Sunday, March 10, 2024 5:58:54 AM

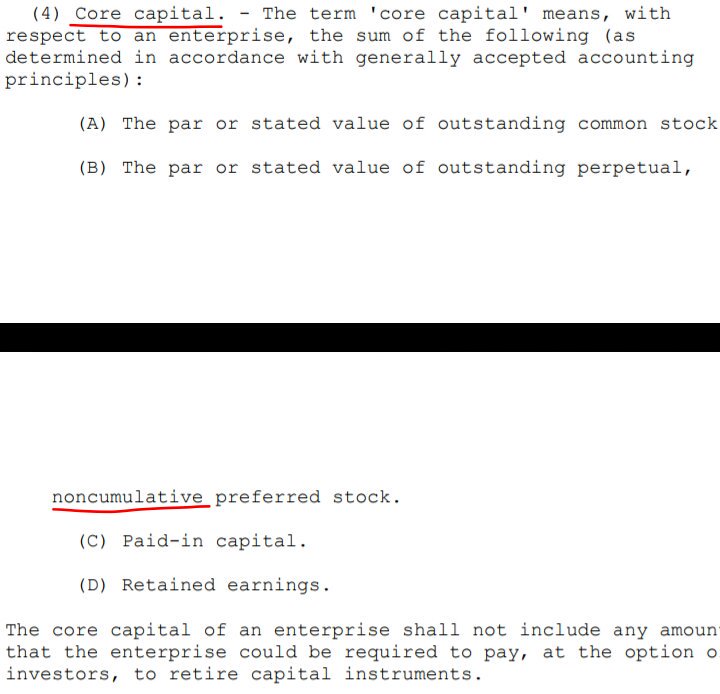

The definition of core capital in HERA.

You don't want to show the other definitions. For instance, the Leverage Capital requirement (previously known as Minimum Capital Level) is met with Core Capital for the capital classification Undercapitalized, and not with the invalid capital metric "Capital Reserve" peddled by Ackman & Co (adjusted $402B core capital shortfall over Leverage ratio).

HERA authorized the FHFA to make amendments in the FHEFSSA percentages (Source): from 0.45% to 2.5% of the MBS Trusts. Regulatory Risk.

Why don't you recommend, like the Mnuchin Treasury, to repeal the statutory definitions regarding Capital, instead of lying repeatedly on this board and I calling you out?

All the laws are later posted on the U.S. Code, which is the link that you have posted. But if you want to know the law where it emanates from, it's the FHEFSSA Section 1303. DEFINITIONS (4) Core capital.

By the way, Section 1303 (2) provides the definition of Capital distribution for the restriction in other section (dividends, SPS LP increased for free and the Lamberth rebate) when FnF remain undercapitalized.

Finally, when you talk about the contribution of the common stocks to the Core Capital, make sure to read the definition properly, because $0 relates to their par-value, not their Total contribution to Core Capital with the Additional Paid-In Capital account + Retained Earnings account + the AOCI account. All of them belong to the common shareholders. Although it doesn't appear in the definition, the Treasury Stock (stock buybacks) is subtracted from the common stock par value (a contra-Equity account).

This is how you calculate the Book Value of a common stock, also known as Common Equity, with the data taken from the Balance Sheets.

For instance, this is how you come up with $JPM (a common stock) with a Price to Book Value ratio of 1.8 times on Friday. You can calculate it yourself with the Balance Sheet posted on Yahoo Finance, section Financials:

https://finance.yahoo.com/quote/JPM/balance-sheet

Common Equity = $300B, calculated with the sum of:

+ $4.1B Common Stock par value ($31.5B Capital Stock, less $27.4B Preferred Stock par value)

- $116.2B Treasury Stock

+ $90B Additional Paid-In Capital account

+ $332.9B Retained Earnings account

+ $-10.4B AOCI (Unrealized losses in AFS securities, not the fraud with Held-to-maturity portfolios still in place)

Number of common shares outstanding = 2.88B

BVPS = $104.2

Closing price = $188.22

Price to Book Value ratio = 1.8 times. Data in the section Statistics.

In Fanniegate, we request a common stock's fair value with a stock valuation of 1x Book Value, in the case of a Taking of our stock by the Treasury Department, under the Separate Account plan that legalizes every action and on the cutoff date of Charter revoked scenario we've been bound for since the February 2011 UST's recommendations on ending the Conservatorships, at the request of the Dodd-Frank law.

Thanks to a CET1 > 2.5% of the Adjusted Total Assets, there is no dilution in the common stocks (future stock offerings) and FnF can redeem the JPS at their par value or Redemption Value (fair value stock valuation).

We don't use the tangible book value because the business will go on, besides I don't think that it would be different.

Later, after an accounting standard change in the upfront "delivery fee" (guarantee-fee) or LLPA, if that's the case, the UST can sweep their $49B Deferred Income, net (currently recorded as Debt, not Equity) through a higher resale price. This way, the taxpayer doesn't realize that FnF have amassed a huge Deferred Income (capital collected but hidden as Debt), specially Freddie Mac with a disproportionate amount, that would raise their eyebrows (likely, regular income recorded as Deferred Income in Freddie Mac, explained here). An amount later recovered by the prospective buyers when they are the ones that amortize the Deferred Income, gross, into earnings in one fell swoop, rendering an effective P/BV ratio paid of just 1.5x for FNMA and 1.6x for FMCC, as a result of the PER valuation of 10x in FNMA and 12x in FMCC, under a Privatized Housing Finance System revamp scenario (no TCCA/CRT fees) and reflecting their different volume growth (FMCC deserves a higher stock valuation)

Not even $1 is taken away from the enterprises. I'm talking about stock valuation. Unlike the JPS that are redeemed like any other obligation or bond issued by FnF in exchange for cash.

The Treasury can foot a whopping $178B profit with this operation. Notice that the other tweet cited, had a stock valuation of PER 14 times in Q3 of 2023.

TAKING+RESALE +JPS REDEEMED:$178B PROFIT

— Conservatives against Trump (@CarlosVignote) March 5, 2024

+$13B extra Corp Tax(Deferred Income)$FNMA/ $FMCC

Price;PER;BV;Mkt Cap

-Existing shareholder

$116/$170;7/8;1/1;$134B/$110B

-UST

$186/$317;11/14;1.6/1.9;$216B/$206B

-Buyer(Amortization of DI)

$173/$266;10/12;1.5/1.6;$201B/$173B#Fanniegate https://t.co/mqKqepObPX

Something like this was proposed by Calabria in 2015. So, it won't come as a surprise.

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM

VPR Brands (VPRB) Reports First Quarter 2024 Financial Results • VPRB • May 17, 2024 8:04 AM