Monday, July 12, 2010 9:26:29 PM

**I am writing this post to help serve as a centralized hub for all things REAL & SPZR, to collect all the DD people have done and hopefully serve as a launching board for investors to start their own DD. I will do my best to provide links so you can follow where the research is coming from and I have also tried to provide some screenshots for additional information as well. As the REAL & SPZR story unfold I will continue to update this post. Please let me know either if you see any mistakes or you believe I've left anything important off. As always this is not meant to supplant your own DD, only complement it. Be aware that mixed in with facts here there is speculation and I am not a financial adviser. Below, I do my best to spell out both the REAL & SPZR stories as I currently understand them.

AS M&A PICKS UP IN OTC LAND, TWO SHELLS FOR A SHELL PLAYERS WATCHLIST

REAL(OTC:REAL) & SPZR (OTC:SPZR) are two empty shells that contain perfect parameters for empty shell runners. A low PPS, great SS, strong management and currently reporting on the OTCQB, make them both very attractive at these levels. I've searched long and hard through hundreds of empty shell picks and I wanted to highlight these two because I feel they have potential as R/M runners. As M&A activity picks up, people will be looking for low SS shells to invest in, these are two I think that will find themselves onto people's lists.

Why a dual DD post? Two words, common management. In the midst of the worst economic downturn and environment for M&A activity in a long time, management that now represents REAL & SPZR put together one of the most unsung, yet successful R/M's of the year. They engineered the R/M of Golf Trust of America into (AMEX:PTX) Pernix Therapeutics. Part of the reason this flew under the radar IMO, was the face that up until now they have been relatively unknown penny shell players. I have been watching both of these stocks for quite some time, but the reason I am featuring them now is I believe they are pretty close to hitting a PPS bottom. I see much more upside potential than downside. From here on out, I will be watching closely for changes in their trading activity and filings as hints to potential R/M.

Sadly, unlike many of my other comprehensive DD posts, this one won't be as flashy, with graphics and oohh, ahhh..things LOL, this will just be the bread and butter, the flash will be once/if these two have their R/M's. Until then, enjoy digging through the details.

WHO IS THIS COMMON MANAGEMENT?

The Pearce/Gottlieb Tag Team. The main players here are Michael Pearce & Jay Gottlieb with several supporting players. Not among the most well-known shell players, because they are relatively new to the shell scene and only have recently begun to gain some attention. Both of them are growing into what I believe are skilled shell players, finding value in companies, taking control of them, cleaning up their books and making them into ideal R/M candidates. Here are their bios:

Michael Pearce

http://people.forbes.com/profile/michael-c-pearce/9194

Michael Pearce, age 48, is Chairman of Pernix Therapeutics Holdings, Inc (NYSE Amex:PTX), a specialty pharmaceutical company. From November 2007 to March 2010, he was Chairman and Chief Executive Officer of Golf Trust of America, Inc. (NYSE Amex:GTA). Mr. Pearce has been a private investor in various companiessince 2002, with emphasis in distressed securities of publicly traded entities. From late 1999 through 2001, he served as Chief Executive Officer of iEntertainment Network. From 1996 to 1998, he served as Senior Vice President of Sales and Marketing of publicly traded VocalTec Communications, later returning in 1999 in a consulting capacity to its Chairman on matters pertaining to strategic alternatives, business development and mergers and acquisitions. From 1983 to 1996, he was employed in various technology industry management positions, including Senior Vice President of Sales and Marketing at Ventana Communications, a subsidiary of Thomson Corporation; Vice President of Sales at Librex Computer Systems, a subsidiary of Nippon Steel; and National Sales Manager at Hyundai Electronics America. From 1979 to 1983, he attended Southern Methodist University.

Jay Gottlieb

http://www.google.com/search?sourceid=chrome&ie=UTF-8&q=jay+gottlieb+forbes

Jay A. Gottlieb, Mr. Gottlieb is a private investor in various companies since 1998. He is involved in analysis and investment in undervalued special situations and shell corporations. He presently owns between 5% and 21% of 10 public companies and is a member of the Board of Directors of Golf Trust of America, Inc. From 1992 to 1998 he was the editor of an investment service that analyzed and published extensive data on companies planning initial public offerings. From 1977 to 1991, Mr. Gottlieb was the President and Chairman of the Board of The Computer Factory, Inc.(NYSE), a nationwide organization involved in retail and direct sales, servicing and leasing of personal computers. From 1969 to 1988, he was President of National Corporate Sciences, Inc., a registered investment advisory service. Mr. Gottlieb holds a Bachelor of Arts from New York University.

A BRIEF SYNOPSIS of GTA/PTX REVERSE MERGER

To be fair GTA had a much, much larger asset base and cash reserve compared to REAL or SPZR, which also helps explain why it traded in the multi-dollar level pre-R/M. Leading up to the R/M, GTA moved from ~$1.75 to nearly $4.75, a move of +271%. You can imagine if they are able to clean up REAL and SPZR, as they have been, at the penny level (not the dollar level), what the potential may be. If Gottlieb, Pearce and team manage to connect either REAL or SPZR with big-time players, not hard to see how these could be real shell movers.

About Pernix Therapeutics (AMEX:PTX):

Pernix Therapeutics is an integrated specialty pharmaceutical company with development and commercial capabilities focused primarily on the pediatric market. Since our foundation, we have focused on the acquisition, development, marketing and distribution of pharmaceutical products that provide timely and cost effective market entry through various regulatory pathways. All of our products and strategies are focused on creating solid intellectual property to protect the investment and development of our products.

Screenshot:

http://pernixtx.com

Timeline of GTA/PTX merger

November 15, 2006 - Gottlieb begins to take ownership stake November 15, 2006.

January 9, 2007 - Michael Pearce comes in as consultant

July 16, 2007 - Disposition of Assets

August 8, 2007 - Company announces should start to actively search for other business opportunity

November 2007 - Michael Pearce becomes CEO/Chairman of the Board

April 16, 2008 - Change of Accountants

October 8, 2008 - Litigation Settlement

January 29, 2009 - Completion of Disposition of Assets

October 7, 2009 - Plan of Merger with Pernix Therapeutics

March 8, 2010 - Name Change from Golf Trust of America, Inc. to Pernix Therapeutics. R/S of 2:1. New O/S: 24,658,594

March 24, 2010 - Pernix announces CEDAX acquisition

May 19, 2010 - Pernix announces stock repurchase authorization

June 3, 2010 - PTX begins trading on AMEX.

Reverse Splits are seen as bad signs by some, but smart shell traders know that this is not always the case especially when you are deaing with stocks that will end up trading on the big boards. That was the case with GTA, the R/S was minimal at 2:1 to bring O/S to ~24,000,000, the company uplisted to AMEX and to top it off, Michael Pearce and management also announced a stock repurchase authorization, potentially bringing the float down even further.

Trading Activity

In addition to looking at a timeline of events to better establish what types of steps a management team takes to get a shell ready for R/M I also look at trading activity. In the case of GTA, as you can see in the chart posted below, there is a steep drop off in shares traded starting in early 2009, all the way up until fall 2009, when the merger was announced. The PPS also shows strong gains during this time. While patterns don't always play out the same, it is a clue that can be used, especially when dealing with similar management teams.

With that brief background of the GTA/PTX merger, we will now look at REAL & SPZR, two additional shell candidates that Gottlieb, Pearce and other revolving players have under their belt. And just as with the GTA to PTX timeline many of the main stumbling blocks have been taken care of. With both SPZR and REAL the management team has taken a significant equity stake, they have disposed of their assets, have been cleaning up their liabilities and like GTA have recently switched accountants. An advantage for both SPZR & REAL, their O/S counts are significantly less than that of GTA prior to R/M, making an R/S less likely. Based on the clean up they have already done, if they have candidates to merge in I would expect the final steps of the process would not take long.

REAL - Reliability, Inc.

About:

Reliability Incorporated has principally been engaged in the design, manufacture, market and support of high performance equipment used to test and condition integrated circuits From 2001 through 2007, Reliability Incorporated and its subsidiaries have sustained significant negative financial results which resulted in the closing or sale of all it’s assets. On April 1, 2007, Reliability completed the merger of its wholly owned subsidiary, Reliability-Medallion, Inc., a Florida corporation, into Medallion Electric Acquisition Corporation and the indirect acquisition, through Medallion Electric Acquisition Corporation, of Medallion Electric, Inc.

Share Structure:

OTCQB

A/S: 20,000,000

O/S: 9.630,000

Estimated Float: (Based on last reported insider and institutional holdings) 4,936,745

There are two things I like. First with the SS there is an incredibly low O/S. Taken in combination with a >50% equity ownership by Gottlieb and team, this makes an R/S much less likely. Second, the current reporting status often provides more impetus to get a deal done sooner rather than later. As current reporting requires more cash to continue filings, current reporting shells can often R/M in a more timely manner as there is a financial incentive to wrap things up quickly.

Management Acquisition of Shares:

On March 11, 2009, the Company issued 3,294,035 shares of its common stock, no par value, to five individual investors for $0.012 per share. I believe this was so the management could get complete control of the shell.This crew was many of the same names as GTA prior to PTX merger.

Along with being named directors management came in buying 3,294,035 shares to gain control of greater than 50% of the O/S. It should also be noted that they bought in at .012/shr. With the price standing at .015, I think .012 remains a solid base for more movement up here. Historically, Gottlieb and team first take a sizable equity stake and then take control of the shell.

Change of Control:

On March 30, 2009 a change of control occurred. At a March 30, 2009 Special Meeting of Shareholders, Jay A. Gottlieb, Greggory A. Schneider, Michael Pearce, Joshua Krom and Ron Gutterson were elected by a majority of the outstanding voting common stock.

Trading Activity:

Since 2009, the shares traded has significantly decreased with shares entering seemingly tighter hands. In the last month, the ask on the L2 has not dropped below .025, despite a few 1000 share buys at the bid.

The Daily Chart shows continued accumulation for the last few months.

The Weekly Chart shows how dramatically the trading decreased after the change of control in spring 2009. It appears shares have found their way into stronger hands.

Net Loss Carryforwards:

At March 31, 2010, the Company had U.S. net operating loss carryforwards of $15.5 million that will expire commencing in 2023 through 2027.

Typically companies are able to use ~8% of total NOL for tax writeoffs, although it can vary significantly from case to case.

Stock Options:

At March 31, 2010, there were no unvested option grants, thus no further stock option expense will be recorded until such time that additional grants are made.

That means management no longer has to deal with the possibility of additional options which can often complicate the R/M process for shell owners.

Shareholders of Record:

This number also helps explain why the trading has been quite tight, the number of shareholders of record has been tightening up.

The Company paid no cash dividends in 2008 or 2009 and had approximately 303 shareholders of record as of December 31, 2008, and 192 shareholders of record as of December 31, 2009, not counting the shareholders who hold the Company stock in street name.

SPZR - Spatializer Audio Laboratories, Inc.

About:

Spatializer Audio Laboratories, Inc. (“Spatializer” or the “Company”) was a developer, licensor and marketer of next generation technologies for the consumer electronics, personal computing, entertainment and cellular telephone markets. Our corporate office is located at 410 Park Avenue – 15th Floor, New York, New York 10022. The Company’s wholly-owned subsidiary, Desper Products, Inc. (“DPI” or “Desper Products”), was in the business of developing proprietary advanced audio signal processing technologies and products for consumer electronics, entertainment and multimedia computing. All Company revenues were generated from this subsidiary. Desper Products was the owner of all technology which was acquired by DTS, Inc. on July 2, 2007. Desper Products was dissolved on December 5, 2008.

Share Structure:

OTCQB

A/S: 300,000,000

O/S: 6,500,000

Estimated Float: (Based on last reported insider and institutional holdings) 4,489,689

Again, much like REAL, two things to like here, a similar set-up, a low SS and also a current reporting status.

Management Acquisition of Shares:

On April 25, 2007, pursuant to a Common Stock Purchase Agreement dated April 25, 2007, the Company sold to a group of investors, in a private transaction, an aggregate of 16,236,615 shares for an aggregate purchase price of $422,152

Change of Control:

On August 13, 2007, the Board of Directors appointed Jay A. Gottlieb as a director of Registrant.

Net-Loss Carryforwards:

At December 31, 2009, we had net operating loss carryforwards for Federal income tax purposes of approximately $21,000,000 which are available to offset future Federal taxable income, if any, through 2015. Approximately $20,700,000 of these net operating loss carryforwards are subject to an annual limitation of approximately $1,000,000.

Despite it's substantial amount, the $1,000,000 limitation, along with an earlier expiration date (2015) makes it less attractive than REAL's IMO.

Asset Distribution:

Upon the conclusion of a nine month indemnification period, the Company distributed $0.21/share, substantially all of its remaining cash assets, to its stockholders, after satisfying its liabilities and leaving an approximate $100,000 cash residual.

Management has shown regard for current shareholders with SPZR as well as with GTA. They could have just R/S'd to bring the SS down to where they wanted it and kept the assets, but they first distributed assets in form of dividend to current shareholders. They then proceeded to do a 10:1 R/S to bring the O/S down under 10,000,000 which allowed them to gain majority equity control. Due to REAL's already low O/S, it seems this was not necessary in that case.

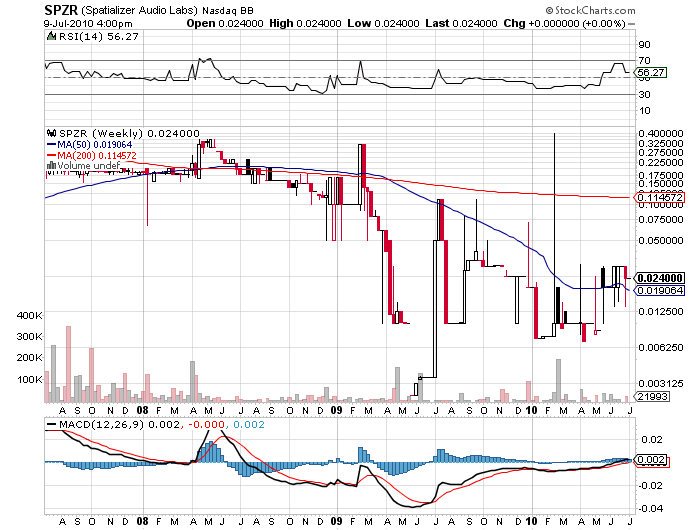

Trading Activity:

This stock seems much more volatile play than REAL, due to what I believe is a larger number of holders.

The Daily Chart shows some accumulation over the last few months.

The volatility can be seen more clearly in the weekly.

I believe this increased volatility can be somewhat explained by the larger number of holders as spelled out in the last 10-K:

To our knowledge, because most shares are held in street name, there were approximately 200 holders of record of the stock of the Company as of March 18, 2010. Our transfer agent has indicated that beneficial ownership is believed to be in excess of 2,000 stockholders.

ANY CONCERNS?

The primary concern with REAL & SPZR are their short-term cash issues, I will be looking to their upcoming filings for news on whether they are able to resolve these issues. If they are, this will bode well for their future potential. Either way, these are currently trading near rock-bottom pricing at the moment.

If my bet was on which stock would have an R/M first, I would bet on REAL, but either way, this is all conjecture and speculation. In the end, I decided to DD REAL & SPZR because of management's recent success with the last shell they held, in combination with a very attractive SS, their current reporting status and recent accumulation in the last few months. While some shell players may decide they won't take a position right away, I believe, at the very least, they are very attractive shell's to have on a watchlist.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.