Monday, June 24, 2024 1:54:02 AM

It's a fact sheet dictated to develop the stipulations contained in the FHEFSSA and the Charter Act, as amended by HERA.

For instance, it contemplates the mechanism of UST backup of FnF that the law only gives the broad picture: authority of UST to finance their operations as a last resort (either purchasing Equity or Debt). Section Purposes of the Charter Act.

This way, we know that FnF can tap the UST for funds only upon "capital deficiency", that is, negative Net Worth, as seen in my signature image below with Freddie Mac.

First of all, FnF had to exhaust before the option of tapping the private capital markets as required in the clause (2) of the section Purposes (previous internet link posted), which is what FnF did with multiple issuances of JPS and common stocks in 2006-2008. So, FnF did their part in the Charter Act. What about the rogue UST?

The SPSPA doesn't have more importance than what is has.

In other words, if it was an attempt to circumvent the law, with the slogan "contract", it's struck down right away.

The NWS dividend was as legal as the 10% dividend. It turns out that the entire Charter Act dynamics is about FnF getting funds from the Treasury Department at rates similar to Treasuries

as of the end of the month preceding the purchase. Subsection (c).

It's the dividend rate that will prevail. All roads lead to Rome, regardless of all the draconian conditions you come up with.

All other rates (up to infinite rate. Subsection (g)) were meant for the Separate Account, knowing that the dividend payments and SPS LP increased for free are capital distributions restricted.

Charter dynamics means that, if you want something else, you can't just amend it, but you have to revoke it and come up with a different Charter Act from scratch.

Other conditions are simply struck down without further consideration, like the initial $1B SPS issued for free, that reduced the core capital in the same amount (debited from the Additional Paid-In Capital Account. Core Capital), with the objective to justify the conservatorship for Critically Undercapitalized enterprises.

A clear breach of the conservator's Rehab power (soundness).

Let alone the Fee Limitation of the Unites States, that tells you that the Treasury can't make profits with FnF's assets and securities.

Calabria's 4.2 bps in HERA for Affordable Housing funds managed by the UST and HUD, and the 2012 TCCA 10bps fee, later BBB fees, although legal, it shows bad taste.

Now, they are useful to claim that the UST has made money during conservatorship in the case of resolution of Fanniegate "as is" or "Takeover", where the UST nets $0 (the amount owed to UST for its cumulative dividend rate on SPS, is netted out with the interests owed to FnF on the $152B due).

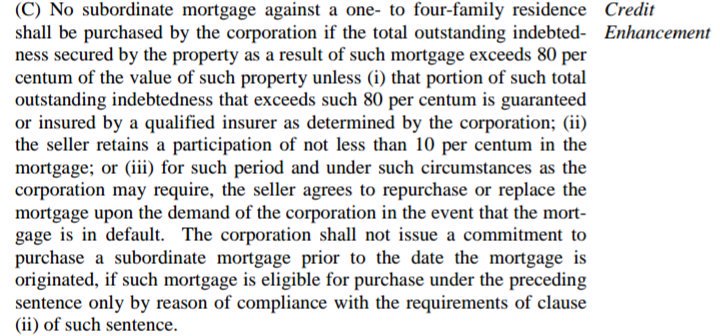

The same with the CRT operations, other than the PMI (#1) and commingles securities (#3), barred in the Credit Enhancement clause of the Charter Act (not among the enumerated ones).

This isn't about taking the money away, and only return it if a judge obliges you to do it, which is what it looks like. We are talking about the U.S. government and the U.S. Congress.

$20B in CRT expenses/recoveries, net, is due (turned into Retained Earnings account to protect FnF from future -unexpected- losses. CET1 for the Capital ratio).

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM