| Followers | 916 |

| Posts | 48081 |

| Boards Moderated | 0 |

| Alias Born | 07/22/2008 |

Monday, June 20, 2011 8:00:21 PM

Enterologics (ELGO.OB) is buying the shares of The BioBalance Corporation and it's subsidiary, BioBalance, LLC, neither of which are publicly traded.

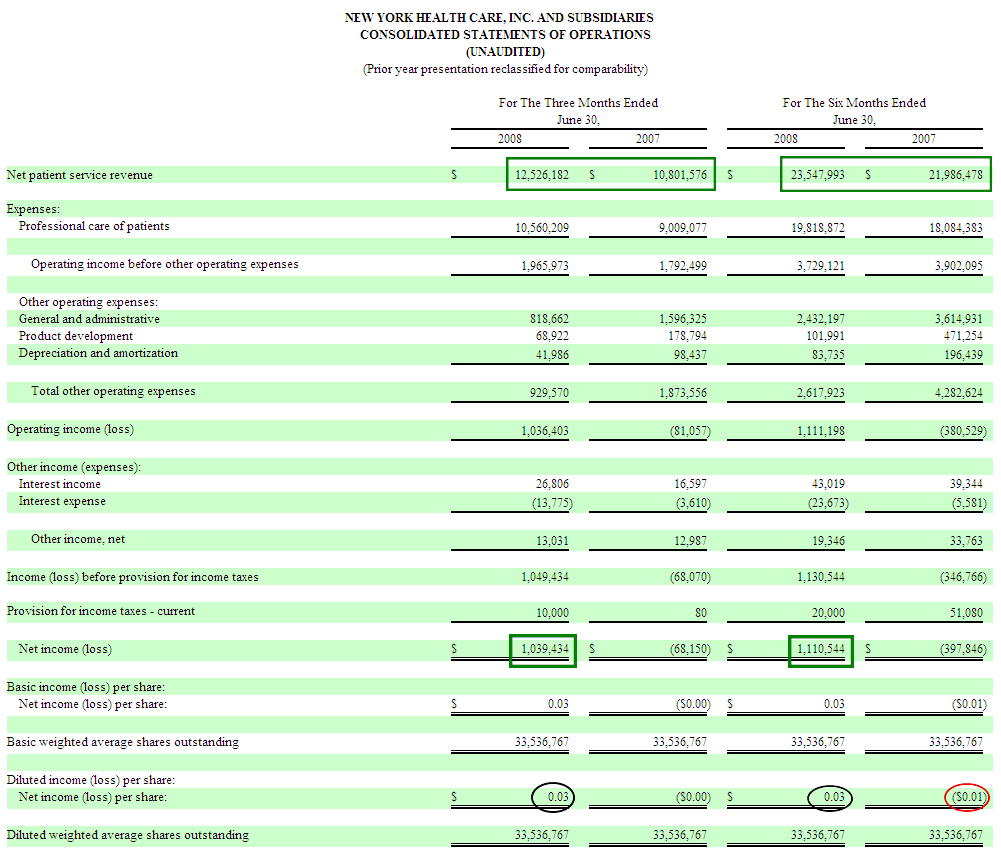

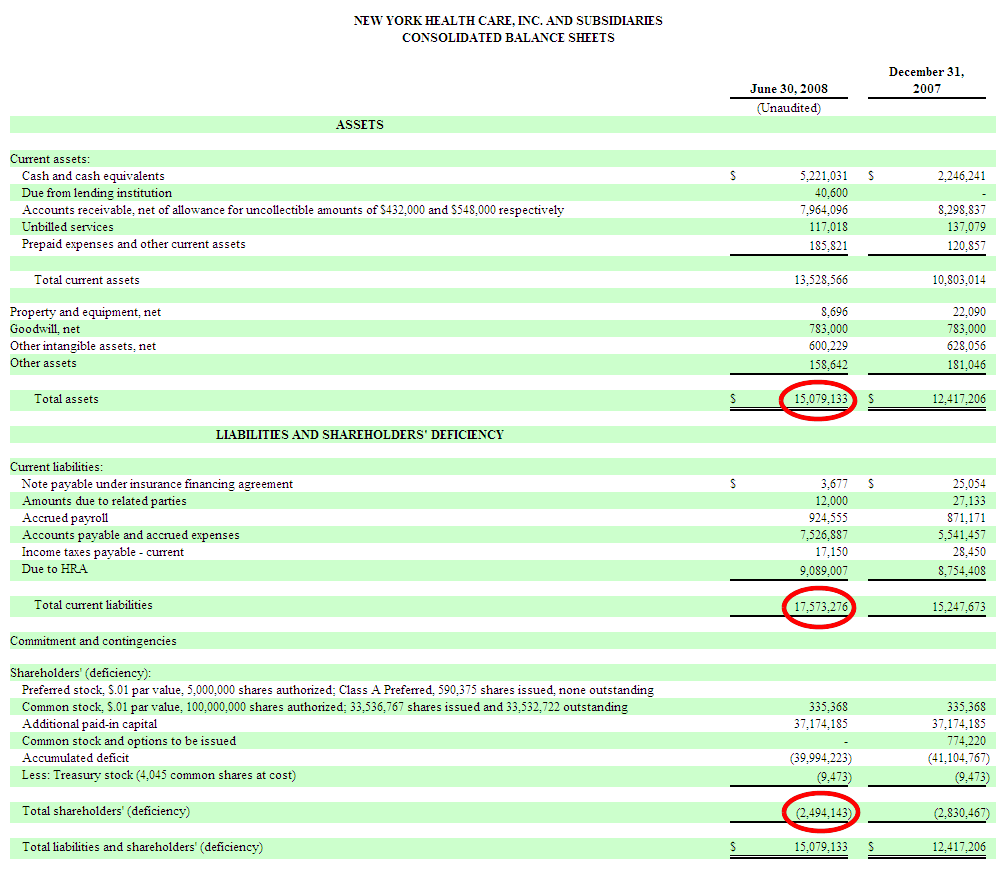

You are buying BBAL publicly traded shares which are the shares of NYHC (New York Health Care, Inc.). However, not all is lost if you thought you were buying something else. For one (1) BioBalance was valued @ $628,056. "As reported in the Company’s Form 10-K for the year ended December 31, 2007, the net carrying value of the intellectual property of BioBalance after recording impairment losses was $628,056." and two (2) BBAL (NYHC) was on pace, in 2008, for yearly revenues of ~$50M and NET PROFITS of ~$1M-$3M which was/is $.03-$.09 earnings per share. If you multiply the EPS by a conservative PE ratio of 10 then BBAL (NYHC) could be valued @ $.30-$.90 per share! Then add the one time GAIN from sale of assets (BioBalance subsidiaries) of $.019 ($628,056 / 33,536,767 BBAL shares) to the price per share, prior to sale, and...who knows WHAT you got? lol...

You need to send correspondence to (or find the telephone number of):

New York Health Care, Inc.

1850 McDonald Avenue

Brooklyn, New York 11223

Attention: Mr. Murry Englard, Chief Executive Officer

with a copy to (his attorney at last filing):

Cohen Tauber Spievack & Wagner P.C.

420 Lexington Avenue

Suite 2400

New York, New York 10170

Attention: Adam Stein, Esq.

Yitz Grossman owns the other 33 1/3% of The BioBalance Corporation worth another $314,028. The PR didn't say whether these shares were also being bought but I imagine they are (or Grossman is coming along, to Enterologics, in some other capacity, maybe still 1/3 owner of BioBalance). A good question to ask the CEO of Enterologics, Inc., in my opinion.

Notice that BBAL's revenues grew almost 20%, Q over Q, from 2007 to 2008 and that Net Income went from a loss of $68,150 to a gain of $1,039,434:

Unfortunately, BBAL's (NYHC) balance sheet doesn't look all that good and may explain the drop in BBAL's price per share over the years:

As you can see from the balance sheet, BBAL (NYHC) owes more in liabilities than they own in assets. However, it's "only" an imbalance of ~$2.5M and they will likely receive ~$650,000 (give or take) from Enterologics that can go towards correcting the imbalance (paying off debt, whoever HRA is). Remember, though, that this information is dated by about 2 1/2 years. Call the CEO of BBAL, Murry Englard, and demand information. Not only with this transaction but with BBAL overall. Like...what are projected revenues for 2011? Will there be a profit (net income) for 2011? What happened after 2008, Q2, when they made ONE MILLION DOLLARS in profit? How much debt is left? Why is the trading illiquid (prior to this last PR)? What is the current OS? Did you sell any shares on this PR? lol...etcetera, etcetera...

Most of this data was derived from the last 10-Q filed on 11/14/2008 by New York Health Care, Inc. (BBAL). It is your mission, should you accept, to take this data and turn it into information, lol...

GLTA and good day.

Branded Legacy Inc. Invites Shareholders to Celebrate Milestones at Open House: Announces Share Buyback and Commitment to Authorized Share Count • BLEG • May 15, 2024 8:30 AM

Alliance Creative Group (ACGX) Releases Q1 2024 Financial and Disclosure Report with an 88% increase in Net Income from Q1 2023 to Q1 2024 • ACGX • May 15, 2024 8:30 AM

Category V Biotech, Inc. Announces Letter of Intent to Acquire Genetic Networks, Expanding into Biotechnology Sector • CATV • May 15, 2024 8:00 AM

POET Announces Design Win and Collaboration with Foxconn Interconnect Technology for High-speed AI Systems • POET • May 14, 2024 10:09 AM

VAYK Added New Manager for Expansion into $64 Billion Domestic Short-term Rental Market • VAYK • May 14, 2024 9:00 AM

Element79 Gold Corp Reports Exceptionally High-Grade Results from Lucero • ELEM • May 14, 2024 7:00 AM