel and aluminum tariffs on those two nations, boosting efforts to encourage lawmakers to ratify a new North American trade deal.

Read More: Trump Removes Steel, Aluminum Tariffs on Canada and Mexico

In a joint statement, Canada said it will lift retaliatory duties on U.S. products as part of the deal. Mexico welcomed Trump’s removal of the duties. Both nations suggested it would open the way for their lawmakers to approve the new trade pact. The metals melee had become an obstacle for lawmakers in all three nations to ratifying the U.S.-Mexico-Canada Agreement, the deal to revamp Nafta that Trump wants to tout as he heads for re-election in 2020.

Trump’s directive sets a 180-day period of negotiations. The goal? “Domestic conditions of competition must be improved by reducing imports,” the proclamation stated. The stroke of this pen did more than delay tariffs. It escalated tensions by saying that auto imports are a threat to national security and “American-owned” producers. Toyota responded with a rare rebuke, saying Trump’s proclamation “sends a message to Toyota that our investments are not welcomed, and the contributions from each of our employees across America are not valued.” Consumer will pay more and have fewer vehicle choices if import quotas are imposed, the automaker said.

China’s response dashed most hopes that the world’s two biggest economies would patch things up soon. “If the U.S. ignores the will of the Chinese people, then it probably won’t get an effective response from the Chinese side,” according to a commentary carried by state-run Xinhua News Agency and the People’s Daily, the Communist Party’s mouthpiece.

Car Trouble

By midweek, Bloomberg News was reporting that Trump was close to delaying a decision by as long as six months to impose tariffs on automobiles and some parts, a move aimed at delaying a simultaneous clash with Europe and Japan. He made the decision official on Friday, but issued a proclamation saying he agreed with his Commerce Department’s conclusion that competition from foreign carmakers and imports from the likes of Toyota and BMW pose a threat to U.S. national security.

Read More: Trump Delays EU, Japan Auto Tariffs for 180 Days for Talks

Made in China

On Monday, the U.S. Trade Representative’s office released a list of about $300 billion worth of Chinese goods including children’s clothing, toys, mobile phones and laptops that Trump is threatening to hit with a 25% tariff. If he proceeds, those new taxes, plus 25% duties on $250 billion of Chinese goods already in place, mean American consumers may start feeling the pinch of higher prices.

Then, on Thursday, Trump extended his crackdown to include the Chinese telecom giant Huawei Technologies Co. He issued an executive order that could effectively ban Huawei and Chinese sister firm ZTE Corp. from the U.S. market. He also placed Huawei on a blacklist that means U.S. suppliers will need licenses to sell the company components.

