Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Yes either a scam or just stupid and dont understand the process. Either way not a company to invest in if they think FINRA approves a RS because they do not.

Perhaps give FINRA a call or email them. They are willing to explain processes to traders.

Seems to me there would be 15,000 shares after the RS and 1.5M shares after the FS. I don't understand why they would do a RS followed by a FS except that the final share count would be a fairly nice round number due to the vast reduction in oddball share numbers after the RS. It's still a mystery why this was approved by the Board of Directors and the majority shareholder back in November, but no action has been taken after 10 months.

It is from their form 10 filing.

Scam? You meant they’re asking for investigation publicly?

If the company has 15 billion shares.. 1 for 1 million rs.. followed by fs of 100 to 1 what is total in os after all that?

Yes its unchanged but the price is 1000000 times greater and this is a shell company merging into another shell company. Who in their right mind will pay that price? Thats right, nobody and everyone will be stuck with way inflated stock that nobody wants. David Cutler is a knows OTC scammer and he already cashed in on the pump. Everyone at this point is a bag holder

FINRA does not approve R/S's they simply record them. A R'S is handled by the company and its treasure. The claim that FINRA approves them is just another OTC scam these shell companies play

FINRA does not approve reverse splits, but it does process reverse stock splits as part of its functions related to company corporate actions in the OTC market. OTC companies must submit notice to FINRA 10 days prior to the record/effective date of the corporate action.

https://www.finra.org/investors/learn-to-invest/types-investments/stocks/stock-splits

The RS is followed by a 100:1 forward split so the net result is you end up 1 share for every 10,000 you have now. I have 10M shares now so I would end up with 1,000 shares. The final VALUE of your shares after the RS and FS, other than rounding effects, is unchanged.

How do you explain this or it is just a special different case?

“On November 1, 2021, the shareholders of Strategic Asset Leasing, Inc., approved a name change and approved a 1-for-2500 reverse split. On April 19, 2022, the Company filed an Articles of Amendment with the State of Wyoming, changing its name to “ANEW Medical, Inc.” and the contemplated 1-for-2,500 reverse split. During January 2022 and in accordance with SEC Rule 10b-17 and FINRA Rule 6490, the Company submitted documents and other information to FINRA in furtherance of pursuing and obtaining approval of the subject reverse stock split and name change. The Company must submit additional documents requested by, and necessary to obtain approval of, FINRA in connection with the subject reverse stock split and name change. As of May 10, 2022, the reverse split and name change have not been declared effective.“

LOL its a 1:1,000,000 RS so for every 1 million shares shareholders would have 1 share. Thats not going to be good for anyone holding this garbage

A reverse split down here with a market cap of 5 million would not be the end of the world. This deal is either going to be huge or it won't. Gets to 50 or 100 million mkt cap won't matter if it's reversed or not.

Your dumping tuesday

Effective November 10, 2021, the Board of directors recommended, and the holder of a majority of the voting power of our outstanding common stock voted, to approve the following items:

- a reverse split of the common stock issued and outstanding on a one new share for one million (1,000,000) old shares basis as of November 10, 2021. Fractional shares will be rounded up to the next whole share. (This action requires an amendment to the Certificate of Incorporation and requires the approval of the Financial Industry Regulatory Authority (“FINRA”)), and

- a forward split of the common stock issued and outstanding as of November 10, 2021. Subsequent to the 1/1,000,000 reverse split described above, each share of post reverse split adjusted issued and outstanding Common Stock shall be forward split on a one for one hundred (100) basis such that each post reverse split old share represents 100 new shares. Fractional shares will be rounded up to the next whole share.

These proposed actions are still pending FINRA approval.

A Reverse and Forward Split

This is very interesting !!!!

$ATYG

#ELGORDODAMUS

Atlas Technology Group Inc (OTCMKTS: ATYG) is and SEC filer and a perfect merger candidate with under $200k in liabilities and no convertible debt on the books. Atlas was incorporated in the state of Nevada in August 1996 under the name Pan World Corporation. In November 1999, the Company changed its name to Tribeworks, Inc. and redomiciled to the state of Delaware. In August 2007, the Company changed its name to Atlas Technology Group, Inc. In August 2015, the Company redomiciled to the State of Florida. In December 2015, the Company changed its name to Moxie Motion Pictures, Inc. In November 2018, the Company changed its name back to Atlas Technology Group, Inc.

$ATYG

#ELGORDODAMUS

$ATYG has certainly not disappointed so far rocketing up well over 100% on the Saxon Capital Group, Inc., 8k trading over 2 billion shares on the day on $1.6 million in dollar volume.

Reverse merger can be more explosive than biotech’s when the incoming Company has real value but is undiscovered to investors and many RM stocks.

$ATYG

#ELGORDODAMUS

No its not my opinion, its a fact. FINRA does not approve R/S's. I posted the link for proof.

Also Saxon Capital Group, Inc is a newly developed corporation registered in Delaware.

FILE NUMBER ENTITY NAME

6911660 SAXON CAPITAL GROUP, INC.

https://icis.corp.delaware.gov/eCorp/EntitySearch/NameSearch.aspx

FINRA does not approve reverse splits, but it does process reverse stock splits as part of its functions related to company corporate actions in the OTC market. OTC companies must submit notice to FINRA 10 days prior to the record/effective date of the corporate action.

FINRA.org

Thall.. That's Your Opinion...I am Buying more Next week..Good Luck to US..

First off Reverse splits are not approved by anyone other than the controlling share holders. FINRA does not approve them, they simply record them.

Second the merger was with another newly formed shell company. This is nothing more than a pump and dump.

FINRA does not approve reverse splits, but it does process reverse stock splits as part of its functions related to company corporate actions in the OTC market. OTC companies must submit notice to FINRA 10 days prior to the record/effective date of the corporate action.

5B os can easily run…MULTI-PENNIES

Are they stupid?

ATYG $$$ MASSIVE MERGER/8K ANNOUNCED HERE..,,THIS IS GOING TO EXPLODE NEXT WEEK AND IN SEPTEMBER..PRICE CORRECTION COMING FAST HERE, .005-.01 FOR STARTERS, THEN BLUE-SKIES TO 0.10+ OR MORE SINCE THIS DEAL/ MERGER IS COMPLETE, AND I AGREE 100% RS "WILL NOT" OCCUR/BE APPROVED, THAT IS A NON-ISSUE, WILL BE REJECTED... SAXON IS MASSIVE, THIS IS CRAZY UNDERVALUED RIGHT NOW..

WHEN ARE MARKETS OPEN NEXT WEEK., I WANT MORE SHARES..LET THE BUYING FRENZY BEGIN......SHARES ARE BEING DEVOURED...COULD BE ONE OF THE BIGGEST MERGER IN RECENT HISTORY...

Longs… what and when is the next catalyst

David Cutler custodian plays. His past two ran to dollars. Filings alone will send this one.

2 tickers he’s RM’d before went from trips to dollar runners

- $DCG*D/$GRN*F went from .0028 o $2.22 in just over 2 months

- $CPM*D went to $4.98 in 7 months

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=157777009

$ATYG One of the OTC runners yesterday on heavy volume..looking forward to seeing what next week brings..

https://stockcharts.com/c-sc/sc?s=ATYG&p=D&b=5&g=0&i=0&r=1662210693639

In the event of a liquidation, each share of Series B Preferred Stock is entitled to $1.00 per share distribution before any distribution is made to holders of any stock ranking junior to the Series B Preferred Stock.

Each share of series B Preferred Stock is convertible into 100,000 common shares of the Company.

No shares of Series B Preferred Stock were issued or outstanding during the years ended December 31, 2021 and 2020.

$ATYG

#ELGORDODAMUS

The Question Now is How far up will they let this run before before it gets approved that is if it gets approved .

You need to read fillings on the where shares will be exercised to give you and idea of a price range where they can let this run too,

And expiration time of that exercise price!!

$ATYG

#ELGORDODAMUS

So, crunching the numbers .. how would a rs & then a fs affect 1 million shares, for example ( just to keep it simple).. I will look at it..ok , I did.. imho:

It would be better to buy after the rs & fs according to my calculations.. if what is proposed is approved..

Keep in mind in the fillings

They proposed RS and a FS

Which is very interesting to say the least!

And is still pending Finra Approval

Plus in one of the filling also was Dicuss an Uplist to Nasdaq market!!!

$ATYG

#ELGORDODAMUS

I agree.. the other Saxon group is located elsewhere .. and is a public co.

Info:

Saxon Capital Group, Inc. develops, owns, and operates prospects and energy projects in East and Southwest Texas. Its projects and prospects comprise the Bateman project in Bastrop and Caldwell counties, the Benton Field in Navarro County, and the Del Monte Prospect in Zavalla County. The company was formerly known as Xsilent Solutions Inc. and changed its name to Saxon Capital Group, Inc. in June 2015. Saxon Capital Group, Inc. was founded in 2005 and is based in Scottsdale, Arizona

Az is not Florida.. just to clear up that issue..

The Company $ATYG is Restructuring

Since Mid last year ,

Many propositions and ideas were put out

It does not mean they will be executed.

That’s why any savvy trader knows that

That you can only rely on the latest

Filling.

This ticker is just getting started

We should see pennies before the next

Big News hit.

You either in it or out Either way

This Chart will do what the chart will do.

Keep in mind the Company is now in Delaware not Florida.

IMHO the Best is yet to come!!!!

$ATYG

#ELGORDODAMUS

Quote:

There is no guarantee that it will be possible to complete the remaining terms of the Agreement!

$ATYG

#ELGORDODAMUS

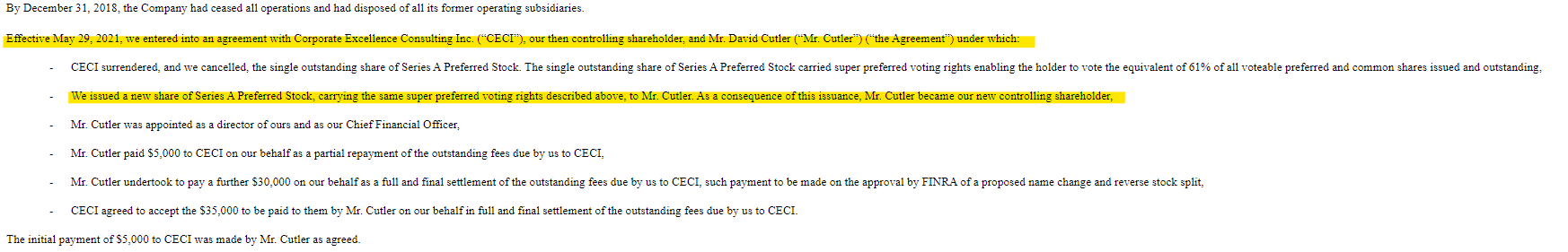

Effective May 29, 2021, we entered into an agreement with Corporate Excellence Consulting Inc. (“CECI”), our then controlling shareholder, and Mr. David Cutler (“Mr. Cutler”) (“the Agreement”) under which:

- CECI surrendered, and we cancelled, the single outstanding share of Series A Preferred Stock. The single outstanding share of Series A Preferred Stock carried super preferred voting rights enabling the holder to vote the equivalent of 61% of all voteable preferred and common shares issued and outstanding,

- We issued a new share of Series A Preferred Stock, carrying the same super preferred voting rights described above, to Mr. Cutler. As a consequence of this issuance, Mr. Cutler became our new controlling shareholder,

- Mr. Cutler was appointed as a director of ours and as our Chief Financial Officer,

- Mr. Cutler paid $5,000 to CECI on our behalf as a partial repayment of the outstanding fees due by us to CECI,

- Mr. Cutler undertook to pay a further $30,000 on our behalf as a full and final settlement of the outstanding fees due by us to CECI, such payment to be made on the approval by FINRA of a proposed name change and reverse stock split,

- CECI agreed to accept the $35,000 to be paid to them by Mr. Cutler on our behalf in full and final settlement of the outstanding fees due by us to CECI.

The initial payment of $5,000 to CECI was made by Mr. Cutler as agreed.

There is no guarantee that it will be possible to complete the remaining terms of the Agreement.

Effective November 10, 2021, the Board of directors recommended, and the holder of a majority of the voting power of our outstanding common stock voted, to approve the following items:

- a reverse split of the common stock issued and outstanding on a one new share for one million (1,000,000) old shares basis as of November 10, 2021. Fractional shares will be rounded up to the next whole share. (This action requires an amendment to the Certificate of Incorporation and requires the approval of the Financial Industry Regulatory Authority (“FINRA”)), and

- a forward split of the common stock issued and outstanding as of November 10, 2021. Subsequent to the 1/1,000,000 reverse split described above, each share of post reverse split adjusted issued and outstanding Common Stock shall be forward split on a one for one hundred (100) basis such that each post reverse split old share represents 100 new shares. Fractional shares will be rounded up to the next whole share.

These proposed actions are still pending FINRA approval.

So that would mean any company could file for a reverse split to drive investors away, allow insiders to buy up cheap shares, which they could then dump when any good news comes out? If it’s that easy, then why not?

It's the new rules. Need to be current to trade on all major brokerages. It gets current through Form 10. It files a 1:1000000 reverse split is coming, last year. It makes everyone sell their shares with fear at cheap price. Insiders buy up shares at cheap price. It doesn't reverse split for over a year and still hasnt. It issues a pump 8k. Insiders dump all their shares at 500-600% profit. It's one of the new ways to legally pump and dump stock. We're talking huge numbers.

I'm not hating on it. It's just a thing, that's all.

Good Luck to everyone!!

What a clever way to pump and dump stock.

Will have to keep a watch on it.

Thanks.

That is the wrong company. Saxon Capital Group that you are referencing trades on NASDAQ as SCGX and trades at $18 . The company ATYG merged with is an empty shell.

https://finance.yahoo.com/quote/SCGX/profile/

That is the wrong company. Saxon Capital Group that you are referencing already trades on the big boards as SCGX. The company ATYG merged with is an empty shell.

https://finance.yahoo.com/quote/SCGX/profile/

So in total once more information is put out, you have to decide, does Saxon go into a long term portfolio, or does it belong as a short term stock? Let me just say this, and this is not financial advice, every short term trader should have a long term portfolio, diversified with a mixture of different sectors. To be trading all the time is great, but I believe if Saxon is what it's propped up to be, then it belongs in the long term portfolio, the rewards would outweigh the risks, significantly.

Also, Saxon will not stay on the OTC, it would be stupid for them to stay on the OTC, instead they will take this company to Nasdaq and as they manage more billions in assets, then they will move to either the Dow or S&P 500. Ticker change and all necessary financial reports will be released which gives you a glimpse of the gross to net profits. Profits and losses. Honestly though, I feel the company should be fine.

I believe if Saxon is managing 25 billion dollars worth of assets then that means the valuation should put this roughly in the dollar area. Where the valuation should be is TBD, but it should be in dollars somewhere. People that like these type of companies, are not in the OTC, because let's be honest, most people in the OTC are just trying to make a quick buck. So if this proves to be a long term hold, then look for higher valuation organically and look for future dividends, because companies like these eventually give dividends.

The merging company needs to reduce this share structure, and I believe they will. Five billion is a bit excessive, if they buyback and retire 50% of the share structure, this will see bigger eyes and money.

“Previously we erroneously reported that Saxon Capital Group, Inc., dba Energy Glass Solar was merging into the Company. This was incorrect, a newly formed Company Saxon Capital Group, Inc. Is merging into the Company and it has nothing to do with Saxon Capital Group, Inc., dba Energy Glass Solar. “

So anyone got DD on this newly formed Company Saxon Capital Group?

HUGE

.$AAWC .. ready for that move.. David Cutler and Redgie Green.. .this is not their 'first Rodeo"... did it before with the two big runners below... Gotta know when to chase sometimes...

— 👑Momentum Kings👑 (@HDOGTX) September 1, 2020

(Cutler's last two)$DCGD Ran $2.00 in 2 months$CPMD Ran $4.98 in 7 months

DCG*D/ GRN*F went up 63,000%

http://www.pennystockdream.com/blog/aawc-is-up-2245-in-just-one-week-on-reverse-merger-speculation

$AAWC David Cutler custodian play. His past two plays ran to dollars. Filings alone will send this one.

2 tickers he’s RM’d before went from trips to dollar runners

- $DCGD/$GRNF went to $2.22 in just over 2 months

- $CPMD went to $4.98 in 7 months

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=157777009

Now that merger is in place won't happen. Company now acquired instant huge valuation with this merger

They will now that the pump and dump is over. Most if not all the current bag holders have no clue that the company is doing a 1:1,000,000 reverse split. For every 1 million shares they become 1 share. Or that they are unsolicited quotes only. This wont end well for most.

To the Shareholders of Atlas Technology Group, Inc.:

This information statement is being provided on behalf of the board of directors (the "Board") of Atlas Technology Group, Inc. (the "Company") to record holders of shares of our common stock ("Shareholders") as of the close of business on the record date of November __, 2021. This information statement provides notice that the Board has recommended, and the holder of a majority of the voting power of our outstanding common stock has voted, to approve the following items:

Proposal 1: To authorize a reverse split of the common stock issued and outstanding on a one new share for one million (1,000,000) old shares basis as of ___________, 2021. Fractional shares will be rounded up to the next whole share. (This action requires an amendment to the Certificate of Incorporation and requires the approval of the Financial Industry Regulatory Authority (“FINRA”)).

Proposal 2: To authorize a forward split of the common stock issued and outstanding as of ______________, 2021. Subsequent to the 1/1,000,000 reverse split described above, each share of post reverse split adjusted issued and outstanding Common Stock shall be forward split on a one for one hundred (100) basis such that each post reverse split old share represents 100 new shares. Fractional shares will be rounded up to the next whole share. (This action requires an amendment to the Certificate of Incorporation and requires the approval of the Financial Industry Regulatory Authority (“FINRA”)).

Warning! This security is eligible for Unsolicited Quotes Only

This stock is not eligible for proprietary broker-dealer quotations. All quotes in this stock reflect unsolicited customer orders. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. An initial review by a broker-dealer under SEC Rule15c2-11 is required for brokers to publish competing quotes and provide continuous market making.

I guess the splits never went through huh

|

Followers

|

257

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

27590

|

|

Created

|

11/11/10

|

Type

|

Free

|

| Moderators | |||

| Reporting Status | Dark: Alternative Reporting Standard Deregistered a/o Nov 12, 2010 |

