Saturday, June 11, 2011 5:32:27 PM

While we are all waiting, TEMN went down and found it's bottom, this is our major support, this is a real company with lots of space for growth and has lots of potential IMO Heres more info on TEMN & Calcounties

> Management Business Profiles <

- TEMN Management

- CalCounties Directors

- Management history

> Mr.Dennis R.Duffy

> Ms. Janis Okerlund

1- TEMN Revs Results in 2010 = + 553k vs 2009 Net loss of -3.6mil = Overall Improvement of $4.2 Mil From 2009.

2- Comparison of the 3 Month Period Ended March 31, 2011 to the 3 Month Period Ended March 31, 2010 > Our revenues for the quarter in 2011 totaled $396,160 compared to $368,624 during the prior year.

3- TEMN is going National (franchised) in like 40 states huge expansion

4- Adding several other Title/Legal/Real Estate Service that will be MERGED and ACQUIRED by TEMN...One stop shopping for their clients

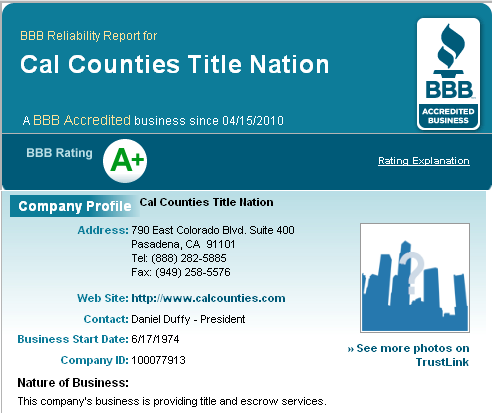

5- TEMN private subsidiary http://www.calcounties.com has a "A +" rating with BBB as of 5/31/11

http://www.la.bbb.org/Business-Report/Cal-Counties-Title-Nation-100077913

> Fully reporting stock http://www.otcmarkets.com/stock/temn/quote

(per 10Q p.2 May 16)

--O/S___811m

--Float__261 M

--A/S___5 bil

-Transfer Agent: www.ClearTrustOnline.com Tel 813.235.4490 F 813.388.4549

-IR firm www.lightningstockleads.com with (Violet Shockley 713-444-0924)

Preferred Stock

On December 23, 2009, the Company issued its four officers and directors each 15 shares of Series A Convertible Preferred Stock of the Company for $60,000. Each share of Series A Convertible Preferred Stock is convertible into 1% of the Company's common stock at the date of conversion. The preferred shares do not have liquidation preference over common shares. Each preferred share is entitled to as many votes equal to 1% of the Company's outstanding common stock. On January 4, 2010, the Company amended the certificate of designation of preferences and rights of Series A Preferred Stock previously filed with the Nevada Secretary of State which changed the number of shares authorized from 50,000,000 to 60 shares. At March 31, 2011 and December 31, 2010, there were 60 shares issued and outstanding

The following table sets forth the number of common shares issuable upon conversion of the Series A Pref Stock & convertible debt March 31 2011

-Series A Preferred Shares = 662,851,338

-Shares issuable upon conversion of debt = 2,139,682,174

Each Series A Preferred Share is convertible into 1% of the Company's outstanding common shares at the time of its conversion. The number of shares upon conversion presented above represents the maximum number of shares to be issued assuming the preferred shares are converted consecutively, rather than all at once. At March 31, 2011, the Company did not have adequate shares authorized to issue upon such a conversion of the debt (Note 11). As discussed in Note 10, the Company increased the number of shares authorized from 2,000,000,000 to 5,000,000,000 on April 26, 2011 to allow for adequate shares to be issued if needed.

======= FILLINGS =======

-May 31 S-8 Form S8 Employee & Consultants Stock Compensation Plan

-May 16 10Q 2011 First Quarterly Report Filing Sec Form 10Q ( p.2 > O/S_811m / Float_261 M / A/S 5 bi)

-April 28 8k Form 8k for A/s increase & upcoming S8 employee compensation Plan

-April 11 10k 2010 Annual Report Filing Sec Form 10-K

======= IMPORTANT NEWS ======= ( ALL NEWS here http://ih.advfn.com/p.php?pid=news&symbol=TEMN )

-May 31 Announces $1,338,005.81 Positive Balance Sheet Adjustment After Removal of Financing Agreement Derivatives

We are pleased to follow through with the removal of liabilities that create a drag on our financial statements and present a skewed picture of the company's progress and potential. We will continue to seek operating capital that will fund our national expansion plan and will make every attempt to bolster our balance sheet wherever possible."

-April 25 President Talks With ChartPoppers.com About Recent Financials and 2011

> To listen to the entire interview visit: http://ChartPoppers.com/iReports

-April 19 TEMN Announces 2010 Results; Overall Improvement of $4,175,603 From 2009

Net income in 2010 was $553,157 vs. 2009 losses of $3,622,446, an improvement of $4,175,603 from 2009. Losses from operations were reduced to $382,972 in 2010 from $1,322,934 in 2009.

" " "Our 2010 financial statements show a marked improvement over 2009 in areas that are critical to our growth. Our key goals in 2011 and 2012 remain unchanged and our focus on license expansion and the driving of direct revenue into our national agency will propel us to greater profitability in 2011 and beyond."

-Mar 23rd TEAM Title, Inc. Receives 5 Title Agent Licenses; Opens 9 Additional Markets While Boosting Bottom Line

pleased to announce that it received its title agent licenses in Georgia, Minnesota, New Jersey, Pennsylvania, and West Virginia. The licenses allow TEAM Title to process direct title and settlement operation in those markets. These markets are in addition to the District of Columbia, New York, Iowa, Kentucky and Rhode Island. TEAM Title seeks to expand its licenses into 38 markets in 2011, including Florida, Arizona, Nevada and Texas.

-Feb 16th Pres Receives Individual Title Agent License in Colorado, GA, IN, LO, MI, MA, Mo, NH, NJ, NC, ND, Rhode Island & West Virginia

Dennis Duffy, CEO of TEAM stated, "Ms. Okerlund's individual licenses are a crucial step in our growth strategy for TEAM Title. Completing licensing for agencies in 38 states is the goal for 2011."

====================== Daily & Weekly Charts ======================

> Daily Charts > A Breakout of 0013 will make TEMN run big time, its gonna be all over 20/50/200 ma's

and will make those indis give good BUY SIGNALS and eventually a potential GOLDEN CROSS 50ma / 200ma cross.:)

> Weekly - look at that A/D line MA & the RSI + Stochastics all showing signs of reversal & when the PPS goes over the 20/50 ma's that will be a good strong signal.

-Res #1 001 (200ma DAILY) + (50ma Weekly (2x breakouts)

-Res #2 0013 pps is the main Resistence level

-Res #3 002 pps ramge

-Res #4 0034/0036 pps range

-Res #5 009/01 round number MAJOR res level

--- DAILY CHARTS ---

--- WEEKLY CHARTS ---

GO $TEMN

"One of the most valuable things any person can learn is the art of using the knowledge & experience of others"

Facts as Proof via Official News/Filings/LOI/Pacer's/Links/Pics/LinkedIn Profiles & other reliable sources

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM