Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Let’s have more producing properties

Don’t let the shares outstanding scare you

Bot means what

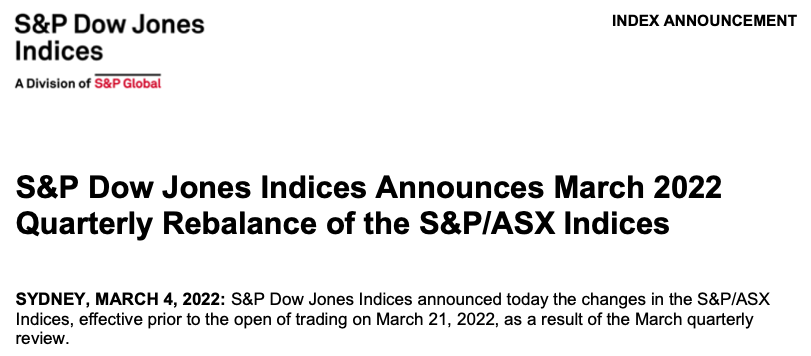

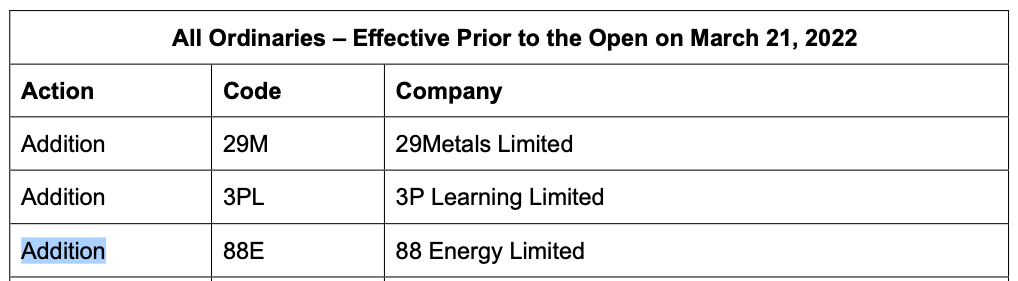

$EEENF >>> ASX closed +11.11%

Link: https://www2.asx.com.au/markets/company/88e

0.0001 and then maybe the moon

Are you TRUSTUNITS LITTLE BROTHER?

Don’t let the shares outstanding scare you

$EEENF ... London finishes up 3%...

yup, it tries to move but someone keeps dumping the bid.

$EEENF: 73's gone, bud.

Wonder dollarssssssss pennies

Get more producing properties

Don’t let the shares outstanding scare you

$EEENF back in buying mode folks. Let’s load up

$EEENF ... NEW ARTICLE : 88 Energy set to expand Alaska oil exploration footprint stck.pro/news/EEENF/37313563

NEW tweet ...

Award of the new acreage demonstrates our commitment to continued exploration on the North Slope of Alaska. The acreage already benefits from a historic well and an existing 3D seismic data suite. More at: https://t.co/KYc6709CkhAward of the new acreage demonstrates our commitment to continued exploration on the North Slope of Alaska. The acreage already benefits from a historic well and an existing 3D seismic data suite. More at: https://t.co/nvSJVi77QY#88E $EEENF #alaska #energy pic.twitter.com/5xzqEincHN

— 88 Energy Ltd (@88EnergyLtd) November 10, 2022

#Alaska #Oil #Oilandgas $88E $EEENF

— UFO Pilot (@GeodesRock49) November 10, 2022

ASX ANNOUNCEMENT 10 November 2022 -

88 Energy Limited North Slope 2022W Leasing Update

New "Project Leonis"

Announcement Link: https://t.co/KYc6709Ckh

Highlights pic.twitter.com/xBMubCUDHs

Current news only, I'm long read that years ago. GET - A - LIFE !!

its time to take out 73.

$EEENF

USA +14%

ASX +11%

London +6%

Germany +15%

73 going now. lets do this.

We have a producing property

A property can be worth millions

almost as much fun as dumpster diving

.........

|

Followers

|

603

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

43272

|

|

Created

|

03/03/21

|

Type

|

Free

|

| Moderators | |||

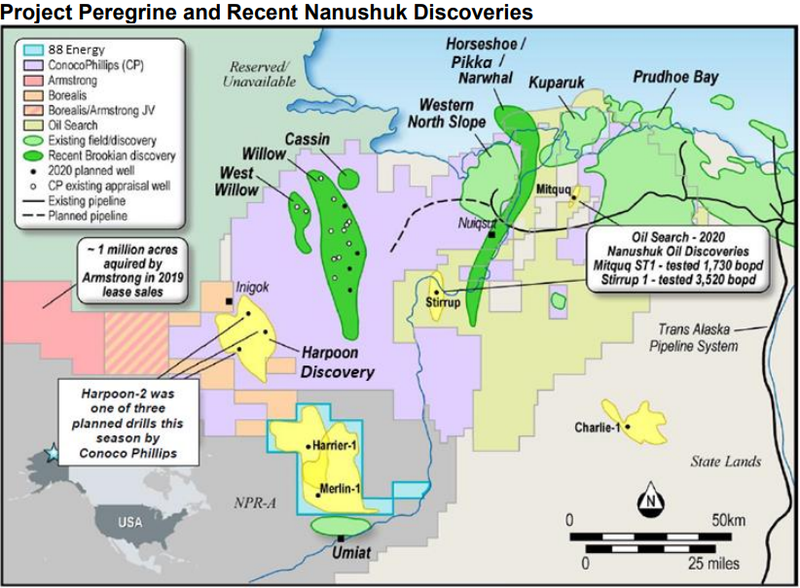

88 Energy Limited (ASX:88; AIM 88E) has advised that pre-spud operations are now entering the final phase as Rig 111 makes it way to the drilling location for Merlin-1, and that the spud date is now scheduled for next Monday, 8 March.

The Merlin-1 well will initially be drilled to 1,500 feet, then surface casing will be installed and the Blow Out Preventer System tested.

This is expected take approximately one week to execute, after which the well will be deepened through the target horizons in the Nanushuk Formation to a maximum total depth of 6,000 feet.

The Merlin-1 well is scheduled for spud in early March 2021 and is targeting 645 million barrels of gross mean prospective resource.

Logging while drilling and mudlogging will provide initial indications as to the prospectivity of the well during this part of the operation that is expected take three to five days.

A sophisticated wireline logging suite will then be run, including sidewall cores and downhole sampling.

Wireline logging is expected to take five to seven days, and if the results are encouraging, then the well will be completed with casing and a flow test conducted.

The drilling of the second well in the program, Harrier-1, remains subject to permitting, Merlin-1 results and weather/schedule.

Commenting on progress and outlining what may lie ahead following Merlin-1, managing director Dave Wall said, “Pre-spud operations are now entering the final phase as Rig 111 makes it way to the drilling location for Merlin-1.

"Success at Merlin-1 could yield over 300 million barrels net to 88E and open up further prospectivity at Project Peregrine (see above), in addition to unlocking the substantial proven resource at the adjacent Umiat oil field, which is 100% owned by 88 Energy.

"Metrics for discovered oil were demonstrated by the late-2017 Oil Search (ASX:OSH) transaction where US$3.10 per barrel was paid in a low oil price environment for an interest in the Pikka Field, a discovery in the Nanushuk Formation.

"Success at Merlin-1 would be transformational for our shareholders and we look forward to providing further information on operations over the next 4 to 6 weeks.’’

https://88energy.com/

https://www.facebook.com/88EnergyLtd/

This section maintained by Pro-Life - DO NOT EDIT OR ADD HERE UNDER ANY CIRCUMSTANCE PER MODERATOR TOS:

NEW on YT: Project Peregrine - 88 Energy - 10.18.2021

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=166410430

https://wcsecure.weblink.com.au/pdf/88E/02495881.pdf

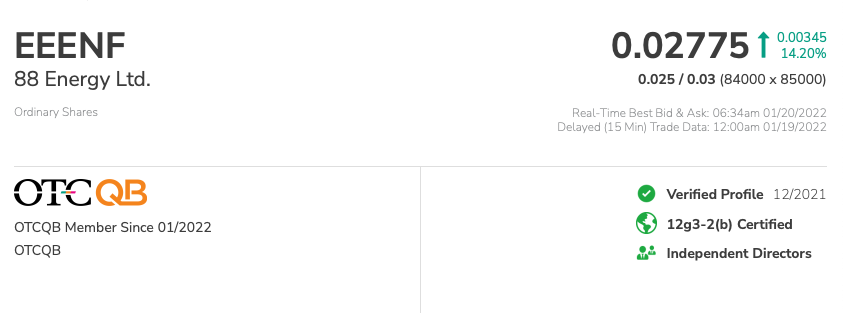

88 Energy trades on 4 global platforms:

Australian Stock Exchange (ASX), London Stock Exchange (LSE) German Boerse (DAX) and otcMarkets:

Check ASX action: https://www2.asx.com.au/markets/company/88e

Check German Boerse action: https://www.boerse-frankfurt.de/equity/88-energy-ltd

Check LSE action: https://www.lse.co.uk/SharePrice.asp?shareprice=88E&share=88-Energy

Check otcMarkets action: https://www.otcmarkets.com/stock/EEENF/quote

Convert AUD to USD or British Pounds to USD: https://www.bankrate.com/calculators/investing/currencycalc.aspx

Lots of 88E coverage: https://www.nextoilrush.com

A Quick Guide to Knowing What You Own as an Oil Investor: https://katusaresearch.com/not-oil-created-equal-quick-guide-knowing-oil-investor/

Share Structure per the company website: https://www.88energy.com/capital-structure/

Newest Investor's Presentation released 9.1.2021:

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02417008-6A1048649?access_token=83ff96335c2d45a094df02a206a39ff4

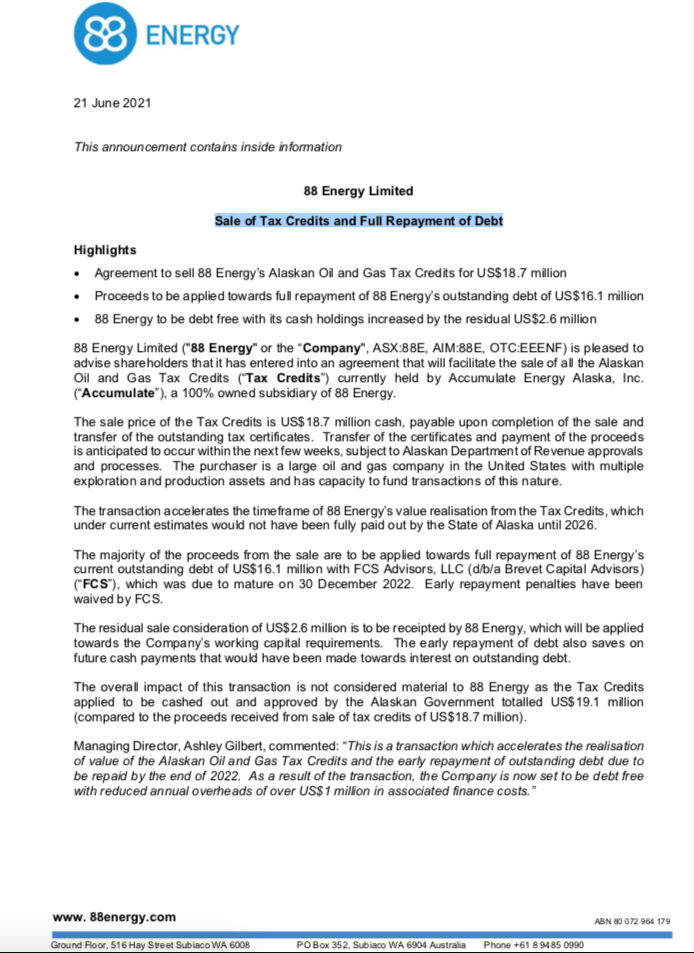

Going debt free... the greatest 88E announcement to date - 6.21.2021!!!

Via e-Mail...

88 Energy Limited

Sale of Tax Credits and Full Repayment of Debt

https://wcsecure.weblink.com.au/pdf/88E/02386132.pdf

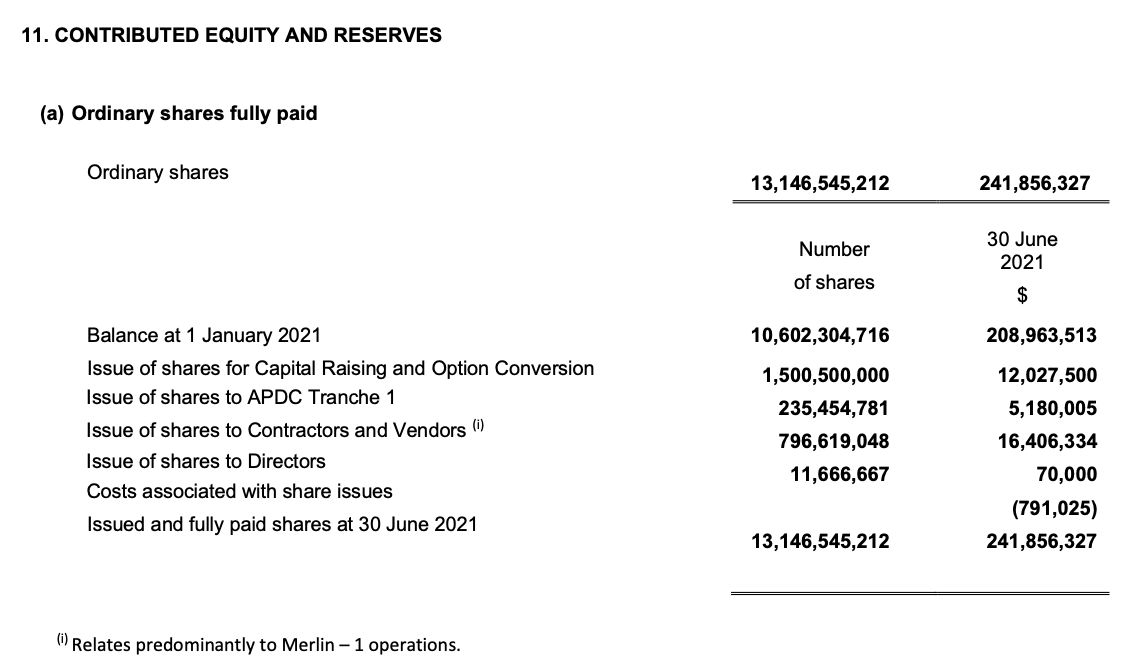

Page 16 from financials released on 10.8.2021 - https://clients3.weblink.com.au/pdf/88E/02405874.pdf

MUST SEE >>> DO NOT MISS <<< IMPORTANT

HUGE Twitter DD thread... 88E ROAD to success exists:

http://twitter.com/StevenStocks5/status/1432107880598102023

88E Due Diligence Collection from PokeStonksTrainer (@HarisRad88):

https://threadreaderapp.com/user/HarisRad88

Must see DD (88 slides of light sweet crude):

https://drive.google.com/file/d/101BYeTf-8hs5vtSbDRNk0jFxFjtvkl1r/view

For future reference going into 2022 and the BLM - from WOOFERHEAD:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=165866733

https://www.proactiveinvestors.com/companies/news/963322/88-energy-updates-on-operations-as-it-sits-on-comfortable-cash-pile-963322.html

https://www.reddit.com/r/EEENF/comments/t1f0iu/alright_folks_lets_get_something_straight/

https://finance.yahoo.com/news/88-energy-limited-asx-88e-230414601.html

doinit Presents... Crude Oil Basics:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=165612520

Brent Crude vs. West Texas Intermediate: The Differences

By

Updated Sep 30, 2020

West Texas Intermediate

In the United States, West Texas Intermediate is the preferred measure and pricing model. It is also slightly "sweeter" and "lighter" than Brent.

West Texas Intermediate (WTI) is slightly lower in price than Brent. As of November 2, 2020, WTI was trading at $38.76 per barrel, while Brent traded at $41.19.

The offshore oil rigs, despite being in the news more often, most famously with the BP oil leak of 2010, are heavily traded as barometers of domestic oil market health.

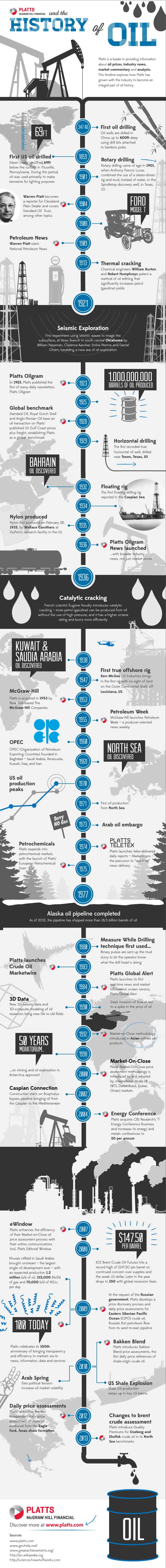

ALASKA'S OIL & GAS INDUSTRY

BACKGROUND • HISTORY • THE FUTURE • FACTS • PRODUCTION

SB21 • PRODUCERS & EXPLORERS • ALYESKA PIPELINE SERVICE COMPANY

REFINERS • LINKS • SOURCES • COMMENTS

https://www.akrdc.org/oil-and-gas

http://dnr.alaska.gov/commis/Presentations/Alaska_North_Slope_Gas_Potential_Sept_2016.pdf

https://www.reddit.com/r/EEENF/

Which Are The Seven Steps Of Oil And Natural Gas Extraction?

http://www.sheerproject.eu/which-are-the-seven-steps-of-oil-and-natural-gas-extraction/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |