Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Yup....all about timing also! Hopefully the upcoming CC will offer some positive developments about filling up our capacity, and yes perhaps the market will be a little more welcoming of positive news, so we get some benefit in the share price.

As frustrated as this whole debacle was, Nick is a take care of it guy, or rather that has been his reputation. Hopefully he can pull this thing together again and start reeling in those orders!!!

Good sign holding up in tough market. Hopefully.

Putting this behind us should be positive but not the market tanks. Can't get a break.

Well at least AVID modified the indenture for the 2029 notes so if they forget to remove the restrictive legend, it is not reason for default!

FFTT

JBAIN

Yes, very good points...I guess no one was responsible and no big deal??????

But going beyond that, just confirming guidance of $137 mil to $147 mil is not going to get it done! The backlog of $206 mil is great, but a backlog in itself does not add to the revenues. For this stock to go anywhere in the near term(2 YEARS), they will have to start converting this backlog to revenues....to go from $140 mil to $400 mil will take a lot of solid incremental revenue increases every quarter.

Even if they hypothetically increased their revenues by an additional $10 mil per quarter(which they have not been able to do over the last year since they somewhat regressed) that would just take us to $180 mil next year(2025).....$220 mil the year after(2026)......well you get the picture...even with these kinds of increases they have a long way to go to get to $400 mil....lets call this the promised land of $25 to $28 per share.....in the range of 7 years.....that is IF they are able to achieve this kind of revenue growth!

The Laughing Water Capital article and comments seem to indicate closer to a 2 year timetable to fill their capacity....not sure how they arrived at that with current guidance for 2024 of $137 to $147 mil??? That would mean that in 2025 they would pull in an additional $250 Mil in revenue???

I guess we will just have to wait and see if the next quarter finally begins to show some solid growth, as without that, we are not going anywhere quickly!

"Immaterial" Also Implies, The PPS Crash From $8's...

$20's & Also Possibly The $30's!...

Were All Over Reactions And Market Manipulation!

I'm Holding To See Rebound From This Fiasco,

Which, As Far As I'm Concerned,

Could Have Been All Planned!...

In The Future, Many May Look Back And Realize

The Buyer Of $CDMO Really Simply Manipulated

Things That The SEC Simply Doesn't Oversee!

Glta Bulls, Watchers, & StockHOLDERS!

The adjustments were immaterial.

Still had a lousy quarter.

Now paying 7% on borrowed money

No one took responsibility for the mistake

No one received consequences for the mistake

Corporate Life in the C-Suite. How sweet it is!

Btw, Today Should Resolve NASDAQ Noncompliance Issues! Glta,eom.

Does everyone feel better now? Looks like restating was a little more involved.

FFTT

JBAIN

AvidBioservices Reports FinancialResults for Third Quarter Ended January31,2024...

link:

https://ir.avidbio.com/news-releases/news-release-details/avid-bioservices-reports-financial-results-third-quarter-ended-1

Glta $CDMO Bulls, Watchers, & StockHOLDERS!

Looks like the three 10Q/A's all have the same conclusion of the adjustments, "immaterial" is the word used

https://ir.avidbio.com/news-releases/news-release-details/avid-bioservices-reports-financial-results-third-quarter-ended-1

Recorded Third Quarter Revenue of $33.8 Million --

-- Signed $41 Million in Net New Business Resulting in Record High Backlog of $206 Million --

-- Celebrated Completion of Recent Expansion Program with Grand Opening of Cell and Gene Therapy Manufacturing Facility in January 2024 --

-- Completed Convertible Debt Offering Subsequent to Quarter End, Extending Debt Maturity to 2029 --

Latest trade. 04/24/2024 17:09:55 EDT W 6.83 167902 NDD

I recently reached out and got a response quickly.

I have met Stephanie several times an actually she is a very nice person. I talk to her for a long time at the last "in person" ASM when I was the only shareholder who attended. So she remembers me. Since then she has always responded to my emails. You just can't over do it or ask her questions that would evolve non public information.

Avid Bioservices Issues New 10Q Filing, Link Attached...

https://ir.avidbio.com/node/20751/html

Glta Bulls, Watchers, & StockHOLDERS!

10K filed.

https://ir.avidbio.com/node/20736/html

I have been sending emails with question to our investor relations person Ms Diaz, but have not received any responses at all....not even to say that she is not able to respond or does not have that information, or will check with management, or when we will have our next CC, etc.???

Not sure what the point is in having an Investor Relations person if they do not respond to emails asking pertinent questions.

Anyone else having an luck getting a response from Stephanie?

Re:Laughing Water...The mention of HALO in the article had me look at their 10k...on their comment regarding bulk rHuPH20..."future capital resource expeditures" ... "the costs of investments in our ENHANZE platform and auto-injector technology including development of new versions of rHuPH20 and auto-injector devices" ...and ... "the costs to develop and validate additional manufacturing processes of rHuPH20, auto-injectors, and testosterone replacement therapies"...with Catalent being excluded from these scenarios one would think that we would have the inside track for these considerations...no?...imao...r

Well, Laughing Water Capital did a good job of explaing the incompetence that happened at Avid that led to our demand payment call on our existing financing vehicle and then having to negotiate a new convertible financing agreement....yes the interest costs alone will cost at least $10 million and had this debacle not taken place, there was a reasonable chance that Avid could have paid off the existing agreement with the increased revenues from contracts along with some standard short term bank financing which would have meant that there would have been zero dilution on this deal having the convertible set at $21.21.....and even if there was a convert on this....I mean if the financiers would have converted at $21.21...well we all would have been happy regardless of the dilution....right??!!

Now back to reality...instead of 1.25% interest on a $144 financing and a convertible at $21.21 we have a new financing deal(due 2029) of $160 million at 7% and a convertible at $9.89, which hopefully will be converted(or else we are really in trouble) at some point, which will lead of course to greater dilution!

However not all is lost, as if you believe in what Laughing Water Capital had to say, things still look very good for the share price going forward...so their target or projected price was only moved down from $30 to $33 to $25 to $28.....so depending how long it takes to fill their capacity, still a pretty strong return on the current value of the shares......unless of course there are more screw-ups down the road!

So I guess I am OK to wait a couple of more years to find out if these guys know what they are talking about and will be happy to walk away with anything in the $25 to $28 range!!!

Still waiting for the restated earnings and of course that long delayed CC.....any questions???

I agee. I just hate trading such a tight range after these type of bonehead mistakes. It is amazing how many times this investment has been knee-capped 😬

trading patter sure don't look like no options play. EOM

We should see something by the end of the year or they fill the the backlog to capacity. Which ever comes first.

I personally think we don’t hear a thing until they have some good news on the sales front. So it softens the blow of the incompetence that happened. They can say look at what we did. Everything is good no personal changes needed

Avid may be the most "misunderstood" ever 🤔🤑

AltraVue Capital is a value-oriented investment manager. We specialize in making long-term investments in a select number of high-quality businesses that have been neglected or misunderstood by the market.

Michael,

I think the 60 days is to come up with a plan that NASDAQ can approve. Here is an excerpt that I found.

"In accordance with Nasdaq's listing rules, the Company will have 60 calendar days after the receipt of a notification letter from Nasdaq to submit a plan of compliance to Nasdaq addressing how the Company intends to regain compliance with Nasdaq's listing rules, and Nasdaq will have the discretion to grant the Company up to 180 calendar days from the due date of the Form 10-K to regain compliance."

Hopefully they won't take that long.

Best regards

dw

MusicBizExec

I am almost certain its 60 days to regain compliance IMO

Michael

I didn’t see a link on their website, but you can ask Stephanie to add your info at mailto:sdiaz@vidasp.com.

Informative, unbiased article. Very good read. Sadly, seems like more information than we will ever glean from the company under current legal guidance. Certainly doesn’t shine a positive light on the players involved in the note fiasco including internal legal. Just inexcusable and there should be “accountability”. Even so paints a positive picture for Avid’s future.

I just wish Nick would stand up, communicate, take the heat and move forward even though the note fiasco was not his direct responsibility. That’s leadership. I’m ready for them to move past this. AIMO

Personally I don't think Nick should go. Nick built this thing, he should see it through. I agree with the article "These are things that one just expects to be done, especially when there is a CFO, internal legal, external legal, and the bankers who structured and sold the bond all involved."

Hart and Ziebell should go and new outside law firm and banker should be hired.

Great article, it is unfathomable that heads don't roll over this. Start with Nic the 6 mil dollar man and destroyer of shareholder value

This is about the best explanation of what happened and going forward I have read so far.

Read all information on Avid. All the way down.

https://seekingalpha.com/article/4684511-laughing-water-capital-q1-2024-letter

Interesting comments on HALO possibly moving more business to Avid

https://www.genengnews.com/insights/viral-vector-capacity-a-biopharm-problem-cdmos-can-solve/

It's been 30 days since NASDAQ issued the non-compliance notice. I think they have 180 days to cure this default but that is no excuse for the lack of communication with shareholders. In my opinion, canceling the earnings call was a huge mistake. And that was on top of an already huge mistake. Why have they not updated shareholders? The only thing that matters at this point is SALES.

SHAREHOLDERS HAVE A RIGHT TO KNOW WHERE THEIR INVESTMENT STANDS AT THIS POINT.

Could you share how you set this level of communication up? I have LinkedIn with a few of the folks so see some things there that's nowhere else. This lack of outbound communication (hopefully just to retail??) is so frustrating but if I can get more I'd be happy!

I didn’t get an email from Avid on the filing as I usually do. What’s up with that? I got emails on all the Form 4’s the other day.

Money talks. Good to see.

Altravue Capital filed a 13G yesterday raising their percent to 5.3% from 4.7%.

https://ir.avidbio.com/node/20731/html

Yes and an 80% decline or precipitous drop in a few short years, speaks volumes to so many areas of poor managerial decisions, for bookings, poor, financial fiduciary responsibility, overseeing the ledgers, nothing happening with the viral vector project and about absolutely almost 0 communication with Management since their mess up with alone interest payments, which cost us a shareholders dearly imho!!! From $35 down to $4+ now $6.71 There’s about an a bad investment as buying a boat that you know has leaks in it! Hoping for the best I’m praying for ALL!

No comment on the 200 contracts for $5 dec puts from Monday @ .85?…r

The fact we are down 65% from one year ago, kind of ruins any talk of an up trend.

well a 6-month chart shows a general uptrend since December, even with the "correction" for the convertible issue. What is your definition of an uptrend if CDMO is not in one?

FFTT

JBAIN

with sharp drops it looks like MM moving the PPS. Most people don't do market sells this early in a positive trend.

FFTT

JBAIN

Might be tough to punch through $7.50. Sure looks like someone is in the accumulation mode. Not sure if it is a MM or II.

FFTT

JBAIN

Will $CDMO Bulls EndTheDay At HighOfDay? Glta,eom.

DRUG SHORTAGES AT ALL TIME HIGH ….

Finding just what the doctor ordered is getting increasingly difficult as more and more prescription drugs become scarce.

From household names like Adderall and Ozempic to cancer treatments, a record 323 drugs were in short supply during the first quarter of 2024, the American Society of Health-System Pharmacists (ASHP) reported recently. The ASHP, which has published the metric since 2001, says the number of hard-to-get drugs has surpassed the previous record high from a decade ago.

It’s hard to overstate the stakes: Not having the right medication on hand is forcing doctors to prescribe alternatives that are often inferior to Plan A treatments. With patient well-being on the line, healthcare regulators are scrambling to find a panacea for a problem that’s been festering since 2021.

Diagnosing a cause

Experts cite a variety of reasons for the widespread shortages: Surging demand can lead to scarcities for drugs like Adderall, which is being prescribed extensively via telehealth, as well as the buzzy weight-loss drug Ozempic.

US regulations incentivize the makers of generic drugs to compete on price, diminishing the motivation for pharma companies to produce them.

Injectables like Ozempic are manufactured through a heavily regulated, technically difficult process that can easily derail.

The Biden administration announced a $5 billion plan earlier this month that it says would help keep pharmacy shelves stocked. It aims to boost transparency in obscure pharma supply chains by tasking an independent organization with scoring manufacturers on their production resilience and quality. Private hospitals that work with reliable generic drug suppliers would be rewarded with extra cash, while those who don’t would be penalized.

The ASHP criticized the proposed penalties, arguing that hospitals that don’t have the means to comply with the requirements would take a financial hit.

Looking ahead: The plan will remain just a plan until lawmakers in Congress agree to greenlight it.

https://links.morningbrew.com/c/jw7?mbcid=35045753.3696491&mid=99265661b2b9e9fcebad1b6287ef164f&mbuuid=kjeiugMA3FMwfayecW3i5Bfj

Def some rediculous silence from Avid.

Stupid me was expecting a PR about Thursday's CC.Will we hear something tom or just more guessing games. Never expected That Nick's handling Avid would turn out this way.

BUT then what do us retail investors expect!!!

Another ambiguity: In our TD Ameritrade account remaining, the Latest Earnings Announcement is set for today, 4/15/2024, but it sets the Upcoming Earnings Announcement as 4/18/2024. I gather 4/18 is correct.

|

Followers

|

838

|

Posters

|

|

|

Posts (Today)

|

3

|

Posts (Total)

|

346548

|

|

Created

|

11/07/03

|

Type

|

Free

|

| Moderators Preciouslife1 4OurRetirement | |||

Avid Bioservices, Inc. (Nasdaq “CDMO”), Tustin CA. http://www.avidbio.com

President/CEO: Nicholas Green (eff. 7-30-20 https://tinyurl.com/yczapcc7 )

Four Avid Fact Sheets a/o 2-2020: https://avidbio.com/resources/fact-sheets/

Avid Bioservices is a CDMO committed to improving the lives of patients by manufacturing products derived from mammalian cell culture for the biotechnology & biopharmaceutical industries. Services include cGMP clinical & commercial product manufacturing, purification, bulk packaging, stability testing & regulatory strategy, submission, and support. The company also provides a variety of process development activities, including cell line development & optimization, cell culture & feed optimization, analytical methods development, and product characterization.

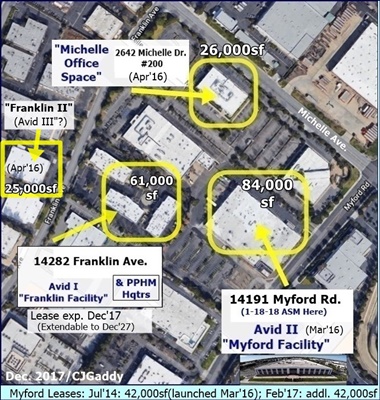

12-2019/Video: Tour of Myford Facility (2mins.): https://vimeo.com/380135562

7-2020: AVID’s Push Towards cv19 (I don’t capitalize things I hate) contracts: https://tinyurl.com/y8wzgneh

UPCOMING EVENTS: https://avidbio.com/events/

Sep1(Tue): Q1/FY21 (qe 7-31-20) Financials & Conf. Call - Transcript: https://tinyurl.com/y329llow

Sep17/Fireside Chat w/Nick Green: 18th Annual Morgan Stanley Global Healthcare Conf.: https://tinyurl.com/y4cbjjrc

Sep21-24/Virtual: Biotech Week Conf., Boston

Sep21-24/Virtual: BioProcess Intl. US Wes Conf., Santa Clara CA

...Time TBD: Presentation by Haiou Yang, PhD "Facility-Fit Driven Dev. for a mAb Production Process"

Oct20 10amPT/VIRTUAL: Annual Shareholders Mtg. https://tinyurl.com/y28blkjn 14A Proxy: https://tinyurl.com/y46ga9el

...ASM Replay (9:45): https://www.virtualshareholdermeeting.com/CDMO2020 (Control# not needed)

Apr20-22 2021/Booth#1159: INTERPHEX, NYC

Dec2(Wed) after mkt: Q2/FY21 (qe 10-31-20) Financials & Conf. Call - Transcript: https://tinyurl.com/y66xk888

Dec14-17: Antibody Engineering & Therapeutics Conf., San Diego

Quotes: Yahoo: Yahoo.com/CDMO Nasdaq: http://www.nasdaq.com/symbol/cdmo RT: http://www.nasdaq.com/symbol/cdmo/real-time

• IR: Stephanie Diaz (Investors) Vida Strategic Partners 415-675-7401 sdiaz@vidasp.com, Tim Brons (Media) 415-675-7402 tbrons@vidasp.com

SEC:

Latest 10Q 10-31-20 iss. 12-2-20 https://tinyurl.com/y3ournzr (Cash 10-31-20=$35.7mm)

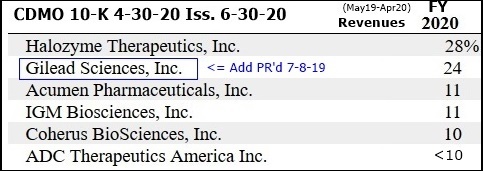

Latest 10K 4-30-20 iss. 6-30-20 https://tinyurl.com/yak25nco (Cash 4-30-20=$36.3mm)

Latest DEF14A/Proxy iss. 8-27-20 (re: 10-20-20 ASM): https://tinyurl.com/y46ga9el

ALL SEC filings for CDMO: https://tinyurl.com/yc4zjyzv

CDMO's Corp. Bylaws (a/o 11-14-14): http://tinyurl.com/y8hsppea

Poison Pill adopted 3-16-06 for 10yrs: http://tinyurl.com/yvypvh 44-pg SEC filing: http://tinyurl.com/5m57ut BUNGLER explains in plain language: http://tinyurl.com/mft4nd6

...3-17-16 Poison Pill extended until 3-16-2021 https://tinyurl.com/y74glo2n (Form8A Amendment #1)

...Poison Pill TERMINATED eff. 9-23-2019 https://tinyurl.com/y2mzx3xo

SHARES:

Shares O/S as of 11-23-20=56,726,334 - history since 4-2006: https://tinyurl.com/y66xk888 (at bottom)

...A/O 10-31-20: 3,451,000 stock options outstanding at a wgt.avg. exercise price of $6.41 (pg.16 10Q).

...MarketWatch.com for CDMO (shows Float): https://www.marketwatch.com/investing/stock/cdmo

1-12-18: S-3 Shelf Registration filed for up to $125mm https://tinyurl.com/y9qtewpw

...12-14-20: Avid raises ~$34M gross, selling 3,833,335@9.00/sh. (underwriter: RBC Capital) https://tinyurl.com/y92yr9g4

...2-20-18: Avid Raises ~$21.8M net, selling 10,294,445@$2.25 (underwriter: Wells Fargo) 8-K: https://tinyurl.com/ya3nenth 424B5: https://tinyurl.com/ycpshgxl

Total INST.+LARGE Holdings now 41,617,965 73.5% a/o 9-30-20 https://tinyurl.com/y652nxpr

13 LARGEST SHAREHOLDERS a/o 9-30-20:

1. Eastern Capital (Kenneth Dart): 4,300,992 7.6% (a/o 8-21-19 14A/Proxy: https://tinyurl.com/y9c972fa – orig. 13G filed 11-2015)

2. Tappan Street (Prasad Phatak): 4,285,000 7.6% (a/o 12-31-19 13G: https://tinyurl.com/wlcwnnv )

3. Blackrock Inc. (Larry Fink): 3,834,816 6.8% (-111,172 a/o 9-30-20 Nasdaq Inst.)

4. IsZo Capital Mgt. (Brian Sheehy): 3,459,888 6.1% (-88,144 a/o 9-30-20 Nasdaq Inst.)

5. Millennium Mgt. 2,678,984 4.7% (+633,918 a/o 9-30-20 Nasdaq Inst.)

6. Vanguard Group 2,659,738 4.7% (-19,553 q/e 9-30-20 Nasdaq Inst.)

7. Snyder Capital 2,302,621 4.1% (-2,258 a/o 9-30-20 Nasdaq Inst.)

8. Altravue Capital 1,973,349 3.5% (+39,534 a/o 9-30-20 Nasdaq Inst.)

9. Wellington Mgt. 1,503,162 2.7% (+236,947 a/o 9-30-20 Nasdaq Inst.)

10. Sargent Invest. Grp. 1,052,099 1.9% (-11,000 a/o 9-30-20 Nasdaq Inst.)

11. State Street 992,280 1.8% (-65,922 a/o 9-30-20 Nasdaq Inst.)

12. Portolan Capital 963,374 1.7% (+528,662 a/o 9-30-20 Nasdaq Inst.)

13. Silvercrest Asset Mgt. 878,805 1.6% (-16,746 a/o 9-30-20 Nasdaq Inst.)

Inst. Holdings (Nasdaq) - updated 45-days after each qtr-end: http://www.nasdaq.com/symbol/cdmo/institutional-holdings

INSIDER-Trans: https://tinyurl.com/ycpw4j9z (formerly PPHM thru 2017: http://tinyurl.com/ypkow8 )

Short Interest, updated twice a month: https://www.nasdaq.com/symbol/cdmo/short-interest

A-T-M (At-The-Market) Sales 3/2009 - 7/14/17 ($272,500,000gr./34,869,747sh=$7.81/sh): http://tinyurl.com/yagmu2on

PPHM shares were 1:7 Reverse Split eff. 7-10-17 (315mm/$.606=>45mm/$4.24) http://tinyurl.com/yymtzcm9

PPHM shares were 1:5 Reverse Split eff. 10-19-09 (~237mm/$.64=>~47.4mm/$3.20) http://tinyurl.com/ykuw588

Potential Value: 9-19-2017: Catalent acquires CDMO Cook Pharmica for $950M ($179Msales x 5.3; EV/EBITDA=17.3) http://tinyurl.com/yd46m8py

AVID TEAM: https://avidbio.com/leadership/ - Open Jobs: https://avidbio.applicantpro.com/jobs

7-30-20: Nicholas Green (ex-Therapure Biopharma) becomes President/CEO of Avid - 6-25-20 PR: https://tinyurl.com/yczapcc7

4-13-20: Avid Hires 2 Senior Directors of Bus. Dev: Jason C. Brady & Sylvia Hinds https://tinyurl.com/sq2679g

1-8-20: Avid Appoints Timothy Compton as Chief Commercial Officer (repl. Tracy Kinjerski) https://tinyurl.com/ydww58sn

7-26-19: Catherine Mackey, PhD (ex Pfizer VP) joins Avid's BOD, replacing Joel McComb https://tinyurl.com/y3xhqmvm

5-8-19: Richard (Rick) B. Hancock named Interim President/CEO; Roger Lias resigns https://tinyurl.com/y4pqdwyc

7-16-18: Daniel Hart (ex-ENO Holdings) joins Avid as CFO https://tinyurl.com/ychz45p2

7-16-18: Michael Faughnan (ex-Lonza/WuXi Biologics) joins Avid as Sr.Dir./BusDev/WestC https://tinyurl.com/yaozdggz (Left 5-2019)

5-29-18: Sandra C. Carbonneau (ex-Lonza) joins Avid as Dir./BusDev./EastCoast https://tinyurl.com/ybvrwn2l (left 12-2019)

5-8-18: Magnus Schroeder (ex-AGC Biologics) joins Avid as VP/Process Sciences https://tinyurl.com/y7tpswaw

2-23-18: CFO Paul Lytle voluntarily resigns eff. 5-24-18 (2-23-18 +90days), "CFO search underway" https://tinyurl.com/ybnjzbv6

9-11-17: Roger J. Lias (ex-Allergan) to become Avid’s CEO and join PPHM’s BOD eff. 9-25-17 https://tinyurl.com/yddufw4s (left 5-8-19)

11-29-17: Tracy L. Kinjerski joins Avid as VP/Bus.Operations https://tinyurl.com/yc4zenkc (Left 1-8-2020)

Profiles of all 7 BOD members: http://ir.avidbio.com/corporate-governance/board-of-directors

...Joseph Carleone/Chair, Nicholas Green(CEO), Richard Hancock, Gregory Sargen, Mark Bamforth, Patrick Walsh, Catherine Mackey

10-24-17: Peregrine Adds Patrick D. Walsh to BOD, "An Industry Veteran with 30+yrs Experience Leading Successful CDMO Org’s” http://tinyurl.com/y3jo2rv7

10-19-17: Peregrine Adds Mark R. Bamforth to BOD, "10yrs/Genzyme; 30yrs of biologics leadership experience, incl. founding 2 CDMOs" http://tinyurl.com/y6ydcaof

ANALYST COVERAGE: http://ir.avidbio.com/analyst-coverage

Also see: https://www.marketbeat.com/stocks/NASDAQ/CDMO/price-target

Janney Montgomery Scott - Paul Knight PT=$10

H.C. Wainwright & Co. - Joseph Pantginis PT=$9

Craig-Hallum Capital Group - Matt G. Hewitt PT=$10

First Analysis Securities - Joseph Munda PT=$7.50

Stephens Inc. - Jacob Johnson PT=11 (10=>11 9-2-20)

FINANCIALS & BUSINESS DEV.:

2-3-21: Avid to Mfg. CV19 Therapeutic Lenzilumab for Humanigen https://tinyurl.com/1hzzksxa

8-26-20: Mapp Biopharmaceutical signs w/Avid for ClinDev of Antiviral Antibody (MBP091) https://tinyurl.com/yxwvr949 BARDA #HHSO100201900018C($16.5M+Opt/$30M), see: https://tinyurl.com/yye8t5nx

8-20-20: Oragenics signs Dev/Mfg Agreement with Avid for COVID-19 Vaccine “TerraCoV2” https://tinyurl.com/yxqg3w4v

8-6-20: Iovance Biotherapeutics signs w/Avid(+Aragen) to Dev+Mfg. IOV-3001 (IL-2 Analog) https://tinyurl.com/y2lgzh6x

7-28-20: Avid Teams with Argonaut to add “Parenteral Fill-Finish Services” https://tinyurl.com/y2lgzh6x

5-6-20: Avid Teams with Aragen to speed up drug dev./delivery timelines https://tinyurl.com/ycuu2m5r

4-23-20: Avid receives $4.4M PPP/CV19 Loan (can apply for forgiveness) 8K: https://tinyurl.com/yaltupxa

...5-12-20: Avid Pays Back $4.4M PPP/CV19 Loan (“New SBA Guidance/abundance of caution”) 8K: https://tinyurl.com/y993tkk6

3-10-20: CDMO's Revs & Burns By Qtr Table, FY07/Q1 thru FY20/Q3 (q/e 1-31-20): https://tinyurl.com/s9cmzmf

......Avid FY20 (fye 4-30-20) revenues guidance: $55-59M; committed backlog=$58mm at 1-31-2020.

7-8-19: Avid Signs New Top10 Global Pharma and Expands Existing Cust. Relationship https://tinyurl.com/yyq8zgb9

6-27-19: "The 5 new clients signed in late FY2018 contributed significantly to revenue diversification in FY2019." SEE CUST SPLITS for FY19: http://tinyurl.com/y5j4dlsv

4-24-18: ”In recent weeks, Avid has signed new agreements with 3 addl. undisclosed intl. drug dev. companies (that’s 4 thus far in CY2018)” https://tinyurl.com/y89whc8d

3-1-18: Acumen Pharm. selects Avid for Process Dev. & Mfg. of ACU193 (Alzheimer’s) https://tinyurl.com/y8jvwleq http://www.acumenpharm.com

2-21-18: Enzyvant selects Avid to commercially mfg. RVT-801 (Farber disease) https://tinyurl.com/yd5xhcx8 http://www.enzyvant.com

2-12-18: Peregrine’s Legacy PS-Targeting IP Sold to ONCOLOGIE INC. (Boston, CEO: Laura E. Benjamin) for $8M/upfront, $95M/milestones https://tinyurl.com/yam8gb3h

...NOTE: 2-13-18: Oncologie Licenses Mologen’s immunotherapeutic ‘lefitolimod’ (TLR9 agonist) https://tinyurl.com/y9z54f4x “ONCOLOGIE is backed by top-tier intl. investors and has the objective to dev. novel personalized medicines in the field of immuno-oncology."

2-28-17: Avid & Cook (acq. by Catalent 12-2017 for $950M; $179Msales x 5.3; EV/EBITDA=17.3) remain Halozyme's 2 CMO's (“working to scale-up/validate/qualify Avid II/Myford for Roche collab.”): http://tinyurl.com/h75teta

FACILITIES: https://avidbio.com/facilities/

10-8-19: Avid Announces Completion of Expansion of Process Dev. Capabilities & Labs https://tinyurl.com/y3hfwst9

...will “significantly accelerate Avid’s ability to drive efficient & rapid on-boarding of new cust. pgms progressing to mfg.”

4-24-18: Avid adding Process Dev. Labs, upgrading capabilities (in phases; total will be >6000sq; 1st one ready Q3CY18/Jul-Sep'18) https://tinyurl.com/y89whc8d

5-2017: Avid II (Myford) adds 2 MilliporeSigma Mobius 2,000L single-use bioreactors; total mfg. capacity now ">11,000L". http://tinyurl.com/ky7bmu4

5-10-17: Halozyme comments on Avid II(Myford) expansion in their 3-31-17/10Q pub. 5-9-17: http://tinyurl.com/mrl34uk

..."validation of the new facility is scheduled to end in Q2/2017… Once this new facility is approved, it will become the primary source for Roche of bulk rHuPH20.”

6-2-16: Corp.Update – Avid Expansion & Drug Development - http://tinyurl.com/zvmhqmr

3-7-16/Avid II: Formal Commissioning of Avid's New 40,000sq "Myford" Facility, “single-use/fully disposable” (potentially $40M addl revs) http://tinyurl.com/y5jmfpo3

12-10-15/Avid II: Avid Expansion into MYFORD Facility now GMP-run ready (potential +$40mm sales) - contemplating further expansion http://tinyurl.com/y539yut4

12-10-14: Avid to Double Mfg. Capacity(“Myford Expansion”) http://tinyurl.com/y2sqoy2u & http://tinyurl.com/kmdgq8t

PRESENTATIONS & ARTICLES: https://avidbio.com/events/

Sep17/Fireside Chat w/Nick Green: 18th Annual Morgan Stanley Global Healthcare Conf.: https://tinyurl.com/y4cbjjrc

5-18-20: Avid Listed In Top CMO Awards Article https://tinyurl.com/yb5cnh6m

...”Avid received 5 CMO Leadership Awards categories, incl. 2 Champion designations: Expertise & Service.”

10-25-18/BioPharma: Roger Lias Interview, “Avid expansion to Triple Process Dev. Capacity” https://tinyurl.com/ybtuk29m

Sept2018/BioTechWEEK: Tracy Kinjerski (VP/BusOP) interview: Avid’s differentiators (6mins.) https://www.youtube.com/watch?v=x3tzo4pZivk

1-29-18: NobleCon14 - 14th Annual Inv. Conf., Ft.Laud. => Roger Lias' webcast/slideshow https://tinyurl.com/yanwk9yo

11-15-17/Outsourcing-Pharma: “How This R&D Company (Peregrine) is Transitioning to a Pure-Play CDMO: ‘Opportunities Are Almost Endless’" - Recap of interviews with Steve King & Avid Pres. Roger Lias http://tinyurl.com/y7dv9faz

CONFERENCE CALLS & ASM's:

12-2-20: Qtly. Conf. Call (Green/Hart/Compton) PR & Transcript https://tinyurl.com/y66xk888

10-20-20 Annual Shareholders Meeting - Replay (9:45): https://www.virtualshareholdermeeting.com/CDMO2020 (Control# not needed)

9-1-20: Qtly. Conf. Call (Green/Hart/Compton) PR & Transcript https://tinyurl.com/y329llow

...CEO N.Green: ”My first few weeks have done nothing but confirm my view that I believe Avid to be a strong and state-of-the-art company with significant opportunity for growth."

6-30-20: Qtly. Conf. Call (Hancock/Hart/Compton) PR & Transcript https://tinyurl.com/y9zbgmos

...RickH: "Based on our customers' growing demand and our expanding business development activity, we believe that we will significantly increase capacity utilization in 2021 and beyond. Accordingly, we have entered into a new phase of planning for the expansion that will support our growing business in the years to come.”

...”Top10 Pharma customer added 7-2019 named in 10-K: GILEAD SCIENCES.”

3-10-20: Qtly. Conf. Call (Hancock/Hart/Compton) PR & Transcript https://tinyurl.com/s9cmzmf

12-9-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/tfewuzc

9-5-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/y6t8zfur

6-27-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/y6zdjyu2

...Rick Hancock, "Most importantly, during Q4, the Company achieved positive income, generating cash from dev. & mfg. operations for the 1st time since the beginning of the CDMO transition (Jan'18)."

3-11-19: Qtly. Conf. Call (Lias/Hart) PR & Transcript http://tinyurl.com/yy6dvjvc

12-3-18: Qtly. Conf. Call (Lias/Hart//Kinjerski) PR & Transcript https://tinyurl.com/y9n374kp

10-4-18: ASM/2018 (@Myford Facility) - Roger Lias’ Slideshow & Attendee Report https://tinyurl.com/yctfzhlb

9-10-18: Qtly. Conf. Call (Lias/Hart) PR & Transcript https://tinyurl.com/y8oc6hx8

...Roger Lias, "During the qtr, we advanced the projects of our existing active clients and continue to engage with numerous potential new customers."

7-16-18: Qtly. Conf. Call (Lias/Kinjerski) PR & Transcript https://tinyurl.com/yaozdggz

...Roger Lias, “In a short period, we’ve established a targeted business dev. operation that is actively providing visibility for Avid Bioservices within our fast growing but competitive marketplace.”

3-12-18: Qtly. Conf. Call (Lias/Kinjerski/Lytle) PR & Transcript https://tinyurl.com/yakdl4wj

...Roger Lias, ”I'm pleased to be able to report that in a very short period of time we've generated significant interest from both emerging & growth biopharmaceutical players and from pharmaceutical multinationals. I'm confident that the plan we're executing will drive a considerable increase in backlog and the opportunity to further enhance capacity utilization in the future.”

......From the 3-12-18 PR: “At present, we are in late-stage negotiations with several potential new customers and expect to announce the executed agreements before the end of the FY[4-30-18].”

1-18-18: ASM/2017 (@Myford Facility) - Roger Lias’ Slideshow & Attendee Reports https://tinyurl.com/yca6enbr 12-7-17 PROXY/14A: https://tinyurl.com/y7qprpg9

12-11-17: Qtly. Conf. Call (Lias/Lytle) Transcript https://tinyurl.com/ybycb2s6

...Roger Lias, "the company is undergoing a broad-scale transformation, the goals of which are to shift complete focus to the Avid Bioservices CDMO business and the complete divestiture of all of Peregrine's legacy R&D assets, which include bavituximab."

9-11-17: Qtly. Conf. Call (King/Lias/Lytle) Transcript http://tinyurl.com/y9y8qdac

...Steve King: “For this reason, we have concluded that in order to best position Peregrine’s R&D assets for successful development, they should be advanced by a partner with the appropriate expertise and ample resources to invest in the necessary clinical trials. To that end, we have been working diligently towards the transformation of the overall business to becoming a pure-play CDMO, while assessing the best strategic options for the R&D assets that would allow stockholders to directly see the future value from their continued developments. By partnering & eliminating future R&D expenditures, we believe we are best positioning Avid for future growth. Through reinvestment & expansion, we believe we will attract new customers and extend current contracts that will help position Avid as a leading U.S. CDMO. We are moving forward expeditiously with strategic discussions as we recognize the need to move quickly both from the R&D & CDMO standpoints. We hope to bring this process to completion over the coming months and will update you on our progress.”

7-14-17: Qtly. Conf. Call (King/Shan/Lytle) Transcript http://tinyurl.com/yb4wulvu

...Steve King: “We are seriously considering the possibility of separating our 2 distinct businesses, Avid and R&D/PS-Targeting.”

3-13-17: Qtly. Conf. Call (King/Shan/Worsley/Lytle) Transcript http://tinyurl.com/grhwjvy

...Steve King: “We believe the recent improvement of stock price is a growing recognition of the value of Avid, and having the full value of the Avid business reflected in our stock price is a top priority.”

12-12-16: Qtly. Conf. Call (King/Shan/Hutchins/Lytle) Transcript http://tinyurl.com/hhn4gga

...Steve King: “Our goal is to bring the overall company to profitability within the next 18mos. We believe just the value of Avid Bioservices is far greater than our current market cap and is only growing in value."

10-13-16 ASM/2016: ATTENDEE Reports & Link to CEO Steve King's 35min/45slide webcast: http://tinyurl.com/jx7ouay

Feb. 2018: Peregrine Pharmaceuticals completed its Mid’17-Early’18 Transition to a Pure-Play CDMO

(Contract Development & Manufacturing Organization), Avid Bioservices, Inc. - CEO: Roger Lias.

**FULL PPHM=>CDMO Transition History (Ronin/SWIM): https://tinyurl.com/ybqvzwhg

1-8-17: Peregrine chgs. name to “Avid Bioservices, Inc.”; new ticker: “CDMO” (+CDMOP) https://tinyurl.com/y8vhjow4

2-12-18: Peregrine’s Legacy PS-Targeting IP Sold to ONCOLOGIE INC. (Boston, CEO: Laura E. Benjamin) for $8M/upfront, $95M/milestones https://tinyurl.com/yam8gb3h

...12-13-18/8-K: Overview of Oncologie sale: https://tinyurl.com/yab9c6cr

NOTE: “PS-targeting Exosome tech. not included; back to UTSW", see: https://tinyurl.com/yakdl4wj

Click here for an ARCHIVE of the History of Peregrine’s Anti-PS/Bavituximab Platform - MOA, Trials, and Activity over the years, from early 2000’s thru 2017, prior to being Sold to ONCOLOGIE:

https://tinyurl.com/y8pq4rhc

Of Interest (post Oncologie Sale):

Oncologie's website: https://oncologie.com/true-home-v2/ NEWS: https://oncologie.com/newsroom/

4-20-18/AACR’18: MSKCC(LudwigCC) Tweets about 2 WolchokLAB/”PPHM” Anti-PS Posters https://tinyurl.com/ycgjhvqa

4-26-18: New Bavi+Keytruda/LIVER Ph2 IST Trial, Sponsor=UTSW, Collab=MERCK https://tinyurl.com/y7fd9vdb

6-7-18: Oncologie Obtains $16.5M Seed Funding Led by Pivotal bioVenture Partners China Fund https://tinyurl.com/ybrrbgg7

6-7-18/BioCentury: Laura Benjamin states, “Oncologie plans to begin a trial mid-summer '18 evaluating Bavi to treat HCC and a P-O-C trial in Gastric cancer in 1Q19/2Q19.” https://tinyurl.com/ycb8r7sm

12-3-18: During q/e 10-31-18, Avid sold remaining legacy R&D asset, r84(anti-VEGF), to Oncologie for $1.0M upfront. Avid is eligible to receive up to an addl. $21M in dev/reg./comm. milestones, and low to mid-single digit royalties on net sales upon commercialization of products utilizing r84 https://tinyurl.com/y9n374kp

11-4-19/PharmaBoardroom: Interview with Oncologie CEO Laura Benjamin discussing the 2 ongoing Bavi Trials w/Keytruda (USA UK Taiwan S.Korea) https://tinyurl.com/ydf6zhsv

...Dr. Benjamin, "We have high expectations of bavituximab and have obtained the global rights for this compound."

...Ongoing Trial #1 (N=80): Open Label, Bavi+Keytruda Adv. Gastric/GEJ Cancer https://clinicaltrials.gov/ct2/show/NCT04099641

......1-17-2020 ASCO/GI Poster: https://oncologie.com/wp-content/uploads/2020/01/2020-01-17-ASGO-GI-poster-final-draft.pdf

...Ongoing Trial #2 (N=34 UTSW): Open Label, Bavi+Keytruda Adv. Hepatocellular Carcinoma https://clinicaltrials.gov/ct2/show/NCT03519997

6-11-20/Fiercebiotech: Oncologie Reels In $80M To Push Clinical Pgms/Build Pipeline https://tinyurl.com/yany8f34 & https://tinyurl.com/y8p9artk

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |