Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Maybe Avid commercial team actually sold something in Q4 2024?

HALO is having a good run. 38.10 on 4.30, now 45.42.

Update: "...2024 Russell Reconstitution schedule is as follows:"...

Tuesday, April 30th – “Rank Day” – Index membership eligibility for 2024 Russell Reconstitution determined from constituent market capitalization at market close.

Friday, May 24th – Preliminary index additions & deletions membership lists posted to the website after 6 PM US eastern time.

Friday, May 31st, June 7th, 14th and 21st – Preliminary membership lists (reflecting any updates) posted to the website after 6 PM US eastern time.

Monday, June 10th – “Lock-down” period begins with the updates to reconstitution membership considered to be final."

source link:

https://www.lseg.com/en/media-centre/press-releases/ftse-russell/2024/russell-reconstitution-2024-schedule

**********************************

So, By Now Some May Already Be Aware Of Which Companies Are On The Yet To Be Released List...

And They Could Be Buying CDMO Shares Early???

Hence, PPS Is Heading up, Up, UP,...

Glta Bulls, Watchers, & StockHOLDERS!

Institutional Shares (Long) 68,579,367 - 108.03% (ex 13D/G) - change of 8.12MM shares 13.85% MRQ

Institutional Value (Long) $ 425,115 USD ($1000)

Has Anyone Seen Russell Reconstitution List Yet? Glta,eom.

Interesting Opening! Glta $CDMO Bulls, Watchers, & StockHOLDERS!eom.

Anyone heard from levitating little bear lately? We seem to be back in the accumulation phase with heavy MM trading.

FFTT

JBAIN

sure looks like a scoop em all up, sell most down kind of accumulation. But for whom?

Let us hope he got something good to say and didn't go there to roast marshmallows.

Someone expecting new info to come out of the fireplace today?…I do know who should be standing in it tho…r

Unfortunately hardly any volume to speak of.

Will FridayNite’s Bullish AH Trading Continue InPreMarket Tomorrow?…

And, Could It Relate To Prior Posts/Discussions

Regarding Takeover/Buyout Rumor?

Glta $CDMO Bulls, Watchers, & StockHOLDERS!

Time&Sales for CDMO Trade Code Legend

Recent

Historical

Date:

Start time:

End time:

Go

Export

Date/Time Price Shares Exch/Mkt

05/10/2024 19:58:53 EDT I 9.00 1 ARCA

05/10/2024 19:58:52 EDT I 9.00 1 CBOE BZX

05/10/2024 19:58:04 EDT I 9.00 10 ARCA

05/10/2024 19:43:41 EDT I 9.15 1 ARCA

05/10/2024 19:37:43 EDT I 9.08 49 ARCA

05/10/2024 19:37:43 EDT I 9.04 1 ARCA

05/10/2024 19:37:43 EDT I 8.99 1 CBOE BZX

05/10/2024 19:36:12 EDT I 8.76 26 ARCA

05/10/2024 19:29:28 EDT T 9.25 100 NDD

05/10/2024 19:28:32 EDT I 9.09 98 ARCA

05/10/2024 19:28:32 EDT I 9.09 1 ARCA

05/10/2024 19:28:32 EDT I 9.04 1 ARCA

05/10/2024 19:28:32 EDT I 8.99 1 CBOE BZX

05/10/2024 19:28:32 EDT I 8.99 1 CBOE BZX

05/10/2024 19:26:56 EDT I 8.75 26 NDD

05/10/2024 19:26:26 EDT T 8.75 100 ARCA

05/10/2024 19:26:17 EDT T 9.17 100 ARCA

05/10/2024 19:25:39 EDT I 9.21 16 ARCA

05/10/2024 19:25:39 EDT I 9.10 30 ARCA

05/10/2024 19:25:39 EDT I 9.09 53 ARCA

05/10/2024 19:25:39 EDT I 9.05 1 ARCA

05/10/2024 19:25:39 EDT I 8.99 1

CNBC SHOWS AFTER HOURS PPS OF $9.25 up another .58 after the regular hours gain of .53! Hopefully this current momentum will carry through upwards and onwards!

ALL THE BEST TO ALL LONGS HERE …..

The stock is kind of drifting aimlessly, kind of like the Avid commercial sales team.

For those who think the buildout was done for a specific piece of business or customer.

If it was then our top management team is even more incompetent an I thought.

Since the buildout started Avid has hired

1 CCO

3 Marketing people

1 Conference person

4 sales people (or they call them Sr. Directors lol)

Well it certainly is a mystery!....This stock seems to trade to the beat of a different drummer and there does not seem to be any correlation lately to what the overall stock market is doing....market can be up or down, but Avid just seems to to be on a different path!

westjetter or anyone

How do we have over 104 % institutional ownership and the price drop of .30 on less then 100,000 shares ? I just don't get it TIA

Michael

We have had a pretty decent run (inspite of our convertible debacle), so a pullback here is not unexpected.....lets hope our new Institutional holders are in it for the longer term. Meanwhile it will be nice to trade in the $8's until we get some additional news or updates in about a month....as in hopefully we will hold the $8's to get us ready for the next run higher!?

Hi UNPATHED; I didn’t send you a private message. I responded to your message which makes it look like it was a private message but yes, I fully understand and having been in this since Tech clone in 1996 I guess I understand and don’t understand a whole Lotta things anymore! Blessings and hope all is well thank you

West, TCLN/PPHM/CDMO has been a trader dream.

