Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

AHPI changed to AHPIQ, bankruptcy.

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

AHPI delisted from the Nasdaq to the OTC:

https://otce.finra.org/otce/dailyList?viewType=Additions

They must have sold the slide whistle.

Staying amazingly high for a dead company

sold andr stopped out of ahpi today. Market looking ugly not positive catalyst under the current administration.

Bought AHPI $4.21-$4.22 this morning

AHPI $4.8 Extremely low float 3 mil possible bounce play coming. With any significant buy volume AHPI will be up 50-200%

https://stockcharts.com/h-sc/ui?s=ahpi

Omicron spreading out of control...cya at $10 on monday

AHPI @ 10.00 > U.S. Equity Futures Sharply Lower; Covid-Related Stocks Surge on Reports of New, Heavily-Mutated Strain, Feared to be more Infectious than Delta Variant.

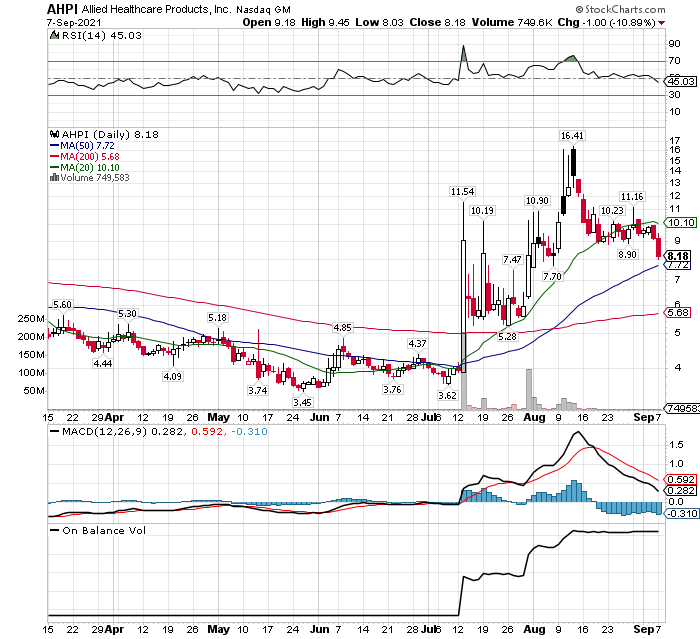

AHPI $8 .18 -$1 -10% breakdown Dems and main media unable to change the crisis narrative back to Covid. Afghanistan debacle is still an issue thats not likely to go away. 109k maskless fans packed into college football stadium chanting F Joe Biden speaks loudly. Covid fear aint happening AHPI fell out of $9 support today after the trend started late last week. Could punch 50ma tomorrow, bounce op may be in the making.

Right now the world is focused on Afghanistan. Once that wanes the media and Dems will get back to work on fanning the Corona Crisis embers into a big bon fire.

Chart

moving lower toward the gap and test the previous highs. Currently underway I consider it in the target zone to re enter. I reloaded the shares I sold around $16 at ave of $9.6.

Chart needs some support built into it at current level while the 20ma catches up, similar to mid to late July. Now is the perfect time with two weeks of Afghanistan evacuations ahead of us which will remain the main focus of Dems/media. In the meantime short loan is paying about $18-$19 per day per 1k shares in interest. Making money on both sides of the trade. 2.99 float AHPI The Perfect Trade On Steroids

Typical AHPI trading would close the gap. Gap closed today big 83% retracement to $9.35 of the last run from $7.7-$16.41.

The massive gap up by some eager beavers with a big move up. The rest of the day was lighter volume with pps moving lower toward the gap and test the previous highs. Typical AHPI trading would close the gap but matters not. We have months of growing momentum and mania ahead. This is just getting warmed up.

AHPI 2.99 mil float is tiny compared to GME's 58 mil float.

GME float is 19.3 times larger than AHPI float.

Right now the world is focused on Afghanistan. Once that wanes the media and Dems will get back to work on fanning the Corona Crisis embers into a big bon fire.

Chart

moving lower toward the gap and test the previous highs. Currently underway I consider it in the target zone to re enter. I reloaded the shares I sold around $16 at ave of $9.6.

Chart needs some support built into it at current level while the 20ma catches up, similar to mid to late July. Now is the perfect time with two weeks of Afghanistan evacuations ahead of us which will remain the main focus of Dems/media. In the meantime short loan is paying about $18-$19 per day per 1k shares in interest. Making money on both sides of the trade. 2.99 float AHPI The Perfect Trade On Steroids

![]()

Cost to borrow report update $39 per 1k shares per day up $6 from Last night lending report paying $33.04 per 1k shares per day.. My 50% is $19.5 per day per 1k shares That is the cost to borrow AHPI. Last night The report is based on previous day when interest was 103% and closing pps was $2 less, yesterday it was 115%. My 50/50 split is $16.52 per day per 1k shares up $1.2 from previous day. When 100% or more of the float shorted. Then the Red dit fellows climb on board like a bunch of people packed into a suburban down south. gov will do their part in covid crisis management. The sweet people at news outlets will be there as well. Everyone's working together just like a team. 2020 this was The Perfect Trade. The float is the same the volume has increased 10 fold, there is a large and growing short and the herd is coming. Now its The Perfect Trade On Steroids.

Pull back testing $12 the big gap up from the other morning. AHPI was $6 2 weeks ago. consolidation and base building before the next breakout. Each move has been a double bagger from each pennant. Next move could be mid $20s

![]()

This is not GME!!! YOU JUST BAILED OUT THE MMs AND F@CKED US

Our friend seems to have loaned his shares. Uggg. This is not GME WTF!!!

Maybe MMs change their strategy for some psychological warfare. Either way HODL!!!

There were 3000 shares available to borrow last night and now there is zero. Looks like shorts only have a little dry powder left.

AHPI has beautiful setup, much like KOSS did last year.. Major short squeeze just about to take place.

Look for another premarket run tomorrow. MMs are getting more bang for their buck. Short exempts are get lower each day by them doing this. This a managed event and I don't like it. We need more retail pressure

Keep it down until pre market tomorrow, my funds clear

Extended Hours moves will be the norm. There is less fomo that goes along with the move so the MMs create less short exempts. This is a managed event.

This algorithm is gonna break soon.

These new shorts are muting the buying pressure from the MMs. Can't but think they are working together to manage their way out of this.

I did not, just getting back fully active on iHub, I’ve been off running a software company that I built, but now I’m locked and loaded trading with Lightspeed

Appreciate the kind words. Did you ride BTBT too

Thanks, made some off your other pick also. You know your stuff and I support you 100%. I was watching over the past days when you mentioned why are people not on this board. Wel FYi I’ve noticed that the boards that should be active are just not as active as they should, not sure if that’s because there is so much going on, but always good to be following a true leader.

Welcome aboard!!!!

I bought a starter package of 500 but waiting on funds from another trade to clear my broker tomorrow. Wish I could ge another 3k at this level. This is holding amazingly (don’t know why I thought it would go to $10)

Someone shorted 25,000 shares this morning billing the MMs out. WTF

Now there is zero available!!! HODL

Someone put their shares up for borrowing. 10,000 shares available

They're trying to shake the tree!!!!

Going to be bumpy, not for the weak of heart

Looks like AHPI is going to hit 20 plus this week. Good luck everyone.

Does that number include shares borrowed and FTDs or is that just shares on loan? Can you ask Etrade?

Post 221 I asked that very question 1,704,000 shares of float shorted. That was as of last Friday. I would. Assume that it may be higher today seeing how the pps keeps moving up.

Nice 8am volume spike means we are getting some more retail attention!!!!

THIS IS A RUNAWAY TRAIN IF NO MORE SHARES BECOME AVAILABLE. However I only am in charge of my own decisions. I also was in on GME but that had a tin of social media support where AHPI has almost none.

The last sec short interest report on July 30th showed a little over 600,000 shares on loan. So I am assuming it is close to 700k at this point conservatively.

|

Followers

|

24

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

321

|

|

Created

|

02/09/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |