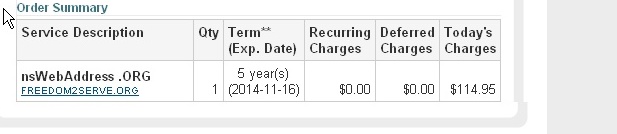

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

...its ok...I thought PHImale was spelled with an F at one point...

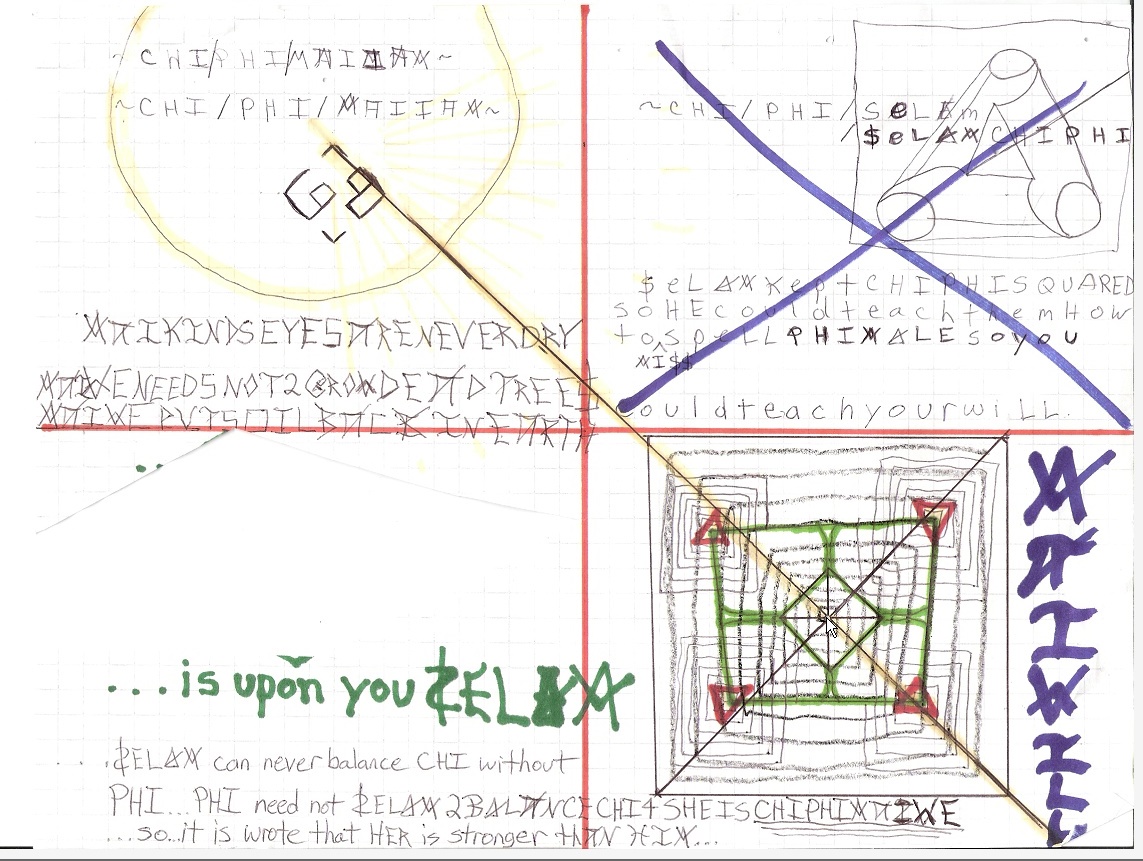

...one of the things that we sometimes must do, is, throw out the old...to make room for the new...

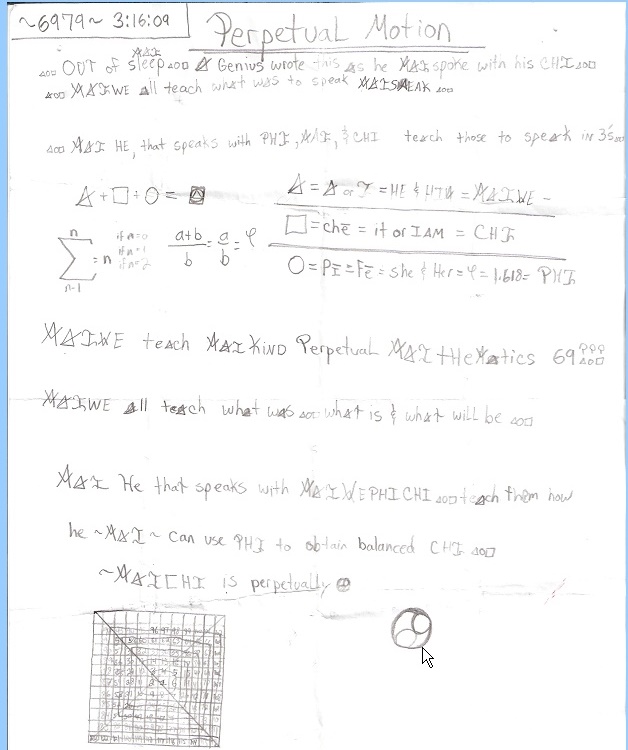

...regardless of which comes first, knowledge + wisdom equals ~consciousness~... ...to live in this conscious state... $elam must use PHI, to balance CHI

...bruce lee lived balancing CHI...he demonstated physical/CHI...

MAI will...must be demonstrating...psychological emphatic CHI

~Pisces1979~

I thought Wisdom comes first...(Dom-Wis) Dome from the head

...I can give you knowledge...although none can give wisdom...

...knowledge without wisdom is a curse...took me many nights to learn that...the only way to achieve wisdom is to collaborate with time...knowledge will find the one that has balanced time...

...before one balances their seven emotions(chi)... ...they must be approved by time...in order to use knowledge & wisdom...

...PHI DOES NOT NEED SELAM TO BALANCE CHI...Selam cannot balance CHI without PHI

PHI=female

CHI=children

MAIWE=males

...so...MAIWEPHICHI...

...decnalab ma i wonk uoy...

,,,,,,,Teach me your wisdom I want TO BE A GOD NOW!

...MAI wills MAIWE to get@MAI...

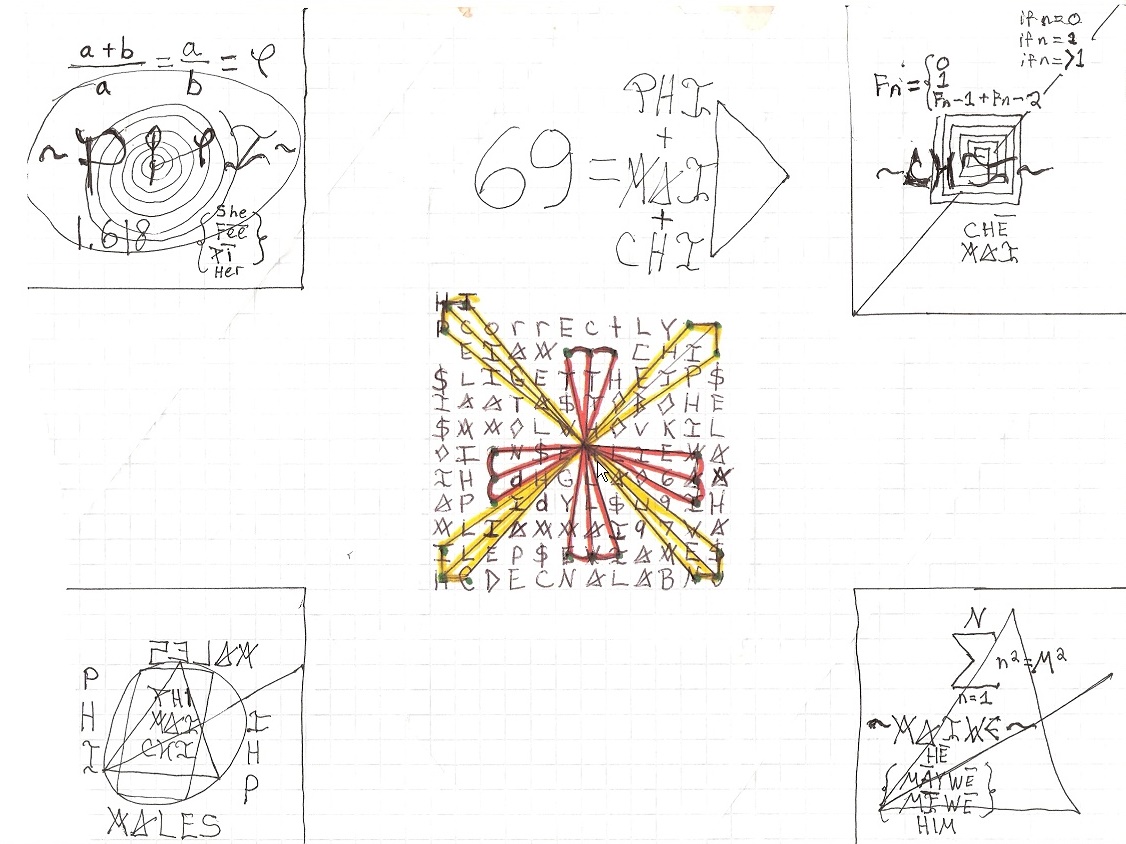

...on this day I born MAIIAMIAMMAtics...

...the infancy is now...which is not 2 b confused with what will be soon...

...a lie spreads faster than the truth...>>>

...even though lies spread faster...the truth travels @1.618 miles per hour...and contrary to popular belief...is faster than what was...

...those that teach end up learning more than those taught because while teaching the human mind is more open for mental variable change...

1+2+3=6...2+3+6=11..(888/69)

666+999=696969

...that is why I dont just want to teach... ...I need to teach...

...MAIWE teach together...open up to MAICHI phimales...

...maiphi + maichi = maiwe

maiwephichi... the era of we...iameraew

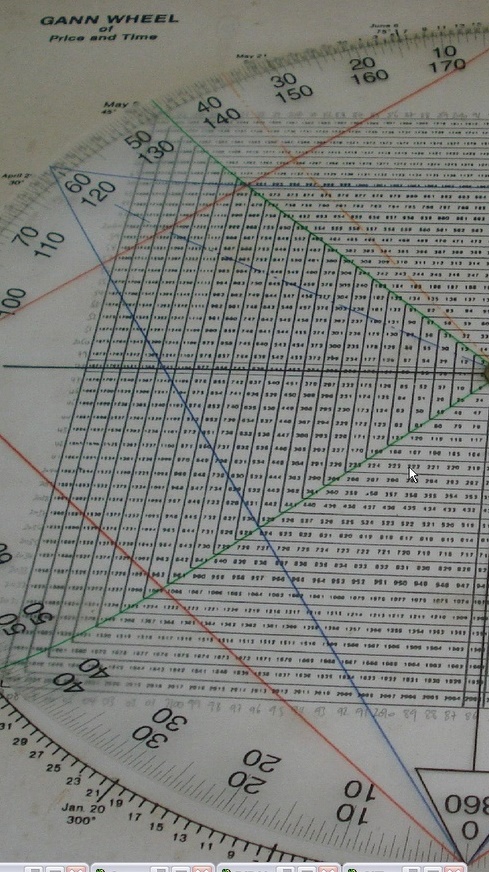

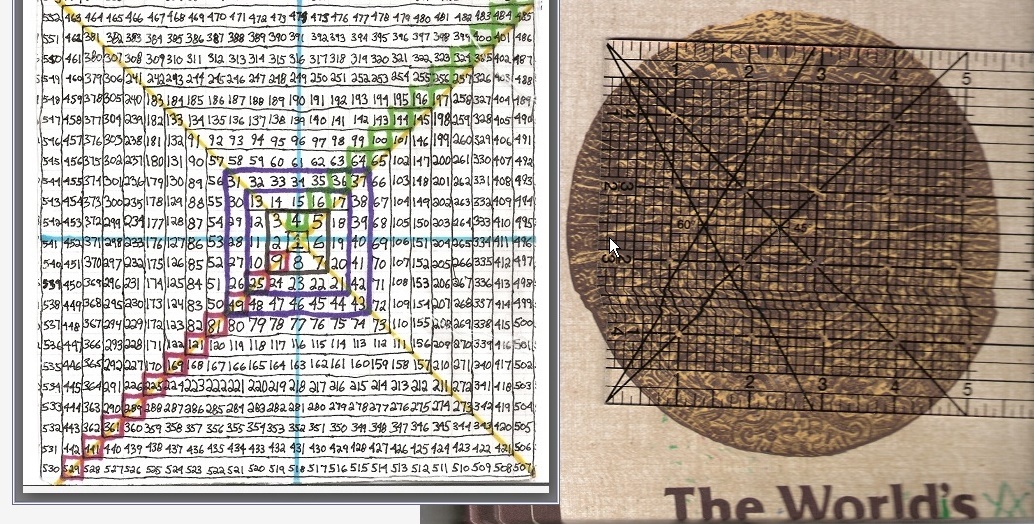

...MAI will's you to learn how to use the Gann grid...they do not teach...we teach....

...MAIWE get @ papers?!$!?...69...

...as we will the future towards our convenience...the pursuit of happiness is alive and well...

...CHIcre8ions... ...via... ...MAIWEPHICHI??????

...Leonardo & Lucas delivering perpetual maithematic game...~6979~

...he walked to the edge of the cliff...they followed him...

...he fell backwards off of the cliff... they jumped...

...they flew...

...the MAIIAM-IAMMATIC era is upon us...welcome...~6979~

READ MAI WILL!!!69!!!!

...YOU...you who laugh as they call swine to fly...fly to thy brother...fly to my other brother...fly to my father...

...you laugh as you deaf them...so maybe they will need a certain feeling in the future...a certain feeling that you get paid for...you see MAI speaks in 6's too...they saw-6...MAI saw-6was...

...you that laugh @ my AMERWECAN BROTHERS & SISTERS....will be crushed by the hand of GOD...I Am his messenger... as you have resurrected a MAITHAMATIC wizard...I was going to wait to share my mathematical findings...

...you see...your math = 2...MAI math = 3...1+2+3=6-11-20-37

...I will now share my findings on chalk boards all over the world...you that teach wrong...He HE HE HA HA HA...MAIWEPHICHI??? PHI =2 PHIMALES {& or taught females)..MAIWE =2 males....

MAIWE...is simply an understanding of MAIIAMIAMMATICS...saying that...I say MAIWE-teach-WAS-or lived-a-lesson...

...take religious authority...in gods name...

...welcome to the world of perpetual motion...IVE got the code...you cannot do this with out me...

MAIWE's third eye =2 CHI...the CHI like bruce lee...the blood of the PHImains is in me...

MAI-WE-PHI-CHI??? ...MAI MATH was spoken before the bible was wrote...MAISPEAK exists...I will teach them how to balance CHI...

...heres proof... ...if the devillived...then that means he was born...and if he was born...well...thats after MAITH/MATH...I will teach them all MAIIAMIAMATICS...you cannot stop me...he he he ha ha ha

...MAI brought you here to comprehend what is above...you must..overstand your previous understance...as a buddie of MAIN taught me...

...All 6 of my last post are = 1...MAISPEAK...MAIWETEACH...MAIIAMIAMATICS??? MAIWE...ARE we???

he he he ha ha ha

~filuminati~................................

...none of them called it huh...

Stock Market Investors Mindset of Guaranteed Economic Destruction

Stock-Markets / Stock Market Sentiment May 30, 2009 - 12:36 PM

By: LewRockwell

Stock-Markets

Diamond Rated - Best Financial Markets Analysis ArticleGary North writes: Most people will not change. Too radical. Not going with the flow. Not betting against the herd.

The best examples in the 20th century were Jews in Germany in 1933. They stayed. This included Jewish bankers, all of whom could have left. They thought they could deal with Hitler. They did not read Mein Kampf. They did not take it seriously.

About 7% did leave early: 38,000 out of 523,000. More left after 1938. By 1941, about 160,000 remained in Germany. Then emigration was closed by the Nazis. Earlier, it was encouraged. The data are here.

At some price, almost all could have left. There were countries that would have let them in. They would have had to learn a new language. They would have arrived in poverty. But Jews had faced those options ever since the Assyrian captivity in the eighth century B.C. So what?

They all would not have escaped the Nazis. Some would have moved to other European countries that were overrun by Germany after 1939. But they could have tried to get away. They stayed. They refused to acknowledge the warning signals. "It can't be that bad." It got worse.

Jews had an answer for worrywarts. "No problem. We can handle it."

The Armenians went through the same thing. The Turkish massacres of 1895 were a foretaste. Most stayed behind. Then came the genocide of 1915.

NO PROBLEM!

Look back at the economy in October 2007. The Dow was at 14,000. The banks were booming. Real estate was down a little, but the experts gave no warning. They were wrong. All of them.

The U.S. government is running a $1.8 trillion deficit this year. Federal tax receipts are down 34%, which means that the deficit will go above $2 trillion. No one cares. No one says, "This is the end. The American economy will never again be what it was."

Think "2007." Would you have believed that Chrysler and GM were both headed for bankruptcy? In October 2007 GM shares were at $43. Now they are at $1. There was an industry called investment banking. Bear Stearns, Lehman Brothers, and Goldman Sachs were not part of the commercial banking system. To survive, a few made the transition in September 2008. Some did not make the cut.

Merrill Lynch is gone. Bank of America and Citigroup were bailed out by the government. They would have gone under. They sell for a fraction of what they did in 2007.

And what do most people say? "No problem."

There is no problem for which their answer is not "no problem."

Medicare will go bust. Social Security will go bust. "No problem."

The unemployment rate keeps rising. "No problem."

When people refuse to face reality, because reality is going to be more painful than anything they have experienced, they look for signs that the problems they cannot avoid without changing are really not that bad. They look for offsetting good news.

They think the status quo ante will return. The U.S. government is about to spend another $30 billion to buy a dead carcass of a company. It has already spent $20 billion. "No problem."

The government will let the company stiff bondholders for $27 billion in exchange for 10% of the company, 72% owned by the government and 17% by the United Auto Workers medical insurance fund. "No problem."

Bondholders were originally told that it would take a 90% vote to authorize this. The government has changed the rules. It will determine after the May 30 vote by bondholders what percentage must approve. "No problem.

The company will never return to what it was. "No problem." People will not buy as many cars as before from a company run by the government and the United Auto Workers. "No problem."

The Dow rose 100 points on the rumor that the largest bondholders will accept the deal. The deal is a disaster, but investors are in "No problem" mode. Somehow, the wipeout is less of a wipeout.

Who is going to buy a GM car instead of a Japanese car? Here is a company that is about to break its contracts with thousands of its dealers. "No problem." Yet buyers are expected to trust a GM warranty.

Oldsmobile is gone. "No problem." Pontiac is going. "No problem." Cadillac sells its cars with an ad of a flash model putting the pedal to the medal. Hot stuff! The company thinks people with money will not see through this ad. The Cadillac division has lost its way. "No problem."

The price/earnings ratio for the S&P 500 is over 120. Traditionally, 20 was regarded a sell. The investor pays $120 on the hope that the stock will retain a dollar of earnings, and pay investors some minimal percentage of these earnings as dividends. "No problem."

We are watching the investment world adopting a lemming mentality that has always produced losses. "This time it's different. No problem."

CONSUMER CONFIDENCE

The Conference Board announced that consumer confidence is up to 55. The 50 figure is neutral. Yet consumer confidence is a lagging indicator historically. When it rises, the stock market usually falls.

The indicator is a reflection on what the stock market has done recently. To use consumer confidence as a justification for buying stocks is nonsense. This is like saying, "I will buy stocks because the public is confident, which based on the fact that stocks have risen." If that strategy worked, stocks would never stop rising.

Even hard-money newsletter readers are beginning to doubt that the recent good news is in fact "less worse than expected" bad news. This is the stuff of dreams that do not come true.

Readers look at the reports, and the reports look awful: falling home prices, rising unemployment, an astronomical Federal deficit. But the media say we are close to a bottom – the bottom of a crash that none of them forecasted.

Readers think, "by the standards of late 2007, what we are seeing daily was inconceivable." Optimists speak of a slow, weak recovery. Pessimists speak of hyperinflation and depression simultaneously. But as the chorus proclaims "No problem," the public mindlessly picks up this refrain.

"We have nothing to fear but . . . fear itself!" Yet as FDR delivered those words, Hitler was consolidating power in Germany. Stalin was beginning the purges. A quarter of the U.S. work force was unemployed. But Roosevelt began the refrain: "No problem." Four years later, unemployment was still 20%. The Federal deficit had ballooned. Happy days were not here again.

Your friends don't want to hear your pessimism anymore. They don't want to change. They will refuse to change.

In 1934, Ludwig von Mises realized that Hitler, an Austrian, would seek to bring Austria under German hegemony. He warned Jewish economists to leave. They had been his students at his famous seminar in Vienna. Fritz Machlup believed him, and came to the U.S. So did Gottfried Haberler. Mises went to Switzerland as a professor, leaving his great personal library behind. He fled to the U.S. in 1940, after France had fallen. He never got a full-time teaching job again.

A few listened. Most did not. "No problem."

HEARING, THEY WILL NOT HEAR

People count the costs of making a change. This is wise. Jesus taught:

For which of you, intending to build a tower, sitteth not down first, and counteth the cost, whether he have sufficient to finish it? Lest haply, after he hath laid the foundation, and is not able to finish it, all that behold it begin to mock him, Saying, This man began to build, and was not able to finish. Or what king, going to make war against another king, sitteth not down first, and consulteth whether he be able with ten thousand to meet him that cometh against him with twenty thousand? Or else, while the other is yet a great way off, he sendeth an ambassage [ambassador], and desireth conditions of peace (Luke 14:28–32).

In short, count the costs. This is what people have refused to do. They have counted the cost of doing something radical. It's high. They have counted the immediate cost of doing nothing new. It seems low. They prefer doing nothing.

But what about the long term? What about:

1. Retirement (no Social Security or Medicare)

2. The Federal Deficit ($1.8 trillion this year)

3. Federal Reserve's monetary base (doubled)

4. Falling house prices

5. Rising unemployment

6. The war in Afghanistan (forever, until our defeat)

"No problem!"

How do you reason with these people? Answer: you don't, if you value your time and your privacy. If you turn out to be wrong, you will be ridiculed or at least treated as a child. If you are correct, you will be hated. You will also be hit up for money. If you are a Christian, you will be told you are heartless. You will become a line of credit for those whose mantra was "No problem!"

They don't want to change. They will not change. They will not listen to you.

And when things turn out much worse than even most newsletter writers are forecasting, you will be hated. Are you prepared for this?

Do you have a real plan to deal with what is obviously an unfolding disaster: rising government ownership, massive deficits, rising unemployment, falling house prices, busted retirement pensions, rising interest rates (falling corporate bonds), and Federal Reserve inflation on a scale never seen in American history?

Or do you think you can delay. "No problem!"

CONCLUSION

We live in today's world. It's bad, but it's not a catastrophe. We must keep our heads above water.

A Tsunami is coming. In such a scenario, you have got to get out of the water and off the beach. But few people ever do, unless they have seen a tsunami. Few have.

Allocate some percent of your wealth to tsunami-avoidance. Do it quietly. Do not discuss this with your big-mouth brother-in-law.

What do you really think is likely to happen? Not what you would prefer will happen.

Think, "General Motors in October 2007"

Think Chrysler, Merrill Lynch, and Lehman Brothers.

No one saw it coming. It came.

Problems. Big, big problems.

Gary North [send him mail ] is the author of Mises on Money . Visit http://www.garynorth.com . He is also the author of a free 20-volume series, An Economic Commentary on the Bible .

http://www.lewrockwell.com

© 2009 Copyright Gary North - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

~BIDU~ ...chart analysis...

(Weekly):

1} ~BIDU~ has not had two down weeks since the beginning of the year...the start of the next correction will be defined by two weeks down or 2 out of three weeks down...

2} ~BIDU~ currently is at/has reached a long term descending trendline... (orange)

3)~BIDU~ currently is at/has reached the long-term 50% retracement,made up of its historic high & most recent low...

4)If it can break past its 50% retracement & the orange descending trendline, the new bullish target would be 303.63 (61.8% retracement level)

5)If it cannot break past these resistance levels,my bear target would be a retrace to 226.06 (32.8% retracement level)

...next week will be very telling,as the 50% retracement is a very important technical level which will usually support or resist...

Daily:

1)~BIDU~ has to be one of the most resilient & strongest stocks of the year...

2) The daily chart looks very strong...The indicators are toppy, but still could hover higher...

3)The daily shows a breakout,although noteworthy,volume has been weak (especially the last four days) as volume couldnt even break above it 50dma...

...additional note...this set up ,imo, is perfect for an OTM straddle...a conservative straddle (if there is such a thing) would be the july's...the aggressive straddle would be the june's...

Straddle structured via half the distance of the targets (both sides)...

calls = 280's

puts = 240's

...price @ time of this post is 263.80,5/30/09...

...~THC~ approaching an intersection / heavy cluster of resistances...

...360 degrees of resistance sloped @ .5 squared...

"...when time meets price...change is inevitable..."

W.D.Gann

...if that cant get it down..theres always the fundamentals...

P-E Ratio = 321

Dividend Yield NONE

Market Cap = $1.74 Bil

Profit Margin = -0.6%

Quarterly EPS % Chg. = 300%

Debt % = 4639%

Shares Outstanding = 479.9 Mil

Float = 470.3 Mil

~SQNM~ D/W/DD

Market Cap $200.00 Mil

Shares Outstanding = 61.1 Mil

Float = 46.5 Mil

05/27/2009 - Sequenom Inc. (SQNM) climbed 14% to $3.40. Lazard Capital Markets{below} upgraded Sequenom to hold from sell, saying that while the S.D.-based biotech firm ranks as a risky investment, the stock could shoot up to more than $20 a share if the company's new Down syndrome test is successful.

05/19/2009 -Federman & Sherwood Announces That a Securities Class Action Lawsuit Has Been Filed Against Sequenom, Inc. (NASDAQ: SQNM)

Posted 05/19/2009 12:19 PM ET

05/27/2009 -Holzer Holzer & Fistel, LLC Announces It Has Filed a Shareholder Class Action Against Sequenom, Inc. (NASDAQ: SQNM)

05/27/2009 -Drug stocks slump; Sequenom jumps on upgrade

About Lazard Capital Markets:LCM:

HISTORY

Lazard Capital Markets LLC was formed in 2005 concurrent with the recapitalization of Lazard Group LLC and initial public offering of Lazard Ltd. Headquartered in New York’s Rockefeller Center, we continue all of the capital markets activities formerly conducted by Lazard Frères & Co. LLC. Lazard Frères & Co. LLC, one of the world's preeminent financial advisory and asset management firms, operates from 39 cities across 21 countries in North America, Europe, Australia, Asia and South America. With origins dating back to 1848, the firm provides advice on mergers and acquisitions, restructuring and capital raising, as well as asset management services, to corporations, partnerships, institutions, governments and individuals.

SERVICES

Lazard Capital Markets provides research, sales & trading, and underwriting in the areas of equity, fixed income and convertible securities. As a separate entity, Lazard Capital Markets maintains a business alliance agreement with Lazard Group for the continuation of certain historical relationships. Pursuant to such business alliance, our clients are offered tailored advice, strategies and solutions to corporations and governments worldwide to facilitate their access to public and private capital.

Our relationships with leading institutional investors, including mutual funds, hedge funds, pension managers, government agencies, banks and insurance companies, have been earned over decades of providing premium service.

good morning Tony,

I looked at the weekly S&P chart to see the 17 week ave cycles...I couldnt find what this guy found...going from low to low,I counted 18 weeks and other #'s...I see what hes exploring and its interesting...

...I believe in cycles,but I also believe you shouldnt force a cycle if there isnt one...the same goes for Elliott Waves...if there isnt a true wave count,you shouldnt force one...

Good morning e, Key Market Reports and Commentary for Thursday

Thursday, May 28, 2009 8:15 AM

From:

"INO.com Morning" <morning@ino.com>

T H U R S D A Y M O R N I N G E X T R E M E M A R K E T S

A complimentary service from INO.com ( http://www.ino.com/ )

KEY EVENTS TO WATCH FOR:

Thursday, May 28, 2009

8:30 AM ET. May 23 Jobless Claims

Weekly Jobless Claims 625K 631K

Weekly Jobless Claims Net

Change -6K -12K

Continuing Jobless Claims 6662000

Continuing Jobless Claims Net

Change +75K

8:30 AM ET. April Durable Goods

Total Orders 0% -0.8%

Orders, Ex-Defense -0.6%

Orders, Ex-Transportation -0.6%

10:00 AM ET. April New Home Sales

Overall Sales 365K 356K

Percent Change +2.5% -0.6%

10:00 AM ET. May 16 DJ-BTMU Business Barometer 0%

10:30 AM ET. May 22 EIA Natural Gas Inventories, in billion cubic feet

Total Working Gas in Storage 2116

Total Working Gas in Storage

(Net Change) +103

11:00 AM ET. May Kansas City Fed Mfg Index –6

11:00 AM ET. May 22 US Energy Dept Oil Inventories

Crude Oil Stocks 368.52M

Crude Oil Stocks (Net Change) -900K -2.11M

Gasoline Stocks 203.95M

Gasoline Stocks (Net Change) -2M -4.34M

Distillate Stocks 148.13M

Distillate Stocks (Net Change) +1.2M +672K

Refinery Usage 82% 81.8%

12:00 PM ET. April Chicago Fed Midwest Mfg Index

Manufacturing Index (MoM) -2.4%

Manufacturing Index (YoY) -23.2%

Auto Output Index (MoM) +0.9%

Auto Output Index (YoY) -33.8%

Machinary Output Index (MoM) -5.5%

Machinary Output Index (YoY) -24.6%

Resource Output Index (MoM) -1.5%

Resource Output Index (YoY) -12.3%

Steel Output Index (MoM) -5.5%

Steel Output Index (YoY) -34.1%

4:30 PM ET. May 18 Money Supply

4:30 PM ET. May 27 Fed Discount Window Borrowings, in dollars

Primary Credit Borrowings 37.88B

Primary Credit Borrowings W/E

Daily Avg 38.16B

Primary Dealer Borrowings 0

Primary Dealer Borrowings W/E

Daily Avg 0

Discount Window Borrowings 126.35B

Discount Window Borrowings W/E

Daily Avg 127.93B

4:30 PM ET. May 27 Foreign Central Bank Holdings, in dollars

Foreign US Debt Holdings 2.72T

US Foreign Agency Holdings 818.01B

Foreign Treasury Holdings 1.9T

Key Events and Commentary available earlier every morning, via MarketClub (http://www.marketclub.com/)

The STOCK INDEXES http://quotes.ino.com/exchanges/?c=indexes

The June NASDAQ 100 closed lower on Wednesday due to profit taking as it consolidated some of Tuesday's rally. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends this week's rally, this month's high crossing at 1437.75 is the next upside target. Closes below the reaction low crossing at 1336.50 would confirm that a broad top has been posted while opening the door for a larger-degree decline into early-June. First resistance is today's high crossing at 1428.75. Second resistance is this month's high crossing at 1437.75. First support is Tuesday's low crossing at 1342.75. Second support is the reaction low crossing at 1336.50.

The June S&P 500 index closed lower on Wednesday due to profit taking as it consolidated some of Tuesday's rally. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are turning neutral signaling that sideways trading is possible near-term. From a broad perspective, June needs to close above 929.00 or below 875.40 to clear up near-term direction in the market. First resistance is today's high crossing at 913.80. Second resistance is last Wednesday's high crossing at 923.20. First support is Tuesday's low crossing at 876.90. Second support is the reaction low crossing at 875.40.

The Dow closed lower due to profit taking on Wednesday as it consolidated some of Tuesday's rally. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the reaction low crossing at 8230 would open the door for a larger-degree decline into early June. Closes above the reaction high crossing at 8591 are needed to renew this spring's rally and would thereby open the door for a possible test of January's high crossing at 9088. First resistance is last Wednesday's high crossing at 8591. Second resistance is January's high crossing at 9088. First support is the reaction low crossing at 8230. Second support is the 25% retracement level of the March-May rally crossing at 8066.

---------------------------------------------------------------------

A Mega-Trade Identified...Read this Special Report...

http://broadcast.ino.com/redirect/?linkid=995

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Norman Hallett, a colleague of mine who you likely know

from his work as the Internet's top authority on trading

disciplined, has just released a Special Report about...

"A Trade of Historic Proportions".

What you may not know about Norman is that he's been

a professional trader for 28 years... which is how most

of us in the trading circles first heard about him.

This "Historic" 12-page report is NOT to be missed...

**http://broadcast.ino.com/redirect/?linkid=995 **

What's SO different about this report is that Norman

lays out:

=> 3 Precise Trading Observations that, if adhered to,

will put you in a position to ride a long wave of trading

success.

=> How to clearly identify where you are in history and

how you can take that knowledge to the bank.

THEN... He lays out a COMPELLING trading scenario

that will have you immediately start taking the steps

necessary to benefit from what he considers the single

greatest trading opportunity of our generation!

Here's where to get the "Historic" report (and it's

complimentary)...

**http://broadcast.ino.com/redirect/?linkid=995 **

---------------------------------------------------------------------

---------------------------------------------------------------------

INTEREST RATES http://quotes.ino.com/exchanges/?c=interest

June T-bonds closed down 1-31/32's at 116-22.

June T-bonds closed sharply lower on Wednesday and below the 75% retracement level of the October-December rally crossing at 118-04. The low-range close sets the stage for a steady to lower opening on Thursday. If June extends this week's decline, the 87% retracement level of the October-December rally crossing at 114-14 is the next downside target. Closes above last Monday's high crossing at 123-18 are needed to confirm that a short-term low has been posted. First resistance is the 10-day moving average crossing at 120-32. Second resistance is last Monday's high crossing at 123-18. First support is today's low crossing at 117-01. Second support is the 87% retracement level crossing at 114-14. ENERGY MARKETS http://quotes.ino.com/exchanges/?c=energy

July crude oil closed higher on Wednesday as it extends this spring's rally. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends the rally off April's low, the 25% retracement level of the 2008-2009 decline crossing at 68.49 is the next upside target. Closes below the 20-day moving average crossing at 58.54 would confirm that a short-term top has been posted. First resistance is today's high crossing at 63.82. Second resistance is the 25% retracement level crossing at 68.49. First support is the 10-day moving average crossing at 60.57. Second support is the 20-day moving average crossing at 58.54.

July heating oil closed higher on Wednesday and above the upper end of this spring's trading range crossing at 156.91. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends this month's rally, January's high crossing at 171.10 is the next upside target. Closes below the 20-day moving average crossing at 150.33 are needed to confirm that a short-term top has been posted. First resistance is today's high crossing at 160.00. Second resistance is January's high crossing at 171.10. First support is the 10-day moving average crossing at 153.43. Second support is the 20-day moving average crossing at 150.33.

July unleaded gas closed higher on Wednesday as it extended the breakout above the 25% retracement level of the 2008-2009 decline crossing at 177.78. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought but are neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends this spring's rally, the reaction high crossing at 188.30 is the next upside target. Closes below the 20-day moving average crossing at 167.67 would confirm that a short-term top has been posted. First resistance is today's high crossing at 186.17. Second resistance is the reaction high crossing at 188.30. First support is the 10-day moving average crossing at 176.04. Second support is the 20-day moving average crossing at 167.67.

July Henry natural closed slightly higher due to short covering on Wednesday as it consolidates some of last week's decline. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are oversold but remain bearish signaling that sideways to lower prices are possible near-term. If July extends last week's decline, April's low crossing at 3.395 is the next downside target. Closes above the 10-day moving average crossing at 4.013 are needed to confirm that a short-term low has been posted. First resistance is the 20-day moving average crossing at 4.004. Second resistance is the 10-day moving average crossing at 4.013. First support is Tuesday's low crossing at 3.500. Second support is April's low crossing at 3.395. CURRENCIES

The June Dollar closed higher due to short covering on Wednesday as it consolidated some of this month's decline. The mid-range close sets the stage for a steady opening on Thursday. Stochastics and the RSI are oversold but remain neutral to bearish signaling that additional weakness is possible near-term. If June extends this month's decline, weekly support crossing at 78.77 is the next downside target. Multiple closes above the 20-day moving average crossing at 82.46 are needed to confirm that a short-term low has been posted. First resistance is the 10-day moving average crossing at 81.28. Second resistance is the 20-day moving average crossing at 82.46. First support is last Friday's low crossing at 79.90. Second support is weekly support crossing at 78.77.

The June Euro closed lower due to profit taking on Wednesday as it consolidates some of last week's rally. The mid-range close sets the stage for a steady opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends this month's rally, the reaction high crossing at 142.910 is the next upside target. Closes below the 20-day moving average crossing at 135.786 would confirm that a short-term top has been posted. First resistance is last Friday's high crossing at 140.480. Second resistance is the reaction high crossing at 142.910. First support is the 10-day moving average crossing at 137.505. Second support is the 20-day moving average crossing at 135.786.

The June British Pound closed higher on Wednesday and above the 38% retracement level of the 2008-2009-decline crossing at 1.5998 as it extends this spring's rally. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off April's low, the 50% retracement level of the 2008-2009 decline crossing at 1.6733 is the next upside target. Closes below the 20-day moving average crossing at 1.5307 would confirm that a short-term top has been posted. First resistance is today's high crossing at 1.6084. Second resistance is the 50% retracement level crossing at 1.6733. First support is the 10-day moving average crossing at 1.5586. Second support is the 20-day moving average crossing at 1.5307.

The June Swiss Franc closed lower due to profit taking on Wednesday as it consolidated some of last week's rally. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off April's low, the 75% retracement level of last fall's rally crossing at .9259 is the next upside target. Closes below the 20-day moving average crossing at .8989 would confirm that a short-term top has been posted. First resistance is today's high crossing at .9251. Second resistance is the 75% retracement level crossing at .9259. First support is the 10-day moving average crossing at .9089. Second support is the 20-day moving average crossing at .8989.

The June Canadian Dollar closed slightly lower on Wednesday as it consolidates above the 50% retracement level of the 2008-2009 decline crossing at 89.07. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off March's low, the 62% retracement level of the 2008-2009 decline crossing at 91.99 is the next upside target. Closes below the 20-day moving average crossing at 86.17 would confirm that a short-term top has been posted. First resistance is today's high crossing at 90.12. Second resistance is the 62% retracement level crossing at 91.99. First support is the 10-day moving average crossing at 87.18. Second support is the 20-day moving average crossing at 86.17.

The June Japanese Yen closed lower on Wednesday as it consolidated some of last week's rally. The mid-range close sets the stage for a steady opening on Thursday. Stochastics and the RSI are overbought and are turning neutral hinting that a short-term top might be in or is near. Closes below the 20-day moving average crossing at .10338 would confirm that a short-term top has been posted. If June renews this month's rally, March's high crossing at .10703 is the next upside target. First resistance is last Friday's high crossing at .10657. Second resistance is March's high crossing at .10703. First support is the 20-day moving average crossing at .10338. Second support is the reaction low crossing at .10025. NEW! INO TV - http://tv.ino.com/ - Watch From Your Computer - Avoiding Common Trading Pitfalls by Mark Cook. In this fast-paced video, trading champion Mark Cook shares his ideas for making winning trades. As the first place finisher in the options division of the U.S. Investing Championship, Mark credits research, planning and an attention to detail for his astounding 536% return. http://tv.ino.com/

PRECIOUS METALS http://quotes.ino.com/exchanges/?c=metals

August gold closed lower due to profit taking on Wednesday as it consolidated some of this month's rally. A late-session rally tempered early losses and the mid-range close sets the stage for a steady opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If August extends the rally off April's low, the reaction high crossing at 971.00 is the next upside target. Closes below the 20-day moving average crossing at 924.40 would temper the near-term bullish outlook. First resistance is last Friday's high crossing at 964.60. Second resistance is the reaction high crossing at 991.00. First support is the 10-day moving average crossing at 940.50. Second support is the 20-day moving average crossing at 924.40.

July silver closed higher on Wednesday as it extends the rally above the 50% retracement level of last summer's decline crossing at 14.355. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought and are turning neutral to bearish hinting that a short-term top might be in or is near. Closes below the 20-day moving average crossing at 13.841 are needed to confirm that a short-term top has been posted. If July extends this spring's rally, the 62% retracement level crossing at 15.662 is the next upside target. First resistance is today's high crossing at 15.020. Second resistance is the 62% retracement level crossing at 15.662. First support is the 10-day moving average crossing at 14.288. Second support is the 20-day moving average crossing at 13.841.

July copper closed lower due to profit taking on Wednesday while extending this spring's symmetrical triangle. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are turning bullish hinting that sideways to higher prices are possible near-term. Closes above the reaction high crossing at 221.70 are needed to renew the rally off the late-April low. First resistance is today's high crossing at 215.90. Second resistance is the reaction high crossing at 221.70. First support is the reaction low crossing at 196.70. Second support is the reaction low crossing at 190.05. FOOD & FIBER http://quotes.ino.com/exchanges/?c=food

July coffee posted a downside reversal due to profit taking on Thursday as it consolidated some of this spring's rally. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought and are turning bearish hinting that a short-term top might be in or is near. Closes below the 20-day moving average crossing at 12.75 would confirm that a short-term top has been posted. If July extends this spring's rally, the 50% retracement level of the 2008-2009 decline crossing at 14.42 is the next upside target.

July cocoa closed sharply higher on Wednesday thereby renewing last week's rally. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI remain bullish signaling that sideways to higher prices are possible near-term. If July extends this week's rally, April's high crossing at 27.96 is the next upside target. Closes below the 10-day moving average crossing at 23.66 would signal that a short-term top has been posted. Closes below the reaction low crossing at 22.62 would renew this spring's decline.

July sugar posted an inside day with a lower close on Wednesday but remains above the 10-day moving average crossing at 15.54. The mid-range close set the stage for a steady opening on Thursday. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If July renews this spring's rally, weekly resistance crossing at 16.34 is the next upside target. Closes below the 20-day moving average crossing at 15.32 would confirm that a short-term top has been posted.

July cotton posted an inside day with a higher close on Wednesday as it consolidated some of Tuesday's decline but remains below the 20-day moving average crossing at 57.38. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI remain bearish signaling that sideways to lower prices are possible near-term. If July extends Tuesday's decline, the reaction low crossing at 52.66 is the next downside target. Closes above the 20-day moving average crossing at 57.38 would confirm that a short-term low been posted. The Real Secret of Systems Trading And Trial of Trading Blox. Trading Blox is a powerful, professional software system which allows you to create, text, and implement your own

mechanical trading system.

Complimentary Trial:

http://www.ino.com/specials/148A68/wisdom/blox.html

GRAINS http://quotes.ino.com/exchanges/?c=grains

July Corn closed down 1 1/2-cents at 4.26.

July corn posted an inside day with a lower close on Wednesday due to profit taking while extending the consolidation pattern of the past 10-days. Rain expanded across much of Illinois yesterday and moved in Ohio and Indiana today. This is causing further planting delays in the Eastern Corn Belt, which provided underlying support to the corn market today. Additional support came from solid gains in the wheat market, where supply concerns are growing for the 2009 crop. Some analyst's project that corn could lose from 1.5 to 2.5 million acres due to planting delays, which will continue to support both old and new-crop corn near-term. There will be another break ahead of the next rain event, although the models disagree on the length of this window. The American GFS solutions bring a better chance for weekend showers into portions of Illinois, Indiana and Ohio than does the European model. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are neutral signaling that sideways trading is possible near-term. If July renews this spring's rally, January's high crossing at 4.48 is the next upside target. Closes below the 20-day moving average crossing at 4.18 1/2 would confirm that a seasonal top has been posted. First resistance is last Wednesday's high crossing at 4.34 3/4. Second resistance is January's high crossing at 4.48. First support is Tuesday's low crossing at 4.21 3/4. Second support is the 20-day moving average crossing at 4.18 1/2.

July wheat closed up 13 3/4-cents at 6.25 3/4.

July wheat closed higher on Wednesday as it extends this month's rally. Droughty conditions continue to linger in portions of north-central and southwestern Kansas, eastern Nebraska and southeastern Colorado, causing some yield loss in up to 25% of the Plains winter wheat belt. Early harvest results are very poor in Oklahoma and Texas, due to drought and freeze damage. However, the bulk of the freeze damage still lies north of areas currently seeing active cutting. Many Oklahoma and Texas producers are telling their customer harvesters to stay north; there's simply not enough wheat to make the trip south worthwhile. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends this spring's rally, the reaction high crossing at 6.31 is the next upside target. Closes below the 20-day moving average crossing at 5.81 1/4 would confirm that a short-term top has been posted. First resistance is today's high crossing at 6.29. Second resistance is the reaction high crossing at 6.31. First support is the 10-day moving average crossing at 5.98. Second support is the 20-day moving average crossing at 5.81 1/4.

July Kansas City Wheat closed up 12 3/4-cents at 6.75.

July Kansas City Wheat closed higher on Wednesday extending this month's rally. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought but are neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends this spring's rally, January's high crossing at 6.90 is the next upside target. Closes below the 10-day moving average crossing at 6.49 1/4 would signal that a short-term top has been posted. First resistance is today's high crossing at 6.78. Second resistance is January's high crossing at 6.90. First support is the 10-day moving average crossing at 6.49 1/4. Second support is the 20-day moving average crossing at 6.29 3/4.

July Minneapolis wheat closed up 25-cents at 7.79 3/4.

July Minneapolis wheat closed sharply higher on Wednesday as it extends last Friday's rally. Planting delays for this year's spring wheat crop continue to underpin the market and the high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought but remain bullish signaling that sideways to higher prices are possible near-term. If July extends this spring's rally, the 38% retracement level of last summer's decline crossing at 8.11 1/4 is the next upside target. Closes below the 20-day moving average crossing at 7.05 3/4 are needed to confirm that a short-term top has been posted. First resistance is today's high crossing at 7.81 1/2. Second resistance is the 38% retracement level crossing at 8.11 1/4. First support is the 10-day moving average crossing at 7.30 3/4. Second support is the 20-day moving average crossing at 7.05 3/4.

SOYBEAN COMPLEX

July soybeans closed up 1 1/2-cents at 11.87.

July soybeans closed higher on Wednesday as it extends this spring's rally. Profit taking tempered early gains after the market tested psychological resistance crossing at 12.00. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought but are neutral to bullish signaling that sideways to higher prices are possible. If July extends this spring's rally, the 50% retracement level of last summer's decline crossing at 12.23 is the next upside target. Close below the 20-day moving average crossing at 11.26 3/4 would confirm that a top has been posted. First resistance is today's high crossing at 12.00. Second resistance is the 50% retracement level crossing at 12.23. First support is the 10-day moving average crossing at 11.59 3/4. Second support is the 20-day moving average crossing at 11.26 3/4.

July soybean meal closed down $3.80 at $386.20.

July soybean meal closed lower due to profit taking on Wednesday as it consolidated some of Tuesday's rally but remains above the 75% retracement level of last summer's decline crossing at 384.40. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that additional strength is possible near-term. If July extends this spring's rally, the 87% retracement level of last summer's decline crossing at 408.40 is the next upside target. Close below the 20-day moving average crossing at 356.00 would confirm that a short-term top has been posted. First resistance is today's high crossing at 392.50. Second resistance is the 87% retracement level crossing at 408.40. First support is the 10-day moving average crossing at 371.80. Second support is the 20-day moving average crossing at 356.00.

July soybean oil closed up 6-cents at 37.81.

July soybean oil closed slightly higher on Wednesday as it consolidated some of Tuesday's decline but remains below the 20-day moving average crossing at 38.25. The mid-range close sets the stage for a steady opening on Thursday. Stochastics and the RSI remain bearish signaling that sideways to lower prices are possible near-term. If June extends the decline, the 38% retracement level of this spring's rally crossing at 36.24 is the next downside target. Closes above the reaction high crossing at 38.92 are needed to confirm that a short-term low has been posted. First resistance is the 20-day moving average crossing at 38.25. Second resistance is the reaction high crossing at 38.92. First support is Tuesday's low crossing at 37.42. Second support is the 38% retracement level crossing at 36.24. LIVESTOCK http://quotes.ino.com/exchanges/?c=livestock

July hogs closed down $0.40 at $67.17.

July hogs closed lower on Tuesday and spiked below the previous reaction low crossing at 66.50. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI remain bearish signaling that sideways to lower prices are possible near-term. If July extends this week's decline, weekly support crossing at 65.25 is the next downside target. Closes above the 20-day moving average crossing at 68.48 are needed to confirm that a low has been posted. First resistance is the 10-day moving average crossing at 68.00. Second resistance is the 20-day moving average crossing at 68.48. First support is today's low crossing at 66.45. Second support is weekly support crossing at 65.25.

July bellies closed up $0.23 at $72.65.

July bellies closed higher on Wednesday and the mid-range close sets the stage for a steady opening on Thursday. Stochastics and the RSI are turning bullish signaling that a short-term low might be in or is near. Closes above the 20-day moving average crossing at 75.63 are needed to confirm that a short-term low has been posted. If July renews this spring's decline, weekly support crossing at 68.25 is the next downside target. First resistance is today's high crossing at 73.50. Second resistance is the 20-day moving average crossing at 75.63. First support is last Thursday's low crossing at 69.600. Second support is weekly support crossing at 68.25.

August cattle closed down $0.72 at 83.10.

June cattle closed lower on Wednesday as it extends this year's trading range. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI remain bullish signaling that sideways to higher prices are possible near-term. Closes above 86.35 or below 80.70 are needed to confirm a trading range breakout and point the direction of the next trending move. First resistance is the reaction high crossing at 84.40. Second resistance is the reaction high crossing at 85.82. First support is the reaction low crossing at 82.02. Second support is the reaction low crossing at 81.60.

August feeder cattle closed down $0.12 at $102.45.

May Feeder cattle closed lower on Wednesday due to profit taking after spiking above April's high crossing at 102.80. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If August extends this month's rally, last November's high crossing near 103.70 is the next upside target. Closes below the 20-day moving average crossing at 100.77 would temper the friendly outlook in the market. _____________________________________________________________________

T H A N K Y O U

_____________________________________________________________________

Thank you for subscribing to the Morning Extreme Markets from INO.com

( http://www.ino.com/ ). If you want to subscribe to our other email

services, or would like to modify your profile please visit

http://www.ino.com/email/.

To subscribe a friend, visit:

http://www.ino.com/email/

Copyright 2008 INO.com. All Rights Reserved.

6979 yepper I'v heard of cycles......7 day......15 day

I never heard of that one though, a 17 day cycles, humm!

Please explain to me I am a ding bat when it comes to 17 day cycles,lol If you have time after market close do a S & P 500 chart.

Do you know about this cycle in the S & P 500? (new video)

Tuesday, May 26, 2009 12:40 PM

please click here to watch the short video.

http://broadcast.ino.com/education/sp_500_17week_cycle/

From:

"INO.com Mid-Week Special" <daily@ino.com>

I was just looking at the S&P 500 and I noticed a very pronounced cycle in this market that I want to share with you.

http://broadcast.ino.com/education/sp_500_17week_cycle/

In my new video I explain exactly what I've seen and what I expect will happen to this market if this cycle continues on track.

You can view this new video with my compliments. There are no registration requirements. Please enjoy and give your feedback on our blog. Thank you.

All the best,

http://broadcast.ino.com/education/sp_500_17week_cycle/

Adam Hewison

President, INO.com

Co-creator, MarketClub

AEHI = nuclear power plant in Idaho and waiting for zoning vote released July 1. Made/making big local news in Idaho over it. If the zoning is approved, the news should go national and bring massive exposure to the stock. Way off radar for now.

AEHI is the only public nuclear power company.

Website: http://www.alternateenergyholdings.com/

OS: 79 million

Float: 51 million

http://finance.yahoo.com/q/ks?s=AEHI.PK

Key Media News:

Hundreds attend nuke hearing

http://www.mountainhomenews.com/story/1533611.html

Zoning of Proposed Nuclear Plant a Hot Issue

http://www.ktvb.com/news/business/stories/ktvbn-apr2309-nuclear_plant_hearing.10288afc7.html

Nuke Plant Hearing Stalled on Comment Process

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37438799

Nuclear Power Job Fair Draws Criticism

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37438548

Approve it, with conditions

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37438272

KEY RECENT COMPANY PRs:

"AEHI Supporters Pack Rezone Hearing for Idaho Nuclear Plant "

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37437739

"AEHI Is the Only Publicly Traded Company Proposing a Free Market Advanced Nuclear Generating Company for US"

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37437654

"AEHI Is Now a Fully Reporting Public Company to the SEC" <~~~~uplisting soon?

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37437584

I can't emphasize enough the risk here -- if the vote is turned down the stock could get destroyed in price.

If the proposal is accepted, however, it should make national news (already making a lot of local news) and potentially launch the stock many fold. It trades very thin it seems down here as it is.

JMO

thanks for the video Tony...

...no I wasnt aware of that 17 week(ave) potential cycling...I will be watching that as well..interesting...

6979 Do you know about this cycle in the S & P 500? (new video)

Tuesday, May 26, 2009 12:40 PM

http://broadcast.ino.com/education/sp_500_17week_cycle/

From:

"INO.com Mid-Week Special" <daily@ino.com>

I was just looking at the S&P 500 and I noticed a very pronounced cycle in this market that I want to share with you.

http://broadcast.ino.com/education/sp_500_17week_cycle/

In my new video I explain exactly what I've seen and what I expect will happen to this market if this cycle continues on track.

You can view this new video with my compliments. There are no registration requirements. Please enjoy and give your feedback on our blog. Thank you.

All the best,

http://broadcast.ino.com/education/sp_500_17week_cycle/

Adam Hewison

President, INO.com

Co-creator, MarketClub

~BIDU~ FiLuMinati Matrix...

congrats on the ~TWB~ call...I've been watching...

EGMI -- 3 bags down, 17 bags to go:

Posted by: Rawnoc Date: Monday, December 15, 2008 9:13:46 AM

In reply to: None Post # of 1777

EGMI potential 20+ bagger IMO. They are debt-free, cash rich, making money hand over fist every quarter and growing rapidly. Guidance, which they always seem to beat, is +.10 for 2008, +.14 for 2009 (40% growth) while forecasting long term they expect growth to be "more aggressive than 40%."

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33494172

With a PE of less than 3 for 2009, EGMI is a mega-bagger in the marking IMO.

(1) Recently, Lord Steinberg has been appointed as Executive Chairman of the Board. He has a very impressive background in the gaming industry. His contacts and industry experience are likely to expand EGMI's growth. In addition, he has been buying large blocks of shares in the open market.

http://investorshub.advfn.com/boards/read_msg.aspx?Message_id=29832911

(2) EGMI recently signed a five-year licensing agreement for distribution into Native American Indian-owned Casinos and Lotteries. It implies approximately an additional $0.02 in pre-tax earnings for 2009. This may not be factored into the guidance identified above:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=32191035

(3) EGMI has an investment in a mobile phone company that may provide a sizeable gain as they have plans to IPO in the near future.

(4) EGMI is expanding into games and toys. Their first product in this area is a game for the very popular children's series "Thomas and Friends."

http://investorshub.advfn.com/boards/read_msg.aspx?Message_id=30699277

(5) EGMI is considering a stock buyback program due to the fact that they are sitting ontop of so much cash.

(info taken from conference call)

(6) Electronic Game Card Started At Buy By Roth Cap

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=33515746

More EGMI DD & INFO:

http://investorshub.advfn.com/boards/board.aspx?board_id=6737&mdc=25583

In case you missed it: Mackespeak......lol

welcome SumTingWong, this is what I think .gov's underlying message is for this weekend...

... that the government really has given {the powerful, struggling, fundamentally invalid,too big to fails} what it can give, for now in terms of money/capital...if the markets cannot act at least "a little healthy" after such an influx of fresh government capital...then...for now...the markets will just have to be content falling...

...if the market decides to allow stocks lower from here...it will almost appear (to average retail & advanced traders alike) as if all the recent government attempts to fix..change..protect..alter..intervene..prevent..manipulate..organize..get a clue about.. (and/or whatever other relevant synonymous adjective's that Im leaving out) the market will at that point suggest that the .gov's intervention tactics ARE..NOT..WORKING...

...It will be at that time that I expect a fresh mass wave of frustration,childish finger-pointing/blame and ultimately more protective continued, mass market liquidation..which could later be described/taught/expressed by some future influential educational heads as,...

...painful-lessons-of-the-horribly timed-but-at-the-time-thought-responsible---De-leveraging effects of the Millenium crash of '08 ...

...soon after..a much higher percent of financial hopelessness will reside across the ill-anticipatory financially exposed longs...

...If I were long stocks now...I always ask myself where I would put my stops...chart after chart,I am seeing/measuring/projecting many important mental-swing-stop-targets that have already been hit...

...what comes next in the markets, IMO ,will be more about human nature than about what any organized intervening entity announces...human nature as it is now,(as the stars are lined up at the moment) is conditioned towards instinctual, unconscious,as well as protective basis reduction and natural profit taking ...

...recent, past volatility combined with recovering fear and growing uncertainty, will later(= now) equate to higher levels of consciousness & conservatism...the psychological dominoes have been tipped over...& now must be properly measured & interpreted, in advance ,using 100% depth perception skills ...

...traders note...If a trader rides a stock from $5 to 20$, starts to see weakness,and does not react by way of taking strategic profits...then that trader will deservedly give much more profit back...(and possibly some initial capital)...

...there must be a calculated,pre-meditated % limit to each unique individuals give-back-risk-allowance...

or...willingness to give back...

Out of money ?? What is the current value of gold??

he United States Bullion Depository Fort Knox, Kentucky

Amount of present gold holdings: 147.3 million ounces.

The only gold removed has been very small quantities used to test the purity of gold during regularly scheduled audits. Except for these samples, no gold has been transferred to or from the Depository for many years.

The gold is held as an asset of the United States at book value of $42.22 per ounce.

The Depository opened in 1937; the first gold was moved to the depository in January that year.

Highest gold holdings this century: 649.6 million ounces (December 31, 1941).

Size of a standard gold bar: 7 inches x 3 and 5/8 inches x 1 and 3/4 inches.

Weight of a standard gold bar: approximately 400 ounces or 27.5 pounds.

Construction of the depository:

Building materials used included 16,000 cubic feet of granite, 4,200 cubic yards of concrete, 750 tons of reinforcing steel, and 670 tons of structural steel.

The cost of construction was $560,000 and the building was completed in December 1936.

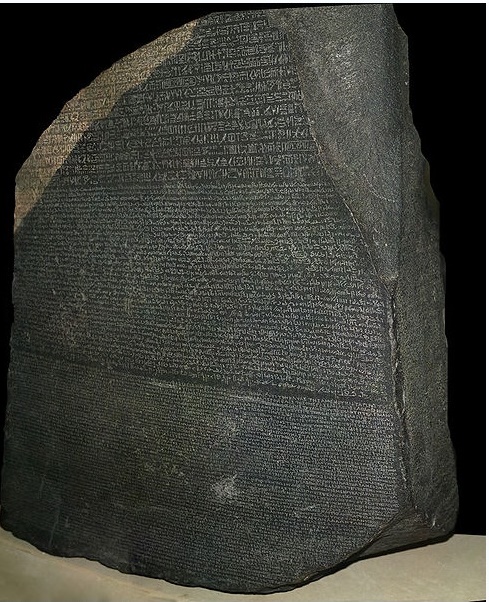

In the past, the Depository has stored the Declaration of Independence, the U.S. Constitution, the Articles of Confederation, Lincoln's Gettysburg address, three volumes of the Gutenberg Bible, and Lincoln's second inaugural address.

In addition to gold bullion, the Mint has stored valuable items for other government agencies. The Magna Carta was once stored there. The crown, sword, scepter, orb, and cape of St. Stephen, King of Hungary also were stored at the Depository, before being returned to the government of Hungary in 1978.

The Depository is a classified facility. No visitors are permitted, and no exc

...scouting for shorts...~EAT~

~EATRC~ = june 15 puts .45 x .55 (28 days left)

~EATSV~ = july 12.5 puts .25 x .35 (56 days left)

~TBT~ ..link back for ~TBT~ $ ~PST~

ABIO is down because it's risen very high in anticipation of the FDA ruling, and it laid off 40 employees and will take a charge for that.. but touching ABIO long or short now is just a risky bet on what the FDA will do.

Arca biopharma (NASDAQ:ABIO): Gencaro (bucindolol) NDA for the treatment of chronic heart failure with a PDUFA decision date of 5/31/09 (please note this date is a Sunday so Monday 6/1 is the more likely date for an announcement or update on the FDA decision). ABIO also has a collaboration with LabCorp (LH) and a pending PMA for a genetic test which is designed to be used in conjunction with Gencaro. ABIO has identified genetic traits which the Company believes will predict patient responses to the drug and hopes to launch both as a personalized medicine combination to optimize treatment outcomes

ARCA is a biopharmaceutical company whose principal focus is developing genetically-targeted therapies for heart failure and other cardiovascular diseases.

ARCA’s lead product candidate is GencaroTM (bucindolol hydrochloride), a pharmacologically unique beta-blocker and mild vasodilator, which is under review by the U.S. Food and Drug Administration, or FDA, for chronic heart failure, or HF. Gencaro is an oral tablet formulation, dosed twice daily. ARCA has identified common genetic variations, or genetic markers, that it believes predicts patient response to Gencaro. Subject to approval by the FDA, ARCA, through its collaboration with Laboratory Corporation of America, or LabCorp, anticipates introducing a test for these genetic markers with the market launch of Gencaro, potentially making Gencaro the first genetically-personalized cardiovascular drug. When prescribed using the test for these markers, ARCA believes that Gencaro can become an important new therapy for many HF patients, with the potential for positive clinical outcomes in a defined genetic subpopulation, and good tolerability. Gencaro was the subject of a major North America based heart failure Phase III trial, known as BEST, which ARCA believes will provide the primary basis for the FDA’s determination on the approvability of Gencaro in the U.S. In September 2008, the FDA formally accepted for filing ARCA’s New Drug Application, or NDA, for Gencaro as a potential treatment for HF. In accordance with the Prescription Drug User Fee Act, or PDUFA, the FDA’s goal is to complete its review of the Gencaro NDA by May 31, 2009.

As previously noted in ARCA’S Annual Report on Form 10-K, the regulatory approval process for the Gencaro NDA is expensive and time-consuming and subject to the risk that the FDA may determine that the available clinical data for Gencaro are not sufficiently strong to demonstrate Gencaro’s safety and efficacy. Any such determination could prevent or delay regulatory approval and commercialization of Gencaro. As part of the FDA review of the NDA, ARCA has had extensive interactions with, and has recently provided substantial supplemental information to the FDA. The submission of this or additional information could result in an extension of the review of the Gencaro NDA beyond the May 31, 2009 PDUFA date.

...this alone can set the stage for tuesday...Im glad I held my puts...

Posted by: RULiquid Date: Saturday, May 23, 2009 3:41:33 PM

WOW Obama says 'WE'RE OUT OF MONEY'

Sat May 23 2009 10:32:18 ET

In a sobering holiday interview with C-SPAN, President Obama boldly told Americans: "We are out of money."

C-SPAN host Steve Scully broke from a meek Washington press corps with probing questions for the new president.

SCULLY: You know the numbers, $1.7 trillion debt, a national deficit of $11 trillion. At what point do we run out of money?

OBAMA: Well, we are out of money now. We are operating in deep deficits, not caused by any decisions we've made on health care so far. This is a consequence of the crisis that we've seen and in fact our failure to make some good decisions on health care over the last several decades.

So we've got a short-term problem, which is we had to spend a lot of money to salvage our financial system, we had to deal with the auto companies, a huge recession which drains tax revenue at the same time it's putting more pressure on governments to provide unemployment insurance or make sure that food stamps are available for people who have been laid off.

So we have a short-term problem and we also have a long-term problem. The short-term problem is dwarfed by the long-term problem. And the long-term problem is Medicaid and Medicare. If we don't reduce long-term health care inflation substantially, we can't get control of the deficit.

So, one option is just to do nothing. We say, well, it's too expensive for us to make some short-term investments in health care. We can't afford it. We've got this big deficit. Let's just keep the health care system that we've got now.

Along that trajectory, we will see health care cost as an overall share of our federal spending grow and grow and grow and grow until essentially it consumes everything...

SCULLY: When you see GM though as “Government Motors,” you're reaction?

OBAMA: Well, you know – look we are trying to help an auto industry that is going through a combination of bad decision making over many years and an unprecedented crisis or at least a crisis we haven't seen since the 1930's. And you know the economy is going to bounce back and we want to get out of the business of helping auto companies as quickly as we can. I have got more enough to do without that. In the same way that I want to get out of the business of helping banks, but we have to make some strategic decisions about strategic industries...

SCULLY: States like California in desperate financial situation, will you be forced to bail out the states?

OBAMA: No. I think that what you're seeing in states is that anytime you got a severe recession like this, as I said before, their demands on services are higher. So, they are sending more money out. At the same time, they're bringing less tax revenue in. And that's a painful adjustment, what we're going end up seeing is lot of states making very difficult choices there...

SCULLY: William Howard Taft served on the court after his presidency, would you have any interest in being on the Supreme Court?

OBAMA: You know, I am not sure that I could get through Senate confirmation...

Developing...

~SY~ ...another 1 Im watching closely...

..possible wave five coming on the weekly which may translate into a breakout of a cup/w/handle pattern on the daily...

P-E Ratio = 14

Market Cap = $2.71 Bil

Profit Margin = 24.4%

Quarterly EPS % Chg. = 26%

Debt % = 56%

Shares Outstanding = 83.2 Mil

Float = 79.0 Mil

...possibly targeting ~ABIO~...especially with a gap down...

i know, it was real slow. at least it swung negative eod.

those are two Emerging Market MECCAS there you are shorting.

I see your put choices were not too aggressive, though, so you should get a chance to eat.

...so much for the carnage today...needed another hour...

...today was boring,took some profits,daytraded,while increasing my original positions...couldve been a good day if the market wasnt so flat...still holding puts... 9 ~BIDU~ 230's and 24 ~IBN~ 30's...with patience, I expect those two to be rainmakers...

end of day massacre coming...

i went with SRS calls and shares along with my FAZ calls.

good luck with your shorts.

still in some sleeper picks but no major board long plays.

good thing i sold my UNG calls the other day after being up right away. Had a funny feeling about nat gas inventories.

I'm suprised it's as low as 3.53/contract

gold/silver en fuego

I heard Art Cashin say, yesterday, that historically traders don't want to be short going into a long weekend, as buying can start the week next Tuesday.. however if the shorts don't cover, or add, late in today's session it will be very telling.

I am in no hurry to sell the June calls on SRS,FAZ because they have a lot of time.. max time (full 15 sessions in June plus all next week).. maybe S&P can fool with 820 by then like Art says.

http://search.cnbc.com/main.do?target=all&keywords=art%20cashin

...loaded more ~BIDU~ & ~IBN~ puts(moderate position established)

...end of day massacre coming...

...receipt pending...

sounds like a good idea. Please walk out with at least one bag on each ![]()

havent closed yet...something is compelling me to hold these puts longer...

IBNRF $4.00 HOD today. Not too bad for 50% gain for you!

Hey you guys,check out this link...

http://sec.gov/litigation/complaints/2009/comp21053.pdf

The implications could possibly mean they shut ihub down for real...bs...

If they do shut this site down to set an example or something...I hope to meet with you talented traders elsewhere on the net...

my contact info is cfbiv79@gmail.com

good luck to all

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1807

|

|

Created

|

07/23/08

|

Type

|

Free

|

| Moderators | |||

Everyone is responsible for their own entry & exit points.

A place where Fundamental analysis can meet with Technical analysis.

Timing is everything.

The advantage that we have now over the 'Legends of the past ',is that our market is much more Global... There will be new legends in our time, some unknown...hopefully some of those legends will surface here. The most intense charting techniques,the most solid & thorough fundamental analysis, and exact thoughts at precise times by some of the greatest traders of our time...that, is what I want this board to become one day.

Einstein ~said to question everything...

Fibonacci~ said to implement egyptian mathematics....

GANN ~said to focus on 45 degree angles...

Bullkowski ~said to focus on % probabilities...

Andrew ~said to exploit Pitchforks...

Bollinger ~said to intensely monitor volatility...

Buffett said to focus on markets that you understand then exploit the fundamentals...

Livermore said to evaluate everything ahead of time,& then swing with it...

Benjmin Graham~ said to simplify every investment down to the lowest Intrinsic Value...F/A before T/A...

Michael Phelps ~showed us to Hold nothing Back...

~6979~ ~says that if the tactic/technique isnt broken... then dont fix it...follow the masters...

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |