Tuesday, April 13, 2010 9:16:07 AM

**I am writing this post to help serve as a centralized hub for all things PYBX, to collect all the DD people have done and hopefully serve as a launching board for investors to start their own DD. I will do my best to provide links so you can follow where the research is coming from and I have also tried to provide some screenshots for additional information as well. As the PYBX story unfolds I will continue to update this post. Please let me know either if you see any mistakes or you believe I've left anything important off. As always this is not meant to supplant your own DD, only complement it. Be aware that mixed in with facts here there is speculation. Do your own research to either back up or refute mine, the more we know the better. Below, I do my best to spell out the PYBX story as I currently understand it.

READY TO PLAY AGAIN?

Playbox has been around since 2007. And unlike most pinks, there have been no name changes, no reverse splits, a limited history, a low O/S, an even lower float, exactly the type of company that someone would want to merge into right? Well, that's why the unusual volume two weeks ago caught my attention and why a few of us started to do DD on it.

How unusual was the volume?

Well it was this unusual. In the history of the ticker (since 2007) it had only traded 11,190,604 shares up until 3/26. And then on 3/26 it traded 6,637,061 shares, nearly 60% of the all-time volume. That surge in liquidity made me take notice, especially as there was very little attention on any of the message boards being paid to it. The following day this increased trading continued.

On this chart you can see the immediate change in volume two weeks ago.

As of 4/12/2010:

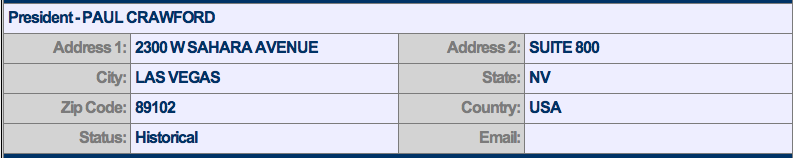

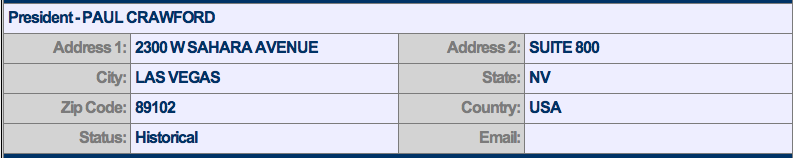

And then less than a week later, there were officer changes at the Nevada SOS. This is the screenshot of the new president:

Sudden record volume a week before officer changes was confirmation, at least to me, that it was more than just P&D traders playing here. It confirmed to me that something is indeed happening behind the scenes. It should also be noted that immediately prior to the 15-12g filing PYBX filed in August 2009, they made sure all of their filings were updated, issued a slew of amended filings and significantly decreased liabilities, all signs they were getting the house in order. PYBX has now been ready and waiting for nearly 8 months. It is ready and well situated for an R/M.

Alot of speculation has begun as to what will happen next and when will it happen. Below I present the three scenarios which most seem to be gravitating towards, any of which would be a great boon for shareholders. Before I lay out those scenarios here are some basics on PYBX.

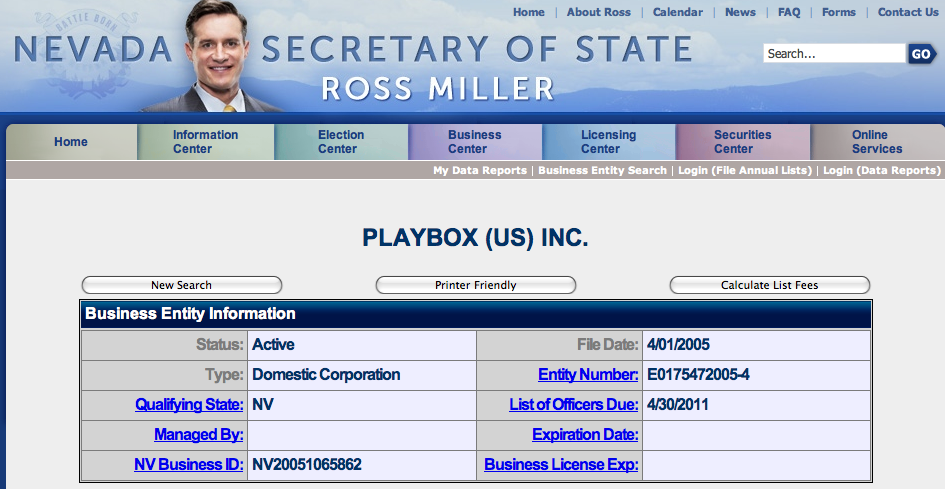

PLAYBOX

Share Structure:

O/S: 54,186,299

A/S: 100,000,000

Float: 16,531,458

Incorporation Documentation:

Timeline

2/25/07 - E-Sports Nordic forms. Gideon Yung listed as head of Business Development.

5/29/07 - E-Sports Nordic address listed as 27 New Bond Street, London W1S 2RH. This is the same as the registered address for PYBX (Playbox).

8/07/07 - PYBX Notice of Effectiveness

4/15/08 - E-Sports Nordic launches frosmo.com

11/14/08 - PYBX Gideon Yung appointed to Board of Directors.

11/17/08 - PYBX Gideon Yung becomes the CEO and at the same time he is the head of business development for E-Sports Nordic.

2/23/09 - E-Sports Nordic officially spins into two companies Frosmo and DoDreams. Allows them to focus on two different areas, MMO Gaming and skill based browser games. Both companies remain in the same office with overlapping management.

5/19/09 - Frosmo receives private investment

8/31/2009 - PYBX Gideon Yung files 15-12g

10/30/2009 - Dodreams receives €750k investment

12/16/2009 - Frosmo reveals since launch in mid-2008 it has been growing 20% every month and currently has 3 million players. Predicts 15 million gamers by the end of 2010.

12/16/2009 - Frosmo launches tournament game portal on Facebook.

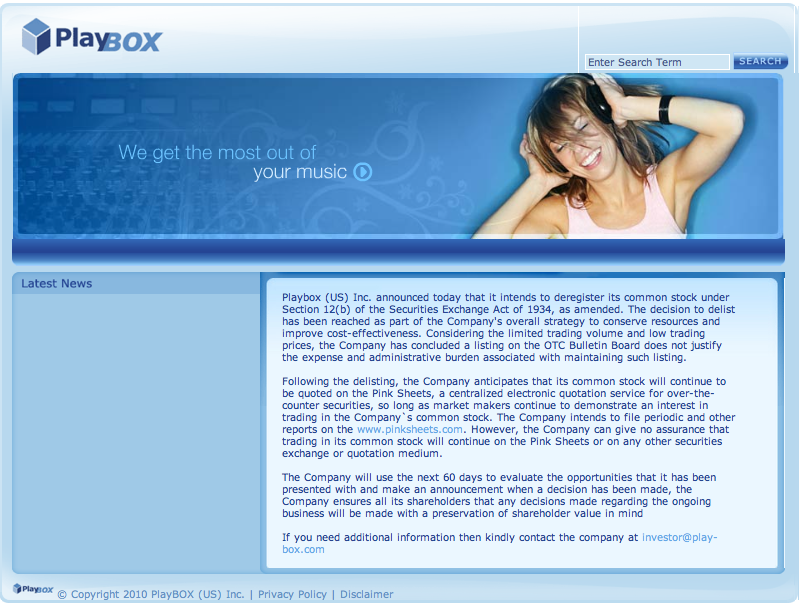

1/1/10 - 3/1/10 - PYBX Not sure exact date, but looks like there was an update on PYBX website. Copyright changed to 2010.

3/09/2010 - Frosmo announces expansion of their Social Gaming platform in Asian Market (will put more on this in DD)

3/26/2010 - PYBX 6,637,061 shares traded, 3x entire yearly volume. In history of ticker only 11,190,604 shares traded. Buys: ~6.1 million Sells: ~500,000

3/29/2010 - PYBX 2,487,000 shares traded Buys: 1.429 million Sells: 1.058 million

3/30/2010 - Paul Crawford and team acquire Diamond Information Institute

4/1/2010 - Diamond Information Institute files NT 10-K

4/5/2010 - PYBX Ownership transferred to Paul Crawford of Crawford Capital Corporation. http://75.146.162.210/crawcap/. Crawford Capital Corp. (CCC) assists early stage businesses in raising capital principally through a network of Angel investors and small venture capital firms.

Homepage Screenshot:

I did notice this in the message to shareholders:

The Company ensures all its shareholders that any decisions made regarding the ongoing business will be made with a preservation of shareholder value in mind

Promising statement, but only time will tell whether this pans out.

New Address: (4/5/10)

I'm not sure this has anything to do with Merrill Lynch at all, but when I type in the address this is what I get.

Here are the three scenarios and below this I will go through each one step-by-step. Just an FYI, I had already done extensive DD on Scenario 1 prior to the officer change announcement. This helps explain why it is more extensive. In future updates, I hope to flesh out the Crawford connection more concretely.

(1) Former CEO Gideon Yung turned the shell over to Crawford et al. to make the shell ready for an R/M with Frosmo and/or Do Dreams.

(2) Paul Crawford and team merge one of their portfolio companies into the PYBX Shell.

(3) Newly acquired Diamond Information Institute merges into Playbox.

SCENARIO 1

Gideon Yung turned the shell over to Crawford et al. to make the shell ready for an R/M with Frosmo and/or Do Dreams.

To understand this scenario I will lay out a little more on the history of Frosmo and DoDreams and why I believe they may seek access to the public market in the US.

E-Sports Nordic

About (From Website):

E-Sports Nordic Ltd. (ESN) provides turn-key services for portals and media companies to operate skill games tournaments for money. ESN’s vision is to become the market leading operator in multiplatform skill games competitions. ESN aims to create a new form of entertainment for the mass market by partnering with leading media companies and games publishers.

E-Sports Nordic began in 2007. It was run by Juha Ruskola, Mikael Gummerus and Gideon Yung, future PYBX shell owner, was the head of business development.

One interesting note. When it was formed, their UK office was listed as the same address as Playbox (PYBX). Then, in February 2009 E-Sports Nordic decided to split into two companies (Frosmo & DoDreams) to allow each to focus on their strengths, one MMO gaming, the other casual social on-line gaming.

Here is the press release announcing the company split into two pieces: Frosmo & DoDreams:

http://frosmo.com/press/Press_ESN_split_20090223.pdf

From ArcticIndex:

They also retain the same address and headquarters:

Where this gets interesting for PYBX is while still with E-Sports Nordic and as Head of Business Development, Gideon Yung moved in and became president and CEO of PYBX. He then proceeded to spend the next 9 months cleaning up the shell, lowering the liabilities and finally filing a 15-12g. It would be hard in that scenario not to see that E-Sports Nordic and/or Frosmo/DoDreams might not have a hand in what was going on. And from analyzing the two companies it split into, Frosmo & DoDreams, they might have a compelling reason to access the public markets.

Frosmo

About:

Frosmo is an online skill game strategy where players can play fun skill games for free, earn Tokens, participate in skill game tournaments, increase their gamer level and progress in Rank. Players with top Ranks can access free prize tournaments where real cash and real prizes are given out.

From PR:

http://www.businesswire.com/portal/site/home/permalink/?ndmViewId=news_view&newsId=20091216005481&newsLang=en

Since its launch in mid-2008, Frosmo has experienced 20 percent player growth per month, and Frosmo’s service is currently played by over 3 million gamers worldwide. Frosmo projects 15 million gamers will be playing its service by 2010.

Homepage Screenshot:

http://frosmo.com

Websites that currently have Fromo games and tournament platform (w/Alexa ranking in world):

Facebook: #2 http://facebook.com

Renren - #84 http://renren.com

Mixi - #92 http://mixi.jp

Maktoob: #164 http://maktoob.com

51.com - #405 http://51.com

China.com -#415 http://china.com

Sanook - #561 http://sanook.com

Ekolay - #712 http://ekolay.net

Mthai - #1,097 http://mthai.com

KapanLagi - #1,803 http://kapanlagi.com

Gamebase - #3,312 http://gamebase.com.tw

Yenta4 - #7,427 http://yenta4.com

Yoho - #8,829 http://yoho.cn

Hacken - #9,251 http://hacken.cc

Molidao - #10,487 http://molidao.com

Wayi - #10,858 http://wayi.com.tw

Hunsa - #11,651 http://hunsa.com

Investments:

An announcement in May 2009 of a significant investment:

http://www.casualconnect.org/newscontent/05-2009/frosmo.html

http://www.arcticstartup.com/2009/05/14/frosmo-secures-a-class-angel-round/

Screenshots of A Few of Their Games:

.jpg)

.jpg)

.jpg)

.jpg)

Recent Frosmo Announcements:

Facebook: http://www.insidesocialgames.com/2010/01/25/frosmos-arcade-tournaments-come-to-facebook/

Various Asian Social Networking Sites:http://search.sys-con.com/node/1313443

MTV3

Current value of just it's website:

From strategicfirst.com:

Frosmo's current stats on Facebook:

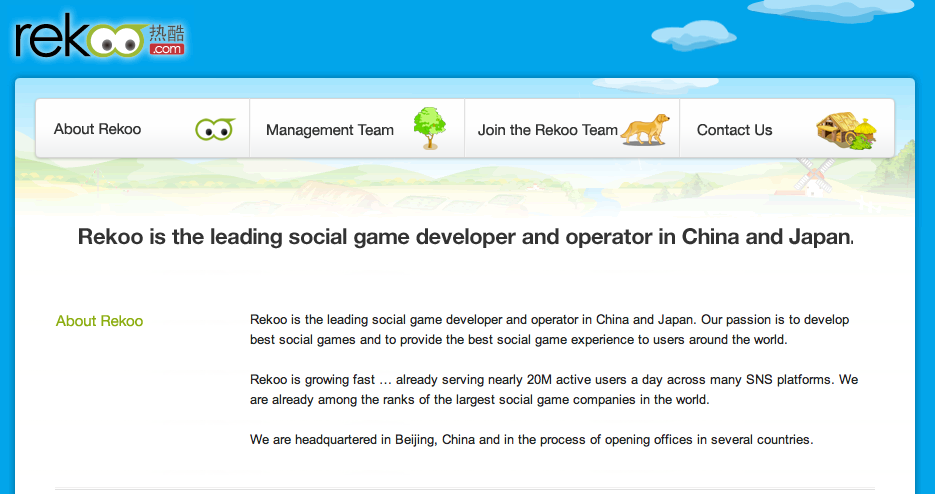

They already have developed stong operations in casual gaming in Europe and have just begun in America and we know they are on Facebook, but this past month on March 9th they also partnered with Rekoo, a leading social game developer and operator in the Asian market.

Homepage screenshot on Rekoo:

And a little more about them from this article in late 2009:

http://www.insidesocialgames.com/2009/08/18/rekoo-bringing-leading-chinese-social-games-to-facebook-qa-with-ceo-patrick-liu/

They also opened a Beijing Office and started Frosmo Asia.

http://search.sys-con.com/node/1313443

What is Frosmo's potential?

To get a better sense of the potential of Frosmo I recommend reading this CNET Article from last month. The future of social gaming, as this article describes, is essentially what Frosmo is doing.

http://news.cnet.com/8301-13772_3-10466496-52.html

And from this report:

http://www.insidevirtualgoods.com/future-social-gaming/

A recent study published by Justin Smith, editor of Inside Social Games, estimates that revenues of virtual goods from social networks and games would reach $1 billion in 2009, and could reach $1.6 billion in 2010.

Frosmo seems to be gaining a foothold in this market and is now growing at a rapid pace. It would make sense at this time that they may consider entering the capital markets. You can also see the potential for incredible growth and also acquisition. It was only two years ago that competitor Playfish was bought by Electronic Arts for $400 million.

A final note to leave on which I encourage most of you to pay no attention to it. But for some reason, I look for indications in any place I can find them. This is probably the epitomy of super stalker/investor. CEO Mikael Gummerus is the creative brains behind the operation at Frosmo. One of the 75 people he is following on his Twitter account is Stocktwits. While this may not seem like a big deal, for a Finnish CEO with a European company at the very least it shows a hint that he at least follows the US capital markets. And how hard would it be, with Frosmo's rapid growth, for him to talk with someone he already works with, Gideon Yung about obtaining a shell for this purpose. As U_Got_Stocks would say, just sayin'.

http://twitter.com/Miksunautti

DoDreams

About (From Website):

We arrange competitions for high quality video games to any amount of players with our proprietary tournament system. Games are fully skillbased and competitions have participation fee and winners receive prizes.

We also license and distribute MMO games. We work in cooperation with media partners to whom we provide game licensing, deployment, hosting, billing and community management.

http://moneyandstorytelling.wordpress.com/tag/dodreams/

Homepage Screenshot:

http://dodreams.com

Investments:

Risto Siilasmaa holds a seat on the Board of Directors for Nokia. It was also announced that he made an investment in DoDreams in. For more on Risto Silasmaa you can go to this wikipedia entry: http://en.wikipedia.org/wiki/Risto_Siilasmaa

http://www.arcticstartup.com/2009/10/30/dodreams-receives-a-major-investment-from-top-finnish-investors/

http://moneyandstorytelling.wordpress.com/tag/dodreams/

Recent hirings and expansion:

http://startupjobs.eu/Jobs/-Position-filled-Senior-NET-Developer-e7a0e5d57a474c5cb14fa4228d8fa94e.aspx

Game Screenshots:

SCENARIO 2

Paul Crawford and team merge one of their portfolio companies into the PYBX Shell.

Paul Crawford may be planning an R/M with one of the companies he already works with. While some of these are already public on the NASDAQ and OTC, it should provide us some insight into ones that may be looking to R/M . New President Paul Crawford owns Crawford Capital Corporation.

Here are some of the portfolio companies he lists at the Crawford Capital Corporation website:

http://75.146.162.210/crawcap/

Commission Junction

http://cj.com

From wikipedia:

Commission Junction is an online advertising company owned by ValueClick. It is specifically in theaffiliate marketing industry.

Commission Junction is the largest affiliate network in North America, powering 62% of the top 500 web retailers affiliate marketing programs and operates worldwide. Along with being the world's largest Affiliate Network, Commission Junction also promotes their Search Marketing services and their media services. Their corporate headquarters is located in Santa Barbara, California, with other offices in Chicago, New York, San Francisco, Westborough and Westlake. Commission Junction has also offices in the UK, Germany, France, Sweden and Spain.

Commission Junction has over 1,500 customers including Overstock.com, Buy.com, Home Depot,Circuit City, and Yahoo!.

NASDAQ:VCLK

Screenshot:

Wireless Ronin Technologies

http://wirelessronin.com

From wikipedia:

Wireless Ronin Technologies, Inc. is a provider of digital signage and interactive kiosk solutions. As the developer of the RoninCast digital signage suite, a complete software solution designed to address the evolving digital signage marketplace, Wireless Ronin claims to provide the ability to manage a wireless or wired digital signage network from one central location. RoninCast allows for customized distribution with network management, playlist creation and scheduling, and database integration. Wireless Ronin specializes in developing custom solutions for the quick serve restaurant (QSR), retail, automotive, and financial services industries. End-to-end service solutions are offered by Wireless Ronin to support RoninCast including consulting, creative development, project management, installation, hosting and training. Through their Network Operations Center located inMinneapolis, Minnesota they offer the ability to monitor the health of networks, schedule content, verify updates, and service clients' needs 24/7/365. The company's common stock trades on theNASDAQ Global Market under the symbol "RNIN."

NASDAQ:RNIN

Screenshot:

Biopolymer Engineering Inc.

http://biopolymer.com

Now named Biothera

From wikipedia:

Biothera is a biotechnology company dedicated to improving immune health. We are developing a natural gluco polysaccharide that targets and directs innate immune system function. Our compound is a biological response modifier that triggers innate immune cells to recognize and destroy pathogens, including an entirely new mechanism for killing cancer. The discovery of this keystone technology has the potential to dramatically enhance existing treatments for most major types of cancer.

The company is commercializing this carbohydrate technology through two business groups:

Pharmaceutical Group. Biothera is developing a drug (Imprime PGG®) to work synergistically with anti-tumor monoclonal antibodies against colon, lung and other cancers. Our business strategy is to continue to advance Imprime PGG through the FDA clinical development process and eventually license the drug to partners that will complete development and take the drug to market.

Healthcare Group. Biothera is commercializing our technology through patented, food-grade ingredients for functional food & beverage, nutritional supplement, cosmetic and animal nutrition products worldwide. Our ingredients are currently in dozens of products in more than 30 countries.

Screenshot:

Qualigen, Inc.

http://qualigeninc.com

About:

Qualigen, Inc. develops, manufactures and markets the new FastPack® IP System, the first custom-designed analyzer which features one-touch operation to perform complex quantitative immunoassays quickly and easily in the physician's office lab.

The following assays are now cleared by the FDA: Thyroid Stimulating Hormone (TSH), free Thyroxine (freeT4), Human Chorionic Gonadotropin (hCG), Total Prostate Specific Antigen (tPSA) and Testosterone. Free PSA is available outside the United States. The success of the FastPack® System in the Urology field, coupled with the addition of thyroid function assays, has opened the door to market the system to the following additional medical specialties: Family Practice, Internal Medicine, Urgent Care, OB/GYN and Endocrinology.

Screenshot:

ALung Corporation

http://alung.com

About:

ALung is a pioneer in the development of respiratory assist technologies that are expected to provide a superior alternative to traditional, invasive respiratory support. Our Hemolung Respiratory Assist System is a safe, simple therapy designed to improve clinical and quality of life outcomes while reducing the cost of care.

Screenshot:

Scanner Technologies, Inc.

http://scannertech.com

About:

SCANNERTECH LLC is a world leader in vision inspection technology. We provide unique and innovative inspection solutions for the semiconductor industry. The UltraVim and UltraVim Plus inspection modules inspect most semiconductor packages in three dimensions, and lead the industry in accuracy, reliability, speed, and ease-of-use. We also offer products for mark inspection, alignment and can customize solutions to meet your specific requirements. Contact us today to solve your inspection needs.

Screenshot:

Space Data Corp

http://spacedata.net

About:

Space Data Corporation delivers low-cost solutions for rural and remote data and voice communication applications using our high-altitude SkySite® Network

Screenshot:

Bixby Energy Systems

http://bixbyenergy.com

About:

Bixby Energy Systems, Inc. is dedicated to finding, developing, and providing the best technology, systems, and methodology available today to provide clean, economical, and independent new energy solutions for the world of the future.

Screenshots:

Localoop

http://localoop.com

About:

LocaLoop's disruptive invention is a Mobile WiMAX enabling distributed intelligence technology realized in software that creates a profitable business case for 'the last mile' broadband Internet services, specifically in underserved low density areas. Because of the price point shift created, it also provides a competitive advantage for service providers in metro/suburban markets. The solution is a Customer Experience Management and Operating Platform for Mobile WiMAX networks, delivered as a Web 2.0 software as a service platform. It may also be applied in fixed applications, thus enabling service providers to accelerate deployment and convergence of communication and media, while profitably providing "quad play "; Broadband Internet Access, Mobile/Fixed Voice, Video/TV and Data and next generation media-rich Web 2.0 personalized services in stationary and mobile situations at an attractive price for consumers and businesses.

Screenshot:

More on Lopaloop from a city council meeting can be found here:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=48823152

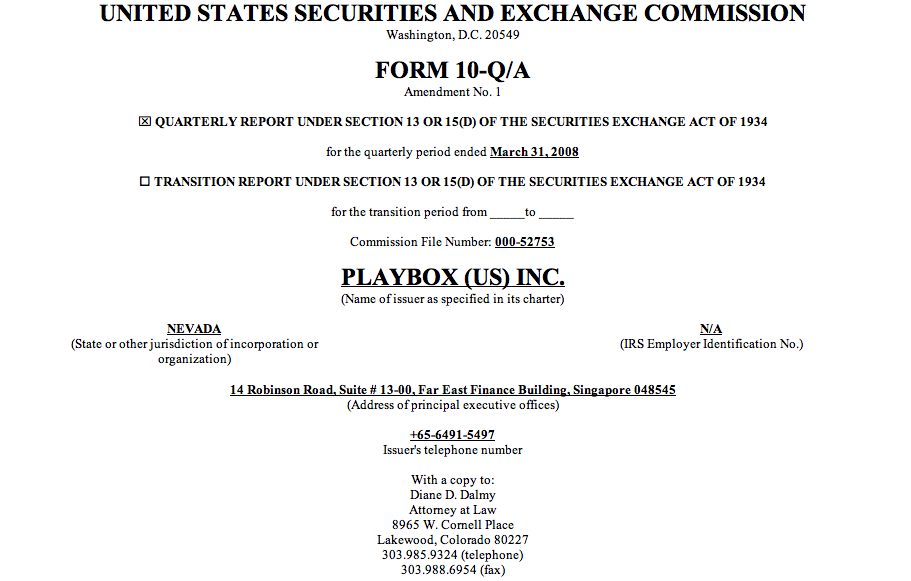

SCENARIO 3

Newly acquired Diamond Information Institute merges into Playbox.

http://www.faqs.org/sec-filings/100330/Diamond-Information-Institute_8-K/

The key to understanding everything that is going on may lie with new Playbox president Crawford and his team and their acquisition of Diamond Information Institute, a public company, on March 11th. This was three weeks before they became officers of Playbox. The clues that provides may help us understand what may happen next and how soon it may happen. First I will highlight what they say the business will be. Then I will highlight what it may mean for Playbox from an M&A perspective. And finally I will present a piece of information that could turn out to be a bit of a smoking gun for this third option.

http://sec.gov/Archives/edgar/data/1429859/000109230610000131/diamondform8k031810.htm

Here is the new business of the company:

The Company’s business operations will involve embarking upon a project to make Venture Capital Investments into private and public Companies.

This is virtually what Crawford Capital Corporation already does. Of course, I'm not for certain, but it does appear that this may be the company that would move into the Diamond Information shell. The total capital they have raised since inception has been $200,000,000+ and they are one of the largest venture capital firms in Minnesota.

This whole section from the 8-K is an interesting read in relation to PYBX. I will highlight the section however that might give us a better sense of timing.

The Company’s business operations will involve embarking upon a project to make Venture Capital Investments into private and public Companies. The eligible companies qualifying for an investment from the Company will be companies who currently have a dynamic business plan and are nearing completion of the establishment of that business plan or are currently established businesses with positive cash flow but require additional funding to develop existing markets or expand into new markets. Emphasis will be on businesses with a very low overhead and cost of sales thus giving them a large increase in positive cash flow with the injection of new capital into the company. A specific emphasis of the Company will be in the Green Energy as well as the renewable energy fields and the development of Software as a Service (SAAS) sector. The Company will also be operating a consultancy division to assist existing private companies to go public as well as assisting companies who are already public to restructure and raise additional money from the capital markets. There are numerous projects already submitted which are currently being considered for funding.

This gives me a sense that if they are looking to reverse merge Playbox with one of their portfolio companies, it looks like they have a number of possibilities already lined up. In the end, however, what makes me think that Diamond Information Institute merging with Playbox still remains a very viable option is this piece of information that I just found.

Smoking Gun?

I'm still trying to piece together what these two pieces of information mean, but they are very interesting. The address of both Playbox and Diamond Information Institute are the same now. In addition and perhaps more importantly the attorney for Playbox in their some of their last filings matches the attorney for Diamond Information Institute in their latest filing on 4/1/10.

Here's the address:

2300 W. Sahara Avenue

Here are screenshots of address for Diamond Information Institute and Playbox.

From Nevada SOS on Playbox as of 4/5/10 (Split into two to fit relevant information):

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=zMu6q9w%252bV3hMYthGBZbITg%253d%253d&nt7=0

From last Diamond Information filing on 4/1/10:

http://sec.gov/Archives/edgar/data/1429859/000109230610000161/formnt10k.htm

And here's the attorney:

Diane D. Dalmy

Screenshots of Diane D. Dalmy on Playbox and Diamond information filings.

From Playbox 10-Q/A filing on 6/15/2009 (at the bottom of the page):

http://sec.gov/Archives/edgar/data/1365359/000132875909000124/form10-qaplaybox.htm

From the Diamond Information filing on 4/1/10 (at top of page):

http://sec.gov/Archives/edgar/data/1429859/000109230610000161/formnt10k.htm

It looks like Diane D. Dalmy came into the Playbox picture in the 10-Q/A filing on 5/20/2009 as they were preparing to file the 15-12g. And she came into the Diamond Information Institute picture on 4/1/2010. Of course it could just be an entire coincidence, but it also could be she is attempting to reconcile the two companies.

IN THE END

What is clear is that this ride is just beginning. With a forward looking event in the form of the 10-K form DIII we may get more of a peek into what Crawford's plans are at least with DIII and perhaps PYBX. That said, I also think there is a possibility that the NT 10-K may have to do with something more immediate happening here, a roll in of DIII to PYBX. Currently from what people have been saying all three of these seem like viable options. And any one of them could be a huge boon for investors.

Contributions by: levelnever, pennyonfire, prado

Greenlite Ventures Completes Agreement with No Limit Technology • GRNL • Jul 19, 2024 10:00 AM

VAYK Expects Revenue from First Airbnb Property Starting from August • VAYK • Jul 18, 2024 9:00 AM

North Bay Resources Acquires Mt. Vernon Gold Mine, Sierra County, California, with Assays up to 4.8 oz. Au per Ton • NBRI • Jul 18, 2024 9:00 AM

Nightfood Holdings Signs Letter of Intent for All-Stock Acquisition of CarryOutSupplies.com • NGTF • Jul 17, 2024 1:00 PM

Kona Gold Beverages Reaches Out to Largest Debt Holder for Debt Purchase Negotiation • KGKG • Jul 17, 2024 9:00 AM

Avant Technologies Welcomes Back Former CEO with Eye Toward Future Growth and Expansion • AVAI • Jul 17, 2024 8:00 AM