Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

you're gone for good I see

Success comes to those who can weather the storm. ~ Tao Te Ching

Louisiana Thinks Funding School Run By ‘Apostle And Prophet’ Is Somehow Constitutional

http://wonkette.com/481709/louisiana-thinks-funding-school-run-by-apostle-and-prophet-is-somehow-constitutional#more-481709

Louisiana’s exciting experiment in public-school vouchers is steaming forward, providing parents and children with educational excellence and traditional values, hooray! But that’s not all! It’s also an excellent lesson in how the free market can improve education, by taking taxpayer funds from the wasteful public schools and handing it to efficient private schools run by religious loons, just the way Real America wants. Among the 119 voucher schools approved so far is New Orleans’ Light City Christian Academy, founded and run by Apostle Leonard Lucas.

The state’s voucher program will be sending this gentleman, who “walks in the fullness of his calling and wears the mantle of an Apostle and Prophet,” some $364,000 to educate 80 students. You know it’s a good school because it has an educational philosophy and everything!

The Academy is a close-knit school embracing a community concept wherein the “whold” child is attended to spiritually, morally and intellectually.

Parents of whold children should find this an exciting opportunity! Strangely enough, some people are skeptical about Light City Christian Academy’s claims to educational excellence. This may be because they Hate Jesus. On the other hand, it could also have something to do with these bloggers’ observations that Apostle Lucas operates some two dozen nonprofit organizations, several of which seem to be … well, maybe just a little scammy, what with the Louisiana Secretary of State listing them as “Not in Good Standing.”

Or maybe it’s just math: Light City Christian Academy claims “a 90% success rate of our graduates continuing higher studies in Universities across the state,” but with total K-12 enrollments from 2008 to today ranging between only 35 and 53 students a year, this may not be an overwhelming record of achievement:

What does this actually mean? 90% of its dozen or so graduates have taken at least one college course in Louisiana?

The good news for Apostle Lucas is that, going forward, his school simply needs to achieve “at least a state-issued grade of D-minus” to continue to accept school vouchers. That kind of competition should make the godless government schools improve their performance!

After Delaying Release Of Voucher Documents, Louisiana To Send Taxpayer Funds To ‘Prophet’

http://tpmmuckraker.talkingpointsmemo.com/2012/08/louisiana_school_vouchers_prophet.php

Casey Michel August 23, 2012, 9:04 AM 7548

Louisiana Superintendent John White, the public face of the state’s massive and much-maligned school voucher system, has been hammered both locally and nationally for his announced slate of school standards. Editorials, educators, and legislators have criticized the program, and the latest news — St. John the Baptist parish (the equivalent of a county) announced on Tuesday it could lose up to $2 million due to the program — only serves to emphasize the controversy.

In an attempt to assuage criticism, White said his department would finally release documents detailing the vetting process that the 119 voucher schools — 99 percent of which are religious — endured prior to their approval. He won’t, however, release the documents until September — one month after many of the students have begun studying at their new schools.

Claiming “a deliberative process privilege,” White’s department was able to delay the release. Department of Education officials claimed that the documents in question — namely, those that displayed the measures taken to judge which schools would receive the 5,600 approved voucher students — were not matters of public record.

The Associated Press filed an initial request for the documents nearly ten weeks ago, but DOE spokesperson Barry Landry informed reporters that the documents would be withheld because the department carried a concern in “providing outdated information that may cause confusion to parents who are trying to make decisions around their participation in the program.”

James Gill, columnist with New Orleans’ Times-Picayune, noted that he believes the approved schools likely received little to no vetting whatsoever. “Evidently the Louisiana education department hasn’t heard that ‘Don’t confuse them with the facts’ is supposed to be a joke,” wrote Gill. http://www.nola.com/opinions/index.ssf/2012/08/odds_are_no_process_existed_fo.html

Gill also noted that another DOE spokesperson, who had cited a desire to avoid “ridicule or criticism” as the impetus for withholding the documents, was effectively rebutted by White’s willingness to open the documents in September.

Indeed, criticism of the voucher system — which the Louisiana Supreme Court failed to block last Thursday — seems likely to increase once the documents are released. After initial tales of schools teaching antediluvian creationism and methods for preparing for the Rapture — including at least one school that discriminates based on religion and sexual orientation — it was reported that the Light City Christian Academy, located in New Orleans, had been approved for 80 students this fall, raking approximately $364,000 in state funds.

The school is not the only Christian institution that will be receiving state monies, but it is, thus far, the only one helmed by a man who says he “wears the mantle of an Apostle and Prophet.” Apostle Leonard Lucas, a one-term state representative, has been the subject of recent profilings for his charitable ventures, many of which are listed as “Not in Good Standing” by the Louisiana Secretary of State.

Should Light City meet the minimum voucher standards over the first year — that is, if they receive at least a state-issued grade of D-minus — they are eligible for an additional 83 students, which, if granted, would jump the K-12 school’s size approximately 400 percent from its 2011-12 total.

White has hinted that he may begin tightening standards going forward, especially in regards to schools approved in the future. However, there’s no indication that there will be any further action taken in stemming the flow of public funds to any of the current schools — meaning that Apostle Lucas’s academy is set to see a six-figure sum from Louisiana taxpayers in turn for offering the self-proclaimed prophet’s “vision” to the students.

Yes, I support Sherman...and all of us who dare to post.........

no the difference is your butt buddy shermann posts constant lies and you are proud of the idiot

you "Stand" with shermann the liar

i never post lies and i don't support those who do

BTW, you can go fuck yourself if you think i am going to read your deflective "political ad" just to deflect from the liars you support

It wasn't a deflection.

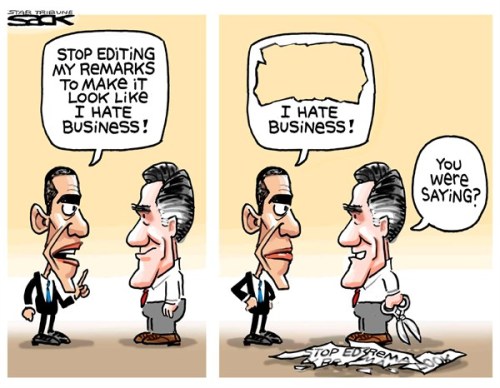

The fact is, both political ads are lies.

Under your strict definition, your support of Obama makes you just as much a liar.

Your quote:

wow... you are a monumental idiot who supports despicable liars

you just pick and choose the lies you like

wow... you are a monumental idiot who supports despicable liars

thanks for proving it

instead of admitting the despicable lie that your butt buddy shermann the paultard posted, you deflect and totally refuse to address it

thanks also for proving you are a coward and a phony

this is about voter suppression... the Republicans in Ohio changed the early voting rules to make it harder to vote for ordinary citizens... the Obama administration is merely trying to reverse the voter suppression

you are actually just like the poster CONix who you banned for posting lies... you just pick and choose the lies you like

what a monumental douchebag you are... Thanks for supporting voter suppression properlyDumb!

For those not paying attention, Obama's lawsuit is not about stopping early voting for the military, the argument before the court is that EVERYONE (including the military) gets to early vote for the same amount of time. Will you learn to read and not just see President Obama mentioned and having your tiny little Teatard brain blow a fuse? Thank you.

OOOOOOOOOOooooooo a political ad was a lie!

You've unearthed a real news item here....

Jeeze, stop the presses!

Here's one you can get equally angry with------

http://cnnpressroom.blogs.cnn.com/2012/08/08/brianna-keila-fact-checks-attack-ad-pinning-womans-death-on-romney/

i've already posted shermann's lie... are you serious??

how many times must i post the same thing???... do you have comprehension or memory problems??

good god man... i'll give it one more shot... see if any light bulbs go off

Romney gets caught lying about Obama, military voters

http://maddowblog.msnbc.com/_news/2012/08/06/13144744-romney-gets-caught-lying-about-obama-military-voters?lite

This is as loathsome a lie as Romney has told all year -- and given his record, that's not an easy threshold to meet.

OKay, Alex. I'm here to take your beating!

Give it your best shot......

I stand for Sherm! He's a great Mod on the P&M board.

If there's any content of any post he's made that you can prove to be false, go for it!

Calling me a coward in a personal message when you've blocked me from answering?

Please, Alex! Everyone doesn't see the world as you do.

It doesn't make them liars.

Actually, you look like quite intolerant.

House Defines Legislative Masturbation Before It Recesses For Summer

06 Aug 2012

Posted by Stan Collender http://capitalgainsandgames.com/

One of the last things the House did last week before leaving Washington for five weeks was to spend time and energy defining legislative masturbation.

At least that's the inescapable conclusion when you read H.R. 6169, the "Pathway to Job Creation through a Simpler, Fairer Tax Code Act of 2012."

That bill, which passed 232-189, supposedly would set up a fast-track process for tax reform by requiring the House Ways and Means Committee to report a bill by April 30, 2013. The full House would then be required to vote on whatever the committee approved within a month.

This was total nonsense and an absolute waste of the House's time and taxpayer money. Even if H.R. 6169 were considered and passed by the Senate (which the leadership knew would never happen), there's no way that a comprehensive tax reform bill will be adopted that quickly in the House or, as the House-passed legislation requires, that a final bill will be sent to the White House by the end of the summer 2013.

14 reasons why this is the worst Congress ever

http://www.washingtonpost.com/blogs/ezra-klein/wp/2012/07/13/13-reasons-why-this-is-the-worst-congress-ever/

Thomas Mann and Norm Ornstein are probably the most respected scholars of Congress in Washington. For more than 40 years, they’ve been the staunchest advocates, and most respected interpreters, of the institution, tutoring legislators from both parties and serving on an almost endless number of commissions and projects dedicated to understanding and improving what they call “the First Branch.” Here’s what they say about the 112th Congress:

"We have been studying Washington politics and Congress for more than 40 years, and never have we seen them this dysfunctional."

Their new book, by the way, is called “It’s Even Worse Than It Looks.” And yes, it’s mainly abut the 112th Congress.

oops, more evidence that properly dumb is a liar and coward

you are not banned on this board so you could have responded

just like willard Rmoney you only want to respond "privately"

but you don't have the ball-sack to respond publicly to blatant lies you support and your incompetence

the case is closed... you are a pitiful buffoon

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=78279026

properlynumb Member Profile properlynumb Member Level

Tuesday, August 07, 2012 11:20:30 AM

Re: None

Post # of 52048

Alex, you fuckin' idiot! I can't respond to your personal message when you banned me!

Who's lying now?

Please let me post the private messages you sent me.

Don't like the concept of free speech?

Transparency?

Romney Demanded Past Opponents To Release Tax Returns (2/2)

Romney Demanded Past Opponents To Release Tax Returns (1/2)

numb nuts, put up or shut up

do you have the nut-sack to tell us whether this is a blatant lie or not?

are you just too stupid to be able to tell an obvious lie from the truth or are you a coward who supports liars? or possibly both

put up or shut up numb nuts

Alex G

Re: shermann7 post# 51805

you are actually just like Willard Romney

you spew lies and have absolutely no shame in doing so... you are nothing less than pitiful

you are willard romney, an incompetent blatant liar... congrats

Quote: Obama Campaign Sues to Restrict Military Voting

Romney Falsely Accuses Obama Campaign Of Trying To Restrict Military Voting Rights

hey numb-nuts, you are wrong on all counts

"gentleman" is certainly in the eye of the beholder isn't it

your definition of a gentleman evidently is someone who posts blatant disgusting lies... as long as someone posts a lie they didn't write then that's okay in your twisted mind

i sent you a couple PMs asking why you ignore the blatant lies of certain irresponsible posters

but like the coward you are you didn't have the ball-sack to respond

so the more valid question is what are YOU afraid of?... the truth obviously

just like your right wing groupies u hang out with, when you get caught in a lie you never admit it, congratulations on supporting liars and incompetent immoral assholes

you are just like willard romney...

also congratulations on supporting voter suppression in Ohio... u may not realize it due to brain damage but you support un-American fascist assholes

don't blame me for your incompetence and lack of integrity

oh, btw... the only reason i continued to post on the board was because i have respect for desrtdriftr... shermann is a pathological liar who u gladly support and YOU are a gibberish peddler, much like ur buddy ixcimi, the insane gibberish peddler

good luck with your mental problems

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=78244580

Thomas Paine and Ben Franklin: You Didn't Build That

By Jason Koebler

July 27, 2012 http://www.usnews.com/news/blogs/washington-whispers/2012/07/27/thomas-paine-and-ben-franklin-you-didnt-build-that

When President Obama said at a rally earlier this month that "if you've been successful, you didn't get there on your own … if you've got a business, you didn't build that," he started a political firestorm, and an opposing "I built that" campaign from Mitt Romney. But it turns out Obama didn't build that argument from scratch, either. And his comments seem to be closer to the founding fathers' principles than opponents might like to believe.

As noticed by Reddit, Benjamin Franklin and Thomas Paine, two men who literally built the country, expressed similar sentiments in the 1700s. And, reading the passages suggests that they wouldn't take all the credit for founding the country, either.

In a Christmas Day letter to Robert Morris in 1783, Franklin wrote that "the remissness of our people in paying taxes is highly blameable," and that "all property…seems to me to be the creature of public convention."

He continues:

"All the Property that is necessary to a man, for the conservation of the individual and the propagation of the species, is his natural right, which none can justly deprive him of: But all property superfluous to such purposes is the property of the publick, who, by their laws, have created it, and who may therefore by other laws dispose of it, whenever the welfare of the publick shall demand such disposition. He that does not like civil society on these terms, let him retire and live among savages."

Paine, in 1795's Agrarian Justice, puts it even more bluntly: "Personal property is the effect of society; and it is as impossible for an individual to acquire personal property without the aid of society, as it is for him to make land originally."

"Separate an individual from society, and give him an island or a continent to possess, and he cannot acquire personal property. He cannot be rich," he writes.

Obama, Franklin, and Paine say it's OK to become rich through hard work—just don't trample on the people who helped make it happen.

In the everlasting words of one Mister Spock, "the needs of the many outweigh the needs of the few."

The Cats of Mirikitani

http://www.thecatsofmirikitani.com/

Eighty-year-old Jimmy Mirikitani survived the trauma of WWII internment camps, Hiroshima, and homelessness by creating art. But when 9/11 threatens his life on the New York City streets and a local filmmaker brings him to her home, the two embark on a journey to confront Jimmy's painful past. An intimate exploration of the lingering wounds of war and the healing powers of friendship and art, this documentary won the Audience Award at its premiere in the 2006 Tribeca Film Festival.

SYNOPSIS

"Make art not war" is Jimmy Mirikitani's motto. This 85-year-old Japanese American artist was born in Sacramento and raised in Hiroshima, but by 2001 he is living on the streets of New York with the twin towers of the World Trade Center still ominously anchoring the horizon behind him. What begins as a simple verite portrait of one homeless man will become a rare document of daily life in New York in the months leading up to 9/11. How deeply these two stories will be intertwined cannot yet be imagined. This is the story of losing "home" on many levels.

How did Mirikitani end up on the streets? The answer is in his art. As tourists and shoppers hurry past, he sits alone on a windy corner in Soho drawing whimsical cats, bleak internment camps, and the angry red flames of the atomic bomb. When a neighboring filmmaker stops to ask about Mirikitani's art, a friendship begins that will change both their lives. In sunshine, rain, and snow, she returns again and again to document his drawings, trying to decipher the stories behind them. The tales spill out in a jumble -- childhood picnics in Hiroshima, ancient samurai ancestors, lost American citizenship, Jackson Pollock, Pearl Harbor, thousands of Americans imprisoned in WWII desert camps, a boy who loved cats... As winter warms to spring and summer, she begins to piece together the puzzle of Mirikitani's past. One thing is clear from his prolific sidewalk displays: he has survived terrible traumas and is determined to make his history visible through his art.

September 11 thrusts Mirikitani once again into a world at war and challenges the filmmaker to move from witness to advocate. In the chaos following the collapse of the World Trade Center, she finds herself unable to passively photograph this elderly man coughing in the toxic smoke, and invites him into her small apartment. In this uncharted landscape, the two navigate the maze of social welfare, seek out family and friends, and research Jimmy's painful past -- finding eerie parallels to events unfolding around them in the present.

Discovering that Jimmy is related to Janice Mirikitani, Poet Laureate of San Francisco, is the first in a series of small miracles along the road to recovery.

Jimmy's story comes full circle when he travels back to the West Coast to reconnect with a community of former internees at a healing pilgrimage to the site of his internment camp Tule Lake, and to see the sister he was separated from half a century ago.

Blending beauty and humor with tragedy and loss, THE CATS OF MIRIKITANI is an intimate exploration of the lingering wounds of war and the healing power of art. A heart-warming affirmation of humanity that will appeal to all lovers of peace, art, and cats.

Stephen King: Tax Me, for F@%&’s Sake!

Apr 30, 2012 4:45 AM EDT

The iconic writer scolds the superrich (including himself—and Mitt Romney) for not giving back, and warns of a Kingsian apocalyptic scenario if inequality is not addressed in America.

http://www.thedailybeast.com/articles/2012/04/30/stephen-king-tax-me-for-f-s-sake.html

Chris Christie may be fat, but he ain’t Santa Claus. In fact, he seems unable to decide if he is New Jersey’s governor or its caporegime, and it may be a comment on the coarsening of American discourse that his brash rudeness is often taken for charm. In February, while discussing New Jersey’s newly amended income-tax law, which allows the rich to pay less (proportionally) than the middle class, Christie was asked about Warren Buffett’s observation that he paid less federal income taxes than his personal secretary, and that wasn’t fair. “He should just write a check and shut up,” Christie responded, with his typical verve. “I’m tired of hearing about it. If he wants to give the government more money, he’s got the ability to write a check—go ahead and write it.”

Heard it all before. At a rally in Florida (to support collective bargaining and to express the socialist view that firing teachers with experience was sort of a bad idea), I pointed out that I was paying taxes of roughly 28 percent on my income. My question was, “How come I’m not paying 50?” The governor of New Jersey did not respond to this radical idea, possibly being too busy at the all-you-can-eat cheese buffet at Applebee’s in Jersey City, but plenty of other people of the Christie persuasion did.

Cut a check and shut up, they said.

If you want to pay more, pay more, they said.

Tired of hearing about it, they said.

Tough shit for you guys, because I’m not tired of talking about it. I’ve known rich people, and why not, since I’m one of them? The majority would rather douse their dicks with lighter fluid, strike a match, and dance around singing “Disco Inferno” than pay one more cent in taxes to Uncle Sugar. It’s true that some rich folks put at least some of their tax savings into charitable contributions. My wife and I give away roughly $4 million a year to libraries, local fire departments that need updated lifesaving equipment (Jaws of Life tools are always a popular request), schools, and a scattering of organizations that underwrite the arts. Warren Buffett does the same; so does Bill Gates; so does Steven Spielberg; so do the Koch brothers; so did the late Steve Jobs. All fine as far as it goes, but it doesn’t go far enough.

What charitable 1 percenters can’t do is assume responsibility—America’s national responsibilities: the care of its sick and its poor, the education of its young, the repair of its failing infrastructure, the repayment of its staggering war debts. Charity from the rich can’t fix global warming or lower the price of gasoline by one single red penny. That kind of salvation does not come from Mark Zuckerberg or Steve Ballmer saying, “OK, I’ll write a $2 million bonus check to the IRS.” That annoying responsibility stuff comes from three words that are anathema to the Tea Partiers: United American citizenry.

Nova Science Now : How Smart Are Dolphins?

Off the coast of Honduras, on Roatan Island, a legendary experiment in dolphin communication is being attempted for the first time in 20 years—one that could prove that dolphins can, in effect, “speak” with one another to coordinate their behavior. Other studies reveal that these playful marine mammals can plan ahead and problem-solve in ways few other animals can.

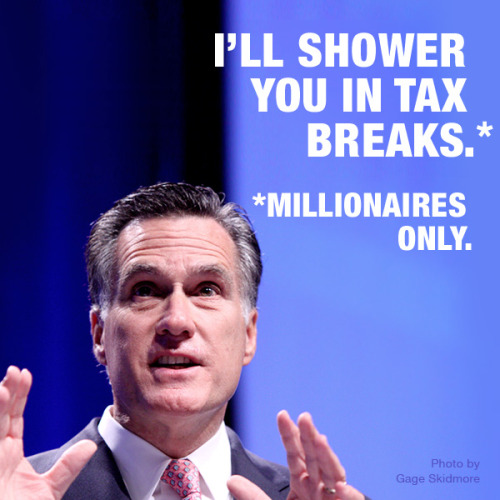

John Boehner says Romney’s wealth won’t hurt him: “the American people don’t want to vote for a loser”

http://thinkprogress.org/special/2012/04/29/473280/boehner-romneys-wealth-wont-hurt-him-because-the-american-people-dont-want-to-vote-for-a-loser/

Amazing perspective on what constitutes winners and losers from the GOP’s John Boehner:

Asked by CNN’s Candy Crowley whether Romney’s wealth presented him with a “hill to climb” in tough economic times, Boehner said: “No. The American people don’t want to vote for a loser. They don’t want to vote for someone that hasn’t been successful. I think Mitt Romney has an opportunity to show the American people that they, too, can succeed.”

Romney has consistently reminded voters of his wealth, noting that he is friends with the owners of NASCAR and pro football teams, that his wife has “a couple of Cadillacs,” or that he doesn’t consider $374,000 in speaking fees to be “very much.” That top Republicans consider Americans who don’t enjoy those luxuries losers or unsuccessful, however, may be why its nominee has had such a tough time gaining favor with average voters throughout the 2012 election.

It will be interesting to see how many conservative “losers” will give their vote to the party protecting corporations and the wealthiest individuals in our current economy — and how many will support the presidential candidate who exemplifies exactly what went wrong with the American Dream of social and economic mobility.

Kaili Joy Gray, Daily Kos

Rep. Paul Ryan (R-WI) is perfectly willing to follow the dictates of the Catholic bishops on limiting women's access to reproductive health care. Funny how he ignores his church when it advises caring for the poor, ending war—and supporting President Obama's proposed federal budget instead of Ryan's own "starve the poor, help the wealthy" plan.

Perhaps the architect of the make-poor-people-pay plan hasn't read the recent guidance from the Conference of Catholic Bishops that "a just framework for future budgets cannot rely on disproportionate cuts in essential services to poor persons; it requires shared sacrifice by all, including raising adequate revenues, eliminating unnecessary military and other spending, and addressing the long-term costs of health insurance and retirement programs fairly."

Let's remind Paul Ryan of his church's advice.

Call out Paul Ryan by faxing him a copy of the statement from the U.S. Conference of Catholic Bishops denouncing his budget proposal.

Thousands of faxes will let Ryan and his fellow conservatives know that you can't hide behind church teachings when it's in line with conservative thinking and ignore it when it's not. Voters are keeping track of the hypocrisy.

Please, click here to send a fax to Paul Ryan.

http://campaigns.dailykos.com/p/dia/action/public/?action_KEY=114

Keep fighting,

Kaili Joy Gray, Daily Kos

Senate Rejects GOP Keystone Pipeline Measure

04:26 PM EST

The Senate on Thursday rejected a Republican measure that would have bypassed the Obama administration's objection to

the Keystone XL pipeline and allowed construction on the project to begin immediately.

http://politicalticker.blogs.cnn.com/2012/03/08/breaking-key-senate-vote-on-pipeline-fails/

The Trees Are All Right

By TIMOTHY EGAN March 8, 2012, 8:30 pm

In most of the American West, the trees are not the right height, which may frighten Mitt Romney, and some of them are so old as to challenge the biblical view of creation that Rick Santorum wants taught in schools.

The tallest trees in the world, the coast redwoods of northern California, grow to 378 feet — more than half the size of Seattle’s Space Needle. The oldest trees in the world, bristlecone pines that cling to hard ground in Nevada’s Great Basin, can live for up to 5,000 years.

The saguaro cactus, with its droopy, anthropomorphic limbs, is the signature tree of the Southwest, though some say it is not technically a tree. And the western red cedar, armored in bark that Indians made into waterproof clothing, is a symbol of the Northwest.

This arbor tutorial is prompted by the slack-jawed ignorance of the last Republicans standing in the bad-idea-fest that is their party primary. Every week, it seems, the conveyor belt of craziness serves up another archaic idea from the people who want to represent a party that claims at least 40 percent of the electorate.

Romney, of course, famously said he liked the trees of Michigan because they were “just the right height” — a bizarre and harmless pander. But last month, in a campaign swing that was overlooked by the national press, Romney told a gathering in Nevada that he wasn’t much of a fan of the trees on public land — at least that was the impression he left.

He said, “I don’t know what the purpose is” of the great American public land legacy — a domain that includes 190 million acres of national forests, 52 million acres of national parks, and more than 500 million acres of open range, wildlife refuges and other turf under management of the Interior Department.

Romney has never been much of an outdoor guy, and strikes me as the kind of person who would wear wingtips on a hike. Once, asked to give a sense of his outdoor cred, Romney said, “I’ve always been a rodent and rabbit hunter — small varmints, if you will.”

Had he ever taken something other than a BB gun beyond the bunny range, Romney would know that American hunters consider themselves privileged to have so much unfenced country that is theirs as a birthright of citizenship. A clueless rich man, Romney can afford the private ranches of Texas, where one-percenters chase exotic animals without breaking a sweat.

The rest of us need our public land. The West is defined by new, fast-growing cities surrounded by the mountains, mesas, forests, sandstone spires and various shared settings. There is no other place in the world where urban and wild coexist over such a huge area. If you are poor, you can feel rich just minutes from the city, in your estate that is a national forest. If you ski in the high Sierra, or raft a runaway river in Utah, you are most likely doing it on land whose only deed of title is held by all citizens.

“Unless there’s a valid, legitimate and compelling public purpose, I don’t know why the government owns so much of this land,” said Romney.

Using Romney’s calculation — in which these lands can only be viewed as a commodity — the public domain more than pays for itself. Federal lands in Nevada, for example, provide about $1 billion in economic impact and support 13,311 jobs — and that doesn’t include the Forest Service. A poll by Colorado College found that 93 percent of the state’s voters agree that national parks, forests and wildlife areas “are an essential part of Colorado’s economy.”

Not to be outdone, Rick Santorum has channeled his inner robber baron while in the West. Speaking in Boise last month, he promised to sell our land to the private sector. The last time somebody seriously proposed that — James Watt, the secretary of the interior under President Reagan — he got a bipartisan round of boos from all corners of the West.

“The federal government doesn’t care about this land,” Santorum said. “They don’t live here, they don’t care about it. We don’t care about it in Washington. It’s flyover country for most of the bureaucrats in Washington, D.C.”

It’s clearly flyover country to Santorum. But try telling the many federal forest and park rangers, the smokejumpers and fish biologists, the backcountry avalanche experts and the game wardens, all of whom live in Western towns — and keep the economy in those places humming — that they “don’t live here.”

Gifford Pinchot, first Chief of the United States Forest Service, in Pennsylvania in 1933. The New York Times

Santorum makes national forests sound like crack houses. Some of them, after long neglect, do look a bit ratty. But the best are American cathedrals. Santorum probably doesn’t know that a former governor of his home state, Gifford Pinchot, was the founder of the modern Forest Service. Pinchot was a rich man who spent his life advocating for places where “the little man,” in his parlance, would be king.

We can thank a hunter, a lover of nature and a man who was always thinking about the kind of country his great-grandchildren would inherit — the fire-breathing Republican Teddy Roosevelt — for most of the nation’s public land. But today, no Republican would dare stand with T.R.

So it goes in this retrograde campaign. Is there any long-held, much-cherished American principle that Republicans and their media outlets will not renounce? Is there any bad idea from the 19th century — or earlier — they will not resurrect?

Romney has shown that he knows the lyrics to “America the Beautiful.” Too bad he doesn’t know anything about the land itself — a gift of better minds than his, one that ensures that some things are equal in this democracy.

http://opinionator.blogs.nytimes.com/2012/03/08/the-trees-are-all-right/

Missing Limbs, More Suicides, No Jobs

Suicide:

1,000 veterans attempt suicide every month. That means every 80 minutes a veteran attempts suicide, every day 18 veterans succeed.

Now more than ever, the military is talking about suicides. In 2010, an Army task force released a massive report, including 250 recommendation, on reducing suicides among soldiers and veterans. “The hard part is eliminating the long-standing stigma, breaking down the invisible barrier,” Army Gen. Peter Chiarelli said. “I do not believe we are losing this battle.”

Homelessness:

The U.S. Department of Veterans Affairs (VA) states the nation’s homeless veterans are predominantly male, with roughly five percent being female. The majority of them are single; come from urban areas; and suffer from mental illness, alcohol and/or substance abuse, or co-occurring disorders. About one-third of the adult homeless population are veterans.

Roughly 56 percent of all homeless veterans are African American or Hispanic, despite only accounting for 12.8 percent and 15.4 percent of the U.S. population respectively.

About 1.5 million other veterans, meanwhile, are considered at risk of homelessness due to poverty, lack of support networks, and dismal living conditions in overcrowded or substandard housing.

Unemployment:

The rate of employment in veterans is 12.1 percent, vs. 9 percent for the U.S. overall.

Dig deeper into the pages of U.S. Bureau of Labor Statistics employment data and you;ll find some disturbing statistics.

Younger vets are coming right out of high school; the job market punishes those with less education.

The youngest of veterans, aged 18 to 24, had a 30.4 percent jobless rate in October, way up from 18.4 percent a year earlier.

For black veterans aged 18-24, the unemployment rate is a striking 48 percent!

Rape:

As veterans, women now face unprecedented challenges. One 2010 study estimated that 15 percent experienced sexual trauma overseas, while a recent Pentagon report found that female vets were twice as likely as men to develop combat-related PTSD, but less likely to seek treatment. Not to mention that for women, a return from war often means reconciling life as a former soldier with life as a mother.

Women are 3 times more likely to be raped by while serving than being killed in combat.

Some women in the military stop drinking water at 7pm to reduce the odds of being raped in a bathroom at night.

Does anyone remember the soldier who was assaulted when she went out for a cigarette? She didn’t report the assault because she was afraid of being demoted for having gone out without her weapon.

Close to one-third of women veterans say they were victims of assault or raped while they were serving. Twice the rate in the civilian population.

The Pentagon estimates that 80% to 90% of sexual assaults go unreported.

Only 8% of cases that are investigated end in prosecution, compared with 40% for civilians arrested sex crimes. Astonishingly, about 80% of those CONVICTED are honorably discharged.

Greg Jeloudov was 35 and new to America when he decided to join the Army.

Jeloudov arrived at Fort Benning, Georgia, for basic training in May 2009.

The soldiers in his unit called him a “champagne socialist” and a “commie faggot.”

Less than two weeks after arriving on base, he was gang-raped in the barracks by men who said they were showing him who was in charge of the United States.

When he reported the attack to unit commanders, he says they told him, “It must have been your fault. You must have provoked them.”

Last year nearly 50,000 male veterans screened positive for “military sexual trauma” at the Department of Veterans Affairs, up from just over 30,000 in 2003.

Male-on-Male sexual assault is common in the military and hidden by personal shame and official denial.

Military Family:

Recent research suggests that military kids are more likely to suffer learning disabilities, behavioral disorders and violent tendencies. Military spouses are vulnerable to alcohol and drug abuse, as are veterans themselves.

And as a couple, they’re twice as likely as civilians to divorce and four times more likely to contend with domestic violence.

Drug Pandemic:

A combination of chronic pain and mental health symptoms mean thousands of soldiers have been prescribed narcotic pain-killers, psychotropics, sleeping pills and other addictive, often dangerous drugs.

14 percent of Army soldiers have been proffered an opiate pain-killer.

73 percent of the Army’s accidental deaths in 2010 were blamed on prescription medication overdoses.

For many of those coming home with a bottle of pills, the habit can be tough to shake.

At least 25 percent of injured soldiers in one warrior transition unit were hooked on prescription meds, according to an Army inspector general report, and 31 percent of those at Walter Reed were using both prescription and street drugs.

Illness From Chemicals:

Today’s veterans might also be up against their very own Agent Orange. Open-air burn pits, used to incinerate household trash, computer parts and human waste at most bases in Iraq and Afghanistan, are now being linked to a host of serious health ailments.

But we might never know what — whether burn pits, toxic dust storms or chemical agent exposure — caused the conditions, which so far include neurological disorders, cancers and chronic respiratory infections.

A recent Institute of Medicine report noted that it was impossible to determine the source of airborne toxins overseas, because of “a lack of data” collected by the Department of Defense.

PTSD:

Arguably the signature wound of the wars in Iraq and Afghanistan, post-traumatic stress disorder affects at least 20 percent of all soldiers deployed since 2001. And symptoms like insomnia, rage and depression are, despite a swath of prescription meds doled out by VA doctors, largely untreatable.

At least, for now. The Pentagon has invested millions into all kinds of research that aims to find a better remedy for PTSD. So far, the military has studied dozens of treatments, including fear-erasing drugs, yoga, virtual-reality therapy and meditation. Sadly, they still aren’t open to everything: Marijuana, one substance that’s got a lengthy track record helping vets calm down, has yet to get the green light.

Source http://www.wired.com/dangerroom/2011/11/veterans-challenges/?pid=944&viewall=true

A good link to JP .. Alex .. the latest ..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72901810

thank you .. nope, i'm not going to substitute .. not _holy ..

justice of the peace .. lol ..

Post Date: 3/5/2012 4:10:16 PM in reply to 72717792 by BullNBear52

Board: Just Politics Reason: Personal Attack

oh you poor dear... so if i disagree with your statement that "Maine could not have had a better Senator than Olympia Snowe for all these years"... that means i'm "attacking you"??

lol, what a thin-skinned light-weight

there are many examples of Olympia Snowe being a do-nothing politician and pandering to the 1% while cutting jobs for average Americans

but boy o boy, when you get something stuck in your craw, no matter how wrong you are, you just cannot let it go... have fun hanging out with your Limbaugh ditto-head buddies

Post Date: 3/5/2012 3:40:47 PM in reply to 72840668 by fuagf

Board: Just Politics Reason: Personal Attack

yeah, that's really weird

BNB has some serious issues

thin-skinned and ego-maniac

he gets along much better with the "no-lib" crowd, the fans of Rush Limpdick

Re: A deleted message

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=72901810

yes, i agree, BnB and i pretty much agree on the vast majority of issues as you and i do also

but when this fella gets something stuck in his craw he is one thin-skinned little pussy, lol

Monday, March 05, 2012 6:11:26 PM

Re: A deleted message Post # of 2258

Alex, he's a decent chap really, with genuine and passionate feelings about just about all of the

things we see as important .. lousy social conditions, for one .. BnB, agrees with us on most things

.. defensive and crusty, yeah .. wtf? sometimes, yeah .. as a friend he gets some allowance from me .. lol ..

Survivorman of the Day

Feb. 19, 2012

A 45-year-old man in Sweden has reportedly managed to survive for two months trapped inside a snowed-in car with no food and only a sleeping bag to keep warm.

Snowmobilers who spotted his vehicle near the northern city of Umea initially believed it to be an abandoned wreck. Upon clearing away the snow, they discovered a dangerously thin person living inside.

“Just incredible that he’s alive considering that he had no food, but also since it’s been really cold for some time after Christmas,” said a rescue team member.

Doctors believe the man managed to survive by going into a “dormant-like state,” similar to ursine hibernation. “Humans can do that,” said doctor Stefan Branth. “He probably had a body temperature of around 31 degrees (Celsius) which the body adjusted to. Due to the low temperature, not much energy was used up.”

It remained unclear how the man found himself stuck in the snow to begin with.

[msnbc / photo: photoblog.]

http://thedailywh.at/2012/02/19/survivorman-of-the-day/

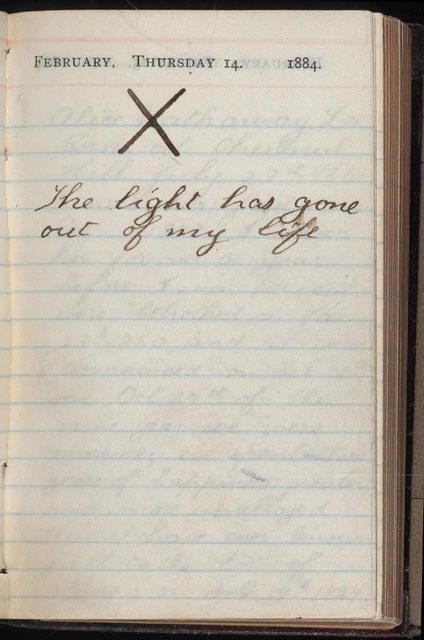

The light has gone out of my life

February 14, 1884...

...Theodore Roosevelt received a terrible blow—both his wife and mother died within hours of one another in the Roosevelt house in New York City. His mother, age 50, succumbed to typhus, and his wife Alice died at the age of 22 giving birth to her namesake. The following diary entries lovingly describe his courtship, wedding, happiness in marriage, and his grief over the death of his wife Alice, after which he never spoke of the union again.

Roosevelt's Pocket Diary

http://www.loc.gov/exhibits/treasures/trm052.html

http://en.wikipedia.org/wiki/Alice_Hathaway_Lee_Roosevelt

http://en.wikipedia.org/wiki/Alice_Roosevelt_Longworth

Economix - Explaining the Science of Everyday Life

February 7, 2012, 6:00 am

Tilting the Budget Process to the G.O.P.

By BRUCE BARTLETT

http://economix.blogs.nytimes.com/2012/02/07/tilting-the-budget-process-to-the-g-o-p/

Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

The House of Representatives voted last week to tilt the budgetary process in favor of the Republican economic agenda. On Feb. 3, the House passed H.R. 3582, the Pro-Growth Budgeting Act of 2012. Innocuous on the surface, its long-term purpose is to institutionalize Republican economic policy into the very fabric of budgetary analysis.

The legislation would require that the Congressional Budget Office and Joint Committee on Taxation do a “dynamic” analysis of major legislation – defined as that with a gross budgetary impact greater than 0.25 percent of the gross domestic product. Such an analysis would calculate the impact on real G.D.P. growth, the capital stock and labor supply.

The dynamic calculation would be supplementary and not replace the current official scoring methodology, but the obvious long-term goal is to require official revenue estimates to incorporate “Laffer curve” effects in order to make it easier to cut taxes and harder to raise them.

The Laffer curve, named for the economist Arthur Laffer, posits that tax rates may be so high that a tax-rate reduction will raise revenue to the government and a tax-rate increase will lower revenue.

While no economist denies the theoretical possibility of a revenue-raising tax cut or revenue-losing tax increase, Republicans talk as if the United States is always on the high side of the Laffer curve – no matter what the tax rates are – so every tax cut will pay for itself and no tax increase could possibly ever raise net revenue and thus reduce the deficit.

There was a plausible case that reducing the top income tax rate in 1981 to 50 percent from 70 percent would raise net revenue, mainly by curbing the value of tax shelters. But of course, reducing the bottom rate to 11 percent from 14 percent was just a pure revenue loser.

Contrary to liberal mythology, the Reagan administration never asserted that the 1981 tax cut would come anywhere close to paying for itself. All its official revenue estimates conformed to standard revenue-estimating methodology and incorporated no supply-side effects.

Nor did the George W. Bush administration ever assert that any of its tax cuts would pay for themselves. Yet Republican leaders like Senator Mitch McConnell of Kentucky continually assert that they did, in fact, pay for themselves and had no impact on the deficit.

A careful study by the C.B.O., however, found that the Bush tax cuts reduced revenues by $3 trillion through 2011, adding that much to the national debt.

As the budget deficit increasingly inhibits Republicans’ tax-cutting, they are planning ahead for tax cuts that they will insist are costless because they will so massively increase growth. But for that approach to work, the C.B.O. and the Joint Committee on Taxation, Congress’s official budget and tax estimators, need to be forced to play along.

That’s what the new legislation is all about.

It goes without saying that Congress deserves the most accurate possible estimates of the revenue effects of tax legislation, and no one denies that many past estimates have sometimes been far off because of unforeseen circumstances, such as recessions.

But Republicans assert that the errors are systematic and result principally from Keynesian economics. As the Budget Committee report on H.R. 3582 explains, the computer models used by the C.B.O. “are driven by traditional Keynesian economic relationships that emphasize the influence of aggregate demand on output in the short term.”

My concern is that the Republican effort is just a smokescreen to incorporate phony-baloney factors into revenue estimates to justify unlimited tax cutting. How soon before the C.B.O. is required to incorporate estimates from the right-wing Heritage Foundation in its calculations?

It already has a very well-financed Center for Data Analysis that the chairman of the House Budget Committee, Paul Ryan of Wisconsin, used to analyze his budget plan last year, bypassing the Joint Committee on Taxation and C.B.O.

Moreover, my memory is still fresh regarding the documented Republican effort in 2003 to suppress internal estimates of the cost of the Medicare Part D program. Medicare’s chief actuary, Richard Foster, has testified to the pressure that was put on him by a Bush administration political appointee, Tom Scully, which was documented by the inspector general for the Department of Health and Human Services.

(I also remember Newt Gingrich’s demand that every Republican in Congress vote yes on this budget-busting legislation, which added $16 trillion to the federal government’s long-term debt, according to Medicare’s trustees.)

I am also suspicious of what appear to be politically motivated investigations into C.B.O. by Republican congressional staff members, reported on Feb. 2 by The Wall Street Journal, and Republican efforts to gut the Government Accountability Office.

As I have previously noted, this fits into a pattern – since getting control of Congress in 1995, Republicans have often abolished institutions that they couldn’t turn into puppet organizations for promoting their agenda.

In other words, it is an issue of credibility. Republicans don’t really care about accurate revenue estimates; they just want them to show that tax cuts pay for themselves, so they can pass more of them without constraint. As my fellow Economix contributor Simon Johnson has noted, the corruption of the agencies that produce budget data is a crucial cause of Europe’s debt crisis.

Confirmation of this fear is the fact that the House-passed legislation would not require a dynamic estimate for appropriations bills, no matter how large. Republicans want the world to know that tax cuts expand real G.D.P., the capital stock and labor supply, but if spending has any such effect they don’t want anyone to know. Implicitly, Republicans want everyone to think that spending never raises growth because it’s their dogma.

But in the real world, everyone knows that government investments in the national highway system, medical and other scientific research, and other programs unquestionably add to growth. And there are times when government spending can provide macroeconomic stimulus, which the C.B.O. has repeatedly documented, to the consternation of Republicans.

Over the last three years, we have seen Republicans politicize every aspect of policy making – filibustering virtually every administration bill and appointment in the Senate, risking default on the national debt by refusing to raise the debt limit, and routinely threatening government shutdowns unless the White House accedes to their demands.

It is reasonable to assume that the Republicans’ effort to alter the budget process is just another aspect of their goal to politicize policy and institutionalize their philosophy.

Copyright 2012 The New York Times Company

Privacy Policy

NYTimes.com 620 Eighth Avenue New York, NY 10018

Bill Moyers is back

http://billmoyers.com/episode/on-winner-take-all-politics/

video at link

On Winner-Take-All Politics

January 13, 2012

In its premiere episode, Moyers & Company dives into one of the most important and controversial issues of our time: How Washington and Big Business colluded to make the super-rich richer and turn their backs on the rest of us.

Bill’s guests – Jacob Hacker and Paul Pierson, authors of Winner-Take-All Politics: How Washington Made the Rich Richer — And Turned Its Back on the Middle Class, argue that America’s vast inequality is no accident, but in fact has been politically engineered.

How, in a nation as wealthy as America, can the economy simply stop working for people at large, while super-serving those at the very top? Through exhaustive research and analysis, the political scientists Hacker and Pierson — whom Bill regards as the “Sherlock Holmes and Dr. Watson” of economics — detail important truths behind a 30-year economic assault against the middle class.

Who’s the culprit? “American politics did it– far more than we would have believed when we started this research,” Hacker explains. “What government has done and not done, and the politics that produced it, is really at the heart of the rise of an economy that has showered huge riches on the very, very, very well off.”

Bill considers their book the best he’s seen detailing “how politicians rewrote the rules to create a winner-take-all economy that favors the 1% over everyone else, putting our once and future middle class in peril.”

The show includes an essay on how Occupy Wall Street reflects a widespread belief that politics no longer works for ordinary people, including footage we took at the OWS rally from October – December 2011.

LOL .. open, easy, honest .. non pretentious .. quick,

articulate and funny .. a good role model for all at 90 ..

and for many of the rest of us .. lol .. quite a gal!

90 years... amazing

Alex, loved the videos close here .. don't ask me how i missed a reply before ..

NBC wants their Golden Girl to know just how she's loved. So they're putting together a very special Betty White birthday show for all to see!

Betty White’s 90th Birthday: A Tribute to America’s Golden Girl will air January 16 from 8-9:30pm. Following this awesome 90 minute special will be a sneak peek of her upcoming hidden camera show — Off Their Rockers.

The series shows Betty sending senior citizens on the streets to prank the Facebook generation. LOL!! Yes, what an awesome concept!

Well Betty, we're glad NBC is wishing you such a happy birthday and we are too!!! We want you to know you're loved all across the board!

http://perezhilton.com/2011-12-19-betty-white-90th-birthday-special#.TwxO-IHvqi0

All the very best for 2012!

ps: Yahoo! .. thanks to, too!!

See also .. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=54495125 ..

both LADIES were great the 2nd time around .. take care ..

American deceptionalism

Under the growing influence of the 1 per cent, American exceptionalism has become American deceptionalism.

Paul Rosenberg Last Modified: 29 Nov 2011 12:56

http://www.aljazeera.com/indepth/opinion/2011/11/2011112995048821377.html

The US media has downplayed the power of the Occupy protests, says author [GALLO/GETTY]

From the dawn of the colonial era, long before they even had a national identity, Americans have always felt they had a special role in the world, though the exact nature of American exceptionalism has always been a matter of some dispute.

Many have taken it to be a special religious destiny, but Alexis de Tocqueville, the first to consider it systematically, affirmed the exact opposite: "a thousand special causes ... have singularly concurred to fix the mind of the American upon purely practical objects." Ironically enough, the exact term "American exceptionalism" was first used by Joseph Stalin, in order to reject it.

And yet, for 70 years American exceptionalism has been most prominently and consistently associated with imperialism ("benevolent", of course!), via the phrase "the American Century". It was coined by Time-Life publisher Henry Luce in February, 1941, 10 months before Japan's Pearl Harbour attack drew the US into World War II. The history of Luce's coinage provides a depth of resonance for a recent twist: a not uncommon, but particularly telling juxtaposition of four Time magazine covers from around the world this week.

In three editions - Europe, Asia and South Pacific - Time magazine's visually hot, tumultuous cover featured a gasmask-protected Egyptian protester, upraised fist overhead with a chaotic street background behind. The headline: "Revolution Redux". Not so in the exceptional American edition. There, the visually cool, wanna-be New Yorker-ish cover was a text-dominated cartoon against a light gray background: "Why Anxiety is Good For You."

Clearly, Time is whistling past the graveyard. As mostly Democratic mayors clamp down hard on Occupy Wall Street outposts across the land, it's obvious that the US' political class is having none of it. They do not believe that anxiety is good for them and they are doing their darnedest to keep a lid on things. Agitated citizens out in the streets are bad enough. Pictures of agitated citizens are simply too much.

Once upon a time, those pictures coming from a Third World dictatorship in a (hopefully) democratic transition would have been comfortably distant, even reassuring - exotic, other, subsumed in history, striving to become more like us, the transcendent ones at the "end of history".

That, after all, was part of the message of Luce's "American Century". But nowadays, everyone knows that the differences between Zuccotti Park and Tahrir Square are increasingly less significant than their similarities. They are matters of degree more than kind. There is no such place as "outside of history" anymore. Those making history know it, and those fighting history know it just as well.

Democratic mayors to the 99 per cent

In the US, the message from the mayors is simple: You've made your point. Now go to your room and shut up. We've got a lawn to keep up, and you've spoiled it. America's "grown-ups" as the political class likes to think of itself, have never had much patience when it comes to the "children", as its mere citizens are known. And yet, America's democratic revolutionary origins are at the very centre of a radically different vision of what American exceptionalism is all about.

The situation in Los Angeles is particularly exemplary. Although city officials welcomed Occupy LA at first, for weeks on end Mayor Antonio Villaraigosa and others have been saying it's time to leave. Villaraigosa - like Obama - is a former progressive organiser turned neo-liberal politician. He was a teacher's union organiser when I first met him in the 1980s, as part of a progressive precinct network aimed at getting disaffected progressive voters to the pols.

Also within the coalition's core was the LA National Lawyers Guild's executive director. When Villaraigosa first took office in 2006, his first big battle was against the teacher's union he used to work for. He took them on with the backing of billionaire real estate developer and education "reformer" Eli Broad. Five years later, as he faces off against Occupy LA, the current NLG executive director, James Lafferty, is one of his major opponents.

With no sense of irony, Villaraigosa thought Thanksgiving weekend was the perfect time for an eviction. "It's clear that this mayor cares more about dead grass than a dead economy," Lafferty responded at an Occupy LA press conference. "The 99 per cent that have been thrown out of their homes, jobless, without proper healthcare and all the rest seem to be less important to him than that lawn."

America's exceptional democracy

As indicated above, the idea of American exceptionalism was always a contested one. But it's hard to deny that the New World in general was seen as a land of opportunity, and the American colonies were the place where the most opportunity was seen for people to actually settle in significant numbers. Yet, the way most people managed to get to this new land of opportunity and freedom was through indentured servitude, and when that failed to provide enough labour, the African slave trade was "Plan B".

The land itself came courtesy of the earliest stages of America's centuries-long series of genocidal wars. And when the American Revolution came, it was lead in large part by slaveholder advocates of freedom - men like Washington, Jefferson and Patrick Henry, whose influence only expanded as the new nation was established.

Although their primary arguments were grounded in universalist appeals, the actual rights-holding subjects of their political system were a relatively tiny minority of well-to-do white males. The promise of rights-based liberal democracy was intoxicating to all, but forbidden to most. Equality was for gentlemen only. And yet, those excluded would not be denied. Scattered state and local battles coalesced into a national abolitionist movement by the 1830s, which in turn spawned a women's rights movement in the 1840s.

In Europe, the US example spawned the French and Polish revolutions, followed by more than a century of struggles in which the example of the US' existence powerfully transformed the Old World in combination with Europe's own internal modernising forces.

And even though the United States itself embarked on an imperialist course sparked by the Spanish-American War in 1898, its example as the first anti-colonial revolutionary regime inspired colonial revolutionaries as well. It was no accident that Ho Chi Minh approached Woodrow Wilson for his support at Versailles after World War I, before turning to communism as his second choice in seeking to rid his country of French colonialism.

From exceptionalism to deceptionalism

But the US had a hard time keeping up with itself, or with the world that it helped create. The European welfare state was a direct response to popular demands for a better, more just, less arbitrary life, demands that were sparked in part by the very existence of the US as an alternative.

As the US itself became more like Europe - more industrialised, more urbanised, less composed of small farmers and more composed of urban workers - the resistance to learning from European advances became increasingly irrational, and at odds with American pragmatism. Our political system lagged behind as well, lacking the fluidity and inventiveness that made parliamentary systems the dominant form of democracy elsewhere around the world.

This perverse refusal to learn from others who have been inspired by us in the political realm is strikingly at odds with Americans' grassroots improvisatory traditions. From food to music to everything in between, Americans have always adopted diverse influences, mixed them together and made them their own, based on the sole criteria of what works.

Yet, with far too few exceptions, we Americans have spectacularly failed to do this in the realms of economics and politics, where powerful elites have emerged to repeatedly stifle the US' spirit of ingenuity. Not only that, they have successfully blinded us as well. Under the growing influence of the 1 per cent, American exceptionalism has become American deceptionalism: a perverse refusal to see what others have done - often inspired by our own earlier examples - and use that knowledge to continue advancing ourselves.

The US' patch-work welfare state is the prime example of this dysfunction. But our lack of industrial policy is even more bizarre, given that we used to believe in it so. Indeed, the same could be said about the welfare state as well. Universal public education was an American idea - outside the South, of course - before catching on elsewhere around the globe. What's more, most of the US was homesteaded through a subsidised process of free or cheap land, supported by public infrastructure - or, in the case of railroads, publicly-subsidised infrastructure.

But when it came to an industrial welfare state, suddenly, everything changed. It's not so hard to understand why: the original industrial workforce was largely immigrant and culturally "other" - Irish at first, then central and southern European, predominantly Catholic or Jewish. It was not until the Great Depression pushed the US economy to the wall that we began to even partially catch up with Germany, which had created its welfare state half a century earlier.

Even then, it took another 30 years for us to add universal health care, but only for senior citizens. The results of creating Medicare were dramatic: Within a decade, American seniors went from being the age-group with the highest poverty rate to the lowest. But that was nearly 50 years ago, 130 years after Germany established its universal healthcare system. Since then, conservative resistance to America's welfare state has stiffened dramatically. Cultural differences between whites of European descent are nothing compared differences with people of colour - which moved dramatic to the fore as legal segregation was finally being dismantled.

Welfare in the US

A 2001 paper from the Brookings Institute, "Why Doesn't the United States Have a European-Style Welfare State?" found a direct correlation between welfare state spending and the size of minority populations - the more minorities, the lower the levels of spending. This held true both internationally (comparing more than 60 different countries) and nationally (comparing all 50 states). The paper did not argue that racial animosity was the sole reason for the US' fragmented and under-sized welfare state. It also cited the US' backwards political institutions - such as our lack of proportional representation - which in turn have roots in our history and geography.

The report stated, "Racial animosity in the US makes redistribution to the poor, who are disproportionately black, unappealing to many voters. American political institutions limited the growth of a socialist party, and more generally limited the political power of the poor."

Among other things, the report offered comparisons across time, which showed the US lagging decades behind Europe throughout the 20th century. The size of subsidies and transfers in the US in 1970 was roughly the same as that in the European Union in 1937. US figures in 1998 roughly matched the EU in 1960.

While American conservatives have long been hysterical about the welfare state in the US, two major points need to be stressed. First: German conservatives established the first comprehensive welfare state, under Chancellor Bismarck in the 1880s. Second, the American welfare state is the smallest and least comprehensive in the Western world. While American conservatives denounce the welfare state for supposedly strangling capitalism, Germany's welfare state has been crucial to its long-term prosperity, even as the US' incomplete welfare state has harmed us considerably. For example, without a national system, healthcare costs built into American cars were a crucial factor leading up to the bankruptcy crisis of 2009.

Nearly a half-century after Medicare, the US was finally ready to take a modest half-step forward toward expanding healthcare coverage. But President Obama's approach was so compromised, and so poorly argued that it's now opened the doorway for a massive reversal that could actually eliminate Medicare - a major decimation of the US' welfare state that would plunge millions of seniors into abject poverty, deprive them of healthcare and subject them to premature death.

Grand bargains

Obama is obsessed with trying to strike a series of "grand bargains" with conservatives, even though they keep rejecting him. As a consequence, he repeatedly begins his negotiations with positions that conservatives have supported in the past, hoping they will support those positions again. At the same time, he refrains from making energetic arguments for the liberal position.

As a result, his stimulus programme was roughly 40 per cent tax cuts (even though they're less effective in creating jobs than direct spending is) in a vain attempt to get Republican support. And when it came to health care, his approach was based on Republican proposals from the 1990s, developed by the conservative Heritage Foundation. It was the same foundation used by Mitt Romney when he was governor of Massachusetts.

Obama never used the popularity, efficiency and overall success of Medicare to argue for a government-centered approach, either an immediate full-fledged socialisation, aka "Medicare for all", or a gradualist approach - a public option for those currently without private insurance. Indeed, Obama collaborated with conservative Democrats in the Senate - most notably Max Baucus - to silence those who advocated for these approaches.

Medicare-for-all advocates were reduced to shouting from the audience and getting arrested, despite representing a substantial body of public opinion. Support for the more gradual public-option approach hovered around 60 per cent or more throughout the year-long legislative process. And yet, these proposals - tried and true in the rest of the industrialised world - could not even get a serious hearing.

Such is the power of American deceptionalism: No one else's experience in the world matters to the American political system.

Less than two years after Obama's Republican healthcare plan passed, its very modesty is being used against it. Although it did involve considerable long-term cost reductions, it was nothing remotely close to reducing costs to full-fledged welfare state levels. For example, calculations by the Centre for Economic and Policy Research show that, for example, if we Americans could get our per-capita health-care costs down to the level of most central European nations, we would have a budget surplus of around 10 per cent in 2080, rather than the current projected deficit of over 40 per cent.

By ignoring the example of other countries, the American political class has spun itself off into an alternate reality in which nothing short of catastrophically bad choices remain. (The situation of global warming denialism is an instructive parallel, in which facts have become entirely irrelevant.) And so, fuelled by an obsession with long-term deficits decades in the future, and ignoring the sky-high level of the unemployed, the US congress may well be about to drift toward abolishing Medicare as its so-called "solution".

Of course, Republicans like Congressman Paul Ryan, who originated the plan, won't come right out and say that. And neither will Democrats, now rumoured to be thinking of joining them in search of yet another "grand bargain". Ryan and company say they want to "save" Medicare by replacing it with a voucher system. As one wag put it, it's like killing my dog named Spot, and giving me a cat named Spot instead, then telling me you haven't killed Spot. But a variety of studies have stripped all the pretense away.

Most significantly, the vouchers ("premium support" in Orwellian Newspeak) would come nowhere near to paying the cost of health insurance for seniors, and the shortfall would only grow more severe over time. So instead of the government going broke, the people would. That's the anti-government Republican plan! But at least the plan would keep the private insurance companies making money hand over fist as they deny you coverage.

And since they're private companies, that counts as a win, according to the rules of American deceptionalism. Even if there is no real competition involved, and Adam Smith would have a heart attack if he saw what was being done in his name.

I've concentrated here on healthcare as a key welfare state component. But the same pattern of delusionary grand bargaining can be seen wherever you care to look. Consider "education reform". "America's schools are failing!" we're told. We have to privatise, voucherise, give parents more choice - that alone can save us.

But none of this is supported by evidence, certainly not the evidence of other countries, whose systems are more centralised and less privatised than those of the United States. The US accounts of nearly half of military spending worldwide. The only folks whose overspending ever came close to us was the Soviet Union, and we sure didn't learn anything from them. On the drug war? Don't even think of thinking about it!

The list could be extended indefinitely. There is not a single area in which Republicans won't condemn anything foreign just for being foreign (unless, for some reason they like it, the way Michele Bachmann likes Chinese slave labour). And there's not a single area where Democrats won't be defensive about thinking outside the box that Republicans have put them in.

If all this leaves you feeling anxious, relax. After all, as Time will tell you, "Anxiety is good for you!"

Paul Rosenberg is the Senior Editor of Random Lengths News, a bi-weekly alternative community newspaper.

You can follow Paul on Twitter @PaulHRosenberg.

The views expressed in this article are the author's own and do not necessarily reflect Al Jazeera's editorial policy.

Faceoff: Occupy Wall Street vs. Tea Party Movement (Infographic)

http://www.accelerated-degree.com/faceoff-occupy-wall-street-vs-tea-party-movement-infographic/

WS money will pour into Scott Brown's campaign - the LAST thing WS wants is Elizabeth Warren sitting in the U.S. Senate.

The Woman Who Knew Too Much

http://www.vanityfair.com/politics/features/2011/11/elizabeth-warren-201111

Millions of Americans hoped President Obama would nominate Elizabeth Warren to head the consumer financial watchdog agency she had created. Instead, she was pushed aside. As Warren kicks off her run for Scott Brown’s Senate seat in Massachusetts, Suzanna Andrews charts the Harvard professor’s emergence as a champion of the beleaguered middle class, and her fight against a powerful alliance of bankers, lobbyists, and politicians.

By Suzanna Andrews Photograph by Nigel Parry

TO PROTECT AND SERVE

Consumer advocate and Senate hopeful Elizabeth Warren, photographed in Washington, D.C.

On the afternoon of July 18, in remarks from the Rose Garden amid the bruising showdown with congressional Republicans over the debt ceiling, President Obama made what the White House billed as a simple “personnel announcement.” In a brief speech, the president announced that he was nominating Richard Cordray, the former attorney general of Ohio, to head the Consumer Financial Protection Bureau, the new government agency set up to protect consumers from abusive lending practices. In his remarks he described the agency, part of the massive 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, as creating “the strongest consumer protections in history,” set up “so ordinary people were dealt with fairly.” After which he turned to thank the woman standing to his right, Elizabeth Warren.

A Harvard law professor, one of the nation’s leading bankruptcy experts and consumer advocates, the 62-year-old Warren had come up with the idea for the agency in 2007. She had advised the Obama administration on its creation in the aftermath of the 2008 financial collapse and helped to push it through Congress. Warren had also spent the last 10 months working tirelessly to build the agency from scratch—hiring its staff of 500, including Richard Cordray, organizing its management structure, and getting the C.F.P.B. up and running for its opening on July 21.

As she crisscrossed the country, spreading the word about the C.F.P.B., Warren became a familiar face to many, especially to those who had seen her on television—on CNBC, Real Time with Bill Maher, and The Daily Show with Jon Stewart. She had gained millions of supporters. With her passionate defense of America’s beleaguered middle class, under assault today from seemingly every direction, she had become like a modern-day Mr. Smith, giving voice to regular citizens astonished at the failure of Washington to protect Main Street—and what increasingly appeared to be its abandonment of middle-class America. By July, the A.F.L.-C.I.O.—speaking for its 12 million members—had called on Obama to name Warren to head the agency. So had scores of consumer groups. Eighty-nine Democrats in the House of Representatives had signed a letter, publicly urging him to choose Warren. Newspapers around the country editorialized on her behalf, as did hundreds of bloggers. By July 18, when Obama announced that he was passing Warren over, he did so after receiving petitions signed by several hundred thousand people and organizations urging him to appoint Warren as the country’s top consumer watchdog.

At the end of his remarks, Obama turned to Warren and kissed her on the cheek. She smiled gamely, though if there are kisses a woman can do without, this was one of them. A Judas kiss, some would say. But if so, the betrayal was not just of Elizabeth Warren. In his remarks, Obama would hint at what had happened to Warren, commenting that she had faced “very tough opposition” and had taken “a fair amount of heat.” He also alluded to the powerful forces arrayed against her, and against the C.F.P.B.—“the army of lobbyists and lawyers right now working to water down the protections and reforms that we’ve passed,” the corporations that pumped “tens of millions of dollars” into the fight, and “[their] allies in Congress.” But he was mincing his words. The fight against Warren and the C.F.P.B. was one of the most brutal Washington battles this year, up there with the debt-ceiling showdown and now the looming battle over the jobs bill—but part of the same war. Arrayed against Warren, and today against the very existence of the C.F.P.B., was the full force of what many, most notably Simon Johnson, the M.I.T. professor and former International Monetary Fund chief economist, have called the American financial oligarchy: Wall Street firms and banks supported mainly by Republican members of Congress, but also politicians on the other side of the aisle, along with members of Obama’s own inner circle.

At a time of record corporate profits, a time when 14 million Americans are out of work, when millions have lost their homes and, according to the Census Bureau, the ranks of those living in poverty has grown to one in six—that Elizabeth Warren could be publicly kneecapped and an agency devoted to protecting American consumers could come under such intense attack is, ultimately, the story about who holds power in America today.

When the C.F.P.B. was first proposed to Congress, in early 2009, the Chamber of Commerce, the leading business lobbying group in the country, announced that it would “spend whatever it takes” to defeat the agency. According to the Center for Public Integrity, from 2009 through the beginning of 2010, it would be one of the biggest spenders among the more than 850 businesses and trade groups that together paid lobbyists $1.3 billion to fight financial reform.

Although a Gallup poll in the fall of 2010 would show that 61 percent of Americans supported Dodd-Frank—which was designed to curb the risky bank activities that triggered the 2008 meltdown and the ensuing recession—the financial establishment would continue to attack it even after it became law on July 21, 2010.