Read More: U.S. Places Huawei and Scores of Affiliates on Export Blacklist

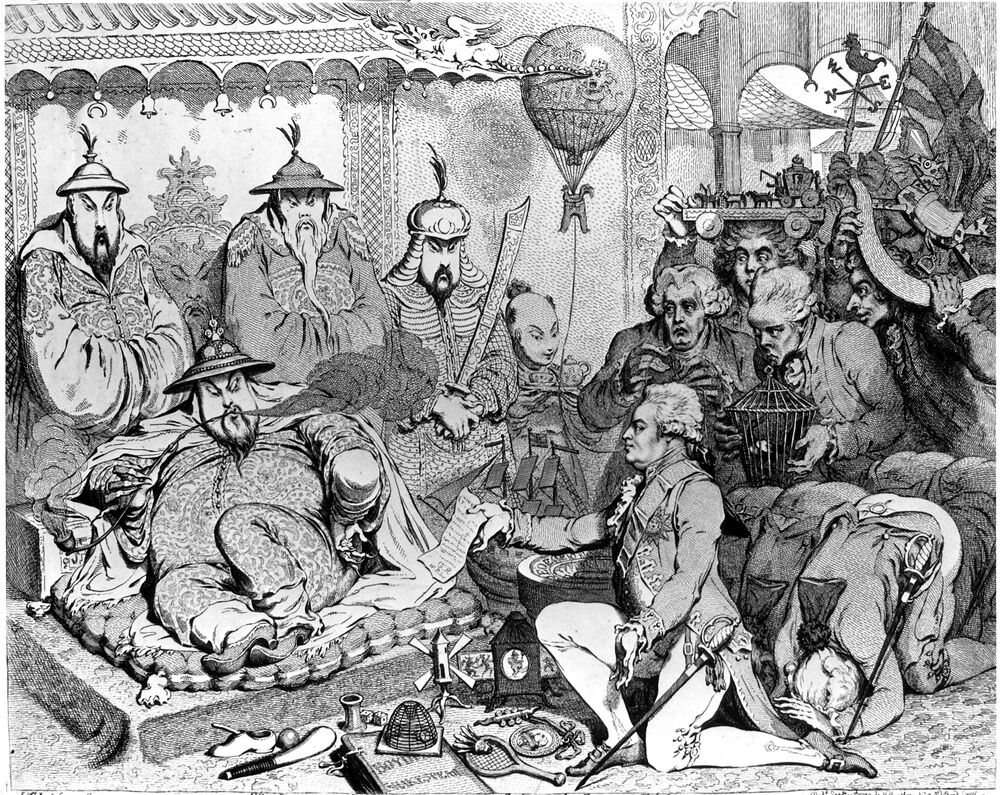

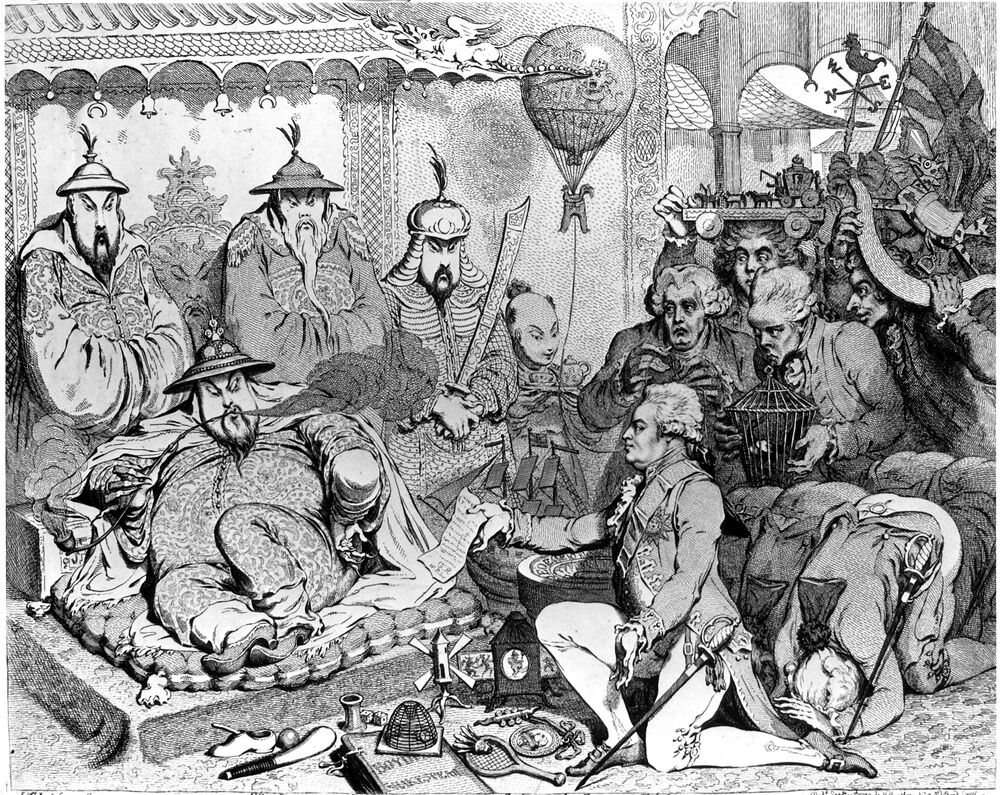

China Doesn’t Want to Be Like the West

The Trump administration has underestimated the strength of resistance to a foreign order imposed by force.

[-chart]assets.bwbx.io/images/users/iqjWHBFdfxIU/iILxWgzvR8JA/v1/1000x-1.jpg[/chart]

https://www.bloomberg.com/news/articles/2019-05-19/the-world-agrees-with-trump-on-one-thing-when-it-comes-to-iran

BIDU Share Structure per Yahoo Profile:

http://finance.yahoo.com/q/pr?s=BIDU

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MzQyN3xDaGlsZElEPS0xfFR5cGU9Mw==&t=1

Authorized Shares (AS) = 825,000,000 Shares

Outstanding Shares (OS) = 34,727,972 Shares

BIDU News: Baidu Announces First Quarter 2019 Results 05/16/2019 04:30:00 PM

BIDU News: Baidu Announces US$1 Billion Share Repurchase Program 05/16/2019 04:30:00 PM

BIDU News: Baidu Rises to Top 5 in IDC Ranking of Public Cloud Services Providers in China 05/08/2019 10:05:04 AM

BIDU News: Report of Foreign Issuer (6-k) 04/30/2019 09:17:05 AM

BIDU News: Baidu and Embassy of Switzerland in China Sign Joint Letter of Intent to Launch the “Switzerland” Mini Program 04/25/2019 04:27:34 AM

You feeling it will continue to decline over the time being? Or are you feeling it was oversold here.

I am seeing that with the lack of growth forecast that there is speculation it will flirt sub 110 in the coming months.

Mind as well at these prices..

I got in 10 years ago and rode the wave to unbelievable highs then got the 10:1 split in May 2010.

Good thing I sold off a good chunk early last Fall. Still holding a couple hundred of free split shares so will monitor this over the next 3 months then decide to buy in again.

They are a good Company but need to stop diversifying so much and spending $$$ on all kinds of new initiatives and keep their focus on Search and Advertising.

Chinese stock alert!

TIGR

Pos, scam?

Easy money for shorts

Nice call. Wow what a shellacking here today...

$BIDU buying all I can at $132

What a lousy Earnings Release - Arrgghhhh...

Instead of focusing on the main business of Internet Search to pull in more Advertising Revenue, they are trying to copy Google and spend $$$ millions on AI and Autonomous Driving.

They better wake up fast because they handle 70% of Search, however, there is a lot of competition gaining on them.

Can't believe the 52 week high was $283.95 therefore, we have fallen off a large cliff with another $15 drop in After Hours.

This Leading Chinese ADR Could Not Catch A Bid When There Was A Likely Trade Deal, Here's The Play

Baidu Inc (NASDAQ:BIDU) is viewed by many as the Google of China, it is the leading internet search engine in the country. The stock has been stuck in a sideways trading range since it bottomed in December 2019 at $153.78 a share. Traders should note that in May 2018 the stock traded as high as $284.22 a share. Today, BIDU stock is trading at $159.14 a share so you can see how this stock has struggled in 2019. Remember, the NASDAQ Composite and the NASDAQ 100 just made new all time highs last week. At this time, the stock looks to have a lot of support around the $150.00 level. This support area is simply a big whole round number that has not been tested yet. Often, markets love big whole round numbers and this should be the case for BIDU stock when it is tested. Should this $150.00 support level fail then the next major support area will be much lower and likely around the $130.00 level.

Nicholas Santiago

InTheMoneyStocks

Baidu going to new highs again yabba dabba doobie

BIDU has gotten it's funk back.

Nice run over the past week.

Could we be gearing up to take out $200 by mid May???

Keep the rally going...

$BIDU US-China Relations: Trust Deficit a Bigger Dampener than Trade

https://finance.yahoo.com/m/3d1de677-68ec-310c-9595-9741b10057e0/us-china-relations:-trust.html

Nice $7 pop today.

Let's get this back to $200 where it belongs.

Go BIDU!!!

https://www.forbes.com/sites/greatspeculations/2018/01/05/why-blackberrys-autonomous-driving-deal-with-baidu-is-significant/#7ef62f6940a1

Why BlackBerry's Autonomous Driving Deal With Baidu Is Significant

BlackBerry signed a deal with Chinese internet giant Baidu to jointly develop self-driving vehicle technology, in what is seen as a shot in the arm for BlackBerry’s automotive ambitions. BlackBerry’s stock rose by about 13% in Wednesday’s trading following the announcement. While BlackBerry has been partnering with several companies that intend to use QNX for their autonomous driving systems, the Baidu deal is notable as it could give the company greater traction in China, the world’s largest automotive market.

We have a $9 price estimate for BlackBerry which is below the current market price.

Baidu’s Approach To Autonomous Cars Is Focused On Scale

Baidu, which is primarily known for its search engine, it is also a leader in the development of deep learning and artificial intelligence. The company is leveraging these strengths to create an open-source autonomous driving platform called Apollo, which it hopes will ensure more rapid development and higher proliferation of autonomous cars. With the BlackBerry deal, Baidu intends to use the QNX operating system as the foundation for its Apollo platform. The platform has been described as the Android of the automotive industry, as it is both modular as well as open source, allowing developers to pick and choose the features they want to use in their systems. Apollo has signed agreements with several large auto companies, including Ford, Hyundai and some Chinese automotive manufacturers. The platform has also attracted partnerships from Tier 1 suppliers, developer platforms, and technology startups. The two companies will also work together to integrate Baidu’s CarLife automotive system with its conversational AI system DuerOS, and high definition maps to run BlackBerry’s infotainment platform.

BlackBerry’s Automotive Ambitions

Software is playing an increasing role in automobiles, with software and electronics estimated to account for upwards of 30% of a modern automobile’s cost. The role of software in automobiles is likely to rise with the advent of autonomous driving systems, and BlackBerry has been looking for early market share gains by forging deals with the largest automotive industry chip suppliers, as well as partnerships with the top three tier-1 auto suppliers – Bosch, DENSO, and Magna. That said, competition is likely to remain strong in this nascent market, with companies ranging from silicon valley giants such as Apple and Google to automotive suppliers doubling down on the market. BlackBerry does bring a lot of strengths to the space given its expertise in security and communications technologies. Moreover, the company’s QNX software has been known to operate mission-critical applications such as medical devices, air traffic control, and control systems. This could give the company some competitive advantages over the long run.

Good Earnings this morning that beat the Street Numbers.

Interesting news:

On the AI front, Baidu made a total of 13 investments in 2018 that made it the most prolific corporate venture capital focused on the realm, according to a report from CB Insights. Microsoft’s M12 venture and Google Ventures followed closely behind.

Though Baidu’s AI business is far from achieving mass commercialization, the segment has scored some notable landmarks. Over 200 million devices now use DuerOS, the company’s answer to the Alexa voice assistant. Baidu’s autonomous driving open platform Apollo has accumulated 135 original equipment manufacturers (OEMs) including Volvo, which is working with its Chinese ally to deliver level four self-driving passenger vehicles that can operate on pre-mapped roads with minimum human intervention.

Guess I should have bought Tuesdays

dip.

Guess I should have bought Tuesdays

dip.

Nice Earnings and a good 6.0% pop today.

Loading more I agree the satiations sounds great.

Shorts are gonna get creamed tomorrow.

Lovin' me some Baidu today....

Let's keep this rolling...

BIDU let's turn this ship around soon.

Going downhill since hitting $284 in early June.

Don't be afraid of Google getting back into China. You own about 90.00 % of the Search Activity so step it up and prove that you are still a winner...

Let me see if I can dig up a good resource for you. I buy and sell options contracts - there are plenty of different trading strategies out there when it comes to options but I prefer to mostly stick to the basics.

Stratford, how does calls work? Do you have info for me or a website. Thanks.

Actually added to my calls position today as well. We may see a gap and run after this recent price action. Next week should be fun - let's see if she gets a big kick higher. GLTA

Nice. I'm in for calls as well. Played a quick weekly this week - bought 212.50 calls Wed and sold Thurs for a nice double (100%). Still in for longer-term calls here. Looking for a return to at least the center channel around $250.

Bought me a starter today.

Thanks. It will go up sometime.

Google planning to re-enter the Chinese market. Believe we're seeing knee-jerk reaction to this recent news but once the dust settles investors will realize that BIDU owns the market. Watching as well to see when a turn-around in price begins.

Am watching it. Waiting for the bottom. Why did it fall this low?

BIDU hovering near the bottom of my (roughly) six month channel. Looks due for a move higher if it can hold this level a bit longer. Anybody else think we're seeing an over-reaction to Google 'news' and total disregard for the nice quarterly numbers? With confirmation of holding this recent channel bottom I'll be jumping in for calls - will wait and see.

Alphabet Inc.’s Google is preparing to launch a "censored version" of its search engine for China that will block results Beijing considers sensitive, The Intercept reported.

It's going down because Google might be entering China again. BIDU is down $40 in only five days! Not good for the share price in the future...Better get out before it tanks even more?

That's correct...impressive figures....

I don't get it that the share price went down that far. Hope to recover soon.

S402005

Once again BIDU delivers impressive Earnings.

Way to go Baidu....

Let's turn this ship around and start moving upwards again.

|

Followers

|

69

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1533

|

|

Created

|

08/05/05

|

Type

|

Free

|

| Moderators | |||

http://www.baidu.com/

Baidu.com, Inc. provides Chinese language Internet search services. Its services enable users to find relevant information online, including Web pages, news, images, and multimedia files through its Web site links. The company offers a Chinese language search platform, which consists of Web sites and certain online application software, as well as Baidu Union, which is a network of third-party Web sites and software applications.

Analyst Coverage

http://ir.baidu.com/phoenix.zhtml?c=188488&p=irol-analysts

Investor FAQs

http://ir.baidu.com/phoenix.zhtml?c=188488&p=irol-faq

BIDU Share Structure per Yahoo Profile:

http://finance.yahoo.com/q/pr?s=BIDU

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MzQyN3xDaGlsZElEPS0xfFR5cGU9Mw==&t=1

Authorized Shares (AS) = 825,000,000 Shares

Outstanding Shares (OS) = 34,727,972 Shares

The BIDU Press Releases

http://ir.baidu.com/phoenix.zhtml?c=188488&p=irol-news

Primary IR Contact

http://ir.baidu.com/phoenix.zhtml?c=188488&p=irol-contacts

IR Department

Phone: +86.10.8262.1188

Fax: +86.10.8260.7007

E-mail: ir@baidu.com

http://ir.baidu.com/phoenix.zhtml?c=188488&p=irol-homeprofile

The Baidu Story

Many people have asked about the meaning of our name. "Baidu" was inspired by a poem written more than 800 years ago during the Song Dynasty. The poem compares the search for a retreating beauty amid chaotic glamour with the search for one's dream while confronted by life's many obstacles. "…hundreds and thousands of times, for her I searched in chaos, suddenly, I turned by chance, to where the lights were waning, and there she stood." Baidu, whose literal meaning is hundreds of times, represents persistent search for the ideal.

Baidu chose a poetic Chinese name because it wants the world to remember its heritage. As a native speaker of the Chinese language and a talented engineer, Baidu focuses on what it knows best - Chinese language search. Applying avant-garde technology to the world's most ancient and complex language is as challenging as it is exciting. At least people here at Baidu think so. As having diligently disclosed in the Prospectus of our recent Initial Public Offering, we believe there are at least 38 ways of saying "I" in Chinese. It is important that we master all the ways of addressing oneself in Chinese because our users depend on us to address every one of their daily queries. And trust us, pin pointing queries in the Chinese language is an art rather than a science.

Our mission is to provide the best way for people to find information. To do this we listen carefully to our users' needs and wants. Have we collected all the Chinese web pages they want to see? Are the pages current and up to date? Are the search results closely related to their queries? Did we return those search results instantly? To improve user experience, we constantly make improvements to our products and services. For example, we introduced "phonetic" or "pin-yin" search which allows our users to type in Chinese keywords using English alphabets. This feature is designed to skip the switching from English inputting to Chinese inputting and for when the user is not sure of the written form of a keyword. Our users definitely notice the many little things that we do differently to ensure a simple and reliable search experience every time.

In addition to serving individual users, we also serve as a media platform for online marketing customers. We not only provide our customers easy access to one of the largest online audiences in China but also targeted groups with defined interests as indicated by queries. Unlike traditional online advertising services which charge by flat fee, our marketing products and services are performance based. Our Pay for Performance model has taken the market by storm because it is cost effective and measurable.

We know that a lot of interesting things are going on in the Internet space, but we don't want to lose focus. China's Internet search industry is only a newly discovered territory. We see vast untapped grounds in our home base and we believe there are still plenty of prizes to be claimed by the best players.

Daily View

Weekly View

China Doesn’t Want to Be Like the West

The Trump administration has underestimated the strength of resistance to a foreign order imposed by force.

[-chart]assets.bwbx.io/images/users/iqjWHBFdfxIU/iILxWgzvR8JA/v1/1000x-1.jpg[/chart]

https://www.bloomberg.com/news/articles/2019-05-19/the-world-agrees-with-trump-on-one-thing-when-it-comes-to-iran

*DISCLAIMER *The Board Monitor, Post Members, and The Board Assistants herewith, are not licensed brokers and assume NO responsibility for your actions, investment decisions, and or messages posted on this forum.

• We do NOT recommend that anyone buy or sell any securities posted herewith. Any trade entered into risks the possibility of losing the funds invested. Always do your research before buying.

• There are no guarantees when buying or selling any security. All Risk is yours.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |