Saturday, March 09, 2013 12:13:16 PM

Before reading this valuation post, understand that these thoughts are derived from a mixture of known and unknown variables that are predicated upon AUCI & Rangemore achieving or surpassing their business objectives for growth. Also understand, this valuation does not take into account any unknown deals or news of growth that have not been announced yet. Considering such, AUCI could go well past .026+ ”IF” such news of substance is generated. This current valuation of .026+ per share is conservatively speaking for where AUCI could reside to trade based what is currently known.

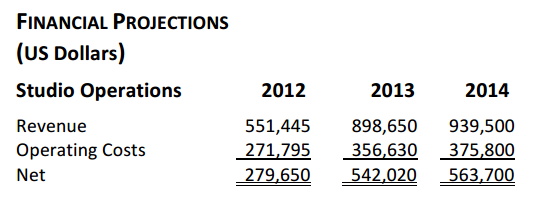

Observe the financial projections below of $542,020 for ”Net Income” from its Rangemore operations for 2013:

http://media.wix.com/ugd//b6b091_e0b3063d842f5e7abf441c4f36a11f7e.pdf

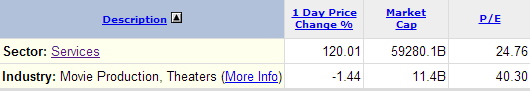

As you can see from below, the Movie Production & Theaters Industry is a $11.4 Billion Industry with a P/E Ratio of 40.30 for the industry:

http://biz.yahoo.com/p/726conameu.html

With the Movie Production & Theaters Industry being a $11.4 Billion Industry, as you can see, AUCI/Rangemore achieving $542,020 is very doable as this amount is not even close to 1% of the 1% generated from the industry.

For inquiring minds, the P/E Ratio is the ”growth rate” for a particular industry. There is much to understand about the P/E Ratio that could be read from the post below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=57154170

The Outstanding Shares (OS) for AUCI is last reported to be 817,834,722 shares from the company’s Transfer Agent (TA) courtesy of georgie18 as indicated within the post below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=83933510

Now let’s derive a ”potential” Fundamental Valuation for AUCI given the variables so far derived…

Net Profit = $542,020

OS = 817,834,722 shares

Earnings Per Share (EPS) = Net Profit ÷ OS

EPS = $542,020 ÷ 817,834,722 shares

EPS = .00066

Expected Price Per Share = EPS x Price to Earnings (P/E) Ratio

Expected Price Per Share = .00066 EPS x 40.30 P/E Ratio

Expected Price Per Share = .0265 per share

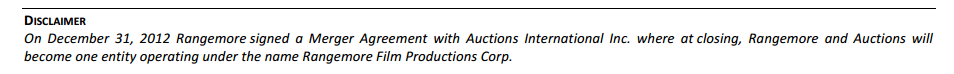

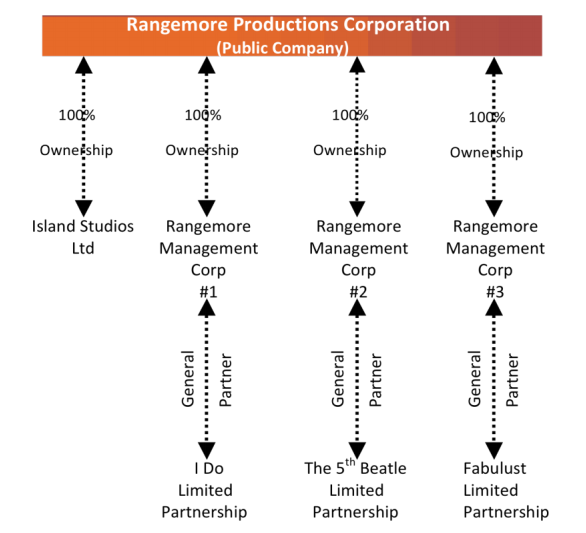

AUCI & Rangemore Merger Ownership Distribution

Below is a breakdown to understand the ownership distribution of the merger between AUCI and Rangemore to transform then both into one company called Rangemore Film Productions Corp:

http://media.wix.com/ugd//b6b091_e0b3063d842f5e7abf441c4f36a11f7e.pdf

FILM PRODUCTIONS

Along with the studio operations, Rangemore will be producing their own independent films. Each project will have its own corporate structure and management team. Rangemore is actively pursuing a number of film projects that they feel will provide shareholders with a better than average rate of return.

AUCI & Rangemore Before & After Studio Renovations

Below are some thoughts and pictures to reflect the AUCI and Rangemore ”before and after” studio renovations to capture the growth that has thus far transpired with the company:

http://media.wix.com/ugd//b6b091_e0b3063d842f5e7abf441c4f36a11f7e.pdf

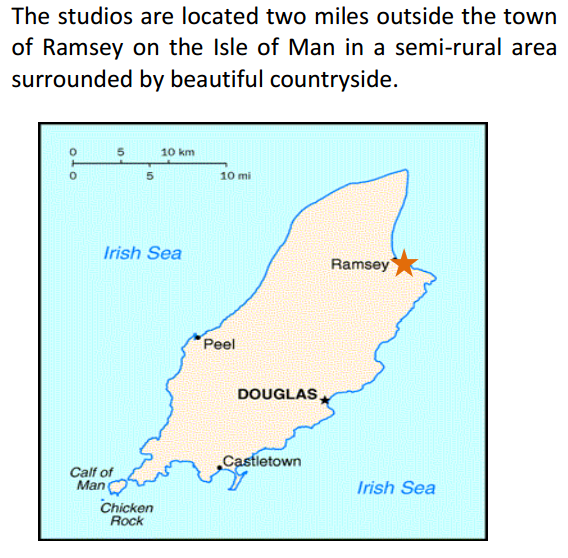

Map Location of the Studios:

http://media.wix.com/ugd//b6b091_3cb65aacaa27eccfb520ad3d76f5d5af.pdf

THE COMPANY

Rangemore Productions Corp (“Rangemore”) operates a film studio on the Isle of Man known as Island Studios. Island Studios is a complete film production facility providing producers and directors with a turnkey solution for their creative needs. The studios have been in operation since 2002 and have been used for a number of feature films. In addition to the studio operations, Rangemore will be independently producing its own TV and film projects.

http://media.wix.com/ugd//b6b091_e0b3063d842f5e7abf441c4f36a11f7e.pdf

From the recent AUCI PR:

http://ih.advfn.com/p.php?pid=nmona&article=56638294

…The ability to participate in the payouts of the independently produced movies is where the upside in the movie industry lies. Low budget pictures produced by independent production companies in the past have been able to routinely generate revenues in excess of $2 million when one considers not only theater, but pay-per-view, home video, foreign markets and ancillary revenues. Looking at the top low budget independently produced pictures, the average 10-year gross was in the neighborhood of $9 million while the top 8 grossed more than $30 millionand the number one pictures earned just over $120 million. The lowest picture in the sample earned approximately $2 million. Occasionally, feature films produced for less than $50,000 will gross hundreds of thousands or even break the multi-million dollar mark. It is the intention of Rangemore, through the arrangement with Flick Me, to create a large and diversified portfolio of film royalties in these types of independently produced films. Rangemore's goal is to generate the maximum amount of return for the minimum amount of investment. Flick Me has two films in pre-production both of which Rangemore is currently reviewing to establish if and to what extent Rangemore will participate. …

Here’s the chart of which the company was referring…

http://media.wix.com/ugd//b6b091_3faed68c7f239c6c2b70c8ba2e4a6edc.pdf

Bio of Officers & Directors; Paul Mullins, Andrew McLaughlin, & Jeremy Graham:

http://media.wix.com/ugd//b6b091_8488ce162ff6f25f4b35be1d60dfe6a9.pdf

http://media.wix.com/ugd//b6b091_b3a8a0b801f3fd9ce4aff15a07a13493.pdf

http://www.rangemoreproductions.com/

http://media.wix.com/ugd//b6b091_e0b3063d842f5e7abf441c4f36a11f7e.pdf

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM

VPR Brands (VPRB) Reports First Quarter 2024 Financial Results • VPRB • May 17, 2024 8:04 AM

ILUS Provides a First Quarter Filing Update • ILUS • May 16, 2024 11:26 AM

Cannabix Technologies and Omega Laboratories Inc. enter Strategic Partnership to Commercialize Marijuana Breathalyzer Technology • BLO • May 16, 2024 8:13 AM

Avant Technologies to Revolutionize Data Center Management with Proprietary AI Software Platform • AVAI • May 16, 2024 8:00 AM