Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I don't know who is selling (no insider reports yet), but there is a small arbitrage discrepancy between USA and SPM. So, anybody who wants to own combined company would rather buy USGIF at this point. And some people do see value in new Scorpio Mining, like this "deep value" analyst, for example. He thinks that AG (used to be my favorite miner, BTW) "could be a tax-loss candidate in the coming months as other companies such as Scorpio (OTCPK:SMNPF)/U.S. Silver & Gold (OTCQX:USGIF) are cheaper and doing a better job looking out for shareholder interests."

http://seekingalpha.com/article/2677155-update-first-majestic-silvers-q3-financials-were-extremely-disappointing

Volume you are seeing are insiders dumping...

SOB!!!!!!

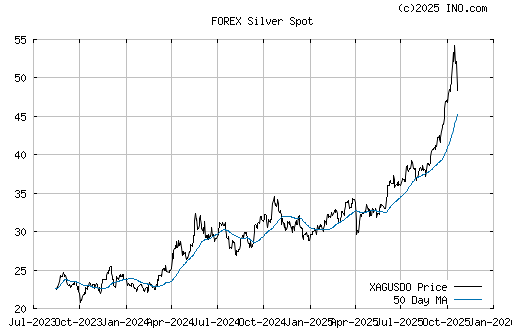

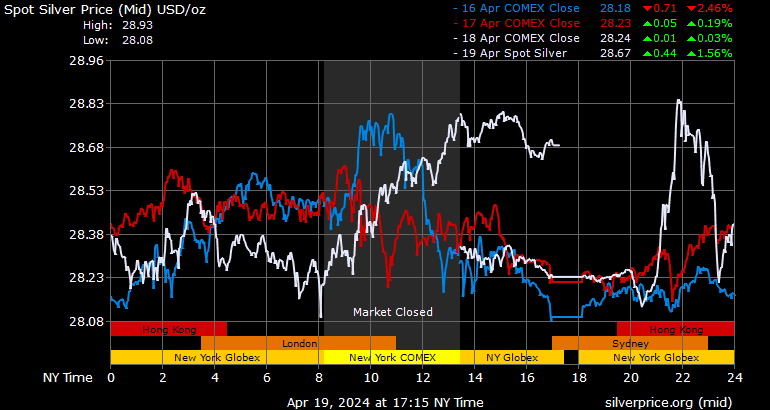

Why is it that when I look into buying a little silver, spot goes up $1 ??????????????????????

Hah! eik

Was ready to order and spot went up .80 cents.....sheesh!!!

You are right, 10 10's or 1 100.

Haven't had a problem selling before............got stuck for some Chinese Pandas though. Not bad, only 5 oz's. But still,stay off ebay....![]()

In general, Engelhards have more value. But I would rather buy ten generic 10 oz bars for the same or better price. They need to be mint sealed and offered by reputable seller. IMO.

Grrrrr....debating of buying 100 ounce bar (Engelhard) $1680??

Or Johnson and Matthey @ 1656

Cripes....price is going up as I speak!!!!!!

Making Sense Of Scorpio Mining's Merger With U.S. Silver And Gold

http://seekingalpha.com/article/2673135-making-sense-of-scorpio-minings-merger-with-u-s-silver-and-gold?uprof=46

Darren Blasutti is running the show...when currency swaps with other countries and China increase US Dollar will lose its dominance backed by petro dollars and IMF.

The default whether or not it occurs will not have much bearing on me personally. I've shredded long held certain stocks. I have diversified into foreign real estate assets, businesses along with the Euro & Yuan. I've kept some holdings- but still deep in bullion to hedge potential erosion of dollar in future.

Right now with strong dollar commodities will continue to slide which presents opportunity. I also hold considerable US land positions that has water, timber, oil and gas, livestock & AG.

True enough, but there's nothing wrong with promotion per se, as long as I'm not one of the guys that gets sucked in by it LoL! It wasn't a bad pitch. They probably had to sell shares at the time. Timing is better now than it was back then. They have a producing mill. That's the significant part. Scorpio is bringing something to the equation, which is more than can be said for the last carpetbaggers that rode through.

Silver, gold, and everything else is gonna continue to decline until the default. That's when things will change, and we won't have long to wait.

http://www.investmentpitch.com/video/0_pxsvoyvt/Scorpio-Mining-TSX-SPM-Video-News-Alert

I knew silver would decline...and there is much more room to drop with a stronger dollar among other factors.

IMO...it's just another Canadian entity owning Galena with other operations in Mexico and acquired some gold property in Nevada. The only difference is Scorpion has been around for some time and are producing $ in Mexico. There are some unanswered questions and this company Scorpio has been promoted in the past as you can see by this 2012 youtube video.

Mav

I'm interested in how capable Scorpio management is. Are they in it for the long haul or are they looking for another bounce and out?

The silver price is gonna skyrocket. Everything is, relative to today's prices.

Is Scorpio management capable of managing the combined operation with true price discovery applied to silver sales?

The stench of manipulation is finally going mainstream as the UBS settlement starts to percolate into the popular consciousness. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=108106168

"The bank was today ordered to pay $800 million to settle a foreign-exchange rate rigging probe. Citigroup Inc. and JPMorgan Chase & Co. will pay about $1 billion each. Bank of America Corp. was fined $250 million, Royal Bank of Scotland Group Plc $634 million and HSBC Holdings Plc $618 million, according to statements from the U.S. Commodity Futures Trading Commission, the Office of Comptroller of the Currency, Britain’s Financial Conduct Authority and Finma."

They got off easy. It's way worse than anybody thinks.

The same regulators that failed to do their job in the first damn place, are the ones slapping the wrist and granting absolution to these lying, cheating, thieving SOB's. Far as I'm concerned, they all belong in jail.

I'M ACQUIRING AFTER MANY YEARS OF BEING OUT...:)

I'm a little wary of Scorpio not making a whole lot of cash down there in Mex. What are their plans with Galena and are they going to take the profits down to Mex and plow $ into Mex operations or is someone finally going to manage develop Galena correctly? The selling IMO could be insiders dumping or long time holders saying vaya con dios amigos. I sold off 100% when it was peaking after acquiring under the radar and less than a dime many many years back. I did ok :)

There is some potential upside here...the coming opening of Scorps El Cajon but we really don't know what and how much that will actually produce. Combined with Galena it could be interesting and would double Scorps output.

With silver world market prices declining on several factors...margins are decreasing and I believe this merge is reflecting that. I called it a few weeks ago that this really needed to be sold to someone who can fully develop Galena and we'll find out if they can or not. But this is a forced marriage merger IMO they didn't have much cash on the books and it was going to shutter and close the adits IMO. This deal keeps Galena open and hopefully some real exploration can further the mines life.

I kind of suspected it was being offered up for sale the stock had been slipping for a long time and like I mentioned the cash was dwindling.

It's not really investing strategy (rather speculative trading approach), but which scenario has better chances (both for 100% return):

1. Combined Scorpio Mining stock goes from 0.29 (USGIF close) to 0.58. OR 2. HL goes from 2.32 to 4.64?

I like Hecla and have been in and out many times. But I would bet on scenario #1 if I had to...

We go back a ways, that's for sure LoL! I looked at Scorpio a long time ago but haven't kept up with their progress the last few years. Wouldn't it be ironic (and somehow fitting) if the newly merged entity became the "steal of a deal" mining play we've been looking for all these years.

The quality of US Silver's physical assets have never been the main problem. Committed management has been the missing link. This could accidentally turn out to be a pretty good deal.

I 100% agree with you ole' buddy...one thing is for sure Montanore and yourself are truly my comrades in arms and people that I actually do trust and that says something in todays internet hidden identification age. I guess maybe we should scour around and find another steal of a deal mining play that no one knows about that's dirt cheap with high upside...and take some positions much like we did with the ole USSIF days many many years ago.

I 100% agree with you ole' buddy...one thing is for sure Montanore and yourself are truly my comrades in arms and people that I actually do trust and that says something in todays internet hidden identification age. I guess maybe we should scour around and find another steal of a deal mining play that know ones knows about...and take some positions much like we did with the ole USSIF days.

I saw it coming sold at peak-I kept saying this wasn't being ran correctly and never would be. Writing was all over the wall for a long period of time now and it wasn't handled correctly at all. Hecla was the only real company that would have done Galena correctly and right...now it's gone. You never know if Scorp runs it further into ground...Hecla could step in later. But as far as original holders of the stock...parties unfortunately over and what a stinking shame that is. Parker was a true gentleman and a wise honest professional in the industry and I miss him dearly.

You're right, Cork....after Parker left it all went downhill for shareholders.

I feel bad for US Silver shareholders. I can't think of a case where shareholders have been so continuously screwed over and abused as by this one (although there are several "contenders" for that dubious honor).

That earlier Hecla deal would have been the best result, and of course that didn't happen.

Now, US Silver is being treated like the junior stepchild in the merger deal between unequal partners.

No doubt the current management took care of themselves on the way out the door, just like the last bunch the last time.

These guys got something for nothing and now they are bailing.

Bunch of GD self serving Turds.

I was here too. Of course, I regret not selling all my shares when PPS popped up after Hecla offer. But I did sell some and have been buying back since about 0.6. As I said, 0.42 is average price. Averaging down is a normal way losers invest in falling knives. ![]()

Eik, I wish I could say 42 cents was my buy in price, I,ve been in this thing back when USG was buying back shares to get share price up to $2 so they could get onto the AMEX. Then Sprott came on the scene and the buyback ended then a reverse split (10-1 I believe). Enter Hecla with a $1.90 take over offer to be turned down. Another THEN, Sprott owning maybe 12% of USG pushed Dumblummon on us for the 30% kick in the arse and oh by the way Sprott owed a lot of Dumblummon, don,t remember what percentage.

Today while I read the SPM web site and Goolge research I find out Sprott owns 1 1/2 percent of this company. Also lets not forget the boundry dispute where they look to loose 50-60% of there claim. All resource info goes out the window including the 43-101. They hope enough resources are left to finish the adjacent development.

Am I worried? hell yes-RC

At least USGIF will be saved from inevitable private placement with current low share price. Combined company will have enough cash for some time. Besides, "the combined management team will be led by Darren Blasutti, who "will assume the title of President and Chief Executive Officer and will draw from the expertise of both companies". I agree, last merger was a disaster for US Silver shareholders. But for our merger partner RX Gold (led by Blasutti) it was the way out of inevitable bankruptcy. So, hopefully Blasutti will take care of his shareholders again. I hold small USGIF position now (at 0.42 average) and feel kind of relief... without any reason. ![]()

http://www.stockhouse.com/companies/bullboard/t.usa/us-silver-gold-inc?postid=23109651

Eik, I can,t help but remember the Dumblummon ripoff at about 30% cost of our shares, I don,t trust Sprott and his boys. RC

Scorpio Mining and U.S. Silver & Gold Announce Business Combination to Create a Well-Funded Junior Silver Producer

TORONTO, Nov. 7, 2014 /CNW/ - Scorpio Mining Corporation ("Scorpio Mining") (TSX: SPM) and U.S. Silver & Gold Inc. ("U.S. Silver & Gold") (TSX: USA) are pleased to announce that they have entered into a definitive agreement (the "Agreement") to complete a merger of equals that will combine their respective businesses (the "Transaction") to create a leading junior silver producer in the Americas.

The combined company will continue under the name of Scorpio Mining Corporation and is positioned to have a strong operating platform with two established producing mines, a third mine in development, an advanced stage exploration project, and pro forma net working capital of approximately C$40 million (including approximately C$21 million in cash)[1]. In addition, the combined company will be led by a highly experienced management team and Board of Directors that will focus on efficiently executing a combined business plan, further reducing costs and optimizing operations given current market conditions and evaluating accretive growth opportunities.

Under the terms of the Transaction, which will be effected by a statutory plan of arrangement, shareholders of U.S. Silver & Gold will receive 1.68 common shares of Scorpio Mining for each share of U.S. Silver & Gold held. Shareholders of Scorpio Mining will not have to exchange their shares of Scorpio Mining in the transaction. Upon completion of the Transaction, the combined company will have approximately 335 million common shares outstanding, of which former shareholders of Scorpio Mining will own approximately 59% and former shareholders of U.S. Silver & Gold will own 41%. The Transaction values the combined company at C$65 million on a basic basis.

http://www.newswire.ca/en/story/1442425/scorpio-mining-and-u-s-silver-gold-announce-business-combination-to-create-a-well-funded-junior-silver-producer

U.S. Silver & Gold Inc. (USGIF: OTCQX International) | U.S. Silver & Gold and Scorpio Mining Announce Business Combination

http://searchingwallstreet.com/u-s-silver-gold-inc-usgif-otcqx-international-u-s-silver-gold-and-scorpio-mining-announce-business-combination/

http://www.mining.com/u-s-silver-and-scorpio-mining-merge-to-create-leading-junior-silver-producer-42446/

Mexican-focused silver producer, Scorpio Mining (TSX: SPM), merged with U.S. Silver & Gold (TSX: USA) to create a silver producer focused on the Americas and better survive low precious metal prices.

The entity will stay under the name Scorpio Mining. The new junior silver miner will have two established producing mines, a third mine in development, an advanced stage exploration project, and pro forma net working capital of approximately C$40 million.

Scorpio Mining's stock was halted today pending announcement of the news.

"This merger creates a stronger, better positioned company that is capable of not only surviving the current low silver price environment, but potentially transitioning from a junior precious metals company to an intermediate producer over the next couple of years," stated Darren Blasutti, President and Chief Executive Officer of U.S. Silver & Gold, in a statement.

Management believes a larger company will be able to realize efficiencies and save the combined company approximately C$2.0 – C$3.0 million per annum.

The news release stated that merging the companies will ". . . create a leading junior silver producer in the Americas."

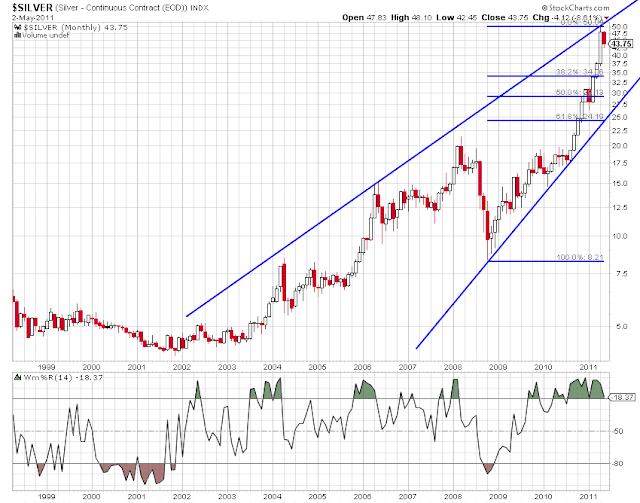

Silver Analyst Who Predicted Silver’s Crash to $15 Three Years Ago Says Massive Rally to $1,000/oz Next!

Posted on November 5, 2014 by The Doc 79 Comments 23,520 views

http://www.silverdoctors.com/silver-analyst-who-predicted-silvers-crash-to-15-three-years-ago-says-massive-rally-coming/

U.S. Silver & Gold Inc - Latest Presentation -

http://www.us-silver.com/Investors/Presentations/default.aspx

http://www.us-silver.com/News-and-Events/News-Releases/News-Release-Details/2014/US-Silver--Gold-announces-results-of-shareholder-meeting/default.aspx

http://www.us-silver.com/

God Bless

U.S. Mint Gold Coin Sales Near 60,000 - "Islamic State, Ebola, Putin, Ukraine" and Swiss Gold Initiative -

GoldCore's pictureSubmitted by GoldCore on 10/29/2014 13:59 -0400

http://www.zerohedge.com/news/2014-10-29/us-mint-gold-coin-sales-near-60000-islamic-state-ebola-putin-ukraine-and-swiss-gold-

The Couer mill not operational during "their switch over" killed this Q...and these Canadian foreigners dragging their feet in blasting a hole down Caladay is looking more and more like they can't and won't pull it off. Guess the Canadians needed PR filler for a dismal Q- shake and bake let's talk about Caladay blah blah blah. IMO time for them to sell Galena- let someone with more $ and experience develop it to it's potential. How many years have they been talking bout Caladay now? One too many...imo. I don't see any upside at this pps and they sure as heck don't offer dividends or anything to hang your hat on. With only $6.7 Mill this is looking like Halloween trick or treat. It never makes any serious pps increase runs so it's looking a potential short play to me anyway.

U.S. Silver & Gold provides third quarter production update

Date : 10/22/2014 @ 4:00PM

Source : PR Newswire (Canada)

Stock : U.s. Silver & Gold Inc. (QX) (USGIF)

Quote : 0.32 0.0 (0.00%) @ 9:45AM

U.S. Silver & Gold provides third quarter production update

Print

Alert

U.s. Silver & Gold Inc. (QX) (USOTC:USGIF)

Intraday Stock Chart

Today : Thursday 23 October 2014

Click Here for more U.s. Silver & Gold Inc. (QX) Charts.

TORONTO, Oct. 22, 2014 /CNW/ - U.S. Silver & Gold Inc. (TSX: USA, OTCQX: USGIF) ("U.S. Silver & Gold" or the "Company") today announced third quarter production figures for its Galena Mine Complex in Idaho.

Highlights

Production of approximately 358,000 silver ounces and 491,500 silver equivalent ounces[1] for the third quarter of 2014 at a silver cash cost of $16.43 per ounce and an all-in sustaining cost of $21.06 per ounce.

Despite processing both lower tonnage and lower silver grades, cash costs and all-in sustaining costs declined 7% and 9% respectively compared with Q3 2013, and 15% and 22% year-over-year as the Company continued aggressive cost cutting and transitioning to higher silver equivalent ore.

Lead production increased by 251% while silver and copper production decreased by 23% and 56% when compared to Q3, 2013.

The transition to predominately silver-lead ore production from silver-copper was completed this quarter as processing of the higher tonnage silver-lead ore was moved to the Galena Mill with the Coeur Mill now handling silver-copper ore. The Coeur Mill was unavailable during the changeover which limited silver-copper production in the quarter.

As a result of the milling downtime and quicker ramp-up of silver-lead production, 2014 production guidance is reduced to 1.65 – 1.75 million silver ounces, with silver equivalent production between 2.1 – 2.2 million ounces. Cost targets will be maintained at $14.50 – $15.50 per ounce in cash costs and $18.00 – $19.00 per ounce in all-in sustaining cash-costs.

As of September 30, 2014, the Company's cash balance totaled approximately $6.7 million.

The Company expects to release its third quarter financial results on Tuesday, November 11, 2014.

"During the first nine months of the year, we were transitioning to sustainable, multi-year lower-cost delivery of predominately silver-lead ore," said Darren Blasutti, President and CEO of U.S Silver & Gold. "In July, we shifted silver-lead ore processing to our higher capacity 1,000 ton per day Galena Mill and over July and August we transitioned lower volume silver-copper ore to our 500 ton per day Coeur Mill. While this reduced mill availability for silver-copper ore processing during the quarter, we expect normal tonnages to be processed in the fourth quarter. This transition also allowed for the completion of additional shaft maintenance and development work which will benefit the Company in the future. We expect the fourth quarter to have higher silver production and lower costs than we saw in the third quarter. With almost all the necessary infrastructure in place, we will be in a position to access additional higher volume silver-lead stopes in 2015 and beyond."

Galena Complex Third Quarter Production Details

The Galena Complex produced 357,669 ounces of silver during the third quarter of 2014 at an average silver grade of 9.7 ounces per ton and a cash cost of $16.43 per ounce of silver. Production for the quarter was reduced while silver-lead processing was shifted from the Coeur Mill to Galena Mill to more efficiently manage the higher volume of silver-lead production. This move is part of the Company's long-term strategy to mine the highest value ore per ton regardless of silver content in order to maximize operating profit. Given the expected mill downtime, maintenance was performed on the Galena Shaft hoist during the quarter which prevented skipping from the high-grade 5200 level for the second half of the quarter, resulting in lower copper grades and production. The work was completed in early October and the shaft is fully operational.

As indicated in Table 1 below, despite drops in tonnage and silver grade year-over-year, silver equivalent grade was maintained due to the increase in silver-lead ore tons milled. Silver-lead production offers overall higher silver equivalent grades and lower mining costs as stopes are typically wider and allow for a greater contribution from mechanized mining. This and the continued focus on cost reductions continued to impact the bottom line overall with cash costs falling 7% and all-in sustaining costs down 9% when compared to 2013 despite lower silver and silver equivalent production.

Table 1

Galena Complex Production Highlights

Q3 2014

Q3 2013

Change

Q2 2014

Change

Total Processed Ore (tons milled)

38,911

40,746

-5%

40,166

-3%

Silver-Lead Ore (tons milled)

23,487

8,507

176%

18,469

27%

Silver-Copper Ore (tons milled)

15,424

32,239

-52%

21,697

-29%

Silver Production (ounces)

357,669

464,850

-23%

520,723

-31%

Silver Equivalent Production (ounces)

491,490

529,860

-7%

649,928

-24%

Silver Grade (ounces per ton)

9.72

11.84

-18%

13.49

-28%

Silver Equivalent Grade (ounces per ton)

13.50

13.53

-1%

16.93

-20%

Lead Production (pounds)

2,479,039

795,665

251%

2,040,198

22%

Copper Production (pounds)

107,112

244,653

-56%

215,302

-50%

Cash Costs ($ per ounce silver)

$16.43

$17.67

-7%

$12.31

33%

All-in Sustaining Costs ($ per ounce silver)

$21.06

$23.11

-9%

$15.36

37%

Quality Assurance / Quality Control ("QA/QC")

U.S. Silver & Gold maintains a QA/QC Program for all assays, including the use of standards, blanks and duplicates. All QA/QC results are routinely evaluated using a program of QA/QC monitoring. Details of the program are provided in the Company's NI 43-101 compliant Technical Report on the Galena Project dated March 22, 2013.

About U.S. Silver & Gold Inc.

U.S. Silver & Gold is a silver and gold mining company focused on growth from its existing asset base and execution of targeted accretive acquisitions. It owns and operates the Galena Mine Complex in the heart of the Silver Valley/Coeur d'Alene Mining District, Shoshone County, Idaho which produces high-grade silver and is the second most prolific silver mine in U.S. history, delivering over 200 million ounces to date. The Caladay Zone is being evaluated for bulk mining development. U.S. Silver & Gold also owns the Drumlummon Mine Complex in Lewis and Clark County, Montana.

Mr. Daren Dell, Vice President, Technical Services and a Qualified Person under Canadian Securities Administrators guidelines, has approved the applicable contents of this news release.

For further information please see SEDAR or www.us-silver.com.

Cautionary Statement Regarding Forward Looking Information:

This news release contains "forward-looking information" within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, the Company's expectations intentions, plans, and beliefs with respect to, among other things, the Galena Complex and the Drumlummon Mine. Often, but not always, forward-looking information can be identified by forward-looking words such as "anticipate", "believe", "expect", "goal", "plan", "intend", "estimate", "may", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of the Company as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of the Company to be materially different from those expressed or implied by such forward looking information. This includes the ability to develop and operate the Galena and Drumlummon properties, risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, social and political developments and other risks of the mining industry. Although U.S. Silver & Gold has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific those contribute to the possibility that the predictions, forecasts, and projections of various future events will not occur. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

_________________________

1 Silver equivalent calculation is based on prices of $20 per ounce silver, $0.95 per pound lead and $3.00 per pound copper.

SOURCE U.S. Silver & Gold Inc.

Copyright 2014 Canada NewsWire

I just increased a bit. Looking for a nice pop!

for my personal ref: Oct 8th ~32 cents

If silver goes back up- mines will stay open. If it keeps falling mines will close up their adits.

Harvey Organ: Shanghai Drained of Silver, Bullion Banks Are About to Attack the COMEX!

ok I'll check back in a month

By all means buy now I'll see you at .10....

very=never, sorry

I've been spot on correct since market peaked and declined and profiting on the downswing. I'll stick to my course and backed with 30+ years of vet experience and millions in banks in bullion and cash I say red works for me fine. I can easily short this but chose not to it's fallen on it it's own like I knew it would and will continue down that trajectory. It's a mathamatical impossibility silver will ever trade that high ever again...let alone in the near future. To understand you need to understand and then practice quantum economics...of which you do not. I don't need or use an algorithm to tell me any of this btw. That's why I sold off almost every long position during late summer across the board except a few select ones of which I will not reveal and put myself in a strong position to start my own version of a Bull Short. Good luck to you though.

your bottom predictions are way off, (i.e. too low)

It's a possibility IMO Galena could be mothballed once again. The silver spot is being hammered and will continue to decline and stay down. I've been around the bush a few years seen the boom and bust cycles. Like I've said before we could be sliding down to $7-$9 an oz but possibly $10-$12 range. Question begs to me is that will these Canadians have the desire to keep Galena open if the going gets tougher? Which I think it will. It's a business and I could easily see them eventually shutting the doors if this becomes a money losing operation and preserving what's in the bank that's left. For now the adits are open but we'll see what happens.

I don't see silver bouncing back and the revenues are going to reflect that. I see potential trouble on horizons in the mining sectors and only the VERY STRONG will survive what's coming and IMO is already occurring. Like I said many many months ago...I wouldn't touch this at .25...I just don't see any upside as silver spot declines.

Here is how I will play this: Wait til it slides down to .10 or under and then take deep positions again. Wait for good things to occur even if it takes years and then sell at peak again.

I'll be buying bullion and lots of it when it bottoms were not close yet. The only silver stock I'll be going on long is HL- any other silver stock I'm shorting until the silver spot stops falling. Only way I buy this stock is if I shorted it and it slips way below .25 and that would be a maybe. To risky and they don't have a ton of cash in the bank IMO for my investment money to be parked here short or long term outlook. I can't see this doubling or tripling at all in this current market of silver spot being hammered down now for too many years.

I see China and Russia as vulnerable here is why-

China's exports will taper off bc their labor expenses are rising less competitive. Their domestic markets for consumption of their own native products are not even close to being developed. Crappy low quality products can't compete with Western quality. They are in a huge massive real estate bubble-and the Communist Central Bank has been trying to steer them through it with internal capital controls last few years trying to head it off-they will fail bc it's a ponzi scheme of massive proportions. There are cities that were constructed with sky rises and streets that are vacant. It's censored you don't see it. Right now there is a shadow banking system in China trying to lure Western money with returns of 5-7% and that's a pure ponzi scheme I know this to be factual bc of personal experience and intel. That will fall as well and China is not as big and strong as what they try to portray to the world. They only grew bc of Nixons opening the door to them...only what 42 years ago back in Feb of 72'? They needed the world. The world doesn't need them only 42 years later. They or any other nation can never topple the USA unless we topple ourselves. We have the most developed internal market of any country in the world bar none. They might grow larger than us bc of sheer population size- but they will never be as developed and market efficient. They are a paper tiger.

The former Soviet Union is screwed and a one horse pony...one sector O & G that's all they have which is pretty damn scary when you think about it. What do they manufacture? For such a highly overall educated society they are still in the stone age when it comes to modernizing and diversifying their economic export or developing their domestic markets. When your oil revenue prices decline and your financial market access to money gets cut off- worse Western capital flees to the tune of $100 Bill so far and will grow without a doubt- and your currency declines...add in billionaires fighting internally for control over smaller pools pf business with the Russian government state owned companies...they are going to down the tubes and be so severely weakened they'll doubtfully come back to where they were. US and Western Govts still control USSR's crap and not the other way around. The only reason Russia gained it's new found wealth was bc the former Soviet Union collapsed and inflow and influx of capital Western style came in-and now it's going out LOL. Back to eating potatoes for the commoner and when the sanctions really start hammering them in another 6 months to a year you'll see Uncle Fester Putin probably in a coup. Those idiots haven't seen anything yet and NATO is going to support 100% the Baltic States and they are going to start shuffling weapons and troops into defend their turf. That's why you see Putin making more sorties testing US and EURO air defenses trying to flex his alleged muscles and thinks he's going to bluff the US and free world into backing down...not going to happen. They have reserves...but before long you'll see them cut in half before years out or within 7-8 months to a year. Couple that with OPEC and US pumping more O & G Russia has been neutralized and is already sliding and it only took a few months....shows how stupid and one sided weaklings they really are.

I love shorting the ruble and I hope it slides even more :)

The Chinese are overall more diversified but they are paper tigers that don't know their place in the world yet acting immature & belligerent at the same time.

In regards to metals when you print trillions of dollars and flood the worlds markets with them it flooded the world with inflation friendly or foe. Economic recessions across the world people and governments stop or slow their buying of goods export wise. This does not bode well for China-during the US recession there was many billions of dollars goods left on the docks in Chinese ports that did not make it's way across the oceans of the world. Chinas internal market is 40 years away from being developed so they know they can depend on the world to export now-they are to vulnerable and Communists know this. Metal prices will continue to drop like I predicted after it's peak.

Mav

It's hard to guess how long they can keep their game going. I sure haven't been able to guess right...every time I short the market it goes up hundreds of points like magic while silver and gold continue to get shellacked.

When a group of private bankers own a money printing press, this is what happens. Wealth gets concentrated into a few hands while the rest of the country gets poorer...hence the need for a police state to keep them under control.

You're right...Bernanke and all those guys are set for life.

Saw that- but he still isn't in the hot seat when the crap hits the fan you know what I mean. It's a ponzi scheme the financial banks and the entire stock market-you just have to know how to get out in front of them.

Actually I just read that Bernanke was having trouble refinancing his home.

http://www.cnbc.com/id/102055197

I have also read the Euro is the place to be.

I'm going to start buying silver again if it gets much lower. The world is in a loony bin and I'd rather have something real to stack.

|

Followers

|

139

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

17231

|

|

Created

|

04/10/08

|

Type

|

Free

|

| Moderators | |||

http://www.us-silver.com/i/pdf/BullBear-Mar2011.pdf

Profitable Production from the Worlds Most Prolific Silver Belt

http://www.us-silver.com/i/pdf/factsheet/ussilver-factsheet.pdf

US Silver Corp -

(OTC) (USOTC:USSIF) (TSX.V, symbol USA) owns and operates the

Galena Mine in the historic Silver Valley of North Idaho.

The Galena Mine and Mill, along with the Coeur Mine and Mill

and the Caladay Project were acquired from Coeur d'Alene

Mines Corp (NYSE-CDE) on June 1, 2006.

A total of 11,000 acres of patented and unpatented mining

claims, along with surface facilities and equipment were

acquired for $15 million.

The Galena Mine lies in the heart of the Coeur d'Alene Mining

District, the most prolific silver district in United States

history with over 1.2 billion ounces of silver production.

Throughout the long history of the Company's properties, the

mines have produced some 9.9 million tons of ore containing

over 200 million ounces of silver, 160 million pounds of

copper, and 22 million pounds of lead at an average grade

of 21.2 ounces per ton of silver, 0.8% copper and 8.8% lead.

The Galena Silver Mine ranks as the second largest primary Silver

mine in US history and has produced Silver since 1884 -

www.us-silver.com/s/Projects.asp

www.us-silver.com/s/PhotoGallery.asp

www.us-silver.com/i/pdf/factsheet/ussilver-factsheet.pdf

U.S. Silver Corp is the second largest primary silver producer in the United States operating from the Silver Valley in northern Idaho with annual silver production of approximately 2.4 million ounces. A dominant regional land package of 14,000 acres of under-explored property provides U.S. Silver tremendous future potential reserve growth in the most prolific silver district in the United States.

Elliott Wave System TA Identifying Trends Contain 5-Wave Pattern - ![]()

- Silver Chart TI Alert 3rd Wave Strong Start The Best To Come ![]()

- Ag in 3rd Wave bull start # 4 - 5 Wave Bulls still to GO

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

Rothschilds World Part 1 "Glen, Rush, Michael...Here's to you boy's"

http://www.youtube.com/watch?v=yhKHwrUA5SM&feature=related

www.us-silver.com/s/StockInfo.asp

http://canadianinsider.com/coReport/allTransactions.php?ticker=USA

http://www.investmentpitch.com/media/552/U.S._Silver_Corp._-_TSX.V__USA/

http://www.us-silver.com/i/pdf/CP_Jan2010.pdf

Silver Mining Town of Wallace "Silver Capital of the World" -

The historic mining town of Wallace

(population 960) is nestled beneath Interstate 90,

halfway between two ski and recreation areas in

northern Idaho's beautiful Silver Valley.

The town has long been famous as the "Silver Capital of the World"

with 1.2 billion ounces of silver produced

in Shoshone county since 1884.

http://wallace-id.com/

Nice to ride with the USSIF winner of the Silver producers ![]()

http://www.walkaboutventures.com/

Communism's True Believers Won't Give Up -

http://www.henrymakow.com/communisms_useful_idiots_wont.html

Silver Price year 1477 Market Value $806 per ounce -

(1998 fiat dollar market value)

Add inflation to Silver Market Value $806/oz since year 1477 -

US$dollar 1913 Market Value = about $0.03 since Fed's 1913 poncy schemes -

USSIF/USA's shareholder we should all be encouraging the company

to look at buying shares back and all the way up -

while the silver Ag price is below $100 per ounce -

and the USA/USSIF share are undervalued and oversold -

its a great opportunity of USSIF below -

a fiat$/sh to start the buy back -

Gov. Debt - MOAB - Mother Of All Fiat Bubbles -

http://monetaadvisors.com/?p=67

Gold has replaced every fiat currency for the past 3000 years -

http://www.kwaves.com/fiat.htm

http://www.canadiancontent.net/commtr/fiat-currency-fall-dollar_958.html

"U. S. Silver

generates 6% of U.S. silver production from its

Galena Mine and Mill.

The company's holdings are a combination of fee land,

patented mining claims, unpatented mining claims and mining leases.

As of 2010, it is profitable, carries no debt and produces silver

at an average cost of $11.50/oz.

With completion of rehab efforts/opening of the Galena shaft,

the company can now move ore from two shafts.

Two distinct ore combinations are present-a lead/silver ore and

a silver/copper ore. . .With both shafts now operating,

the company expects to produce 3.3 Moz. Ag (not silver-equivalent)

in 2011.

Current production is running at about 2.7 Moz. annualized."

David Morgan, Morgan Report (07/06/10)

Gold Spot - Au & Ag The Only Real Money -

The super red banksters cults -

Rothschilds World Part 1 "Glen, Rush, Michael...Here's to you boy's"

http://www.youtube.com/watch?v=yhKHwrUA5SM&feature=related

http://maxkeiser.com/

Eric Sprott and Andrew Morris: Follow the money into silver

http://www.sprott.com/Docs/MarketsataGlance/2011/0311%20Follow%20the%20M...

USSIF chart TA alert Ag-bull move LT firm higher ![]()

USSIF Ag-Global USA Richest Silver Mine

USSIF/USA's agenda priority should be to establish the

control of at least 51% of the outst. shares -

USSIF/USA's shareholder we should all be encouraging the company

to look at buying shares back and all the way up -

while the silver Ag price is below $100 per ounce -

and the USA/USSIF shares are undervalued and oversold -

its a great opportunity of USSIF below -

a fiat$/sh to start the buy back -

USSIF/USA has a long hike back UP to a more fair share price -

The Day The Fiat Dollar Die -

- a person / or a nation / be bankrupt -

- about the same for all, will be said -

http://inflation.us/videos.html

it has happen to all fiats before -

e.g. -

not to long ago to USSR, Zimbawe, Argentina,

Germany etc. btw. -

Gold & Silver have replaced every fiat currency

for the past 3000 years -

http://www.kwaves.com/fiat.htm

The NWO banksters cults owned by...

http://www.reformation.org/adolf-hitler.htmlKHAZAR EMPIRE,ILLUMINATI & THE NEW WORLD ORDER part 1 -

Masons -

http://www.youtube.com/watch?v=ZSlJOsVGTtI&feature=BF&list=PLF6B986D4B11DDA56&index=1

http://www.youtube.com/watch?v=AMFA9bDii8Q&feature=BF&list=PLF6B986D4B11DDA56&index=2

http://www.silver-investor.com/

http://lebed.biz/endofliberty.html

"We have gold and silver because we cannot trust Governments."

President Herbert Hoover

http://www.888c.com

God Bless

Welcome to U.S. Silver Corporation discussion board -

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |