Saturday, March 08, 2014 11:12:16 AM

by Clark March 7, 2014

Now that it appears clear the bottom is in for gold,

it’s time to stop fretting about how low prices

will drop and how long the correction will last and

start looking at how high they’ll go and

when they’ll get there.

When viewing the gold market from a historical perspective,

one thing that’s clear is that the junior mining stocks

tend to fluctuate between extreme boom and bust cycles.

As a group, they’ll double in price, then crash by 75%...

then double or triple or even quadruple again, only to

crash 90%. Boom, bust, repeat.

Given that we just completed a major bust cycle and not

just any bust cycle, but one of the harshest on record,

according to many veteran insiders the setup for a major

rally in gold stocks is right in front of us.

This may sound sensationalistic, but based on past

historical patterns and where we think gold prices are

headed, the odds are high that, on average, gold

producers will trade in the $200 per share range

before the next cycle is over.

With most of them currently trading between $20 and

$40, the returns could be stupendous.

And the percentage returns of the typical junior will

be greater by an order of magnitude, providing

life-changing gains to smart investors.

What you’re about to see are historical returns of both

producers and juniors during three separate boom cycles.

These are factual returns; they are not hypothetical.

And if you accept the fact that this market moves in

cycles, you know it’s about to happen again.

Gold had a spectacular climb in 1979-1980, and gold

stocks in general gave a staggering performance at

that time many of them becoming 10-baggers

(1,000% gains and more).

While this is a well-known fact, few researchers have

bothered to identify exact returns from specific

companies during this era.

Digging up hard data from before the mid-1980s,

especially for the junior explorers, is difficult

because the information wasn’t computerized at the time.

So I sent my nephew Grant to the library to view

the Wall Street Journal on microfiche.

We also include information we’ve had from

Scott Hunter of Haywood Securities; Larry Page,

then president of the Manex Resource Group;

and the dusty archives at the Northern Miner.

Note: This means our tables, while accurate, are not

at all comprehensive.

Let’s get started…

The Quintessential Bull Market: 1979-1980

The granddaddy of gold bull cycles occurred during the

1970s, culminating in an unabashed mania in 1979 and 1980.

Gold peaked at $850 an ounce on January 21, 1980, a rise

of 276% from the beginning of 1979.

(Yes, the price of gold on the last trading day of 1978

was a mere $226 an ounce.)

Here’s a sampling of gold producer stock prices from

this era.

What you’ll notice in addition to the amazing returns

is that gold stocks didn’t peak until nine months

after gold did.

Keep in mind, though, that our data measures the exact

top of each company’s price.

Most investors, of course, don’t sell at the very peak.

If we were to able to grab, say, 80% of the climb,

that’s still a return of 231.6%.

Here’s a sampling of how some successful junior gold

stocks performed in the same period, along with the

month each of them peaked.

If you had bought a reasonably diversified portfolio

of top performing gold juniors prior to 1979, your

initial investment could have grown 23 times in just

two years.

If you had managed to grab 80% of that move, your

gains would still have been over 1,850%.

This means a junior priced at $0.50 today that

captured the average gain from this boom would sell

for $12 at the top, or $9.75 at 80%.

If you own ten juniors, imagine just one of them

matching Copper Lake’s better than 100-bagger

performance.

Here’s what returns of this magnitude could mean to you.

Let’s say your portfolio includes $10,000 in gold

juniors that yield spectacular gains such as the above.

If the next boom cycle matches the 1979-1980 pattern,

your portfolio could be worth $241,370 at its peak…

or about $195,000 if you exit at 80% of the top prices.

You have to play the cycle.

Returns from that era have been written about before,

so I can hear some investors saying,

“Yeah, but that only happened once.”

Au contraire. Read on…

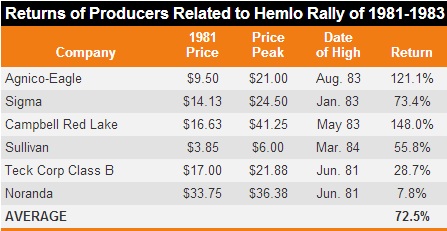

The Hemlo Rally of 1981-1983

Many investors don’t know that there have been several

bull cycles in gold and gold stocks since

the 1979-1980 period.

Ironically, gold was flat during the two years of

the Hemlo rally.

But something else ignited a bull market.Discovery.

Here’s how it happened…

Back in the day, most exploration was done by teams

from the major producers.

But because of lagging gold prices and the resulting

need to cut overhead, they began to slash their

exploration budgets, unleashing a swarm of experienced

geologists armed with the knowledge of high-potential

mineral targets they’d explored while working

for the majors.

Many formed their own companies and

went after these targets.

This led to a series of spectacular discoveries,

the first of which occurred in mid-1982, when

Golden Sceptre and Goliath Gold discovered

the Golden Giant deposit in the Hemlo area of

eastern Canada.

Gold prices rallied that summer, setting off a

mini bull market that lasted until

the following May.

The public got involved, and as you can see,

the results were impressive for such a short

period of time.

Gold producers, on average, returned over 70% on

investors’ money during this period.

While these aren’t the same spectacular gains from

just a few years earlier, keep in mind they occurred

over only about 12 months’ time. This would be akin

to a $20 gold stock soaring to $34.50 by this time

next year, just because it’s located in a

significant discovery area.

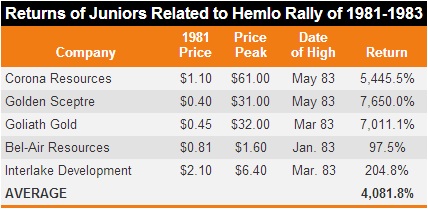

Once again, it was the juniors that brought the

dazzling returns.

The average return for these junior gold stocks that

had a direct interest in the Hemlo area exceeded

a whopping 4,000%.

This is especially impressive when you realize that

it occurred without the gold stock industry as a

whole participating.

This tells us that a big discovery can lead to

enormous gains, even if the industry as

a whole is flat.

In other words, we have historical precedence that

humongous returns are possible without a mania,

by owning stocks with direct exposure to

a discovery area.

By May 1983, roughly a year after it started, gold

prices started back down again, spelling the end

of that cycle—another reminder that one must sell

to realize a profit.

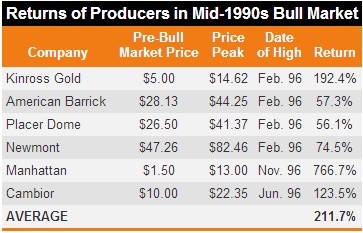

The Roaring ’90s

By the time the ’90s rolled around, many junior

exploration companies had acquired the

“intellectual capital” they needed from the majors.

Another series of gold discoveries in the mid-1990s

set off one of the most stunning bull markets

in the current generation.

By the summer of ’96, these discoveries had sparked

another bull cycle, and companies with little more

than a few drill holes were selling for $20 a share.

The table below, which includes some of the better

known names of the day, is worth the proverbial

thousand words.

The average producer more than tripled investors’

money during this period.

Once again, these gains occurred in a relatively

short period of time, in this case inside

of two years.

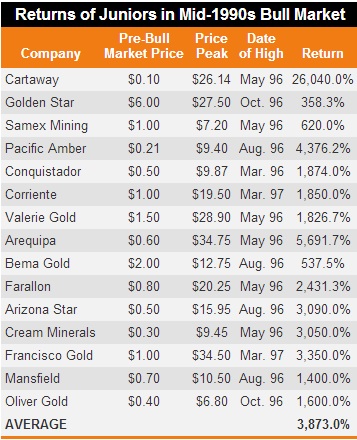

Here’s how some of the juniors performed.

And if you’re the kind of investor with the courage

to buy low and the discipline to sell during a frenzy,

it can be worth a million dollars.

Hold on to your hat.

Many analysts refer to the 1970s bull market as the

granddaddy of them all—and to a certain extent it

was but you’ll notice that the average return of

these stocks during the late ’90s bull exceeds what

the juniors did in the 1979-1980 boom.

This is akin to that $0.50 junior stock today reaching

$19.86… or $16, if you snag 80% of the move.

A $10,000 portfolio with similar returns would grow

to over $397,000 (or over $319,000 on 80%).

Gold Stocks and Depression

Those of you in the deflation camp may dismiss all

this because you’re convinced the Great Deflation

is ahead.

Fair enough. But you’d be wrong to assume gold stocks

can’t do well in that environment.

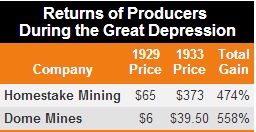

Take a look at the returns of the two largest

producers in the US and Canada, respectively,

during the Great Depression of the 1930s,

a period that saw significant price deflation.

During a period of soup lines, crashing stock

markets, and a fixed gold price, large gold

producers handed investors five and six times

their money in four years.

If deflation “wins,” we still think gold equity

investors can, too.

How to Capitalize on This Cycle

History shows that precious metals stocks move

in cycles.

We’ve now completed a major bust cycle and,

we believe, are on the cusp of a tremendous boom.

The only way to make the kind of money outlined

above is to buy before the boom is in full swing.

That’s now. For most readers, this is literally

a once-in-a-lifetime opportunity.

As you can see above, there can be great variation

among the returns of the companies.

That’s why, even if you believe we’re destined for

an “all-boats-rise” scenario, you still want

to own the better companies.

What if you invest in 'Caledonia Mining Corporation

and it become a LION -

ex. in 1975?..

take a look at the past gains in a few juniors:

$GOLD INDX Chart TA TI P&F Alert Bullish Price Objective $2,040.0 / oz

CAL Chart TA TI P&F Alert Bullish Price Objective $3.63 / oz

Caledonia Mining Corp. -

CALVF:NASDAQ - TSE:CAL - CMCL Aim London -

Ex.

Let's focus on what more makes CAL a better buy than almost

any other gold stock out there -

ex...a few...

Caledonia Blanket Gold Mines enjoy Zimland corp. taxes

are 25% and its only

about half of US & Can bolshevistic 50% taxes +

Blanket Gold Mines have much less than half of

the high labour cost in US & Can.

Note.

all producers on the list have higher gold prod. cost than

Caledonia Mining's low prod. cost @ $554/oz -

CAL paying a dividend every quarter to the shareholders -

Fyi. do a dd...for a low cost gold mines producer with

very low labour cost and taxes....

Caledonia Mining Corp. -

CALVF:NASDAQ - TSE:CAL - CMCL Aim London -

CAL Blanket Gold Mines enjoy “Cash costs $554/oz at

the Gold mine are running

at $554/oz - one of the lowest cost -

gold producers in the world -

which positions the CAL company well to keep

generating cash to self-fund expansion and

CAL paying dividends every quarter to shareholders -

CAL has more than $25 million in cash in

Western London banks and NO DEBT -

http://www.commodity-tv.net/c/mid,21943,Mines_und_Money_London_2013/?v=252888

http://www.brrmedia.co.uk/event/119251/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=95869580

CAL / CALVF employ more than 1000 happy miners -

who got 15% ownership in Blanket Gold Mines -

the miners work very good for they work

for them self -

ex...Zimland corp. taxes are 25% and its only

about half of US & Can bolshevistic 50% taxes +

Blanket Gold Mines have less than half of

the high labour cost in US & Can. -

CAL Blanket Gold Mines enjoy the kind best mining

weather and it has produced gold since 2000yrs back -

Kingdoms of Africa - Great Zimbabwe -

http://www.youtube.com/watch?v=AyKrTdv-t4E

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=96263045

The ruins of Great Zimbabwe – the capital of the Queen of Sheba -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67548731

Au-Kingdom -

E.g.,

http://whc.unesco.org/en/list/364/video

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=96354613

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=97759402

God Bless

Recent CMCL News

- Form EFFECT - Notice of Effectiveness • Edgar (US Regulatory) • 08/23/2024 04:15:07 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/19/2024 10:00:07 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/19/2024 10:00:06 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 08/19/2024 06:00:00 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 08/19/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/15/2024 10:00:11 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 08/15/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/12/2024 03:32:56 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/12/2024 10:00:08 AM

- Caledonia Mining Corporation Plc Results for the Quarter ended June 30, 2024; Details of Investor Presentation • GlobeNewswire Inc. • 08/12/2024 06:00:00 AM

- Form F-3 - Registration statement by foreign private issuers • Edgar (US Regulatory) • 08/09/2024 08:12:39 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/06/2024 10:00:05 AM

- Caledonia Mining Corporation Plc: Notice of Results and Investor Presentation • GlobeNewswire Inc. • 08/06/2024 06:00:00 AM

- Caledonia Mining Corporation Plc: Publication of 2023 ESG Report • GlobeNewswire Inc. • 08/01/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/25/2024 10:00:11 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 07/25/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/23/2024 10:00:13 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 07/23/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/22/2024 10:00:12 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 07/22/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/19/2024 10:00:09 AM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 07/19/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/15/2024 05:50:06 PM

- Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder • GlobeNewswire Inc. • 07/15/2024 06:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/12/2024 10:00:12 AM

FEATURED Integrated Ventures Acquires 51% Stake In GetTrim.Com (TM), Telemedicine Platform With Focus On Expansion Into Booming GLP-1 Powered Weight Loss Market • Sep 4, 2024 8:45 AM

Avant Technologies Announces Strategic Review Process Intended to Maximize Shareholder Value • AVAI • Sep 4, 2024 8:00 AM

PickleJar Launches National "Get on the Bus" Campaign, Unveils Thompson Square Tour Bus Wrap • PKLE • Sep 4, 2024 7:17 AM

Maybacks Global and Inventel Products To Launch Global 24 Hour Shopping Channel • AHRO • Sep 3, 2024 9:15 AM

UC Asset announces plan of management stock buyback • UCASU • Sep 3, 2024 9:00 AM

Element79 Gold Corp Appoints Warren Levy to Board of Directors • ELMGF • Aug 28, 2024 9:51 AM