This is a real company, very predictible. We now have a 400-500M/yr capacity with margin from 7 to 35%. Do the maths.

This capacity is FDA/GMP certified.

It is not an easy market to get in. Moat wise.

63Mx15 is just under 1B.

Very curious how you arrived at the $15 per share number? You are assuming our convertible financiers will convert in the $11 to $11.50 range at which point the buyout/takeout agreement is announced???

I don't quite see it, but it certainly is plausible and not out of the realm of possibilities.....if you get this right, you should open up your own Financial Planning office, or even a mini hedge fund???

Either way, it will be interesting to see how we trade over the next month...especially after our next CC, where fingers crossed, we got some solid guidance for the year and years ahead???

And yes...we will watch Halozyme.

Can't reply to your private message. Been following H5N1 for 25 years or so and well aware of catastrophic outcomes. Like to post facts, which were deleted by mods while your headline remains. Hmmm.

I Wonder, Could Cohen/P72 Be TakeoverActivist(Or Buyer)? EasyDouble-Glta,eom.

Thanks. IF That Happens, Many II’s Will Be…

Upset. It Will Be Possible Those II’s Could Force PPS Above That $15 Target, To Lessen Their Losses.

Best Wishes To All StockHOLDERS!

Bavi’s success doesn’t surprise me one bit. Problem is OncXerna is in no position to pay phase 3 royalties. Thus the slow walk of Bavi in all these phase 2 trials. Eliminate phase 3 royalties and allow Bavi to proceed to potential approval without the added financial burden for a yet unproven entity. Take royalties on approval only. Win win for everyone. AIMO

Quite a it of activity the last few days. From Fintel. Anyone know 12 West Capital? Added 2.75 mil shares. Institutions now own 104.87%

File Date Source Investor Type Avg Price

(Est) Shares ? Shares

(%) Reported

Value

($1000) ? Value

(%) Port Alloc

(%)

2024-05-08 13F Russell Investments Group, Ltd. 176 -99.96 1 -99.97

2024-05-08 13F Great Lakes Advisors, Llc 65,283 -2.85 437 0.23

2024-05-07 13F Sei Investments Co 138,963 -1.97 931 1.09

2024-05-07 13F Susquehanna International Group, Llp 91,275 -49.91 612 -48.40

2024-05-07 13F Swiss National Bank 124,400 0.00 833 3.09

2024-05-07 13F Arizona State Retirement System 17,380 -1.49 116 1.75

2024-05-07 13F Cornerstone Planning Group LLC 15 0.00 0

2024-05-07 13F New York State Common Retirement Fund 887,302 17.02 6 25.00

2024-05-07 13F 12 West Capital Management LP 2,750,000 18,425

2024-05-07 13F M&t Bank Corp 103,567 0.13 694 3.13

2024-05-06 13F SG Americas Securities, LLC 0 -100.00 0

2024-05-06 13F Advisory Services Network, LLC 0 -100.00 0

2024-05-06 13F Teacher Retirement System Of Texas 14,073 -3.54 0

2024-05-06 13F Quantbot Technologies LP 0 -100.00 0

2024-05-06 13F HighTower Advisors, LLC 11,241 74

2024-05-06 13F Addison Advisors LLC 158 0.00 1 0.00

2024-05-06 13F Parallel Advisors, LLC 1,956 -1.86 13 8.33

Either going private or being bought out.

11.50+30%

This company is 98% down from the March 2000 madness.

Remeber I bought at 0.25 DEC 99 and sold at 16 MAR 2000.

Since then it was a trader paradise. Shorts and pumpers had fun.

The CDMO industry will florish in the next 5 years.

We will not benefit from this. 15$ and out. Let's see.

(No more poison pill... How in the world you lose 1.25% notes to be replaced by 7%???)

Hint...Watch HALO

Seems to be talk about Bavituximab in the last week?

Don't know what it means?

https://www.usnews.com/news/health-news/articles/2024-05-06/combo-therapy-may-be-advance-against-liver-cancer

https://www.utsouthwestern.edu/newsroom/articles/year-2024/may-combined-therapy-live-cancer.html

Google "Bavituximab" in the last week

How do you know this?

Your Confidence Seems High, But, Just For Clarification…

Are you suggesting that first the PPS will reach $15, then the announced takeover price would be + an additional 30%? So, takeover price = about $20?

Or, When PPS hits about $11.50, the takeover price would be plus the 30% incentive. So, takeover price ends up around $15?

Either way, the tone of your confidence seems to imply that this won’t be something that happens in 2025. Possibly by end of spring? Maybe sooner?…

Thanks in advance for your reply.

Glta Bulls, Watchers, & StockHOLDERS!

As I said last week, it is really unfortunate we will be taken over at 15.

A lot of II bought in the 20's.

More than 90% of stock is in II hands.

Time will tell at what speed we get to 15. It's gonna be like +30% when news hit. Then finito. No more trading...

Looks like the doors at Avid have been opened up with these conferences.

Would have to say that from my point of view our problems are behind us.

How long has it been since our stock has gone up 7 days in a row??

Avid Bioservices to Participate at Upcoming Investor Conferences

May 7, 2024 at 4:05 PM EDT

Download PDF

TUSTIN, Calif., May 07, 2024 (GLOBE NEWSWIRE) -- Avid Bioservices, Inc. (NASDAQ: CDMO), a dedicated biologics contract development and manufacturing organization (CDMO) working to improve patient lives by providing high quality development and manufacturing services to biotechnology and pharmaceutical companies, today announced that the company will participate at two upcoming investor conferences. Nick Green, president and chief executive officer, will be the featured speaker in a fireside chat at the RBC Capital Markets 2024 Global Healthcare Conference, and will deliver a corporate presentation at the 2024 Bank of America Securities Healthcare Conference.

Details of the company’s participation are as follows:

RBC Capital Markets 2024 Global Healthcare Conference

Conference Date: May 14-15, 2024

Fireside Chat Time/Date: 4:35 – 5:05 p.m. Eastern on Tuesday, May 14, 2024

Location: InterContinental New York Barclay, New York

2024 Bank of America Healthcare Conference

Conference Date: May 14-16, 2024

Presentation Time/Date: 11:55 a.m. – 12:10 p.m. Eastern on Thursday, May 16, 2024

Location: Encore Hotel, Las Vegas, NV

About?Avid Bioservices, Inc.

Avid Bioservices (NASDAQ: CDMO) is a dedicated contract development and manufacturing organization (CDMO) focused on development and CGMP manufacturing of biologics. The company provides a comprehensive range of process development, CGMP clinical and commercial manufacturing services for the biotechnology and biopharmaceutical industries. With more than 30 years of experience producing biologics, Avid's services include CGMP clinical and commercial drug substance manufacturing, bulk packaging, release and stability testing and regulatory submissions support. For early-stage programs the company provides a variety of process development activities, including cell line development, upstream and downstream development and optimization, analytical methods development, testing and characterization. The scope of our services ranges from standalone process development projects to full development and manufacturing programs through commercialization. www.avidbio.com

Contacts:

Stephanie Diaz (Investors)

Vida Strategic Partners

415-675-7401

sdiaz@vidasp.com

Tim Brons (Media)

Vida Strategic Partners

415-675-7402

tbrons@vidasp.com

Block trade

05/07/2024 14:15:03 EDT V 8.59 199700

Well, we broke through, but low volume, so it may not hold.

how many times do we have to bump up against the 8.50 PPS range before we break through?

The share price is slowly inching higher....can we stay above $8 without news? Also we are only about a month away from our next CC and year end financials....will we have the beat I am hoping for, along with strong revenue projections for next year, and dare I say, some talk of a profit????

And just to throw one more thing into the mix, it seems the FTC is taking a look at the Novo purchase of Catalent to determine whether the sale will lesson competition? So this just throws a little more uncertainty not only for Novo and Catalent shareholders, but also for their customers???

So....I would think this can only help Avid??

Preciously relevant: "The FDA reported that one in five milk samples in the U.S. showed traces of the virus. Samples from regions with infected herds were more likely to have traces of the virus.

The FDA says that pasteurized milk is still safe to drink as pathogens would be killed in the process. However, unpasteurized milk has been shown to have live H5N1 viruses."

Pure FYI: https://share.newsbreak.com/6t0dloe4

Chart starting to show steady increase in pps

Do we know when our next earnings will be announced?

Maybe... when Avid announces that they have acquired enough business to make a profit? Just bouncing around some ideas here![]()

Well the short answer, is I have no idea, but also not really sure what triggered the first leg up and then of course the leg back down(well the down is easier than the up as no doubt some of our convertible financing issuers probably led the shorting charge once they realized that converting was off the table)!

But a possible answer would be a solid beat for this year and increased projections going forward. During the CC, it really did sound like Nick was possibly hinting that they may beat their projections...just they way he spoke and at that time he would probably already have a pretty good idea since the next quarter was almost over by the time they had the delayed CC.

Now if I am wrong here, I will be gravely disappointed, but I am going to say that they break $150 mil last year beating their $137 to $147 projection. Now going forward, they really have to start ramping up and taking advantage of their unused capacity so is there a chance they do $175 mil plus?

And finally, they have used this $400 mil as max capacity for over 2 plus years now....with the ongoing inflation, I am going to say this figure is too conservative. I also believe that once(if) they get closer to $400 mil, they will be able to squeeze out a little more....maybe a fair bit more, but that is all speculation.

And with Steve C in the picture, anything can happen....if he is going for a quick trading profit, we will pay the price...if on the other hand he sees something more....well we just may benefit!

More seriously what will trigger the next leg.

|

Followers

|

838

|

Posters

|

|

|

Posts (Today)

|

6

|

Posts (Total)

|

346551

|

|

Created

|

11/07/03

|

Type

|

Free

|

| Moderators Preciouslife1 4OurRetirement | |||

Avid Bioservices, Inc. (Nasdaq “CDMO”), Tustin CA. http://www.avidbio.com

President/CEO: Nicholas Green (eff. 7-30-20 https://tinyurl.com/yczapcc7 )

Four Avid Fact Sheets a/o 2-2020: https://avidbio.com/resources/fact-sheets/

Avid Bioservices is a CDMO committed to improving the lives of patients by manufacturing products derived from mammalian cell culture for the biotechnology & biopharmaceutical industries. Services include cGMP clinical & commercial product manufacturing, purification, bulk packaging, stability testing & regulatory strategy, submission, and support. The company also provides a variety of process development activities, including cell line development & optimization, cell culture & feed optimization, analytical methods development, and product characterization.

12-2019/Video: Tour of Myford Facility (2mins.): https://vimeo.com/380135562

7-2020: AVID’s Push Towards cv19 (I don’t capitalize things I hate) contracts: https://tinyurl.com/y8wzgneh

UPCOMING EVENTS: https://avidbio.com/events/

Sep1(Tue): Q1/FY21 (qe 7-31-20) Financials & Conf. Call - Transcript: https://tinyurl.com/y329llow

Sep17/Fireside Chat w/Nick Green: 18th Annual Morgan Stanley Global Healthcare Conf.: https://tinyurl.com/y4cbjjrc

Sep21-24/Virtual: Biotech Week Conf., Boston

Sep21-24/Virtual: BioProcess Intl. US Wes Conf., Santa Clara CA

...Time TBD: Presentation by Haiou Yang, PhD "Facility-Fit Driven Dev. for a mAb Production Process"

Oct20 10amPT/VIRTUAL: Annual Shareholders Mtg. https://tinyurl.com/y28blkjn 14A Proxy: https://tinyurl.com/y46ga9el

...ASM Replay (9:45): https://www.virtualshareholdermeeting.com/CDMO2020 (Control# not needed)

Apr20-22 2021/Booth#1159: INTERPHEX, NYC

Dec2(Wed) after mkt: Q2/FY21 (qe 10-31-20) Financials & Conf. Call - Transcript: https://tinyurl.com/y66xk888

Dec14-17: Antibody Engineering & Therapeutics Conf., San Diego

Quotes: Yahoo: Yahoo.com/CDMO Nasdaq: http://www.nasdaq.com/symbol/cdmo RT: http://www.nasdaq.com/symbol/cdmo/real-time

• IR: Stephanie Diaz (Investors) Vida Strategic Partners 415-675-7401 sdiaz@vidasp.com, Tim Brons (Media) 415-675-7402 tbrons@vidasp.com

SEC:

Latest 10Q 10-31-20 iss. 12-2-20 https://tinyurl.com/y3ournzr (Cash 10-31-20=$35.7mm)

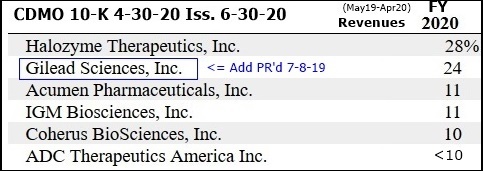

Latest 10K 4-30-20 iss. 6-30-20 https://tinyurl.com/yak25nco (Cash 4-30-20=$36.3mm)

Latest DEF14A/Proxy iss. 8-27-20 (re: 10-20-20 ASM): https://tinyurl.com/y46ga9el

ALL SEC filings for CDMO: https://tinyurl.com/yc4zjyzv

CDMO's Corp. Bylaws (a/o 11-14-14): http://tinyurl.com/y8hsppea

Poison Pill adopted 3-16-06 for 10yrs: http://tinyurl.com/yvypvh 44-pg SEC filing: http://tinyurl.com/5m57ut BUNGLER explains in plain language: http://tinyurl.com/mft4nd6

...3-17-16 Poison Pill extended until 3-16-2021 https://tinyurl.com/y74glo2n (Form8A Amendment #1)

...Poison Pill TERMINATED eff. 9-23-2019 https://tinyurl.com/y2mzx3xo

SHARES:

Shares O/S as of 11-23-20=56,726,334 - history since 4-2006: https://tinyurl.com/y66xk888 (at bottom)

...A/O 10-31-20: 3,451,000 stock options outstanding at a wgt.avg. exercise price of $6.41 (pg.16 10Q).

...MarketWatch.com for CDMO (shows Float): https://www.marketwatch.com/investing/stock/cdmo

1-12-18: S-3 Shelf Registration filed for up to $125mm https://tinyurl.com/y9qtewpw

...12-14-20: Avid raises ~$34M gross, selling 3,833,335@9.00/sh. (underwriter: RBC Capital) https://tinyurl.com/y92yr9g4

...2-20-18: Avid Raises ~$21.8M net, selling 10,294,445@$2.25 (underwriter: Wells Fargo) 8-K: https://tinyurl.com/ya3nenth 424B5: https://tinyurl.com/ycpshgxl

Total INST.+LARGE Holdings now 41,617,965 73.5% a/o 9-30-20 https://tinyurl.com/y652nxpr

13 LARGEST SHAREHOLDERS a/o 9-30-20:

1. Eastern Capital (Kenneth Dart): 4,300,992 7.6% (a/o 8-21-19 14A/Proxy: https://tinyurl.com/y9c972fa – orig. 13G filed 11-2015)