| Audited Financials | Audited |

| Latest Report | Mar 31, 2013 Quarterly Report |

| CIK | 0001093636 |

| Fiscal Year End | 12/31 |

| OTC Marketplace | Pink No Information |

| SIC - Industry Classification | 7312 - Outdoor advertising services |

| Incorporated In: | DE, USA |

| Year of Inc. | 1997 |

| Employees | 50 a/o Mar 27, 2016 |

| Christopher Broughton | CEO |

| Gary D. Lopez | President |

| Michael Zoyes | Consultant |

| Not Available |

| Acadia Group Inc. |

| 10757 S. Riverfront Pkwy. |

| Suite 125 |

| South Jordan, UT, 84095 |

| United States |

| Market Value1 | $52,807 | a/o Feb 24, 2017 | |

| Authorized Shares | 15,000,000,000 | a/o Aug 02, 2013 | |

| Outstanding Shares | 5,280,705,874 | a/o Aug 02, 2013 | |

| -Restricted | Not Available | ||

| -Unrestricted | Not Available | ||

| Held at DTC | Not Available | ||

| Float | 4,519,348,854 | a/o Aug 02, 2013 | |

| Par Value | 0.0001 |

| Signature Stock Transfer, Inc. |

| 115 | a/o Aug 02, 2013 |

Atlas Technology Group, Inc.

PO Box 147165

Lakewood, CO 80214

QUESTION: Why did David Cutler leave up the Racing Limos sign on the ATYG

OTCMarkets profile? That’s misleading.

QUESTION: Why is Courtney Morris still listed as CEO, SECRETARY, AND

DIRECTOR ON the FLORIDA SOS? This was supposedly changed, yet the

SOS doesn't reflect the changes. Why not? It appears Cutler and his nominee,

Redgie Green, dropped the ball a/o 09/05/21

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=MOXIEMOTIONPICTURES%20P150000656311&aggregateId=domp-p15000065631-854a8494-9bab-4756-b85e-7779f681c576&searchTerm=Moxie%20motion%20pictures&listNameOrder=MOXIEMOTIONPICTURES%20P150000656311

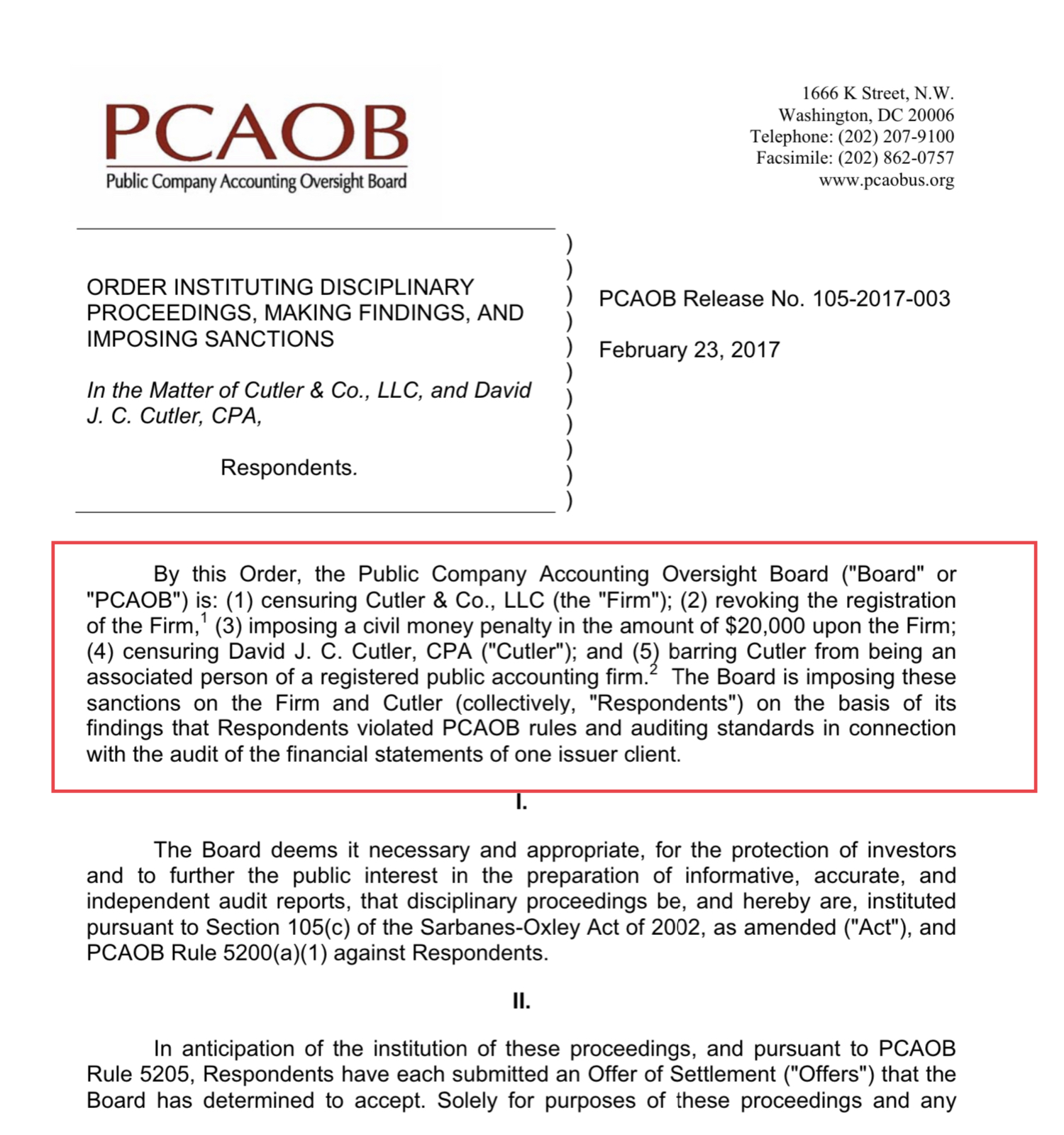

NOT CLEAN DAVID CUTLER - Cutler was barred by the PCAOB from being an

associated person of a registered public accounting firm.

This bar was lifted by the PCAOB effective January 15, 2020.

I won’t be sweeping Cutler’s NOT CLEAN background under the rug.

Respondents:

1) failed to exercise due professional care,

2) including professional skepticism, and

3) failed to obtain sufficient appropriate audit evidence to support the

opinion expressed in the auditor's report.

4) failed to obtain sufficient appropriate evidence to address identified

fraud risks related to Sungame's revenue and unearned revenue.

5) failed to adequately document critical aspects of the audit

6) Cutler failed to adequately supervise the audit.

See the PCAOB letter below, along with a link to factual information:

ETC.

BE CAREFUL OF PUMP-N-DUMPS

DON’T BE FOOLED BY FAKE CLAIMS

READ MORE HERE:

https://pcaobus.org/Enforcement/Decisions/Documents/105-2017-003-Cutler.pdf

Atlas has been a holding company. In 2014 its asset, Racing Limos America,

Inc. was removed from the Company. In January of 2014 ATYG acquired Green

LED Technology Inc. (GLT) GLT is an Energy Efficient Lighting Distributor. It

imports products from China that have been private labeled under the trade

name ECOGREENBULB & REPCO Brands. In October of 2015, The Company

Acquired Moxie Motion Pictures Inc. Michael Zoyes tried to change its name

to Moxie Motion Pictures Inc. These Corporate Actions were NEVER accepted

by FINRA, hence NO Name change.

** MICHAEL ZOYES was listed as an a “consultant” for ATYG

EDGAR: https://www.sec.gov/edgar/browse/?CIK=1093636&owner=exclude

OTCMarkets: https://www.otcmarkets.com/stock/ATYG/overview

Company History

IRREGARDLESS IF IT'S CONSIDERED "WONDERFUL"

OR NOT, THIS SECTION OF THE IBOX IS FACTUAL, NOT

FOR PROMOTION, NOT A PUMP & DUMP

~~~~~~~~~~~~~~~~~~~~~~~~~~~

***Werbe's Wonderful section of IBOX***

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |