Friday, November 15, 2013 11:27:10 AM

IMO, buying Jan calls now is not a wise decision.

Do ya'll understand contango???

VXX is a mathematical beast ruled by contango. And contango is the steepest that it has been in many, many months.

Do ya'll understand why Tuesday is a critical date for the VIX-proxies??? (VIX futures expire at 1615 that afternoon!)

Do you realize that the VIX can rise over 10% to as high as 13.5 by Tuesday afternoon and VXX will still fall another 1-2%?

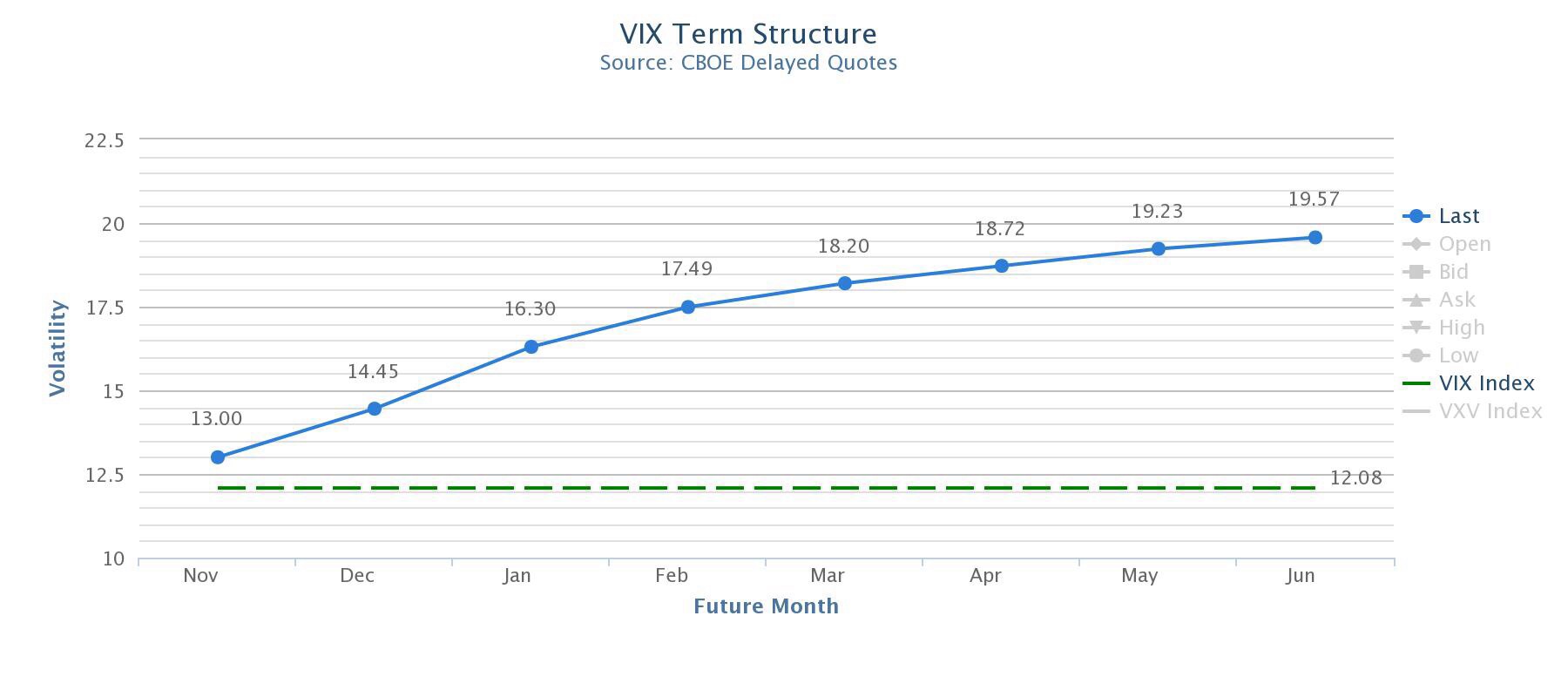

Please study the chart below from vixcentral.com. It graphs the VIX futures curve. (spot VIX is dotted line). VXX at market close Tuesday will be based entirely on the price of Z3, December futures. Contango btwn Z3 and spot is an outrageous 20%.

Spot and front month must converge and expiry and, most likely, with spot so low, spot will mostly move up to meet November.

If spot remains at 12.10, VXX could fall another 10% just by Tuesday.

Meanwhile, you are speculating now anticipating that the debt crisis might heat up again by late December.

BUT contango between Devember and Jan futures is a robust 13%.

I've written a thousand times that if you anticipate a stock mkt correction the best play is to short a leveraged index ETP.

Stingray and I have explained these V-proxies ad nauseum on the UVXY board.

Regardless, good luck on your "investment".

Doc

Recent VXX News

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 09:25:11 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 09:21:10 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 09:15:52 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 08:14:45 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 08:10:31 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 07:47:15 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 07:27:52 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 07:23:47 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 07:11:54 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 07:11:42 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 07:08:25 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 06:54:20 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 06:54:05 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 06:25:46 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 05:27:03 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 05:00:45 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 04:52:11 PM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 03/11/2024 03:34:14 PM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 03/11/2024 03:30:31 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 03:21:02 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 03:10:38 PM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 03/11/2024 03:03:20 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/11/2024 02:47:16 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/08/2024 08:47:00 PM

- Form 424B2 - Prospectus [Rule 424(b)(2)] • Edgar (US Regulatory) • 03/08/2024 08:19:13 PM

FEATURED POET Announces Design Win and Collaboration with Foxconn Interconnect Technology for High-speed AI Systems • May 14, 2024 10:09 AM

FEATURED Element79 Gold Corp Reports Exceptionally High-Grade Results from Lucero • May 14, 2024 7:00 AM

VAYK Added New Manager for Expansion into $64 Billion Domestic Short-term Rental Market • VAYK • May 14, 2024 9:00 AM

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM