Monday, September 16, 2013 8:00:19 AM

It’s good to see you here. The GLER last PR explained a lot that I’m not sure if investors fully understood the magnitude of all that was delivered. These two sentences below were probably the combined single most important, yet subliminal sentences within the PR and I believe it was ignored by many. See below…

http://ih.advfn.com/p.php?pid=nmona&article=59127679

Hawk Manufacturing is a privately held corporation looking to complete a roll-up of the plastics and metals manufacturing industries. The objective of Hawk is to combine several metals and plastics fabrication businesses under a single operating company…

Those two sentences clearly are saying how the ”goal’ for Hawk is to 100% roll up into GLER to become one company. I have personally called the company to confirm that this thought is correct. Right now they own 20% of each other, but after Hawk completes the four acquisitions that was PR-ed, Hawk is then going to be rolled up into GLER to become one company.

The reason why it is being done this way is because the deal would have been far too complicated if Hawk would have fully rolled up into GLER first then had done the acquisitions. The acquisitions had to be done by Hawk first while Hawk is still a private company, then the roll up into GLER. So in essence, all of what I am about to elaborate on, will be the new GLER.

GLER is in the process of having a major makeover. It is going to transform into a company with four different profitable entities into it. See below:

http://ih.advfn.com/p.php?pid=nmona&article=59127679

Global Earth Energy, Inc. (OTCQB:GLER) partner HAWK Manufacturing (HAWK) continues to work on reaching acquisition agreements with four businesses in three states. These businesses had combined 2012 annual revenues of $27 million and 2012 annual EBITA profits of $4 million. Expecting to close these acquisitions before the end of 2013, HAWK anticipates using existing financial facilities of more than $10 million to close on these transactions. …

There are some other key topics of interest to note within that same GLER PR. We know that these four acquisitions will all already be profitable making up the total $27 million in revenues and the $4 million in profits. We know that these four acquisitions will bring variety to GLER operations as a new entity. I think I need to further explain why GLER will be worth the wait and why Hawk will use the $10 million to close on these transactions.

One of the acquisitions was said to be a company that provides oilfield services to both the Permian Basin and Eagle Ford Shale oil ranges with "Master Service Agreements" already in-place with major oil production companies. Just this one acquisition alone is huge in itself because of already having an established clientele intact from an established area; the Permian Basin and Eagle Ford Shale.

The Permian Basin

Here is some info about the Permian Basin from the website of the Texas Railroad Commission who is the governing regulatory authority for all companies producing oil in that region:

http://www.rrc.state.tx.us/permianbasin/

The Permian Basin is an oil-and-gas-producing area located in West Texas and the adjoining area of southeastern New Mexico. The Permian Basin covers an area approximately 250 miles wide and 300 miles long. Various producing formations such as the Yates, San Andres, Clear Fork, Spraberry, Wolfcamp, Yeso, Bone Spring, Avalon, Canyon, Morrow, Devonian, and Ellenberger are all part of the Permian Basin, with oil and natural gas production ranging from depths from a few hundred feet to five miles below the surface. The Permian Basin remains a significant oil-producing area, producing more than 270 million barrels of oil in 2010 and more than 280 million barrels in 2011. The Permian Basin has produced over 29 billion barrels of oil and 75 trillion cubic feet of gas and it is estimated by industry experts to contain recoverable oil and natural gas resources exceeding what has been produced over the last 90 years. Recent increased use of enhanced-recovery practices in the Permian Basin has produced a substantial impact on U.S. oil production.

Below is a map to show the area that makes up the Permian Basin:

http://www.searchanddiscovery.com/documents/2008/08165breton/images/fig01.htm

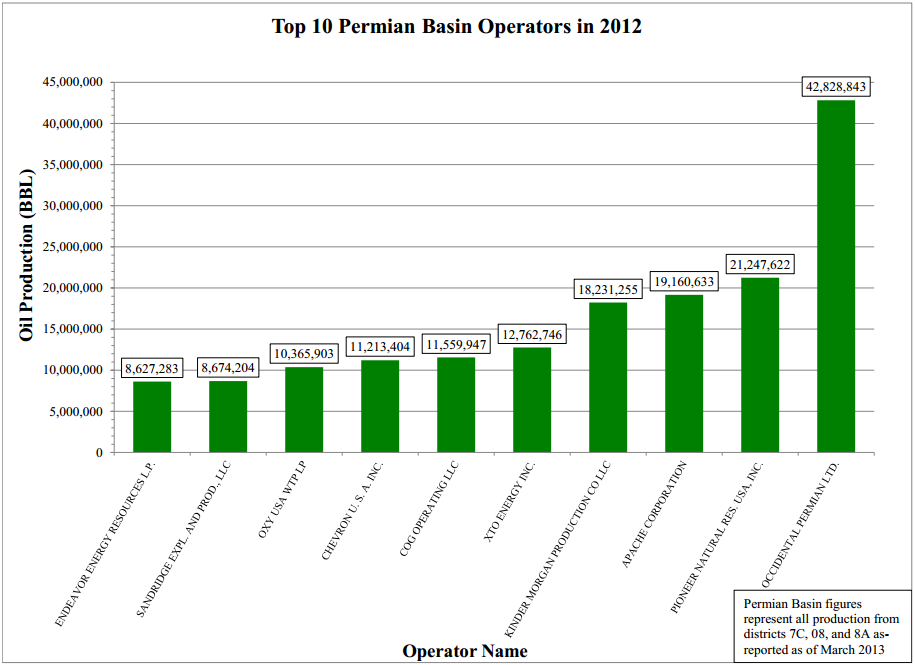

Below is a chart that reflects the Top 10 Operators within the Permian Basin for 2012 just to get an idea of the multi-billion companies that are involved with pulling oil out of the ground for this area. Also, one of those companies is probably very likely one of the major oil production companies who within this GLER acquisition PR is referring to already having a "Master Service Agreements" in-place with. As you can see from the chart below, these multi-billion dollar companies are very well known and are listed across the bottom of the chart:

The Eagle Ford Shale

Here is some info about the Eagle Ford Shale from the website below:

http://www.universalcitytexas.com/index.aspx?NID=831

The Eagle Ford Shale is a 400 mile long and 50 mile wide gas and oil producing site that stretches across south Texas from the Mexican border all the way up to east Texas. The shale, which has an average thickness of 250 feet, is significant because it produces both oil and gas - the gas coming in both wet and dry forms.

The Houston Cronicle has reported that Eagle Ford Shale has become the heart of economic activity in Texas, attracting foreign companies that have become some of the largest employers in the state. According to the Railroad Commission of Texas, there were 368 producing oil leases and 550 producing gas wells in 2011. From January to October 2011, more than 13 million barrels of oil were produced in Eagle Ford Shale. …

http://www.energyfromshale.org/hydraulic-fracturing/eagle-ford-shale-gas?gclid=CJ_km5jXz7kCFc5FMgodQiUAtA

The Eagle Ford Shale gas formation was discovered in 2008 and is unlike many other shale formations because it has both oil and natural gas resources. Located in Southwest Texas, the Eagle Ford Shale is estimated to have 20.81 trillion cubic feet of natural gas and 3.351 billion barrels of oil. The formation ranges in depth from 5,700 to 10,200 feet and covers over 3,000 square miles.

Below is a map of the Eagle Ford Shale:

http://www.universalcitytexas.com/index.aspx?NID=831

Within this same GLER PR, the company mentioned that HAWK is working to acquire a company that makes products for industrial food distribution. When you simply Google ”industrial food distribution” to research, look to see what pops up to get an idea of the type of products that this company that Hawk is acquiring to be placed into GLER will be making for companies:

https://www.google.com/#q=industrial+food+distribution

Below is a little more to understand the growth of this Industry to understand the magnitude of this ”additional acquisition” that’s to be coming into GLER too…

http://www.ifdaonline.org/About-IFDA/Who-Are-Foodservice-Distributors

This largely behind the scenes industry includes more than 2,500 companies operating thousands of warehouses and massive transportation fleets. A typical broadline foodservice distributor may serve anywhere from 1,000 to 6,000 accounts from a single distribution center and offer their customers more than 10,000 items to meet specific operator needs. In 2012, estimated distributor annual sales in North America exceeded $200 billion.

Here is something else that Hawk mentioned within that same PR that is very powerful:

http://ih.advfn.com/p.php?pid=nmona&article=59127679

HAWK reported to GLER that it is working with the various state and local agencies to expand operations and bring new employment to the areas; HAWK is negotiating incentives at the state and local level that could total more than $17 million in tax incentives and other benefits.

GLER believes that HAWK intends to use existing credit facilities for more than $10 million to complete this transaction and similar transactions going forwards, and intends to work with various states and local governments and finance authorities on tax incentives, and direct benefits that could top more than $40 million over the life of the company.

To help you better understand how these Tax Incentives work, first read the complete article below to see how the St. Paul bakery is an example for tax incentive success. Then read the following article to see where big Tax Incentive deals cited where Illinois offered $275 million to keep Sears and $100 million to hold onto Motorola Mobility; New Jersey dropped $250 million to keep Prudential Insurance and $102 million to retain Panasonic North America, both in 2011; NCR got $109 million in incentives from Georgia to leave Ohio in 2009. There’s even much more cited within the article which clearly explains the job factor that GLER and Hawk keeps referring to. Then read the following article to see the examples below on how Tax Incentives worked out for Lions Gate Entertainment (NYSE: LGF), Time Warner Inc. (NYSE: TWX), and TVB (HKG: 0511).

St. Paul bakery is an example for tax incentive success

http://www.startribune.com/opinion/commentaries/214422791.html

Other Major Tax Incentive Deals Cited:

http://www.passfail.com/news/kc-star/another-report-takes-on-the-tax-incentive-game/another-report-takes-on-the-tax-incentive-game-7051040.htm

http://emerginggrowth.com/posts/state-tax-incentive-packages-leverage-film-production/06/20/2013

In North Carolina alone, film and television production companies such as Lions Gate Entertainment (NYSE: LGF), Time Warner Inc. (NYSE: TWX), and TVB (HKG: 0511), took advantage of the state’s movie and television production incentives. The economic impact of the industry cannot be underestimated within the state. Over 8,500 jobs and $206.7 million in wages are directly related to the industry in the state. In 2011 alone, 24 major films and five TV shows were filmed in the state including The Hunger Games, Journey 2: The Mysterious Island and Homeland. Tax incentives in the state include a refundable tax credit equal to 25% of qualifying in-state production expenses if a minimum of $250,000 is met. The state has a $20 million per feature credit cap.

To add, as I had previously posted, the CEO of Hawk, John M. Ragsdale, is a GSA Contract Holder which means that GLER/Hawk will always be in line to make sure that a certain amount of government contracts are awarded. Read below as further confirmation of such for the company in a response I made to sprtcrdlui …

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=91854790

GLER’s Hawk 23 Government Defense Contracts…

This is huge DD and is much appreciated. The importance about the 23 Government Defense Contracts that were obtained by Hawk is that it adds another level of huge credibility that what they are doing is very real. This means that GLER must be credible or Hawk would not had wanted to have done a Share Exchange Agreement with them to own 214,027,096 shares of GLER. In my opinion, Hawk must really know what is coming out in the future or they would not have ever done such a deal with GLER to own so many shares.

Confirmation of the Government Contracts below:

http://www.governmentcontractswon.com/department/defense/hawk-manufacturing-828402474.asp?yr=10

This next part is something that I believe is so important, that I believe that I must reiterate about it again.

http://ih.advfn.com/p.php?pid=nmona&article=59127679

Hawk Manufacturing is a privately held corporation looking to complete a roll-up of the plastics and metals manufacturing industries. The objective of Hawk is to combine several metals and plastics fabrication businesses under a single operating company in order to achieve the following:

• Expand current operations through strategic capital and other resource infusions

• Diversify current operations by leveraging acquisition customer codes and relationships

• Leverage customer relationships with companies like Delta Airlines, US Airways, John Deer and others to generate additional business.

• Increase geographic coverage by launching satellite operations

• Leverage synergies across all operations through purchasing economies of scale, consolidation of support operations, and other resource sharing

Again, with the above, it is very important to understand that those first two sentences in bold are clearly saying how the goal for Hawk is to 100% roll up into GLER to become one company. Again, I have personally called the company to confirm that this thought is correct. Right now they own 20% of each other, but after Hawk completes the four acquisitions that was PR-ed, Hawk is then going to be rolled up into GLER to become one company.

The reason why it is being done this way is because the deal would have been far too complicated if Hawk would have fully rolled up into GLER first then had done the acquisitions. The acquisitions had to be done by Hawk first while Hawk is still a private company, then the roll up into GLER. So in essence, all of what I have elaborated on above, will be the new GLER.

As for that one bullet from above that I have in bold, I think it is very important to note that Hawk is going to help GLER ”leverage customer relationships with companies like Delta Airlines, US Airways, John Deer and others to generate additional business” which I believe we will hear more about after the roll up of Hawk into GLER.

I think all should read this very important post below which now should add more clarity after reading the thoughts above:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=91903536

Courtesy of sprtcrdlui, read the posts below to see how GLER should soon have over $47 Million in Revenues and $4 to $8 Million in Annual EBITA Profits:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92045863

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92045702

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=92045635

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.