| Followers | 679 |

| Posts | 141164 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Saturday, April 27, 2024 10:52:02 AM

By: Hedgopia | April 27, 2024

• Following futures positions of non-commercials are as of April 23, 2024.

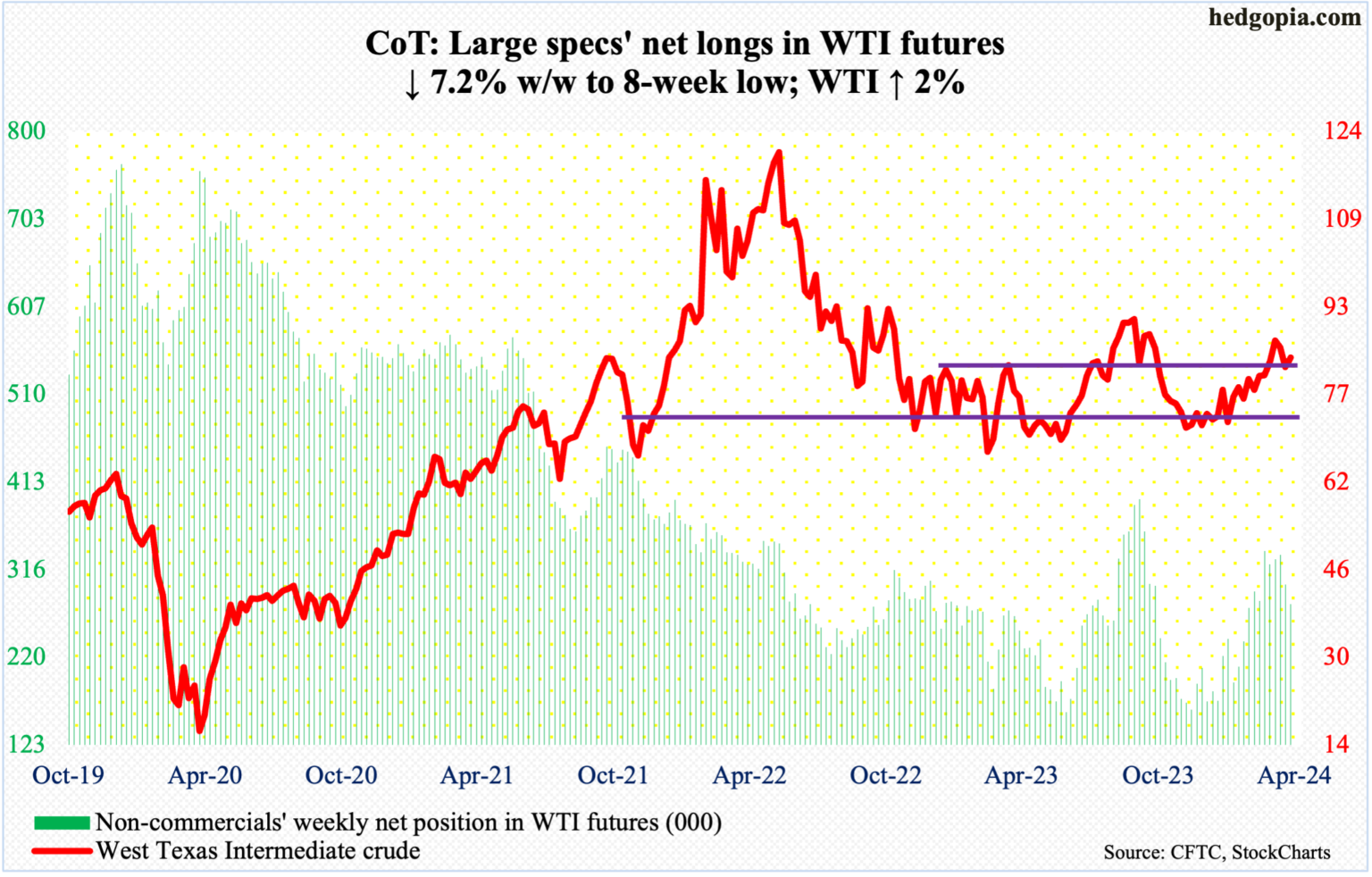

WTI Crude Oil: Currently net long 278.4k, down 21.7k.

After dropping from $87.67 on the 12th to Monday’s low of $80.70, West Texas Intermediate crude quickly gave back nearly seven points intraday in seven sessions. Earlier, it bottomed at $67.71 last December.

Selling stopped at the 50-day, with the crude hugging the average ($81.49) for four sessions, ending the week up two percent to $83.85/barrel. With this, oil bulls also defended breakout retest at $81-$82. WTI went back and forth between $71-$72 and $81-$82 for 19 months before pushing through the upper end a month ago.

The weekly remains overbought, but the ball remains with the bulls so long as they defend $81-$82.

In the meantime, US crude production in the week to April 19th was unchanged for seven consecutive weeks at 13.1 million barrels per day; nine weeks ago, output was at a record 13.3 mb/d. Crude imports increased 36,000 b/d to 6.5 mb/d. As did distillate inventory, which rose 1.6 million barrels to 116.6 million barrels. Stocks of crude and gasoline, however, dropped 6.4 million barrels and 634,000 barrels respectively to 453.6 million barrels and 226.7 million barrels. Refinery utilization rose four-tenths of a percentage point to 88.5 percent.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM

Moon Equity Holdings, Corp. Announces Acquisition of Wikolo, Inc. • MONI • May 7, 2024 9:48 AM