Saturday, April 10, 2010 11:22:25 PM

The key to understanding everything that is going on may lie with new Playbox president Crawford and his team and their acquisition of Diamond Information Institute, a public company, on March 11th. This was three weeks before they became officers of Playbox. The clues that provides may help us understand what may happen next and how soon it may happen. First I will highlight what they say the business will be. Then I will highlight what it may mean for Playbox from an M&A perspective. And finally I will present a piece of information that could turn out to be a bit of a smoking gun for this third option.

http://sec.gov/Archives/edgar/data/1429859/000109230610000131/diamondform8k031810.htm

Here is the new business of the company:

The Company’s business operations will involve embarking upon a project to make Venture Capital Investments into private and public Companies.

This is virtually what Crawford Capital Corporation already does. Of course, I'm not for certain, but it does appear that this may be the company that would move into the Diamond Information shell. The total capital they have raised since inception has been $200,000,000+ and they are one of the largest venture capital firms in Minnesota.

This whole section from the 8-K is an interesting read in relation to PYBX. I will highlight the section however that might give us a better sense of timing.

The Company’s business operations will involve embarking upon a project to make Venture Capital Investments into private and public Companies. The eligible companies qualifying for an investment from the Company will be companies who currently have a dynamic business plan and are nearing completion of the establishment of that business plan or are currently established businesses with positive cash flow but require additional funding to develop existing markets or expand into new markets. Emphasis will be on businesses with a very low overhead and cost of sales thus giving them a large increase in positive cash flow with the injection of new capital into the company. A specific emphasis of the Company will be in the Green Energy as well as the renewable energy fields and the development of Software as a Service (SAAS) sector. The Company will also be operating a consultancy division to assist existing private companies to go public as well as assisting companies who are already public to restructure and raise additional money from the capital markets. There are numerous projects already submitted which are currently being considered for funding.

This gives me a sense that if they are looking to reverse merge Playbox with one of their portfolio companies, it looks like they have a number of possibilities already lined up. In the end, however, what makes me think that Diamond Information Institute merging with Playbox still remains a very viable option is this piece of information that I just found.

Smoking Gun?

I'm still trying to piece together what these two pieces of information mean, but they are very interesting. The address of both Playbox and Diamond Information Institute are the same now. In addition and perhaps more importantly the attorney for Playbox in their some of their last filings matches the attorney for Diamond Information Institute in their latest filing on 4/1/10.

Here's the address:

2300 W. Sahara Avenue

Here are screenshots of address for Diamond Information Institute and Playbox:

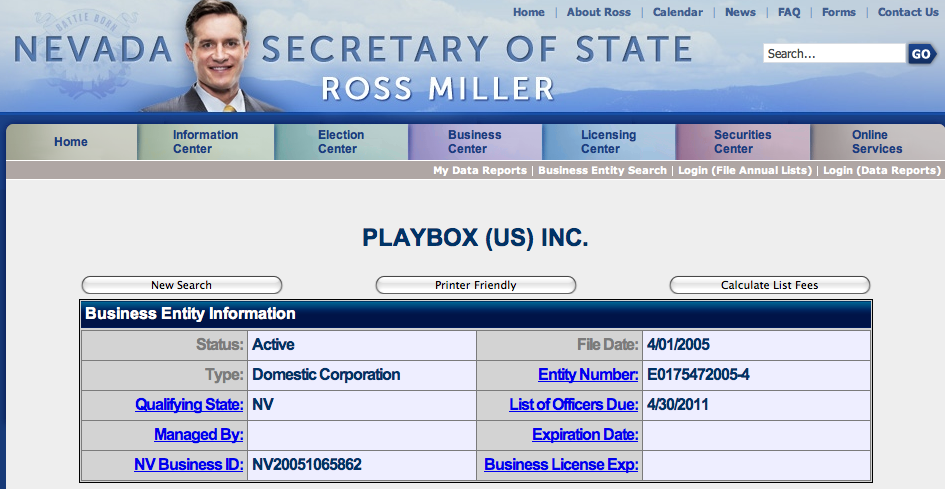

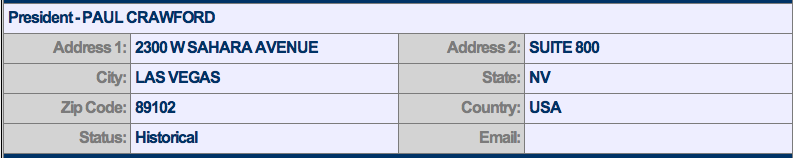

From Nevada SOS on Playbox as of 4/5/10 (Split into two to fit relevant information):

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=zMu6q9w%252bV3hMYthGBZbITg%253d%253d&nt7=0

From last Diamond Information filing on 4/1/10:

http://sec.gov/Archives/edgar/data/1429859/000109230610000161/formnt10k.htm

And here's the attorney:

Diane D. Dalmy

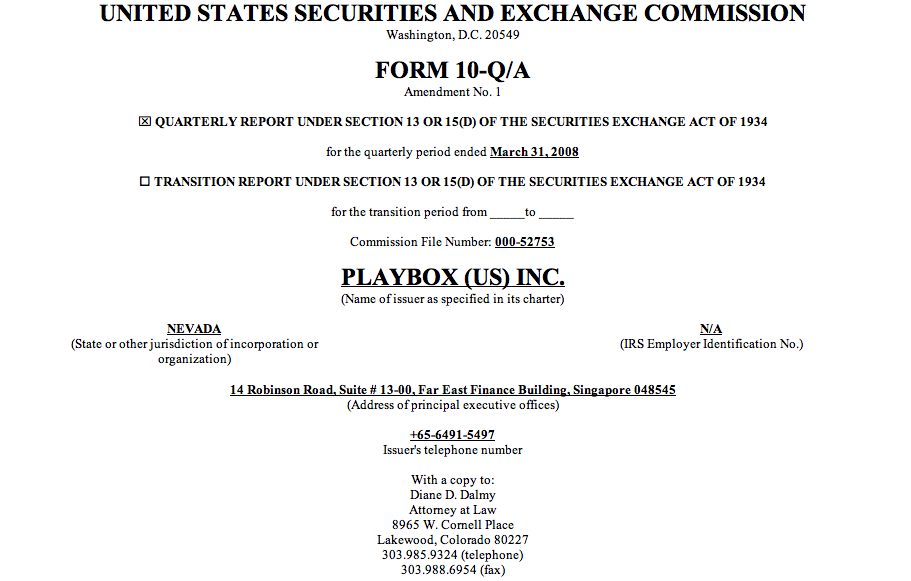

Screenshots of Diane D. Dalmy on Playbox and Diamond information filings:

From Playbox 10-Q/A filing on 6/15/2009 (at the bottom of the page):

http://sec.gov/Archives/edgar/data/1365359/000132875909000124/form10-qaplaybox.htm

From the Diamond Information filing on 4/1/10 (at top of page):

http://sec.gov/Archives/edgar/data/1429859/000109230610000161/formnt10k.htm

It looks like Diane D. Dalmy came into the Playbox picture in the 10-Q/A filing on 5/20/2009 as they were preparing to file the 15-12g. And she came into the Diamond Information Institute picture on 4/1/2010. Of course it could just be an entire coincidence, but it also could be she is attempting to reconcile the two companies.

Either way, I will continue to work all the angles because I am increasingly convinced that something is about to happen here.

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM