Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Alamos Gold Announces Acquisition of Orford Mining Including the Qiqavik Gold Project

https://s24.q4cdn.com/779615370/files/doc_news/2024/Jan/20240115-Alamos-Gold-Announces-Acquisition-of-Orford_FINAL.pdf

Analyst Recommendations for Wednesday, December 13 -

Alamos Gold (TSE:AGI) (NYSE:AGI) had its price target raised by analysts at BMO Capital Markets

from C$19.00 to C$23.00. This represents a 24.0% upside from the current price of C$18.55. ![]() )

)

MAGA - IMPEACHMENT FURY ENGULFS BIDEN WHITE HOUSE AS REPUBLICANS CRY COVER UP

WATCH

https://www.bitchute.com/video/xKIejs-6FlU/

WATCH: Former President Trump Takes Questions From Crowd Members | 2023 Rewind

Forbes Breaking News

2.59M subscribers

Silver Tops $25, Gold Above $2040 | LIVESTREAM w/ Michael Oliver

Liberty and Finance

94.9K subscribers

$Alamos Gold (TSX:AGI) - High-Margin Growth Strategy Built for Shareholders

Crux Investor

87.6K subscribers

Alamos Gold Declares Quarterly Dividend

T.AGI | 3 days ago

TORONTO, June 05, 2023 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today announced that the Company’s Board of Directors has declared a quarterly dividend of US$0.025 per common share. The Company has paid dividends for 14 consecutive years during which time $304 million has been returned to shareholders through dividends and share buybacks, including $20 million thus far in 2023.

The dividend is payable on June 29, 2023 to shareholders of record as of the close of business on June 15, 2023. This dividend qualifies as an “eligible dividend” for Canadian income tax purposes.

Dividend Reinvestment Plan

The Company has implemented a dividend reinvestment plan (“DRIP”). This gives shareholders the option of increasing their investment in Alamos, at a discount to the prevailing market price and without incurring any transaction costs, by electing to receive common shares in place of cash dividends. For shareholders that elect to participate in the DRIP, common shares will be issued from treasury at a 3% discount to the prevailing market price.

Enrollment in the DRIP is optional. Further information on the plan, including the forms needed to enroll are available on the Company’s website at http://www.alamosgold.com/investors/Dividend-Reinvestment-Plan. In order to be eligible to participate in the June 29, 2023 dividend, enrollment must be completed by 4:00 pm EST on the fifth business day prior to the June 15, 2023 dividend record date.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a strong portfolio of growth projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 1,900 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Senior Vice President, Investor Relations

(416) 368-9932 x 5439

All amounts are in United States dollars, unless otherwise stated.

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

AGI this gold play is ready to explode. Ready for 13.00 then 14.00. Absolutely the best gold monster.

AGI ready to rock. No debt and great management. Watch how this heads to 13.00 in the weeks to come

Still my best overall hedge.

Alamos Gold Reports Second Quarter 2022 Results

READ MORE

https://www.alamosgold.com/home/default.aspx

NEWS HIGHLIGHT

JUNE 28, 2022

Alamos Gold Announces Phase 3+ Expansion of Island Gold to 2,400 tpd, Driving a

Larger, More Profitable Operation with Average Annual Gold Production of 287k oz,

Industry Low All-in Sustaining Costs of $576/oz, and a 31% Increase in Net Present

Value (“NPV”) to $2.0 Billion at $1,850/oz Gold

https://www.alamosgold.com/home/default.aspx

Alamos Gold Announces Phase 3+ Expansion of Island Gold to 2,400 tpd, Driving a Larger, More Profitable Operation with Average Annual Gold Production of 287k oz, Industry Low All-in Sustaining Costs of $576/oz, and a 31% Increase in Net Present Value (“NPV”) to $2.0 Billion at $1,850/oz Gold

HIGHLIGHT

JUNE 28, 2022

https://www.alamosgold.com/news-and-events/default.aspx#news--widget

https://www.alamosgold.com/investors/default.aspx#corporate-presentations

https://www.alamosgold.com/

Alamos Gold Enters into Automatic Share Purchase Plan and Announces Share Repurchases Under Normal Course Issuer Bid

T.AGI | 4 days ago

TORONTO, May 19, 2022 (GLOBE NEWSWIRE) --

Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today announced that it has entered into an automatic share purchase plan (“ASPP”) with a broker in order to facilitate repurchases of Alamos’ Class A common shares (“Common Shares”) under its previously announced normal course issuer bid (“NCIB”). Since December 24, 2021, Alamos has purchased 1.0 million shares in total pursuant to the NCIB at an average price of US$7.415 at a cost of $7.4 million, with all the purchases occurring in May 2022.

During the effective period of the ASPP, Alamos’ broker may purchase Common Shares at times when Alamos would not be active in the market due to insider trading rules and its own internal trading blackout periods. Purchases will be made by Alamos’ broker based upon parameters set by Alamos when it is not in possession of any material non-public information about itself and its securities, and in accordance with the terms of the ASPP. Outside of the effective period of the ASPP, Common Shares may continue to be purchased in accordance with Alamos’ discretion, subject to applicable law. The ASPP has been entered into in accordance with the requirements of applicable Canadian securities laws.

Alamos previously announced that it had received approval from the Toronto Stock Exchange ("TSX") to, during the 12-month period commencing December 24, 2021 and terminating December 23, 2022, purchase up to 29,994,398 Common Shares, representing approximately 10% of the Company’s public float of the Common Shares as of December 15, 2021, being 299,943,980 Common Shares (as of December 15, 2021, there were 391,962,704 Common Shares issued and outstanding), by way of a NCIB on the TSX or through alternative trading systems or by such other means as may be permitted under applicable law.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Vice President, Investor Relations

(416) 368-9932 x 5439

All amounts are in United States dollars, unless otherwise stated.

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note

This news release includes certain statements that constitute forward-looking information within the meaning of applicable securities laws ("Forward-looking Statements"). All statements in this news release, including statements regarding potential future purchases by Alamos of its Common Shares pursuant to the NCIB including ASPP, other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are Forward-looking Statements. Forward-looking Statements are generally, but not always, identified by the use of forward-looking terminology such as "expects", is “expected", "anticipates", "plans" or “is planned”, “trends”, "estimates", "intends" or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms.

Alamos cautions readers not to place undue reliance on the forward-looking statements in the information and content on this news release as a number of factors could cause actual future results, conditions, actions or events to differ materially from the targets, outlooks, expectations, goals, estimates or intentions expressed in the Forward-looking Statements. These factors include, but are not limited to: changes in the financial markets, changes in applicable laws and governmental regulations, fluctuations the price of gold, fluctuations in relative currency values, risks related to obtaining and maintaining necessary permits and the unpredictability of and fluctuation in the trading price of the Company’s common shares.

Additional risk factors and details with respect to risk factors affecting the Company are set out in the Company’s latest Annual Information Form and MD&A, each under the heading “Risk Factors”, available on the SEDAR website at www.sedar.com or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information found in this news release. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

https://www.usdebtclock.org/

https://www.worldometers.info/coronavirus/country/us/

https://www.whatdoesitmean.com/index.htm

God Bless.

As well as it's doing- it might be time to take some profits pretty soon.

Alamos Gold Announces Significant Permitting Milestone at Island Gold with Filing of Closure Plan Amendment

March 16 2022 - 05:00PM

GlobeNewswire Inc.

https://ih.advfn.com/stock-market/NYSE/alamos-gold-AGI/stock-news/87576492/alamos-gold-announces-significant-permitting-miles

BY MT Newswires

— 1:13 PM ET 08/24/2021

01:13 PM EDT, 08/24/2021 (MT Newswires) -- Platinex Inc. ( PANXF

on Tuesday surged 12.5% on last look after reporting the purchase of additional mining claims in Shining Tree.

The purchase price includes 5 million Platinex ( PANXF common shares and a 2% net smelter returns royalty on the mining claims.

Platinex ( PANXF ) has consolidated the former Ronda mine which is the largest former producer at Shining Tree providing virtually 100% ownership of the mine workings, depth, and strike extensions by buying the claims of Alamos Gold Inc. ( AGI ) unit Trillium Mining Corp.

The transaction provides Alamos with an equity position in Platinex ( PANXF and greater regional participation in the developing Shining Tree camp.

At Shining Tree, the company said its work program, which began in September 2020, is ongoing and includes a program of linecutting, DHIP inversion study of the Herrick drilling done in 2008-2011, an IP survey covering 28.5 line kilometers of the grid, including parts of the Caswell and Ronda Mine area, and areas south of and through the Herrick Mine and Churchill Mine.

The IP survey identified 25 IP chargeability anomalies including 16 identified as high priority, the company added.

The company expects to announce the Herrick Resource Estimate in October with recommendations for additional definition drilling.

$Alamos Gold Extends Gold Mineralization Below Mineral Reserves and

Resources at Young-Davidson Including Intersecting Higher Grades in

Hanging Wall and Footwall

https://www.alamosgold.com/home/default.aspx

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=164515626

https://www.alamosgold.com

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

It's nice to own this. It would be easy to trade, but I never get around to it.

Richest gold mines in Canada in Q1 2021 - report

Vladimir Basov Vladimir Basov

Friday June 18, 2021 12:34

Kitco News

$The second richest Alamos Gold’ Island Gold mine is a high grade,

low-cost underground mining operation located just east of the town

of Dubreuilville, Ontario, Canada, 83km northeast of Wawa.

Underground grades processed averaged 13 g/t Au in the first quarter,

an 11% increase over Q1 2020 and above the Mineral Reserve grade.

All richest gold mines in Canada are underground operations.

The complete list is below.

Richest gold mines in Canada in Q1 2021

https://www.kitco.com/news/2021-06-18/Richest-gold-mines-in-Canada-in-Q1-2021-report.html

$Alamos Gold Reports Best Hole Drilled to Date at Island Gold (71.21 g/t

Au (39.24 g/t cut) over 21.33 m true width),

Extending High-Grade Gold Mineralization Down-Plunge from Existing

Mineral Resources

Alamos Gold Inc.

Tue., June 15, 2021, 3:30 a.m.

https://ca.finance.yahoo.com/news/alamos-gold-reports-best-hole-103000554.html

Ps.

Alamos Gold should buy MMY bargain producer of gold & silver -

$Monument Mining Limited (MMY.VN) -

$MMY- $70 mil in assets and only a $42 mil market cap? NO DEBT! ![]() )

)

https://www.barchart.com/stocks/quotes/MMY.VN/opinion

$Way undervalued and oversold - 5 bagger + + + + ? or more -

IMO!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=161590519

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$Alamos Gold Reports Best Hole Drilled to Date at Island Gold (71.21 g/t

Au (39.24 g/t cut) over 21.33 m true width),

Extending High-Grade Gold Mineralization Down-Plunge from Existing

Mineral Resources

Alamos Gold Inc.

Tue., June 15, 2021, 3:30 a.m.

https://ca.finance.yahoo.com/news/alamos-gold-reports-best-hole-103000554.html

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

$Alamos Webinar; Check out the Bloor Street Capital webinar

this week with

John McCluskey, CEO of Alamos Gold Inc

https://bit.ly/33NIyGh.

Not a bad time to re-enter the $GOLD producers as gold seems to have build a solid foundation to launch from

Alamos Gold Makes US$1.0 Billion Claim Against Turkey, Takes

Alamos Gold this morning announced that it is making a US$1.0 billion

investment treat claim against the Republic of Turkey in relation to

unnecessary delays at one of its projects.

In connection with the claim, the company is also being forced

to take a significant impairment charge within its

second quarter results.

https://thedeepdive.ca/alamos-gold-makes-us1-0-billion-claim-against-turkey-takes-215-million-impairment-charge/

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA.

blackccat thanks; It will be a lot of $money for Alamos when

it works out and all we need to do its to pray for the

positive Alamos side ![]() )

)

imo!

https://www.alamosgold.com/news-and-events/default.aspx

APRIL 20, 2021

Alamos Gold Announces US$1 Billion Investment Treaty Claim Against the Republic of Turkey

DOWNLOAD PRESS RELEASE

PDF FORMAT (OPENS IN NEW WINDOW)

PDF 131 KB

TORONTO, April 20, 2021 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or, including its direct and indirect subsidiaries, the “Company”) regrets to announce that its Netherlands wholly-owned subsidiaries Alamos Gold Holdings Coöperatief U.A, and Alamos Gold Holdings B.V. (the “Subsidiaries”) will file an investment treaty claim against the Republic of Turkey for expropriation and unfair and inequitable treatment, among other things, with respect to their Turkish gold mining project. The claim will be filed under the Netherlands-Turkey Bilateral Investment Treaty (the “Treaty”), and is expected to exceed $1 billion, representing the value of the Company’s Turkish assets.

Alamos has had an active presence in Turkey since 2010. Over that time frame, the Company’s Turkish operations have met all legal and regulatory requirements, complied with best practices relating to sustainable development including meeting the highest environmental and social management standards, created hundreds of jobs, and developed trusting relationships with the local communities. Alamos and the Subsidiaries have invested over $250 million in Turkey, unlocked over a billion dollars worth of project value, and contributed over $20 million in royalties, taxes and forestry fees to the Turkish government. Over the life of the project, government revenues alone are expected to total $551 million. Additionally, Alamos and the Subsidiaries have invested $25 million to date towards various community and social initiatives.

In October 2019, well into construction of the Kirazli Gold Mine (“Kirazli”), the government failed to grant a routine renewal of the Company’s mining licenses, despite the Company having met all legal and regulatory requirements for their renewal. This past October, the Turkish government refused the renewal of the Company’s Forestry Permit. The Company had been granted approval of all permits required to construct Kirazli including the Environmental Impact Assessment approval, Forestry Permit, and GSM (Business Opening and Operation) permit, and certain key permits for the nearby Agi Dagi and Çamyurt Gold Mines. These permits were granted by the Turkish government after the project earned the support of the local communities and passed an extensive multi-year environmental review and community consultation process.

In its effort to secure the renewal of its mining licenses, the Company has attempted to work cooperatively with the Turkish government, has raised with the Turkish government its obligations under the Treaty, has sought to resolve the dispute by good faith negotiations, and has made considerable effort to build support among stakeholders and host communities. The Turkish government has failed to provide the Company with a reason for the non-renewal or a timeline for renewal of its licenses.

The failure to renew the Company’s mining licenses will result in the loss of over a half a billion dollars in future economic benefits to the Republic of Turkey, including tax and other revenues, and thousands of jobs within Turkey. In addition to the lost job opportunities, this will also have a lasting impact on the local population through the disruption of ongoing investments into community projects.

“Alamos began investing in Turkey in 2010, warmly welcomed by the Turkish government through its foreign investment office. After 10 years of effort and over $250 million invested by the Company we have been shut down for over 18 months in a manner without precedent in Turkey, despite having received all the permits required to build and operate a mine. The Company has worked in Turkey to the highest standard of conduct with respect to social and environmental best practices. Despite this effort, the Turkish government has given us no indication that relief is in sight, nor will they engage with us in an effort to renew the outstanding licenses. We are hopeful that the arbitration process will bring about the engagement that we have sought from the Turkish state, and lead to an equitable resolution to this impasse,” said John A. McCluskey, President and Chief Executive Officer of Alamos Gold.

Alamos and the Subsidiaries are being represented by the leading Canadian law firm Torys LLP, with a team that includes John Terry and former Canadian Supreme Court Justice, the Hon. Frank Iacobucci. The Company is also being supported by its strategic advisor John Baird, former Canadian Minister of Foreign Affairs and Senior Advisor to Bennett Jones LLP.

Bilateral investment treaties are agreements between countries to assist with the protection of investments. The Treaty establishes legal protections for investment between Turkey and the Netherlands. The Subsidiaries directly own and control the Company’s Turkish assets. The Subsidiaries invoking their rights pursuant to the Treaty does not mean that they relinquish their rights to the Turkish project, or otherwise cease the Turkish operations. The Company will continue to work towards a constructive resolution with the Republic of Turkey. If required, Alamos and the Subsidiaries are confident in the Subsidiaries’ ability to recover and enforce any favourable judgement pursuant to this Treaty, which will be rendered by three independent international arbitrators. Although timelines with respect to bilateral investment treaty arbitration can vary depending on procedural steps and delay tactics employed by nation states, it is estimated to have finality within five years. A portion of the cost of such an arbitral process is expected to be recovered as part of the arbitration process.

The failure by the Republic of Turkey to renew the mining licenses in the 18 months since their expiry, the failure of discussions with the Republic of Turkey to date to resolve the situation, and the resulting current decision to proceed with a bilateral investment treaty claim is an impairment trigger for accounting purposes. As a result, Alamos and the Subsidiaries expect to incur an after-tax impairment charge of approximately $215 million, which will be recorded in the second quarter financial statements. The non-cash charge reflects Alamos’ and the Subsidiaries’ entire net carrying value of the Turkish assets.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

Investor Contact

Scott K. Parsons

Vice President, Investor Relations

(416) 368-9932 x 5439

ir@alamosgold.com

Media Contact

Rebecca Thompson

Vice President, Public Affairs

(416) 368-9932 x 5448

media@alamosgold.com

All amounts are in United States dollars, unless otherwise stated.

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This News Release contains statements about expected or anticipated future events, financial results and litigation outcomes that are forward-looking in nature and, as a result, are subject to certain risk and uncertainties such as the inherently uncertain nature of potential and ongoing litigation proceedings including outcomes and costs, general economic, political, market and business conditions, regulatory processes and actions, new legislation, government actions or inactions, technical issues, potential delays or changes in plans, the occurrence of unexpected events and the Company’s capability to execute and implement its future plans.

The Republic of Turkey has recently experienced significant political, social, legal and regulatory instability. The impact of the change in political climate in Turkey in recent years is not fully known, but may include heightened control of the judiciary, bureaucracy, media and the private business sector. While the Company is taking the actions described in this News Release to mitigate the effects of the actions of the Turkish government in respect of the Company’s assets and gold mining projects in the Republic of Turkey, there can be no assurance that such mitigating actions will be effective or successful. If unsuccessful, the Company’s assets and gold mining projects in Turkey may be subject to resource nationalism and further expropriation; the Company may lose the full value of its assets and gold mining projects in Turkey and its ability to operate in Turkey. Even if successful, there is no certainty as to the quantum of any damages award, recovery of all, or any, legal costs. Any resumption of activities in Turkey, including renewal of the requisite operating licenses or permits, or even retaining control of its assets and gold mining projects in Turkey can only result from agreement with the Turkish government. The litigation described in this News Release may have an impact on foreign direct investment in the Republic of Turkey which may result in changes to the Turkish economy, including but not limited to high rates of inflation and fluctuation of the Turkish Lira which may also affect the Company’s relationship with the Turkish government, the Company’s ability to effectively operate in Turkey, and which may have a negative effect on overall anticipated project values.

Additional risk factors affecting Alamos and the Company’s ability to achieve expectations set forth in the forward-looking statements contained in this News Release and in general are set out in the Company’s latest 40F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors” available on SEDAR (www.sedar.com) or on EDGAR (www.sec.gov). The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Primary Logo

Source: Alamos Gold Inc.

$Alamos Gold Makes US$1.0 Billion Claim Against Turkey, Takes

Alamos Gold this morning announced that it is making a US$1.0 billion

investment treat claim against the Republic of Turkey in relation to

unnecessary delays at one of its projects.

In connection with the claim, the company is also being forced

to take a significant impairment charge within its

second quarter results.

https://thedeepdive.ca/alamos-gold-makes-us1-0-billion-claim-against-turkey-takes-215-million-impairment-charge/

http://www.alamosgold.com

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

I have no familiarity with investment treat claims. I can see why they are making the claim, but I wonder if they think they will actually receive any monies or whether this is a method to compel Turkey to reissue the permits in question.

Alamos Gold Makes US$1.0 Billion Claim Against Turkey, Takes

Alamos Gold this morning announced that it is making a US$1.0 billion

investment treat claim against the Republic of Turkey in relation to

unnecessary delays at one of its projects.

In connection with the claim, the company is also being forced

to take a significant impairment charge within its

second quarter results.

https://thedeepdive.ca/alamos-gold-makes-us1-0-billion-claim-against-turkey-takes-215-million-impairment-charge/

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

AGI NAKEDSHORTREPORT: here’s a

good place to start -

https://nakedshortreport.com/company/AGI

$My suggestion to all LONGS are;

Please, Copy the above info and email it to AGI -

Please, make AGI aware of the situation and

pray, that AGI start to buy back the shares -

the shorts have to dive for cover (by margin calls) and

the shares should double - triple + + + + to fair share price ![]() )

)

IMO!

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Alamos Gold (NYSE:AGI) declares $0.025/share quarterly dividend, 25% increase from prior dividend of $0.02.

Forward yield 1.29%

Payable March 31; for shareholders of record March 17; ex-div March 16.

May consider adding a little more with this news.

Alamos Gold Acquires Trillium Mining Consolidating Large Land Package Adjacent to Island Gold Mine

December 17 2020 - 05:00PM

GlobeNewswire Inc.

Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) is pleased to announce that it has completed an agreement to acquire Trillium Mining Corp. (“Trillium”) for cash consideration of C$25 million. Trillium holds a large land package comprised of 5,418 hectares (“ha”) directly adjacent to, and along strike from the Island Gold Deposit within the Michipicoten Greenstone Belt.

The acquisition has significantly expanded the Company’s land package around the Island Gold mine to 14,929 ha, a 57% increase (see Figures 1 and 2). This newly acquired land includes significant exploration potential in proximity to existing high-grade Mineral Resources and regionally.

Near Island Gold mine exploration potential

Based on the current geological interpretation of the E1E structure which hosts the Island Gold Deposit, there is strong potential for the structure to extend onto the Trillium mineral tenure. This is further supported by recent drilling, including the best surface exploration hole to date, MH25-04 grading 28.97 grams per tonne of gold (“g/t Au”) (26.89 g/t cut) over 21.76 metres (“m”) true width, and MH25-03 grading 15.38 g/t Au (14.19 g/t cut) over 15.02 m (both previously reported).

These intercepts extended high-grade gold mineralization over significantly greater widths up to 100 m down-plunge from the nearest Inferred Mineral Resource block in Island East. The deposit remains open laterally and down-plunge (Figure 2).

Regional exploration potential

The Trillium land package also provides significant regional exploration potential, adding 10 kilometres of strike extent within the Goudreau Lake Deformation Zone (GLDZ), a primary control on gold mineralization within the Goudreau-Lochalsh segment of the Michipicoten Greenstone Belt. Alamos’ consolidated land package now covers a total of 17 kilometres of highly prospective structures and stratigraphy within the GLDZ. In addition to the Island Gold and Kremzar Deposits, this now includes two past producing gold mines (Cline and Edwards), as well as several historic high-grade gold showings, including the Markes and Vega Zones (Figure 1).

The larger consolidated land package will allow for Alamos to apply a systematic, district scale approach to exploration with targeting based on greenstone belt scale structural and stratigraphic controls on gold mineralization.

Included within the Trillium land package is the Highland Property which is in the final year of a five year option agreement. Following the exercise of the option, expected on February 26, 2021, Alamos will own 100% of the Highland Property.

“The acquisition of Trillium is consistent with our strategy of consolidating prospective land in proximity to our Island Gold mine where we have had tremendous exploration success over the last several years. Island Gold’s Mineral Reserve and Resource base has more than doubled since 2017. We see excellent potential for this growth to continue given ongoing exploration success. The acquisition of these claims ensure we maintain full ownership over future growth of the existing deposit and regionally where there have been a number of high-grade gold occurrences including two past producing mines,” said John A. McCluskey, President and Chief Executive Officer.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”).

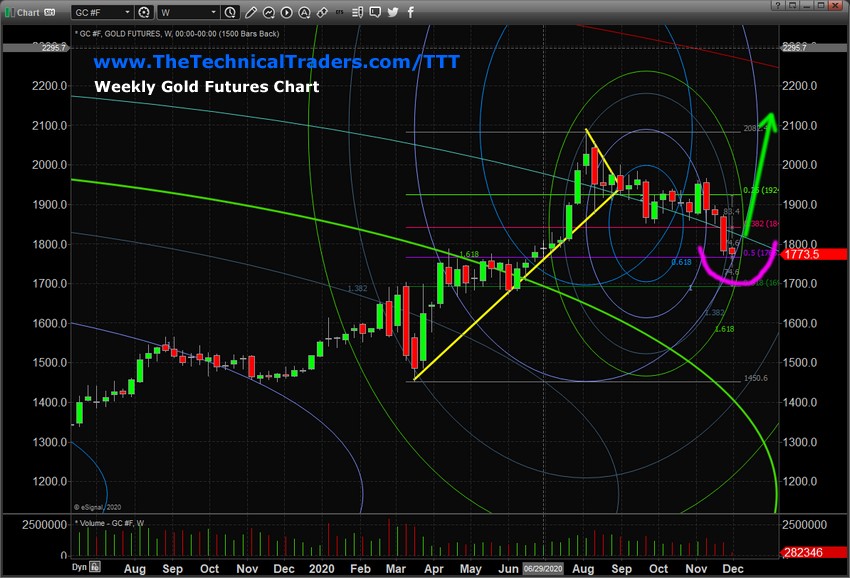

blackcat thanks; Gold Wave Forecast – Is Gold Going To $3750 Or Higher?

December 5, 2020 Chris Vermeulen Technical Analyst, Trader, & Founder of Technical Traders Ltd

28

Watching Gold fall to recent lows over the past few weeks has been heartbreaking for Goldbugs. We know the real value of Precious Metals has continued to be under-appreciated over the past 24+ months – even though gold has rallied from $1165 to over $2085 (an incredible 79%). The recent 15% decline in gold has shaken some investors away from the longer-term opportunities, so we wanted to share our research and highlight some simple Elliot Wave structures with you.

My research team and I believe the recent downward price trend in gold is an ideal setup for an Intermediate Wave 4 pullback of a broader Wave 3 advance. In other words, we believe gold is in the midst of a broad advance cycle that may eventually push price levels to $5000 and above. But, we’ll focus on right now and what we believe is setting up from a Technical Analysis perspective.

The first thing to remember about Elliot Wave Analysis is that we must consider the broad market trends, the intermediate market trends, and the short term wave formations. With almost all types of Technical Analysis, we focus on different time perspectives of price trends and setups to help us better determine opportunities and outcomes.

Simple Elliot Wave StructureS Explained

For those of you unfamiliar with Elliot Wave theory and structure, please pay attention to the example chart below.

Generally, price advances or declines move in three basic shapes:

(1) A straight rally or decline with no visible price corrections within it

(2) An ABC wave formation – which consists of an Impulse wave, a moderate correction, then a final conclusion wave that reaches a new price high or low.

(3) An ABCDE wave formation – which consists of an ABC wave formation followed by an additional moderate correction wave, then another final conclusion wave that reaches a new price high or low.

In the first example, above in black, you can see a very simple detail of the overall (ideal) five total waves that make up every major Elliot Wave structure. In theory, every price advance or decline attempts to follow this structure, BUT, of course there are variances in this structure that often take place.

This is where the second example of a wave, the more detailed wave structure in blue and red, shows how Wave 1 was completed with an ABCDE wave structure and Wave 2 was completed with an ABC wave structure. As you continue to explore how these waves set up and interlink with one another, you can start to imagine how many variations there are within each wave structure. Every segment in each of these examples is considered a Wave Leg, thus every one of these could continue to generate multiple smaller wave structures as we dig deeper into the data.

Elliot Wave Analysis – quarterly gold chart

In this first Quarterly gold chart, below, we are focusing on the broader long-term trends in Gold. This chart spans nearly 30 years of gold price activity and the purpose of starting with this chart is to highlight the Elliot Wave setup showing the Wave 1, Wave 2, and new Wave 3 formations. Our research team believes the end of the DOT COM Equities appreciation cycle (near 2000) prompted a gold appreciation cycle that lasted until 2009~10. The Excess Phase (Blow Off Top) that took place between 2010 and 2013 represented the “unwinding” of the enthusiasm for gold at that time. Then, Gold entered a depreciation phase that lasted from 2009 to 2018~19. That is when we believe a new gold Appreciation phase begun and is still currently a driving force in the continued rally in Precious Metals.

If our research is correct, we are in the midst of a longer-term Wave 3 upside price trend that has recently completed an Intermediate Term Wave 4 downside correction. This suggests that we are now setting up for an Intermediate Term Wave 5 rally that may be equal to the previous Wave 3 rally (roughly $920). If this takes place, gold will likely end the next rally phase near $2700 – where it will enter a new corrective price wave formation – completing the initial Intermediate-term Wave 1 leg.

Confirmation of this setup would come when a solid price bottom sets up above $1725 in gold and when we see price levels rally above $1975 – establishing a recent new price high. As technical traders, we understand that Elliot Wave and Fibonacci Price theories inter-twine with one another. Elliot Wave theory is a process of attempting to mathematically illustrate Fibonacci Price theory at work – creating patterns in price. We believe there are underlying energy frequencies in each wave that prompt current and future price rotations and targets. We are still researching and learning about much of this technique as we further develop our Fibonacci Price Amplitude Arc theory and others.

ELLIOT WAVE ANALYSIS – WEEKLY GOLD CHART

The following Weekly gold chart highlights where we believe a bottom in price must setup to efficiently confirm the Wave 4 correction structure and begin to prompt a new Wave 5 advance to $2700 or higher. Any future breakdown in Gold price levels on this chart below $1715.50 would potentially negate the Wave 4 structure and set up a potentially deeper price correction phase (possibly the end of the longer-term Wave 3 setting up for a deeper corrective wave). As long as gold prices bottom and begin to rally anywhere above the $1715.50 level, we believe the Wave 4 corrective wave is validated – prompting the start of a new Wave 5 advance.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Given the foregoing, it is important that we watch that $1715.50 level as gold prices continue to hammer out a potential bottom and this broad Elliot Wave pattern continues to unfold. If our research is accurate, then we will see a big upside price trend begin somewhere near December 7, 2020. Our Fibonacci Price Amplitude Arcs (visible on this Weekly chart) show where we believe energy frequencies align (see the starting point of the GREEN ARROW). These alignment areas in price energy typically result in potentially strong price impulse moves.

Any bottom forming near the MAGENTA drawn levels, before the GREEN & BLUE energy frequencies would align with our thinking that gold has retraced nearly 50% of the recent trend (from the March 2020 COVID lows to the recent highs) and therefore may be setting up for a Wave 5 advance targeting $2700 or higher.

As exciting as this may seem, please remember this is a very long-term forecast for gold. This is not something that will happen in a few days or weeks – this trend will likely take place over weeks, months, and years. Still, if you consider the implications to the global market and potential trends, then you will begin to understand that a rally in gold to levels above $2500 suggests that certain pressures and uncertainties will continue to unfold over the next 24+ months in the US and global markets. Gold rallies when fear and uncertainty are present in the markets.

In closing, it may be a very good Christmas rally in gold to close out the end of 2020. There will be lots of great trading opportunities in gold over the next few years as the price of gold works through the different waves discussed above. If you want to stay on top of the price action in gold, silver, and equities then sign up to The Technical Trader newsletter and trade alerts today.

Chris Vermeulen

Chief Market Strategist

Alamos Gold Inc. – Consensus Indicates Potential .8% Upside

Charlotte Edwards

December 8, 2020

8:56 pm

Alamos Gold Inc. with ticker code (AGI) have now 6 analysts in total covering the stock. The consensus rating is ‘Buy’. The target price ranges between 10.63 and 6.5 calculating the average target price we see 8.82. Given that the stocks previous close was at 8.75 this now indicates there is a potential upside of .8%. The day 50 moving average is 8.8 and the 200 moving average now moves to 9.26. The company has a market cap of $3,613m. Company Website: http://www.alamosgold.com

Alamos Gold Inc., together with its subsidiaries, engages in the acquisition, exploration, development, and extraction of gold deposits in North America. It also explores for silver and precious metals. The company’s flagship project is the Young-Davidson mine, which includes contiguous mineral leases and claims totaling 11,000 acres located in Northern Ontario, Canada. It also holds interests in a portfolio of development stage projects in Turkey, Canada, Mexico, and the United States. The company was formerly known as AuRico Gold Inc. and changed its name to Alamos Gold Inc. in July 2015. The company was incorporated in 2003 and is headquartered in Toronto, Canada.

Good news travels fast (but only if you make that happen):

https://www.directorstalkinterviews.com/alamos-gold-inc.---consensus-indicates-potential-.8-upside/412945909

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

I added some to all of our accounts earlier this year. Been a really nice hold through all of the volatility. Current profit on the position is 72%. I'd call it a "buy" too,

Alamos Gold Inc. – Consensus Indicates Potential .8% Upside

Charlotte Edwards

December 8, 2020

8:56 pm

Alamos Gold Inc. with ticker code (AGI) have now 6 analysts in total covering the stock. The consensus rating is ‘Buy’. The target price ranges between 10.63 and 6.5 calculating the average target price we see 8.82. Given that the stocks previous close was at 8.75 this now indicates there is a potential upside of .8%. The day 50 moving average is 8.8 and the 200 moving average now moves to 9.26. The company has a market cap of $3,613m. Company Website: http://www.alamosgold.com

Alamos Gold Inc., together with its subsidiaries, engages in the acquisition, exploration, development, and extraction of gold deposits in North America. It also explores for silver and precious metals. The company’s flagship project is the Young-Davidson mine, which includes contiguous mineral leases and claims totaling 11,000 acres located in Northern Ontario, Canada. It also holds interests in a portfolio of development stage projects in Turkey, Canada, Mexico, and the United States. The company was formerly known as AuRico Gold Inc. and changed its name to Alamos Gold Inc. in July 2015. The company was incorporated in 2003 and is headquartered in Toronto, Canada.

Good news travels fast (but only if you make that happen):

https://www.directorstalkinterviews.com/alamos-gold-inc.---consensus-indicates-potential-.8-upside/412945909

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Starting to climb, Up more than a dollar since yesterday. easy double from here. $$$

Maybe so.

Wonder if they have any interest in it?

Nice to see the profits we have in AGI really starting to amount to something.

This Conquest CQR Gold Junior AGI Should Buy - CQR Has Also Great Golden Rose Gold Mine Close To AGI Gold Mines -

Golden Rose Mine- Contains a reserve 2.4 million tonnes at 0.26 ounces of gold a tonne that contains 619,000 ounces of gold.

10/5/20160 Comments

https://www.ontarioexplorations101.com/temagami-ontario-mines/golden-rose-mine-owned-by-temagami-gold-inc-contains-a-reserve-24-million-tonnes-at-026-ounces-of-a-tonne-that-contains-619000-ounces-of-gold

Company Conquest Resources Limited

Address Suite 700, 220 Bay Street, Toronto, ON M5J 2W4 Canada

Phone 416-362-8243

Fax 416-368-5344

Email Address terence_mckillen@conquestresources.net

Website http://www.conquestresources.net

Mining Companies Flock To Stake Claims

In Red Lake After Recent Gold Strikes In That Area

Conquest's Alexander Property comprises 27 patented claims

acres adjoining

Goldcorp's Red Lake mine.

Published: July 28, 2020 at 8:32 a.m. ET

https://www.marketwatch.com/press-release/mining-companies-flock-to-stake-claims-in-red-lake-after-recent-gold-strikes-in-that-area-2020-07-28-81973250

Alexander Gold Project

Red Lake, Ontario

is claimed by Goldcorp to be

the richest gold mine in the world

The Alexander Property is situated within 2 kilometres of more than

28 million ounces of gold from past production and current resources

and within 400 metres of Goldcorp’s Far East Zone gold discovery.

The Alexander Property is of ample size to accommodate a high-grade

gold deposit at depth as repetition of the adjacent deposits at

Goldcorp’s Red Lake gold mine.

The stratigraphy under the property remains essentially untested

below 700 metres depth.

The richest gold bearing ore zones exist below a vertical depth of

1,300 metres in the High Grade Zone at

the Goldcorp Red Lake gold mine which is less

than 800 metres from the property boundary.

Conquest's target on the Alexander claims is an extension,

or repetition, of the mineralization at the Red Lake mine.

The Red Lake mine is claimed by Goldcorp to be

the richest gold mine in the world with

approximately 28,000,000 ounces of historic

production and current reserves.

https://www.conquestresources.com/project/alexander-gold/

Location and Property Description

Conquest's Alexander Property comprises 27 patented claims

covering 448 hectares (1,107 acres) adjoining

Goldcorp's Red Lake mine.

Conquest’s land is situated just beyond the security gate at

Goldcorp’s Red Lake gold mine and is almost completely

surrounded by Goldcorp's Red Lake mine property.

The Alexander claim holdings are patented and do not

require any annual minimum expenditures, other than

nominal property taxes.

https://www.conquestresources.com/project/alexander-gold/

https://www.conquestresources.com

$15,000 gold price? Jim Rickards and Peter Schiff give forecasts (Part 1/3)

48,024 views •Jul 30, 2020

Alamos expands Island Gold with high-grade hits ahead of study release

Canadian Mining Journal Staff | July 14, 2020 | 2:58 pm

Exploration Canada Gold

Alamos expands Island Gold with high-grade hits ahead of study release

Island Gold mine – Image courtesy of Alamos Gold

Alamos Gold has released exploration results from its Island Gold mine in Ontario, which extend high grade areas at the Island East and Main zones, as well as at Island West.

The majority of the notable intercepts in the latest release are from the E1E zone and confirm the vertical continuity of this area over up to 1.2 km, between depths of 300 metres and 1,500 metres.

DRILLING AT ISLAND MAIN RETURNED 10.3 METRES OF 52.1 G/T GOLD AND 4.3 METRES OF 21.01 G/T GOLD UP TO 150 METRES EAST OF EXISTING MINERAL RESERVES

Drill highlights from Island East Lower include 2.3 metres of 44.3 g/t gold and 4.9 metres of 29.05 g/t gold – Alamos continues to hit gold mineralization at E1E within a 120-metre-long gap between inferred resource portions, suggesting a 1.2-km vertical span of this zone in the eastern portion of the deposit.

At Island East Upper, notable new intercepts from E1E include 3.6 metres of 18.72 g/t gold and 2.2 metres of 21.3 g/t gold: these high-grade intervals are from an area that is 200 metres east of existing reserves.

Drilling at Island Main returned 10.3 metres of 52.1 g/t gold and 4.3 metres of 21.01 g/t gold up to 150 metres east of existing mineral reserves.

In addition, surface drilling at Island West returned 5.6 metres of 25.41 g/t gold from the C-zone, extending the gold mineralization by 70 metres from previous drilling.

Additional holes targeting potential new parallel zones returned 2.8 metres of 40.34 g/t gold and 8.6 metres of 3.9 g/t gold.

“Island Gold has seen exceptional growth over the last several years with the deposit doubling in size since we acquired it in 2017,” John McCluskey, the company’s president and CEO, said in a release.

“This growth has been incorporated into a Phase III Expansion study of the operation, which we will be releasing the details of later this week.”

McCluskey added that these latest high-grade exploration results suggest both significant potential for reserve and resource growth at the site as well as upside to the Phase III Expansion scenario.

Four underground and three surface rigs are currently working at Island Gold, with a focus on near-mine resource definition.

Last year, Island Gold generated 150,400 gold oz. at mine-site all-in sustaining costs of $656 per oz. Proven and probable reserves for the site total 3.6 million tonnes at 10.37 g/t gold, containing 1.2 million gold oz. Cut-off grades are between 2.82 g/t gold and 4.89 g/t gold.

(This article first appeared in the Canadian Mining Journal)

https://www.mining.com/alamos-expands-island-gold-with-high-grade-hits-ahead-of-study-release/

There is a live QA webinar with Alamos CEO tomorrow at 4:05 pm EDT. Could be an excellent opportunity to hear about catalysts. https://bit.ly/3ceRxCo

Alamos Gold Inc New (AGI)

8.59 ? 0.34 (4.12%)

Volume: 2,160,264 @04/30/20 10:49:16 AM EDT

Bid Ask Day's Range

- - 8.13 - 8.77

AGI Detailed Quote

Alamos Gold reacquiring NSR royalty, lowers cost guidance

Allen Sykora Allen Sykora

Monday March 16, 2020 11:38

Kitco NewsShare this article:

Editor's Note: With so much market volatility, stay on top of daily news! Get caught up in minutes with our speedy summary of today's must-read news and expert opinions. Sign up here!

(Kitco News) - Alamos Gold Inc. (TSX: AGI; NYSE: AGI) is reacquiring a 3% net-smelter-return royalty on the Island Gold Mine and as a result lowered its cost guidance for 2020, the company announced Monday.

Alamos said it entered into an agreement to acquire and cancel the NSR royalty for $54 million, or C$75 million.

The royalty was acquired from a privately held company and would have been payable on gold production within four patented claims that comprise the majority of currently defined mineral reserves and resources within the Island Gold deposit, the company said.

Sponsored By : Dynamic Funds

We all need advice from time to time.

A professional financial advisor can help you set realistic financial goals and understand which investment products make sense for your portfolio.

Alamos also reported a decrease of $40 per ounce, or 7%, in Island Gold’s 2020 total cash cost guidance to between $480 and $520. The company listed a $40-per-ounce decrease in mine-site all-in sustaining cost guidance to between $740 and $780 per ounce.

The company’s consolidated total cash costs – for all operations – were trimmed by $13 an ounce to between $757 and $797, compared to $770 to $810 previously.

“The acquisition of the royalty further reduces costs at what is already a low-cost operation while also increasing our exposure to the tremendous exploration upside,”said John A. McCluskey, president and chief executive officer.

“Since we acquired Island Gold in 2017, the mineral reserve and resource base has doubled with the deposit approaching 4 million ounces across all categories. With the deposit open laterally and down-plunge across several areas of focus, we see excellent potential for this growth to continue at a greatly reduced royalty on future production.”

By Allen Sykora

For Kitco News

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=154369468

Nice. At least we had one green stock today.

Alamos Gold Announces Repurchase of 3% NSR Royalty on Island Gold Mine and Corresponding Reduction in 2020 Cost Guidance

T.AGI | 10 hours ago

TORONTO, March 16, 2020 (GLOBE NEWSWIRE) --

Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today announced that it has entered into an agreement to acquire and cancel a 3% net smelter return (“NSR”) royalty payable on production from the Island Gold mine (the “Royalty”) for total cash consideration of C$75 million ($54 million).

The Royalty was acquired from a privately held company and is payable on gold production within four patented claims (the “Subject Claims”) that comprise the majority of currently defined Mineral Reserves and Resources within the Island Gold deposit.

The acquisition and elimination of the royalty will immediately reduce operating costs and increase operating cash flow while providing increased exposure to Island Gold’s significant exploration potential.

Transaction highlights:

Acquisition and cancellation of the Royalty on all future gold production from the Subject Claims that comprise the majority of the Island Gold deposit. As of December 31, 2019, the Subject Claims contained:

• 0.9 million ounces of Mineral Reserves, representing 71% of Island Gold’s total Mineral Reserves, and

• 1.1 million ounces of Inferred Mineral Resources (see Table 1)

$40 per ounce, or 7%, decrease in Island Gold’s 2020 total cash cost guidance to between $480 and $520 per ounce and $40 per ounce decrease in mine-site all-in sustaining cost guidance to between $740 and $780 per ounce

Increased exposure to Island Gold’s substantial exploration potential with combined Mineral Reserves and Resources having doubled to 2.0 million ounces within the Subject Claims since the end of 2016, including:

• 0.5 million ounce increase in Mineral Reserves to 0.9 million ounces, net of 0.3 million ounces of mining depletion. This reflects the discovery of new Mineral Reserves and strong conversion rate of Inferred Mineral Resources to Reserves of 83% since the end of 2016, and

• 0.5 million ounce increase in Inferred Mineral Resources to 1.1 million ounces

Increased exposure to higher gold prices. At spot gold prices of approximately $1,530 per ounce, Alamos will save $46 per ounce on production from the Subject Claims. In 2019, royalty payments to the Subject Claims totalled C$8 million

Reduction in effective NSR royalty rate on Island Gold’s Mineral Reserves to 2.2% from approximately 4.4%

“The acquisition of the royalty further reduces costs at what is already a low-cost operation while also increasing our exposure to the tremendous exploration upside. Since we acquired Island Gold in 2017, the Mineral Reserve and Resource base has doubled with the deposit approaching four million ounces across all categories. With the deposit open laterally and down-plunge across several areas of focus, we see excellent potential for this growth to continue at a greatly reduced royalty on future production,” said John A. McCluskey, President and Chief Executive Officer.

Island Gold and Consolidated 2020 Cost Guidance Reduced with Elimination of Royalty

Mineral Reserves within the Subject Claims currently account for 71% of total Mineral Reserves at Island Gold. In 2020, over 90% of Island Gold’s gold production is expected to come from within the Subject Claims. With the elimination of the Royalty and associated cost savings, the Company has lowered its 2020 total cash cost and mine-site all-in sustaining cost guidance by $40 per ounce. On a consolidated basis, total cash cost and all-in sustaining cost guidance has also been reduced by $13 per ounce as detailed below.

2020 Initial Guidance 2020 Revised Guidance

Island Gold

Gold Production 000 oz 130-145 130-145

Cost of Sales(1) $/oz $880 $840

Total Cash Costs(2) $/oz $520-560 $480-520

Mine-site AISC(2) $/oz $780-820 $740-780

Consolidated – Alamos Gold

Gold Production 000 oz 425-465 425-465

Cost of Sales(1) $/oz $1,130 $1,117

Total Cash Costs(2) $/oz $770-810 $757-797

Mine-site AISC(2) $/oz $1,020-1,060 $1,007-1,047

(1) Cost of sales includes mining and processing costs, royalties, and amortization expense, and is calculated based on the mid-point of total cash cost guidance.

(2) Refer to the "Non-GAAP Measures and Additional GAAP" disclosure at the end of this press release and the Q4 2019 MD&A for a description and calculation of these measures.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”).

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Vice President, Investor Relations

(416) 368-9932 x 5439

All amounts are in United States dollars, unless otherwise stated.

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note

This news release includes certain statements that constitute forward-looking information within the meaning of applicable Canadian and U.S. securities laws ("forward-looking statements"). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are forward-looking statements. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “continue”, "expect", "anticipate", "estimate", “guidance” or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms. In particular, this news release contains forward-looking statements with respect to the anticipated benefits of the acquisition and cancellation of the Royalty including associated cost savings.

Alamos cautions readers not to place undue reliance on the forward-looking statements which are not guarantees of future events as a number of factors could cause results, conditions, actions or events to differ materially from the targets, outlooks, expectations, goals, estimates or intentions expressed in the forward-looking statements. These factors include, but are not limited to: fluctuations of the price of gold and foreign exchange rates (particularly the Canadian dollar and U.S. dollar); changes to current estimates of mineral reserves and resources; changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates and may be impacted by unscheduled maintenance, labour and contractor availability and other operating or technical difficulties); disruptions affecting operations; risks related to obtaining and maintaining necessary permits, licenses and authorizations required to carry out planned exploration or development work; changes in project parameters as plans continue to be refined;availability of and increased costs associated with mining inputs and labour; contests over title to properties; employee and community relations; changes in national and local government legislation (including tax legislation), controls or regulations and risk of loss due to sabotage and civil disturbances.

For a more detailed discussion of such risks and other factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this news release, see the Company’s latest 40-F/Annual Information Form and MD&A, each under the heading “Risk Factors”, available on the SEDAR website at www.sedar.com or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Cautionary Note to U.S. Investors – Mineral Reserve and Resource Estimates

All Mineral Resource and Reserve estimates included in this news release or documents referenced in this news release have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms "Mineral Reserve", "Proven Mineral Reserve" and "Probable Mineral Reserve" are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ materially from the definitions in the Securities Exchange Commission (the “SEC”) Industry Guide 7 ("SEC Industry Guide 7") under the United States Securities Act of 1933, as amended, and the Exchange Act. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. The terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Mineral Reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a Mineral Resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

The SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (the “SEC Modernization Rules”). The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to international standards. The SEC Modernization Rules will become mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021.

Table 1: Island Gold Mineral Reserves and Resources as of December 31, 2019

Island Gold Mineral Reserves and Resources as of December 31, 2019

Subject Claims Total – Island Gold % of Total

Tonnes Grade Ounces Tonnes Grade Ounces Ounces

(000's) (g/t Au) (000's) (000's) (g/t Au) (000's) (000's)

Proven & Probable Mineral Reserves 2,411 11.20 868 3,643 10.37 1,215 71%

Measured & Indicated Mineral Resources 426 5.74 79 879 6.51 184 43%

Inferred Mineral Resources 2,649 12.42 1,058 5,392 13.26 2,298 46%

Primary Logo

GlobeNewswire

March 16, 2020 - 3:30 AM PDT

Tags:

INDUSTRIAL METALS & MINERALS

1

Alamos Gold Declares Quarterly Dividend and Adopts Dividend Reinvestment and Share Purchase Plan

T.AGI |

TORONTO, March 03, 2020 (GLOBE NEWSWIRE) --

Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today announced that the Company’s Board of Directors has declared a quarterly dividend of US$0.015 per common share and introduced a Dividend Reinvestment and Share Purchase Plan (“DRIP”).

Quarterly Dividend Increased 50%

As announced in December 2019, the Company has increased its quarterly dividend by 50% to an annual rate of US$0.06 per common share. The increase is a reflection of the Company’s strong free cash flow outlook with the lower mine expansion at Young-Davidson on track to be completed in June 2020. This represents the Company’s 11th consecutive year of paying a dividend during which time the Company has returned $161 million to shareholders through dividends and share buybacks.

The dividend is payable on March 31, 2020 to shareholders of record as of the close of business on March 17, 2020. This dividend qualifies as an “eligible dividend” for Canadian income tax purposes. For shareholders that elect to participate in the DRIP as outlined below, common shares granted as part of the March 31, 2020 dividend will be issued from treasury at a 2% discount to the prevailing market price.

Dividend Reinvestment and Share Purchase Plan

The Company has implemented a dividend reinvestment and share purchase plan. This will give shareholders the option of increasing their investment in Alamos, at a discount to the prevailing market price and without incurring any transaction costs, by electing to receive common shares in place of cash dividends.

Shareholders who elect to participate in the DRIP will also have the option of acquiring additional common shares in the Company (subject to limitations) at a discount to the prevailing market price, and without incurring additional transaction costs.

The Company has the discretion to elect to issue such common shares at up to a 5% discount to the prevailing market price from treasury, or purchase the common shares on the open market including the facilities of the New York Stock Exchange, and will advise as such with each dividend declaration.

Enrollment in the DRIP is optional. Further information on the plan, including the forms needed to enroll are available on the Company’s website at http://www.alamosgold.com/investors/Dividend-Reinvestment-Plan. In order to be eligible to participate in the March 31, 2020 dividend, enrollment must be completed by 4:00 pm EST on the fifth business day prior to the March 17, 2020 dividend record date.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons

Vice President, Investor Relations

(416) 368-9932 x 5439

All amounts are in United States dollars, unless otherwise stated.

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Primary Logo

GlobeNewswire

March 3, 2020 - 4:00 AM PST

Tags:

INDUSTRIAL METALS & MINERALS

All the mines that have been developed, around those mines,

in Abitibi for example, there’s a lot of potential,”

Guilbault told Kitco News on the sidelines of

the Xplor Mining Convention in Montreal.

Ex....

http://abcourt.com/

https://abcourt.com/miningproperties/

In GOD We Trust -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Nice results! Thanks!

Alamos Gold Reports Mineral Reserves and Resources for the Year-Ended 2019

T.AGI | 1 day ago

Island Gold’s Significant Growth Continues with a 21% Increase in Mineral Reserves and 46% Increase in Inferred Mineral Resources

All amounts are in United States dollars, unless otherwise stated.

TORONTO, Feb. 18, 2020 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its updated Mineral Reserves and Resources as of December 31, 2019. For a detailed summary of Mineral Reserves and Resources by project, refer to the tables below.

Highlights

Island Gold’s Mineral Reserves and Resources increased by a combined 921,000 ounces, net of mining depletion, including:

21% increase in Proven and Probable Mineral Reserves to 1.22 million ounces (3.6 million tonnes (“mt”) grading 10.37 grams per tonne of gold (“g/t Au”)), net of mining depletion

46% increase in Inferred Mineral Resources to 2.30 million ounces (5.4 mt grading 13.26 g/t Au) with grades also increasing 13% reflecting higher grade additions in Island East

Combined Mineral Reserves and Resources now total 3.70 million ounces, double the 1.84 million ounces at the time of acquisition in 2017, net of 364,000 ounces of mining depletion

Global Proven and Probable Mineral Reserves of 9.73 million ounces of gold (203 mt grading 1.49 g/t Au), up slightly from 9.70 million ounces at the end of 2018 with increases primarily at Island Gold offsetting 576,000 ounces of mining depletion

Global Measured and Indicated Mineral Resources of 7.04 million ounces of gold (199 mt grading 1.10 g/t Au), down 3% reflecting the conversion to Mineral Reserves at Young-Davidson

Global Inferred Mineral Resources increased 10% to 5.98 million ounces of gold (130 mt grading 1.43 g/t Au), with grades also increasing 10% driven by the 725,000 ounce increase at Island Gold

Global exploration budget of $36 million in 2020, a 24% increase from the $29 million spent in 2019. This includes $21 million at Island Gold focused on defining additional near mine Mineral Reserves and Resources, $7 million budgeted at Mulatos and $5 million budgeted at Lynn Lake

“We had another tremendous year at Island Gold on all fronts with the asset continuing to evolve into a world class ore body. Over the past two years we have added more than two million ounces of Mineral Reserves and Resources, before mining depletion, with the deposit now approaching four million ounces in all categories. We see strong potential for this growth to continue with the deposit open laterally and down-plunge across multiple areas of focus,” said John A. McCluskey, President and Chief Executive Officer.

“The majority of this growth is being incorporated into a Phase III expansion study of Island Gold supporting what we expect will be a larger, increasingly profitable, long-life operation in one of the best mining jurisdictions in the world,” Mr. McCluskey added.

TOTAL MINERAL RESERVES AND RESOURCES

https://stockhouse.com/news/press-releases/2020/02/18/alamos-gold-reports-mineral-reserves-and-resources-for-the-year-ended-2019

In GOD We Trust -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

This is nice.

I have been adding bits here and there on dips.

Alamos Gold Further Extends High-Grade Mineralization at Island Gold

T.AGI | 41 minutes ago

Exploration Success from 2019 Program Expected to Drive Strong Growth

in Mineral Resources

TORONTO, Jan. 15, 2020 (GLOBE NEWSWIRE) --

Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”)

today reported new results from surface and underground exploration

drilling at the Island Gold mine, further extending high-grade gold

mineralization beyond existing Mineral Resources in all three areas of

focus.

All reported drill widths are true width of the mineralized zones,

unless otherwise stated.

Main Extension Down-Plunge: high-grade mineralization extended

80 metres (“m”) east of existing Mineral Resources (MH17-12) and

50 m below the nearest previously reported intersection (MH17-07).

High-grade mineralization has been extended over 1,000 m east of

current mine workings and remains open along strike to the east, and

both up- and down-plunge.

New highlights include:

121.32 g/t Au (96.47 g/t cut) over 3.81 m (MH20-01);

108.17 g/t Au (94.56 g/t cut) over 2.57 m (MH17-11); and

36.45 g/t Au (13.23 g/t cut) over 8.04 m (MH17-12).

Eastern Extension: high-grade mineralization intersected 170 m east of the nearest Indicated Mineral Resource (620-610-07). This area is located 225 m above the high-grade intersections in the new area of focus. New highlights include:

32.19 g/t Au (25.48 g/t cut) over 4.68 m (620-610-01); and

20.18 g/t Au (20.18 g/t cut) over 3.24 m (620-610-07).