Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

nation wide cash prices...

http://www.naturalgasintel.com

https://www.investing.com/commodities/natural-gas-contracts

HH +.61 @3.51?

yah....we been opening windows for fresh air

worked some today

putting signs together for next week

headed down south Monday to put out signs

best of luck to yah

cc

was rough one

still not up to par

by next week should be ok

cc

ewe... I know that one. Not fun at all. Yeah that passing it back and forth, morphing into something new, can climb right back on ya.

Run the heat and open the windows/fresh air for you and yours ~ Get well... stay well.

We're too old for that crap.

I see you as well and completely healed CC, I was wondering what happened to you. I hope you feel better starting now,

Gods speed,

SD

My.....been out with the flue since tuesday of last week

throwing up has not been fun

just now getting over it

wife now trying to get it

has been real bad for me.....no energy

entire body aching....head aches

have not looked at anything since last monday

should be good by next week

cc

Good morning CC. Are you interested in shorting 2.96?

or any other number?

Looking over CC's etf board... http://investorshub.advfn.com/ETF-Trading-30170/

I'm pretty fed up with /ng

Not the S&P ~ YET... But, is anyone see the changing of the guard here for the SOX?

I'm wanting to short the sox via SOXS @ /ES +/-2700?

BIG recent Volume

Howdy,

I miss y'alls input on NG and such. I don't know where y'all went but have a very Merry Christmas dudes.

SD

Contango spread Dec-19/Jan-20 almost a buck?

How?

https://www.investing.com/commodities/natural-gas-contracts

~ widely interesting

I'm using my old zipline Haywire "Logging-term" to drag logs out of the tight steep places.

It was acting like it was starving for fuel, low rpm, no power... right down to an idle.

Low on fuel, refueled it... ran better but still starving and then right back down to an idle again after 10min of work.

Dozer was 2/3 the way up the hill dragging about a cord and a 1/2 in logs when it stopped.

100 yard walk from the house. No electric power.

I figured it was time to change the water separator, fuel filters.

Sure enough!

...then the starter took a dump on me. Bad timing.

I can't purge the air from the fuel lines at the injectors without a starter, let alone run it.

google a JDE-80 wrench. What I need to pull the starter.

blade is down... will have to jack it up to get the hydraulics and blade arms out of the way from the starter.

Belly pan can't be removed up against dirt.

It's been pouring rain. Will be for two more days and then the overnight temps drop under 30 for a week+. Cold wrenches.

I might just hang it up for the season.

I have another place to get wood but it means bucking rounds, loading and unloading the truck. I end up handling the wood too many times.

It's better to drag the logs to the woodshed buck rounds, split and throw them in.

Handled less. The less I have to touch each piece of wood the better.

200' zip line sounds fun.

Merry Christmas

Will be out most of if not rest of week

Work load is heavy right now

Have 2 construction jobs going on right now

With 2 other people wanting me there yesterday

Crazy right now

Putting in zip line before Christmas for grandkids

200 feet long

We are gonna have a blast

hope all is well on your end

Did u get ur dozer fixed

cc

12/20/16 Dec Cash$ low. Reverse split date this year...

interesting dates

https://www.barchart.com/futures/quotes/NGY00/interactive-chart

not sure that 2.59 is real... one day spike down/up? Looks like an error.

short it.... 2.66 right now

see 2.612

cc

Asian market keeps shorting the pop

are u best trading Sunday contracts

shorting them

warm weather

cc

closed out this evening

shall see how all this falls out

what a turd natty has been

give n take

give n take

cc

Stopped myself out after this post. Good bye.

slapped it down so hard...who'll buy it now going...EDIT:

into next week's warm anomaly

Other than natgas cash price, why would shorts cover here?

Will Cash$ slip next week and the front months follow it?

Is this the makings of a bloodbath to 5\lower?

My thoughts: I don't like this... give me 6.10 so I can dump 1/2.

EDIT: Do you really think this is going to gap/run monday?

if you look at either U or D

have you noticed as pps rises short volume increase

rocks back and forth

trading natty is bruttal

for natty to go anywhere.....need be buying dips

when u see this .... up it goes

cc

they been buying since yesterday

giving it support

notice the tails on most of the candles

looking at the charts you can see where it usually runs when u see that

most of the times

unless big guys drop it on u

then

no matter what u do it will drop

we could see a possible run from here

no telling....shall see

......looking at the chart below

they been flipping U....for about a week

in n out.....rinse n wash....repeat

rinse....wash....repeat

believe big boys doing it

they have to get out of short positions....so....they flipping it

they can only do this for so long

creating a tight spring

to

soon let it go....should get good bounce from there

shall see how tomorrow turns out

Date............Short Volume.......Total Volume.......Short Percent

12-14-2017......7,656,962.........16,062,043..........47.67%

12-13-2017......6,665,308.........16,541,153..........40.3%

12-12-2017......13,534,678........25,336,310..........53.42%

12-11-2017......5,088,476.........10,557,954..........48.2%

12-08-2017......5,695,780.........12,140,735..........46.91%

12-07-2017......19,984,662........48,502,977..........41.2%

12-06-2017.......5,850,797........13,094,525..........44.68%

12-05-2017......12,254,352........37,078,461..........33.05%

edit......

D short positions beginning to rise

http://volumebot.com/?s=dGAZ

cc

I sure hope today's 2.70+ wall-o-shorts is gone overnight.

I never did it....Some how you were on ignore

Now See u

cc

picked up some U for 5.61

cc

snapshots of the latest 30th...

https://www.netweather.tv/charts-and-data/gfs

https://www.tropicaltidbits.com/analysis/models/?model=gfs®ion=us&pkg=T2ma&runtime=2017121400&fh=384&xpos=0&ypos=0

https://www.tropicaltidbits.com/analysis/models/?model=gfs-ens®ion=nhem&pkg=z500a&runtime=2017121400&fh=30

https://www.tropicaltidbits.com/analysis/models/?model=gfs®ion=us&pkg=T2m&runtime=2017121400&fh=384&xpos=0&ypos=129

https://www.tropicaltidbits.com/analysis/models/?model=gfs®ion=nhem&pkg=uv250&runtime=2017121400&fh=384

I got this msg...

Sorry, this member has blocked you from sending messages to them or you have blocked them.

I checked, I didn't inadvertently block you, maybe you did me?

I went to a private msg you sent me long time ago and checked the tab on the bottom of the post.

I did not block you

you can -del this after you read it

can not see any of your posts

edit,......

sent a report about it to I-Hub

cc

Sorry you’re having problems with your computer

Sorry you’re having problems with your computer

I bought some UGAZ this morning for 5.80

MM’s been screwing with us last 2 weeks

TOS....never freezes up on me

cc

08:38 myself: TOS is such a resource hog. It keeps locking up my pc to the point where all I can do is reboot. I swear, it's like a virus. Would you please put a leash on it's resource consumption. It seems to be getting worse.

08:44 XxxxX_TOS: Good morning, have you attempted to adjust the memory settings in the log in screen yet? usually if you set the max setting to below the highest value it can go it will help with system lock ups like that

08:49 myself: yes I have. infact someone from your end did a remote access to my pc and set it for me. It worked for a while but it's right back to same old sh$t crashing twice a day... can't let it run all night or it will crash for sure RIGHT WHEN YOU NEED IT... frustrated.

08:49 XxxxX_TOS: yeah I wouldn't let it run all night, I'd close it when you don't plan on using it

08:49 XxxxX_TOS: its designed to be restarted regularly

08:51 myself: well it should backfill overnight trades/volume then, so I can see what happened last night. But it doesn't.

08:52 XxxxX_TOS: Yeah, theres a million things it should do, agreed with you there, but we have to deal with the reality of what it can do currently.

08:56 myself: Well I just thought I would pass on my frustration. I thought it was just me and my system but it's not. I googeled TOS keeps crashing. I'm not alone. Pass my msg to please put a leash on the platform. IT TAKES 8 min to reboot my pc

08:57 XxxxX_TOS: Will do

08:57 myself: thanks

Pacific

Crazy

haven't seen it print this far below rising cash$...

before.

Apparently cold is not coming into the tail end of the forecast runs.

Thought a rising Cash$ environment would support the front months till the weather started projecting cold again.

Brutal: I had my @ss handed to me all the way down here

Like a rubber band... please snap back to Cash$ ~ at least

before Cash$ has a chance to fall

Interesting read.....The EIA projects that - trending from 2016 to 2040 - natural gas production will go from 27.4 quadrillion BTUs or quads (a quad is roughly a thousand BCF) to 39 quads. This 12.6 quad increase - an increase of nearly 50% - will be almost one half due to an increase in exports from 2.1 quads to 7.1 quads, and a decrease in imports from 3.1 quads to 1.3 quads. Net exports are projected to go from a negative number in 2016 to 5.8 quads in 2040. Total natural gas exports are projected to increase by 240% to 7.1 quads in 2040. The increase in total natural gas exports (and therefore LNG exports) is one of the most robust predictions in the EIA forecast. In addition to the base case projection of a 240% increase, the very pessimistic "Low Oil and Gas resource and technology case" projects a 136% increase, and the "High Oil and Gas resource and technology case" projects a 458% increase. In the short term, EIA is projecting that LNG exports will increase to a level of roughly 1 quad (about 3.5% of total US production) by 2018. As we move forward, we should see a steadily increasing flow of LNG exports which will result domestic natural gas production to steadily increase.

The Midstream Sector is trading at its lowest valuations in years!

During the year 2017, investors have favored growth and momentum stocks over "value stocks" (i.e., stocks with a low P/E ratio), including high paying dividend stocks. While most momentum stocks are currently trading at over-stretched valuations due to the recent gains, several high yield sectors (notably Midstream MLPs, Property REITs and BDCs) have become "deep value stocks", with plenty of upside potential. This phenomenon can be attributed to the fact that investors have been piling up on momentum stocks, - including FANG stocks. Money has been chasing the same stock driving prices higher.

What is worthy to note is that despite all the bullish news about natural gas exports, and recent news from the Energy Information and Administration ("EIA") that the United States will become the world's "undisputed" leader in oil production by the year 2025, most midstream MLPs are trading around their respective 52-week lows.

In fact, the midstream sector (including natural gas midstream) is currently trading at multi-year low valuations.

5 High-Yield Companies Set to Benefit from a Booming Natural Gas Production

The midstream companies that already own established natural gas assets are ahead of the game, and are set to benefit the most from increased natural gas production and/or LNG exports. These companies are worthy of consideration by investors in a world in which US natural gas production should steadily increase as we go forward.

Below is a list of 5 high-yield companies that are set to benefit from this trend:

click on link below:

https://seekingalpha.com/article/4131013-bank-u-s-natural-gas-growth-high-yield-mlps-13_7-percent

cc

this could go lower

was afraid of this

if con't hold here

could we see 2.44

cc

God~save~me. bot U~5.83 @Cash$-recent-low-tide 2.69...

6.97 avg

Please give me 31 cents to /ng 3.oo

edit... probably should have waited for Feb 2.69?

eyeballing recent Cash$ low-tide @2.69 should have just bought@5.83...

and called it close enough @2.691

all winter months in the process of tagging or reaching for Cash$ low-tide @2.69

waiting on someone to buy today

waiting on IRS to send me a refund

waiting to talk to them....at least :30 min wait

have lot to do....will get with you soon

cc

Primed and ready. /ng consolidate/wait for winter verification?...

eye on last cash$ +.05 @2.80 today 2.79 needs to hold

would like to unload my last 1/2 @6.93 "tried yesterday" to position myself lower as consolidation takes place

j8 5min OBV really dumped yesterday's close...

some is trying to come back in this am

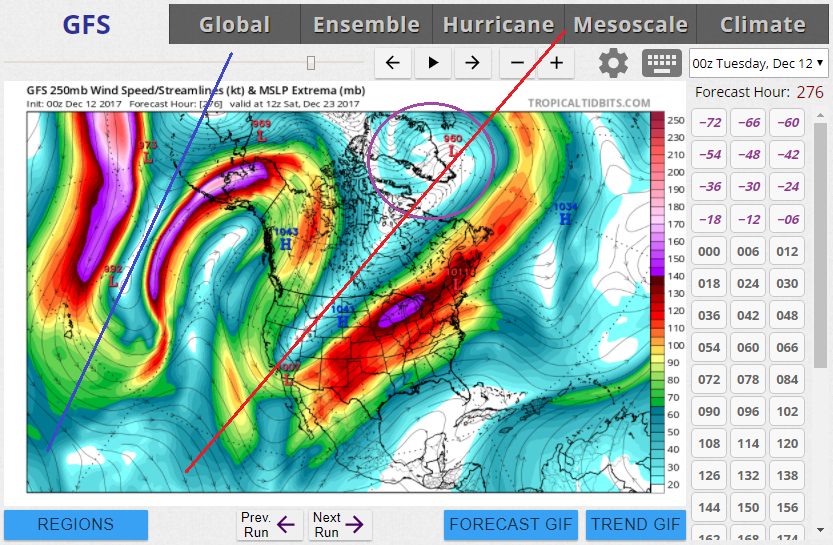

wanted to see this slant hold sweeping east "red"...

https://www.tropicaltidbits.com/analysis/models/?model=gfs®ion=namer&pkg=uv250&runtime=2017121200&fh=24&xpos=0&ypos=

23rd but it flys apart after this with a low pressure disruption in alaska

looking at the chart there were buyers today

not sure enough to keep it afloat

shall see tomorrow

sure would like to see 2.847or better by morning

am holding on

when buls are exhausted and sell off

it will run

edit....

appears trying to run......hope so

7:25 central time

cc

Compared: Looks same as macd, with different color scheme.

bogus script?

REPLY: go up to Setup-Open Shared Item. Then paste the link you created into the box. Choose Preview then Open and the system will open an new window. You will then want to right click on the chart and choose Style-Save Style so you permanently save the layout.

That worked!

Thanks! Back at ya buddy. Test 6.25 please.

Re: PPO: I finally found the script http://tos.mx/yBmYfF

but because my pc is partitioned off for my daughter...

thinkorswim is not installed for all users on this computer

To retrieve this content you will need to download and install thinkorswim for all users, then restart your browser.

What?! ... this is frustrating

Looking at the 26 th temp map appears

the Cold temp has dropped down lower around Calif

and further East

Appears winds blowing Cold temps SouthEastern winds

See if it last

Could be Good for natty

Shall see how holds up

This evening could be interesting

See if get a pop or not

Have some cash on side lines

cc

upper dynamics: low end jet-stream, 250mb-windspeed/streamlines...

https://www.tropicaltidbits.com/analysis/models/?model=gfs®ion=namer&pkg=uv250&runtime=2017121000&fh=24&xpos=0&ypos=

end of run goes right back to that dual feed system that starts/splits in the pacific @ california for north and south paths.

The south path looks much like that cross mexico flow that kept blowing the cold up and out last year.

but this year, we have that split thing going on...

the north path helps churn that huge (* purple cold patch) (* https://www.netweather.tv/charts-and-data/gfs ) northeast of US "that wasn't there last year ~ it was in siberia" maybe the east will wobble some purple cold down one system after another.

That southern/split flow needs to stay south a tad longer before turning north or the southern split @california needs to stop all together and join the rest of the jetstream

bigger picture

https://www.tropicaltidbits.com/analysis/models/?model=gfs®ion=nhem&pkg=uv250&runtime=2017121000&fh=384

a strong high mexico cross flow is a possible troubling repeat of last year's winter delay

end of run

The bigest return on a chart is the 3rd Leg UP

look for my Dumpster Diving pics..............................................link back for prior pics

GOALS:

1....Start your trade at beginning of run.....not after it begins

2....steady returns of 15 % to 45 % per trade

3....NOT to shoot for the moon

4....Don't hold stinkie pinkies under .50 overnight

5....trade off support and resistance points

6....Before entering ........know where to exit

7.....do your own D * D, buy at your own risk

//////////////////////////////////////////////////////////

GAINNERS LOOSERS

http://finance.yahoo.com/gainers?e=us

////////////////////////////////////////////////////////////

A few education site suggestions:

OTC Markets......SEC Fillings.........................http://www.otcmarkets.com/stock/NAWL/financials and http://www.otcmarkets.com/stock/ONTC/company-info

http://investorshub.advfn.com/boards/board.aspx?board_id=7882..... another site....http://investorshub.advfn.com/boards/board.aspx?board_id=10118

Short Squeeze ..... http://otcshortreport.com/index.php?index=bets&action=view#.VR0-luG19WE

Low Float Explenation & how to trade um...........http://investorshub.advfn.com/boards/read_msg.aspx?message_id=62370553

search back through lowtrade's old posts....very informative..........http://investorshub.advfn.com/boards/board.aspx?board_id=3972

http://investorshub.advfn.com/boards/board.aspx?board_id=10298

News

Data......................http://data.cnbc.com/quotes/BPZR/tab/8.1

GOOGLE NEWS......multiple......https://www.google.com/finance?q=bpzr&ei=-3n7VPn4HoPa8AbZsICoBw

PENNYSTOCKINSIDERS NEWS.............http://www.pennystocksinsiders.com/mediaroom/1448/

P R NEWS........http://www.prnewswire.com/news-releases/

Bloomberg .........Earnings announcements.......................http://www.bloomberg.com/apps/ecal?c=US

Microcap News.................http://www.microcapmarkets.com/news.jsp?sParam=M_A&market=NASDAQ

Chart Patterns .......learn these patterns they are invaluable

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns...........................................................http://www.chartpatterns.com/

Clinical Trials - http://www.clinicaltrials.gov/

FINRA Daily Short List - www.regsho.finra.org/regsho-Index.html

Floats - http://investorshub.advfn.com/boards/board.aspx?board_id=15223

Form 4 Filings - http://www.secform4.com/index.php

Google News Business - http://news.google.com/?ned=us&topic=b

Google News Home - http://news.google.com/

Holiday Schedule for Stock Markets - http://www.allstocks.com/html/stock_markets_holidays.html

High Short Interest Stocks - http://www.highshortinterest.com/

Insider Buy & Sell Info - http://www.insidercow.com/latestFillings/buyByCompany.jsp;jsessionid=00CD11F05D6090BBECE249167FD45A5B

Low Float Stocks - http://www.lowfloat.com/

MicrocapMarkets NASDAQ <$5 - http://www.microcapmarkets.com/data_main_nav.jsp?market=NASDAQ

MicrocapMarkets OTCBB - http://www.microcapmarkets.com/data_main_nav.jsp?market=OTCBB

Mining - http://www.miningmx.com/

Naked Shorting - www.businessjive.com/

Patterns - http://thepatternsite.com/

Pinksheets Stock Info - www.otcmarkets.com/pink/index.jsp

REG SHO List - www.regsho.com/tools/short_list.php

Reverse Merger Report - http://reversemerger.dealflowmedia.com

Reverse Splits - http://investorshub.advfn.com/boards/board.aspx?board_id=3017

Searching Blogs, News, etc. - http://www.icerocket.com/

Shell Stocks - http://www.shellstockreview.com

SHO Threshold List - http://www.nasdaqtrader.com/Trader.aspx?id=RegSHOThreshold

Short Stocks - http://shortsqueeze.com/

Stock Chart Patterns - www.trending123.com/patterns/index.html

Stock Promotions - www.stockpromoters.com

Stock Promotions - www.stockreads.com/

Stock Research - http://www.stockhouse.com

Trading Halts - http://www.nasdaqtrader.com/Trader.aspx?id=TradeHalts

Transfer Agent Contact Information - http://investorshub.advfn.com/boards/board.aspx?board_id=10067

Transfer Agents in the United States - http://www.stocktransfer.com/index.cfm?action=about.network.transferAgents

Technical Analysis Chart Lessons

1 ....... Commodity Channel Index (CCI) 48/70 ........explenation for using in charts ...... see scans below

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=58320577

2....... Using The CCI Indicator With The Candlestick "Reversal Bar" Pattern

•Reversal Bars work best in a developed trend - If a trend has been going for some time, then it is reasonable to wonder when it is going to end. The reversal bar can help. If a trend has previously been down, then the reversal bar (bar #2) should make a lower low.

•Close should be greater than the previous close: Not only should the price reverse back up, but it should do so convincingly.

•Close should be greater than the open: At the end of the day there is more interest in buying the market than selling it.

I have marked the outside -200/+200 range in red lines, and the mid -100/+100 range in blue lines.

If you look at the example chart above and try to interpret the CCI without taking into account the Reversal bars, which are marked, then we have 2 situations where we have the CCI indicating the change of trend. The potential change in trend is indicated by the fact that the CCI has reached -200 or + 200 and is either overbought or oversold.

The first blue circle shows an oversold situation, where the CCI has turned up from the -200 level. This is an indication to go long and I would wait for the CCI to cross the -100 level before entering a trade.

The second red circle shows an overbought situation along with divergence, which is a strong signal to go short. Similarly, one would wait for the CCI to cross the +100 level down, before taking a short position.

The problem is that the CCI indicator is not strong enough as a stand alone method but when you also use reversal bars as a confirmation, it can be very accurate

There are 4 Reversal Bars marked on the chart, as these bars satisfy all the 3 conditions mentioned above to qualify as Reversal Bars. All 4 of the reversal bars resulted in a profit but the Reversal bars 2 and 4 occur around the time the CCI was overbought/oversold, which gives the trade an additional confirmation.

Below is the link and rules for using the CCI Indicatots :

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=59051282

(Interesting charts and Data as updated)

http://www.fao.org/worldfoodsituation/FoodPricesIndex/en/

SCANS

the simpler the scan the better it is

1........Doji

[type = stock] and [country = us] and [volume > 500,000] and [close > .10 ] and [close < 3.00] and [1 day ago close < 2 days ago close] and [ today's close = today's open] and [ today's low < today's close]

2 ....... 5 cross 10

[type = stock] and [volume > 100000] and [country is US] and [Close > 0.04] and [Close < 0.9] and [2 day's ago Stoch RSI(10) <= 0.20] and [Stoch RSI(10) > 0.20] and [Stoch RSI(20) > 0.05] and [Stoch RSI(30) > 0.05] and [Close > Open] and [Williams %R (14) > yesterday's Williams %R (14)]

3......... EMA-4 cross EMA-12.....you can substitute EMA's

[type = stock] and [country = us] and [daily sma(20,daily volume) > 500000] and [Volume > 499,999] and [Close < 3.00] and [today's ema(4,close) >= today's ema (12,close)]and [yesterday's ema(4,close) <= yesterday's ema (12,close)] and [ close > .10 ]

5......CCI-48 .......

- 100 .... can possibly produce ADX cross

[type = stock] and [country = us] and [daily volume > 500000] and [Close < 3.00 ] and [today's CCI(48) > -100 ] and [close > .10] and [3 day's ago CCI(48) < -100]

+ 100..... can possibly produce 3rd or 5th Fib. wave, see A T & T chart above

[type = stock] and [country = us] and [daily volume > 500000] and [Close < 3.00 ] and [close > .10] and [3 day's ago CCI(48) < 100] and [today's CCI(48) > 100 ]

6.......CCI - 70.....

- 100 ...... can possibly produce ADX cross

[type = stock] and [country = us] and [daily volume > 500000] and [Close < 3.00 ] and [today's CCI(70) > -100 ] and [close > .10] and [3 day's ago CCI(70) < -100]

+ 100..... can possibly produce 3rd or 5th Fib. wave, see A T & T chart above

[type = stock] and [country = us] and [daily volume > 500000] and [Close < 3.00 ] and [close > .10] and [3 day's ago CCI(70) < 100] and [today's CCI(48) > 100 ]

......Acording to J. Peter Steidlmeyer who used to be on the Chicago Board of Trades.

In Bull Markets

1....Lows on Monday's and Tuesdays'

2....Profit on Thursdays' and Friday's

In Bear Markets

1....Highs on Mondays and Tuesdays

2....Lows on Thursdays and Fridays

Characteristics of Waves ...............http://investorshub.advfn.com/boards/read_msg.aspx?message_id=111801236

Check History....Due Dilligance ..........http://finance.yahoo.com/q?s=ungs&ql=1 ................http://www.otcmarkets.com/stock/ungs/quote

Thanks for stopping by

good luck trading

| | ||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |