Monday, February 22, 2010 8:54:02 PM

Any stock sale is considered a Fail To Deliver sale until the sale has been reconciled as located and delivered by the respective Brokerages .

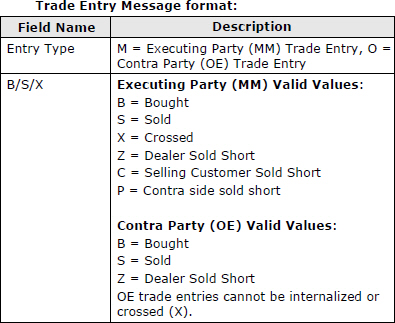

That is wrong, there's no "FTD = Sold and we'll find shares later" value

Sell trades with no shares would still be tagged as a sell, NOT short, and notice crossing has it's own value also.

It doesn't matter when, or how, the shares are delivered. If they're not delivered in due time, then the FTD rule kicks in, which is completely different than the daily short total, and REG SHO matters not.

And there's even more that's not reported

"Trades in certain classes of securities, such as Rule 144A securities, are reported to the ORF, but not disseminated. Non-disseminated securities will not be included in either the daily short sale volume file or the monthly short sale transaction file."

"Tape reports are submitted to FINRA for public dissemination by the appropriate exclusive Securities Information Processor (‘‘SIP’’), while non-tape reports are submitted to FINRA, but are not submitted to the SIP for public dissemination. FINRA will not be including non-tape reports in either the daily short sale volume file or the monthly short sale transaction file. Accordingly, in those instances where the short sale indicator is only included in the related non-tape report, the short sale data published in the daily and monthly files may be under-inclusive. Similarly, the published figures will not include odd lots since these transactions are not disseminated to the consolidated tape."

"Once the Daily Short Sale Volume File is made publicly available at the end of each trading day, FINRA notes that users of such data should not expect the daily and monthly data to reconcile because, among other things, monthly transaction data will include reporting through the end of FINRA transaction reporting hours that terminate as late as 8:00 p.m., while daily volume reports will only include volume reported during regular trading hours."

"FINRA will not incorporate trading information into the daily short sale volume file that has not been executed and reported within the trading day. While members generally are required to report trades in equity securities to FINRA within 90 seconds, a firm could improperly delay reporting of short sales until well after the close, which would result in the under-reporting of over-the-counter short sale volume."

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM