Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Silver Correction – ABC Pattern Downmove Price Target

by Olivier on May 18, 2011

http://www.tischendorf.com/2011/05/18/silver-correction-abc-pattern-downmove-price-target/

The bullish sentiment after the Silver volume climax top is still very high. In my book way too many traders are trying to anticipate a bottom and are eager to buy into this downward move. Eventually there will be one lucky guy who doesn’t get his fingers cut off trying to catch a falling knife. In any case, try to catch falling knives on a regular basis and in the long run odds are extremely high for you to be taken to the cleaners.

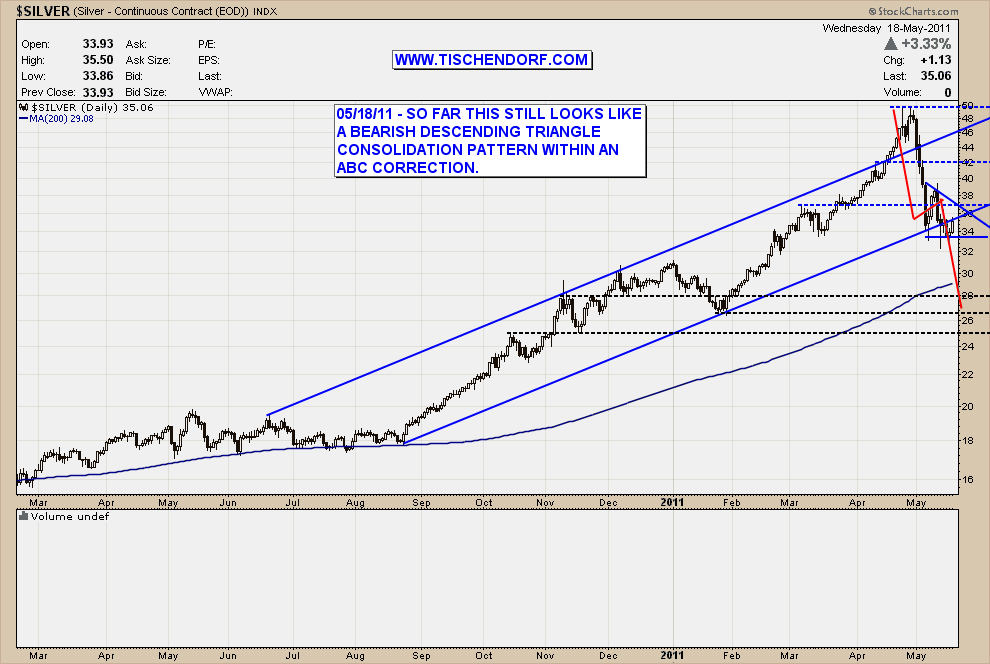

That being said today was another day that infamous SLV vs. SLW divergence could be observed. SLV is up 3.4%, the best big cap silver miner proxy SLW – Silver Wheaton is up a measly 0.4 %. As long as we see the Silver miners and also the Gold Miners underperform, the path of least resistance for Silver is down. Here is a chart of the price of Silver which clearly shows the technicals call for much further downside:

Up-to-date Daily Silver price chart on my public list. Click on the chart to maximize.

The red lines in the chart imply we are in the midst of an ABC correction. Technically speaking the price target for Silver should be in the 27-28$ USD area. The price target does make sense considering the above mentioned situation. Everybody thinks we have one of the greatest buying opportunities at hand. I saw people who said this correction will be over ‘within weeks’. I couldn’t disagree more. These guys are biased and are always talking their book, no matter what happens. Every technical trader worth his salt expects this will ‘take months’ for silver to rebuild pressure and make its next attempt at taking out the 50$ USD level in order to make new highs. What makes a target below 30$ attractive is the fact we would see a test of the moving average 200. The 27-28 target would allow for some overshooting to the downside. This would be similar to a move gunning stops and killing bullish sentiment.

Conclusion: There is still way too much hope and denial when it comes to the recent silver price correction. A further move to the downside would take care of that. Don’t be greedy. Don’t try to be a hero. Let the price come to you. Let’s see what happens.

On to a quick overview of various sectors and a few individual stocks:

Solar: SOLR – GT Solar is still one of my favourites. The recent outperformance actually might imply the market is starting to price in the LED potential as the rest of the solar stocks are still seriously underperforming.

Uranium: First signs some of the Uranium stocks might not want to go down more. CCJ – Cameco is now pulling back to the downside of the descending triangle pattern. It’s do or die time. If price gets rejected we will see another downmove, if price can move ‘back into the pattern’ it will be a sign selling pressure is waning and sellers are starting to get exhausted.

Natural Gas: I’ve recently mentioned this sector will most likely be the biggest beneficiary of the Fukushima incident. I am also monitoring WPRT – Westport Innovations very closely as it is trading near its all time high as opposed to let’s say CLNE – Clean Energy Fuels.

Mobile Internet Theme: I will soon add a second sector overview chart as the theme is starting to garner a lot of attraction. Additional components that will most likely be part of the new chart are: MITK – Mitek Systems, AUGT – Augme Technologies, NXPI – NXP Semiconductors to name but a few.

Gold: Much stronger than Silver and less extended. CNL.TO – Continental Gold one of my favourites for this year is still far from acting well though. Unless the miners and especially the one’s like CNL.TO I am watching very closely are not displaying any kind of strength it is best to stand aside. BAT.V – Batero Gold is a good example for a gold miner getting killed. It has given back almost all of its gains after its huge break out a few months ago.

Agriculture: ANDE – Andersons is still one of my favourites. It is now bouncing off support but I am typically more interested in buying breakouts as opposed to buying on support. Regarding sectors flying ounder the radar, Sugar might be fitting that description. IPSU – Imperial Sugar is starting to display great buying interest. Suedzucker AG the biggest European sugar company is trading very close to its all time highs and is displaying a potentially very bullish multi year cup with handle pattern which could lead to substantial gains over the next few years. Stock is not listed in the US though.

Lithium: PPO – Polypore is the picks and shovels approach stock for this sector and is most likely to benefit immensely if we move towards using more and more electric cars. In any case, so far it is outperforming the LIT – Lithium ETF.

SP 500, what you need to know

http://gicharts.blogspot.com/2011/05/sp-500-what-you-need-to-know_21.html

Posted by Moise Levi at 9:47 AM

1) Re entry

2) Warning

3) Out

My friend Olivier, you can read his great blog here, http://www.tischendorf.com/ reminded me that it has been a while since the sell in May did not take place.

He is right, we could face a major slow down

We could actually face a global slow down if you read the latest news .....

Possible Market Top

by Carl Swenlin

A reader recently called me a perma-bull, which is amusing, since by nature I'm usually disposed toward bearishness. I will, however, remain bullish until our mechanical timing model switches from a buy. The model will be bullish until the 20-EMA for the S&P 500 crosses down through the 50-EMA. We can see on the chart below that those moving averages are converging, but there is plenty of room before a crossover will take place.

While the model provides discipline, we are still permitted to look at indicator charts and speculate about the future. For example, on the chart above we can see a rising wedge pattern, which is a bearish pattern that usually resolves to the downside. There is still room and time for prices to bounce around inside the wedge, and the rising trend line is still holding, so this is not strongly conclusive.

Below is a Percent Buy Index (PBI) chart for the broad market. It shows the percentage of buy signals for the 100 Dow Jones market sectors. While it is still at a relatively high reading, there is a negative divergence between the PBI and the price index. This shows that the price advance is being undermined because fewer sectors are participating.

The next chart is the weekly bar chart of the S&P 500 Index. The concern here is that the weekly PMO has topped and is falling below its EMA (green line). There is also a negative divergence between the two PMO tops and the price tops. This is really bearish.

Bottom Line: The S&P 500 has not yet given the fatal sign of breaking down through the rising trend line drawn from the August 2010 low, but there are internal indicators that are giving strong evidence that an important top may have been made on May 2. That is to say that we could have begun a substantial correction, or the bull market may be over.

http://blogs.decisionpoint.com/chart_spotlight/2011/05/possible-market-top.html

Farm Runoff in Mississippi River Floodwater Fuels Dead Zone in Gulf

By: Jenny Marder

http://www.pbs.org/newshour/rundown/2011/05/the-gulf-of-mexico-has.html

A dead zone -- already the size of the state of New Jersey -- is growing in the Gulf of Mexico, fueled by nutrient runoff from the swollen Mississippi River.

This year, with floodwaters from the Birds Point levee breach and the Morganza and Bonnet Carret spillways spreading over farmland and other residential areas, the river is collecting tremendous amounts of fertilizer and pesticides. This is contributing to what scientists say may become the largest dead zone ever, and posing a serious threat to already taxed marine life.

During the rainy season, fertilizer, animal waste, sewage and car exhaust wash into the Mississippi and the Atchafalaya rivers, flow south and empty into the mouth of the Gulf.

Nitrogen and phosphorous from farm runoff and animal waste are especially toxic to ocean life. They act as natural fertilizers, feeding harmful algae and causing it to bloom wildly. As bacteria consume these blooms, they suck oxygen from the water, depleting the ocean's oxygen reserves. Scientists call this oxygen depletion hypoxia.

"We're expecting probably the largest-ever amount of hypoxia," said Nancy Rabalais, a marine scientist and executive director of the Louisiana Universities Marine Consortium. "That's the the prediction based on the amount of nitrogen coming down the river."

A surge of fresh water creates a layering effect in the seawater, which compounds the problem. The freshwater sits above the heavier saltwater, acting as a cap that prevents oxygen from reaching the deeper water levels.

"The bottom layer of the ocean gets so low in oxygen that sea life has to swim away and vacate the area, and if they can't get away, they suffocate," said Matt Rota, science and water policy director for the Gulf Restoration Network.

Flooding could cause further injury to fisheries in the northern Gulf of Mexico, already reeling from last year's oil spill, Rabalais said. Dead zones alter the habitat for crab, shrimp, fish and lobster, often forcing them to shallow areas. This includes catchable seafood, like shrimp and snapper, which are vital to the area's fisheries.

"A lot of the Louisiana shrimp fisheries use smaller vessels," Rabalais said. "With the price of fuel and the distance they have to go, they might opt not to go offshore."

Possibly the largest source of nutrients comes from farms in Illinois, Iowa, Ohio and southwest Minnesota, where drainage tiles -- plastic pipes that crisscross underground - - drain the once-wet soil, making it arable, and dry enough for corn and soybean crops. But these pipes also flush nitrogen fertilizer into tributaries, which lead to rivers and eventually the Gulf.

In fact, research shows that the most heavily tile-drained areas of North America also contribute the largest source of nitrates to the Gulf of Mexico, which add to the dead zone, according to Mark David, a professor of biogeochemistry from the University of Illinois.

David is researching options for reducing nitrate levels. They include valves and beds of woodchips inside the tiles, as well as restoring wetlands, which filter pollution naturally.

It's not the farmers' fault, David said, but there's little incentive for farmers to reduce their nitrate output. "There's a fundamental problem in the whole system if we really want to reduce nitrate and phosphorous loss from the system. Everything's been voluntary up to this point, and that hasn't gotten us anywhere."

Shark Fin Soup

via Tim Ferriss

http://www.fourhourworkweek.com/blog/

"More than 100 million sharks are now slaughtered annually to fuel the shark fin soup trade. The soup is non-nutritive, expensive, and doesn’t even taste particularly good (yes, I tried it in China in the 90's). It is served mostly as a status symbol at Asian weddings, formal functions, and high-end restaurants.

How is this fine soup made?

Shark fins are cut-off the sharks in a process called “finning.” The practice is wasteful, unsustainable and ecologically unsound. Here’s how it works: sharks are caught on long-lines (miles of line floating in the oceans, affixed with hooks and bait), brought to the boat, and their fins are hacked off. Next, since shark meat isn’t worth as much as shark fins, the mutilated but normally live animals are thrown back in to the water to sink and die.

Sharks cannot reproduce fast enough to keep up with mass-production shark finning. In the Atlantic ocean alone, shark populations in many species have decreased more than 90% percent in the last 15 years alone. It’s fucking disgusting.

I wanted to be a marine biologist for nearly 15 years, and if there is two things to remember about sharks, here they are:

- Most sharks don’t attack humans and have no interest in us whatsoever. I’ve dived with hundreds of sharks without incident.

- If you destroy apex predators (predators at the top of the food chain), the rest of the food chain topples soon thereafter.

If the oceans go to hell, so do we. To stick it to the bad guys and help the good guys, here are two five-minute options:

http://www.fourhourworkweek.com/blog/2011/04/29/five-minutes-on-friday-six-minutes-on-saturday-listen-to-music-save-japan-email-a-company-save-200000-sharks/#comment_list

I like Matt Taibbi - excellent research AND writes well. I saw Taibbi last night talking with CNN's Elliot Spitzer about this article.

“To recap: Goldman, to get $1.2 billion in crap off its books, dumps a huge lot of deadly mortgages on its clients, lies about where that crap came from and claims it believes in the product even as it’s betting $2 billion against it. When its victims try to run out of the burning house, Goldman stands in the doorway, blasts them all with gasoline before they can escape, and then has the balls to send a bill overcharging its victims for the pleasure of getting fried.”

Another month, another terrifying expose of Goldman Sachs from Rolling Stone’s Matt Taibbi, who chronicles how Goldman Sachs spent the better part of a decade selling off bad investments, betting that they would fail, and then taking your tax money to pay off the loans. And now I know exactly where SEAL Team Six ought to strike next. I’m told Goldman’s compound is somewhere in lower Manhattan.

http://www.rollingstone.com/politics/news/the-people-vs-goldman-sachs-20110511

.

Osama bin laden Home Movies

http://www.msnbc.msn.com/id/42941138/ns/world_news-death_of_bin_laden/

The Pentagon today released five home videos of Osama bin Laden obtained during the raid on his compound in Abbottabad.

The first video contains “[a] complete, unreleased message to the American people” recorded between October 9th and November 5th of last year. Three of the five, dubbed “practice videos,” show a bin Laden — his beard dyed black — preparing to record various scripted statements. The fifth (above) features footage of a frail-looking, blanket-wrapped, gray-beaded bin Laden sitting on the floor of his compound, watching news coverage of himself on an old television.

NYT’s The Lede points out that “[a]t two points during the footage…Bin Laden appeared to click away immediately when the news broadcasts he was watching showed footage of President Obama.”

http://thelede.blogs.nytimes.com/2011/05/07/c-i-a-briefing-on-bin-laden-documents/?hp#one-account-of-the-videos

All five clips have been intentionally stripped of their audio, as Pentagon officials considered it “inappropriate” to spread “the word of a terrorist.”

Honest to goodness .. when I read something like that I believe we should give that conflict back the French and

the Brits .. they were doing a bang up job .. ! now..? ......wonder if this is how nato performs in Afghanistan?

........just thoughts ..

Gaddafi planes 'destroy Misurata fuel tanks'

Rebels say Nato was alerted but failed to respond to raid by small aircraft on besieged city’s “only source” of fuel.

Government forces used small, pesticide-spraying planes for the overnight attack in Qasr Ahmed close to the port, Ahmed Hassan, [rebel] spokesman, said on Saturday. […]

The rebels have also accused Gaddafi of using helicopters bearing the Red Cross emblem of dropping mines into Misurata’s harbour.

http://english.aljazeera.net/news/africa/2011/05/201157112432539341.html

An Iraqi girl screamed Tuesday after her parents were killed when American soldiers fired on their car when it

failed to stop, despite warning shots, in Tal Afar, Iraq. The military is investigating the incident.

.......2005 article embedded in yours

http://www.nytimes.com/2005/01/19/international/middleeast/19iraq.html

Face That Screamed War’s Pain Looks Back, 6 Hard Years Later

Samar Hassan, with a relative, had never seen the photo of her, below, taken after her parents were killed by U.S. soldiers in Iraq.

By TIM ARANGO

Published: May 7, 2011

http://www.nytimes.com/2011/05/07/world/middleeast/07photo.html?_r=2&hp=&pagewanted=all

MOSUL, Iraq — Until the past week, Samar Hassan had never glimpsed the photograph of her that millions had seen, never knew it had become one of the most famous images of the Iraq war.

“My brother was sick, and we were taking him to the hospital and on the way back, this happened,” Samar said. “We just heard bullets.

“My mother and father were killed, just like that.”

The image of Samar, then 5 years old, screaming and splattered in blood after American soldiers opened fire on her family’s car in the northern town of Tal Afar in January 2005, illuminated the horror of civilian casualties and has been one of the few images from this conflict to rise to the pantheon of classic war photography. The picture has gained renewed attention as part of a large body of work by Chris Hondros, the Getty Images photographer recently killed on the front lines in Misurata, Libya.

The photograph of Samar is frozen in history, but her life moved on, across a trajectory that is emblematic of what so many Iraqis have endured. In a country whose health care system has almost no ability to treat the psychological aspects of trauma, thousands of Iraqis are left alone with their torment.

Now a striking 12-year-old, Samar lives on the outskirts of Mosul in a two-story house with four other families, mostly relatives.

The household is a cramped bustle of activity as women cook and clean and children scramble about. Samar’s older sister, Intisar, and her husband, an unemployed former police officer, care for her. Two of his sons are policemen, and their salaries support the extended family.

The pains of war have been visited on thousands of Iraqis, but even here Samar’s story stands apart. Three years after her parents were killed, her brother Rakan died when an insurgent attack badly damaged the house where she lives now. Rakan had been seriously wounded in the shooting that killed their parents, and he was sent to Boston for treatment after Mr. Hondros’s photos were published. An American aid worker, Marla Ruzicka, who helped arrange for Rakan’s treatment, was herself later killed in a car bomb in Baghdad.

Intisar’s husband, Nathir Bashir Ali, suspects his house was bombed by insurgents as retribution for sending Rakan to the United States. “When Rakan came back from America, everyone thought I was a spy,” he said.

Samar left school last year because she was too shy and not doing well, Mr. Ali said, although Samar said she would like to return and hoped to be a doctor when she grew up. She leaves the house only on infrequent family excursions and has two friends who visit to play with dolls and chat. She spends her days cleaning, listening to music on her purple MP3 player and watching episodes of her favorite television show, the Turkish soap opera “Forbidden Love,” about lovers named Mohanad and Samar.

“I am Samar,” she said, wearing a long red dress and sitting on the couch next to Mr. Ali. Two of her siblings, also in the car when their parents were killed, sat nearby.

“I’ve taken them many times to the hospital, where they get pills” for emotional problems, Mr. Ali said. “All of them take pills.”

He says Samar’s 8-year-old brother, Muhammad, talks to himself when he is alone. “When we go out and see a family, they get sad,” he said. Sometimes he finds the children in a room together, crying. “When they remember the accident, it’s like they just died.”

The photo of Samar had far-reaching impact, for it was visual testimony to a particular scourge of this war: the shooting of innocent civilians as they approached American checkpoints or foot patrols, killings made possible by liberal rules of engagement aiming to protect soldiers from suicide car bombers. The image was a point of discussion at the highest reaches of the Pentagon as it considered ways to reduce civilian casualties.

The Iraq war delivered few singular images for the popular imagination, partly because the country was too dangerous for photographers to move around freely, but also because in an age of saturated media coverage and short attention spans, it may be more difficult for news images to take root in the collective memory.

The military also set strict rules for embedded journalists that kept many graphic images from the public eye; the military asked Mr. Hondros to leave his embed assignment after he shot the pictures of Samar.

Liam Kennedy, a professor at University College Dublin, researches conflict photography and uses Mr. Hondros’s image of Samar in his class as one of the few photos from the Iraq war that could stand out in history, comparing it to the famous Vietnam image by the Associated Press photographer Nick Ut of a young girl running from a napalm attack.

“It really seems to say something of what’s going on at the time,” Professor Kennedy said. “All the arbitrariness of the violence that was going on at that time is summed up by that girl.”

Sarah Leah Whitson, director of the Middle East and North Africa division for Human Rights Watch, keeps a copy of the photo on a bulletin board in her office in New York. She remembers crying when she first saw the photo in a newspaper, and having to explain the image to her children.

“At the time, I thought it captured perfectly the horrors of the war that was not really understood by Americans,” she said. “Everything in that girl’s face symbolized what I felt all Iraqis must feel.”

She added, “I kept thinking, ‘I wonder what life will be like for this girl?’ ”

Mr. Hondros spoke about the photograph in a 2007 interview with the syndicated news program “Democracy Now.”

“I think one of the reasons the photo had this sort of resonance that it does is because it has a sort of empty feeling,” he said. “You know, the poor girl, all alone in the world now, just standing there in the dark.”

This week Samar, hugging a pillow to her chest, recalled: “He was taking pictures of me, I remember. Then he stopped, and they brought me a jacket and put me in the truck and treated the wound on my hand. And they gave me some toys.”

She had never seen the picture until this week, but she said she understood that it showed the world “the sad thing that is happening in Iraq.”

Near the end of the interview, she pointed to a family photograph on the wall. “I always dream about my father and mother and brother,” she said.

Duraid Adnan contributed reporting.

Rick Perry to President Obama: Screw Alabama, what about Texas?

http://www.dailykos.com/story/2011/04/29/971469/-Rick-Perry-to-President-Obama:-Screw%C3%82%C2%A0Alabama,-what-about-Texas

Fri Apr 29, 2011 at 12:45 PM PDT

Two years ago, Rick Perry was talking about

Texas Independence. Now he wants a bailout.

Mr. Secession himself wants more Federal aid, and he's got no sense of shame in demanding it:

Texas Governor Rick Perry criticized the Obama administration on Thursday for not responding to a request for a disaster aid for the parched state, where wildfires have scorched nearly 2 million acres.

"You have to ask, 'Why are you taking care of Alabama and other states?' I know our letter didn't get lost in the mail," Perry, a Republican and frequent critic of the federal government, said after addressing a Texas emergency management conference.

So hundreds die in storms throughout the South and Rick Perry's response is to question why those states are getting federal aid instead of Texas? Funny how he doesn't mention that Texas has already gotten at least $39 million in firefighting aid from FEMA over the past two fire seasons and has already received 22 grants in this fire season alone.

It's a sign of the times that tea party's favorite governor, the guy who said Texas ought to consider seceding from the United States, is now begging the Federal government for dollars. It used to be that conservatives said Texas was the miracle that proved the conservative vision of government worked best, where low taxes actually increased revenue and led to balanced budgets, that the only problem they had with government was that there was too much of it. But then reality set in, and now Texas doesn't have enough money to pay its bills. And its governor has gone from talking up secession to pleading for a bailout.

Well, perhaps if Republicans hadn't been so successful in stigmatizing the notion of Federal aid to states, Rick Perry would be getting the money he says he needs.

and if i remember correctly pols in Texas were recently calling for eliminating FEMA, making states handle their own natural disasters

of course then shortly after, TX Gov Perry was asking for FED help for wild fires

Tornado forecasting saved countless lives this week. Too bad Congress, including Alabama’s

entire GOP delegation, voted against maintaining forecast quality

http://climateprogress.org/2011/05/01/tornado-forecasting-saved-countless-lives-this-week-too-bad-congress-including-alabamas-entire-delegation-voted-against-maintaining-forecast-quality/

He's one hundred percent correct. Look what's happening here ..

Record floods cause Army Corps to blow up levee, inundate 130,000 acres of farmland to save small town

http://climateprogress.org/2011/05/03/floods-army-corps-levee/

.......look what happened in Alabama and Tenn. and the repubs all voted to get rid of the weather warning system .. go figure.

Wall Street Journal Launches WikiLeaks-Style Site called SafeHouse

Similar to WikiLeaks, SafeHouse allows whistleblowers to confidentially upload documents to the site. A senior Wall Street Journal editor will manage the standalone site, which is based on secure servers. […]

SafeHouse opened for submissions on Thursday. Whistleblowers can choose whether to send their contact details or to remain anonymous. Users can also request to “become a confidential source” of the paper, though this requires contact details.

However, the site’s terms and conditions – which users must agree to before uploading material – could prove controversial. They state that the Journal “reserve[s] the right to disclose any information about you to law enforcement authorities or to a requesting third party, without notice, in order to comply with any applicable laws and/or requests under legal process […]“.

http://www.psfk.com/2011/05/wall-street-journal-launches-wikileaks-style-site.html

Mayor Michael Bloomberg Plans to Eliminate 4,100 Public School Teachers Through Layoffs, and About 2,000 Through Attrition, the Most Since the 1970s

http://www.nytimes.com/2011/05/06/nyregion/bloomberg-budget-will-seek-400-million-more-in-cuts.html?_r=2

"Captain Wayne Porter of the U.S. Navy and Marine Corps Colonel Mark Mykleby, who wrote the paper for the Woodrow Wilson Center http://www.wilsoncenter.org/events/docs/A%20National%20Strategic%20Narrative.pdf , argue that the United States has its policies all wrong. America’s greatest national security threats aren’t terrorism or foreign armies—they are a crumbling infrastructure at home, the depletion of natural resources, climate change, and an overdependence on what they call “defense and protectionism.” Counterintuitively, this paper from special assistants to Joint Chiefs of Staff Chairman Admiral Mike Mullen, argues that America’s best hopes for world leadership lies in classical left-wing tropes of conservation, soft power, and aggressive humanitarian work abroad.

Click through for their four biggest (and most controversial) suggestions on the best path to maintaining America’s global hegemony."

This is nothing short of revolutionary. Read it!

(And in case anyone gets confused: That’s not CAPT Porter or COL Mykleby. It’s an Aussie officer and a USAF cameraman. And a solar cell. Rock on, military solar cells.)

http://motherjones.tumblr.com/post/5248424544/fastcompany-captain-wayne-porter-of-the-u-s

i think it's time to have this country run by our Military till we can start acting like adults

..........2011 -- - American Fascist

SP 500 warning level

SP 500 chart analysis ;

1) 50 days simple MA = Main resistance level

2) Short trigger is now "clear"

3) Bad news are "over" ??? Yeah, right ....

4) iPath S&P 500 VIX Short-Term Futures ETN (VXX) : Key support stands @ 32.5 $

Posted by Moise Levi

http://gicharts.blogspot.com/2011/03/sp-500-warning-level.html

Phantom Rogue

How can the CFPB be raging out of control when it hasn't done anything yet?

By Timothy Noah

Posted Wednesday, March 16, 2011, at 8:48 PM ET

On March 16 the House Financial Institutions and Consumer Credit Subcommittee held an oversight hearing about the Consumer Financial Protection Bureau. Committee Chair Shelley Moore Capito, R.-W.Va., called it "one of the most important hearings this subcommittee will hold this Congress." Its urgency was underscored by a Wall Street Journal editorial that appeared that same morning calling the CFPB "a bureaucratic rogue." Members of Congress complained that the CFPB was unaccountable to the congressional appropriations process; too heavily influenced by politics; indifferent to the "safety and soundness" (i.e., solvency) of financial institutions; and an all-around bureaucratic nuisance. Sitting in the press section, I began to feel guilty that I'd never before written about this regulatory monster

Then I remembered: The CFPB hasn't done anything yet.

I don't mean that as a criticism of the CFPB, which was created by last year's Dodd-Frank financial reform law. The CFPB doesn't open for business until July 21. That isn't some self-protective gimmick, like the way the producers of Spider Man: Turn Off The Dark keep postponing opening night even as the show continues to play before live audiences. The CFPB isn't allowed to play before live audiences—which is to say, start regulating—until July 21, the opening night assigned it by Treasury Secretary Tim Geithner (following guidelines laid down in Dodd-Frank). That's the "transfer date" when regulatory authority currently held by seven existing agencies is turned over to the CFPB. By then Elizabeth Warren, the consumer advocate much-loathed by the GOP who is currently setting up the CFPB in her capacity as special adviser to Geithner (she is also an assistant to the president), may have gone the way of Julie Taymor. (Here's Warren's opening statement.)

I also don't mean to suggest that Warren hasn't been working very hard. She's been running all over the country giving speeches and meeting with bankers and consumer groups. She's been hiring people for the agency. She's been "laying the groundwork for the Bureau to write new rules required by the Dodd-Frank Act," according to a Treasury document. She's created an agency Web site.

Curiously, though, none of the House subcommittee Republicans wanted to ask her about any of that. They just wanted to yammer about how terrible the CFPB was, by which they really meant how terrible the Dodd-Frank legislation creating the CFPB was. Warren, much to her credit, refrained from uttering what struck me as the logical response: "Dude, I didn't write Dodd-Frank." (Though I suppose the Republicans could have answered, in turn, that its provision creating the CFPB was originally her idea. Rep. Barney Frank, D.-Mass., wasn't present to hear criticism of his handiwork because, though former chairman and current ranking member of the House Financial Services Committee, he does not sit on this subcommittee.)

One substantive action Warren has taken in her capacity as non-director of the CFPB (the Republicans were correct to point out that President Obama would have made her director if he thought she could win Senate confirmation) was to recommend how to settle with the banks over foreclosuregate. Warren did this at Geithner's request. Reportedly a $20 billion figure is in play. The subcommittee Republicans wanted to know what Warren had recommended. Was the $20 billion her idea? Was she trying to sell that to the banks? "We are not negotiating with anyone," she answered. "This is a law enforcement matter that is headed by the Department of Justice." Oh, come on, said Rep. Scott Garrett, R.-N.J. Aren't we talking about "mere paperwork violations"? Warren: "It would not be appropriate for any member of the government, me or anyone else, to comment on what's involved in those negotiations. It would just not be right."

The rest of the hearing consisted mainly of House subcommittee Republicans lecturing Warren about what a vicious marauding beast Congress created in the CFPB (with the occasional Democrat chiming in to say he or she hoped Warren gets installed as CFPB director).

The biggest Republican complaint was that the CFPB doesn't receive appropriations directly from Congress. Instead, it gets its money via "authorized transfers" from the Fed, its parent agency. That does seem a little strange. But Warren explained that four other banking agencies (the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the soon-to-be-defunct Office of Thrift Supervision, and the Fed itself) are similarly funded outside the congressional appropriations process, and that this is done to preserve their independence from, well, banks.

Moreover, Warren said, the CFPB is the only federal agency that can be overruled by other agencies. That was a slight exaggeration (other agencies that are part of larger cabinet departments can sometimes be overridden by cabinet chiefs), but the CFPB will be uniquely hamstrung. The Dodd-Frank bill created a Financial Stability Oversight Council whose members represent nine agencies (Treasury, the Fed, the CFPB, the Comptroller of the Currency, the Securities and Exchange Commission, the FDIC, the Commodity Futures Trading Commission, the Federal Housing Finance Agency, and the National Credit Union Administration). The FSOC will be able to overrule any CFPB regulation it doesn't like. Most or all of its other member agencies are, by law, required to help preserve the banks' "safety and soundness" (again: solvency), even if the CFPB itself is not. Yes, answered Rep. Edward Royce, R.-Calif. (who last year tried and failed to insert "safety and soundness" language directly into Dodd-Frank), but there's a "very high threshold" to override. (It takes a two-thirds majority vote.) Warren answered that the FSOC veto is "something that exists literally nowhere else in government."

These colloquies, though pointless, were at least about real issues. Others ... not so much.

Rep. Patrick McHenry, R.-N.C., pressed Warren about the fact that she was a political appointee. "Do you understand why it is controversial?" he asked. "Karl Rove had a similar position in the White House." (McHenry is a Rove protégé.) Uh, no he didn't.

Rep. Sean Duffy, R.-Wisc., said he was troubled that the CFPB wasn't set up like the Federal Trade Commission or the Securities and Exchange Commission, whose power is dispersed among multiple commissioners of both political parties. Yes, that's one model, Warren answered, but the Office of Thrift Supervision and other banking regulators "have a single director. I think when Congress made the decision, I think it was the right decision."

Rep. Blaine Luetkemeyer, R.-Mo., tried to get Warren to name an upper limit on the possible cost of any CFPB regulation to business, and when she wouldn't name a dollar amount he said that showed the agency was unconcerned with cost-benefit analysis. Warren answered that the agency is statutorily bound to make cost-benefit analyses of its regulations' potential impact, and resisted any urge to point out that Luetkemeyer's idea of cost-benefit analysis was all cost and no benefit.

Rep. Steve Pearce, R.-N.M., sounding very much like somebody's crazy uncle, asked how the CFPB could be "the angel, be the champion of the consumer," if it didn't try to do anything about inflation? Warren, looking slightly dumbfounded, answered that it wasn't the CFPB's job to make monetary policy.

I left the hearing wishing President Obama could find some way to appoint Warren director of the CFPB. I think the subcommittee Republicans secretly wish the same. They deserve a chance to interrogate her about actions she's actually taken. That opportunity was denied them here.

Timothy Noah is a senior writer at Slate. He can be reached at thecustomer@slate.com.

Article URL: http://www.slate.com/id/2288493/

The Bizarre Smear Campaign on Elizabeth Warren Continues

Posted in Uncategorized by Mike on March 18, 2011

http://rortybomb.wordpress.com/2011/03/18/the-bizarre-smear-campaign-on-elizabeth-warren-continues/#comments

Simon Johnson asks “Who is Afraid of Elizabeth Warren?” Zach Carter finds that editorial writer Mary Kissel is leading the Wall Street Journal’s opinion column’s attack campaign against Elizabeth Warren. Here’s their argument: ”The consumer bureau is essentially a bureaucratic rogue. We’d like to see Congress kill the agency entirely. But at the very least Congress should remove it from the Fed, make it part of the Treasury and subject it to annual appropriations.”

Jesus wept. Listen, the Federal Reserve had an agency called “Division of Division of Consumer and Community Affairs.” We know this because on January 20th, 1998, the Division of Division of Consumer and Community Affairs circulated to the Governors a memo urging them to vote to “adopt a policy to not conduct consumer compliance examinations of, nor to investigate consumer complaints regarding, nonbank subsidiaries of bank holding companies.”

They followed this advice of the consumer affairs division of the Fed. Which juiced the subprime market through a regulatory arbitrage; regular banks had a rule that shadow banks did not, and bank holding companies suddenly were given a push to find creative ways to create nonbank subsidiaries off-balance sheet hidden from investors. This is a matter of fact. The Federal Reserve has always been involved with consumer protection; it’s just that they’ve done a terrible job of it, always treating it as subservient to making bankers happy and we need to re-conceptualize the role of it as it being the priority mission.

You know who else is involved with consumer protection? Everybody. The OCC, OTS, NCUA, Federal Reserve Board, FDIC, FHFA, HUD, VA, FTC and DOJ all have consumer protection in their mission. For all (except possibly the FTC, which lacks massive jurisdiction) it’s an orphan and subordinate mission. By consolidating regulators lenders that deal with consumers have a single, straightforward regulator to deal with, reducing burden and increasing clarity by providing a level-playing field. From the Roosevelt Institute’s Make Markets Be Markets conference, graphs courtesy of the Consumer Federation of America, you can either have this:

or this:

Also, quick: How many mortgages are there in the country? Put away the google, the short answer is that nobody knows. There’s terrible data in general, and terrible public data in particular, on the consumer lending market. Most of the debt data we have are aggregate data that the Fed puts together for macro models. For people like me who think we have a balance sheet recession, where the distribution of debt matters, having a BLS-like set of resources to pull trusted and consistent data would be awesome. And here’s another interesting thing about the CFPB: it has a mandate for research and data collection.

This anti-Warren rage never ends, though it always surprises me. This Tim Noah article is the best I’ve seen about the CFPB: Phantom Rogue: How can the CFPB be raging out of control when it hasn’t done anything yet? Read all of it. The GOP is going crazy accusing Warren of doing things when (a) the CFPB doesn’t exist and/or (b) the CFPB can’t do that specific feature anyway. The CFPB’s actions are subject to a veto vote from the FSOC. If anything, that makes its not independent enough, and certainly not a rogue institution.

I still think Warren is the best candidate for the job. The past several months have gone very well. So what causes this level of freakout?

Is it that she’s critical of Wall Street and the way bailouts were handled? That’s pretty representative of the country. Is it that she doesn’t assume entry-level convex optimization math proves that markets always work perfectly in a world with bad information, bailed out too big to fail institutions shaking hands with the government, in a world with power, in a world where capital structure and debt matter in a critical way, etc.? Warren uses economic analysis, and uses it well, but as the beginning of the discussion, not the end of it. I still don’t get it.

Aside: For those discussing if economics is a science, and are frustrated that educated people think there’s something shady about the way economics as a science is deployed in elite conversation, this post of Warren’s from a while ago about whether an economic statement is a question of fact or of law shows a sophistication in terms of working through the implications of economics.

Preparing for the "Bang!"

by Carl Swenlin

http://blogs.decisionpoint.com/chart_spotlight/2011/03/preparing-for-the-bang.html

(This is an excerpt from Friday's blog for Decision Point subscribers.)

My wife is something of an insomniac, so she listens to a lot of nighttime talk shows -- not the best cure for insomnia, I'll bet. Recently she told me about the comments of some guest on some talk show -- sorry, but that's as good as I can do for attribution -- who had an analogy for the U.S. financial woes. He said we are like a person who makes $50,000 a year, spends $75,000 a year, and has $375,000 in credit card debt. Hopeless is what it is.

From Mauldin and Tepper's Endgame: The End of the Debt Supercycle: There is a limit to how much debt you can pile on. As the work of Reinhart and Rogoff points out in This Time It's Different (2009), there is not a fixed [emphasis mine] limit for debt or some certain percentage of GDP where it all breaks down. Rather, the limit is all about confidence. Everything goes along well, and then "bang!" it doesn't.

"Confidence" has always been the keyword in financial markets. We get a daily diet of economic news with a determined spin about how the economy is gradually improving, but in the background the Fed and the politicians keep digging a deeper hole of debt. And the story is the same around the globe -- governments trying to exacerbate the threat of horrible levels of debt by piling on even more debt.

The real question is if the collapse really will be a "bang!" moment, of whether there will be some kind of advance warning upon which we can act. As a technical analyst I believe there will most likely be a gradual deterioration ahead of the "bang!", and we must assume that the deterioration has gone too far when the 20-EMA crosses down through the 50-EMA. To illustrate this point, let's look at two of the most catastrophic financial events in the last 100 years -- the 1929 Crash and the 1987 Crash.

The first chart is of the Dow Industrials in 1929. Note that the 20-EMA crossed down through the 50-EMA about two weeks ahead of the Crash. Some will complain about the two whipsaw signals earlier in the year, but this kind of activity characteristically precedes major tops and part of the cost of doing business if you want to avoid major declines. To mitigate the damage of these whipsaws, our timing model only generates a NEUTRAL signal (instead of a SELL) when the crossovers occur above the 200-EMA.

Next is the 1987 Crash. It is hard to see, but the 20/50-EMA crossover occurred four days ahead of the crash. Again, there was a short whipsaw earlier in the year.

Bottom Line: Catastrophic market events are usually a big surprise to most people, but they rarely take place without giving some advance technical warning signs. The moving average crossover has been a reliable, though by no means perfect, signal for impending trend changes. It is certainly one way we can attempt to be prepared ahead of the "bang!".

* * * * * * * * * * * * * * * * * * * * *

Being Street Smart

Sy Harding

http://www.decisionpoint.com/tac/HARDING.html

Reasons to Distrust the Snap-Back Rally! March 18, 2011.

Thankfully the news out of Japan regarding the potential for nuclear meltdowns has subsided, and global stock markets have rallied for two days in relief. Many on Wall Street are claiming the correction in global stock markets is therefore over, and it's a buying opportunity.

But let's think this through and not react too quickly. The human toll and economic damage in Japan was from the earthquake, not the subsequent potential problems with nuclear plants.

Let's consider first what was going on prior to the catastrophe.

Global markets were in quite significant corrections. For instance Brazil, China, India, and Hong Kong, topped out in November and were down 12% to 17% prior to the earthquake. Markets in Europe and the U.S. peaked in mid-February and were down 3% to 4%.

So an important question is whether the factors that had global markets already topped out prior to the earthquake have gone away. Unfortunately, the answer is that they remain in place, and if anything have worsened, and the aftermath of the disaster in Japan will likely add to them.

Those continuing problems are;

Rising global inflation.

Increasingly aggressive monetary tightening by important countries like Brazil, China, India, Hong Kong, and smaller emerging markets, in efforts to tackle the rising inflation, moves likely to also slow their economic growth.

Uncertainties created by political uprisings in oil-producing countries.

The on-going European debt crisis.

Austerity programs in European countries aimed at tackling the debt crisis, including cuts in government spending and jobs.

The coming cutbacks in U.S. federal, state, and local government spending to tackle their record budget deficits.

The approaching end of the Fed's QE2 pump-priming program.

And now added to those problems is the massive natural disaster in the world's third largest economy, Japan, a very important part of the global manufacturing and high-tech supply chain. It has come at the worst time for the struggling Japanese economy. The damage has already forced the closing of factories by Nissan, Toyota, and Sony, as well as several oil refineries, while large agricultural areas were wiped out, which can only add to concerns about rising food prices. Japan's problems will affect other global economies.

Optimists are pointing to reconstruction as being a positive for Japan's economy, noting that six months after the Kobe earthquake in Japan in 1995 almost all of Kobe's factories and infrastructure had been rebuilt. They are leaving out that Japan's stock market declined for six months after the smaller Kobe earthquake and during the re-building stage, losing 32% of its value. At the present time, the Japanese market is down only 15%.

Meanwhile, European central banks have now acknowledged inflation concerns, and the UK says it could begin raising interest rates as soon as its April meeting.

The uprisings in oil-producing countries have not gone away, and indeed have become more violent. In Libya, Dictator Muammar Gaddafi launched military operations this week to crush demonstrators, and the U.N. authorized military attacks against Gaddafi forces to assist the demonstrators. The previously peaceful uprising in Bahrain became violent after Bahrain's royal family called in military forces from Saudi Arabia to help it put down the revolt.

The uprisings in Egypt, Tunisia, Libya, Bahrain, and Yemen, and unrest in Syria, Iran, and Saudi Arabia, reportedly even have leaders in Russia, Cuba, and China nervous.

In the European debt crisis, Portugal's credit rating was downgraded further this week, and its Prime Minister said he will quit if Portugal's parliament does not consent to his proposed austerity measures.

And on it goes. The previous problems that had global stock markets topped out on fears of rising inflation and concerns about the sustainability of the fragile global economic recovery, have not gone away, and if anything worsened while attention was diverted by the disaster in Japan.

On the technical analysis side, the additional five-day market plunge following the disaster in Japan had markets short-term oversold, and likely to see a short-term rally off the oversold condition.

But it's questionable whether a bottom is in yet, particularly in the U.S.

At their peaks, global stock markets, including that of the U.S., were extremely overbought above their long-term 200-day moving averages, to a degree that almost always results in a decline at least down to retest the support at that moving average. In their corrections, some of which began in November, others in mid-February, markets in Asia and Europe did decline to that moving average. In several cases the support did not hold and they broke below it.

But the U.S. market so far has pulled back only 6%, leaving it still 7% above its 200-day m.a.

Additionally, investor sentiment in the U.S. does not indicate a bottom. This week's poll of its members by the American Association of Individual Investors (AAII) shows bearishness has increased to 40.1%, but that is still well below the 55% to 65% bearishness usually seen prior to market lows.

So for now anyway, I still like the safe haven of treasury bonds, which I wrote up in my column last weekend. The iShares 20-yr bond etf, symbol TLT, has gained more than 5% in the five weeks since its early February low. And I still like gold bullion and the SPDR Gold etf, symbol GLD. Gold is the long-time hedge against rising inflation. I even like the idea of some downside positions against the U.S. market, and I'm looking at some toppy looking stocks that might be short-sale candidates.

as predicted

pump n dump, symx

Deletion

Post Date: 3/7/2011 5:25:48 PM in reply to 60673540 by ManicTrader

Board: StockGoodies Plays of the Week Reason: Off-Topic

so it's a pump n dump?

Deletion

Post Date: 3/7/2011 11:41:32 PM in reply to 60694891 by Alex G

Board: AG's Scratchin' Post Reason: Off-Topic

ManicTrader Member Level Share Monday, March 07, 2011 1:32:31 PM

Re: None Post # of 14606

Alerted $SYMX in thread last nite 65% today weeeeeeeeeeeeee

Deletion

Post Date: 3/7/2011 5:25:48 PM in reply to 60673540 by ManicTrader

Board: StockGoodies Plays of the Week Reason: Off-Topic

so it's a pump n dump?

re SYMX

Ignore Filter:

Disabled

Ignore List:

Alias Options

160 - IxCimi UnHide

4528 - Dances-W-waves3 UnHide

5147 - EZ2 UnHide

6531 - rollingrock UnHide

10122 - extelecom UnHide

10266 - trade2much UnHide

12244 - basserdan UnHide

12329 - brightness UnHide

12862 - Newly2b UnHide

14742 - DewDiligence UnHide

18545 - rooster UnHide

19354 - steviee UnHide

22826 - n4807g UnHide

22931 - hogsgeteaten UnHide

25565 - BRIG_88 UnHide

25583 - Rawnoc UnHide

31550 - doggydog UnHide

45975 - Stockbuilder UnHide

49494 - bbotcs UnHide

49660 - dickmilde UnHide

54677 - gfp927z UnHide

58262 - redfisher UnHide

60086 - northam43 UnHide

60448 - Taxmantoo UnHide

61573 - fugeguy UnHide

64770 - benzdealeror2 UnHide

67836 - asus UnHide

67966 - m_stone_14 UnHide

69851 - stuffit UnHide

70977 - eaglesurvivor UnHide

75788 - GEO928 UnHide

77751 - rbl100 UnHide

79443 - joseywalestx UnHide

80237 - hArdCoReJESUSfreAk UnHide

82672 - lmcat UnHide

85101 - h24ever UnHide

87964 - highline UnHide

111384 - FoodStamps4stocks UnHide

126532 - alien-IQ UnHide

133824 - FLORIDAGRL UnHide

138074 - CluelessStockJunkie UnHide

139504 - gemstone57 UnHide

142288 - intheclouds UnHide

147855 - omegahpla UnHide

169888 - FadeMeToWin UnHide

181152 - b4atf UnHide

LMAO!.. .this post now deleted for "personal attack"

even tho it was posted to "none"... LMFAO!

Request Deletion Review

Post Date: 1/31/2011 5:00:56 PM

Board: Your Economy Reason: Personal Attack

Obama and Business May Get On Well, but When Will That Produce Jobs?

By SIMON JOHNSON

President Obama is embarked on a major charm offensive with the business sector, as seen, for example, in the appointments of William M. Daley (formerly of JPMorgan Chase, now White House chief of staff) and Jeffrey R. Immelt (chairman and chief executive of General Electric and now also the president’s top outside economic adviser).

This should not be an uphill struggle – much of the corporate sector, particularly bigger and more global businesses, is doing well in terms of profits and presumably, at the highest levels, compensation. But when exactly will this approach deliver jobs and reduce unemployment? And does it increase risks for the future?

Republican rhetoric over the last two years was relentless in its assertion that the Obama administration was antibusiness. Supposedly, this White House attitude undermined private sector confidence and limited investment.

In reality, the opposite was the case. Relative to any postwar recession, the rebound in profits during the Obama administration has been dramatic. To be sure, the end of 2008 was shocking to many entrepreneurs and executives, as credit was disrupted in a much more dramatic fashion than they thought imaginable. Large and immediate cuts in employment followed.

But then the government saved the failing financial sector. The means were controversial, but the end was essential – without private credit, the United States economy would have fallen far and for a long time.

And profits rebounded almost at once. The financial sector recovered quickly on the back of implicit guarantees provided to our largest banks. The only bad quarter was at the end of 2008 (leading to great angst among bankers about their bonuses in 2009). The nonfinancial sector has done even better.

Profits for the private sector fell no more than 20 percent from top to bottom in the cycle, and in the third quarter of last year (the latest available data from the Bureau of Economic Affairs), profits were back at the level of 2006. After the deep recessions of the early 1980s, it took at least three times as long for profits to come back to the same extent (I went through this comparison in more detail last week for The New York Times’s Room for Debate).

Investment in plants and equipment has also recovered fast – this was the one bright part of the domestic economy in the last two years (the other being exports). Look around at the places you work, where you do business and where you shop. Is there any indication they have cut back on information technology spending recently?

Over all, the policies of late 2008 and early 2009, including the much-debated fiscal stimulus, protected corporate profits to an impressive degree. Even though this was the steepest recession of the last 70 years, profits fell only briefly and seem likely to be just as strong as they were before the crisis.

Large global American-based companies, in particular, are well positioned to take advantage of growth in such emerging markets as India, China and Brazil. But the link between corporate performance — measured in terms of profit or executive pay for American companies — and domestic employment has fundamentally changed in recent decades.

At the very least, employment responds more slowly now than in previous cycles as output and sales recover. Consider this chart from the Calculated Risk blog (and revisit it regularly). As the picture shows so vividly, we are still waiting for employment to turn back up decisively. Compared with previous recessions, the delay is simply stunning.

Ideally, in a situation like this, we’d provide more stimulus to the economy in some form. But our monetary policy is already close to exerting its maximum efforts, and the scope for using fiscal policy was undermined by high deficits during the “boom” years of the 2000s, so there is no safe fiscal space for action – even if the politicians could agree on what to do.

We are reduced to waiting for the private sector to recover enough to want to take on new employees. No one has a good answer for why this is so slow – perhaps because it is so easy and so cheap to hire workers in those emerging markets that are now booming, or perhaps because the skill mix available at prevailing wages in some parts of the United States is not what employers want.

Or perhaps companies are effectively keeping out new entrants, keeping profits artificially high and, at the sectoral level, limiting employment. The constraints on entrepreneurship in our post-credit-crisis economy need careful scrutiny.

Hopefully, the administration’s charm offensive will not prevent it from enforcing American antitrust laws, which were more than slightly neglected in the Bush years.

Listening attentively to the nonfinancial sector makes sense in this situation. In return, corporate leaders need to focus on creating jobs in the United States. But bending over backward to accommodate the wishes of the financial sector is exactly what got us into this mess to start with.

Allowing our largest banks to become even bigger and more dangerous would be a very bad mistake.

______________

Geopolitical unrest and world oil markets

Change is on the way in the Arab world, with Egypt the latest focal point. Here I review recent events and their implications for world oil markets.

I begin with a timeline, if not to connect the dots, at least to collect the dots in a single list.

• Sudan, Jan 9-15: Country holds a referendum whose apparent outcome will be a split of South Sudan into its own a separate country.

• Lebanon, Jan 12: Key cabinet ministers resign in protest against impending indictments from a U.N.-backed investigation into the 2005 assassination of former prime minister Rafiq al-Hariri, toppling the governing coalition. U.S. Secretary of State Hillary Clinton offered this assessment:

We view what happened today as a transparent effort by those forces inside Lebanon, as well as interests outside Lebanon, to subvert justice and undermine Lebanon's stability and progress.

• Tunisia, Jan 14: President Ben Ali flees the country in response to widespread protests.

• Iraq, Jan 17-27: Over 200 people killed in a spate of recent bombings, a sharp and tragic increase from the recent norm.

• Egypt, Jan 29: Cairo appears to be near anarchy as a result of an uprising against President Mubarak.

• Yemen, Jan 29: Demonstrations and rallies have resulted in clashes with police, with unclear implications at this point for the stability of the regime.

An optimist might see the common thread in many of these developments to be the realization across parts of the Arab world of the power of popular will to overthrow dictators, the first step toward democracy and a better life for the people. A pessimist might see in at least some of these situations deliberately orchestrated chaos for purposes of seizing power by a new group of would-be ruthless leaders. A realist might acknowledge the possibility of both factors in play at once, and worry that ideologically motivated uprisings have often turned out to be usurped by groups with their own highly anti-democratic agenda. In the event that some of the transitions of power prove to be more chaotic than peaceful, let me comment on their potential to disrupt world oil markets.

continued

http://www.econbrowser.com/archives/2011/01/geopolitical_un.html

LMAO!, another post deleted by the fascists at the "Your Economy" board as "off topic"

Request Deletion Review

Post Date: 1/30/2011 11:59:45 PM

Board: Your Economy Reason: Off-Topic

"In Camden, New Jersey, one per cent of patients account for a third of the city’s medical costs."

http://www.boingboing.net/2011/01/29/howto-make-health-ca.html

Atul Gawande's New Yorker feature "The Hot Spotters" is a fascinating look at a small group of doctors and medical practitioners who are working on reducing systemic health care costs by doing data-analysis to locate the tiny numbers of chronically ill patients who consume vastly disproportionate resources because they aren't getting the care they need and so have to visit the emergency room very often (some go to the ER more than once a day!) and often end up with long ICU stays.

The approach is marvellous because it is both data-driven (data-mining is used to identify which patients aren't getting the care they need) and extremely compassionate ("super-utilizers" are voluntarily enrolled in programs where they get 24/7 guaranteed access to doctors, nurses and social workers). The programs are successful, and even though they cost a lot to administer, they still generate system-wide savings -- one patient helped with this sort of care had previously cost $3.5 million a year because of heavy ER and ICU use. In other words, providing excellent, personalized care to the small number of patients who don't fit the system's model saves far more money than making the system more stringent, with more paperwork, higher co-pays and other punitive measures. It's a win-win.

Except that it's not really catching on. Some of the doctors pioneering this approach are frustrated because they can save Medicare or an insurer millions, but they can't get funded by Medicare or the insurers -- instead, they have to fundraise from private foundations.

http://www.newyorker.com/reporting/2011/01/24/110124fa_fact_gawande#ixzz1CS8GvPZG

"As he sorts through such stories, Gunn usually finds larger patterns, too. He told me about an analysis he had recently done for a big information-technology company on the East Coast. It provided health benefits to seven thousand employees and family members, and had forty million dollars in "spend." The firm had already raised the employees' insurance co-payments considerably, hoping to give employees a reason to think twice about unnecessary medical visits, tests, and procedures--make them have some "skin in the game," as they say. Indeed, almost every category of costly medical care went down: doctor visits, emergency-room and hospital visits, drug prescriptions. Yet employee health costs continued to rise--climbing almost ten per cent each year. The company was baffled.

Gunn's team took a look at the hot spots. The outliers, it turned out, were predominantly early retirees. Most had multiple chronic conditions--in particular, coronary-artery disease, asthma, and complex mental illness. One had badly worsening heart disease and diabetes, and medical bills over two years in excess of eighty thousand dollars. The man, dealing with higher co-payments on a fixed income, had cut back to filling only half his medication prescriptions for his high cholesterol and diabetes. He made few doctor visits. He avoided the E.R.--until a heart attack necessitated emergency surgery and left him disabled with chronic heart failure.

The higher co-payments had backfired, Gunn said. While medical costs for most employees flattened out, those for early retirees jumped seventeen per cent. The sickest patients became much more expensive because they put off care and prevention until it was too late.

"In Camden, New Jersey, one per cent of patients account for a third of the city’s medical costs."

http://www.boingboing.net/2011/01/29/howto-make-health-ca.html

Atul Gawande's New Yorker feature "The Hot Spotters" is a fascinating look at a small group of doctors and medical practitioners who are working on reducing systemic health care costs by doing data-analysis to locate the tiny numbers of chronically ill patients who consume vastly disproportionate resources because they aren't getting the care they need and so have to visit the emergency room very often (some go to the ER more than once a day!) and often end up with long ICU stays.

The approach is marvellous because it is both data-driven (data-mining is used to identify which patients aren't getting the care they need) and extremely compassionate ("super-utilizers" are voluntarily enrolled in programs where they get 24/7 guaranteed access to doctors, nurses and social workers). The programs are successful, and even though they cost a lot to administer, they still generate system-wide savings -- one patient helped with this sort of care had previously cost $3.5 million a year because of heavy ER and ICU use. In other words, providing excellent, personalized care to the small number of patients who don't fit the system's model saves far more money than making the system more stringent, with more paperwork, higher co-pays and other punitive measures. It's a win-win.

Except that it's not really catching on. Some of the doctors pioneering this approach are frustrated because they can save Medicare or an insurer millions, but they can't get funded by Medicare or the insurers -- instead, they have to fundraise from private foundations.

http://www.newyorker.com/reporting/2011/01/24/110124fa_fact_gawande#ixzz1CS8GvPZG

"As he sorts through such stories, Gunn usually finds larger patterns, too. He told me about an analysis he had recently done for a big information-technology company on the East Coast. It provided health benefits to seven thousand employees and family members, and had forty million dollars in "spend." The firm had already raised the employees' insurance co-payments considerably, hoping to give employees a reason to think twice about unnecessary medical visits, tests, and procedures--make them have some "skin in the game," as they say. Indeed, almost every category of costly medical care went down: doctor visits, emergency-room and hospital visits, drug prescriptions. Yet employee health costs continued to rise--climbing almost ten per cent each year. The company was baffled.

Gunn's team took a look at the hot spots. The outliers, it turned out, were predominantly early retirees. Most had multiple chronic conditions--in particular, coronary-artery disease, asthma, and complex mental illness. One had badly worsening heart disease and diabetes, and medical bills over two years in excess of eighty thousand dollars. The man, dealing with higher co-payments on a fixed income, had cut back to filling only half his medication prescriptions for his high cholesterol and diabetes. He made few doctor visits. He avoided the E.R.--until a heart attack necessitated emergency surgery and left him disabled with chronic heart failure.

The higher co-payments had backfired, Gunn said. While medical costs for most employees flattened out, those for early retirees jumped seventeen per cent. The sickest patients became much more expensive because they put off care and prevention until it was too late.

LMAO... censorship is good for me but not for thee

Re: A deleted message Post # of 57515

Take off the block and allow me to reply, or I will just say it here...

this post i'm replying to was deleted by ihub as being "off topic"

per the "Your Economy Board"

iHub fascists... anti-free speech

http://investorshub.advfn.com/boards/board.aspx?board_id=1948

Obama and Business May Get On Well, but When Will That Produce Jobs?

By SIMON JOHNSON

President Obama is embarked on a major charm offensive with the business sector, as seen, for example, in the appointments of William M. Daley (formerly of JPMorgan Chase, now White House chief of staff) and Jeffrey R. Immelt (chairman and chief executive of General Electric and now also the president’s top outside economic adviser).

This should not be an uphill struggle – much of the corporate sector, particularly bigger and more global businesses, is doing well in terms of profits and presumably, at the highest levels, compensation. But when exactly will this approach deliver jobs and reduce unemployment? And does it increase risks for the future?

Republican rhetoric over the last two years was relentless in its assertion that the Obama administration was antibusiness. Supposedly, this White House attitude undermined private sector confidence and limited investment.

In reality, the opposite was the case. Relative to any postwar recession, the rebound in profits during the Obama administration has been dramatic. To be sure, the end of 2008 was shocking to many entrepreneurs and executives, as credit was disrupted in a much more dramatic fashion than they thought imaginable. Large and immediate cuts in employment followed.

But then the government saved the failing financial sector. The means were controversial, but the end was essential – without private credit, the United States economy would have fallen far and for a long time.

And profits rebounded almost at once. The financial sector recovered quickly on the back of implicit guarantees provided to our largest banks. The only bad quarter was at the end of 2008 (leading to great angst among bankers about their bonuses in 2009). The nonfinancial sector has done even better.

Profits for the private sector fell no more than 20 percent from top to bottom in the cycle, and in the third quarter of last year (the latest available data from the Bureau of Economic Affairs), profits were back at the level of 2006. After the deep recessions of the early 1980s, it took at least three times as long for profits to come back to the same extent (I went through this comparison in more detail last week for The New York Times’s Room for Debate).

Investment in plants and equipment has also recovered fast – this was the one bright part of the domestic economy in the last two years (the other being exports). Look around at the places you work, where you do business and where you shop. Is there any indication they have cut back on information technology spending recently?

Over all, the policies of late 2008 and early 2009, including the much-debated fiscal stimulus, protected corporate profits to an impressive degree. Even though this was the steepest recession of the last 70 years, profits fell only briefly and seem likely to be just as strong as they were before the crisis.

Large global American-based companies, in particular, are well positioned to take advantage of growth in such emerging markets as India, China and Brazil. But the link between corporate performance — measured in terms of profit or executive pay for American companies — and domestic employment has fundamentally changed in recent decades.

At the very least, employment responds more slowly now than in previous cycles as output and sales recover. Consider this chart from the Calculated Risk blog (and revisit it regularly). As the picture shows so vividly, we are still waiting for employment to turn back up decisively. Compared with previous recessions, the delay is simply stunning.

Ideally, in a situation like this, we’d provide more stimulus to the economy in some form. But our monetary policy is already close to exerting its maximum efforts, and the scope for using fiscal policy was undermined by high deficits during the “boom” years of the 2000s, so there is no safe fiscal space for action – even if the politicians could agree on what to do.

We are reduced to waiting for the private sector to recover enough to want to take on new employees. No one has a good answer for why this is so slow – perhaps because it is so easy and so cheap to hire workers in those emerging markets that are now booming, or perhaps because the skill mix available at prevailing wages in some parts of the United States is not what employers want.

Or perhaps companies are effectively keeping out new entrants, keeping profits artificially high and, at the sectoral level, limiting employment. The constraints on entrepreneurship in our post-credit-crisis economy need careful scrutiny.

Hopefully, the administration’s charm offensive will not prevent it from enforcing American antitrust laws, which were more than slightly neglected in the Bush years.

Listening attentively to the nonfinancial sector makes sense in this situation. In return, corporate leaders need to focus on creating jobs in the United States. But bending over backward to accommodate the wishes of the financial sector is exactly what got us into this mess to start with.

Allowing our largest banks to become even bigger and more dangerous would be a very bad mistake.

______________

Geopolitical unrest and world oil markets

Change is on the way in the Arab world, with Egypt the latest focal point. Here I review recent events and their implications for world oil markets.

I begin with a timeline, if not to connect the dots, at least to collect the dots in a single list.

• Sudan, Jan 9-15: Country holds a referendum whose apparent outcome will be a split of South Sudan into its own a separate country.

• Lebanon, Jan 12: Key cabinet ministers resign in protest against impending indictments from a U.N.-backed investigation into the 2005 assassination of former prime minister Rafiq al-Hariri, toppling the governing coalition. U.S. Secretary of State Hillary Clinton offered this assessment:

We view what happened today as a transparent effort by those forces inside Lebanon, as well as interests outside Lebanon, to subvert justice and undermine Lebanon's stability and progress.

• Tunisia, Jan 14: President Ben Ali flees the country in response to widespread protests.

• Iraq, Jan 17-27: Over 200 people killed in a spate of recent bombings, a sharp and tragic increase from the recent norm.

• Egypt, Jan 29: Cairo appears to be near anarchy as a result of an uprising against President Mubarak.

• Yemen, Jan 29: Demonstrations and rallies have resulted in clashes with police, with unclear implications at this point for the stability of the regime.

An optimist might see the common thread in many of these developments to be the realization across parts of the Arab world of the power of popular will to overthrow dictators, the first step toward democracy and a better life for the people. A pessimist might see in at least some of these situations deliberately orchestrated chaos for purposes of seizing power by a new group of would-be ruthless leaders. A realist might acknowledge the possibility of both factors in play at once, and worry that ideologically motivated uprisings have often turned out to be usurped by groups with their own highly anti-democratic agenda. In the event that some of the transitions of power prove to be more chaotic than peaceful, let me comment on their potential to disrupt world oil markets.

continued

http://www.econbrowser.com/archives/2011/01/geopolitical_un.html

Scientists make next-generation computers with gold and DNA

http://io9.com/5745520/scientists-make-next+generation-computers-with-gold-and-dna

Researchers have fabricated a lattice out of gold and virus fragments. It could make your computer much faster. And turn it into a biological machine.

Optical computing technology, a growing field in the tech sector, involves computers that send data using beams of light. In order to expand the capabilities of optical computing, engineers are required to find materials that manipulate light very precisely. Photonic crystals are one such helpful material. A photonic crystal can block very precise wavelengths of light, making it a great optical tool. But creating such a crystal is a challenge. Now scientists have tested a new method for making them, and they have done using the coolest materials possible: Gold and virus parts.

Tiny gold nanospheres and pieces of virus were hooked together using strands of DNA. The DNA pieces were created specifically for the experiment. Small spheres of gold attach to certain base pairs and form part of the lattice. Gold, while malleable for a metal, is relatively heavy and rigid for such a small structure. The lattice is made more bendable by its organic component, capsids, which are what make up the protein shells of viruses. These bits of virus 'skin' string together the tough gold spheres.

A mix of all of these components - DNA, capsids, and gold spheres - self-assembles into a lattice. The structure of that lattice can, with certain materials, be made into a photonic crystal. No one would have to build a crystal to use in optical computing, mixing together the right ingredients could make it build itself.

Sung Yong Park, one of the scientists who worked on the project, was excited by the jump from mechanical to organic assembly:

Organic materials interact in ways very different from metal nanoparticles. The fact that we were able to make such different materials work together and be compatible in a single structure demonstrates some new opportunities for building nano-sized devices.

No word on what happens when the virus bits and the DNA combine to make self-reproducing computers. It will probably be the end of the world. Who knew it would come in the form of crystalline gold viruses?

http://www.nature.com/nmat/journal/v9/n11/full/nmat2877.html

DNA-controlled assembly of a NaTl lattice structure from gold nanoparticles and protein nanoparticles

Extreme oversold condition in the Vix ?

http://gicharts.blogspot.com/2011/01/extreme-oversold-condition-in-vix.html

Just pay attention to the "extreme oversold condition" in the VIX.

Raise your stop on the SP 500 to 1260

Posted by Moise Levi

Gold and Silver warning

http://gicharts.blogspot.com/2011/01/gold-and-silver-warning.html

SPDR Gold Trust ETF (GLD) and iShares Silver Trust ETF (SLV) chart analysis ;

1) Using on both charts the support level (light grey) and their simple 50 days MA.

2) If you decided to go short on both, focus on the stop loss level

3) GLD shows a triple top ....

4) SLV shows a head and shoulder ?