Saturday, December 08, 2012 11:44:14 AM

From the PR recently released below, the following was indicated for Bonanza Gold and Silver results for SRGE:

http://ih.advfn.com/p.php?pid=nmona&article=55362306

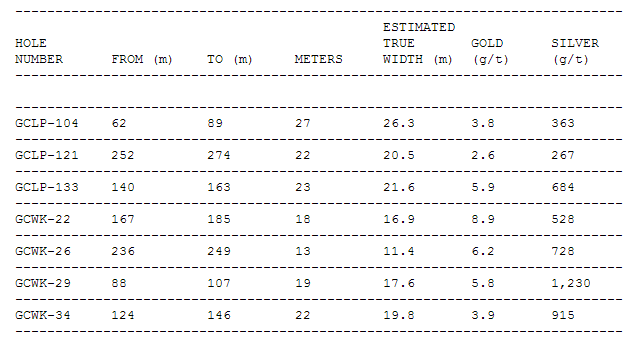

Analytical Highlights of the Phase I diamond drill program:

If you were to take the amount of gold ranging from a low of 2.6 g/t to 8.9 g/t, you would get an average of 5.3 g/t of gold for the Gran Cabrera mine.

If you were to take the amount of silver ranging from a low of 267 g/t to 1,230 g/t, you would get an average of 673 g/t of silver for the Gran Cabrera mine.

With g/t representing grams per ton, consider the conversion from grams to ounces (oz) per ton:

http://www.metric-conversions.org/weight/grams-to-ounces.htm

5.3 g/t of gold = 0.18695 oz/ton of gold

673 g/t of silver = 23.739 oz/ton of silver

Now let’s consider that either SRGE or a JV partner would be willing to instill a mill with the capacity of the previously announced mill processing capacity of 500 tpd (tons per day) which is very rational to consider. Consider the valuations for gold and silver below.

Gold from 500 tons per day (tpd) Processing Capacity Mill at the Gran Cabrera:

Gold at Gran Cabrera = 500 tpd of ore x .18695 oz/ton

Gold at Gran Cabrera = 93.475 oz per day

Gold per year = 93.475 oz per day x 365 days per year

Gold per year = 34,118 oz of gold per year

Gold = $1,700.00+ per ounce as of 12/07/2012:

http://www.kitco.com/charts/livegold.html

Annual Gold Revenues from Gran Cabrera = 34,118 oz x $1,700

Annual Gold Revenues from Gran Cabrera = $58,000,600 per year

The Yahoo link below reflects a ”Net Profit Margin” for the Gold Industry of 24.00% as of 7 Dec 2012 (This means that the ”Net Expense Margin” for gold operations is 75.00%):

http://biz.yahoo.com/p/134conameu.html

Annual Gold Net Income from Gran Cabrera = $58,000,600 x .24

Annual Gold Net Income from Gran Cabrera = $13,920,144 per year

Silver from 500 tons per day (tpd) Processing Capacity Mill at the Gran Cabrera:

Silver at Gran Cabrera = 500 tpd of ore x 23.739 oz/ton

Silver at Gran Cabrera = 11,869 oz per day

Silver per year = 11,869 oz x 365 days per year

Silver per year = 4,332,185 oz of silver per year

Silver = $33.00+ per ounce as of 12/07/2012:

http://www.kitco.com/charts/livesilver.html

Annual Silver Revenues from Gran Cabrera = 4,342,040 oz x $33.00

Annual Silver Revenues from Gran Cabrera = $142,962,105

The Yahoo link below reflects a ”Net Profit Margin” for the Silver Industry of 41.00% as of 7 Dec 2012 (This means that the ”Net Expense Margin” for silver operations is 59.00%):

http://biz.yahoo.com/p/135conameu.html

Annual Silver Net Income from Gran Cabrera = $142,962,105 x .41

Annual Silver Net Income from Gran Cabrera = $58,614,463 per year

Annual Gold Net Income from Gran Cabrera = $13,920,144 per year

Annual Silver Net Income from Gran Cabrera = $58,614,463 per year

Total Gold & Silver Annual Net Income from Gran Cabrera = $72,534,607 per year

EPS = Earnings Per Share

NI = Net Income

OS = Outstanding Shares

EPS = NI ÷ OS

EPS = $72,534,607 ÷ 545,874,868 OS

EPS = .132 per share

Now to determine a fundamental valuation of where SRGE should be trading if this amount for Net Income is captured, we must multiply the EPS by the Price to Earnings (P/E) Ratio for the industry in which it would trade which in this case would be the Gold Industry. As indicated below, 21.20 is the P/E Ratio for the Gold Industry:

http://biz.yahoo.com/p/134conameu.html

To understand more about the logic centered on the P/E Ratio, please read the link below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=57154170

Now let’s derive a share price of where SRGE could fundamentally trade now that we have our EPS:

Expected Price Per Share = EPS x P/E Ratio

Expected Price Per Share = .132 x 21.20

Expected Price Per Share = $2.79 per share

For those who like to operate from a ”worst case scenario” perspective, below is a valuation considering that ”if” the SRGE’s current Authorized Shares (AS) of 1,500,000,000 shares is maxed out to be the OS used as the key denominator to asses this fundamental valuation. Consider below a derived EPS from a ”worst case scenario” perspective:

EPS = NI ÷ OS

EPS = $72,534,607 ÷ 1,500,000,000 OS

EPS = .048 per share

Expected Price Per Share = EPS x P/E Ratio

Expected Price Per Share = .048 x 21.20

Expected Price Per Share = $1.01 per share

So, this means that SRGE is worth as a ”best case” perspective $2.79 per share based on its Gran Cabrera mine alone. This means that SRGE is worth as a ”worst case” scenario $1.01 per shares based on its Gran Cabrera mine alone. It must be noted that the above valuation ”could” be derived over time based on the data presented by SRGE. How soon would be based upon a variety of variables to include if a major Joint Venture (JV) entity would get involved to assist as it is very attractive. Also, as this must be noted again, the above valuation is only from the recent SRGE drill program that was done on their Gran Cabrera mine alone. SRGE is worth significantly more when you consider the valuation added in from their additional mines that they own of which we all are familiar with I’m sure.

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM