Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

D$D thanks, it open buy opportunities again ![]()

for LT longer term safety ![]()

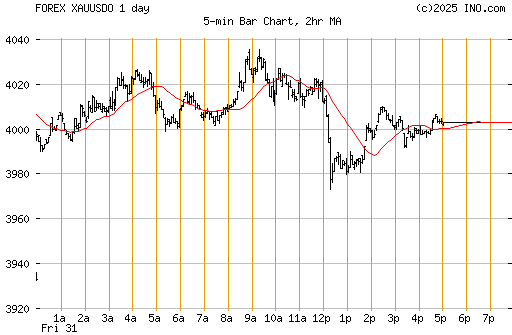

with the dollar going a bit up...short term daytrading -

may gain for a short term -

don't u think GOLD - OIL -

for a short term may move down? -

short term - day trades -

and more buy opportunities for the longer term ![]()

when stagning a bit for gold for st shorter term -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=38479774

BUy XOMA CHart --->

BOB - ... with the dollar going Up ...

don't u think GOLD - OIL , Market may move down ?

or stagning a bit for gold ..

Good day,

D&D

found this

"""XOMA may run on the news out… we’ll see

http://finance.yahoo.com/news/XOMA-052-Clinical-Results-pz-15457818.html?.v=1

yeah, it’s phase 1, but reads like there was some phase 2 data in there

“We continue to develop evidence supporting one of the most significant potential medical advances in decades — a move from insulin therapy to anti-inflammatory treatment of patients with Type 2 diabetes. Our results have provided not only the safety data that is typical in a Phase 1 trial but also encouraging signs of biological activity,” said Steven B. Engle, XOMA’s Chairman and Chief Executive Officer.

""""

Do yourself a favour, D&D..thanks, Gold Au LT going UP for sure ![]()

That was the month that was for the precious metals sector

whereby the precious metals stocks led the charge just

pipping an outstanding performance by silver which beat

gold and the DOW leaving the US Dollar to collect

the wooden spoon.

It is still early days for the stocks but it is good to see them

demonstrating some leverage when compared

to gold and silver prices.

The reason for taking on the risk of exposure to the mining

stocks is to gain leverage in this bull market, otherwise it

would be a straight forward play of buying the physical metal

and sitting on it to risk confiscation as the bolshevikz did

in 1934 and forbid US citizen to hold gold to 1971.

Ownership of a small amount of the gold and silver is highly

recommended but the less risk averse among us look to

the stocks to provide greater returns ![]()

From the beginning of this bull run in 2001 this was the

case until the 2008 De-leveraging sell off decimated this

tiny sector as illustrated below....

Richest and lowest cost gold mine -

http://www.goldcorp.com/operations/red_lake_mine/

Red Lake Strategic penny play ![]()

PowerPoint Presentation (May 2009 ![]()

http://www.conquestresources.net/Powerpoint/CQR_20090524.pdf

http://www.conquestresources.net/presentations.php

This weekend World Resource Investment Conference -

June 7 - 8, 2009

Vancouver Convention and Exhibition Centre

http://www.cambridgehouse.ca/index.html

http://www.cambridgehouse.ca/ch_register.html

The price of gold can be volatile in the short term,

gold has always maintained its value over the long term.

Through the years, it has served as a hedge against inflation

and the erosion of major currencies, and thus is

an investment well worth considering....

http://www.goldcorp.com/operations/red_lake_mine/

Gold is strategic long term safety -

ex..strategic penny gold play....

http://www.conquestresources.net/

http://investorshub.advfn.com/boards/board.aspx?board_id=11788

God Bless

RDI.TO / RDIAF Big Pump is starting in Germany in Canada

Pala against Rockwell Diamonds

Timeframe: 2009-06-17

Target: maybe 0.40C$

Some informations will be posted in InfoBox of RDIAF Board

MNAP should run higher next time.

MNAP was at a price of 6$ without pump or anything. just to have good fields in some countries. After some drill starts delayed and the finance crisis was hit the world...MNAP made a down move.

But now…it will be turning.

Kyrgyzstan will be drilling in some days or drilling has been started. Normally the company put out a news release and on santos website we don’t find anything about a drill start. So we believe it will be in some days…next week. There was another delay cause a technical problem two weeks ago.

In Kyrgyzstan Manas has signed a US $56 million farm-out agreement with Santos a large independent Australian oil and gas producer covering its 1.2 billion barrels in place, light oil play (independent resource evaluation Scott Pickford, 2005).

http://www.santos.com/Content.aspx?p=91

North Azar 1 Fergana / Kyrgyzstan Oil 0-50 70.0 Q2 09

East Chongara 1 Fergana / Kyrgyzstan Oil 0-50 70.0 Q2 09

Santos holds 70% on these fields. 5% hold national Kyrgyzneftegas. MNAP has 25%. 1.2 bn bbl and infrastructure can be used short for delivering to refinery in the North.

That’s just the small part of cake, which we will have fun in next weeks. 2 wells will be drilled at first. If they hit there conceivability… further 4 wells will be drill.

The big one will be Albania. The costs will be much higher. Present negotiations with possible partners will end in some days. I wait for that farm-out. Later, if MNAP will have just 20% … 3 Billion recoverable resources are enough. Albania is ready to drill. Some years ago, Shell was in Albania and made seismological analysis. Cause political disturbances…Shell went out of Albania…MNAP went in.

Info Albania (2007) BB: http://www.undiscoveredequities.com/manasgustavson.pdf

Actual information’s: http://www.manaspetroleum.com/s/Presentations.asp

These two parts will give a good news flow next weeks and months.

But that is not all.

MNAP has 5 parts in the world.

Kyrgyzstan…Albania…Chile…Mongolia…Tajikistan

1. Albania 12.3 Billion STOOIP(P50)

• 100%, operated by Manas):

• Ongoing 600 KM 2-D seismic program managed

• Deep prospects ready to drill

2. Mongolia

• 74 % - 90%, operated by Manas

• 39.048 km2 acreage adjacant to one of Chinas largest Oilfields

3. Kyrgyzstan 1.2 Billion STOOIP (P50)

• 25%, operated by Santos

• Farmed out and fully carried by Australian major „Santos“

• Ongoing seismic program

• First well announced to be drilled by Santos in Q2 2009

4. Tajikistan 800 Million STOIP (P50)**

• 90%, operated by Santos

• Farm out and carry by Australian major „Santos“ (option farm-in signed)

• Ongoing seismic program

5. Chile 2.9 TCF Gas

• 20%, operated by Geopark

• Farmed out and caried by local operators Geopark and Pluspetrol

• in 6.600 km2 proven oil system (1.6 million acres)

**Option farm in signed with Santos

We have 3 fields with (P50)…that’s the hugh potential.

target next two weeks...1$ without Albania.

With Albania and maybe some weeks: who knows...maybe 1,50$...2,50$...3.50$ or more

there is enough newspower next time

yes yes ... I didn't read all...but the consens is: next year are US on a hard and strong way...fight for informations ;) and don't believe all ... it's same in Europe

Monetize Or The System Collapses

Posted: June 3 2009

dollar vulnerability no surprise to us, collapse is the cost for not paying attention, Fed failures the cause of devaluations, stimulus plans may well be insufficient to bolster economy, Jobless rate indicates where we stand now in our weakened economy

Re-emergence of dollar vulnerability has taken almost all professionals by surprise. That has been prompted by the expansion of the Fed’s balance sheet, the upward movement in interest rates and the massive monetization that has been underway for some time. The Fed like many other central banks has been extending money and credit for the past 5-1/2 years. Those who watch closely were well aware of this. That is why the Fed has not published M3 for three years. Official Fed interest rates may be zero but real market has them higher than 3-1/2% in the long end of the market. Investors have finally fixated on the massive monetization in progress. If the Fed does not monetize the system collapses. In order to save the system the dollar has to be sacrificed. This needless to say is a very distasteful choice for the Fed. They can no longer have it both ways. The perceived result is hyperinflation, which we have forecast for some time.

This past week the Fed and the Treasury via the “Working Group on Financial Markets,” struggled to hold the stock market up, along with the bond market and to continue to suppress gold and silver. The group was created in August 1988, under Executive Order 12631. It was later nicknamed the “Plunge Protection Team” by the Washington Post. The group was the answer to the plunge in the stock market in late October 1987. Incidentally, the Fed and the Treasury both illegally interceded in that market chaos arresting the collapse. They gave banks and brokerage firms unlimited amounts of money to stop the free falling market. The group is supposed to promote the integrity, effectiveness, regularity and competitiveness of our markets, to maintain the confidence of investors. The group produces no reports, the public knows nothing about it, nor does 80% of Wall Street, there are no minutes of their meetings, and everything is done in secret. We have witnessed hosts on CNBC deny that it even exists, when they know it manipulates markets worldwide 24/7. The members of the president’s group are the Chairman of the Federal Reserve, the head of the New York Fed, the Secretary of the Treasury, the Chairman of the SEC and the head of the CFTC, the Commodity Futures Trading Cooperation. The original intention of the order has been badly distorted and a good example of that was the termination of reporting on M3 in March 2006. The influence on all these entities cannot be underestimated. Since 1988 Goldman Sachs, Citigroup and JP Morgan have run them. They have been able to manipulate markets with abandon. As you can see their leadership has not led to healthy, free financial markets. Their greed has again destroyed our markets as they have over the past 96 years for the Fed and last 20 years for the group. Over these years a number of indicators, such as M3 have been discontinued so that professionals and others could follow the flow of credit and money creation and its affect on the dollar. The Fed and the Treasury do not want you to know what they are doing. Their attitude is that you don’t have a need to know. As a result of professionals, Congress and individual Americans are not paying attention, as the international monetary system is collapsing.

In 1832, President Andrew Jackson in vetoing a bill to form a second national bank, similar to today’s Fed said, “Distinctions in society will always exist under every just government. Equality of talents, of education or of wealth cannot be produced by human institutions, in the full employment of the gifts of heaven and the fruits of superior industry, economy, and virtue, every man is equally entitled to protection by law, but when the law undertakes to add to these natural and just advantages artificial distinctions, to grant titles, gratuities, and exclusive privileges to make the rich richer and the potent more powerful, the humble members of society – the farmers, mechanics and laborers – who have neither the time nor means of securing like favors to themselves, have a right to complain of the injustice of their government.” His veto of the bill stood. The bankers were unable to buy sufficient votes to override the veto.

On May 23, 1933, Rep. Louis T. McFadden brought formal charges against the board of Governors of the Federal Reserve Banking System, the Comptroller of the Currency and the Secretary of the Treasury, for numerous criminal acts, included but not limited to conspiracy, fraud, unlawful conversion and treason. McFadden survived two attempts on his lfe, but died in 1936 of poisoning. He was in a position to speak with authority of the vast ramifications of this gigantic private credit monopoly, as Chairman of the House Banking & Currency Committee for more than ten years. His speeches are there for all to see in the Congressional Record. We’ll give you just a taste of his thoughts. “Mr. Chairman we have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks. They have cheated the government of these United States and the people of the United States out of enough money to pay the national debt. The depredations and inequities of the Fed have cost enough money to pay the national debt several times over.”

Those comments are mild compared to the rest of his speech. We again refer you to The Creature from Jekyll Island by G. Edward Griffith and Secrets of the Federal Reserve by Eustace Mullins.

The Fed planned and executed the events that created two bubbles in the small space of ten years. They have ensconced us now in the biggest financial crisis in American history. Unfortunately, few are able to foresee what devastating affect it will have on not only America, but on the entire world as well. As a result the dollar will fail further impairing the economic structure and bringing an end to the dollar as a reserve currency. What will replace the dollar no one knows. Certainly not today’s fiat currencies, unless they back their currencies with gold. No one wants to accept another worthless currency.

Unfortunately the Fed still believes they can create money and credit and manipulate interest rates and not pay a price for it. The Fed’s failure has caused a massive ongoing devaluation with no end in sight. Foreigners are finally starting to get it after ten years of dollar degeneration. That is why the dollar is falling and interest rates are rising. They are not going to tolerate much more monetization before the dollar selling becomes a torrent. From here on out it is going to get really nasty.

We have tried to take a peek into the future as others have and the best case scenario is probably 10% annual inflation along with what we already have in the system. As we’ve seen in times past inflation usually comes in waves. Then there are the massive budget deficits as far as the eye can see. It is no wonder interest rates are rising, the dollar is falling and gold and silver are starting to move away.

Wages are not keeping up with real inflation and they won’t in the future. In order to defray the loss in tax revenues and the $12 trillion plus fiscal deficit our President now calls for a VAT, Value Added Tax, on everything we buy. Europe has VAT taxes and they run around 17% to 20%. This is on top of state and federal income taxes. VAT is popular with governments because they are tough to evade.

More taxes are not the solution. Cutting spending is the solution. Our President and Congress want to turn us into tax slaves. Such a tax would as well further impede economic growth. What most professionals do not seem to understand is that monstrous borrowing is going to take place for years to come if lenders will lend. If they do lend it will be at much higher real interest rates that America won’t be able to afford to borrow. We can assure you taxes on the rich won’t rise. They are the people who financed both parties. All this portends a decline in residential and commercial real estate and years of bumping along the bottom. House prices are off 19% yoy and 32% from their 2006 highs. We predicted a median 32% fall in 11/04. It looks like the drop could be 40%. Homes over $750,000 have a 40-month overhang. Unfortunately Fitch says 75% of modified loans will go bad again in six months to a year. So much for government planning. In addition, we are facing higher unemployment and inflation and that certainly won’t help. We know about the troubles in ALT-A and Option ARM loans, but what is really disconcerting is that the foreclosure rate on prime fixed rate loans has doubled over the past year and now is the biggest segment of foreclosures due to unemployment. Over 10% of homeowners are late on payments or in foreclosure. 25% of subprime loans are in foreclosure, 14% of FHA loans and 6% of prime loans. No one will say the word, but we entered depression in February. Unemployment will deepen somewhat over the next 1-1/2 years, but little gain will be made. Business cannot expand even if they wanted too. The banks have yet to lend to them and if they have it is at greatly reduced levels.

We hear again the false clarion call that the developing world is decoupling and will lead us out of this morass. Don’t believe a word of it.

Insiders on Wall Street knew a week ago that the US government would give GM $30.1 billion for 60% of GM. That the UAW would get 17.5% and Canada would lend $9.5 billion for 12%. They also knew long ago Chrysler would be given away to Fiat. How’s that for insider trading? This is why you cannot have a revolving door between banking and Wall Street with the Treasury and the Fed.

What people, especially professionals, do not understand is that the $14.8 trillion in debt being created to bail out Wall Street, banking and insurance is systemic and will do more damage to the economy than the credit crisis we have witnessed for 22 months. Either costs are cut 60%, or taxes increased a like amount, or the debt to GDP will climb, inflation or no inflation. All we know is soon prices will double.

We will be interested to see how the government handles AIG’s naked exposure to credit default swaps they wrote. We could be talking hundreds of billions of dollars. Are American taxpayers going to bail out banks, Wall Street and hedge funds again? If they do not the result could be very nasty. Put this together with a collapsing dollar and rising interest rates and we could have bedlam.

Where was the SEC when one minute before the close, JP Morgan announced it will raise $5 billion in equity and repay $25 billion in TARP funds by the end of June? That happened on Monday. On last Friday who bought 2,500 SPMs near the close and jacked up the S&P 500 2%? Where is the SEC? This is market manipulation and it is the 8th time it has happened in four weeks.

It is our government of course.

World Bank President Robert Zoellick warned policy makers that fiscal-stimulus plans are insufficient to turn around the “real economy” and rising joblessness threatens to set off political unrest across the globe. “While the stimulus has given an impulse, it’s like a sugar high unless you eventually get the credit system working,” Zoellick said in an interview yesterday with Bloomberg Television’s “Political Capital with Al Hunt.” “When unemployment increases, that’s probably the most political combustible issue.”

It is not every 31-year-old who, in a first government job, finds himself dismantling General Motors and rewriting the rules of American capitalism. But that, in short, is the job description for Brian Deese, a not-quite graduate of Yale Law

School who had never set foot in an automotive assembly plant until he took on his nearly unseen role in remaking the American automotive industry…

A bit laconic and looking every bit the just-out-of-graduate-school student adjusting to life in the West Wing — “he’s got this beard that appears and disappears,” says Steven Rattner, one of the leaders of President Obama’s automotive task force — Mr. Deese was thrown into the auto industry’s maelstrom as soon the election-night parties ended... he has emerged as one of the most influential voices in what may become President Obama’s biggest experiment yet in federal economic intervention.

In May, the dividend-paying stocks (362) in the S&P 500 (equal weight) posted a total return of 5.89%, vs. 7.12% for the non-payers (138), according to Standard & Poor's.

Year-to-date, the payers are down 1.61%, vs. a gain of 24.12% for the non-payers.

The four-week flood of money into developing-nation stock funds that drove the MSCI Emerging Markets Index to an eight- month high is sending the strongest sell signal since equities peaked in October 2007.

Inflows totaled $12 billion, or 3.5 percent of developing- nation fund assets, the most since the 22- country benchmark hit its record high 19 months ago, said EPFR Global, which tracks $10 trillion in investments worldwide. The only other time since 2001 that funds attracted as much cash, in February 2006, the MSCI gauge lost 8.4 percent in four months.

Unemployment in the U.S. probably surpassed 9 percent in May for the first time in more than 25 years, underscoring forecasts that the economy will be slow to pull out of the worst recession in half a century, economists said before a report this week.

The jobless rate climbed to 9.2 percent, the highest level since September 1983, according to the median of 59 estimates in a Bloomberg News survey before the June 5 Labor Department report. Other data may show manufacturing and service industries shrank at a slower pace and consumer spending dropped.

“The economy is decaying at a slower rate and that is the best you can say,” said Steven Ricchiuto, chief economist at Mizuho Securities USA Inc. in New York. “I can’t tell you we are out of the woods yet.”

No comments yet for Monetize Or The System Collapses. Your comment could be first.International Forecaster Subscribers can log in and add comments. Subscription Information.

http://www.theinternationalforecaster.com/International_Forecaster_Weekly/Monetize_Or_The_System_Collapses

thank you for calling...is on watchlist

wake up europe> ABWTQ

. >.20 break then we fly...........maybe dollars

this is your wake up call.

AbitibiBowater wins approval of US$600-million loan

http://www.canada.com/business/fp/AbitibiBowater+wins+approval+million+loan/1662563/story.html

sold SPNG at .0785 sorry for late posting...but was stressful to monitoring L2

Pinkystinky...never again ;)

never forget that " PINKY rhymes with STINKY "

lol...it was so funny...and I have learnd that lessons

u mean - A$$ MOD ?

lol

you idiot !

that's not funny -lôl-

t(his fuckin CEO has surely made some big coins on us !

MATT the RAT

weeeeeeeeeeeeeee ... what can I do now?

hey buddy nowe you are co mod here!!

TOFS was the same...not much bookmarks...but after 3 months? LOL

ups...was another sender.

Wait some weeks, it will be a good board.

thanx :) but the board have not much bookmarks ...

I feel fine ... have a look at MNAP

maybe this week or next week news about drill start in Kyrgyzstan and maybe the better drill start in Albania.

If you need some informations ... tell me

long trading holi SHIT !

you lucky Tekky' !

i imagine you're well so :)

long trading-holiday LOL

woooohoooooooooooo where ya been amiiigo' !

hey D&D ... whats up?

congratulation baggers ... you win

nice tradingday!

TOP MUTUAL FUND HOLDERS

Holder Shares % Out Value* Reported

FIDELITY GROWTH COMPANY FUND 6,824,010 5.03 $5,663,928 31-Mar-09

PRICE (T.ROWE) MID CAP GROWTH FUND 4,750,000 3.50 $3,942,500 31-Mar-09

VANGUARD EXPLORER FUND, INC. 2,625,089 1.93 $4,751,411 31-Jan-09

ISHARES RUSSELL 2000 INDEX FD 1,663,738 1.23 $1,380,902 31-Mar-09

VANGUARD SMALL-CAP INDEX FUND 1,378,184 1.01 $2,921,750 31-Dec-08

VANGUARD TOTAL STOCK MARKET INDEX FUND 1,328,339 .98 $2,816,078 31-Dec-08

JANUS GLOBAL LIFE SCIENCES FUND 1,066,257 .79 $884,993 31-Mar-09

ISHARES RUSSELL 2000 VALUE INDEX FD 974,033 .72 $808,447 31-Mar-09

VANGUARD SPECIALIZED-HEALTH CARE FUND 938,500 .69 $1,698,685 31-Jan-09

OPPENHEIMER QUEST FOR VALUE FD-OPPENHEIMER QUEST OPPORTUNITY 876,515 .65 $1,586,492 31-Jan-09

http://finance.yahoo.com/q/mh?s=HGSI

TOP INSTITUTIONAL HOLDERS

Holder Shares % Out Value* Reported

Taube Hodson Stonex Partners Limited 10,000,656 7.36 $8,300,544 31-Mar-09

FMR LLC 7,384,477 5.44 $6,129,115 31-Mar-09

Barclays Global Investors UK Holdings Ltd 7,152,715 5.27 $5,936,753 31-Mar-09

PRICE (T.ROWE) ASSOCIATES INC 7,048,380 5.19 $5,850,155 31-Mar-09

MORGAN STANLEY 5,748,722 4.23 $4,771,439 31-Mar-09

VANGUARD GROUP, INC. (THE) 5,386,390 3.97 $4,470,703 31-Mar-09

OPPENHEIMER FUNDS, INC. 3,058,429 2.25 $2,538,496 31-Mar-09

STATE STREET CORPORATION 2,877,242 2.12 $2,388,110 31-Mar-09

HSBC HOLDINGS PLC 2,748,800 2.02 $2,281,504 31-Mar-09

WELLINGTON MANAGEMENT COMPANY, LLP 16,867,156 12.42 $35,758,370 31-Dec-08

Human Genome Sciences Inc.

14200 Shady Grove Road

Rockville, MD 20850-7464

United States - Map

Phone: 301-309-8504

Fax: 301-309-8512

Web Site: http://www.hgsi.com

BUSINESS SUMMARY

Human Genome Sciences, Inc. operates as a biopharmaceutical company in the United States. The company’s clinical development pipeline includes novel drugs to treat hepatitis C, lupus, inhalation anthrax, and cancer. It focuses on the commercialization of Albuferon (albinterferon alfa-2b) for hepatitis C and LymphoStat-B (belimumab) for lupus. The company has completed Phase III development trials for Albuferon and is conducting two Phase III clinical trials of LymphoStat-B. It also delivers doses of ABthrax (raxibacumab) to the U.S. Strategic National Stockpile for use in the event of an emergency for the treatment of inhalation anthrax. In addition, the company has various drugs in the earlier stages of clinical development for the treatment of cancer, led by the TRAIL receptor antibody HGS-ETR1 and a small-molecule antagonist of IAP (inhibitor of apoptosis) proteins. Further, Human Genome Sciences, Inc., through a strategic collaboration agreement with GlaxoSmithKline, has substantial financial rights to certain products in the GlaxoSmithKline clinical pipeline, including darapladib that is in Phase III development as a treatment for coronary heart disease; and Syncria (albiglutide), which is in Phase III development as a treatment for type 2 diabetes. Additionally, it has a strategic commercial collaboration agreement with Novartis International Pharmaceutical, Ltd. for the co-development and commercialization of Albuferon; and a strategic licensing and collaboration agreement with Aegera Therapeutics, Inc. to develop and commercialize HGS1029 and other small-molecule inhibitors of IAP (inhibitor of apoptosis) proteins in oncology. Human Genome Sciences, Inc. was founded in 1992 and is headquartered in Rockville, Maryland.

short squeeez??

Shares Outstanding5: 135.79M

Float: 129.84M

% Held by Insiders1: 6.85%

% Held by Institutions1: 66.10%

Shares Short (as of 12-May-09)3: 9.51M

Short Ratio (as of 12-May-09)3: 1.7

Short % of Float (as of 12-May-09)3: 7.00%

Shares Short (prior month)3: 9.44M

don't know

why the big drop?

|

Followers

|

1

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

211

|

|

Created

|

04/05/09

|

Type

|

Free

|

| Moderators | |||

Indices

Stocks on watchlist

SOLF

FRPT

get it first :

subscribe to our newsletter

DISCLAIMER

all readers or posters will trade on their own risk.

Opinions expressed on this board are just that. Opinions.

Privat Traders & europe stock club is not RESPONSIBLE FOR ANY LOSS OR GAIN ASSOCIATED WITH OTHERS TRADING ACTIVITY - WE ARE NOT AN FINANCIAL ADVISORS

Please do your own due diligence before buying or selling ANY SECURITY in the open market, there are no guarantees.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |