Monday, September 27, 2010 3:20:30 PM

Below I have set out the major part of the findings from the DD I completed to satisfy myself that KATX and KATG is a good investment. This DD was for my own use and I am simply offering here as a good starting point for others to do their own DD. It is definitely not investment advice, just my DD. Disclosure – I have bought and am holding shares in KATX and KATG (BVIG).

Corporate Overview

Summary of Current Opportunity

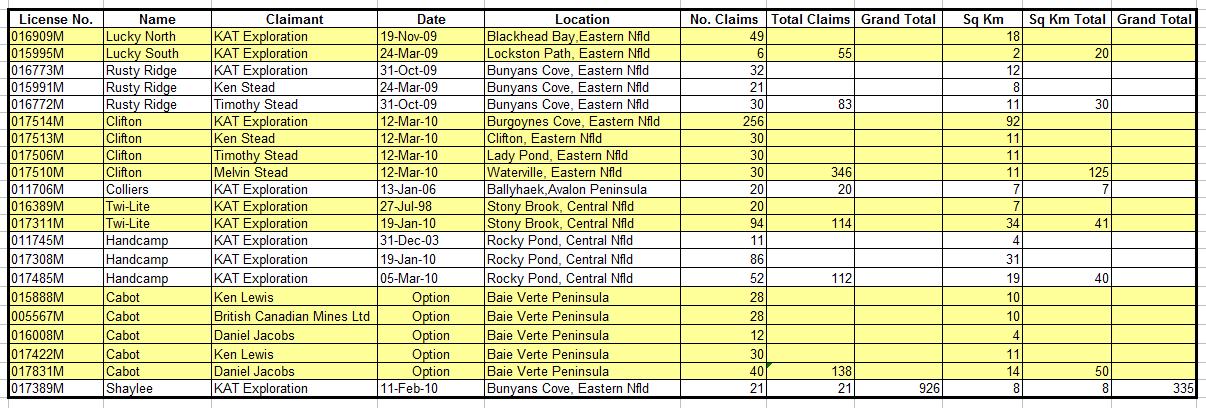

KAT Exploration (KATX) and KAT Gold Holdings (KATG) together make up a dual listed company currently trading on the Pinksheets and OTCBB markets respectively. I will refer to the combined group as KAT. KAT is a Canadian junior exploration company based in Newfoundland and with a portfolio of eight separate properties at various stages of exploration. Most notable amongst the properties is Handcamp which is a gold property owned by KATG and which has recently completed the first phase of drilling which encountered significant and exciting levels of gold and silver as well as showings for copper, zinc and lead. A second phase of drilling is planned to commence in 2010 which aims to discover the extent of the mineralisation. The other six properties are all owned by KATX and includes Rusty Ridge which is an IOCG (Iron order, Copper and Gold) property which has been likened to the great Olympic Dam copper, gold, silver and uranium mine in Australia and Lucky which is currently under an option agreement with VALE, the world’s second largest mining company.

KAT has secured funding up to $5m for its exploration activities and has been rapidly growing in terms of adding expertise both at director and functional levels and purchasing additional properties as well as stepping up its exploration activities quite considerably in the last six months. In addition to the current portfolio, KAT plans to expand its portfolio by purchasing properties in various stages of development right up to production, and will also diversify outside of Newfoundland although remaining with a focus on North America. KAT has also retained the very high powered Wall Street attorney firm Gusrae, Kaplan, Bruno & Nusbaum to assist with the mid term goals of moving to the NYSE and/or NASDAQ exchanges.

The immediate future for the KAT group looks very exciting, with first phase drilling about to commence at Rusty Ridge and second phase drilling at Handcamp planned to start immediately afterwards. In addition to the exploration, the restructuring of KATG should be completed shortly which will allow the group to trade freely on OTCBB for the first time. The company also plans to explore and prove up several of its other properties in the near term and announcements on these and activities by VALE are anticipated. Finally, information contained in recent financial filings indicates that KAT will shortly be purchasing additional properties, potentially including properties containing mines in commercial production.

As a final thought, KAT seems to me to be the right company in the right place at the right time. With its focus on mineral exploration and its diverse mixture of precious metals (gold and silver), base metals (copper and zinc) and REEs (rare earth elements) all of which are currently much sort after and increasing rapidly in value, KAT is very well positioned to take advantage of both the current financial climate and the immediate and ongoing need for increased mineral production.

Corporate History

KAT Exploration (KATX) is and owned by two brothers Ken and Tim Stead (the name KAT comes from Ken And Tim). Ken and Tim are old hands at mineral exploration, having worked in the mining and exploration industry since the ‘70s and in particular both were previously involved in another mining exploration company in Newfoundland called Cornerstone Resources where they gained much experience in both copper and gold exploration.

Ken and Tim left Cornerstone Resources in 2004 and KAT Exploration (KATX) was incorporated in 2005 as a vehicle for Ken and Tim to branch out on their own. In May 2009 the company bought a pinksheets shell and changed it to its current name and approximate share structure. An initial financing deal in the summer of 2009 did not work out, which forced the share price down.

From November 2009 onwards the company has started to gain a market interest and the share price has grown from around 0.002 to its current price of around 0.085. In this period there have been three major price increases, firstly in November 2009 when the share price rose to around 0.040 (2,000%) when the company released its first press releases about its Rusty Ridge and Lucky properties and interest amongst pinksheets investors and traders grew rapidly. The share price then consolidated until the second price increase in January 2010 where the price rose from around 0.020 to around 0.085 (425%) when the company released information about a new financing arrangement of up to $5m ($1m advanced straight away and the remaining $4m upon meeting ongoing criteria) and further information about its properties and near term exploration plans. The share price again consolidated until its final increase in May from around 0.060 to a high of 0.252 (420%) based upon speculation on the results of the exploratory drilling on KAT Exploration’s Handcamp property that was announced in April. Since April 2010 the share price has slowly dwindled back down to the January highs of 0.085 and the reasons for this are several and complex.

Current Situation

In April 2010 a second company was purchased. This company (Bell Viaggio – BVIG) was an OTCBB shell was changed to KAT Gold Holdings Corporation (currently still BVIG but soon to be KATG) in July 2010. One of KAT Exploration’s flagship properties is called Handcamp and it is Kat Exploration’s most advanced property in terms of exploration. This property was transferred into the ownership of KATG in exchange for a 1:4 share distribution of KATG’s shares for existing KATX shareholders. This transfer of value from KATX to KATG is the largest reason for the downward movement of KATX’s share price since June 2010, since of course a considerable part of the value which was retained in KATX is now owned by KATG and will be reflected in KATG’s share price. As such, since this transfer in mid July, the price of both KATG and KATX needs to be considered as an overall reflection of value, which means that although the share price has fallen since it’s high of 0.252 in May it has not in fact fallen as much as might be thought by just looking at the KATX chart and not accounting for the value of KATG’s shares. The distribution of KATG’s shares will take place imminently and at this point KATG will effectively become free-trading, as currently there is a very limited float and in any case investors and traders are waiting for the share distribution in order to learn the “final” O/S and corresponding share price. More details on KATX and KATG’s share structures are provided below.

Company Directors

Ken Stead – President and CEO

Ken is the CEO and very much the public face of the business. Prior to founding KAT Exploration he was the co-founder of Cornerstone Resources in 1997. In the thirteen year period from 1997 until now, Ken has focussed the majority of his time and energy in exploring the Sedimentary-Hosted Stratiform Copper environment and is Newfoundland’s and perhaps one of Canada’s leading hands on explorers of this type of environment.

Tim Stead – VP of Field Operations

Ken’s brother Tim is KAT Exploration’s and KAT Gold Holding’s VP of Field Operations. Tim also worked for Cornerstone Resources and like Ken has experience working in the Sedimentary-Hosted Stratiform Copper environment, but subsequently has acquired much experience and knowledge of massive sulphide deposits as well as gold, and it was Tim who oversaw the exploration and proving up of KAT Exploration’s Handcamp property prior to the recent growth of the organisation which has seen more expertise brought in to help KAT Exploration and it’s offshoot company KAT Gold Holdings grow to the next level.

Between them, Ken and Tim Stead own roughly 35% of KATX’s common shares.

Jack (John) Zwicker – Secretary and Investor Relations Officer

For many years Mr. Zwicker held a position as director of Public Works for a large Municipality in NS. Included in this position was the oversight of large construction contracts, along with managing large budgets and a work force necessary to maintain the department. He also has entrepreneurial business and management experience in the private sector. For a number of years; he has served in voluntary work that has required people skills and the organizing of large events. Mr. Zwicker’s role is IR and business advisory.

W. Les Thistle

Mr. Thistle was appointed legal counsel and a director of KAT Exploration on February 19th 2010. Mr. Thistle graduated from Memorial University of Newfoundland in 1991 with a Bachelor of Commerce degree (concentration in finance), from Osgoode Hall Law School in Toronto in 1994 with a Bachelor of Laws degree (concentration in corporate and tax law) and was admitted to the Bar of the Law Society of Newfoundland and Labrador in 1995. After finishing law school, Mr. Thistle practiced at 2 law firms in the St. John’s area of the Province of Newfoundland and Labrador, Canada, before starting his own firm. In 1996 Mr. Thistle founded W. Les Thistle Law Office, a general practice law firm located in the City of Mount Pearl, in the Province of Newfoundland and Labrador, Canada. The law firm serves corporate and individual clients throughout Canada. Mr. Thistle is the senior lawyer at the firm. His primary areas of practice are corporate law, contract law, real estate and personal injury. Mr. Thistle has litigated matters in all levels of court in the Province of Newfoundland and Labrador including the Court of Appeal of the Supreme Court.

J. Wayne Pickett

J. Wayne Pickett was appointed a director and "Senior Vice President of Capital Projects” in July 2010. Mr. Pickett received his Master of Science, Earth Science (Geology) from Memorial University of Newfoundland in 1989. He is a Registered Professional Geoscientist being a member of the Professional Engineers and Geoscientists of Newfoundland and Labrador and the Association of Professional Engineers and Geoscientists of British Columbia. He has a broad range of geological experience having worked for more than 30 years exploring for gold, silver, base metals and uranium throughout Canada and to a lesser extent elsewhere in the world including Mexico, Peru, Colombia and Ghana. He was part of the geology teams that discovered the Collins Bay “B” Zone Uranium Deposit in northern Saskatchewan for Gulf Minerals and the Bobby’s Pond VMS Deposit for Inco in Newfoundland. While serving in a management role with Crosshair Exploration, its main breccia-hosted uranium deposit in Labrador was expanded significantly and new deposits were discovered.

Biographies for KAT Exploration’s directors can be viewed on the corporate web site here

Corporate Structure

Dual Listed Company – Single Overall Entity

There are two different market listings – KAT Gold Holdings Corporation (currently BVIG but shortly to be changed to KATG) which is listed on OTCBB and currently owns just the Handcamp property and KAT Exploration Inc (KATX) which is listed on the Pinksheets market and currently owns the remainder of the portfolio of properties. This dual listing occurred very recently when a “shell” OTCBB company called Bella Viaggio was purchased in April 2010 and is subsequently undergoing the process of conversion into KAT Gold Holdings.

The company directors are identical for and serve in largely the same capacities on the boards of both KAT Exploration Inc and KAT Gold Holdings Corporation. It therefore follows that KAT Exploration and KAT Gold Holdings could be viewed as one single corporate entity, referred to technically as a dual listed company.

KAT Exploration Inc

Originally incorporated in 2005 and merged into a pinksheets shell in May 2009, the company underwent restructuring in 2009 and the first half of 2010 and has now emerged with a stable share structure which the CEO Ken Stead has stated will not be significantly altered unless by necessity for the purposes of a JV (joint venture) – in other words shareholders will not see dilution unless to move the company massively forwards with a significant and company-changing event.

Common Stock authorized: 700,000,000

Common Stock outstanding 641,603,664

Preferred Stock authorized: 30,000,000

Class A Preferred outstanding: 11

Class B Preferred outstanding: 580,000

Public Float: 332,431,815

The CEO Ken Stead has stated that there are no plans to convert the Class A or Class B stock (which were originally created as a mechanism to retain overall control prior to the last round of restructuring and are no longer required) and it is therefore anticipated that at some stage in the future these shares will be retired.

KAT Gold Holdings Corporation

KATG was purchased as a vehicle to get a part of “the group” listed on the OTCBB in order to gain the corresponding advance in prestige and trust that comes with this move upwards. As a very recently purchased OTCBB entity, the work to restructure KATG is still ongoing and as such the current structure does not fully represent the final structure. One imminent structural change is a 1:4 distribution of 160 million KATG shares to KATX shareholders on the record date of mid July 2010, which will be given to KATX shareholders as payment for the transfer of KAT Exploration’s Handcamp property from KATX into KATG.

The structure shown below is therefore “best endeavours” right at this moment and it is possible that more common or preferred stock will be released, although the company has not made any announcement to this effect. One large change is due imminently, which is the share distribution to KATX shareholders that is outlined above.

Common Stock authorized: 500,000,000

Common Stock outstanding 163,657,130

Preferred Stock authorized: 5,000,000

Preferred Stock outstanding: nil

Current Public Float: 613,797 currently (will change when share distribution occurs)

Future Public Float: 167,000,000 (possible scenario after share distribution)

Corporate Activity

Aside from the world class properties, the most exciting thing about the KATX and KATG group is the level of corporate activity that has occurred in the last few months, so much so in fact that parts of it have almost been forgotten by investors due to the understandable focus upon activity at the properties themselves and in particular Handcamp where the first phase of drilling has just been completed and Rusty Ridge where the first phase of drilling is about to commence.

Additions to the Team

The most exciting recent addition to the team is the appointment in July 2010 of Mr J. Wayne Pickett M.Sc., P.Geo. (NL,BC) to the board of directors. Mr Pickett is a registered geoscientist and is qualified to sign off NI 43-101 compliant exploration reports. Mr Pickett has considerable experience in mineral exploration and has worked both in Canada and elsewhere on gold, silver, copper and uranium exploration projects for a number of organisations including Cornerstone Resources and Teck Exploration. As a board level director, Mr Pickett brings substantial expertise and credibility to the group.

Mr Pickett’s resume can be viewed here

The other recent addition to the team is Mr R. James Weick M.Sc. (Earth Science), P.Geo. Mr Weick was appointed to the role of Geologist in May 2010 and he was responsible for heading up the exploration programme at Handcamp prior to handing over to and working alongside Mr Pickett. Mr Weick has a very impressive background in mineral exploration including the supervision of geochemistry, geophysics, trenching and drilling projects from reconnaissance exploration through to prefeasibility deposit resource / reserve estimation.

Mr Weick’s resume can be viewed here

A communication from the CEO Ken Stead has indicated that a further geologist and geophysicist has also been hired to assist with the ongoing exploration work.

Financial Backing

As has previously been mentioned, in January 2010 the company announced that it had secured funding of an initial $1m and up to a further $5m based upon meeting agreed criteria in return for 50 million restricted shares. According to the press release the funding was designed to “provide operational support for Kat for at least the next 5 years” and as such the company is therefore well supported financially. This provides a strong financial foundation that allows the company to take advantage of opportunities to explore and prove up existing properties and to purchase other properties, as well as to restructure the company and hire additional expertise. Since announcing the investment the company has gone on to announce two drilling exploration and drilling programmes, the purchase of an OTCBB shell company, additional property claims and the purchase of an option to explore another property that has already been explored with a drilling programme.

The press release for the funding can be viewed here

Corporate Attorneys

A very exciting development was announced in May 2010, the appointment of Gusrae, Kaplan, Bruno & Nusbaum as the group’s corporate attorney. Gusrae, Kaplan, Bruno & Nusbaum specialise in corporate listing, uplisting, mergers and acquisitions and associated restructuring and are a highly prestigious Wall Street partnership with a reputation second to none.

Quote from their web site:

Gusrae, Kaplan, Bruno & Nusbaum has been providing legal advice to the securities industry for over 30 years. Our clients include financial institutions, broker-dealers, investment advisors, individual investors, and public and private companies.

All of our attorneys exclusively practice securities related matters. We represent clients in corporate finance transactions, as well as litigation before self-regulatory organizations, federal securities regulators, State and Federal courts, and industry arbitrations. We continually maintain strong relationships with regulators and various members of the legal community who specialize in securities-related matters which enables us to achieve the most effective outcome possible for our clients.

In addition, our attorneys have extensive backgrounds in working with companies to assist our client in virtually every area of federal and state securities laws and all types of transactions and issues. We have the knowledge and experience needed to consistently provide highly sophisticated legal service expected by companies of all sizes, ranging from startups to several hundred million dollar offerings.

Our lawyers include the former general counsel for the New York Mercantile Exchange, a former general counsel of a brokerage firm, and a former regional attorney at the NASD. We also have attorneys that have over 30 years of experience in private practice in the field of securities law.

Based on the recent Security Transactions (since 1 Jan 10) by our law firm here are the results on the stock price:

CHPN = Low of 0.05 on 25 Feb 10 with high at 3.00 on 7 May 10 (currently 2.90)

CSNH = Low of 0.07 on 21 Oct 09 with high at 3.29 on 16 Apr 10 (currently 2.30)

LTUS = Low of .38 on 18 May 09 with high at 2.00 on 21 Jan 10 (currently 0.92)

The Gusrae, Kaplan, Bruno & Nusbaum web site can be viewed here

Future Plans

Much of KAT group’s future intentions have been announced in PRs and financial filings. Some of these plans are longer term and therefore are likely to adapt and change as circumstances reveal themselves and new opportunities are followed up.

Private Independent Consultants

In January 2010 KAT announced the appointment of private independent consultants to “provide an array of major mining support and other ventures to be announced later that will significantly enhance shareholder value”. The identity of these consultant are unknown but the speculation is that they may also be linked to the investors in some way. The fact that they can provide major mining support is a strong indication that these consultants may also be a part of or strongly linked to a large mining corporation such as Teck or VALE.

Asian Listing

One of the tasks assigned to the private independent consultants in January 2010 was to ”proceed to meet the requirements of gaining a listing on one of the largest Asian Stock Market Exchanges, later to be named”. No further information has been released since January 2010, but once announced, this further listing could make a substantial difference to the value of the KAT group as there is a lot of interest in the Asian markets currently for copper, gold, rare earth elements and other minerals.

Carbon Credits

Another one of the tasks assigned to the private independent consultants in January 2010 was to “assist in increasing shareholder value by diversifying and adding "Carbon Credit" projects into KAT's portfolio of assets”. The company has further explained that carbon credits projects in Brazil and Sierra Leone are being considered. Like the Asian listing, no further information has been released since January 2010, but once announced, this project could also make a substantial contribution to the KAT group share price.

The press release that outlined details for the private independent consultants and the plans for an Asian listing and for a carbon credits project can be viewed here

Purchase of Additional Properties

In a recent filing by KAT Gold Holdings Corporation, KAT has restated and further amplified on its intentions to purchase additional mineral properties in the near future. These plans are very exciting and reading between the lines would appear to be reasonably advanced. The information contained in the most recent filing is shown below:

The Company intends to build its business through the exploration and development of the existing Handcamp gold property; the acquisition, exploration, staking and development of future gold properties and the acquisition of producing gold properties. The Company’s strategy is to diversify its revenue sources by combining the secure and reliable revenue source of producing gold properties with the potential of gold exploration projects. The Company plans to explore and stake new gold properties, acquire development stage gold exploration properties, carry out exploration programs on the acquired properties, and develop any viable gold producing properties it discovers, acquires and is able to pursue, assuming that it is able to raise the requisite financing for such activities. While its head office and the Handcamp gold property are both located in the Province of Newfoundland and Labrador, the Company has not limited itself graphically with respect to future properties. The Company is committed to examining all promising and viable properties that come to its attention with a particular interest in North American properties.

The Company’s search for producing gold properties has been directed towards small and medium-sized gold companies and properties. For its initial acquisitions, if any, the Company is seeking lower risk property interests. In building its portfolio of gold properties, the Company intends, subject to obtaining the requisite financing, to explore and stake new gold properties, acquire active gold producing properties as well as development stage gold properties. As the Company continues to develop its portfolio of interests, it will search for properties that have the following qualities:

~ least developmental drilling exploration potential in proven producing areas and highly promising areas;

~ significant additional production capacity in existing gold producing properties;

~ further developmental potential; and

~ those where the Company will have the ability to assume operatorship of existing gold producing properties.

Further Additions to the Team

In addition to the roles already filled over the last few months, the company is currently advertising to fill another seven geologist, geophysicist and field assistant roles. These roles are a strong indication of the short term growth expectations of the group and of the seriousness with which the organisation takes its plans to purchase one or more mines in active production. The roles are:

~ Resource Geologist

~ Field Assistant

~ Geologist

~ Geoscientist

~ Mine Geologist

~ Exploration Geologist

~ Generative Geologist

The advertisement for these roles can be seen on the corporate web site here.

Corporate Restructuring

The company has released a flowchart which attempts to summarise the planned corporate restructuring that the group is currently part way through. The first proposed additional change is that a second property (Twi-Lite) will be moved from KATX to KATG with a corresponding share distribution of KATG shares paid to KATX shareholder at the time in compensation for the loss of Twi-Lite’s value. The second proposed additional change is that KAT Exploration Inc (KATX} will be reversed into another OTCBB shell and renamed KAT Copper Holdings (KATC) to complement KATG and to move the entirety of the group off Pinksheets and onto OTCBB. There is no hard time line for these two events but the likelihood is that they will occur within the next six months or so. Meantime the KATG share distribution for KATX shareholders in compensation for the transfer of Handcamp to KAT Gold Holdings should complete in the next few weeks.

The corporate structure flowchart can be seen below:

Criticisms

It’s a Pump and Dump Scam

Even a small amount of DD would show that this is complete rubbish. For example the corporate filings for both KATX and KATG can be viewed on the OTCMarkets web site here and the properties that KATX and KATG have licensed from the Newfoundland Government can be viewed on the government’s own mining claims web site here

Lack of Transparency

A second criticism has been the lack of information about and transparency around the identity of the investors that have backed KAT and the exact details of the deal that has been struck with these investors. Whilst this criticism does have some merit and investors would certainly like to be privy to more information about the funding, the assumption is that part of the terms of the agreement were to agree to a non disclosure arrangement for the time being at least. As such the company’s hands are tied and shareholders will need to wait upon further news when it is possible to release it.

Unnecessarily Complex Corporate Structure

There has been an argument put forward that if the corporate restructuring had not been embarked upon then the share price would either not have dipped at all from its high of around 0.25 or at least not dipped anywhere near as much as it has done. This argument holds some weight since of course the restructuring has taken some of the value of KATX out and placed it into KATG, lowering the KATX value (though of course raising the KATG value proportionately). Because shareholders are yet to see their KATG share distribution and because as a result KATG is not as yet freely trading it is difficult to know what the final outcome will be regarding whether or not the value of Handcamp coming out of KATX will be fully reflected in the ongoing share price of KATG. An additional lowering effect may have occurred because psychologically the lowered KATX share price “feels” negative, even though the upcoming KATG shareholding should be allowed for.

Unexciting Properties

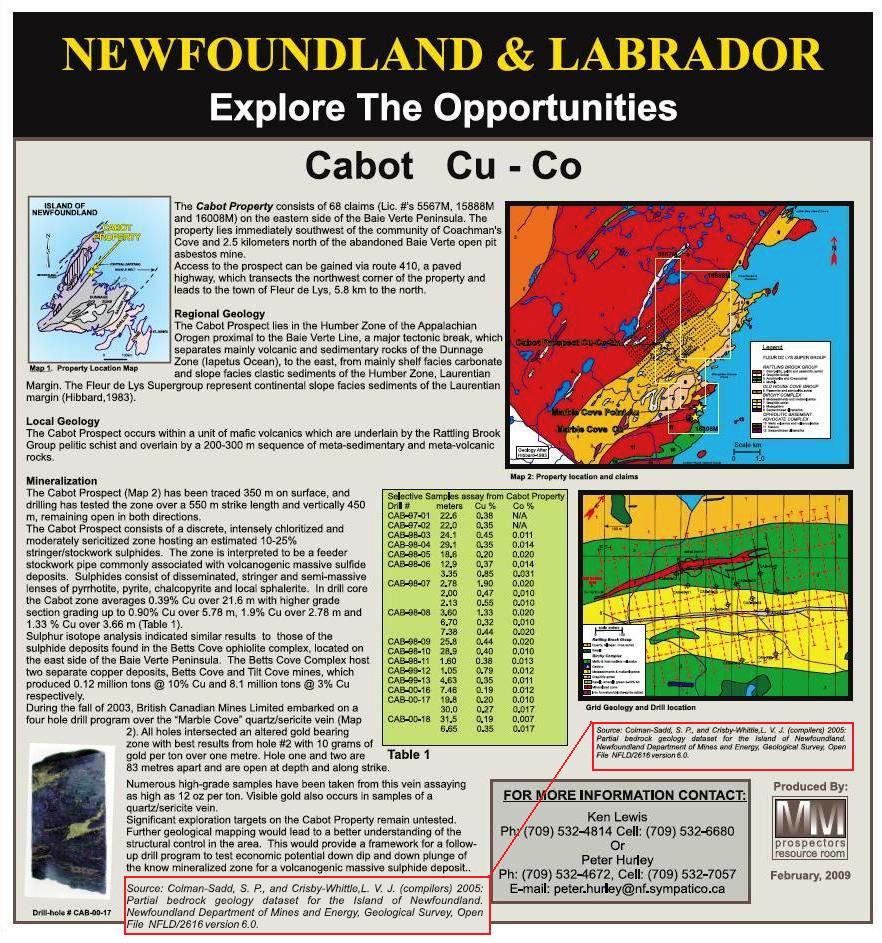

Some have argued that the KAT groups properties are not all that special or maybe even below average and may therefore contain little or no true value once fully explored. It is difficult to argue for or against this stance without a long and complex discussion on the relative merits for each of the properties. It is certainly true to say that there is insufficient information about Clifton, Shaylee, Twi-Lite and Colliers to be able to determine any sort of likely final value, although all four of them have potential. Of the four remaining properties Cabot has visible gold and interesting initial drill results that could well warrant a second drilling phase, Lucky is currently being explored by VALE, Handcamp has shown excellent gold and silver showing in its initial phase of drilling and will go on to a second drilling phase and Rusty Ridge’s geophysical and other exploration looks very exciting indeed, with a drilling programme about to commence that may give even stronger evidence for a large copper deposit.

Properties

In total KAT owns 335 sq km of properties. Although I include information on the eight KAT properties below they have been well covered in previous DD and in particular I would strongly recommend reviewing posts from BirdmanBob, Investor911, Stervc, Er0ck, Biochemist2002 and myself Rick-UK as well as the excellent iBox and stickies.

Property 1: Handcamp

Handcamp is a very special and unique type of gold deposit known as a "Felsic" VMS deposit. World wide there are only something like 800 VMS deposits and only the best of these are "Felsic". According to the USGS, Handcamp is the highest grade VMS gold site in all of Newfoundland. Surface rock and soil samples show a level of gold FAR higher than any of the surrounding mining sites owned by other companies and to find these levels of gold in just the surface rocks implies FAR more gold in deeper deposits.

KAT Exploration has recently added a further 5,311 acres to its Handcamp claim. A test drilling programme has been planned and the drilling company has been appointed. This is a well respected multinational drilling company called Cabo Drilling - http://www.cabo.ca/. The drilling starts in May and is likely to take 3 to 4 weeks to complete, although updates as to progress during this period are expected.

According to CEO Ken Stead: “[Handcamp] is just south of the new gold processing facility which just opened this year by Anaconda Mining. That in itself is just south of what used to be the Nugget Pond Gold Mine, which is now being operated by Crew Gold and then there’s the Duck Pond Deposit, which is being mined as a massive sulphide deposit, and is a bit to the south also.” Handcamp’s situation so close to existing gold mines and Anaconda Mining’s gold processing facility could make a potential JV with Anaconda a good prospect for both companies.

What is also of interest is the fact that Handcamp lies absolutely dead central within an area marked out by the Canadian Government as being of special interest due to its underlying geology, and was given special attention in an air survey of Canada.

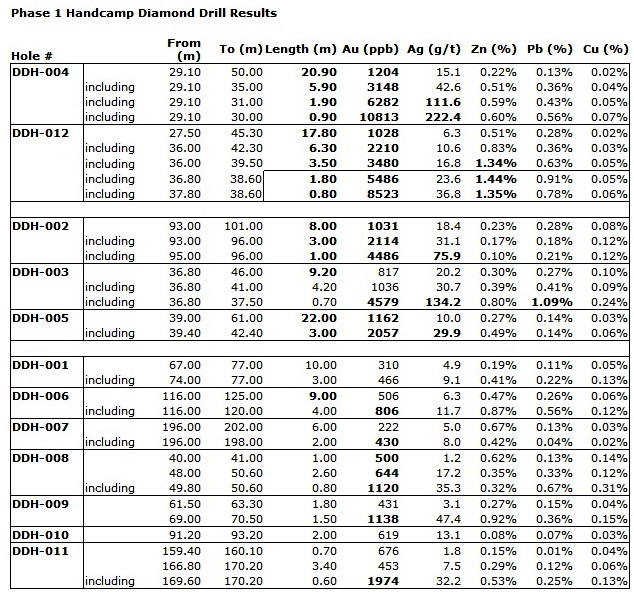

In August 2010 KAT Exploration completed the first phase of a drilling programme at Handcamp and the results were published in a press release. This first phase included 12 holes and significant levels of gold including some cores showing up to 10g/t were found in every drill core, along with some very exciting showings for silver plus additional zinc, copper and lead. The first phase has shown sufficient potential for the company to announce a second drilling phase which it hopes to commence shortly, which will attempt to determine the true scale of the mineralisation that the first phase uncovered both in terms of depth and width, as well as uncovering additional mineralisation that has been identified by recent geophysical, trenching and other exploration activities at the site.

Handcamp is a very important property for the KAT group and if the second phase of drilling is successful then this success will be reflected in a corresponding increase in share price for KATG (as KAT Gold Holdings now owns Handcamp). The increase will likely be dramatic as the O/S and float for KATG will be relatively small even allowing for the upcoming share distribution (see above).

Quote from the press release:

Ken Stead, President CEO, states, "The first phase of exploration, which included induced polarization geophysics, trenching and 1640m of diamond drilling in 12 drill holes, has now been completed on the Hand Camp Property. A second phase starting this fall is in planning and will include additional line cutting, induced polarization geophysics and diamond drilling. With data collected so far and the very encouraging results from this first phase, the company feels that this project warrants a full scale exploration program to determine the true significance of the deposit. With just four areas drilled at such wide intervals within such a large structure and the fact that we intersected gold in all 12 drill holes, we feel there is high potential for further encouraging results within this mineralized structure. Also the number of targets yet remaining to be tested outside this determined structure lends itself to a high degree of optimism that this project will be of great value to the company."

The full press release showing the results from the first phase of drilling can be found here.

Property 2: Rusty Ridge

Rusty Ridge is KAT’s other big copper claim. An airborne magnetic IP resistivity survey of Rusty Ridge showed a strong magnetic anomaly and this combined with soil geochemical analysis strongly indicates the presence of high levels of minerals including copper and rare earth elements (REE). In an interview for CEO/CFO Interviews, our CEO Ken Stead said: ”There was an interpretation done by an independent geophysics company from Vancouver, on the other side of Canada, who likened many of the signatures that we are finding to that of the Olympic Dam in Australia. That is actually their words not ours.” (Olympic Dam is the world’s fourth largest copper mine, valued in the billions of dollars.)

The PR released in June 2009 described Rusty Ridge thus: Anomalous levels of the Light Rare Earth Elements (LREE) cerium and lanthanum, all present in Olympic Dam (and others), were not only detected in soils but also in rock samples. Other rare earth elements such as Yttrium(Y), Niobium(NB), Zirconium(ZR) along with Uranium, were all detected in both soil and rock samples. In addition, the soil geochemistry also produced anomalies in silver, gold and copper.

According to the KAT Exploration website “This property has already generated a lot of interest from mining companies” and according to CEO Ken Stead this claim ”is ready for drilling”. What conclusions can we draw from this? IMO Rusty Ridge has a very good chance of becoming absolutely massive. Copper and Rare Earth Elements are of massive strategic importance right now and these commodities are set to rise even further in value as reserves come under greater pressure. It’s still all to play for in the sense that (so far as we are aware) no test drilling has yet occurred at Rusty Ridge. Finally, on 16th April, Ken Stead said “…we have made a few new and unexpected discoveries on the RR during our last period of sampling so we will continue with a summers program of the same and spend some time on the Shaylee right next door”.

The drill is currently being positioned at Rusty Ridge and drilling will commence imminently.

Property 3: Lucky

Lucky is one of KAT’s copper claims and the reason why Lucky is so exciting is that on 23 November 2009, KAT announced the results of initial sample and analyses for Lucky and by 11 December 2009, VALE Inco, the world’s second largest mining company had staked claims all around it to an annual cost of $1m. Following this activity in June 2010 KAT Exploration announced an option agreement with VALE for a joint venture of the South Lucky part of the property. The option agreement gave VALE the rights to explore and prove up the South Lucky property in return for an 80% interest in it.

Quote from the press release:

Ken Stead, President/CEO of KAT, states, "The very fact that a company of Vale's caliber has enough interest in the area and sees enough potential in the Lucky properties to warrant an option with KAT, leaves us very excited. We are very pleased to be exploring these copper properties with Vale and look forward to bringing them to their full potential."

The full press release showing the option agreement with VALE can be found here.

Now why would a billion dollar company like VALE want to do all of this? My conclusion is that VALE are very interested indeed in the potential of Lucky. A JV with a mining company like VALE is the Holy Grail for junior exploration companies like KAT. KAT looks to be on the brink of an amazing partnership and anecdotal evidence supports the view that initial exploration at the Lucky property has begun.

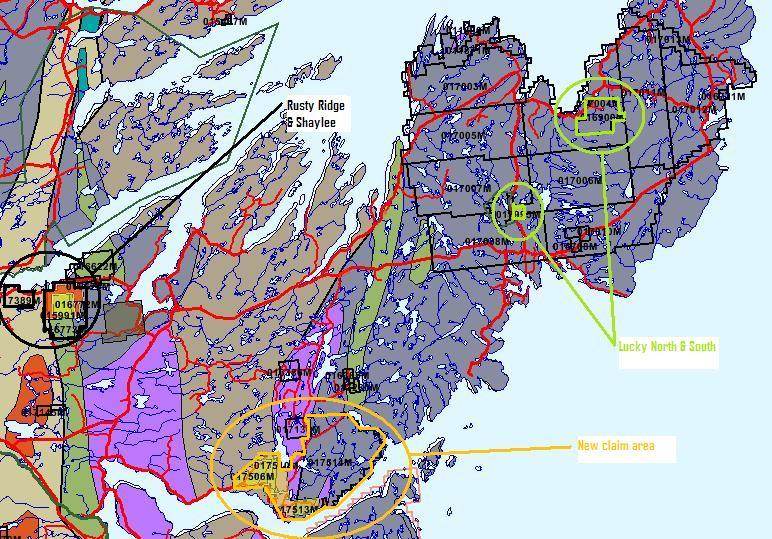

Of additional interest at Lucky is the fact that on 19 November, just prior to the announcement of the initial sample analysis results on 23 November, KAT Exploration claimed an additional 18sq kilometres of land just north of the original 2sq kilometres claim that has so far been explored. Not much is known about this second area (North Lucky), but it is not included in the option agreement with VALE and as such can be considered as a separate asset in its own right that is owned wholly by KAT Exploration.

Shareholders await further news about South Lucky which is anticipated imminently. Meantime CEO Ken Stead has been quoted as stating that in his opinion the copper at Lucky could be worth around $10bn or more, which at 20% ownership would bring $2bn of value for KATX. The email that contains this statement is shown below:

Posted by: siljie

Date: Saturday, June 12, 2010 9:28:00 AM

In reply to: None Post # of 61799

Email response from Ken for some insights:

My QSN: First of all, I'm excited that Vale is interested! Well done, and congratulations to all of us! The PR says that VALE has paid $20,000 (and possible 75,000 for extending this 3 yrs) to own the option to JV with KATX. If Vale chooses to spend at least .75 million for exploration costs, they then own 80% of the claims, and 20% stays with KAT. My first question is, what if Vales does not choose to do this, but chooses to exercise the option to JV, what kind of terms might we be looking at, and is it better for KATX to fund the exploration ourselves, prove up reserves and get a more valuable deal?

Ken's ANS: First off, the $20K & $75K is money that is paid at the beginning of each anniversary date is just to cover the cost of administration. No major company will pay much of anything until they are pretty certain there's something there. If Vale does not complete the 3 year deal and spend .75 million (which would take them to a feasiblity study so they know there's a deposit there) then the property returns to KAT 100%. The advantage KAT has is, VALE is building a $2.5 billion refinery just to the south of the Lucky properties and need copper for process. If there is a deposit there worth mining they will not sit on it as that’s their reason for working… in such an urgent way.

My QSN: 2ndly, why has KATX agreed to give up 80% of its interests in return for this sub-million exploration cost, the exchange appears vastly disproportionate? I am not knowledgeable on the mining industry, so I'm not sure if really the 80:20 will turn out to be a really balanced exchange eventually accounting for all associated costs etc (I don't know these). And/Or perhaps it is justified to significantly sweeten the deal for VALE for subsequent dealings to work out in our favour. Please give me some insights into these.

Ken's ANS: After the 3 year option is execised then comes a feasibilty study which would cost nothing less then $50 million to which Vale will have to pay 80% of the cost. If there is not an ecomomical deposit then we've saved our money and Vale has wasted its. Also, most deals like this for a smaller company like KAT might just stand the chance of only being able to retain a 2% NSR(net smeltering royality). A copper/silver deposit such as could possibly be on the Lucky property has the potential to be valued at $5 billion and much more. That being the case KAT owning 20% of the deposit would equal in value of $1 billion for KAT, which any company would be happy to own. Therefore 20% of an economical deposit has tremendous value for a company.

I sent this today around noon time Europe, and got a reply in 45min.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=51220992

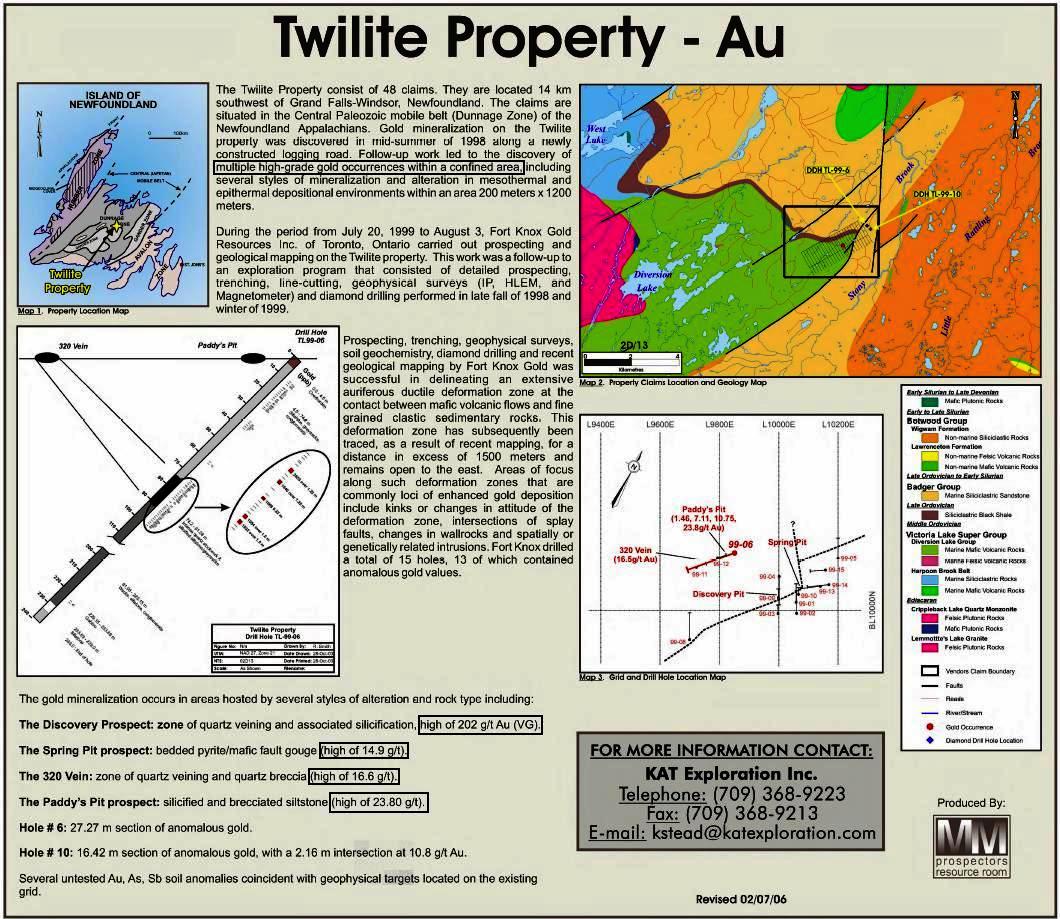

Property 4: Twi-Lite

Twi-Lite is KAT’s other exciting gold claim alongside Handcamp. Twi-Lite includes:

• The Discovery Prospect: Zone of quartz veining and associated silicification, high of 202 g/t Au (Visible Gold)

• The Spring Pit Prospect: bedded pyrite/mafic fault gouge (high of 14.9 g/t)

• The 320 VeinProspect: zone of quartz veining and quartz breccias (high of 16.6 g/t)

• The Paddy's Pitt Prospect: silicified and brecciated siltstone (high of 23.80 g/t)

A data sheet for Twi-Lite can be found here

Less is known about Twi-Lite than about the first three claim areas described above, however, what is particularly exciting is first of all the very interesting figures of up to 202g/t of gold from the initial samples, and secondly the fact that on 19th January 2010, KAT Exploration added a huge new, additional 34sq kilometres to the claim area, bringing it to a total of 41sq kilometres. Just taking that first fact into consideration – 202g/t of gold is massive, and I do mean massive. Better than at Handcamp even. My understanding is that exploration at Twi-Lite is still at an early stage, but I think we can expect more information about it this summer.

One additional benefit of Twi-Lite is that a road runs straight through the claim area, making it relatively inexpensive to explore further and cheaper to transport equipment to the site and minerals from the site in the future. Twi-Lite is definitely one to watch!

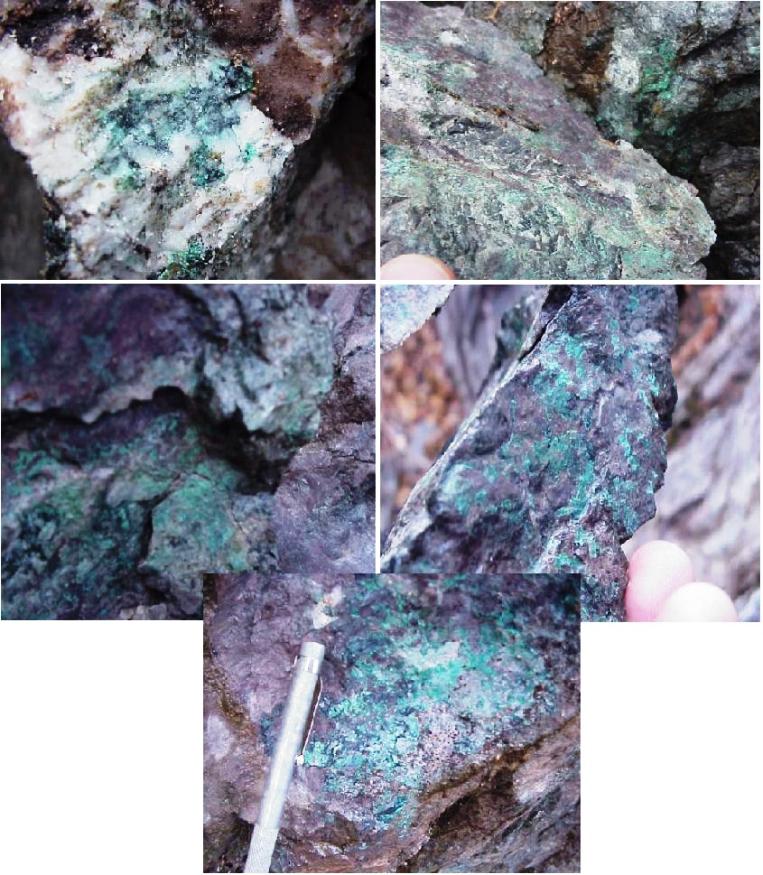

Property 5: Shaylee

Shaylee is a region of volcanic rock traversed by numerous faults which early indications appear to indicate contain high levels of copper. Even less is known about Shaylee than about Twi-Lite. Shaylee sits adjacent to and very nearly abutting Rusty Ridge, and was an area that Ken and Tim Stead have only very recently claimed on 11 February 2010, although they had explored the area beforehand. Shaylee has two very interesting copper anomalies, the first 1km long by 75m wide and the second 200m long by 50m wide. It’s proximity to Rusty Ridge means that KAT Exploration can include further exploration at Shaylee into its plans for exploration at Rusty Ridge, and this precisely what our CEO Ken Stead intends to do. What I also think is interesting is the idea that KAT Exploration could potentially find a JV partner for Rusty Ridge but retain the mineral rights at Shaylee, then piggyback off the work carried out at Rusty Ridge to add further value to KATX shareholders. Just an idea!

The image below shows Rusty Ridge to the right (three claim areas together) and Shaylee to the left…

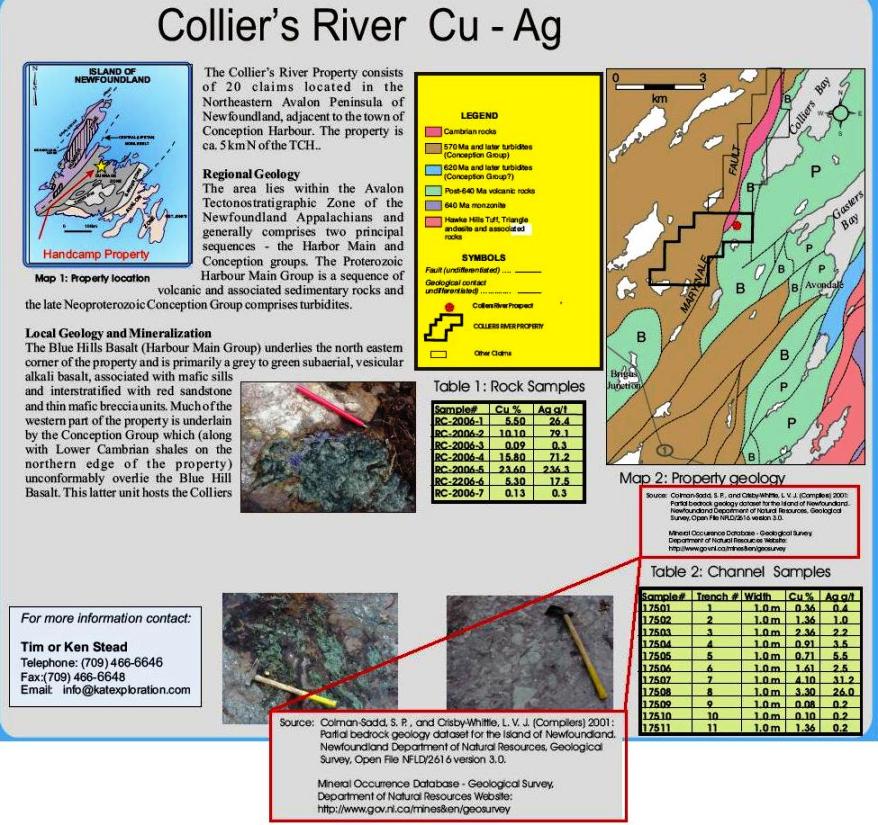

Property 6: Colliers

Colliers contains deposits of both copper and silver. The work at Colliers has as yet been preliminary but copper mineralisation in the form of VRC (Volcanic Redbed Copper) is strongly indicated and both grab sampleas and channel samples have produced high levels of silver as well as copper. In fact, assays from the surrounding host rock yielded results as high as 23.60% copper and 236.30 g/t silver. I have very little information as yet about KAT Exploration’s plans for Colliers, but as previously mentioned, copper is a valuable commodity and precious metals such as silver are also excellent and highly valuable minerals.

Property 7: Clifton

Clifton is a brand new claim area for KAT Exploration and by far our largest, reaching a whopping 124sq kilometres in size – that is a huge area and quite costly to claim and to maintain that claim (to keep a claim active, a certain amount of exploration activity must occur within a specified period, else the claim lapses).

Clifton lies south of the Lucky claims and appears to share a lot of the same underlying geology. It also has great accessibility. Our CEO Ken Stead has said that the company will carry out further exploration of this new claim area in the late spring or summer.

Part of the recent JV between Cornerstone and VALE was for Cornerstone’s claim to the north of Lucky and next to the VALE claims that surround Lucky. The other part is for Cornerstone’s claims that lie just south of our Clifton claim. So VALE are JV partnering in the Clifton area as well as in the Lucky area.

Property 8: Cabot

In July 2010 KAT announced it had entered into an option agreement for 100% ownership of a property in NW Newfoundland called Cabot. The Cabot property is a copper property with 12 existing drill holes, but in fact it has been purchased particularly for its gold potential and indeed visible gold has been found in rock hand samples at the Cabot property. The owners of the Cabot property had failed to maximise upon the potential at Cabot and have seen the value to them of exchanging their rights at Cabot for KAT shares. Completion of the assaying of the initial drilling programme and a further exploration of the property are understood to be high up on the priority list for future KAT activities and the property looks as though it could prove to be very exciting for KAT shareholders.

Recent KATX News

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 06/20/2024 11:58:38 AM

Glidelogic Corp. Announces Revolutionary AI-Generated Content Copyright Protection Solution • GDLG • Jul 26, 2024 12:30 PM

Southern Silver Files NI43-101 Technical Report for its Updated Preliminary Economic Assessment for the Cerro Las Minitas Project • SSV • Jul 25, 2024 8:00 AM

Greenlite Ventures Completes Agreement with No Limit Technology • GRNL • Jul 19, 2024 10:00 AM

VAYK Expects Revenue from First Airbnb Property Starting from August • VAYK • Jul 18, 2024 9:00 AM

North Bay Resources Acquires Mt. Vernon Gold Mine, Sierra County, California, with Assays up to 4.8 oz. Au per Ton • NBRI • Jul 18, 2024 9:00 AM

Nightfood Holdings Signs Letter of Intent for All-Stock Acquisition of CarryOutSupplies.com • NGTF • Jul 17, 2024 1:00 PM