| Followers | 190 |

| Posts | 33941 |

| Boards Moderated | 9 |

| Alias Born | 04/14/2010 |

Friday, February 07, 2014 10:02:15 PM

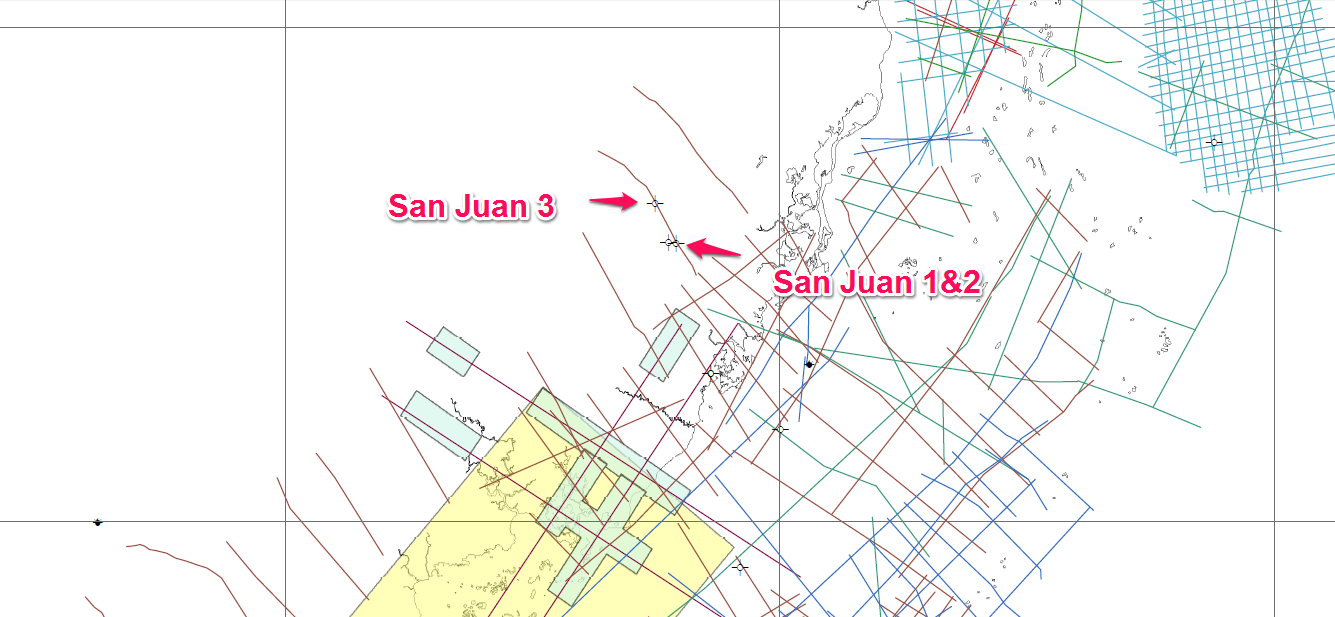

Looks like Treaty was salting the Barns lease.

And Jakobot (US Fuels) tried to pull a fast one with the TRRC... Looks a lot like fraud to me...

Here's the Proposal for Decision and the Statement of the case...

http://www.rrc.state.tx.us/meetings/ogpfd/7B-80369-mrc.pdf

Then there is Belize!!

No oil in Belize.

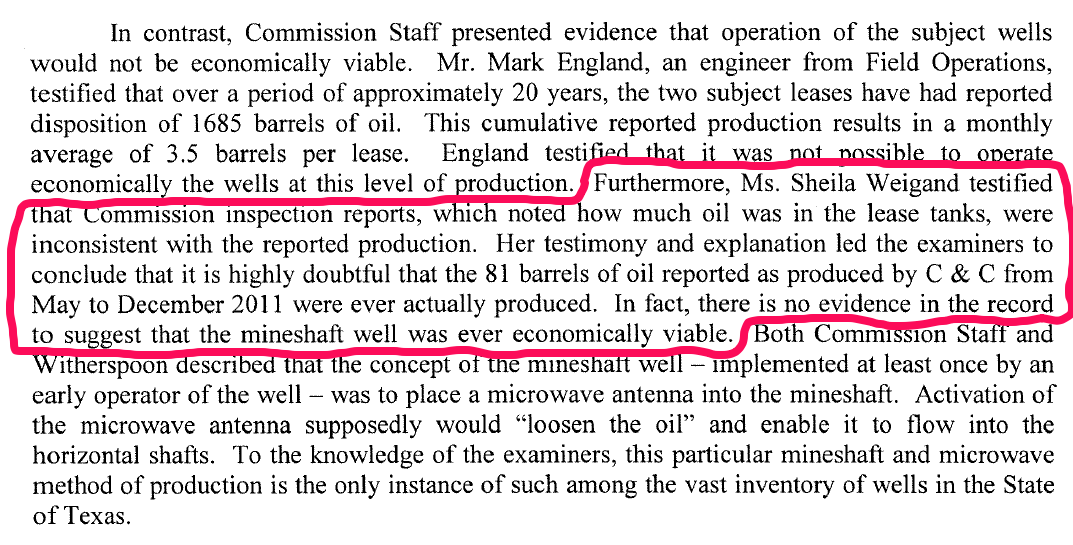

New Belize Map out dated June 2013... It shows San Juan well 1 & 2 as "dry holes"... Not even dry hole with gas or oil shows but a "dry hole"...

Treaty calling them not commercially viably is very misleading. Calling them that would imply that some oil was found. The TRUTH is that NO oil was found... NOTHING.

http://estpu.gov.bz/images/GPD/Geophysical/Seismic%20Aeromagnetic%20Surveys%20and%20Wells%20Drilled%20in%20Belize%202000%20-%202013.pdf

It also does not show the Aeromagnetic Survey that Treaty started to do. That is likely because it was never completed.

Screen shot below...

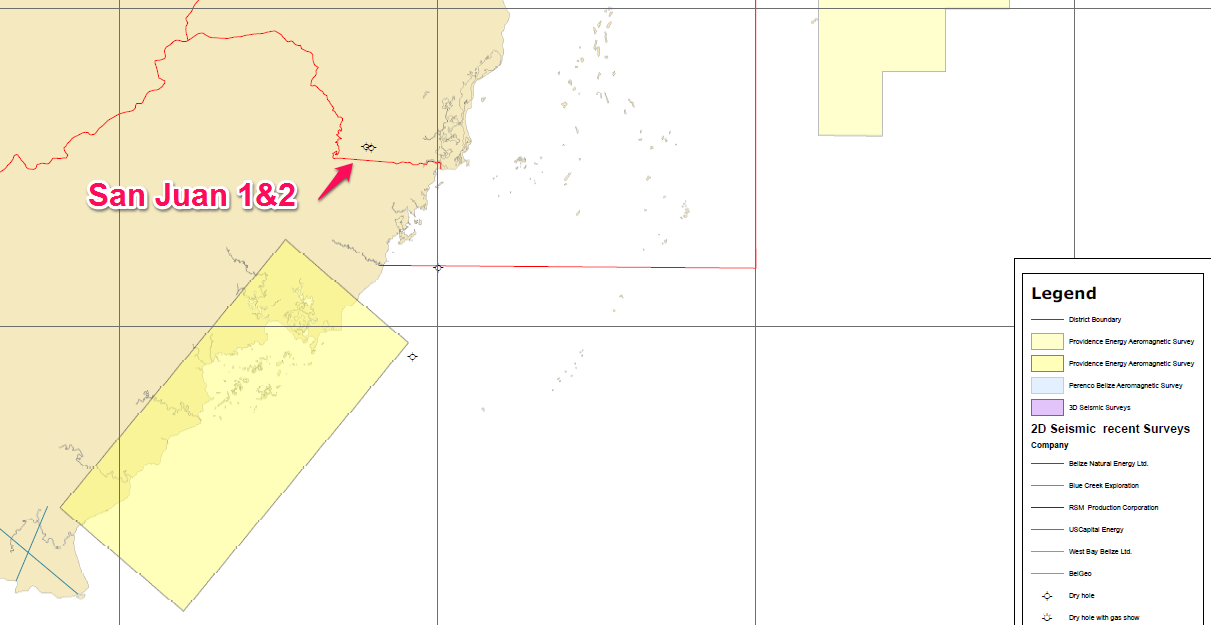

Another map showing all the wells drilled in Belize. There have been some wells with oil shows to the South and West of Treaty's concession. But nowhere near where Treaty is drilling.

Treaty is drilling in the wrong area...

San Juan 3 is another dry hole as shown in this recently updated map from the Belize Geology and Petroleum Department, the same as 1&2 which are only a mile to the south. Like I have said before Treaty went in the WRONG direction in choosing the drilling site for San Juan 3.

No oil in San Juan 3...

http://estpu.gov.bz/images/GPD/Geophysical/Seismic%20Aeromagnetic%20Surveys%20and%20Wells%20Drilled%20in%20Belize.pdf

Screen Shot Below...

That brings something else to mind... How in the heck does Treaty get a claim of 6 million barrels from a dry hole???

It looks as if the whole Belize thing is nothing but a ruse to sell shares.

Wonder what the SEC thinks of this PR about a dry hole??

Our internal analysis indicates that the Stann Creek Field covers an area of around 350 acres, and with 4-acre spacing we would expect to drill up to 90 wells in this oil field. Based on our initial findings, we estimate there are about 5,000,000-6,000,000 Barrels of recoverable oil in place in this first finding."

http://ih.advfn.com/p.php?pid=nmona&article=50943326

All complete Treaty BS...

And how does Treaty report in a 8-K a "pay zone" in a dry hole???

Treaty Energy Corporation (“Treaty” or the “Company”) today reported drilling success on its first oil well, San Juan #2, in Belize, Central America. Treaty reached the initial pay zone of 1235 to 1290 feet and found hydrocarbons at this depth.

http://www.sec.gov/Archives/edgar/data/1075773/000135448812000365/teco_8k.htm

More Treaty BS...

The Belize Geology and Petroleum Department says the well was a dry hole without ANY gas or oil shows. Soooo it now appears that Treaty was in fact very misleading in reporting the findings in Belize and that the Belize Geology and Petroleum Department was the reality...

Fake Belize Oil Strike in the News...

http://www.youtube.com/watch?v=NbkQouLFmuM&feature=youtu.be

http://www.youtube.com/watch?feature=player_embedded&v=SqXNtQJFg84

http://www.upstreamonline.com/live/article1231931.ece

Treaty's been deceiving investors, the public and the people of Belize all along Treaty has known for some time that they were going to plug San Juan 1,2 and 3.

Treaty has yet to make this info public....

http://edition.channel5belize.com/archives/93511

Belize was nothing but a show for investors.

Check out Paragraphs 5,6, and 7 of this court filing from a former investor suing Treaty Energy to get is money back when he realized what Treaty was telling him a load of BS...

https://docs.google.com/file/d/0B8fPIL-cKPM-YU5yUWxOT3ZhTjQ/edit

Why does Treaty have a bad reputation?

Because they don't pay their bills. Contactors need to resort to legal action to get paid. Nobody likes to have to do that. It's Treaty's MO and it's BS...

Proof...

List of judgments and liens against Treaty Energy.

Heartland lien for $383,742.54 That would explain why their is no drilling or completion of the Stockton 3 going on. Treaty has been misleading investors AGAIN...

Also $52,500.00 of it is standby time.

Was it Treaty that said this was not a issue???

https://docs.google.com/file/d/0B8fPIL-cKPM-RGRvZFRkXzVaYVU/edit

Archer drilling lien, The folks that drilled the Madeley $26,785.25

https://docs.google.com/file/d/0B8fPIL-cKPM-a2Z0RDl2STcwUU0/edit?pli=1

Driller in Belize $65,000.00

https://docs.google.com/file/d/0B8fPIL-cKPM-eng2M0MzajJ1ME0/edit?pli=1

Jims rental lien, $111,810.17

https://docs.google.com/file/d/0B8fPIL-cKPM-ODdhd2dtaTVDYm8/edit?pli=1

J&L Trucking lien &3,388.00

https://docs.google.com/file/d/0B8fPIL-cKPM-SzFETUxUMndEYlE/edit?pli=1

Another J&L Trucking lien $2,653.00

https://docs.google.com/file/d/0B8fPIL-cKPM-TTdHUDhTZHhXTE0/edit?pli=1

Mud company lien $6,726.88

https://docs.google.com/file/d/0B8fPIL-cKPM-LXhxWUE1ZHlOMDQ/edit?pli=1

Recovery equipment for work on the Brown lease $18,444.83

https://docs.google.com/file/d/0B8fPIL-cKPM-N0pGaC1BTGhHUkk/edit?pli=1

Recovery Energy Judgment

https://docs.google.com/file/d/0B8fPIL-cKPM-WmxNNGhtc2l1eU0/edit?pli=1

Shack Energy Services $2,451.55

https://docs.google.com/file/d/0B8fPIL-cKPM-UmFBRDNLeXk1VEE/edit?pli=1

Shack Energy Services $2,451.55

https://docs.google.com/file/d/0B8fPIL-cKPM-UmFBRDNLeXk1VEE/edit?pli=1

New Archer Drilling Oct 4th filling

https://docs.google.com/file/d/0B8fPIL-cKPM-aktuVkFCWG5KR00/edit?usp=sharing&pli=1

Archer Drilling Exhibit A Oct 4th filling

https://docs.google.com/file/d/0B8fPIL-cKPM-RFViQmYxME1rTjA/edit?usp=sharing&pli=1

Oct 2nd Circle K judgment $27,397.40

https://docs.google.com/file/d/0B8fPIL-cKPM-NjhGZTY3NUhZcm8/edit?usp=sharing&pli=1

Treaty also owes Princess Petroleum and the Government of Belize money. Treaty owes the TRRC like $16,000.00 in fines and the Barnes land owner an estimated $70,000.00 in damages as well as the cementer $ 65,000.00. Treaty also still needs to plug the mine well, that is another $60,000.00 - $70,000.00. I'm sure there are many others Treaty has screwed along the way as well.

Treaty also has serious TRRC compliance issues.

Proof...

Master Default Order for Non-compliance...

http://www.rrc.state.tx.us/meetings/masterdefault/new/2012/12-04-12-mdo.pdf

TRRC order to plug 8 wells on the McCommas lease.

https://docs.google.com/file/d/0B8fPIL-cKPM-dmVRWXota1d1eXM/edit

Treaty's new and the second Master Default Order...

Treaty didn't bother to show up for this one either...

http://www.rrc.state.tx.us/meetings/masterdefault/new/2014/01-07-14-mdo.pdf

Treaty's operator C&C Petroleum's delinquent P-5

C&C Petroleum's delinquent P-5 here

Then add to it all the BS excuses. Nobody likes to hear BS...

Treaty has been taken to court for failure to work the Louisiana lease...

https://docs.google.com/file/d/0B8fPIL-cKPM-d050WU90YV9RMk0/edit

Remember this???

NEW ORLEANS, Oct. 31, 2012 /PRNewswire/ -- Treaty Energy Corporation (OTCQB: TECO) (www.treatyenergy.com), a growth-oriented international energy company, announced that it has signed a Letter of Intent with TNC Energy to Fund, Develop, and Produce all leases and wells recently purchased by Treaty Energy located in Converse, La. (Sabine Parrish).

Under the terms of the proposed agreement TNC Energy will provide all development funds necessary to bring into production the 50 existing wells, as well as the drilling of additional wells upon completion of the work overs.

TNC Energy has related to the Treaty Energy management team, that their engineers have estimated production levels of up to 600 bbls/day out of the 50 existing wells after completion of the work overs.

Work over cost are estimated at $15,000 per well and completion time for all wells is expected to take approximately 3 to 4 months. TNC Energy is currently on site and proceeding with the work over of the wells. Treaty Energy Corp will not be responsible for any other investments in the venture nor any other operational responsibilities.

Andrew Reid, Co-CEO of Treaty Energy Corp., stated "I am pleased to have Treaty Energy join in this joint venture with a well-capitalized group like TNC Energy. If estimated production levels are achieved, this JV could add up to 240 bbls/day of prime Louisiana light oil to Treaty's daily production."

Treaty also makes wild claims of great things that never happen...

Proof...

Here is a list of the actual..

July 13.0 BOPD 403 Barrels For The Month

June 6.8 BOPD 204 Barrels For The Month

May 3.38 BOPD 105 Barrels For The Month

April 4.36 BOPD 131 Barrels For The Month

March 9.23 BOPD 286 Barrels For The Month

Feb. 17 BOPD 476 Barrels For The Month

Jan. 8.53 BOPD 256 Barrels For The Month

2012

Dec. 5.80 BOPD 180 Barrels For The Month

Nov. 9.83 BOPD 295 Barrels For The Month

Oct. 9.06 BOPD 281 Barrels For The Month

Sept. 9.6 BOPD 288 Barrels For The Month

Aug. 8.06 BOPD 250 Barrels For The Month

July 10.09 BOPD 313 Barrels For The Month

June 10.37 BOPD 311 Barrels For The Month

May 0.32 BOPD 10 Barrels For The Month

April 0 BOPD 0 Barrels For The Month

March 0 Treaty acquired C&C Petroleum, operator #120104

Feb 0 BOPD 0 Barrels For The Month

Jan 0 BOPD 0 Barrels For The Month

2011

C&C Petroleum Operator #120104

Production by Filing Operator

http://webapps.rrc.state.tx.us/PR/initializePublicQueriesMenuAction.do

This is what Treaty told the world and investors. All turned out to be a complete fantasy...

On 4/12/2011

"Production on these leases for the last reported month of January 2011 was 379 BBLS of sweet crude oil."

http://ih.advfn.com/p.php?pid=nmona&article=47263045

On 4/20/2011

"SHOTWELL W. F. and the SHOTWELL "C" leases.

Treaty indicated that production on these leases is currently 4.18 barrels of oil per day"

http://ih.advfn.com/p.php?pid=nmona&article=47375429

On 5/23/2011

"Mr. Reid added, "With the addition of the 8 leases announced today, I believe that Texas oil production should reach 1200 barrels in June and will grow monthly, as wells are reworked on all of our Texas leases. The goal that we have set for Treaty is to be producing at the rate of 900-1000 BOPD by the end of this year."

http://ih.advfn.com/p.php?pid=nmona&article=47788854

On 7/6/2011

"Therefore we are projecting monthly oil production for August to be about 1000 BBLS and for September to be about 1250 BBLS."

http://ih.advfn.com/p.php?pid=nmona&article=48339951

On 7/8/2011

"Stephen L. York, President and COO of Treaty Energy Corporation, stated, "With the completion of the SHOTWELL acquisition we now have 13 leases covering 1,900 acres with current production of 35-40 barrels of oil per day."

http://ih.advfn.com/p.php?pid=nmona&article=48373870

On 8/1/2011

"Mr. York commented, "These rework activities are expected to increase our oil production by 300-420 barrels per month over the next two weeks, to about 1500 to 2000 barrels per month. While our stated goal is to bring our Texas oil production to 30,000 barrels of oil per month as soon as practical, the economical steps being taken at this time are crucial to us meeting our long term goals in Texas."

http://ih.advfn.com/p.php?pid=nmona&article=48644305

On 9/8/2011

Mr. York added, "The best estimate of Texas production on the currently owned and paid for leases will be 75 to 90 barrels of oil per day after the rework of the 15 shut in wells. Our goal by the end of 2011 is to be at 200 to 350 barrels of oil per day. This production number can vary based on the number of new wells that are expected to be drilled and completed. We expect to exceed 1,000 barrels per day by the end of June 2012. At $80 per barrel, this will translate to about $29.2 million in gross revenues annually from our Texas oil production alone."

http://ih.advfn.com/p.php?pid=nmona&article=49102561

On 10/4/2011

"Our current production from 35 wells is about 50 BOPD, with production expected to be in excess of 60 BOPD by the end of October."

http://ih.advfn.com/p.php?pid=nmona&article=49409925

On 1/17/2012

"In addition, Mr. York commented, "Treaty remains on track to achieve our previously stated goal of 1000 BOPD by end of June 2012. Current production from existing wells has stabilized and with continuing work-overs we expect production to shortly increase to 1500-2000 barrels per month."

http://ih.advfn.com/p.php?pid=nmona&article=50781875

On 5/7/2012

"With drilling starting almost immediately, Treaty will endeavor to fulfill its goal of 1,000 barrels of oil per day in Texas, as stated in prior news releases."

http://ih.advfn.com/p.php?pid=nmona&article=52304074

Then there is the history of management...

All investors and potential investors in Treaty should read this... Particularly paragraphs 12,13,14,15 and 18...

No spin here...

Gwyn apparently has misappropriated and used for his own expenses from these "funds" that he was managing more that $200,000.00 bucks.

http://www.nfa.futures.org/basicnet/CaseDocument.aspx?seqnum=3322

On June 12, 2013, NFA issued a Complaint charging L3M and Gwyn with willfully providing incomplete and misleading information to pool participants; failing to observe high standards of commercial honor and just and equitable principles of trade; and providing misleading information to NFA. The Complaint also charged L3M with failing to file a disclosure document or annual financial statement for the fund with NFA; failing to furnish participants in the fund with a financial statement; and failing to comply with CPO quarterly reporting requirements. Finally, the Complaint charged L3M, L3T and Gwyn with failing to cooperate with NFA

http://www.nfa.futures.org/basicnet/Case.aspx?entityid=0190801&case=13BCC00007&contrib=NFA

That's what the NFA has concluded. It's all right here...

http://www.nfa.futures.org/basicnet/CaseDocument.aspx?seqnum=3322

And the NFA has already taken action...

NOTICE OF MEMBER RESPONSIBILITY ACTION AND ASSOCIATE RESPONSIBILITY ACTION:

On June 12, 2012, NFA issued a Member Responsibility Action ("MRA") against Level III Management LLC ("L3M") and Level III Trading LLC ("L3T")and an Associate Responsibility Action ("ARA") against Bruce A. Gwyn ("Gwyn") whereby:

1. L3M, L3T and Gwyn are suspended from NFA membership and associate membership, respectively, effective immediately and until further notice;

2. L3M, L3T and Gwyn, and any person acting on behalf of L3M and L3T, are prohibited from soliciting or accepting any funds from customers, pool participants or investors, soliciting investments for any managed accounts, pools or other investment vehicles, including the Level III Trading Partners LP ("L3LP" or "the Fund"); or placing any trades, except liquidation trades in L3LP or any other customer account or fund over which L3M, L3T and Gwyn exercise control;

3. L3M, L3T and Gwyn, and any person acting on behalf of L3M and L3T, are prohibited from disbursing or transferring any funds over which they or any person acting on their behalf exercises control (including bank, trading and other types of accounts), without prior approval from NFA; and

4. L3M, L3T and Gwyn are required to provide copies of this MRA/ARA by overnight courier or e-mail to all: a) customers; b) participants in L3LP; c) other investors; and d) banks, brokerage firms, and other financial institutions with which money, securities or other property is on deposit in the name of L3M, L3T, L3LP, or Gwyn or over which L3M, L3T, L3LP or Gwyn exercise control.

This action is effective immediately and deemed necessary to protect customers of L3M and L3T since L3M and Gwyn have misappropriated L3LP's funds and misled customers regarding the value of their investments in L3LP by providing customers with false and misleading performance information about those investments. Moreover, L3M and Gwyn appear to have acted in a manner that placed Gwyn's interests above the interests of his customers by knowingly investing the pool participants' assets in several investment ventures without adequately disclosing the investments' risky nature and Gwyn's relationship to them. In addition, L3M and Gwyn have not provided certain L3M customers with a current disclosure document ("DD") approved by NFA that adequately discusses the true nature of the Fund's investments. Lastly, L3M and Gwyn have failed to cooperate with NFA's investigation because they have refused to make Gwyn available in person to answer NFA's questions about L3M's and L3T's activities, and Gwyn and L3M have failed to produce requested records regarding the Fund's riskiest investments (i.e., all supporting documents for the Fund's asset balances).

The MRA and ARA will remain in effect until such time as L3M, L3T and Gwyn have demonstrated to the satisfaction of NFA that they are in complete compliance with all NFA Requirements.

Plenty more here:

http://www.nfa.futures.org/basicnet/Case.aspx?entityid=0190801&case=12MRA00005&contrib=NFA

Andrew Reid barred from working as a broker by FINRA...

https://docs.google.com/file/d/0B8fPIL-cKPM-ZHZfaV9KSWVEQUE/edit

..

..

..

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.