Sunday, March 23, 2014 9:31:27 PM

UPDATED GDSM CATALYSTS – 3/23 Lots of potential here for GDSM!

This is STILL not a one trick pony company here. This is going to be multifaceted and explosive for an extended period of time. Things are coming together as the MJ subsidiary has been filed in CO and MJ website is coming very soon.

Looking at: (these are projected and/or being worked on by GDSM)

1. Golden Cross (completed)

2. MJ Subsidiary formation in CO (completed and filed 3/5/14)

3. MJ Website is purchased (completed 3/10/14)

4. MJ Website MJ-Xchange.com comes online mid-April

5. Details of MJ Subsidiary are reveled -- companies involved etc.

6. MJ Subsidiary shelf offering and spin off

7. GDSM generates cash from shelf offering -- unloads debt burden + cash for asset acquisition

8. GDSM shareholders receive MJ shares via spin off

9. Audit is completed (getting there as of 3/11/14 PR)

10. Uplisting to OTCQB

11. Divvy to GDSM shareholders

12. MJ Wholesale/Distribution via grow facilities in CO is completed

13. Revenue & Profit generation from MJ business ventures (“turn-key” and acquisition of established companies are being rolled into the deal)

14. Company is looking into several oil well participations

There are a ton of potential catalysts here AND WE DON'T EVEN HAVE THE FULL PICTURE YET!

Take your pick.

SUPPORTING EVIDENCE FOR THE ABOVE CATALYSTS.

(Each number corresponds to the aforementioned catalyst #)

1) http://stockcharts.com/h-sc/ui?s=GDSM&p=D&yr=0&mn=3&dy=0&id=p32081451931

2) http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98709338

3) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-to-Roll-Out-MJ-Xchange-com?id=77628&b=y

4) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Provides-Corporate-Update?id=77772&b=y

5) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=76344&b=y

6) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=75856&b=y

7) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=75856&b=y

http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=76804&b=y

8) Speculation but confirmed via GDSM – shareholder contact

9) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-New-MJ-Subsidiary?id=77166&b=y

10) http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98664113

http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Provides-Corporate-Update?id=70754&b=y

11) Speculation but not atypical in a shelf offering.

12) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=76804&b=y

13) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=76804&b=y

14) http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=75537&b=y

____________________________________________________________________________________________________

CURRENT GDSM BUSINESS PLAN TO ENTER MJ SECTOR (RATIONALE FROM RECENT PR)

Through additional due diligence into the marijuana industry, the Company believes that opportunity exists to participate in the growth via acquisition/construction of "turn-key" grow facilities, as well as, retail dispensary locations. Both would have identical looks to create a recognizable brand for roll out into other locations/states as laws are changed. (The dispensaries cannot be owned by a public company. However, the company can own and lease the land and buildings.)

Given the capital required to pursue this strategy, the Company, via its subsidiary, would propose to be the general partner and raise capital from private investors. Obviously, the Company would retain an interest and control the brand.

This real estate strategy would complement the private business or be a standalone business line.

The new subsidiary is being worked on with the Company's legal advisor.

BREAKDOWN OF THE KNOWN GDSM MJ BUSINESS PLAN:

1. Build the online presence and roll the accessory side into it.

2. Buy the grow facilities for supply and distribution.

3. Buy the commercial real estate assets to lease to dispensaries.

4. Sell accessories through the website, brick and mortar stores, and local dispensaries (including those under lease agreement).

5. Supply the dispensaries and other parts of the channel.

6. Begin to look at other markets outside of Colorado.

Right now most MJ companies are bits and pieces of an integrated business. GDSM is looking to bring all the parts together to form a more integrated business model.

ITEMS COMPLETED BY THE COMPANY AS OF 3/21/2014.

1. The initial steps of setting up the MJ subsidiary in Colorado have been completed. MJ Acquisition Corp. was established on 3/5/12 in CO.

2. MJ-Xchange.com was purchased by the company. GDSM will be moving forward with developing its social media aspect of its business. The Company believes this will site will attract people interested learning more about the industry, advertise their products, as well as the Company's products, and provide a forum for users to interact via their own accounts.

____________________________________________________________________________________________________

Gold Coast Mining to Roll Out MJ-Xchange.com

WILTON, CT--(Marketwired - Mar 19, 2014) - Gold Coast Mining Corp. (OTC Pink: GDSM) (PINKSHEETS: GDSM), provides the following Corporate Update:

The Company is pleased to announce that it has obtained the url mj-xchange.com and will be moving forward with developing its social media aspect of its business. The Company believes this will site will attract people interested learning more about the industry, advertise their products, as well as the Company's products, and provide a forum for users to interact via their own accounts.

The Company believes that MJ-Xchange will be the "go to" source for all things marijuana with the added ability for users to have "inboxes" and the capability to communicate with other participants, each with their own account/inbox, etc.

Social media is just one of the Company's business segments. The Company is currently meeting with several MJ industry participants and manufacturers to further penetrate the market. Initially, the Company's geographic focus is Colorado. Colorado has predicted that in 2014 it will see nearly $600 million in profits related to MJ sales all of which is taxed. Colorado will realize $67 million in tax revenue alone from those profits which will in part go to funding schools. The Company is positioning itself to participate in this growing market that will bring extraordinary benefit to its shareholders.

The Company continues to follow developments in other states to continue its expansion and branding strategy. The Company will keep its shareholders and the investment community updated as events unfold.

GDSM MJ ACQUISITION CO. INFO*** 3/12

(See the direct link to the information below the picture. You must reenter the entity name as the site times out after 2 hours of inactivity.)

MJ Acquisition Corp. identification number 20141153313. Documents delivered to this office electronically through 03/12/2014 @ 14:50:03 in the State of Colorado.

MJ Acquisition Corp.

ID number: 20141153313

http://www.sos.state.co.us/biz/BusinessEntityHistory.do?quitButtonDestination=BusinessEntityDetail&pi1=1&masterFileId=20141153313&srchTyp=ENTITY&entityId2=20141153313&nameTyp=ENT

http://www.sos.state.co.us/biz/BuildCertificate.do?masterFileId=20141153313

PR FROM GDSM ABOUT THE MJ SUBSIDIARY FILING:

http://www.marketwatch.com/story/gold-coast-mining-announces-new-mj-subsidiary-2014-03-11?reflink=MW_news_stmp

____________________________________________________________________________________________________

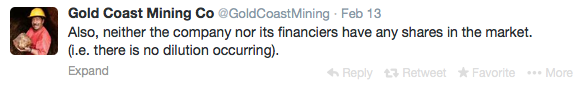

NO MAJOR DILUTION!!! Period. (see explanation of Share Structure below)

Tweet From 3/5/14:

Another recent Tweet:

More from recent PR (2/28/13):

“Finally, the Company wishes to address its share structure. The current common stock outstanding is approximately 3.2 billion shares and has not changed in the last 90-100 days.”

http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-Corporate-Update?id=75856&b=y

CURRENT GDSM SHARE STRUCTURE:

First, the company is in the process of changing Transfer Agents (TA) from Continental to one that is open (ungagged) and friendly to shareholder requests for share structure (SS) information. The change should occur very soon.

Understanding the current SS and what has occurred since the beginning of 2013 (verified via company filings and by GDSM management):

The company had to dilute last year (2013) - 1.235B in dilution occurred because the company had debts to pay and prior management did a very poor job of reigning this in. Well, those debts have been paid. One more debt rolled off in November and that hit the float this year, so the OS went from 1.965B to 3.2B (in 2013) and then 100M was added in 2014 to make it roughly 3.3B.

In terms of the company stating no dilution - one must remain aware that those statements are for the time periods indicated (it is not totally open-ended). It doesn't mean the company has not put some shares in the market to raise operating capital to get the audits completed, deals done, etc. However, once the SS is revealed I believe that everyone will see that dilution has been very minimal (think 100M to 250M shares and that is all). Additionally, the funds have been raised to generate revenue, grow the company, finalize clerical issues, and bring value to the business and its stakeholders. Companies do this all the time -- large cap companies are no different, with respect to equity financing.

Going forward the company is seeking private financing that has restrictions placed on the shares that are shareholder friendly (non dilutive). GDSM is working to keep the OS as tight as possible -- one will see in the coming weeks and months if one decides to stick around.

____________________________________________________________________________________________________

AUDIT INFO: (HERE ARE THE FACTS!):

From the PR dated March 11, 2014 (10 days ago -- impatient people want it now, now, now. It is coming. It takes time for the auditor to complete the filings. Geez!)

"The Company also reports that the four outstanding items requested by the Company's CPA, to complete the audit, has been submitted."

3/11/14 PR here:

http://www.otcmarkets.com/stock/GDSM/news/Gold-Coast-Mining-Announces-New-MJ-Subsidiary?id=77166&b=y

And those are the facts.

NO REVERSE SPLIT AND UPLIST CONSIDERATION

I would like to touch on another topic, a reverse split. At this point in time, it makes no sense to do a reverse split. Without the benefit of a settlement, “uplisting” and clear path to growth, performing a reverse split is a guaranteed return to the triple zeros.

Mike Shea has reiterated this sentiment countless times.

Something that is missed in this statement is the desire to UPLIST!

The MMJ Subsidiary will help facilitate the uplist -- along with the completed audits that are being worked on right now by Corso & Company.

From recent PR (Audit info):

"From an internal perspective, the Company engaged Corso and Company to perform its audit. Corso and Company will provide audited financial statements for fiscal years 2011 & 2012, a reviewed statement for the six month period ended June 30, 2013, as well as, the completion and filing of corporate tax returns for the last four years. The audit is progressing and should be completed by the end of November, allowing the Company to file its Form 10, "up list" and regain its full reporting status."

____________________________________________________________________________________________________

MICHAEL F. SHEA, CEO, DIRECTOR BIO and Background DD

Mr. Shea has more than 25 years of Corporate Finance experience having held senior positions at Citigroup, ABN Amro, GE Capital & Bank of America.

Shea’s background includes mergers & acquisitions, capital raising, structuring finance, restructurings and investor relations with for Fortune 1000 companies (e.g. Massey and URS), as well as, junior miners (e.g. Imagin Natural Resources and St. Cloud Mining). Mr. Shea’s experience has also included a position as Chief Financial Officer for a small-cap junior mining company listed on the TSX Venture Exchange, with full responsibility for audits, Exchange reporting, legal, investor relations and capital raising.

Mr. Shea’s success at structuring and completing capital market transactions for billion dollar companies is a timely advantage for the junior mining industry:

$15 billion of senior debt financings

$7 billion of fixed income issuances

$2 billion of M&A activity

$100 million of equity capital.

http://www.linkedin.com/pub/michael-shea/7/550/72

http://www.silvermineadvisors.com/leadership.html

https://twitter.com/SilvermineAdv

(Just notice the twitter post July 12 2011 – the connection to Wilton, CT)

http://www.zoominfo.com/p/Michael-Shea/393525974

http://seekingalpha.com/user/788783/profile

http://seekingalpha.com/user/788783/instablog

Following the Secretary of State Business trail (For GDSM – FL and ILST – NV)

GDSM FL SOS:

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail/EntityName/domp-p01000117523-2e1a6cdf-e4b8-4d8f-b4c5-f33bb7e0f07c/Gold%20Coast%20Mining/Page1

ILST NV SOS:

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=8UhzlbNBCIP0VFSHMgduFQ%253d%253d&nt7=0

____________________________________________________________________________________________________

ADDITIONAL INFORMATION

Shareholders received 3/4/14 Info -- Confirmation of the MJ with an established company in accessories (still in play just not with Chris C.) and looking for a turn key or bolt on acquisition for wholesale supply and distribution. THERE IS NOW MORE TO OFFER IN THE END ONCE THEY WORK IT ALL OUT.

Read the tweets below it. The deal is still the same for MJ subsidiary -- the accessory business! Plus not (as of 3/19 it will include a website and social outlet).

IT SAYS "NOTHING HAS CHANGED AND PROGRESS IS BEING MADE. THE R/E IS JUST ANOTHER WAY TO PARTICIPATE IN MJ" -- MEANING THE ACCESSORIES DEAL IS STILL IN PLAY (just not with Chris C directly), LEASED GROWER DISTRIBUTION STILL ON, DISPENSARIES ARE OFF THE TABLE, BUT GDSM CAN LEASE COMMERICAL SPACE TO MJ DISPENSARIES.

More DD:

1. They will use a shelf offering for the MJ sub. -- to pay everything back. Since Gelpid issued roughly $5MM in debt to GDSM and GDSM is going to build the MJ subsidiary first then spin the company out with a shelf offering that will raise capital to pay Gelpid back. Effectively there is no debt burden assumed by GDSM in this scenario. This is one way for Gelpid to get their $5MM back.

From PR February 18:

"legal discussions are occurring to determine the best strategy for establishing a subsidiary, spinning it off and arranging a registered shelf offering;"

2. The PR states from today that the land lease purchases (for wholesale supply and distribution) will be financed via private investor capital:

"Given the capital required to pursue this strategy, the Company, via its subsidiary, would propose to be the general partner and raise capital from private investors. Obviously, the Company would retain an interest and control.” (THIS IS HOW THEY WILL FUND THE NEW VENTURE -- GROW FACILITIES: PRIVATE CAPITAL FINANCING, NON-DILUTIVE TO GDSM SHAREHOLDERS!)

No MAJOR Dilution – UPDATED 3/5 - This is going to help the share price elevate tremendously!

From the company website:

Finally, the Company wishes to address its share structure. The current common stock outstanding is approximately 3.2 billion shares and has not changed in the last 90-100 days. (CONFIRMED 3/5/14)

CONFIRMED ZERO DILUTION 3/5/14 AT PARTICULAR TIMES (SEE AFOREMENTIONED EXPALANTION OF THE SHARE STRUCTURE)

(THIS IS 200M SHARES FEWER THAN FITX AND WE ALL KNOW HOW THAT ONE HAS TURNED OUT! -- and based on the update to the projected current OS right in line with FITX)

AS Increase Explanation

The Company was looking at an acquisition that would have required the issuance of a significant amount of stock. (The AS was raised prior to the recent activity related to the share price. Mike recognizes this and maintains that the AS increase was initially pursued to help finalize a deal that ultimately did not work out – IN THE PAST!)

Mike has no intention of severely diluting shareholders (see aforementioned explanation of the share structure) given the recent proposed MJ deal.

To accommodate this potential acquisition, the Company raised the authorized amount of common stock to 6.5 billion. In light of current events, the Company is no longer pursuing this acquisition but will reserve the authorized for settlement negotiations and future opportunities.

The underlined statement above conveys that the AS will be reserved for settlement negotiations (i.e., it will help facilitate the MJ shelf offering) and for future activities (NOT PRESENTLY NEEDED – THE SHELF OFFERING WILL SIGNIFICANLTY POSITIVELY IMPACT GDSM’S CASH FLOW NEEDS AND REMOVE THE GELPID DEBT BURDEN!)

____________________________________________________________________________________________________

COMPANY LINKS TO EXPLORE:

https://twitter.com/GoldCoastMining

http://www.gdsmholdings.com

http://www.otcmarkets.com/stock/GDSM/quote

Recent GRLF News

- Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • InvestorsHub NewsWire • 06/24/2024 12:30:00 PM

- Green Leaf Innovations, Inc. Engages Olayinka Oyebola & Co for Two-Year Audit • InvestorsHub NewsWire • 05/28/2024 12:30:00 PM

- Form 253G2 - • Edgar (US Regulatory) • 01/29/2024 06:37:20 PM

- Form QUALIF - Notice of Qualification [Regulation A] • Edgar (US Regulatory) • 11/07/2023 05:15:09 AM

- Form 1-A POS - • Edgar (US Regulatory) • 11/01/2023 08:02:30 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM