Tuesday, June 16, 2009 11:47:25 AM

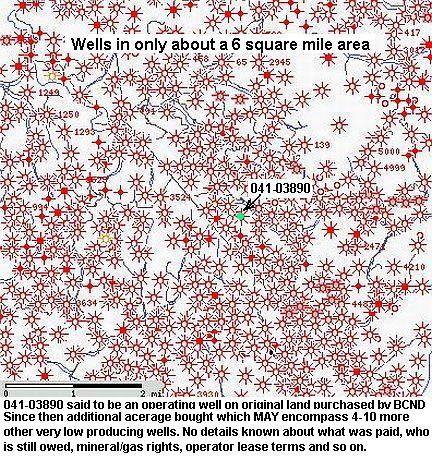

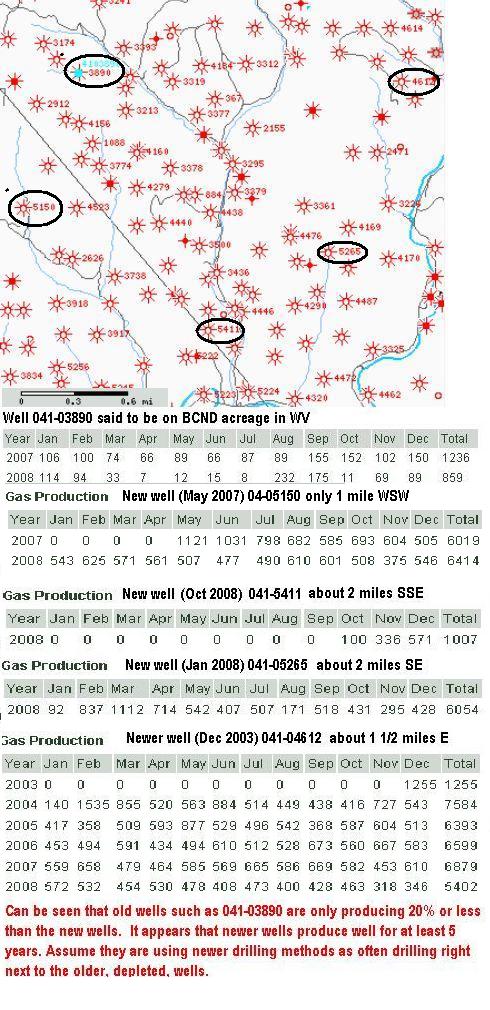

If they decide to buy the rest of us out they then need to up their ante to include fair value for the Grapeville land after cleared, including potential development value as well as estimated value of any natural gas there. Plus the value of the 259.5 acres of already gas producing WV property, the wells already there, and potential production from new wells. They also must pay a fair value for the leases we've purchased for the PA coal and the terminal area. They also must consider the anticipated amount from the Dominion settlement. All of which is owned by the shareholders of BCND.

IMO the overall, unrealized value, can not be less than $10,000,000 supporting a .0033 pps. This is well below the potential value if the gas in WV, almost an absolute, and then the gas and coal in PA pan out. all imo of course.

They are no doubt buying all they can as cheaply as they can. Makes sense. But, before the hand is closed, if the remaining shareholders do not get at least .0033 a share we will have been robbed.

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM