Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This week Value Line replaced Autoliv (ALV) with Phllip Morris (PM, yield = 4.7%) because of current dividend yield. ALV in about a year's time has risen in stock price faster than dividend increase. That pushed its effective yield down to around 2.2%/Yr. This isn't all bad since the stock price rose to $122.52 from $85.10 at the start. This occurred in their Model Portfolio II.

This sort of swap happens once in a while as Value Line's #II model as it has a "dual mandate" of seeking above average yield while also looking for reasonable price appreciation potential. In this case, ALV satisfied the price appreciation while the dividend remained steady.

For AIM users, ALV may still be a viable choice for a longer term investment. AIM would have done well with the price appreciation while harvesting the yield along the way. The three year chart for ALV looks like AIM would have been selling more than buying but there were a few "round trips" along the way.

https://schrts.co/NrxIusBs

Best wishes,

OAG Tom

Hi R, Re: Value Line's Stock Screener..........................

Sorry for the late reply, I need to check in here more often!

I've tinkered with the Stock Screen function at Value Line with some success in generating investment ideas to fuel my AIM method. It's been interesting, but I can't say I've found it to be the perfect answer. I'm not sure I've put one of the screen selection stocks into my portfolio as of yet.

I have found that if I load the screener up with too many conditions, it tends to make the lists VERY short. My suggestion would be to try one condition at a time and then trim its range to get a manageable list length. Jot down the condition and range for future reference and/or print the short list. Try again with the next condition and see what you get. Save or print and repeat for the next one.

You may find a common theme and that may help you focus on a specific business sector that's currently depressed and ready for a rebound. I tend to concentrate on three goals when selecting stocks.

1) Price Appreciation over Time

2) Dividend Capture over Time

3) Profitable Volatility Capture over Time.

AIM will manage the holding with all three goals, so I just sort for things I think will satisfy these. This gives me the overall "Total Return" target through all sorts of market conditions. One stock may be stellar for Dividends in one era and good for Growth in another. Another era might have reasonable frequency and amplitude of price movement that will drive AIM's profit capture mechanism. AIM's ability to adapt to the situation is why I consider each of these three goals when choosing a new investment.

Let me know if this helps.

Best wishes,

OAG Tom

Do you use the Value Line "Stock Screener" If so, what settings do you use to find a candidate stock? i.e. Beta, Price stability, % Chg in 52 week high, % Chg in 52 week low, Sales Growth 5 years, Book value growth 5 years, ??any other parameters?? Thanks.

Correction:

Euronet is EEFT and its long term history looks like it would have been very well benefitted by AIM's management method...........

https://schrts.co/BDFeeuht

....and Starbux would have also benefitted from Mr. Lichello's magic.

https://schrts.co/PBWdMjKX

Best wishes,

OAG Tom

Value Line swapped out VST this week in their Dividend model portfolio. It's been their best performer in that model for 2024, but that has diluted the dividend to just around 1% or half the VL average dividend. They still like the company, but felt the need to pick a better yield.

They chose HP, Inc. (HPQ, yield = 3.7%) as the replacement. They like it for longer term growth and also for the nice current yield.

Happy Hunting and be sure to take careful AIM.

Best wishes,

OAG Tom

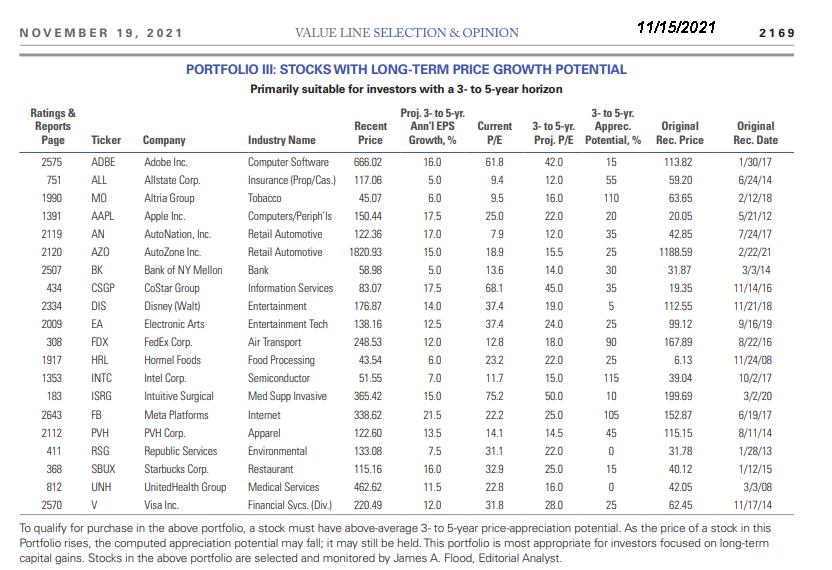

Here's the latest on the two Model Portfolios I watch at Value Line.............................

Above Average Dividends...........................

Above Average 3-5 Year Appreciation Potential......................

The "Growth" list is quite stable and these stocks don't rotate very often. This is good for AIM as Mr. Lichello's management method takes TIME to provide its benefits. This makes a great shopping list when the markets are in correction.

The "Dividend" list provides a good source of stocks for long term total return (dividends + price appreciation + AIM management). Rarely do these stocks fall precipitously, so they seem well suited for long term AIM management.

Best wishes,

OAG Tom

Tom, this was super helpful, thank you!!

Do you have a suggestion on where to look for the latest aggregated wisdom for AIM?

For example, what's the most current recommendation for:

1. How to manage a portfolio of stocks? (AIM individually, or as a portfolio?)

2. Best values on Portfolio Control, Cash Balance, frequency of rebalancing, etc etc?

Trying to find 1 place with all the latest info, instead of piecemealing it together from various posts. :)

Thank you again!

Hi T, Re: Value Line Model Portfolios for long term AIMing................

The two lists have several suitable candidates for AIMing. The above average dividend list may seem a bit stoggy but might offer good total return (price growth + dividend capture + profitable volatility capture). The 3-5 year list doesn't change positions very often if that makes a difference to you. Most libraries at universities and public libraries will have Value Line for your review.

Look for those stocks with the higher 3-5 year growth potential as a first filter. Next, check the BETA of those stocks you choose. The higher the better for AIM in general. BETA gives a feel for correlation of the stock price with market direction as well as a feel for amplitude of price change. So, a high BETA will generally trade in the same direction as the market but with a bit more amplitude. One of my favorite Value Line measures is on their individual stock pages in the lower right hand corner. It's labeled "Stock's Price Stability" and also helps to give a bit of personality to the issue in question. A lower number indicates higher price volatility where a higher number indicates higher stability. For instance, EXAS, a medical test maker, has a Stock's Price Stability of just 15. INTC comes in around 70 by comparison. Price Stability and BETA may help you trim these lists down a bit. Note that neither gives you any "quality" measure, however. Financial Strength, debt structure and profitability need to be looked at also.

The higher dividend stocks on Model II's list can be evaluated in similar fashion. AIM might not trade these stocks as often, but AIM always trades effectively.

Using StockCharts.com's Zig Zag graphing function can also help when viewing your stocks on a 'Weekly' basis. ZigZag can help guide you toward proper SAFE settings for your chosen stocks. If you are trying to choose between, say, INTC and AMD, if both are fundamentally sound companies, then you could use the same ZigZag setting for both and see which one has historically has more 'round trip' moves over the previous 3 years. That might offer a tie breaker for selection.

Hope this helps,

OAG Tom

I'm interested in fundamentally sound stocks (often with dividends).

The VL Stocks fit this quite well.

The question is: Are these stocks volatile enough for AIM?

Do you manage these stocks with different AIM settings?

Here are the latest Value Line "Model Portfolios" I follow. One is for above average dividend yields and the other is based on their above average 3-5 year appreciation potential.

In the Dividend portfolio this week they removed CVS Healthcare (CVS, yield = 3.26%) and replaced it with Autoliv (ALV, yield = 3.96%). Their rational was that CVS hadn't lived up to their stock price hopes where they felt ALV's dividend plus potential share price growth offered better total return.

Best wishes,

OAG Tom

Re: Value Line's Model Portfolios for Income and Long Term Growth.........

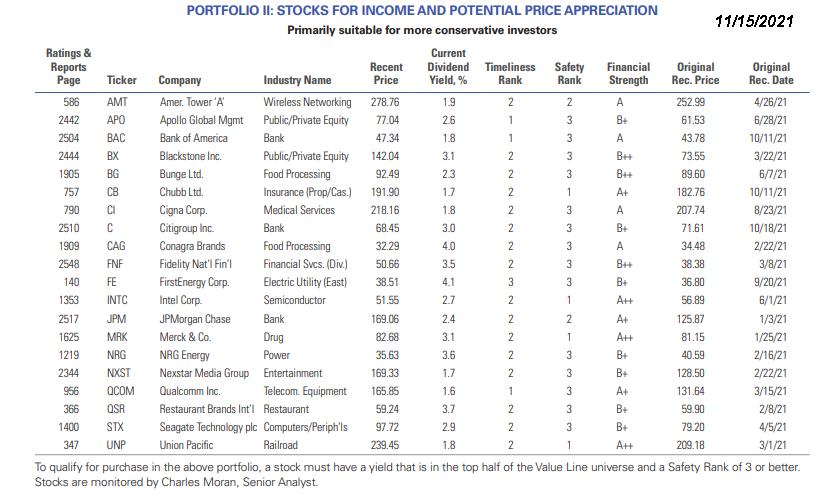

Here's the latest scans from Value Line for these two strategies. Note they include the original starting date and price of each position.

The "growth" portfolio has a very slow turnover rate, which should be expected with its 3-5 year time horizon. This makes the components good potential AIM candidates as AIM takes TIME.

With the rapidly changing interest rate environment the "income" portfolio has had some higher turnover. The market decline improved the average dividend level of Value Line and new stocks therefore met the goal of being above average yield.

Best regards,

OAG Tom

great advice, I will peruse better and look to add more when it is worth

Another new stock added to VL's Portfolio III (3-5 year appreciation potential).

Generac Holdings is a Wisconsin based "alternative energy" company I've followed closely since 2014.

This week, we are buying

Generac Holdings, a Wisconsin-based manufacturer of residential and commercial

back-up power systems. The company has a strong balance sheet, a dominant

market position, and bright earnings prospects, as it has targeted a very promising

sector of the economy. Many countries around the world, including the United

States, have electric grids that need to be upgraded. Indeed, rising demand for

electricity has not been met by utilities building additional base load units. Due

mostly to ESG concerns, new capacity has generally been derived from wind and

solar power, which are both interruptible. Many homeowners and businesses have

witnessed how long and devastating some electric outages can be. With a second

independent power source, homes and commercial concerns can continue to

function. What’s more, both markets are barely penetrated. In addition to natural

disasters, many regions do not have an easy time meeting peak demand. Just

recently in Texas, usage was so high that the grid almost crashed. As it is still

spring, it raises concerns over what may happen during an extended heat wave.

In any case, priced at about $220 a share, Generac is trading at less than 20

times 2022’s estimated earnings. While this is higher than the current market P/E

ratio of 16.2, it is well below the stock’s P/E of nearly 45 when it peaked at $524 a

share late last year. - Value Line

GNRC is a long time favorite of mine and has done well with AIM, too.

While a bit out-of-date, this history of AIM's management of GNRC should tell us something about both the company and AIM's risk management.

Best wishes,

OAG Tom

Value Line continues to offer investors with longer term horizons some good choices. Note in the right column how long some of these stocks have been on this list. Some a decade or more.

I keep this list handy when I'm looking for something to add to my "stocks" portfolio. Here's the same stocks with the column second to the right showing their gains since being recommended:

I'm sure there are stocks here that would have benefitted from AIM's management along the way.

Best regards,

OAG Tom

You're quite welcome CRL, Re: Value Line's models................

Here are the latest for these two hunting grounds for AIM candidates:

Note the columns on the far right show when these stocks were first added to these lists. Both are relatively stable lists so offer good potential as long term AIM holdings.

Best wishes,

OAG Tom

Thank you very much! You are a good teacher and giver

Tom thank you as always for posting! I have been using these lists for a long time now. Now I am researching and studying better the Leap concept of Jeff with AIM. Do you know where I could find historical quotes of expired Leaps options? i read all of Jeff books, I would appreciate your personal opinion. Indeed, leaps option would give much volatility to safe 1 good stocks.

Here's a quick view at the latest Value Line Models' holdings, how they've done since being added (last two columns) and some other interesting info:

Portfolio II - Dividend oriented Stocks

Portfolio III - 3-5 Year Growth Potential Stocks

These stock models can be found in Value Line's "Selection and Opinion" section each week. They don't change very much or very frequently, but that's all the better for AIM since Mr. Lichello's management method takes time to develop and produce profits.

Best wishes,

OAG

Good morning S, Re: LEAPS and AIM...................

I agree these would be good sources for searching out AIM LEAP contracts. I'll capture the most recent lists and put them here later.

OAG

Might be worthwhile to do A.I.M. with LEAPS options on Value Line stocks with high rankings.

Here are the two model portfolios (dividends and LT Growth) from Value Line that I feel have some good choices for AIM Users:

and

Like any model portfolios there are some that are better than others. Of these two, the dividend income portfolio has had more changes over the last year in components than the "growth" portfolio. I own and AIM some stocks in my "sandbox" that have been on both lists at various times.

OAG Tom

Hi C, Re: VAlue Line's latest model portfolios.................

Here's the latest. Note there haven't been a lot of changes in either, but lately Portf II has had some.

Portfolio II is currently showing a modest loss of about 12% on average for the stocks listed. This is on higher dividend paying stocks, making it a surprise because of their defensive nature.

Portfolio III is break-even right now on average. It's fallen from a higher profit level than P II but is just at the threshold of going negative. There are some good values here, too.

OAG

thank you Tom, always a pleasure to read and learn

Good question,

Generally I've been sticking with them as long as the fundamentals remain okay. For instance, I still own Kraft Heinz (KHC) even though it was dropped from the list and tanked badly. I'm expecting they will plug the holes and right the ship eventually. There are several very valuable divisions that might be sold to help in the process.

VL Port drops a company...

Hi Tom,

How are you handling the case where you use the VL ports for company selection for AIM, initiate a position, and then the company is subsequently dropped from the VL portfolio?

Thanks

Hi Toof, Re: Appreciation Potential.................

That's been the cautionary note in Value Line for some time. So many

stocks, in their opinion, have been at or near their 3-5 year potential

range. Not a lot of upside potential there. This is partly why my Sandbox

portfolio had more dividend payers in it now than a couple of years ago. I

figure I might as well get paid for the wait.

While the dividends are soothing, recently several of my picks from these

lists have been generating some buying activity. The market swoon affected

stocks across many sectors. Most of the stocks in my portfolio are set up

with something similar to AIM-High. I'm trading 10% of Portfolio Control on

most as a minimum trade.

Hi Tom

Doesn't look like a lot of appreciation potential at the current time.

Toofuzzy

Thanks for sharing, Tom. In the process of rebuilding my own sandbox. Looks like a great place to play. ;o)

Take care.

Jon

Two changes this week..................

VL Portf II drops OGE and replaces with LMT at $308.83...

VL Portf III drops TIF and replaces with CELG at $84.56....

Both dropped positions were profitable as trades in respective portfolios.

From this list, I currently own KHC, WBA and WPC in my Sandbox.

Current Portfolio II selections:

Portfolio II: Stocks For Income And Potential Price Appreciation

Primarily suitable for more conservative investors

Ratings &

Reports

Page Ticker Company Recent Price Timeliness Safety P/E Yield % Beta Financial Strength Industry Name

919 T AT&T Inc. 32.21 3 1 9.5 6.3 0.75 A++ Telecom. Services

2510 CM.TO Can. Imperial Bank 114.36 3 1 9.6 4.8 0.80 A+ Bank

308 DAL Delta Air Lines 49.92 3 3 8.1 2.9 1.25 B+ Air Transport

1975 DEO Diageo plc 142.12 3 1 25.3 2.3 1.00 A+ Beverage

634 EPD Enterprise Products 27.38 3 3 17.1 6.4 1.30 B+ Pipeline MLPs

2358 IGT Int’l Game Tech. 22.74 3 3 15.7 3.5 1.20 B Hotel/Gaming

2564 IVZ Invesco Ltd. 26.79 3 3 9.4 4.5 1.40 A Financial Svcs. (Div.)

215 JNJ Johnson & Johnson 121.58 3 1 17.4 3.0 0.90 A++ Med Supp Non-Invasive

1760 JCI Johnson Ctrls. 33.32 3 3 11.3 3.1 1.30 A Diversified Co.

1923 KHC Kraft Heinz Co. 62.09 3 2 16.1 4.2 0.95 A+ Food Processing

1142 LOW Lowe’s Cos. 94.87 3 2 17.4 2.0 1.05 A+ Retail Building Supply

1929 MDLZ Mondelez Int’l 40.86 3 2 16.7 2.4 1.00 A Food Processing

913 OGE OGE Energy 35.08 2 2 17.1 4.2 0.95 A Electric Util. (Central)

2319 RCL Royal Caribbean 103.96 3 3 12.8 2.3 1.10 B++ Recreation

1777 MMM 3M Company 195.52 3 1 18.8 2.8 0.95 A++ Diversified Co.

316 UPS United Parcel 105.88 3 1 14.7 3.4 0.90 A Air Transport

1549 WPC W.P. Carey Inc. 65.64 3 3 26.8 6.2 0.85 B+ R.E.I.T.

970 WBA Walgreens Boots 61.13 2 2 10.0 2.9 0.95 A+ Pharmacy Services

418 WM Waste Management 81.86 2 1 20.5 2.3 0.80 A Environmental

1407 WDC Western Digital 78.04 1 3 5.5 2.6 1.30 A Computers/Peripherals

The PIC List faded out quite some time ago. It wasn't a bad idea, but no longer fit with my investing M.O. at that time.

In more recent times I've been using Value Line's Selection and Opinion section for a source of potential AIM stocks. There four portfolios updated weekly from which to choose stocks. They range from Momentum shorter term (12 Months) suggestions to longer term, mature, higher dividend type of stocks.

Portfolio I is "Stocks with Above-Average Year-Ahead Price Potential"

Portfolio II is "Stocks for Income and Potential Price Appreciation"

Portfolio III is "Stocks with Long Term Price Growth Potential"

Portfolio IV is "Stocks with Above Average Dividend Yields"

Each list is 20 stocks, so there are a total potential of 80 stocks from which to choose. Value Line does track their performance and gives updates when stocks leave or are added to the lists.

For AIM usage probably Portf I is the weakest, since the time horizon is too short for AIM to contribute meaningfully. I've been filling my "Sandbox" portfolio with stocks from Portfs II and III in recent times and they've been doing well enough that the lists are becoming comfortable hunting grounds for my AIM.

Two reasons I like these lists are that the companies are generally well known and trade reasonable volumes and turn-over is very low. Months will go by on II and III where no changes at all are made. That's good for AIM in that we can let it work its show while we collect the dough. Further, I've found that these more mature companies have reasonably good cyclical moves without need for high doses of MAALOX. Of the 47 stocks I've had on these two lists since I started following them well over a year ago, their average Low to High ratio is 1.40:1. That's enough to generate some AIM activity and only 6 of them have zero dividends. So, there is some rent to be collected while holding these stocks if you choose the right ones.

Another aspect of owning well known companies is they generally have active Options potential as well. Those of you who piggy back AIM with some selling of Calls or Puts should be able to find yet another way to collect some rent from your ownership.

Generally I have been using 10% of Portfolio Control as my minimum order value. That translates to selling 10% of shares and buying 12% more shares when trades occur. Further I've been using 10% SAFE on the Buy side with Zero on the Sell side. While this creates roughly a 30% Hold Zone, I'm still getting nice trades occasionally. Part of my reasoning is I've been selecting for my Sandbox stocks with reasonable dividends. My logic is I don't want to be selling shares that are paying nice yield when the cash is going to be earning squat.

I've been picking stocks on the conservative or value side from these lists. I have a watch list of them set with the 52 Week Low as the Alarm. I'm not as concerned about new highs. When I see an alarm for a new low, then it gives me some time to study the stock in question and my chances are better at buying it when it's near a cyclical low point.

You may choose to pick the higher BETA stocks from these lists and to not select for Dividends. This would probably spice up the AIM activity to a degree. I'll leave your selections to you. If you choose from these three longer term portfolios most likely they will stand the test of time and AIM will help build value along the way.

Hi B, You'll find Value Line's "Highest Growth Stocks" (HGS)list on Page 39 of their "Summary and Index" section of the weekly updates. Most libraries have V/L available for free. The list doesn't change very fast, so it's not like you have to be there first thing Monday AM to see the changes.

Look for the #4 and 5 Timeliness ranked stocks. Then look at their recent (last month to 3 months) history to see what has happened to make the stock out-of-favor.

Here's ATNI for instance (timeliness #5 but still on the HGS list:

(Nice repeating pattern. Don't know when it dropped to Timeliness #5, but looks like a lot of pain is already realized by others)

and STLD (timeliness #5 and still on the HGS list):

(worth study to see why it is #5 and what their prospects are. Looks like enough zigs and zags to drive the AIM engine)

Those are the only two current #5 Timeliness stocks on the HGS list so they're the only two that would qualify for the PIC List at this time.

Best regards, Tom

Tom, Thank you for your prompt and detailed reply. After reading some value oriented books i.e. Rule #1 and Buffettology is seemed to me that using this methodology for stock picking and then using AIM to manage them "might" be the way to go. VL's 1-5 filtered stocks appear to do the same but is seems that it does not include the concept of moats as an additional filter.

People seem to have shyed away from stocks after the crash and burn of some high profile stocks over the last few years. Question is would these stocks have even passed either the VL or Buffett filters. I have my doubts.

I wonder if the use TA indicators to support, reinforce, filter AIM buy/sell signals would help or hinder AIM results.

Have you checked out VSS software from Mark Hing to select stock candidates ? Do you still invest in stocks or have you moved over entirely to ETF's.

Thanks.

Hi B, Re: AIM PIC List.......................

It seemed to be working okay but lacked a following here on Investors Hub. The idea was to use Value Line's excellent screen of "Highest Growth Stocks" but only use stocks that were rated #5 in Timeliness (out of favor) as choices for getting started. Once that occurred, the stock would remain in the account either until it became again a #1 Timely stock or would become an AIM holding and let the Lichello model work its magic.

Sometimes there were no #5s, so I guess one could use #4 and #5 as the Timeliness review points. What we wanted was really good companies with long successful track records to manage with AIM. What we also wanted was not to pay the "premium" that is usually associated with the #1 Timely stocks. We wanted to buy great companies when they were out of favor.

We kept the study going a long time. You can look at the various holdings and their histories at http://www.aim-users.com/pic.htm .

Here's a list of the stock tickers we'd used back then:

ADCT, ADPT, APCC, AVD, BBDB.TO, CBK, CDN, CCU, CERN, CGNX, CHUX, CLE, COGN, CSCO, CSC, ELN, ELX, ERICY, FHCC, FIC, GPS, HELE, INTC, IVC, KEA, KSS, LEG, MCRS, MKL, MOLXE, MTW, NAUT, NBTY, OSI, PLAB, PPC, RATL, ROST, SCH, SMTC, SUNW, SWFT, TIF, TLAB, TROW, VOD, VOL, VP, WMS, WTSLA, ZQK.........

Just for fun, here's Chirstopher & Banks Clothing for the last three years with typical Lichello AIM settings. The red "zig zag" lines show reversals of at least 30% or more making them tradeable with AIM's mechanism set to standard values.

and here's how AIM was handling it up to about the start of the graph above:

One would have needed deep pockets to have bought all the shares AIM would have suggested in late 2008, but there would have been nice rewards and plenty of cycles from which we could have profited.

Thanks for asking about this topic. If you're looking for a relatively good way to select stocks for AIMing, this simple method seemed to work just fine. Looking at the October 1st Value Line list, Steel Dynamics (STLD) and Atlantic Telenetwork (ATNI) were the only two stocks out of 100 that qualify as PIC candidates.

Best regards, Tom

Hi Tom, I see that this strategy came to an abrupt end in 2007. Was it not fruitful and worth persuing ?

Here's one more I almost forgot:

Hibbett Sports dribbled onto the PIC court near the beginning of September and was started with a 65% invested/ 35% cash reserve at the time. It nearly tripped a sale only to retreat to the Buy side recently. Overall historical growth has been excellent on this company, so assuming it gets back its starting position, it should make a nice AIM stock.

Best regards, Tom

Here are some recent PIC stocks:

1 - RES just appeared this week and with a P/E of around 13, BETA of around 1.45 and paying a 1.6% dividend, it might not be a bad long term AIM holding.

2 - NTAP was added a short while ago and has done well so far

3 - CHS did well initially when it first joined the PIC List about a year ago. In more recent times it's been hard pressed to do anything but add inventory. We have significantly more shares now than when this one was started.

All were started with a cash reserve level taken from the i-Wave at the time (hint hint on the latest addition). Overall the PIC List portfolio has done well enough this year. I'll have to tabulate the current results and post here later.

Best regards, Tom

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |