Wednesday, July 08, 2009 1:20:51 AM

DMPD (.0027) – DD Compilation

BOARD: http://investorshub.advfn.com/boards/board.aspx?board_id=10094

DMPD(DM Products, Inc.) has been a relatively dormant stock for over a year. The company has continued to update it’s investors by posting it’s financials, but it’s stock has seen a lack of trading activity until just recently. On Monday it posted a 566% gain on record volume. Tuesday saw strong volume, but profit takers crept in and closed it red at .0027.

Tuesday’s close sets it up for a retest of the .007 high on Tuesday. On the chart below, you will see why it found strong resistance there, and failed to breach. Wednesday should be different and a .01+ test is in the cards.

Here is why:

Though the company has not released any news lately, 2 things struck me on the financial report.

Infomercial production costs 239,598

The financial report was for the first 3 months of 2009. What would the company be creating an infomercial for to spend ¼ million dollars on. Usually the advertising campaign would not cost more than 10% or so of the expected revenue.

Read the company profile below:

DM Products, Inc. develops, finances, produces, markets and distributes unique and innovative consumer products through infomercials, media marketing and other distribution channels. The company's primary objective is to penetrate this rapidly expanding industry by introducing their consumer products to both national and international markets through a series of made for TV infomercial campaigns. It intends to aggressively and systematically expand its already existing products list using a direct response model. Our goal is to become one of the leaders in a $300 billion a year industry.

As part of the company's strategy, we intend to continue to develop strategic alliances with strong companies that are established operators in the infomercial and advertising industries.

The company is approached with new ideas for new products from various individuals, inventors and companies. As opportunities arise, the company's officers and directors will continue to present new, innovative, and unique products to the consumers.

Sounds to me like they have something in the works.

DMPD is trading at .0027, and the filings show no dilution for at least 2 years. Then look at this!?!?!?!

Note 7: Line of Credit

DM Products, Inc has three Lines of Credit with zero balances

Company has 3 lines of unused credit!? Now it does not say how much, and they may be $50 :) but i doubt it.

Now take a look at the Chairman and president of the company who took over last year and his impressive bio.

James R. Clarke

Mr. Clarke has over 30 years of Senior and Executive level management experience, including developing operations and building international distribution networks throughout the US and worldwide. He founded five companies, one of which grew to revenues of $10,000,000 in less than two years. "Mr. Clarke's assuming the President and Chairman responsibilities will allow me to focus my time and energy on the operations end of the business," said Kurt Cockrum, former President and Chairman of DM Products.

Mr. Clarke began his business career with Owens Corning Fiberglas of Los Angeles, CA in their Mechanical Products and Systems sales Division, and was promoted after one year to Distribution Manager for Southern California. Appointed president to turn-around a public company (Veritec-VRTC), Mr. Clarke directed the company out of bankruptcy/Chapter 11 with success. Over the past 20 years, he operated as President or CEO with several other companies, and has previous Board experience. He received his BS in Business Administration and MS in Marketing from Oklahoma State University.

Now tell me you wouldn’t want this guy on your team to turnaround the company.

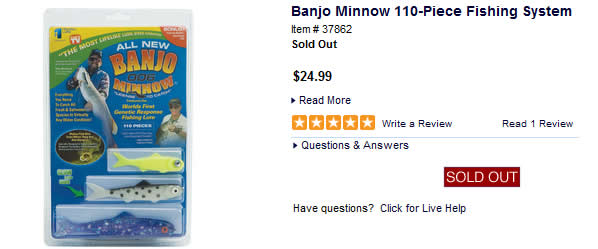

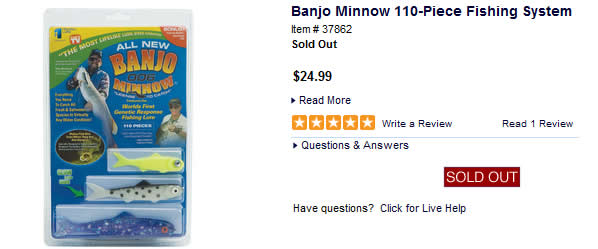

Obviously if you read the board, you would see what the major product line is right now. It’s the Banjo Minnow… a renowned Lure. I know nothing about fishing, and I have never heard of them before, but ask any fisherman around, and they know the name. Brand Recognition on a sub pennystock.

Now check around on where it’s sold. Seems to be selling well, and every review is 5 stars.

And then there is the Youtube videos, at least 5 on the last month:

The Share Structure is Tight with 70 million in the float and 300 million Authorized. We have traded 20 million in the past two days. Think we have churned through the profit takers and it will be thin to .01 on Wednesday and Thursday.

Check the chart below:

That is all I have for now. I do have some more golden nuggets of DD I will share Thursday night.

Last thought. We have a company that makes $20 sponges that trades at .12+. This company is looking to be have huge market share in the infomercial industry, already has a Recognized Brand Name, and is looking for more… yet trades at .0027!?!?!?!

Not sure what your thinking, but I’m thinking this is way undervalued. .01+ Weds/Thurs IMHO

GLTA!

- Jimmybob

BOARD: http://investorshub.advfn.com/boards/board.aspx?board_id=10094

DMPD(DM Products, Inc.) has been a relatively dormant stock for over a year. The company has continued to update it’s investors by posting it’s financials, but it’s stock has seen a lack of trading activity until just recently. On Monday it posted a 566% gain on record volume. Tuesday saw strong volume, but profit takers crept in and closed it red at .0027.

Tuesday’s close sets it up for a retest of the .007 high on Tuesday. On the chart below, you will see why it found strong resistance there, and failed to breach. Wednesday should be different and a .01+ test is in the cards.

Here is why:

Though the company has not released any news lately, 2 things struck me on the financial report.

Infomercial production costs 239,598

The financial report was for the first 3 months of 2009. What would the company be creating an infomercial for to spend ¼ million dollars on. Usually the advertising campaign would not cost more than 10% or so of the expected revenue.

Read the company profile below:

DM Products, Inc. develops, finances, produces, markets and distributes unique and innovative consumer products through infomercials, media marketing and other distribution channels. The company's primary objective is to penetrate this rapidly expanding industry by introducing their consumer products to both national and international markets through a series of made for TV infomercial campaigns. It intends to aggressively and systematically expand its already existing products list using a direct response model. Our goal is to become one of the leaders in a $300 billion a year industry.

As part of the company's strategy, we intend to continue to develop strategic alliances with strong companies that are established operators in the infomercial and advertising industries.

The company is approached with new ideas for new products from various individuals, inventors and companies. As opportunities arise, the company's officers and directors will continue to present new, innovative, and unique products to the consumers.

Sounds to me like they have something in the works.

DMPD is trading at .0027, and the filings show no dilution for at least 2 years. Then look at this!?!?!?!

Note 7: Line of Credit

DM Products, Inc has three Lines of Credit with zero balances

Company has 3 lines of unused credit!? Now it does not say how much, and they may be $50 :) but i doubt it.

Now take a look at the Chairman and president of the company who took over last year and his impressive bio.

James R. Clarke

Mr. Clarke has over 30 years of Senior and Executive level management experience, including developing operations and building international distribution networks throughout the US and worldwide. He founded five companies, one of which grew to revenues of $10,000,000 in less than two years. "Mr. Clarke's assuming the President and Chairman responsibilities will allow me to focus my time and energy on the operations end of the business," said Kurt Cockrum, former President and Chairman of DM Products.

Mr. Clarke began his business career with Owens Corning Fiberglas of Los Angeles, CA in their Mechanical Products and Systems sales Division, and was promoted after one year to Distribution Manager for Southern California. Appointed president to turn-around a public company (Veritec-VRTC), Mr. Clarke directed the company out of bankruptcy/Chapter 11 with success. Over the past 20 years, he operated as President or CEO with several other companies, and has previous Board experience. He received his BS in Business Administration and MS in Marketing from Oklahoma State University.

Now tell me you wouldn’t want this guy on your team to turnaround the company.

Obviously if you read the board, you would see what the major product line is right now. It’s the Banjo Minnow… a renowned Lure. I know nothing about fishing, and I have never heard of them before, but ask any fisherman around, and they know the name. Brand Recognition on a sub pennystock.

Now check around on where it’s sold. Seems to be selling well, and every review is 5 stars.

And then there is the Youtube videos, at least 5 on the last month:

The Share Structure is Tight with 70 million in the float and 300 million Authorized. We have traded 20 million in the past two days. Think we have churned through the profit takers and it will be thin to .01 on Wednesday and Thursday.

Check the chart below:

That is all I have for now. I do have some more golden nuggets of DD I will share Thursday night.

Last thought. We have a company that makes $20 sponges that trades at .12+. This company is looking to be have huge market share in the infomercial industry, already has a Recognized Brand Name, and is looking for more… yet trades at .0027!?!?!?!

Not sure what your thinking, but I’m thinking this is way undervalued. .01+ Weds/Thurs IMHO

GLTA!

- Jimmybob

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.