Thursday, January 13, 2011 2:50:33 PM

**I am writing this post to help serve as a centralized hub for all things GFME, to collect all the DD people have done and hopefully serve as a launching board for investors to start their own DD. I will do my best to provide links so you can follow where the research is coming from and I have also tried to provide some screenshots for additional information as well. As the GFME story unfolds I will continue to update this post. Please let me know either if you see any mistakes or you believe I've left anything important off. As always this is not meant to supplant your own DD, only complement it. Be aware that mixed in with facts here there is speculation and I am definetly not a financial adviser. So do your own research to either back up or refute mine. In the end, the more we know the better. Below, I do my best to spell out both the GFME story as I currently understand it.

Updated DD (Sections with updates will be notated by ** Update): Homeclick Valuation Potential, Newly Registered Trademarks (Yardstar, Hechinger), George Foreman's Commercials for Nation's Health, Brands Acquired by Home Decor/Homeclick (Hechinger, Builder's Square), Note from Homeclick's Director of Marketing, More on Net Operating Loss, Merger Checklist, Website Analytics from Quantcast

WILL GFME BE HOLTZMAN'S MASTERPIECE?

George Foreman (fighter/entrepreneur/businessman) and Seymour Holtzman (lifelong investor/shareholder activist) both may be heading into the twilight of their careers, but they may have one last surprise for us all. Based on the last six months and the recent filings of GFME, they may be part of one of the year's biggest R/M's. Every GFME filing brings new revelations and new potential, each one better than the last IMO. With their release of an 8-K in November, we are finally getting a glimpse of a potential blockbuster R/M with a company called Homeclick. At last count Home Decor Products (parent of Homeclick) was bringing in ~ $90,000,000 in revenue a year. Combine all this with an estimated float ~1.2 Million and the fact that virtually every company Holtzman has touched has been on the big boards (Casual Male Retail Group, Jewelcor Inc., Gruen Marketin Corporation among others) and investors would be remiss not to pay close attention.

For those of us who have been following GFME since the Spring, it's been an amazing lesson in DD and the value of reading filings. As some have remarked in many ways the filings released since June have been acting like PR's, giving us little hints here and there of what may be next. Below is a little more on what has been found. As the story evolves, this DD post will grow and evolve.

SHARE STRUCTURE

A/S: 25,000,000

O/S: 5,097,116

Float: ~1,221,179 (Based on Holtzman/Foreman/NITE Holdings)

INSIDER HOLDINGS

Knight Securities (NITE) - 256 shares - (from SC13G/A on October 6)

George Foreman and sons - 1,799,743 shares - (based on June Agreement

Jewelcor Management Inc. (Holtzman Entity) - 153,766 (from SC13D on May 25)

Jewelcor Investments LLC (Holtzman Entity) - 80,000 (from SC13D on May 25)

Seymour Holtzman - 1,842,172 - (from SC13D on May 25)

Total shares owned by institutions or insiders based on last report: 3,875,937

** (Update): BRIEF TIMELINE FOR GFME

2/25/09 - GFME filings indicate problem with payments to the Foremans

4/09 - Home Decor Products files for Chapter 11 Bankruptcy

4/09-6/09 - Chuck Gartenhaus & Seymour Holtzman acquire assets of Home Decor Products and role it into Homeclick LLC

2/28/10 - Efrem Gerzsberg, President & Director of GFME resigns. Seymour Holtzman takes over the operation.

5/25/10 - SC 13D/A shows Seymour Holtzman and his entities have been acquiring shares

6/4/10 - 8-K announces deal with Nation's Health (Company will share with Foreman in revenue during his gig as spokesman for Nation's Health). In exchange he receives 1,799,743 shares of GFME. Resolves previous issues with Foremans.

6/4/10 - 8-K also announces that it will remove references of Foreman from company. It states that there will be a vote on a name change with a subsequent PR.

10/13/10 - Announced hiring of Madsen & Associates, CPA to bring filings up-to-date.

11/8/10 - 8-K announces resignation of Holtzman and announces appointment of Chuck Gartenhaus, President of Homeclick LLC and John Swatek, ex-CFO of Home Decor Products.

12/10/10 - 8-K announces company dealing with note holders

Since February there have been 15 filings, one every month except for May and September:

http://www.otcmarkets.com/stock/GFME/financials

FORWARD LOOKING EVENTS

While I list timeline events above, here are anticipated forward looking events based primarily on mentions in previous filings.

(1) Audited Financials (Announced in 8-K on October 13th)

(2) Name Change (Announced in 8-K on June 4th)

(3) PR (Announced in 8-K on June 4th)

(4) Nation's Health Roll-out. As part of deal with George Foreman GFME is left with recurring revenue from deal he made with Nation's Health.

TRADING ACTIVITY

Daily Chart (As of 1/13/11)

Weekly Chart (As of 1/13/11)

HOW DOES DEAL GFME MADE WITH NATION'S HEALTH FIT IN WITH R/M?

It is my belief that it was a parting gift as part of the deal Holtzman and Foreman put together, he would get ~ 1.8 million shares and Foreman would agree to split revenue with GFME as long as the Nation's Health deal runs, adding a consistent revenue stream for GFME. The following part of the 8-K seems to show that the company will, in the long run, no longer be connected with Foreman. The filing today seems to confirm the case.

The GFE Parties agree that: (i) at each future meeting of stockholders and action by written consent of stockholders of GFE, GFE shall use its commercially reasonable efforts to solicit votes in favor of removing any references to “George Foreman” or any derivative therefrom from the name of the company until such name change is approved by stockholders; and (ii) GFE shall promptly after such stockholder approval (x) file with the Delaware Secretary of State an amendment to GFE’s certificate of incorporation to reflect such name change and (y) amend the GFV Operating Agreement to remove any references to “George Foreman” or any derivative therefrom from the name of the company.

** (Update): Here are a few of the commercials recorded by Foreman for Nation's Health as part of this deal. We have no confirmation as to whether these commercials have seen airtime yet.

http://www.nationshealth.com/enrollwithgeorge

And a little more on Nation's Health:

http://www.manta.com/c/mm01jn3/nations-health-inc

** (Update): NET OPERATING LOSS

Why utilize GFME for reverse merger with Homeclick?

What's the major incentive for Homeclick to merge in here from a strictly financial basis? While we don't know where GFME stands from a cash/asset basis as we await updated filings, we do have indications on the potential NOL to be utilized. We know from previous filings that it appears at the minimum the NOL is $189,220,861 (from the last 10-Q). I have rarely seen a NOL in this range from all the R/M's I have followed. ~$189 million is significant, although I would expect it is more than that now. This IMO is the major incentive to bringing Homeclick into GFME regardless of any other significant assets there may or may not be (Nation's Health deal etc..).

Of course, as many R/M veterans who have studied and researched them before know the ability to utilize the NOL depends on a number of factors. And you need to go through and study each one of them to gauge how and if it can be utilized. The primary reason for limitations on the NOL is a significant change in ownership. Generally if there is more than a 50% decrease in ownership, then there will be limitations on the usage of NOL's. Other things that can limit the usage of NOL post merger are share issuance, warrants etc. and other state by state situations. As Holtzman owns significant chunks of both Homeclick and GFME, it is very feasible that they can utilize and retain most of this NOL in a post merger entity. Keep in mind if they were to issue too many shares as part of a merger and change the ownership, those limitations would come into affect, limiting how they could use the NOL and the amount they could utilize. In fact, it seems quite likely to me at least that has been part of his plan since 2009 when he started acquiring shares and also consolidating shares into his hands from his other business entities. The $189 million NOL is just another interesting piece of the puzzle to look at.

WHAT DO WE KNOW ABOUT HOMECLICK/HOME DECOR?

We know Holtzman was an investor with them in the past as well as former Chairman of the Board:

http://www.thefreelibrary.com/HomeClick+Receives+$5+Million+from+Investor+Seymour+Holtzman;+Online...-a0113064163

We also know at last report Home Decor was bringing in ~$100,000,000 in revenue in 2006. It was listed on Inc. 500 List of Fastest Growing Companies. It also was recognized as the #5 Internet Retailer for the Home. We also know it went bankrupt in April 2009 and that's when Holtzman and Gartenhaus stepped in and acquired the companies assets. They then brought it back on-line in June 2009.

Here is more from Wikipedia on Homeclick & Home Decor:

This is the list of website assets that Home Decor had:

Of these it appears they consolidated a number of these sites into Homeclick.com. The ones that now link back to Homeclick.com are Hechinger.com, ChefsCorner.com, KnobsandThings.com, PoolClick.com & ChristmasCatalog.com.

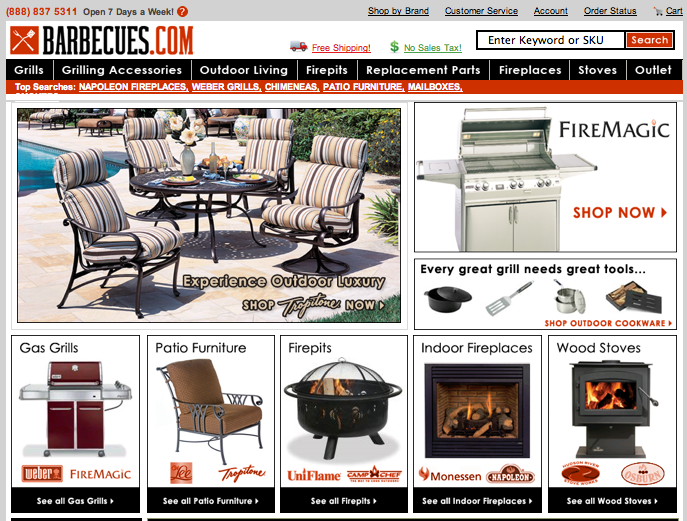

Here are the following websites that are operational and run by Homeclick (w/screenshots):

Homeclick.com

AbsoluteHome.com

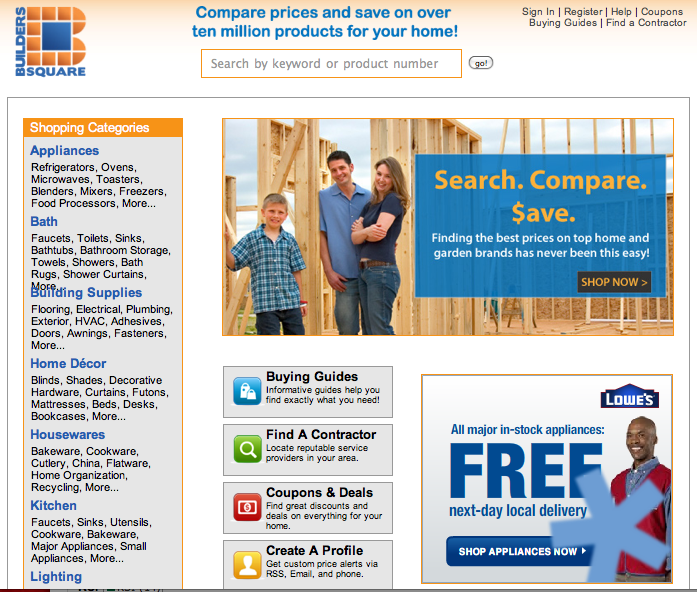

BuildersSquare.com

Barbecues.com

Note from President Gartenhaus to Homeclick Customers (9/3/10):

** (Update): Note from Director of Marketing, Arthur Freydin, to previous customers of Home Decor (soon after Gartenhaus/Holtzman takeover):

My name is Arthur Freydin and I am Director of Marketing at HomeClick, LLC (parent company of Homeclick.com as of June 1, 2009).

I would like to address some of the issues in the many admittedly dated (the original post is now 6 years old) comments below.

First, some very important background information:

Homeclick.com was owned by Home Decor Products, Inc until April, 2009 when the mentioned parent company declared bankruptcy and stopped taking customer orders. Homeclick.com was taken offline between the months of April and June while the new parent company, Homeclick, LLC, finalized the purchase of all prior assets and realigned itself to better meet customer demand as well as implementing the proper systems to ensure that the same issues that plagued Home Decor Products did not carry over to the new, more agile company. Homeclick, LLC relaunched Homeclick.com on June 1st, 2009 and has exceeded expectations of both its investors as well as its ever-growing customer base.

Instead of directly responding to all questions in the comments, I’d like to highlight some strengths of the new Homeclick.com as well as the differences in operations and revised policies from the prior parent company (Home Décor Products). I’d also like to stress that some of the comments in this post are now over 4 years old and no longer apply due to technological advancements in online retail. The post itself was written on December 19th, 2003 – 6 years ago. Homeclick.com has undergone a number of facelifts and countless system upgrades over the years.

The most noticeable changes to Homeclick.com happened between the months of April and June, right before we re-launched the new version of the site. Most changes happened behind the scenes:

• The customer service and sales departments have been merged into one efficient team. Combining the teams allows us to focus on the individual caller, allowing any one person on our team to cater to any questions throughout the conversation. Our representatives always receive up-to-date product training and are empowered to make their own decisions with minimal involvement from management, cutting down on the time it takes to reach a resolution by more than half. This benefits the customer tremendously and greatly reduces the time they need to spend on the phone.

• We no longer charge the credit card at time of order placement – we charge ONLY when the order is actually shipped. This new policy is a great improvement over the old, archaic policy of Home Décor Products and many of our online competitors.

• We are streamlining the entire process from the time a visitor makes their way onto our website to order completion & delivery. The entire process has been re-worked to better suit our visitors and customers.

Over the past 9 months of new ownership under Homeclick, LLC, we have seen tremendous improvements and undertaken large-scale projects to make sure our customers receive unparalleled customer service while still somehow driving down prices through direct vendor relationships and streamlined processes. All of our enhancements have directly affected customer service as evidenced by our glowing reviews on Shopzilla, ResellerRatings, NexTag and others. Our visitors and customers are truly happy to be doing business with us and that is our true reward to the many months of hard work that got us to where we are today.

I can now confidently say that Homeclick.com is once again a powerhouse retailer in a highly competitive space. We continue to carry best-of-breed manufacturers such as TOTO, Progress Lighting, American Standard, Napoleon, Whirlpool, and many more. We are truly a one-stop shop for anyone that is looking to remodel an entire kitchen or someone that is just looking to add to their outdoor living space. We do it all, and now with our renewed focus on customer service, we do it better than anyone else while being the low price leader that you have come to expect from Homeclick.com!

If you should have ANY questions regarding this post or any other matter, please do not hesitate to contact me personally at afreydin@homeclick.com. We are here for you!

Thank You,

Arthur Freydin

Director of Marketing @ Homeclick.com

** (Update): HECHINGER & BUILDER'S SQUARE ACQUISITION

Here is a little more on Hechinger and Builder's Square, two significant brand names in home improvement that Home Decor/Homeclick acquired through bankruptcy:

Builder's Square:

More on Builders Square. Perhaps some of you remember this big box home improvement retailer from a number of years back. Either way here's the wiki on it and how it was sold by Kmart and eventually came into Home Decor/Homeclick's hands.

Http://wikipedia.org/wiki/Builders_Square

Hechinger:

In addition to Builders Square here is a little more on Hechinger and how Home Decor/Homeclick came to acquire brand name. It appears to me from the DD that with Builders Square they may have acquired some of their facilities for their online operations in addition to name usage. With Hechinger it appears they acquired the brand name along with product lines associated with it.

Http://wikipedia.org/wiki/hechinger

Here's a Washington Post article on Home Decor's acquisition of Hechinger:

http://www.washingtonpost.com/wp-dyn/content/article/2006/03/27/AR2006032701623_pf.html

** (Update): NEWLY REGISTERED TRADEMARKS

Last month Homeclick filed for two new trademarks for the first time since 2006. Here is more info. on the Hechinger and Yardstar trademarks.

http://www.trademarkia.com/hechinger-85189606.html

http://www.trademarkia.com/yardstar-85189644.html

** (Update): HOMECLICK VALUATION POTENTIAL

In an effort to get a better grasp on what a proper valuation would be for a Homeclick stock if they roll into GFME (appearing likely with management changes) I looked through a few things that might provide us a bit more insight.

Internet Retailer Rank

Here's what we last knew with regards to Homeclick from 2009. This was from last spring at around the same time as the bankruptcy and in the midst of the recession. It may help give us some indications of revenue at the time.

http://www.internetretailer.com/2009/03/27/home-d-cor-products-ceases-operations

The company, which operates HomeClick.com, AbsoluteHome.com, Barbecues.com, PoolClick.com and other web stores, has shut down its corporate web site: HDPI.com. Home Décor Products, No. 143 in the Internet Retailer Top 500 Guide (Just so there is no confusion Home Decor Products, Inc was renamed Homeclick LLC when Gartenhaus & Holtzman acquired the assets)

Here is confirmation from an April 2009 Online Trust Alliance List on the No. 143 number:

http://docs.google.com/viewer?a=v&q=cache:e8WKOFykrfsJ:https://otalliance.org/docs/Apr09%2520InternetRetailers.pdf+homeclick+internet+top+200+retailer&hl=en&gl=us&pid=bl&srcid=ADGEESiI8pH06WsdWSIYx8hBABUlRMDFdb3MP8nMpzGVQ2rBq49OVCqfcJ50P2vlqCT6kq2Cn-nSBR16qhFqsA6-tghrFnFKYaXJk4GFnH0-Puz2nE2bM4RW4J4koq3xuIKPQtIKnIMR&sig=AHIEtbQyiV0YfREvtGUfDQke_hbxPFhbIw

As of last year's report that put the company a little below the National Football League, Brookstone, Bed Bath & Beyond and a little above Dillards, Inc. & Coach Inc.

Revenue Potential

So how about revenue numbers? Here are some more details regarding this year's numbers.

http://www.internetretailer.com/2010/05/27/top-500-guide?p=2

In it they mention Aeropostale @ No. 118 with on-line revenues of $129 Million and The Buckle Inc. @ No. 217 with on-line revenues of $52.3 Million. It would be a good bet that Homeclick's most likely revenue numbers should be somewhere in that range.

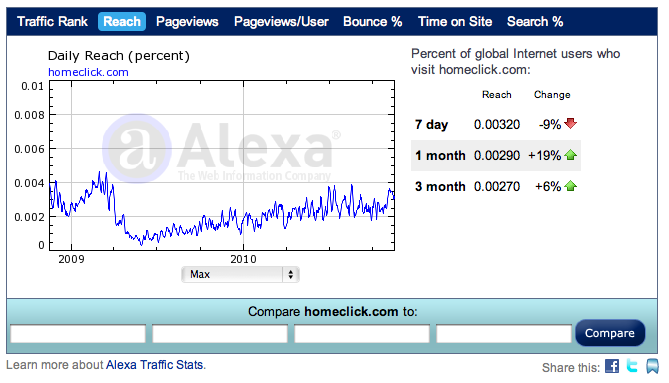

However, I also wanted to check web stats for Homeclick to see how significant the drop off in traffic was after the bankruptcy filing and if and how well they have been able to recover since then. Here are the charts.

Reach

Traffic Rank

It appears to show a drop off in ranking and reach with the bankruptcy in the spring of 2009 and then a slow and steady uptick starting in June 2009 when Holtzman and Gartenhaus brought it back online. Since then, they are now approaching levels pre-bankruptcy.

** (Update): Website Analytics from Quantcast

http://www.quantcast.com/homeclick.com

Other Public Companies on List

To figure out what pps could look like, I looked for other public companies in the same range on the Internet Retailer List (from #100 - #200). I also place GFME in there (next to Home Decor) as a way to give some perspective if Homeclick does indeed R/M. I believe this gives us a better idea of not only valuation potential, but also the potential for an uplist.

#101 - Delia's, Inc (NASDAQ:DLIA)

Shares Outstanding: 31.31 M

Market Cap: $56.67 M

#103 - Charming Shoppes, Inc. (NASDAQ:CHRS)

Shares Outstanding: 115.46 M

Market Cap: $421.43 M

#107 - Ann Taylor Stores Corp. (NYSE:ANN)

Shares Outstanding: 59.04 M

Market Cap: $1.41 B

#109 - PetMed Express (NASDAQ: PETS)

Shares Outstanding: 22.78 M

Market Cap: $387.09 M

#116 - Game Stop Corp. (NYSE:GME)

Shares Outstanding: 150.35 M

Market Cap: $3.16 B

#123 - Dick's Sporting Goods, Inc. (NYSE:DKS)

Shares Outstanding: 115.88 M

Market Cap: $3.94 B

#128 - Bluefly, Inc. (NASDAQ:BFLY)

Shares Outstanding: 24.61 M

Market Cap: $59.55 M

#134 - Bed, Bath & Beyond (NASDAQ:BBBY)

Shares Outstanding: 259.11 M

Market Cap: $11.31 B

#136 - American Greetings Corporation (NYSE:AM)

Shares Outstanding: 40.07 M

Market Cap: $835.16 M

#137 - Indigo Books & Music, Inc. (TSE:IDG)

Shares Outstanding: 24.87 M

Market Cap: $381.75 M

#142 - Vitacost.com, Inc. (NASDAQ:VITC)

Shares Outstanding: 27.76 M

Market Cap: $186.53 M

#143 - Home Decor Products, Inc. (now Homeclick LLC)

**If Homeclick was rolled into GFME this is how things looks at the moment.

Shares Outstanding: 5.09 M

Market Cap: $4.33 M

#146 - Coach, Inc. (NYSE:COH)

Shares Outstanding: 296.38 M

Market Cap: $16.15 B

#147 - Dillards, Inc. (NYSE:DDS)

Shares Outstanding: 66.08 M

Market Cap: $2.10 B

#155 - NBTY, Inc. (NYSE:NTY)

Shares Outstanding: 63.42 M

Market Cap: $3.49 B

#161 - The Finish Line, Inc. (NASDAQ:FINL)

Shares Outstanding: 53.32 M

Market Cap: $918.65 M

#167 - Frederick's of Hollywood, Inc. (AMEX:FOH)

Shares Outstanding: 38.33 M

Market Cap: $36.41 M

#170 - Zale Corp. (NYSE:ZLC)

Shares Outstanding: 32.11 M

Market Cap: $103.07 M

#172 - Green Mountain Coffee Roasters, Inc. (NASDAQ:GMCR)

Shares Outstanding: 131.95 M

Market Cap: $4.11 B

#173 - Autozone, Inc. (NYSE:AZO)

Shares Outstanding: 44.63 M

Market Cap: $11.27 B

#175 - Select Comfort Corp. (NASDAQ:SCSS)

Shares Outstanding: 55.42 M

Market Cap: $464.93 M

#183 - Discovery Communications, Inc. (NASDAQ:DISCA)

Shares Outstanding: 284.32 M

Market Cap: $12.11 B

#186 - Vitamin Shoppe, Inc. (NYSE:VSI)

Shares Outstanding: 27.91 M

Market Cap: $881.93 M

#188 - Under Armour, Inc. (NYSE: UA)

Shares Outstanding: 51.00 M

Market Cap: $2.67 B

#190 - Jos. A. Bank Clothiers, Inc. (NASDAQ:JOSB)

Shares Outstanding: 27.53 M

Market Cap: $1.19 B

Every stock between #100 & #200 on the Internet Retail list is on the Big Boards. This reinforces my belief that if Homeclick does indeed roll into GFME uplisting is the most likely scenario. That said, many of the companies that I have listed above have operations beyond on-line so it makes it difficult to compare revenue numbers. However, to give you an idea, the closest company on that list to Home Decor (#143) was Vitacost (#142) which is an all on-line company and it is currently trading on the Nasdaq and has a market cap of $180.98 Million.

PRICING POTENTIAL

This is always very hard to gauge and I'm not really going to attempt to. However, I think there are a couple things to keep in mind when looking at it.

First, Holtzman's guarantee to Foreman of a minimum $20 million market cap or he would give Foreman $1 million in preferred shares. That's a pretty confident move that this will at least be in the $4-5 range. It also happens to coincide with a potential NYSE listing price.

That brings us to Listing Requirements. As virtually everything Holtzman has been a part of it at one point or another ends up on big boards, it is important to remember what the listing requirements are. As an example, NYSE (the exchange Holtzman is most familiar with) requires at least a 1.1 million public float and a market cap of $100 million for listing (IPO's only require $40 million from my understanding). It also requires $4/shr. My bet is on the NYSE based on Holtzman's experience, but certainly Nasdaq and AMEX would also be possible. Each of those would also require a much higher pps. I'm of the belief Holtzman and Gartenhaus didn't spend what I am assuming is quite a bit to acquire these assets if their ultimate goal was not uplisting.

Even if they had a $10 million annual profit with current SS this could be valued well past $10 with the current share structure. You can, of course, imagine from there, how much higher it could go long-term with revenues and profit more significant than that.

SPLIT POTENTIAL

The last element you have to always take into account is any chance of a reverse split. While the O/S, Float and A/S situation and favorable share structure all argue heavily against that possiblity here are a couple angles I looked at in an attempt to be thorough. Each of them and all that I have found continues to argue against this possibility.

(1) Eliminating Shareholders

Of course they could do one to try and get rid of the tiny shareholders,but I would be surprised. 1/10 would bring the O/S down to ~500,000 and would only take out those with less than 10 shares. 1/100 would bring the O/S down to ~ 50,000 shares and only take out those with less than 100 shares. Add in all signs pointing to potential uplist and no reason for them to decrease the number of shareholders they have when that would hurt them on minimum shareholder count towards a potential uplist.

(2) The Foreman Situation

They just gave Foreman 1,799,743 shares as a way to settle some previous disagreements with previous president he had. I know Holtzman and Foreman were close in dealings they had with CMRG. In exchange the Nation's Health deal will continue to provide revenue for GFME. Combine that 8-K agreement for shares with this additional point by Holtzman (which we showed earlier in DD) and I can only think an R/S would make this a legal mess.

Pursuant to a Registration Rights Agreement entered into concurrently with the contribution and issuance of Membership Interests described herein, the Reporting Persons have been granted demand and piggyback registration rights, and have been granted the right to cause preferred stock of the Company with an aggregate liquidation preference of $1 million to be issued to them if a market capitalization target of $20 million for the Company is not achieved three years of the closing of the transactions described herein. The Registration Rights Agreement is Exhibit 10.3 to this Schedule 13D and is incorporated herein by reference.

(3) Holtzman as Shareholder Activist

Holtzman has been called a shareholder activist for a reason. There have been numerous times where he has stood up for shareholder interests. I believe he may end up playing a similar role here. Here are a couple of times that he has acted as a shareholder activist.

http://www.prnewswire.com/news-releases/riskmetrics-group-inc-supports-seymour-holtzmans-proposal-to-declassify-the-board-of-directors-of--lakeland-industries-inc-96287283.html

http://www.just-style.com/news/seymour-holtzman-opposes-blair-takeover-bid_id96307.aspx

I've never seen him do an R/S on any of the stocks he has been on. Much as when he was cleaning up CMRG when he took over, he cleaned it up and then passed it back to new management etc. I think he generally makes money on his common shares holdings, that's his pay.

(4) Previous Indication of Revenue from Homeclick

Based on the $90 million revenues of Homeclick previously and the way they have been rolling out these filings I believe it will reach the minimum uplist PPS without any need for an R/S. I believe, in the end, that long-term the greater likelihood remains on an F/S, than an R/S.

MERGER CHECKLIST

5/2009 - Acquire Company you plan to take public (Check)

Holtzman & Gartenhaus acquire Homeclick assets.

2/2010 - Take Over R/M Candidate (Check)

Holtzman, Chairman of the Board, takes over as CEO of GFME

5/2010 - Consolidate Shares (Check)

Holtzman buys up shares

6/2010 - Settle previous company issues (Check)

Makes share deal with Foremans that guarantees them at least $20 million market cap.

6/2010 - Bring additional assets into company (Check - not a necessity, but nice nonetheless)

Announcement of potential Nation's Health/Foreman deal

10/2010 - Finalize outstanding deals (Check)

Agreement with Nation's Health and George Foreman completed

10/2010 - Prepare Filings (Check)

Appoints new auditor to get financials for EOY 2008 & 2009 ready

11/2010 - Officer Changes (Check)

Gartenhaus appointed CEO and Home Decor CFO Swatek appointed as Senior Vice President

12/2010 - Deal with remaining financial obligations (Andersen & Holtzman entities) (Check)

Deals with interest payments. Interest waived on first set of notes (Andersen holds First Notes) & payments made for second set of notes (Holtzman entities hold Second Notes)

IN THE END

In the end, the story of GFME is evolving day to day. From June we have learned we have a tiny float stock, in which Foreman and Holtzman have taken sizable positions. We found out the money Foreman earns from Nation's Health deal will be split with company as long as deal exists, providing a consistent revenue stream. We found out in October that they have hired an auditor to get all of their filings current. In November we were given the biggest hint of what would happen here with Gartenhaus becoming CEO and bringing in Swatek as a Director. In December they filed that they were dealing with notes issues. Now we just await news on the many forward looking events that their filings have pointed towards. Based on the speed of the filings just a matter of time before Holtzman, Gartenhaus and team tell us what the next move is.

DD Contributions by: texasoil, rylawi, toucan, cautionupahead, stockman69, levelnever, emeraldcityking009, hokiefan95

Disclosure: I hold a long position in GFME

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.