Substantial Resources

TORONTO, Oct. 11, 2012 /PRNewswire/ -

U.S. Silver & Gold Inc.

("U.S. Silver & Gold" or the "Company") (TSX:USA; OTCQX:USGIF) is

pleased to provide a comprehensive update on its year-to-date

exploration results and exploration plans for the remainder of

2012 and beyond, as well as an update on other corporate

developments.

The Company's assets are comprised of two 100% owned operating

mines - the high grade gold and silver Drumlummon Mine in Montana

and the high grade silver Galena Mine Complex in Idaho.

Galena Mine Complex

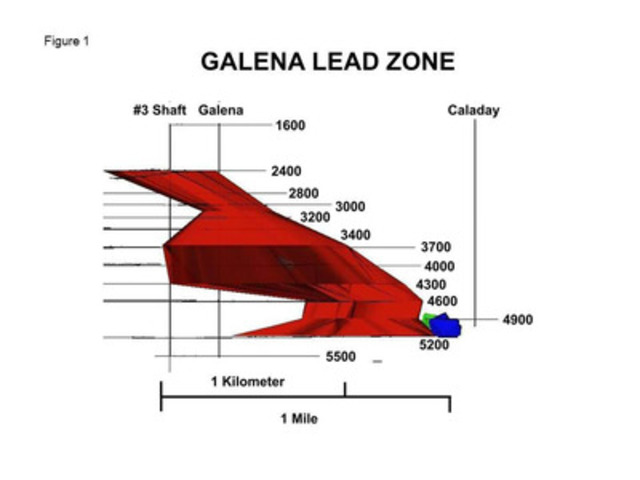

The Lead Zone

Drilling by previous owners identified a large area of lead /

silver mineralization in the Galena Mine Complex.

Recently, the exploration staff at the mine compiled past results and

incorporated recent underground drilling to define a significant

potential resource in what is known as

the Lead Zone ("LZ" previously referred to as the "Caladay Lead Zone").

The LZ is a semi-continuous mineralized zone that extends from the

2400 level to the 5200 level and potentially into

the Caladay Mine at depth.

The zone covers approximately 2,800 vertical feet.

The estimated strike length on the known levels ranges between

1,200 and 3,600 feet and the apparent widths range

between 200 and 400 feet.

The LZ occurs as a large lead-silver (Ag-Pb) zone of disseminated and

stringer-controlled mineralization containing higher grade linear

zones.

Figure 1 located -

Galena Lead Zone shows the drill indicated extent.

Only a small portion of the LZ has been drilled extensively.

In 2012, a drilling program allowed the development of a resource

on the 4000 and 4900 Levels of

approximately 600,000 to 700,000 tons where test mining

will be carried out in the fourth quarter of 2012.

This drilling indicates potential global grades of

3 to 4 ounces per ton (103 to 137 grams per tonne) silver and

3 to 5 percent lead.

All targeted areas contain 1 to 3 continuous zones of higher

grade mineralization, ranging between

5.5 to 10.0 ounces per ton (189 to 343 grams per tonne) silver and

5 to 11 percent lead, surrounded by lower grade material.

High grade zones represent 30 to 40 percent of the total global

tonnage with continuous widths ranging between 15 and 30 feet.

Between these zones are lower grade areas, 60 to 80 feet wide with

grades of approximately 1 to 3 ounces per ton (34 to 103 grams

per tonne) silver and 1 to 4 percent lead.

Drilling to date by others (principally ASARCO Incorporated) and recently by

U.S. Silver & Gold has led to a global tonnage target for the LZ

of between 60 to 70 million tons and a potential global resource

of between 150 to 200 million ounces of silver.

"The Galena Mine Complex has been in production for almost

60 years, and ore continues to be found year after year.

Exploration has consistently exceeded annual production and we

expect this will be the case in 2012 with resources growing once

again extending the life of the Complex," stated

Darren Blasutti, President and CEO of U.S. Silver & Gold.

"Recent drilling results in the Lead Zone are particularly

noteworthy.

Based on what we've seen, this area has the potential to redefine

the Galena Complex as we become more comfortable in our ability

to use lower cost bulk mining methods in exploiting this deposit."

The results of some significant intersections in the LZ are

presented in Table 1 below. These intersections indicate two

zones approximately 25 feet apart

averaging 13.4 feet of 8.63 ounces per ton (296 grams per tonne)

silver and 3.38 percent lead, and

77.3 feet of 6.76 ounces per ton (232 grams per tonne) silver and

10.92 percent lead.

There are zones of higher grade silver within the broader

mineralized zones.

Table 1

Lead Zone - Representative Drill Intersections

From To Width (ft) Ag (oz/t) Cu (%) Pb (%)

218.60 220.00 1.40 27.50 1.10 10.74

220.00 223.00 3.00 2.07 .03 1.77

223.00 226.50 3.50 7.63 .16 2.99

226.50 229.80 3.30 3.51 .07 1.04

229.80 232.00 2.20 1.62 .05 .37

257.10 261.70 4.60 6.30 .25 2.57

261.70 265.50 3.80 2.21 .01 2.92

265.50 269.00 3.50 2.28 .01 2.88

269.00 273.00 4.00 2.95 .01 3.92

273.00 275.80 2.80 5.08 .01 8.93

275.80 278.50 2.70 18.40 .01 34.48

278.50 280.00 1.50 6.67 .01 12.77

280.00 282.80 2.80 24.50 .04 42.92

282.80 285.00 2.20 1.39 .01 2.60

285.00 289.00 4.00 1.59 .01 2.20

289.00 293.00 4.00 3.03 .04 4.02

To convert ounces per ton to grams per tonne multiply by

34.286.

Note: Since these drill holes were completed from different drill

stations and intersect the veins at various angles the recovered

intersections may not reflect true widths.

Please refer to www.us-silver.com for additional drilling results on

the Lead Zone.

The drill program for 2013 will focus on the area between the 4600 and

5200 levels, which has the potential to add between 10 million and

15 million ounces of silver to the mine's resources next year.

Silver Vein and 350-370 Vein

The majority of expected silver production from

the Galena Mine Complex is currently being sourced from

the Silver Vein.

Drilling during 2012 has extended several of the known higher

grade veins including the prolific Silver Vein.

The Silver Vein and the 350-370 Vein have yielded high grade

intersections suggesting veins extend at depth and in areas close

to existing workings available to develop additional resources in

the near term.

Two newly identified veins are thought to be splays off one of

the existing veins and could be exploitable in the near future.

Examples of recent drill intersections can be found in Table 2 below.

Table 2

Silver Vein and 350-370 Vein

Hole # From To Width (ft) Ag (oz/t) Cu (%) Pb (%) Description

DH52-379 81.4 84.4 3.0 2.18 0.05

84.4 86.0 1.6 25.20 0.41 4.6ft at 9.52 oz/t Ag

209.0 210.3 1.3 112.60 1.93 0.26 4th Vein

210.3 213.0 2.7 3.39 0.07 4.0ft at 38.9 oz/t Ag

225.8 226.8 1.0 35.80 0.58

226.8 230.5 3.7 1.29 0.02 4.7ft at 8.63 oz/t Ag

233.9 236.4 2.5 25.00 0.36 0.11

DH52-380 170.9 172.0 1.1 104.40 1.87 0.13 4th Vein

172.0 174.0 2.0 0.61 0.01 0.10 3.1ft at 37.4 oz/t Ag

199.7 201.9 2.2 0.92 0.01 0.10

201.9 203.0 1.1 42.40 0.55 0.59

203.0 206.3 3.3 7.66 0.08 0.23 6.6ft at 11.43 oz/t Ag

DH52-381 0.0 3.5 3.5 9.96 0.21

3.5 8.0 4.5 10.70 0.18

8.0 12.5 4.5 7.58 0.15 12.5ft at 9.36 oz/t Ag

70.0 73.1 3.1 1.62 0.02

73.1 74.2 1.1 283.20 4.23 New Veins

74.2 77.2 3.0 1.52 0.02 7.2ft at 44.59 oz/t Ag

135.8 136.4 0.6 117.40 1.93 0.6ft at 117.4 oz/t Ag

158.5 162.3 3.8 8.50 0.14 3rd Vein

162.3 165.6 3.3 15.80 0.24

165.6 169.0 3.4 21.40 0.35

169.0 172.2 3.2 12.90 0.25 13.7ft at 14.07 oz/t Ag

262.5 263.6 1.1 25.70 0.58

319.5 321.5 2.0 14.40 0.25

506.5 508.2 1.7 88.00 2.5

DH52-382 84.0 85.0 1.0 35.80 0.71 4th Vein

85.0 86.0 1.0 1.22 0.02 2.0ft at 18.51 oz/t Ag

196.0 197.0 1.0 45.40 0.69

197.0 198.0 1.0 1.47 0.02 2.0ftat 23.45 oz/t Ag

211.0 212.0 1.0 1.85 0.02

212.0 214.0 2.0 99.00 1.20 5th Vein

214.0 215.0 1.0 2.33 0.03 4.0ft at 50.5 oz/t Ag

DH52-382Z 13.6 14.4 0.8 10.20 0.20 0.10 350 Vein Delineation

103.0 104.0 1.0 7.49 0.08 6.06

To convert ounces per ton to grams per tonne multiply by 34.286.

Note: Since these drill holes were completed from different drill stations and intersect the veins

at various angles the recovered intersections may not reflect true widths. Please refer to

www.us-silver.com for additional drilling results on the Silver Vein and 350-370 Vein.

Coeur Mine

Resource definition drilling resumed late in the third quarter in the Coeur Mine from the 3100 Level. To date, approximately 3,000 feet of drilling has been completed. These results will be included in the next exploration release. The program is targeting to expand the existing 3.3 million ounces of silver resource to a target of 6 million ounces by the end of 20131.

Drumlummon Mine

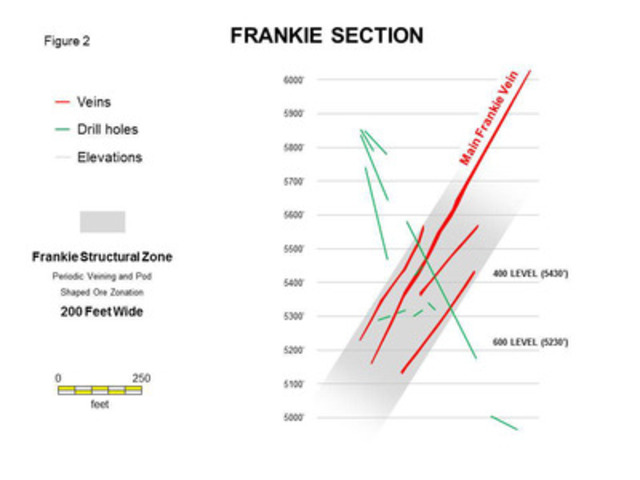

Frankie Vein

The Frankie Vein System was discovered during a surface drilling program in the spring of 2012. In September, an incline was driven from the Drumlummon decline into the Frankie Vein establishing an underground drilling station to explore the veins discovered through surface drilling. This incline exposed the Frankie Veins in the face of the drift. Analysis of face samples in Drill Station 22 averaged 0.816 ounces per ton (28 grams per tonne) gold and 75.23 ounces per ton (2,579 grams per tonne) silver. It should be noted that samples were collected along the strike of the vein not perpendicular to the vein. Therefore they do not represent the true width which varies between 1.4 and 8 feet across the exposure. See Figure 2 - Frankie Section.

The vein at this position is a quartz-calcite-adularia crustiform vein including amethyst and colloform banding with sulfides. Sulfides are locally abundant. See Table 3 below for recent Frankie Vein Intersection Drilling Highlights. The Frankie Vein system is expected transition to production in early 2013.

__________________________________________________________________________________________________________________________________________

1 Note that potential quantities and grades disclosed in this news release are conceptual in nature and there has been insufficient exploration to define a mineral resource on the all of the targets in the Galena Mine Complex. It is uncertain if further exploration will result in all of the targets in the Galena Mine Complex being delineated as a mineral resource.

Table 3

Frankie Vein - Intersection Drilling Highlights

Drill Hole From To Width (ft) Au (oz/t) Ag (oz/t) Level

DDH12-619 338 350 12 0.322 56.19 600

324 338 14 0.280 2.41

324 350 26 0.299 27.23

DDH-12-614 116 126 10 0.116 4.73 600

DDH-12-617 27 28 1 0.286 15.64 600

73 75 2 0.322 2.09

96 98 2 0.164 3.93

108 110 2 0.262 11.91

120 121 1 0.676 19.30

129 133 4 0.421 15.90

159 163 4 0.357 0.39

DDH-12-632 180 182 2 0.156 0.25 720

DDH-12-633 32 34 2 0.302 0.40 600

DDH-12-633 214 216 2 0.330 0.81 600

DDH-12-633 306 309 1 0.668 12.05 590

DDH-12-633 307 309 2 0.144 0.20

306 309 3 0.317 4.15

DDH-12-633 408 410 2 0.108 1.99 580

DDH-12-634 193 194 1 0.676 2.28 670

DDH-12-634 195 197 2 1.790 2.03

193 197 4 1.064 1.59

DDH-12-634 332 334 2 0.212 0.59 720

DDH-12-640 194 196 2 0.174 0.37 510

DDH-12-641 235 237 2 0.022 1.06 540

DDH-12-644 107 109 2 0.094 3.27 580

DDH-12-645 91 93 2 0.116 1.34 580

DDH-12-647 192 194 2 0.392 25.05 580

DDH-12-649 44 54 10 0.523 41.8 570

DDH-12-649 112 122 10 0.198 0.14 660

DDH-12-651 19 49 30 0.252 4.42 550

DDH-12-662 197 199 2 0.296 0.45 750

To convert ounces per ton to grams per tonne multiply by 34.286.

Note: Since these drill holes were completed from different drill stations

and intersect the veins at various angles the recovered intersections

may not reflect true widths. Please refer to www.us-silver.com for

additional drilling results on the Frankie Vein.

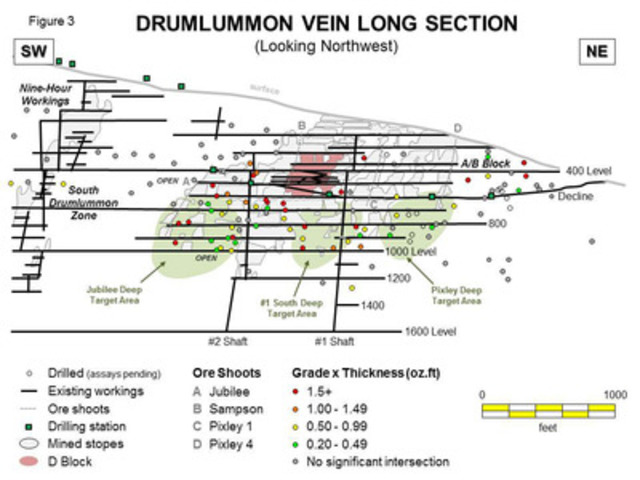

Deep Drumlummon

Drilling on the 400 Level in the old workings continues to identify potential mineralization in the deeper parts of the Drumlummon Mine. The existing mineralized zones, previously mined in the Jubilee #2 South and Sampson areas, have been extended below the 700 Level. In the area between the # 1 and # 2 shafts, new mineralized material has been intersected below the 600 level (See Figure 3 - Drumlummon Long Section).

Two narrow potential high grade veins, which are apparent splays off the Charlie and Drumlummon Veins, have also been intersected and are being explored. These are the New Year Vein (splay off the Charlie Vein) and the St. Louis Vein (splay off the Drumlummon). Historically, the St Louis Vein was mined further to the south of the existing workings. The New Year and St. Louis Veins, and the Pixley area are sufficiently near existing infrastructure to allow for immediate mining. However accessing the South Drumlummon area will require additional development. Parts of the South Drumlumon area could be available for mining in 2013. See Table 4 below for recent drilling highlights from the Drumlummon Mine.

Table 4

Recent Drilling Highlights - Drumlummon Mine

Target Hole # From To Width (ft) Au (oz/t) Ag (oz/t)

New Year DDH-12-592 87 91 4 0.258 0.230

DDH-12-599 181 183 2 0.786 3.354

DDH-12-599 208 210 2 0.608 0.432

DDH-12-601 264 270 6 0.504 2.340

South Drumlummon DDH-12-608 294 302 8 0.39 1.160

DDH-12-608 308 314 6 0.59 1.190

CP-12-061 79 83 4 0.803 0.56

CP-12-070 66 70 4 0.332 0.16

St Louis CP-12-072 81 85 4 0.484 0.36

CP-12-072 129 135 6 0.206 0.27

CP-12-077 52 60 8 0.635 0.74

Pixley CP-12-077 62 68 6 0.263 0.23

CP-12-084 81 87 6 0.293 0.66

CP-12-084 107 111 4 1.140 3.92

CP-12-086 39 41 2 1.090 11.96

To convert ounces per ton to grams per tonne multiply by 34.286.

Note: Since these drill holes were completed from different drill stations and

intersect the veins at various angles the recovered intersections may not reflect

true widths. Please refer to www.us-silver.com for additional drilling results on the

Drumlummon Mine.

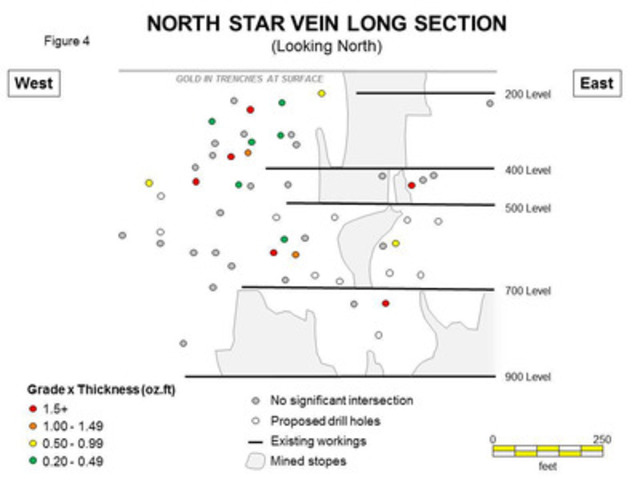

North Star Vein

Previous drilling in the Northstar Vein (See December 11, 2011 RX Gold & Silver press release) indicated there are potential mineralized shoots in this system. See Figure 4 - North Star Vein Long Section. An underground drilling program is in progress which will seek to define and expand the known mineralization. Three drill holes have been completed and while all show intersected quartz veins and breccia with varying sulphide content, assays have not yet been completed.

Belmont Mine

The Belmont property, located approximately one mile west of the Drumlummon mine, was purchased in 2012. The property was mined from the late 1800s through the early 1900s and is reported to have produced 500,000 tons at an average grade close to one ounce per ton (34 grams per tonne) from two main veins: the Belmont and Bald Mountain.

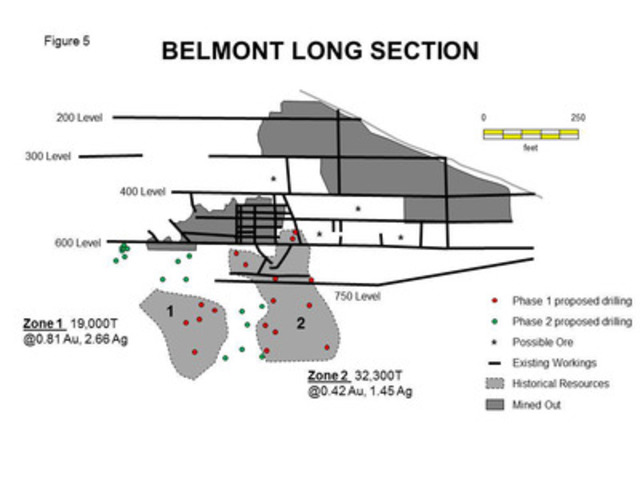

More recently, it was explored by AMEX and Gulf Titanium ("the previous owners") from 1982 to 1991 and non-NI 43-101 compliant mine reserves of 77,000 tons of 0.59 ounce per ton (20 grams per tonne) silver were reported, along with additional resources of 170,000 tons of similar grade (See Figure 5 - Belmont Long Section). They conducted mining operations using a decline developed to the 750 Level and there is a reported 7,000 tons of broken material remaining within the mine.

The previous owners discovered two new mineralized shoots below the stopes of the Bald Mountain Vein and "blind" splays or parallel veins in the hanging wall of the known structure. Calculations using historical drill-hole results from Gulf Titanium, indicate additional potential for over 50,000 (non-43-101 compliant) tons at an average grade of 0.56 ounces per ton (19 grams per tonne) silver.

Please note that a qualified person has not done sufficient work to classify this historical estimate as current mineral resources or mineral reserves and the Company is not treating the historical estimate as current mineral resources or mineral reserves.

Geological mapping, data compilation and sampling during the past field season confirmed the presence of a minimum of eight veins on the property. A surface drilling program is planned for the fourth quarter of 2012 to test the more significant veins by "twinning" some of the existing drill holes from locations on the surface to confirm the presence of the known mineralization and test for other veins indicated by previous drilling in the hanging wall of the structure. A second phase of drilling will attempt to expand the known mineralized zones and will be completed in 2013.

QA/QC

US Silver & Gold maintains a QA/QC Program for all assays, whether completed at the Drumlummon laboratory or at a contract laboratory including the use of standards, blanks, duplicates. All QA/QC results are evaluated using a program of QA/QC monitoring. Both the contract laboratory and the internal laboratory maintain programs of QA/QC as well.

Corporate Update

Vice President, Technical Services

Daren Dell has joined U.S. Silver & Gold in the newly-created position of Vice President, Technical Services. Mr. Dell brings over 20 years of experience to this role gained at Barrick Gold and precursor companies. While at Barrick he was Director, Corporate Development and prior to that, Director, Technical Evaluations. Before joining Barrick, Mr. Dell was at Placer Dome for over 15 years where he held various positions of increasing responsibility.

"I am extremely pleased to have Daren join our team," said U.S. Silver & Gold President and CEO Darren Blasutti. "The extensive knowledge that Daren has gained from evaluating mining assets around the globe will be of significant benefit to our operational and strategic plans moving forward. He not only brings solid technical skills to this role, he is also very strong at building and nurturing the kinds of relationships that will help successfully complete organic growth projects and acquisitions. With growth as our focus, he will be a tremendous asset."

Mr. Dell will work with the CEO on external opportunities and with the Chief Operating Officer at the Drumlummon and Galena Mines assisting with operations and organic projects while also providing support as the Company expands mine operations.

About U.S. Silver & Gold Inc.

U.S. Silver & Gold Inc.

is a newly formed silver and gold mining company focused on growth from its existing asset base and the execution of targeted accretive acquisitions.

U.S. Silver & Gold owns and operates the Galena Mine Complex in

the heart of the Silver Valley/Coeur d'Alene Mining District,

Shoshone County, Idaho and the Drumlummon Mine Complex in Lewis

and Clark County, Montana.

Within the Galena Mine Complex, the Galena mine produces high-

grade silver and is the second most prolific silver mine in U.S.

history, delivering over 200 million ounces to date, the Coeur

mine is under re-development with production expected in late

2012 and the Lead Zone is being evaluated for bulk mining

development.

The Drumlummon mine currently produces high-grade gold and silver

with historical production of

1 million ounces of gold and

12 million ounces of silver and has never been fully exploited or

explored.

Visit

http://www.us-silver.com

Mr. Jim Atkinson, Vice President, Exploration and a Qualified Person under Canadian Securities Administrators guidelines has approved the contents of this news release.

Some of the potential quantities and grades disclosed in this news

release are conceptual in nature.

At the current stage of exploration, there is insufficient

drilling to determine the extent of continuity of the

mineralization required to define a mineral resource for all

mineralization at the Galena Mine Complex and Drumlummon Mine.

It is uncertain if further exploration will result in certain

exploration targets being delineated as a mineral resource.

Please see SEDAR or www.us-silver.com for the 43-101 compliant Technical Report and Resource Estimate on the Drumlummon Mine Project dated April 9, 2012 and the Galena Project dated March 19, 2012.

Cautionary Statement Regarding Forward Looking Information:

This news release contains "forward-looking information" ----

future events or other such factors which affect this

information, except as required by law.

SOURCE

U.S. Silver & Gold Inc.

Image with caption: "Figure 1 - Galena Lead Zone (CNW Group/U.S. Silver & Gold Inc.)". Image available at:

Image with caption: "Figure 2 - Frankie Section (CNW Group/U.S. Silver & Gold Inc.)". Image available at:

Image with caption: "Figure 3 - Drumlummon Vein Long Section (Looking Northwest) (CNW Group/U.S. Silver & Gold Inc.)". Image available at:

Image with caption: " Figure 4 - North Star Vein Long Section (Looking North) (CNW Group/U.S. Silver & Gold Inc.)". Image available at:

Image with caption: "Figure 5 - Belmont Long Section (CNW Group/U.S. Silver & Gold Inc.)". Image available at:

http://tmx.quotemedia.com/article.php?newsid=54947428&qm_symbol=USA

US Silver and Gold, Inc. @ The Silver Summit 10th Anniversary : Spokane

Friday October 26, 2012

1:30 SPEAKING HALL by US Silver and Gold, Inc.

CORPORATE PRESENTATION

http://cambridgehouse.com/event/silver-summit-10th-anniversary

Upcoming Conferences

The Silver Summit 10th Anniversary

Thu Oct 25, 2012

Vancouver Resource Investment Conference 2013

Sun Jan 20, 2013

USGIF Chart TA Alert AgBull Golden Cross -

USGIF Target#1 Bull ride back to fiat$6.50

Recent USA News

- Liberty All-Star® Equity Fund August 2024 Monthly Update • PR Newswire (US) • 09/18/2024 05:00:00 PM

- Form N-CSRS - Certified Shareholder Report, Semi-Annual • Edgar (US Regulatory) • 08/30/2024 08:00:00 PM

- Form N-PX - Annual Report of proxy voting record of management investment companies • Edgar (US Regulatory) • 08/29/2024 03:06:06 PM

- Americas Gold and Silver Reports Q2-2024 Results • Business Wire • 08/15/2024 08:45:00 PM

- Liberty All-Star® Equity Fund July 2024 Monthly Update • PR Newswire (US) • 08/14/2024 11:44:00 PM

- Americas Gold and Silver Signs Credit and Off-Take Agreement for EC120 Project • Business Wire • 08/14/2024 09:06:00 PM

- Americas Gold and Silver Corporation Provides Q2-2024 Production Results; Galena Complex Silver Production the Highest Per Quarter in Over 10 Years • Business Wire • 07/17/2024 08:30:00 PM

- Liberty All-Star® Equity Fund June 2024 Monthly Update • PR Newswire (US) • 07/17/2024 04:40:00 PM

- Liberty All-Star® Equity Fund Declares Distribution • PR Newswire (US) • 07/08/2024 04:00:00 PM

- Americas Gold and Silver Corporation Announces Election of Directors and Annual Meeting Voting Results • Business Wire • 06/25/2024 06:36:00 PM

- Liberty All-Star® Equity Fund May 2024 Monthly Update • PR Newswire (US) • 06/14/2024 09:30:00 PM

- Form PRE 14A - Other preliminary proxy statements • Edgar (US Regulatory) • 06/14/2024 07:15:12 PM

- Form N-30B-2 - Periodic and interim reports mailed to shareholders • Edgar (US Regulatory) • 06/05/2024 03:06:37 PM

- Americas Gold and Silver Reports Q1-2024 Results • Business Wire • 05/15/2024 09:00:00 PM

- Liberty All-Star Equity Fund April 2024 Monthly Update • PR Newswire (US) • 05/14/2024 03:48:00 PM

- Americas Gold and Silver Corporation Provides Q1-2024 Production Results; Appoints Jim Currie as Chief Operating Officer • Business Wire • 05/01/2024 11:00:00 AM

- Liberty All-Star Equity Fund March 2024 Monthly Update • PR Newswire (US) • 04/12/2024 11:53:00 PM

- Liberty All-Star® Equity Fund Declares Distribution • PR Newswire (US) • 04/08/2024 05:34:00 PM

- Americas Gold and Silver Corporation Reports Full-Year 2023 Results • Business Wire • 03/28/2024 10:13:00 PM

- Americas Gold and Silver Corporation Drills Bonanza Grade at Galena Complex • Business Wire • 03/26/2024 11:00:00 AM

- Liberty All-Star Equity Fund February 2024 Monthly Update • PR Newswire (US) • 03/13/2024 05:22:00 PM

- Form N-CSR - Certified Shareholder Report • Edgar (US Regulatory) • 03/07/2024 05:36:13 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM