Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Being Street Smart

June 11

Sy Harding

But Go Away for How Long?

‘Sell in May and Go Away’ sure did work for the month of May, the worst May for the stock market since 1962. And so far the month of June has not been much better.

But go away for how long? Two months? Three months? July is usually a pretty good month for a summer rally isn’t it?

You could decide that, given the continuing global economic recovery, and that interest rates remain low and accommodative, the 10% correction already seen is more than sufficient and the correction is already over.

Or you might judge that the contagious debt crisis in Europe will spread, and combined with the austerity measures being imposed in European countries, will slow global economies, and that hasn’t been factored into stock prices by a mere 10% correction.

You could determine that investor sentiment remains too bullish and complacent for a correction bottom to be in yet, and that corporate insiders are still selling and usually begin buying again before a market correction ends.

Or you might look at technical charts and conclude the market is short-term oversold and due for at least a short-term rally that could get something going on the upside and leave the correction behind.

However, you could also look at convincing research that seems to say you don’t have to guess how long to stay away, don’t have to suffer headaches trying to fathom what cold winds blowing around the globe from Europe and China, or disappointing jobs or retail sales reports might do to the economic recoveries, and therefore to stock markets.

For instance, there is the mountain of evidence that supports the annual seasonal pattern from which the mantra ‘Sell in May and Go Away’ was born.

It says sell everything on May 1, and stay away until November 1, standing aside for the entire unfavorable period between, when history shows the market experiences most of its serious corrections and only in rare years experiences meaningful rallies.

Recognizing that the market does not top out into a correction on the same day in the spring every year, nor does it launch into a rally on the same day in the fall each year, in 1999 I introduced a similar strategy that has been one of the portfolios in my newsletter since. It is also based on the market’s annual seasonality, but utilizes a technical ‘momentum reversal’ indicator to better identify the best entry and exit dates each year. Its simple rules over the last 11 years resulted in a gain of 124% compared to a gain of 6.6% for the S&P 500 over what has become known to investors as ‘the lost decade’, in which two bear markets have devastated portfolios. Meanwhile the worst annual decline of the seasonal investor in those 11 years was 4.2%.

So, the market’s annual seasonal pattern says stay away until the October/November time-frame, take only 50% of market risk, and yet outperform the market, and therefore most professional money managers and mutual funds by a wide margin over the long-term (and the long-term is all that counts in investing).

Another consistent historical pattern may also be of assistance in this second year of the current Four-Year Presidential Cycle.

Since at least 1918, the stock market has experienced a substantial rally from the low in the 2nd year of every presidential administration to the high in the following year. That rally has averaged a gain of 50% for the Dow.

A study published in 2005 by Dr. Marshall D. Nickles of Pepperdine University showed that for the period from 1942 to 2004, if an investor bought the S&P 500 index on October 31 in the 2nd year of each presidential term, and held until December 31 of the following election year, he would not have lost money in any of those periods of being in the market, and would have gained a total of 7,170% (not counting interest on cash when out of the market).

He compared that to an investor being invested only in the opposite periods, who would have had losses in six of the 13 periods, the largest of which was 36%. And rather than see a 7,170% gain over the period, would have seen his original investment shrink by 35%.

I have a similar strategy based on the Four-Year Presidential Cycle that can have an entry as early as August 15 in the 2nd year of the cycle. (And we also have a non-seasonal Market-Timing Strategy, that will also help us identify when the bottom is in, and which takes also downside positions for profits in market declines).

So there you have proven seasonal strategies that say the odds are the low for the year will not be seen until at least August, but more likely not until the October/November time-frame.

Of course that does not preclude rallies in the meantime that fail at lower highs on the way down to the probable low later in the year. And you could also bet against the odds and, like playing a roulette wheel, might win occasionally and think you have something that will work long-term.

But now you know why I have been saying that the February low was probably not the market low for the year, and short-term rallies notwithstanding the low is still probably several months away, and is likely to be significantly lower.

President of the United States not allowed to post on IHUB

Posted by: Alex G Member Level Date: Wednesday, June 09, 2010 11:36:29 PM

do you think the current POTUS would be allowed to post on the nolib board?

and how long do you think this post will last without being deleted for "off topic" LOLOL

The Lounge | Politics | Zeev's Turnips Talk Politics (ZTTP)

Public Reply | Private Reply | Keep | Last Read Replies (2) | Next 10 | Previous | Next

Posted by: Alex G Member Level Date: Wednesday, June 09, 2010 11:36:29 PM

In reply to: Vexari who wrote msg# 490259 Post # of 490270 Send a link via email Share on Facebook Tweet this post

do you think the current POTUS would be allowed to post on the nolib board?

and how long do you think this post will last without being deleted for "off topic" LOLOL

video of interview which led to miner's firing

http://www.post-gazette.com/multimedia/?autoStart=true&topVideoCatNo=default&clipId=4685647&flvUri=&partnerclipid=

Ex-Massey Miner: Safety Gripes Led To Firing

http://www.npr.org/templates/story/story.php?storyId=127529659

June 7, 2010

A former Massey Energy coal miner has filed a federal whistle-blower complaint, claiming he was fired after complaining about unsafe conditions at two Massey mines in West Virginia, NPR News has learned. One of the coal mines is Upper Big Branch, where an explosion killed 29 workers April 5.

Ricky Lee Campbell's complaint says he repeatedly told his supervisors about failing brakes on the coal shuttle cars he drove at the Slip Ridge Cedar Grove mine.

The 24-year-old from Beckley, W.Va., also spoke to a newspaper about unsafe conditions at Upper Big Branch, where he worked until shortly before the accident. And he provided information in the federal investigation of the blast.

Campbell spoke to the newspaper on April 7. A week later, he was given a five-day suspension "subject to discharge" and then fired April 23. He then filed the whistle-blower complaint with the Labor Department, contending that his persistent safety concerns, his media interview and his role in the federal probe prompted his termination.

A preliminary investigation by the agency concluded that Campbell's complaint "is not frivolous" and "there is reasonable cause to believe that Mr. Campbell's dismissal was motivated by his exercise of protected activities."

Egregious Citations Issued to BP

By Nathan Yau - Jun 6, 2010 - Data Sources

http://flowingdata.com/2010/06/06/egregious-citations-issued-to-bp/

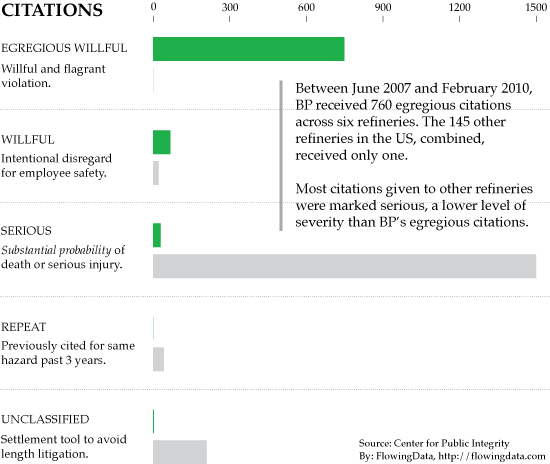

BP processes about 1.5 million barrels of crude oil per day, across six refineries in the United States. In total, 150 refineries in the United States process just under 18 million barrels per day, so BP processes about 8.5 percent of it. However, as reported by the Center for Public Integrity, 97 percent of the most dangerous violations found by OSHA were on BP properties.

There are several levels of citations. The most dangerous are egregious willful and willful, in that order. Egregious citations are flagrant violations and willful citations are intentional disregard for employee safety and health.

Between June 2007 and February 2010, there were 761 egregious citations issued in total. All but one of them were issued to BP. In the same time period, 69 of the 91 willful citations also belonged to BP.

Most citations for other companies were in the serious category, meaning there was "substantial probability" of death or serious injury. There were 1,521 serious citations issued to non-BP refineries, versus BP's thirty. However, if we take into account barrels of oil processed by the rest, we get an even worse image of BP. Really, it's bad no matter how you look at it:

"The rig's on fire! I told you this was gonna happen!"

— By Josh Harkinson

| Mon Jun. 7, 2010 3:00 AM PDT

http://motherjones.com/blue-marble/2010/06/rigs-fire-i-told-you-was-gonna-happen

A prominent Houston attorney with a long record of winning settlements from oil companies says he has new evidence suggesting that the Deepwater Horizon's top managers knew of problems with the rig before it exploded last month, causing the worst oil spill in US history. Tony Buzbee, a lawyer representing 15 rig workers and dozens of shrimpers, seafood restaurants, and dock workers, says he has obtained a three-page signed statement from a crew member on the boat that rescued the burning rig's workers. The sailor, who Buzbee refuses to name for fear of costing him his job, was on the ship's bridge when Deepwater Horizon installation manager Jimmy Harrell, a top employee of rig owner Transocean, was speaking with someone in Houston via satellite phone. Buzbee told Mother Jones that, according to this witness account, Harrell was screaming, "Are you fucking happy? Are you fucking happy? The rig's on fire! I told you this was gonna happen."

Whoever was on the other end of the line was apparently trying to calm Harrell down. "I am fucking calm," he went on, according to Buzbee. "You realize the rig is burning?"

At that point, the boat's captain asked Harrell to leave the bridge. It wasn't clear whether Harrell had been talking to Transocean, BP, or someone else.

On Friday a spokesman for Transocean said he couldn't confirm or deny whether the conversation took place. He was unable to make Harrell available for an interview.

During hearings held late last month by the Coast Guard and the Minerals Management Service, Harrell denied any conflicts with his BP or Transocean bosses. He said that he did not feel pressured to rush the completion of the well, even though the rig had fallen behind schedule.

Yet Buzbee's claims add weight to other statements that contradict Harrell's version of events. Testifying before the Coast Guard and MMS panel last month, Douglas Brown, the chief mechanic on the Deepwater Horizon, said that on the morning of the day that the rig exploded Harrell had a "skirmish" over drilling procedures during a meeting with BP's "company man," well site leader Robert Kaluza. "I remember the company man saying this is how it's going to be," Brown told the panel. As Harrell was leaving the meeting, according to Brown, "He pretty much grumbled, 'I guess that's what we have those pincers for,'" referring to the blowout preventer on the sea floor that is supposed to be the last resort to prevent a leak in the event of an emergency. The blowout preventer failed following the explosion on the rig, causing the massive spill. (Transocean's chief electronics technician, Mike Williams, also recalled the argument but named a different BP "company man," BP's top official on the rig, Donald Vidrine).

In a statement to the Wall Street Journal, Transocean appeared to back the claims that Harrell had feuded with BP: "The testimony certainly seems to suggest that [Harrell] disagreed with the operator's instructions, but what those were and why he disagreed are matters that will ultimately be determined during the course of investigations."

Other rig workers have also claimed that they were pressured by BP and their supervisors to cut corners. Transocean roustabout Truitt Crawford told the Coast Guard that he overheard senior management saying that BP was "taking shortcuts" by replacing drilling mud in the well with saltwater, which would have provided less weight to contain the well's surging pressure. Transocean's Williams told 60 Minutes that a supervisor had dismissed evidence that the well's blowout preventer had been damaged. And workers with Halliburton, the well's cementing contractor, had complained that BP's use of cement "was against our best practices" and told the oil company that it would likely have "a SEVERE gas flow problem" unless the well's casings were centered more carefully.

Buzbee told Mother Jones that the sailor's version of Harrell's phone conversation following the explosion was corroborated by a statement from a second crew member who says he also overheard the call. Both statements were taken in-person by Buzbee's investigator and safety consultant, who has interviewed some 60 people involved in the disaster, and signed by the witnesses, he said. Buzbee declined to make the full statements available to Mother Jones because, he said, "it is work product, meaning that it is something that I do not have to produce or disclose in litigation but that can be used at the right time in the litigation." He added that he intends to take a deposition from the crew members at a later time.

Buzbee's case against the operators of the Deepwater Horizon is hardly his first foray into suing major oil companies. After a BP refinery in Texas City exploded in 2005, killing 15 workers and injuring dozens more, he won $100 million in punitive damages from the company. In the wake of the 2002 shipwreck of the Prestige oil tanker, which devastated the coast of Galicia, he won a $70 million settlement from Spain's government on behalf of the country's Basque region. And he's also nabbed $15 million from Transocean and $6.2 million from Halliburton for injured offshore oil workers.

Yet Buzbee is convinced that the Gulf oil spill lawsuit will be his biggest ever. "It's the grandaddy of all cases," he said. "This is going to define BP and whether BP survives. This is going to be the biggest case in the history of the United States, no doubt about it."

CORRECTION: An earlier version of this story incorrectly stated that Buzbee won a $70 million settlement from the American Bureau of Shipping for its role in the Prestige oil spill off the coast of Spain. The settlement came from Spain's government. Mother Jones regrets the error.

Evidence Indicates that the Bush Administration Conducted Experiments and Research on Detainees to Design Torture Techniques and Create Legal Cover

Illegal Activity Would Violate Nuremberg Code and Could Open Door to Prosecution

Physicians for Human Rights

June 7, 2010

FOR IMMEDIATE RELEASE

(Cambridge, MA) In the most comprehensive investigation to date of health professionals' involvement in the CIA's "enhanced" interrogation program (EIP), Physicians For Human Rights has uncovered evidence that indicates the Bush administration apparently conducted illegal and unethical human experimentation and research on detainees in CIA custody. The apparent experimentation and research appear to have been performed to provide legal cover for torture, as well as to help justify and shape future procedures and policies governing the use of the "enhanced" interrogation techniques. The PHR report, Experiments in Torture: Human Subject Research and Evidence of Experimentation in the 'Enhanced' Interrogation Program, is the first to provide evidence that CIA medical personnel engaged in the crime of illegal experimentation after 9/11, in addition to the previously disclosed crime of torture.

This evidence indicating apparent research and experimentation on detainees opens the door to potential additional legal liability for the CIA and Bush-era officials. There is no publicly available evidence that the Department of Justice's Office of Legal Counsel determined that the alleged experimentation and research performed on detainees was lawful, as it did with the "enhanced" techniques themselves.

"The CIA appears to have broken all accepted legal and ethical standards put in place since the Second World War to protect prisoners from being the subjects of experimentation," said Frank Donaghue, PHR's Chief Executive Officer. "Not only are these alleged acts gross violations of human rights law, they are a grave affront to America's core values."

Physicians for Human Rights demands that President Obama direct the Attorney General to investigate these allegations, and if a crime is found to have been committed, prosecute those responsible. Additionally, Congress must immediately amend the War Crimes Act (WCA) to remove changes made to the WCA in 2006 by the Bush Administration that allow a more permissive definition of the crime of illegal experimentation on detainees in US custody. The more lenient 2006 language of the WCA was made retroactive to all acts committed by US personnel since 1997.

"In their attempt to justify the war crime of torture, the CIA appears to have committed another alleged war crime – illegal experimentation on prisoners," said Nathaniel A. Raymond, Director of PHR's Campaign Against Torture and lead report author. "Justice Department lawyers appear to never have assessed the lawfulness of the alleged research on detainees in CIA custody, despite how essential it appears to have been to their legal cover for torture."

PHR's report, Experiments in Torture, is relevant to present-day national security interrogations, as well as Bush-era detainee treatment policies. As recently as February, 2010, President Obama's then director of national intelligence, Admiral Dennis Blair, disclosed that the US had established an elite interrogation unit that will conduct "scientific research" to improve the questioning of suspected terrorists. Admiral Blair declined to provide important details about this effort.

"If health professionals participated in unethical human subject research and experimentation they should be held to account," stated Scott A. Allen, MD, a medical advisor to Physicians for Human Rights and lead medical author of the report. "Any health professional who violates their ethical codes by employing their professional expertise to calibrate and study the infliction of harm disgraces the health profession and makes a mockery of the practice of medicine."

Several prominent individuals and organizations in addition to PHR will file a complaint this week with the US Department of Health and Human Services' Office for Human Research Protections (OHRP) and call for an OHRP investigation of the CIA's Office of Medical Services.

The PHR report indicates that there is evidence that health professionals engaged in research on detainees that violates the Geneva Conventions, The Common Rule, the Nuremberg Code and other international and domestic prohibitions against illegal human subject research and experimentation. Declassified government documents indicate that:

* Research and medical experimentation on detainees was used to measure the effects of large- volume waterboarding and adjust the procedure according to the results. After medical monitoring and advice, the CIA experimentally added saline, in an attempt to prevent putting detainees in a coma or killing them through over-ingestion of large amounts of plain water. The report observes: "'Waterboarding 2.0' was the product of the CIA's developing and field-testing an intentionally harmful practice, using systematic medical monitoring and the application of subsequent generalizable knowledge."

* Health professionals monitored sleep deprivation on more than a dozen detainees in 48-, 96- and 180-hour increments. This research was apparently used to monitor and assess the effects of varying levels of sleep deprivation to support legal definitions of torture and to plan future sleep deprivation techniques.

* Health professionals appear to have analyzed data, based on their observations of 25 detainees who were subjected to individual and combined applications of "enhanced" interrogation techniques, to determine whether one type of application over another would increase the subject's "susceptibility to severe pain." The alleged research appears to have been undertaken only to assess the legality of the "enhanced" interrogation tactics and to guide future application of the techniques.

Experiments in Torture: Human Subject Research and Experimentation in the 'Enhanced' Interrogation Program is the most in-depth expert review to date of the legal and medical ethics issues concerning health professionals' involvement in researching, designing and supervising the CIA's "enhanced" interrogation program. The Experiments in Torture report is the result of six months of investigation and the review of thousands of pages of government documents. It has been peer-reviewed by outside experts in the medical, biomedical and research ethics fields, legal experts, health professionals and experts in the treatment of torture survivors.

The lead author for this report was Nathaniel Raymond, Director of the Campaign Against Torture, Physicians for Human Rights (PHR) and the lead medical author was Scott Allen, MD, Co-Director of the Center for Prisoner Health and Human Rights at Brown University and Medical Advisor to PHR. They were joined in its writing by Vincent Iacopino, MD, PhD, PHR Senior Medical Advisor; Allen Keller, MD, Associate Professor of Medicine, NYU School of Medicine, Director, Bellevue/NYU Program for Survivors of Torture; Stephen Soldz, PhD, President-elect of Psychologists for Social Responsibility and Director of the Center for Research, Evaluation and Program Development at the Boston Graduate School of Psychoanalysis; Steven Reisner, PhD, PHR Advisor on Ethics and Psychology; and John Bradshaw, JD, PHR Chief Policy Officer and Director of PHR's Washington Office.

The report was extensively peer reviewed by leading experts in related medical, legal, ethical and governmental fields addressed in the document.

Physicians for Human Rights (PHR) mobilizes the health professions to advance the health and dignity of all people by protecting human rights. As a founding member of the International Campaign to Ban Landmines, PHR shared the 1997 Nobel Peace Prize.

http://physiciansforhumanrights.org/library/news-2010-06-07.html

Scientists skeptical about rush to build sand barriers

http://www.latimes.com/news/nationworld/nation/la-na-oil-spill-berms-20100606,0,7544795.story

Louisiana officials demand swift action to block oil, but berms are costly, fragile and potentially harmful.

Dolphins swim in heavily oiled waters off Grand Terre Island as a few boats skim in the pass.

Oil could be seen on the dolphins' fins. (Carolyn Cole, Los Angeles Times / June 5, 2010)

The frenzied response to the BP oil well blowout in the Gulf of Mexico has featured any number of wing-and-a-prayer options from engineers and elected officials. But the debate over a sand-barrier plan that skeptical scientists are referring to as "The Great Wall of Louisiana" has been the most politically charged.

Republican Gov. Bobby Jindal, Sen. David Vitter (R-La.) and angry parish presidents have hammered the Obama administration in past weeks over what they characterize as a glacial federal approval process for the state's plan to construct 128 miles of sand berms, dredging up 102 million cubic yards of seabed in the process, to bolster the state's barrier islands and absorb oil before it reaches sensitive coastal marshes.

The Army Corps of Engineers gave final approval last week to a scaled-down version of the project after rejecting the state's original proposal, which could have cost as much as $950 million and taken as long as nine months to build.

But as Jindal and other politicians celebrate the partial victory, coastal researchers warn that the project can't be built in time to help — even if it had been approved when first proposed last month. And scientists warn that it may have unforeseen consequences.

The berm system could reroute the spill up the Mississippi Delta, and it would be unlikely to survive even a mild storm during the current hurricane season.

It also will absorb the short supplies of sand badly needed for projects to restore the state's coastline, damaged by past hurricanes.

Heavy equipment, including barges and dredge lines, could interfere with nesting season, now at its peak, for protected bird species.

Even Coast Guard Adm. Thad Allen, who ultimately approved the project, was lukewarm in his endorsement.

"There are a lot of doubts whether this is a valid oil spill response technique, given the length of construction and so forth," he said in announcing the first of six berm sites at Scofield Island, west of the Mississippi River. "We are not averse to attempting this as a prototype."

BP, which was ordered by Allen to pick up the estimated $360 million cost of the revised 45-mile-long berm project, washed its hands of the outcome. "The company will not assume liability for unintended consequences," said spokesman Mark Proegler. "We're counting on the government to make the right decisions."

Although the state signed contracts with a dredging firm, BP has yet to provide the funding.

"To date, BP has done a great job in sending us press releases and attorneys, but they haven't sent us any money to dredge," Jindal said Friday. "We are moving ahead without BP. We gave them two choices: They can either send us a check, get out of the way and let us start this work, or they can sign a contract and do it themselves. We are going ahead without them."

The Army Corps of Engineers has located a dredger. "We could see sand by Monday," Jindal said.

Jindal's frenetic pace is part of the state's gamble on the "worth-a-shot" approach to protecting its bays and bayous, 140 miles of which are coated in oil. So far, the state has built a "marsh fringe barrier," made up of sand plugs and small berms, in four coastal parishes, and has filled sea-bottom depressions with sandbags. Workers have strung tall, four-sided Hesco basket barriers in bays and laid more than 750 miles of booms throughout the four-state gulf region.

The use of sand berms to collect oil has been around for some time but has never been employed on this scale. Jindal has been the plan's most vociferous booster.

Louisiana has for decades been fighting a losing battle to reestablish its barrier islands, low-lying sand spits where natural shifting and erosion have been exacerbated by the channelization of the Mississippi and by recent catastrophic hurricanes. The Chandeleur Islands once extended almost to the Mississippi coast but lost 85% of their land mass in Hurricane Katrina in 2005.

The looming tropical storm season has some scientists questioning the expenditure of money and resources on an experimental project. Although the berms will be 300 feet wide at their base, tapering to 25 feet at the top, a sand wall is not considered a robust structure.

The berms "will not survive even a low-intensity tropical storm in the northern gulf," said Jack Kindinger, director of the U.S. Geological Survey's Coastal and Marine Science Center in St. Petersburg, Fla. "If we have one next week, the berms will be gone. We have to be careful not to do more harm than good."

Kindinger said that the new barriers may increase tidal action in open water, which would boost the salinity in estuaries and alter the lives of marsh plants and wildlife.

In a similar manner, the project could inadvertently drive oil into the Mississippi sound, the Biloxi marshes and Lake Borgne, according to the Army Corps' analysis.

Gregory Stone, director of the Coastal Studies Institute at Louisiana State University, warned that scooping sediment out of the sea bottom could accelerate wave action.

"It's not advisable to go out into shallow water and dredge and not expect potential negative impacts," Stone said. "That's going to increase the energy of the waves."

Such worries prompted the Interior Department to conclude: "We do not think the risks inherent in proceeding without more environmental study and knowledge are acceptable."

Coastal scientists and oceanographers were brought in this week to present their views on the berm proposal to state and federal responders. Many said they were frustrated, wondering why their expertise was not brought to bear sooner.

"You cannot do this without some sort of reasonable quantification as to what will happen," Stone said. " I understand we are in a jam right now, but, good Lord, we have sophisticated computer models that can do this in a matter of weeks.… It's sort of unconscionable that we've gone well over a month without scientific input."

Denise Reed, interim director of the Pontchartrain Institute for Environmental Science at the University of New Orleans, said that given the construction timelines, expectations that the berms will stop oil are unrealistic.

"There is a public sense that this is the solution that we need," she said. "I found this proposal extremely difficult to evaluate because it's so idealized and conceptual.… We are not going into it with our eyes wide open."

julie.cart@latimes.com

Copyright © 2010, The Los Angeles Times

Leopards Can't Change Their Spots; Neither Can Wall Streeters

Leo Hindery, Jr.

Chairman, U.S. Economy/Smart Globalization Initiative at the New America Foundation

Posted: May 25, 2010 09:30 AM

Like so many who worked to defeat the Republicans in November 2008, I was convinced that despite the nightmarish economy we were about to 'inherit' in January 2009, in the process we were going to be given a once-in-a-lifetime opportunity. It would give government back to the middle class and throw out the 30 years of laissez faire financial regulatory practices that had almost single-handedly destroyed our economy, left us with greatest income inequality ever, and saddled future generations with crushing federal indebtedness.

The easiest target, and the one I was convinced we would tackle first, was Wall Street: the profit-driven, greedy, selfish institution that, with its unbridled compensation practices and current light-touch regulatory regime is, I truly believe, behind almost every major societal and economic ill that has befallen the United States since 1980.

I knew we couldn't change Wall Streeters, but when it came to reining them in, properly regulating them, and, in some cases, punishing them, it was going to be like shooting ducks in a barrel. All the pain they had caused was obvious, and the 'evidence' even then was laid out more clearly than in a Law & Order episode. And we would be finished early in 2009, for sure.

Well, as Pogo said in the long-ago comic strip, "We have met the enemy and he is us." We have already let Wall Street off the hook, as they say, for fully a year more than I ever thought possible, because of apologists for Wall Street within both the White House and Congress. But even more concerning, depending on how the upcoming House and Senate conference on financial regulatory reform legislation turns out, we may be about to give the Street 'soft-touch' regulatory reform that it will laugh about -- and again run to the bank with -- for at least a generation.

Once you've missed some or all of a God-given major regulatory reform opportunity, political exhaustion sets in and abusive practices become even more abusive and embedded. In the specific case of Wall Streeters, if we miss 'getting' them now, as they say, these greedy guys will simply get greedier and their practices more harmful as their securities become ever more complex and thus beyond any reasonable regulatory oversight capability.

As sort of a 'canary in the coal mine' to larger financial reform, we've seen on the relatively simple issue of trying to reform the abusive tax treatment of "carried interest," which costs the Treasury $10 to $12 billion per year, just how disingenuous, misleading and vile the anti-financial reform crowd can be. Thus it comes as no surprise that the very same tactics and in some cases, even the very same lies, which have been used over the last nearly four years to push back on carried interest reform have now been embraced by many of the Republicans who just voted against the Senate's finance reform bill. And the similarities between the two efforts will be even more apparent in coming weeks as the actual reconciliation with the House version takes place.

For example, last Thursday, Senator Richard Shelby (R-AL), ranking member of the Senate Banking Committee, said, with regard to the Senate Bill, "I cannot support legislation that threatens business conditions and threatens job creation." On the very same day, May 20, the President of the grossly self-serving Private Equity Council said that any change in the taxation of carried interest would "hurt those companies that are most desperately in need of capital to sustain or create jobs."

This is such B.S., as neither overall financial reform nor reforming carried interest has anything at all to do with 'job creation,' and it is unconscionable to threaten the American people this way. At the onset of this Great Recession, which we now know was brought on mostly by Wall Street and investment excesses, the number of real unemployed Americans was 16.8 million -- the number today is 30.3 million, an increase of 13.5 million, and we are 'short' 22 million jobs in order to be at or near full employment. Substantially and quickly reforming the villain that largely caused the Great Recession is the sine qua non to creating those 22 million jobs, not the other way around, as these fellows falsely insist.

The next several weeks are when the substantial financial industry reforms that were promised in the 2008 presidential campaign will come to pass -- or not. There will be at least seven 'indicators' of who won in conference, and pray God, it isn't, as it was in 1999, Wall Street and, to steal a phrase from President Obama, its "hoards of lobbyists", which have already spent an unbelievable $1 million per Member of Congress (more than $500 million in total!) lobbying on these issues.

Specifically, we need to see:

1. As proposed by the House, the consumer protection reform goals met through a stand-alone agency (the "Consumer Financial Protection Agency") subject to annual budget appropriations by Congress, rather the Senate's weak alternative of a consumer protection bureau within the Federal Reserve. (This has everything to do with foxes, chickens and henhouses, and the idea of housing consumer protection within the ineffective and uninterested Federal Reserve needs to fail.)

2. Ideally, no compromise, least of all by the administration, on Senator Lincoln's (D-AR) requirement that big banks spin off their trading in swaps into separate subsidiaries. But if the Senator fails, and the strength of the opposition within the administration suggests sadly that she will, then at least the House version of the so-called "Volcker Rule" has some teeth, whereas the Senate's (which is Geithner's) version calls for nothing more than a namby-pamby "period of study".

3. No 'shielding' of auto dealers from oversight by the new consumer agency. The House is just wrong on this.

4. As proposed by Senators Cantwell (D-WA) and Feingold (D-WI), and others, no loopholes when it comes to regulating the trading of derivatives.

5. Application of the concept of "insurable interest" to all credit default swaps, together with the outright barring of "naked" credit default swaps. Regarding the latter, just as you can't take out a life insurance policy on a stranger, you shouldn't be able to use swaps as a form of 'death insurance' to bet that an asset or financial activity will fail.

6. No compromise when it comes to insisting that "failing" financial institutions be reviewed by a special panel of bankruptcy judges. (There is no good reason for the administration to be resisting this, and they shouldn't.)

7. Some restrictions on excessive compensation overall and especially at "failing" institutions, to absolutely include the 'clawing back' of ill-gotten individual earnings. If not now and not in this bill, then when and where?

Wall Street is desperately in need of reform, yet, because of the ways it compensates itself, it is incapable of self-reform and fairness. We know from countless examples its self-serving (and selfish) tactics, we know the harm it has done, and we know the even greater harm it can do if left unchecked.

President Obama needs to vigorously and resolutely weigh in on the House-Senate conference efforts and make sure that the bill that comes out of the reconciliation process reflects the results and values that he talked about during his campaign -- he simply cannot leave it to Wall Street and its industry lobbyists, to the 'diluters' and 'over-compromisers' on Capitol Hill, or to the Wall Street apologists within his own administration and hope that Congress produces strong financial regulatory reform legislation. Opponents of reform learned years ago, more than proponents ever have, that 'in conference' is where reforms can easily die (and greedy guys can win even more).

Leo Hindery, Jr. is Chairman of the US Economy/Smart Globalization Initiative at the New America Foundation and a member of the Council on Foreign Relations. Currently an investor in media companies, he is the former CEO of Tele-Communications, Inc. (TCI), Liberty Media and their successor AT&T Broadband. He also serves on the Board of the Huffington Post Investigative Fund.

http://www.huffingtonpost.com/leo-hindery-jr/leopards-cant-change-thei_b_588491.html

Where are the jobs?

Intermedia Partners’ Leo Hindery talks about the May jobs report and whether America can expect a double dip recession.

http://www.msnbc.msn.com/id/31510813/#37517303

http://motherjones.com/files/Congressional_Letter_re_BP-1.pdf

Ms. Elizabeth Bimbaum, Director

Minerals Management Service

Department of the Interior

1849 C Street, N.W.

Washington, DC 20240

Dear Director Bimbaum:

In recent months, we have heard disturbing reports regarding British Petroleum’s (BP) Atlantis

platform in the Gulf of Mexico. This platform, the largest oil and natural gas platform in the

world, may be operating without crucial engineering documents, which, if absent, would increase

the risk of a catastrophic accident that would threaten not only the workers on the platform, but

also the Gulf of Mexico and the communities who depend on the resources it provides.

In March 2009, a whistleblower notified the Minerals Management Service (MMS) that he

believed BP did not have required engineer-approved drawings for BP Atlantis’s subsea

components. Industry standards and federal regulations require the company to have these

documents before any platform can start production. These include “as-built” drawings, which

are essentially an operator’s guide to how the platform components work from start up to shut

down and are critical for operators to have at their disposal.

A review of BP’s database in existence at that time and provided by the whistleblower appears to

show that of the over 7,176 documents and drawings for Atlantis’s subsea components --- a total

of 6,393 of them --- over 90% --- may not have been approved by a professional engineer, as

required by regulation. BP’s own internal communication indicates that using incomplete or

inaccurate documents “could lead to catastrophic Operator errors due to their assuming the

drawing is correct.”

We are also concerned that your interpretation of 30 C.F.R. § 250.903(a)(1), and its application

to approval of operations at Atlantis indicates a less than acceptable standard. Specifically,

communications between MMS and congressional staff have suggested that while the company

by law must malntain “as-built” documents, there is no requirement that such documents be

complete or accurate. This statement, if an accurate interpretation of MMS authorities, raises

serious concerns.

MMS owes it to all American taxpayers to fully investigate the allegations made related to

environmental and safety standards of domestic offshore energy production. The urgency of

these allegations is highlighted by the recent oil spill in the Timor Sea that, according to one

source, leaked 2000 barrels per day for 10 weeks before it was finally stopped after five attempts

by the operator. These accidents are a reminder that even as drilling technology and clean-up

methods have improved there is still a considerable risk to the environment, and public health

and safety precautions should be taken seriously by both MMS and industry.

The MMS has an obligation and a duty to ensure that natural resource extraction from public

lands and the outer Continental Shelf is done with the utmost concern for the environment and

the health and safety of workers and the public. Making sure that these standards are adhered to

will take on added importance as the nation sets its sights on a national agenda of energy

independence. It is critical that we get this right.

We urge MMS to conduct a full investigation of whether British Petroleum had a complete and

accurate set of required engineering drawings for the BP Atlantis platform and its associated

subsea components prior to the start of production from that platform, and to report back to

Congress on the results of that investigation as soon as possible. We also request that MMS

describe how a regulation that requires offshore operators to maintain certain engineering

documents, but does not require that those documents be complete or accurate, is appropriately

protective of human health and the environment.

We look forward to hearing from you about this matter.

The Next Deepwater Horizon?

Fri Jun. 4, 2010 3:00 AM PDT

http://motherjones.com/politics/2010/06/next-deepwater-horizon

Last week, President Barack Obama put new deepwater drilling operations on hold for another six months. With the Gulf of Mexico spill entering its fifth week, this move was meant to show that the administration is taking a more cautious approach to offshore drilling, after it had announced a vast expansion just weeks before the BP disaster.

Many news accounts on the moratorium extension implied that all deepwater Gulf operations had been shut down. But that's not the case. The administration is allowing deepwater drilling operations already in production in the Gulf to continue—including some that may pose a greater risk than the Deepwater Horizon. Exhibit A: BP's other major Gulf operation, the Atlantis, which sits 124 miles off the Louisiana coast.

Kenneth Abbott, a project control supervisor BP contracted to work on the Atlantis, and the environmental group Food & Water Watch filed suit against the federal government on May 17 seeking a temporary injunction to force the Minerals Management Service (MMS) to shut down the platform. Abbott claims that his contract was terminated shortly after he alerted management to the rig's lack of crucial engineering documents in late 2008.

According to Abbott, the BP Atlantis lacks more than 6,000 documents that are key to operating the rig safely. Abbott has said that the vast majority of the project's subsea piping and instrument diagrams were not approved by engineers, and the safety systems are out of date. In March 2009, Abbott took his concerns about the rig to MMS, the Department of Interior office responsible for regulating offshore drilling. He says the agency requested some of these documents from BP, but failed to seek specific diagrams of key components necessary for ensuring the rig's secure operation.

An internal BP email that came out in the course of Abbott's dispute refers to the potential for "catastrophic operator errors" on the rig due to these lapses. The suit argues that without these documents, the rig operators "are flying blind, and have no way to assure the safety of offshore drilling operations." Food & Water Watch began pushing for lawmakers to intervene on the rig back in August 2009.

A group of 19 Democratic House lawmakers raised concerns about the Atlantis in a letter to MMS in February, noting "disturbing reports" of safety lapses and warning of the "risk of a catastrophic accident." In a May 19 letter, those lawmakers, led by Rep. Raul Grijalva (D-Ariz.), urged Interior Secretary Ken Salazar to call for "an immediate shutdown [of the Atlantis rig] until it can be shown that this platform is operating safely." The Atlantis, which produces 200,000 barrels of oil a day, operates 7,000 feet below the sea surface—2,000 feet deeper than the Deepwater rig. That suggests that if a blowout occurred, the Atlantis could release far more oil than the Deepwater well. "We are very concerned that the tragedy at Deepwater Horizon could foreshadow an accident at BP Atlantis," the House members wrote.

MMS promised House members after their initial letter that the agency would conduct an audit of the Atlantis and issue a report by the end of May. But that report has been delayed due to the Gulf disaster, according to the agency.

Elizabeth Birnbaum, who served as head of MMS until she resigned amid criticism of the beleaguered agency last month, told a House panel on May 26 that the agency has reviewed operations at the Atlantis and has "not found anything" indicating that the rig should be shut down. But Grijalva believes that the agency may just be inspecting the inadequate paperwork that it has already approved without giving the rig any closer scrutiny.

This contention is also supported by Food & Water Watch, which submitted a Freedom of Information Act request on March 1 to MMS for records related to agency employees conducting inspections of the Atlantis rig's subsea documents. The request was rejected—an MMS FOIA officer stated that the agency doesn't require documentation of the subsea components as they were built. Food & Water Watch says that without reviewing those documents, MMS would be unable to truly determine whether or not the rig was safe.

In the past weeks, Obama has repeatedly criticized the "cozy" relationship between oil companies and federal regulators. And the Department of Interior’s report on the offshore operations calls for new inspection and reporting procedures, tighter enforcement of existing rules, and the development of "new, faster ways of stopping blowouts in deepwater," among other recommendations. Yet at a Senate hearing last month, Interior Secretary Ken Salazar shrugged off the suggestion that the administration should pause operations that were approved under the same lax system that allowed the Deepwater rig in the first place. "We were not going to have those stopped mid-way," Salazar told senators.

"We're missing an opportunity, the administration is, by not insisting that production be suspended until we fully investigate the allegations," says Grijalva in an interview. "There's not only urgency to it, but it would be a prudent, politically smart thing for them to do as well.”

"It's clear to us that while there are problems with the entire industry, BP is probably the worst actor in terms of cutting corners, not having safety procedures, not having the necessary safety tech for operating platforms," said Wenonah Hauter, executive director of Food & Water Watch. "There should be a review by MMS of all the operating platforms to make sure safety documents and procedures are in place." (A spokesperson for Abbott could not be reached for comment.) The Center for Biological Diversity has also filed suit against the Department of Interior for granting waivers to the National Environmental Protection Act for Gulf leases, and has signaled that it intends to sue over non-enforcement of both the Marine Mammals Protection Act and Endangered Species Act in the Gulf.

Meanwhile, the group of House members are going to continue to push for a halt on all drilling operations. Says Grijalva, "Given the track record of industry and the track record of the agency in charge of oversight, it just seems to be the one safe route to take right now to assure the American people that another catastrophe won't happen."

Kate Sheppard covers energy and environmental politics in Mother Jones' Washington bureau. For more of her stories, click here. She Tweets here.

Suryia The Orangutan And Roscoe The Hound Dog

http://andrewsullivan.theatlantic.com/the_daily_dish/2010/06/suryia-the-orangutan-and-roscoe-the-hound-dog.html

Support for Wall Street Reform Grows

A CNN/Opinion Research survey indicates that a growing number of Americans support increased federal regulation over banks and other financial institutions. Six out of ten people questioned say they favor the legislation, with 38% opposed.

Support for the bill is up seven points from March, and opposition is down five points.

http://politicalticker.blogs.cnn.com/2010/06/02/cnn-poll-americans-split-on-top-two-obama-initiatives/?fbid=NVkFFm3fpp5

Fiorina Dismisses Global Warming as the Weather

In a new ad, Carly Fiorina (R) mocks Sen. Barbara Boxer's (D-CA) concern for climate change as a national security issue.

Says Fiorina: "Terrorism kills -- and Barbara Boxer's worried about the weather."

Ben Smith says it's "either a sign that global warming is no longer taken seriously even in California, or a very odd political calculation."

comments:

Um, Carly says--in the context of a national security ad--that she's "battle tested?!?" How stupid can you get? How long will it be before someone asks what the hell she means by that? What battles? ? Is she claiming combat experience, or just sounding ridiculous by throwing around those words without thinking for a second about what they actually mean?

(Also, whenever I hear her say, "I ran H. P.,"? I can't help but complete the phrase with "...into the ground.")

The rate of joblessness dropped in 346 areas, rose in 12 and remained flat in 14. That is a significant month-to-month improvement, as in March, unemployment fell in 257 metro areas and climbed in 89. [...]

Economists expect the economy to have added 500,000 jobs and the overall unemployment rate to track down.

http://washingtonindependent.com/86236/unemployment-falls-in-93-percent-of-metro-areas

Robert Gibbs: Oil crisis “solved by plugging hole & responding to damage done, not by method acting”

Wednesday, June 2, 2010 at 4:24 PM

Jake Tapper has a good quote from Robert Gibbs:

“If the president thought that yelling at the top of his lungs would solve this crisis, he would stand on top of the White House and do that. But he believes this crisis will be solved by plugging the hole and responding to the damage done, not by method acting.”

He was responding to the criticism of President Obama’s coolness in the face of the gigantic oil volcano crisis. There have been numerous calls for him to be more emotional, which of course, would be gratifying, because we could all relate to that so easily. It’s reassuring somehow, and even cathartic, to see someone as unflappable as President Obama get all wee-wee’d up with us.

However, Gibbs is right. Taking action, getting something done, solving problems all take precedence over being Prez Emo. I believe he feels our pain, despite the fact that I wouldn’t mind seeing him reveal his feelings from time to time.

It’s more comforting to know that he can stay calm in the midst of a calamity while the rest of us are tearing our hair out. He deserves credit for that.

Incredible sinkhole in Guatemala City caused by rains from tropical storm Agatha

http://www.flickr.com/photos/gobiernodeguatemala/

Guatemala: First, volcanic eruption; then, devastating tropical storm

Xeni Jardin at 10:55 AM Monday, May 31, 2010

http://www.boingboing.net/2010/05/31/guatemala-first-volc.html#more

Guatemala is in a state of crisis today after twin natural calamities struck: First, the Pacaya volcano (close to the capital) became active. Lava flowed, and the volcano spewed black sand and rock and ash everywhere. A newscaster covering the event, near the volcano, was killed by flying rocks.

Then, tropical storm "Agatha" struck, destroying homes, causing floods, and creating tens of thousands of internally displaced. Infrastructure in this country—where the majority live in poverty—is very poor, and ill-equipped to handle such a double blow. As of last night, official numbers on storm: about 30,000 "refugees," close to 120,000 evacuated, 93 dead and rising.

The poorest always suffer the most when events like this happen, and the two events together caused surreal conditions: knee-deep black sand mud, and "instant concrete" which formed when rains met ash, clogging up drains and laying waste to fragile sewage systems. Said a friend on Twitter, "Water and sand everywhere... it's like the beach, only a lot less fun."

Guatemala isn't the only Central American nation affected: at least 10 are dead in El Salvador, and Honduras has declared a state of emergency.

Offshore drilling ban would be a blow to Louisiana economy

By Rebecca Mowbray, The Times-Picayune

May 30, 2010, 10:16PM

Port Fourchon is the launching point for 90 percent of the deepwater activities in the Gulf of Mexico.

To coastal communities and marine-related industries across southern Louisiana, President Barack Obama's announcement Thursday that work at 33 deepwater drilling operations would be suspended immediately was like sealing the region's economic death from the ongoing oil plume gushing into the Gulf of Mexico.

"It's bad enough that we have an oil spill to deal with and the fishermen can't work. Now they're going to take away the oil industry, and we'll have nothing, " said Chett Chiasson, executive director for the Greater Lafourche Port Commission, which runs Port Fourchon, the launching point for 90 percent of the deepwater activities in the Gulf of Mexico.

If the rigs stop prospecting for oil, then catering companies stop cooking food for rig workers, boats stop bringing them supplies, mechanics stop servicing the supply boats and so on.

Chiasson predicts the hardest-hit communities will lose jobs that won't easily be recovered.

"This industry should not have to suffer because of one company's horrible mistake, " Chiasson said. "This will cause people to lose their jobs. I have no doubt about it."

The president and Interior Secretary Ken Salazar's announcement late last week to halt all deepwater drilling in the Gulf of Mexico "at the first safe stopping point" while the Interior Department figures out what regulatory changes are necessary for offshore oil prospecting seemed designed to reassure the nation that drilling would only proceed in a safe and environmentally sensitive manner.

But to those who work in the offshore industry and in the communities at the epicenter of the spiraling disaster from the April 20 Deepwater Horizon rig explosion and oil leak, it smacked of a lack of understanding of the role that the oil business plays in the Louisiana economy.

In the 2008 presidential election, no coastal parishes except for Orleans supported Obama; last week's offshore drilling announcement only seemed to make his administration even less popular in the oil-affected parishes.

"The president now needs to come down and talk to the offshore industry and reassure us that we're not going to be thrown to the wolves. I think they owe us that, " said Ken Wells, president of the Offshore Marine Service Association. "Our economy around here cannot sustain a collapse of this industry."

Sixteen companies have operations that will be affected by the six-month shutdown, including Shell, Chevron, BP, Marathon, Eni, Petrobras, Hess and LLOG Exploration, a Metairie-based division of Hess.

The Interior Department won't release the names of the wells or locations, saying the information is proprietary.

On Friday, people across the offshore industry were trying to get clarification on exactly what the requirements of the shutdown would be and whether it's really for six months.

On Sunday, the Minerals Management Service issued some additional guidance. That bulletin does not say that the drilling hiatus will be limited to six months; it only says that new permits won't be issued for six months.

The notice also raises the possibility that the shutdowns could affect wells that are in production.

"To obtain approval to conduct an activity in support of existing deepwater production, you must submit your request..." the notice reads. Applications must include a detailed, site-specific risk analysis with discussion about how to handle a loss of well control.

Shell Exploration and Production said it wouldn't have anything to say about how its operations would be affected until this week. Chevron said that it is drilling one well now in the Gulf of Mexico and had planned to drill three others this year. The California company, which has offices in Covington, said Friday it is working with the Interior Department and awaiting specific notice on what it is required to do.

Louisiana Economic Development Secretary Stephen Moret has had a team working to assess the moving target of the economic impact of the rig explosion since late April.

So far, it looks like 22 of the 33 rigs that are affected are off the coast of Louisiana, Moret said, and it's possible that some of the remaining 11 could be rigs that were scheduled to start operations in Louisiana waters in the next few months.

Depending on how the rules shake out, Moret has three scenarios for how bad the moratorium could be for Louisiana's economy.

Within a very short time, Moret believes the state will lose 3,000 to 6,000 direct and indirect jobs.

If the suspensions are maintained, it could rise to 10,000 jobs. And if the moratorium persists while oil prices rise, the state could lose 20,000 jobs over the next 12 to 18 months in the form of lost direct and indirect jobs, and missed job creation opportunities because rising petroleum prices stimulate more energy development.

Since it's unclear what's involved with the shut-downs, it's unclear whether companies will keep their rigs afloat in the Gulf with a skeleton crew or move them to Brazil, which is considered one of the world's biggest deepwater drilling opportunities.

The cost of keeping the rigs idle is significant. BP, for example, was renting the Deepwater Horizon semi-submersible rig from Transocean Ltd. for $500,000 a day before it exploded and sank.

"There's definitely a real risk that some of these rigs could be moved outside of the Gulf of Mexico because of the cost of keeping them idle, the regulatory uncertainty and opportunities in other parts of the world, " Moret said.

Others are convinced that rigs will be floated to foreign waters, and if they're moved, it will take two to three years for the equipment to finish up its new contracts elsewhere and come back.

"The drilling equipment and the rigs, if they know that they can't work for the next six months, they'll re-deploy to the rest of the world. It will be a lot longer than the next six months, " said Otto Candies III, secretary/treasurer of the Des Allemands marine transport company Otto Candies LLC, who called the president's announcement "a knee-jerk reaction."

Candies said his company employs 500 and has a supplier list of 100 companies, so the impact at his company would be wide.

Shane Guidry, chairman and chief executive of Harvey Gulf International Marine LLC in New Orleans, said that his company services all of the deepwater drilling operations in the Gulf. But his company also operates around the world, so it will be affected in several ways.

Harvey Gulf won a three-year contract in February to support Shell Oil's exploration and production work in Alaska, but Guidry said that deal will be scuttled by the moratoriums.

Guidry is convinced that companies will tow their rigs to foreign waters.

Because his company does work in places like Mexico, Trinidad and Brazil, and is interested in expanding to Africa, he'll be able to follow the rigs and retain work, but he said it's Louisiana that loses.

If he sends his boats to Brazil or Africa, he'll need to hire local workers there and re-flag his vessels, which means it won't be easy to bring them back to the Gulf of Mexico in a few years if activity cranks up.

"He has no idea what he's done, " Guidry said of the president. "We'll follow them out of the country. We'll re-deploy boats to other regions. It's really sad."

Those servicing the offshore industry say that deepwater drilling is a lot more fragile than one might think.

After oil prices crashed in 1999, deepwater drilling activity in the Gulf of Mexico didn't really get going again until 2004.

Then, with the recession and oil prices crashing in late 2008 and companies' concerns about their ability to raise capital, many drilling plans got put on hold.

With the nation emerging from recession and prices beginning to creep up, companies have only recently begun to initiate new exploration projects. Because drilling in deep water is so expensive, it's very price-sensitive.

Meanwhile, deepwater drilling is the best opportunity in the Gulf of Mexico.

With shallow finds largely tapped out, some 70 percent of the oil in the Gulf of Mexico comes from deepwater or ultra-deep water, meaning depths of 5,000 to 10,000 feet. But planning a new well takes about a year, and with the western Gulf of Mexico lease sale in August being canceled, the moratoriums could deter new operations for years to come.

Actions the Interior Department is taking on offshore drilling

-- Companies must cease drilling all new deepwater wells. Although the term "deepwater" generally means more than 5,000 feet, the directive applies to activities in more than 500 feet of water.

-- Companies that have been approved for an application for a permit to drill, but which have not yet started drilling the well, are prohibited from doing so.

-- MMS will not consider drilling permits for deepwater wells and related activities for six months.

-- Companies must secure the well being drilled "at the next safe opportunity, " and must submit plans to stop operations by Tuesday at 5 p.m. eastern time.

-- The August lease sale for the Gulf of Mexico is canceled. A proposed lease sale off the coast of Virginia is canceled, and proposed exploratory drilling in the Arctic is suspended.

-- Existing deepwater production wells may also be affected. Companies that want to continue existing deepwater production must submit a request to MMS that includes information about the well, safety systems and a "structured risk analysis" about the requested drilling activity. The risk analysis must include discussion about the risks of losing well control specific to that site.

Nigeria's agony dwarfs the Gulf oil spill. The US and Europe ignore it

The Deepwater Horizon disaster caused headlines around the world, yet the people who live in the Niger delta have had to live with environmental catastrophes for decades

A ruptured pipeline burns in a Lagos suburb after an explosion in 2008 which killed at least 100 people. Photograph: George Esiri/Reuters

http://www.guardian.co.uk/world/2010/may/30/oil-spills-nigeria-niger-delta-shell

We reached the edge of the oil spill near the Nigerian village of Otuegwe after a long hike through cassava plantations. Ahead of us lay swamp. We waded into the warm tropical water and began swimming, cameras and notebooks held above our heads. We could smell the oil long before we saw it – the stench of garage forecourts and rotting vegetation hanging thickly in the air.

The farther we travelled, the more nauseous it became. Soon we were swimming in pools of light Nigerian crude, the best-quality oil in the world. One of the many hundreds of 40-year-old pipelines that crisscross the Niger delta had corroded and spewed oil for several months.

Forest and farmland were now covered in a sheen of greasy oil. Drinking wells were polluted and people were distraught. No one knew how much oil had leaked. "We lost our nets, huts and fishing pots," said Chief Promise, village leader of Otuegwe and our guide. "This is where we fished and farmed. We have lost our forest. We told Shell of the spill within days, but they did nothing for six months."

That was the Niger delta a few years ago, where, according to Nigerian academics, writers and environment groups, oil companies have acted with such impunity and recklessness that much of the region has been devastated by leaks.

In fact, more oil is spilled from the delta's network of terminals, pipes, pumping stations and oil platforms every year than has been lost in the Gulf of Mexico, the site of a major ecological catastrophe caused by oil that has poured from a leak triggered by the explosion that wrecked BP's Deepwater Horizon rig last month.

That disaster, which claimed the lives of 11 rig workers, has made headlines round the world. By contrast, little information has emerged about the damage inflicted on the Niger delta. Yet the destruction there provides us with a far more accurate picture of the price we have to pay for drilling oil today.

On 1 May this year a ruptured ExxonMobil pipeline in the state of Akwa Ibom spilled more than a million gallons into the delta over seven days before the leak was stopped. Local people demonstrated against the company but say they were attacked by security guards. Community leaders are now demanding $1bn in compensation for the illness and loss of livelihood they suffered. Few expect they will succeed. In the meantime, thick balls of tar are being washed up along the coast.

Within days of the Ibeno spill, thousands of barrels of oil were spilled when the nearby Shell Trans Niger pipeline was attacked by rebels. A few days after that, a large oil slick was found floating on Lake Adibawa in Bayelsa state and another in Ogoniland. "We are faced with incessant oil spills from rusty pipes, some of which are 40 years old," said Bonny Otavie, a Bayelsa MP.

This point was backed by Williams Mkpa, a community leader in Ibeno: "Oil companies do not value our life; they want us to all die. In the past two years, we have experienced 10 oil spills and fishermen can no longer sustain their families. It is not tolerable."

With 606 oilfields, the Niger delta supplies 40% of all the crude the United States imports and is the world capital of oil pollution. Life expectancy in its rural communities, half of which have no access to clean water, has fallen to little more than 40 years over the past two generations. Locals blame the oil that pollutes their land and can scarcely believe the contrast with the steps taken by BP and the US government to try to stop the Gulf oil leak and to protect the Louisiana shoreline from pollution.

"If this Gulf accident had happened in Nigeria, neither the government nor the company would have paid much attention," said the writer Ben Ikari, a member of the Ogoni people. "This kind of spill happens all the time in the delta."

"The oil companies just ignore it. The lawmakers do not care and people must live with pollution daily. The situation is now worse than it was 30 years ago. Nothing is changing. When I see the efforts that are being made in the US I feel a great sense of sadness at the double standards. What they do in the US or in Europe is very different."

"We see frantic efforts being made to stop the spill in the US," said Nnimo Bassey, Nigerian head of Friends of the Earth International. "But in Nigeria, oil companies largely ignore their spills, cover them up and destroy people's livelihood and environments. The Gulf spill can be seen as a metaphor for what is happening daily in the oilfields of Nigeria and other parts of Africa.

"This has gone on for 50 years in Nigeria. People depend completely on the environment for their drinking water and farming and fishing. They are amazed that the president of the US can be making speeches daily, because in Nigeria people there would not hear a whimper," he said.

It is impossible to know how much oil is spilled in the Niger delta each year because the companies and the government keep that secret. However, two major independent investigations over the past four years suggest that as much is spilled at sea, in the swamps and on land every year as has been lost in the Gulf of Mexico so far.

One report, compiled by WWF UK, the World Conservation Union and representatives from the Nigerian federal government and the Nigerian Conservation Foundation, calculated in 2006 that up to 1.5m tons of oil – 50 times the pollution unleashed in the Exxon Valdez tanker disaster in Alaska – has been spilled in the delta over the past half century. Last year Amnesty calculated that the equivalent of at least 9m barrels of oil was spilled and accused the oil companies of a human rights outrage.

According to Nigerian federal government figures, there were more than 7,000 spills between 1970 and 2000, and there are 2,000 official major spillages sites, many going back decades, with thousands of smaller ones still waiting to be cleared up. More than 1,000 spill cases have been filed against Shell alone.

Last month Shell admitted to spilling 14,000 tonnes of oil in 2009. The majority, said the company, was lost through two incidents – one in which the company claims that thieves damaged a wellhead at its Odidi field and another where militants bombed the Trans Escravos pipeline.

Shell, which works in partnership with the Nigerian government in the delta, says that 98% of all its oil spills are caused by vandalism, theft or sabotage by militants and only a minimal amount by deteriorating infrastructure. "We had 132 spills last year, as against 175 on average. Safety valves were vandalised; one pipe had 300 illegal taps. We found five explosive devices on one. Sometimes communities do not give us access to clean up the pollution because they can make more money from compensation," said a spokesman.

"We have a full-time oil spill response team. Last year we replaced 197 miles of pipeline and are using every known way to clean up pollution, including microbes. We are committed to cleaning up any spill as fast as possible as soon as and for whatever reason they occur."

These claims are hotly disputed by communities and environmental watchdog groups. They mostly blame the companies' vast network of rusting pipes and storage tanks, corroding pipelines, semi-derelict pumping stations and old wellheads, as well as tankers and vessels cleaning out tanks.

The scale of the pollution is mind-boggling. The government's national oil spill detection and response agency (Nosdra) says that between 1976 and 1996 alone, more than 2.4m barrels contaminated the environment. "Oil spills and the dumping of oil into waterways has been extensive, often poisoning drinking water and destroying vegetation. These incidents have become common due to the lack of laws and enforcement measures within the existing political regime," said a spokesman for Nosdra.

The sense of outrage is widespread. "There are more than 300 spills, major and minor, a year," said Bassey. "It happens all the year round. The whole environment is devastated. The latest revelations highlight the massive difference in the response to oil spills. In Nigeria, both companies and government have come to treat an extraordinary level of oil spills as the norm."

A spokesman for the Stakeholder Democracy Network in Lagos, which works to empower those in communities affected by the oil companies' activities, said: "The response to the spill in the United States should serve as a stiff reminder as to how far spill management in Nigeria has drifted from standards across the world."

Other voices of protest point out that the world has overlooked the scale of the environmental impact. Activist Ben Amunwa, of the London-based oil watch group Platform, said: "Deepwater Horizon may have exceed Exxon Valdez, but within a few years in Nigeria offshore spills from four locations dwarfed the scale of the Exxon Valdez disaster many times over. Estimates put spill volumes in the Niger delta among the worst on the planet, but they do not include the crude oil from waste water and gas flares. Companies such as Shell continue to avoid independent monitoring and keep key data secret."

Worse may be to come. One industry insider, who asked not to be named, said: "Major spills are likely to increase in the coming years as the industry strives to extract oil from increasingly remote and difficult terrains. Future supplies will be offshore, deeper and harder to work. When things go wrong, it will be harder to respond."

Judith Kimerling, a professor of law and policy at the City University of New York and author of Amazon Crude, a book about oil development in Ecuador, said: "Spills, leaks and deliberate discharges are happening in oilfields all over the world and very few people seem to care."

There is an overwhelming sense that the big oil companies act as if they are beyond the law. Bassey said: "What we conclude from the Gulf of Mexico pollution incident is that the oil companies are out of control.

"It is clear that BP has been blocking progressive legislation, both in the US and here. In Nigeria, they have been living above the law. They are now clearly a danger to the planet. The dangers of this happening again and again are high. They must be taken to the international court of justice."

What Have we Bought for $1 Trillion?

Rep. Jan Schakowsky

Congresswoman from Illinois

Posted: May 28, 2010 05:37 PM

As of 10:06 on Sunday, May 30th, we will have spent $1 trillion in Iraq and Afghanistan.

A trillion dollars is a baffling amount of money. If you write it out, use twelve zeros. Even after serving in Congress for over a decade, I, like most Americans, still have a hard time wrapping my head around sums like this.

This month, we mark the seventh anniversary of President Bush's declaration of "mission accomplished" in Iraq, yet five American soldiers have been killed there in May alone. Iraqis went to the polls nearly three months ago, but the political system remains so fractured that no party has been able to piece together a coalition. There are some indications that sectarian violence is again on the rise.

The only clear winner of the Iraq war is Iran. Their mortal enemy, Saddam Hussein, was taken out and fellow Shiites are in charge. Iran has been emboldened to the point of threatening the stability of the region and the world with its growing nuclear capability.

And then there's Afghanistan, which, after nearly a decade of war, represents the longest continuous U.S. military engagement ever. Even the non-partisan Congressional Research Service recently declared the situation in Afghanistan as a "deteriorating security situation and no comprehensive political outcome yet in sight." And the U.S. military just suffered its 1,000th casualty in Afghanistan on Friday.

So the real question is: What have we bought for $1 trillion? Are we safer? As our troops and treasure are still locked down in Iraq and Afghanistan, terrorists are training, recruiting and organizing in Somalia, Yemen and dozens of other places around the globe. While it appears that we have made significant progress in weakening Al Qaeda's network, we have increasing concerns about homegrown terrorists.

Isn't it time to invest in a different strategy? I have been doing a lot of thinking about the nexus between the low status of women and the presence of instability, violence and terrorism. It is simply a fact that the countries in which women are least empowered are the most violent. Could it be that policy-makers and defense experts have overlooked a tool that is staring us right in the face? It's in the eyes of women -- sometimes masked by a burqa, sometimes scarred with acid, sometimes tear stained from the grief of losing a husband or child to war. It's these women who are often fiercely determined to stop the killing and provide a secure environment for their families. Does it even make sense for half of the human race to play only a minor role in countries now plagued by war and violence?

The data indisputably prove the case that when investments are made in women, communities are more stable, healthier, and less violent. The principle tools, which just happen to be far less expensive than the weapons and manpower of war, are the education of girls and economic empowerment of women.

We already have some positive experience that we can build upon. Where the U.S. military and our NATO allies have made a conscious effort to reach out to local women in a culturally sensitive way, they have seen the benefits of utilizing the unique abilities of these women. A Canadian-led Provincial Reconstruction Team in Kandahar met regularly with local women leaders who notified NATO of local corruption and security threats and also conveyed their priorities for improving life in their communities. The U.S. marines have found that using Female Engagement Teams to establish dialogue and collaboration with Afghan women has helped to build rapport between Americans and Afghans, as well as providing critical intelligence that might otherwise have been missed.