2. Tappan Street (Prasad Phatak): 4,285,000 7.6% (a/o 12-31-19 13G: https://tinyurl.com/wlcwnnv )

3. Blackrock Inc. (Larry Fink): 3,834,816 6.8% (-111,172 a/o 9-30-20 Nasdaq Inst.)

4. IsZo Capital Mgt. (Brian Sheehy): 3,459,888 6.1% (-88,144 a/o 9-30-20 Nasdaq Inst.)

5. Millennium Mgt. 2,678,984 4.7% (+633,918 a/o 9-30-20 Nasdaq Inst.)

6. Vanguard Group 2,659,738 4.7% (-19,553 q/e 9-30-20 Nasdaq Inst.)

7. Snyder Capital 2,302,621 4.1% (-2,258 a/o 9-30-20 Nasdaq Inst.)

8. Altravue Capital 1,973,349 3.5% (+39,534 a/o 9-30-20 Nasdaq Inst.)

9. Wellington Mgt. 1,503,162 2.7% (+236,947 a/o 9-30-20 Nasdaq Inst.)

10. Sargent Invest. Grp. 1,052,099 1.9% (-11,000 a/o 9-30-20 Nasdaq Inst.)

11. State Street 992,280 1.8% (-65,922 a/o 9-30-20 Nasdaq Inst.)

12. Portolan Capital 963,374 1.7% (+528,662 a/o 9-30-20 Nasdaq Inst.)

13. Silvercrest Asset Mgt. 878,805 1.6% (-16,746 a/o 9-30-20 Nasdaq Inst.)

Inst. Holdings (Nasdaq) - updated 45-days after each qtr-end: http://www.nasdaq.com/symbol/cdmo/institutional-holdings

INSIDER-Trans: https://tinyurl.com/ycpw4j9z (formerly PPHM thru 2017: http://tinyurl.com/ypkow8 )

Short Interest, updated twice a month: https://www.nasdaq.com/symbol/cdmo/short-interest

A-T-M (At-The-Market) Sales 3/2009 - 7/14/17 ($272,500,000gr./34,869,747sh=$7.81/sh): http://tinyurl.com/yagmu2on

PPHM shares were 1:7 Reverse Split eff. 7-10-17 (315mm/$.606=>45mm/$4.24) http://tinyurl.com/yymtzcm9

PPHM shares were 1:5 Reverse Split eff. 10-19-09 (~237mm/$.64=>~47.4mm/$3.20) http://tinyurl.com/ykuw588

Potential Value: 9-19-2017: Catalent acquires CDMO Cook Pharmica for $950M ($179Msales x 5.3; EV/EBITDA=17.3) http://tinyurl.com/yd46m8py

AVID TEAM: https://avidbio.com/leadership/ - Open Jobs: https://avidbio.applicantpro.com/jobs

7-30-20: Nicholas Green (ex-Therapure Biopharma) becomes President/CEO of Avid - 6-25-20 PR: https://tinyurl.com/yczapcc7

4-13-20: Avid Hires 2 Senior Directors of Bus. Dev: Jason C. Brady & Sylvia Hinds https://tinyurl.com/sq2679g

1-8-20: Avid Appoints Timothy Compton as Chief Commercial Officer (repl. Tracy Kinjerski) https://tinyurl.com/ydww58sn

7-26-19: Catherine Mackey, PhD (ex Pfizer VP) joins Avid's BOD, replacing Joel McComb https://tinyurl.com/y3xhqmvm

5-8-19: Richard (Rick) B. Hancock named Interim President/CEO; Roger Lias resigns https://tinyurl.com/y4pqdwyc

7-16-18: Daniel Hart (ex-ENO Holdings) joins Avid as CFO https://tinyurl.com/ychz45p2

7-16-18: Michael Faughnan (ex-Lonza/WuXi Biologics) joins Avid as Sr.Dir./BusDev/WestC https://tinyurl.com/yaozdggz (Left 5-2019)

5-29-18: Sandra C. Carbonneau (ex-Lonza) joins Avid as Dir./BusDev./EastCoast https://tinyurl.com/ybvrwn2l (left 12-2019)

5-8-18: Magnus Schroeder (ex-AGC Biologics) joins Avid as VP/Process Sciences https://tinyurl.com/y7tpswaw

2-23-18: CFO Paul Lytle voluntarily resigns eff. 5-24-18 (2-23-18 +90days), "CFO search underway" https://tinyurl.com/ybnjzbv6

9-11-17: Roger J. Lias (ex-Allergan) to become Avid’s CEO and join PPHM’s BOD eff. 9-25-17 https://tinyurl.com/yddufw4s (left 5-8-19)

11-29-17: Tracy L. Kinjerski joins Avid as VP/Bus.Operations https://tinyurl.com/yc4zenkc (Left 1-8-2020)

Profiles of all 7 BOD members: http://ir.avidbio.com/corporate-governance/board-of-directors

...Joseph Carleone/Chair, Nicholas Green(CEO), Richard Hancock, Gregory Sargen, Mark Bamforth, Patrick Walsh, Catherine Mackey

10-24-17: Peregrine Adds Patrick D. Walsh to BOD, "An Industry Veteran with 30+yrs Experience Leading Successful CDMO Org’s” http://tinyurl.com/y3jo2rv7

10-19-17: Peregrine Adds Mark R. Bamforth to BOD, "10yrs/Genzyme; 30yrs of biologics leadership experience, incl. founding 2 CDMOs" http://tinyurl.com/y6ydcaof

ANALYST COVERAGE: http://ir.avidbio.com/analyst-coverage

Also see: https://www.marketbeat.com/stocks/NASDAQ/CDMO/price-target

Janney Montgomery Scott - Paul Knight PT=$10

H.C. Wainwright & Co. - Joseph Pantginis PT=$9

Craig-Hallum Capital Group - Matt G. Hewitt PT=$10

First Analysis Securities - Joseph Munda PT=$7.50

Stephens Inc. - Jacob Johnson PT=11 (10=>11 9-2-20)

FINANCIALS & BUSINESS DEV.:

2-3-21: Avid to Mfg. CV19 Therapeutic Lenzilumab for Humanigen https://tinyurl.com/1hzzksxa

8-26-20: Mapp Biopharmaceutical signs w/Avid for ClinDev of Antiviral Antibody (MBP091) https://tinyurl.com/yxwvr949 BARDA #HHSO100201900018C($16.5M+Opt/$30M), see: https://tinyurl.com/yye8t5nx

8-20-20: Oragenics signs Dev/Mfg Agreement with Avid for COVID-19 Vaccine “TerraCoV2” https://tinyurl.com/yxqg3w4v

8-6-20: Iovance Biotherapeutics signs w/Avid(+Aragen) to Dev+Mfg. IOV-3001 (IL-2 Analog) https://tinyurl.com/y2lgzh6x

7-28-20: Avid Teams with Argonaut to add “Parenteral Fill-Finish Services” https://tinyurl.com/y2lgzh6x

5-6-20: Avid Teams with Aragen to speed up drug dev./delivery timelines https://tinyurl.com/ycuu2m5r

4-23-20: Avid receives $4.4M PPP/CV19 Loan (can apply for forgiveness) 8K: https://tinyurl.com/yaltupxa

...5-12-20: Avid Pays Back $4.4M PPP/CV19 Loan (“New SBA Guidance/abundance of caution”) 8K: https://tinyurl.com/y993tkk6

3-10-20: CDMO's Revs & Burns By Qtr Table, FY07/Q1 thru FY20/Q3 (q/e 1-31-20): https://tinyurl.com/s9cmzmf

......Avid FY20 (fye 4-30-20) revenues guidance: $55-59M; committed backlog=$58mm at 1-31-2020.

7-8-19: Avid Signs New Top10 Global Pharma and Expands Existing Cust. Relationship https://tinyurl.com/yyq8zgb9

6-27-19: "The 5 new clients signed in late FY2018 contributed significantly to revenue diversification in FY2019." SEE CUST SPLITS for FY19: http://tinyurl.com/y5j4dlsv

4-24-18: ”In recent weeks, Avid has signed new agreements with 3 addl. undisclosed intl. drug dev. companies (that’s 4 thus far in CY2018)” https://tinyurl.com/y89whc8d

3-1-18: Acumen Pharm. selects Avid for Process Dev. & Mfg. of ACU193 (Alzheimer’s) https://tinyurl.com/y8jvwleq http://www.acumenpharm.com

2-21-18: Enzyvant selects Avid to commercially mfg. RVT-801 (Farber disease) https://tinyurl.com/yd5xhcx8 http://www.enzyvant.com

2-12-18: Peregrine’s Legacy PS-Targeting IP Sold to ONCOLOGIE INC. (Boston, CEO: Laura E. Benjamin) for $8M/upfront, $95M/milestones https://tinyurl.com/yam8gb3h

...NOTE: 2-13-18: Oncologie Licenses Mologen’s immunotherapeutic ‘lefitolimod’ (TLR9 agonist) https://tinyurl.com/y9z54f4x “ONCOLOGIE is backed by top-tier intl. investors and has the objective to dev. novel personalized medicines in the field of immuno-oncology."

2-28-17: Avid & Cook (acq. by Catalent 12-2017 for $950M; $179Msales x 5.3; EV/EBITDA=17.3) remain Halozyme's 2 CMO's (“working to scale-up/validate/qualify Avid II/Myford for Roche collab.”): http://tinyurl.com/h75teta

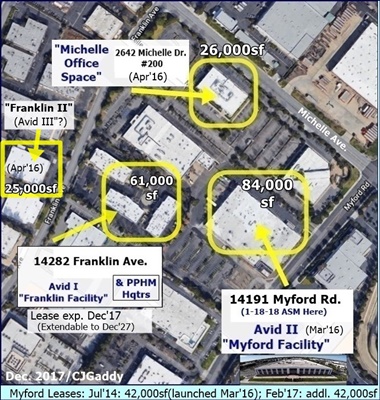

FACILITIES: https://avidbio.com/facilities/

10-8-19: Avid Announces Completion of Expansion of Process Dev. Capabilities & Labs https://tinyurl.com/y3hfwst9

...will “significantly accelerate Avid’s ability to drive efficient & rapid on-boarding of new cust. pgms progressing to mfg.”

4-24-18: Avid adding Process Dev. Labs, upgrading capabilities (in phases; total will be >6000sq; 1st one ready Q3CY18/Jul-Sep'18) https://tinyurl.com/y89whc8d

5-2017: Avid II (Myford) adds 2 MilliporeSigma Mobius 2,000L single-use bioreactors; total mfg. capacity now ">11,000L". http://tinyurl.com/ky7bmu4

5-10-17: Halozyme comments on Avid II(Myford) expansion in their 3-31-17/10Q pub. 5-9-17: http://tinyurl.com/mrl34uk

..."validation of the new facility is scheduled to end in Q2/2017… Once this new facility is approved, it will become the primary source for Roche of bulk rHuPH20.”

6-2-16: Corp.Update – Avid Expansion & Drug Development - http://tinyurl.com/zvmhqmr

3-7-16/Avid II: Formal Commissioning of Avid's New 40,000sq "Myford" Facility, “single-use/fully disposable” (potentially $40M addl revs) http://tinyurl.com/y5jmfpo3

12-10-15/Avid II: Avid Expansion into MYFORD Facility now GMP-run ready (potential +$40mm sales) - contemplating further expansion http://tinyurl.com/y539yut4

12-10-14: Avid to Double Mfg. Capacity(“Myford Expansion”) http://tinyurl.com/y2sqoy2u & http://tinyurl.com/kmdgq8t

PRESENTATIONS & ARTICLES: https://avidbio.com/events/

Sep17/Fireside Chat w/Nick Green: 18th Annual Morgan Stanley Global Healthcare Conf.: https://tinyurl.com/y4cbjjrc

5-18-20: Avid Listed In Top CMO Awards Article https://tinyurl.com/yb5cnh6m

...”Avid received 5 CMO Leadership Awards categories, incl. 2 Champion designations: Expertise & Service.”

10-25-18/BioPharma: Roger Lias Interview, “Avid expansion to Triple Process Dev. Capacity” https://tinyurl.com/ybtuk29m

Sept2018/BioTechWEEK: Tracy Kinjerski (VP/BusOP) interview: Avid’s differentiators (6mins.) https://www.youtube.com/watch?v=x3tzo4pZivk

1-29-18: NobleCon14 - 14th Annual Inv. Conf., Ft.Laud. => Roger Lias' webcast/slideshow https://tinyurl.com/yanwk9yo

11-15-17/Outsourcing-Pharma: “How This R&D Company (Peregrine) is Transitioning to a Pure-Play CDMO: ‘Opportunities Are Almost Endless’" - Recap of interviews with Steve King & Avid Pres. Roger Lias http://tinyurl.com/y7dv9faz

CONFERENCE CALLS & ASM's:

12-2-20: Qtly. Conf. Call (Green/Hart/Compton) PR & Transcript https://tinyurl.com/y66xk888

10-20-20 Annual Shareholders Meeting - Replay (9:45): https://www.virtualshareholdermeeting.com/CDMO2020 (Control# not needed)

9-1-20: Qtly. Conf. Call (Green/Hart/Compton) PR & Transcript https://tinyurl.com/y329llow

...CEO N.Green: ”My first few weeks have done nothing but confirm my view that I believe Avid to be a strong and state-of-the-art company with significant opportunity for growth."

6-30-20: Qtly. Conf. Call (Hancock/Hart/Compton) PR & Transcript https://tinyurl.com/y9zbgmos

...RickH: "Based on our customers' growing demand and our expanding business development activity, we believe that we will significantly increase capacity utilization in 2021 and beyond. Accordingly, we have entered into a new phase of planning for the expansion that will support our growing business in the years to come.”

...”Top10 Pharma customer added 7-2019 named in 10-K: GILEAD SCIENCES.”

3-10-20: Qtly. Conf. Call (Hancock/Hart/Compton) PR & Transcript https://tinyurl.com/s9cmzmf

12-9-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/tfewuzc

9-5-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/y6t8zfur

6-27-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/y6zdjyu2

...Rick Hancock, "Most importantly, during Q4, the Company achieved positive income, generating cash from dev. & mfg. operations for the 1st time since the beginning of the CDMO transition (Jan'18)."

3-11-19: Qtly. Conf. Call (Lias/Hart) PR & Transcript http://tinyurl.com/yy6dvjvc

12-3-18: Qtly. Conf. Call (Lias/Hart//Kinjerski) PR & Transcript https://tinyurl.com/y9n374kp

10-4-18: ASM/2018 (@Myford Facility) - Roger Lias’ Slideshow & Attendee Report https://tinyurl.com/yctfzhlb

9-10-18: Qtly. Conf. Call (Lias/Hart) PR & Transcript https://tinyurl.com/y8oc6hx8

...Roger Lias, "During the qtr, we advanced the projects of our existing active clients and continue to engage with numerous potential new customers."

7-16-18: Qtly. Conf. Call (Lias/Kinjerski) PR & Transcript https://tinyurl.com/yaozdggz

...Roger Lias, “In a short period, we’ve established a targeted business dev. operation that is actively providing visibility for Avid Bioservices within our fast growing but competitive marketplace.”

3-12-18: Qtly. Conf. Call (Lias/Kinjerski/Lytle) PR & Transcript https://tinyurl.com/yakdl4wj

...Roger Lias, ”I'm pleased to be able to report that in a very short period of time we've generated significant interest from both emerging & growth biopharmaceutical players and from pharmaceutical multinationals. I'm confident that the plan we're executing will drive a considerable increase in backlog and the opportunity to further enhance capacity utilization in the future.”

......From the 3-12-18 PR: “At present, we are in late-stage negotiations with several potential new customers and expect to announce the executed agreements before the end of the FY[4-30-18].”

1-18-18: ASM/2017 (@Myford Facility) - Roger Lias’ Slideshow & Attendee Reports https://tinyurl.com/yca6enbr 12-7-17 PROXY/14A: https://tinyurl.com/y7qprpg9

12-11-17: Qtly. Conf. Call (Lias/Lytle) Transcript https://tinyurl.com/ybycb2s6

...Roger Lias, "the company is undergoing a broad-scale transformation, the goals of which are to shift complete focus to the Avid Bioservices CDMO business and the complete divestiture of all of Peregrine's legacy R&D assets, which include bavituximab."

9-11-17: Qtly. Conf. Call (King/Lias/Lytle) Transcript http://tinyurl.com/y9y8qdac

...Steve King: “For this reason, we have concluded that in order to best position Peregrine’s R&D assets for successful development, they should be advanced by a partner with the appropriate expertise and ample resources to invest in the necessary clinical trials. To that end, we have been working diligently towards the transformation of the overall business to becoming a pure-play CDMO, while assessing the best strategic options for the R&D assets that would allow stockholders to directly see the future value from their continued developments. By partnering & eliminating future R&D expenditures, we believe we are best positioning Avid for future growth. Through reinvestment & expansion, we believe we will attract new customers and extend current contracts that will help position Avid as a leading U.S. CDMO. We are moving forward expeditiously with strategic discussions as we recognize the need to move quickly both from the R&D & CDMO standpoints. We hope to bring this process to completion over the coming months and will update you on our progress.”

7-14-17: Qtly. Conf. Call (King/Shan/Lytle) Transcript http://tinyurl.com/yb4wulvu

...Steve King: “We are seriously considering the possibility of separating our 2 distinct businesses, Avid and R&D/PS-Targeting.”

3-13-17: Qtly. Conf. Call (King/Shan/Worsley/Lytle) Transcript http://tinyurl.com/grhwjvy

...Steve King: “We believe the recent improvement of stock price is a growing recognition of the value of Avid, and having the full value of the Avid business reflected in our stock price is a top priority.”

12-12-16: Qtly. Conf. Call (King/Shan/Hutchins/Lytle) Transcript http://tinyurl.com/hhn4gga

...Steve King: “Our goal is to bring the overall company to profitability within the next 18mos. We believe just the value of Avid Bioservices is far greater than our current market cap and is only growing in value."

10-13-16 ASM/2016: ATTENDEE Reports & Link to CEO Steve King's 35min/45slide webcast: http://tinyurl.com/jx7ouay

Feb. 2018: Peregrine Pharmaceuticals completed its Mid’17-Early’18 Transition to a Pure-Play CDMO

(Contract Development & Manufacturing Organization), Avid Bioservices, Inc. - CEO: Roger Lias.

**FULL PPHM=>CDMO Transition History (Ronin/SWIM): https://tinyurl.com/ybqvzwhg

1-8-17: Peregrine chgs. name to “Avid Bioservices, Inc.”; new ticker: “CDMO” (+CDMOP) https://tinyurl.com/y8vhjow4

2-12-18: Peregrine’s Legacy PS-Targeting IP Sold to ONCOLOGIE INC. (Boston, CEO: Laura E. Benjamin) for $8M/upfront, $95M/milestones https://tinyurl.com/yam8gb3h

...12-13-18/8-K: Overview of Oncologie sale: https://tinyurl.com/yab9c6cr

NOTE: “PS-targeting Exosome tech. not included; back to UTSW", see: https://tinyurl.com/yakdl4wj

Click here for an ARCHIVE of the History of Peregrine’s Anti-PS/Bavituximab Platform - MOA, Trials, and Activity over the years, from early 2000’s thru 2017, prior to being Sold to ONCOLOGIE:

https://tinyurl.com/y8pq4rhc

Of Interest (post Oncologie Sale):

Oncologie's website: https://oncologie.com/true-home-v2/ NEWS: https://oncologie.com/newsroom/

4-20-18/AACR’18: MSKCC(LudwigCC) Tweets about 2 WolchokLAB/”PPHM” Anti-PS Posters https://tinyurl.com/ycgjhvqa

4-26-18: New Bavi+Keytruda/LIVER Ph2 IST Trial, Sponsor=UTSW, Collab=MERCK https://tinyurl.com/y7fd9vdb

6-7-18: Oncologie Obtains $16.5M Seed Funding Led by Pivotal bioVenture Partners China Fund https://tinyurl.com/ybrrbgg7

6-7-18/BioCentury: Laura Benjamin states, “Oncologie plans to begin a trial mid-summer '18 evaluating Bavi to treat HCC and a P-O-C trial in Gastric cancer in 1Q19/2Q19.” https://tinyurl.com/ycb8r7sm

12-3-18: During q/e 10-31-18, Avid sold remaining legacy R&D asset, r84(anti-VEGF), to Oncologie for $1.0M upfront. Avid is eligible to receive up to an addl. $21M in dev/reg./comm. milestones, and low to mid-single digit royalties on net sales upon commercialization of products utilizing r84 https://tinyurl.com/y9n374kp

11-4-19/PharmaBoardroom: Interview with Oncologie CEO Laura Benjamin discussing the 2 ongoing Bavi Trials w/Keytruda (USA UK Taiwan S.Korea) https://tinyurl.com/ydf6zhsv

...Dr. Benjamin, "We have high expectations of bavituximab and have obtained the global rights for this compound."

...Ongoing Trial #1 (N=80): Open Label, Bavi+Keytruda Adv. Gastric/GEJ Cancer https://clinicaltrials.gov/ct2/show/NCT04099641

......1-17-2020 ASCO/GI Poster: https://oncologie.com/wp-content/uploads/2020/01/2020-01-17-ASGO-GI-poster-final-draft.pdf

...Ongoing Trial #2 (N=34 UTSW): Open Label, Bavi+Keytruda Adv. Hepatocellular Carcinoma https://clinicaltrials.gov/ct2/show/NCT03519997

6-11-20/Fiercebiotech: Oncologie Reels In $80M To Push Clinical Pgms/Build Pipeline https://tinyurl.com/yany8f34 & https://tinyurl.com/y8p9artk

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |